Jan 5, 2020

The year 2019 was characterized by a slow-down in global growth, which was weighed down by the negative effects of the trade conflicts among the major economies. These include:

- An on-going trade dispute between the US and China,

- Uncertainty in Britain over its exit from the European Union (“Brexit”),

- Geopolitical tension between the US and Iran, disrupting the mid-stream and down-stream oil supply channel, and,

- Overall slowing global trade, which, according to the World Trade Organization, is forecasted to grow by 1.2% in 2019.

According to IMF, global GDP growth in 2019 is expected to come in at 3.0%, a 0.3% point downgrade from their initial projection from the April 2019 World Economic Outlook, and lower than the 5-year average of 3.5%. The IMF downgraded their expectations mainly as a result of uncertainty about prospects for some economies in the Eurozone, which include the slowdown in the German economy, and a projected slowdown in China and the United States, which have resulted in a much more subdued pace of global activity.

The World Trade Organization (WTO) lowered their outlook for world trade growth in 2019 to 1.2%, from their 2.6% expectation in April 2019, citing that the ongoing trade conflicts pose the biggest downside risk. The uncertainty generated by the continuous trade conflicts has had the impact of reducing international trade as export and import growth slowed down across all regions.

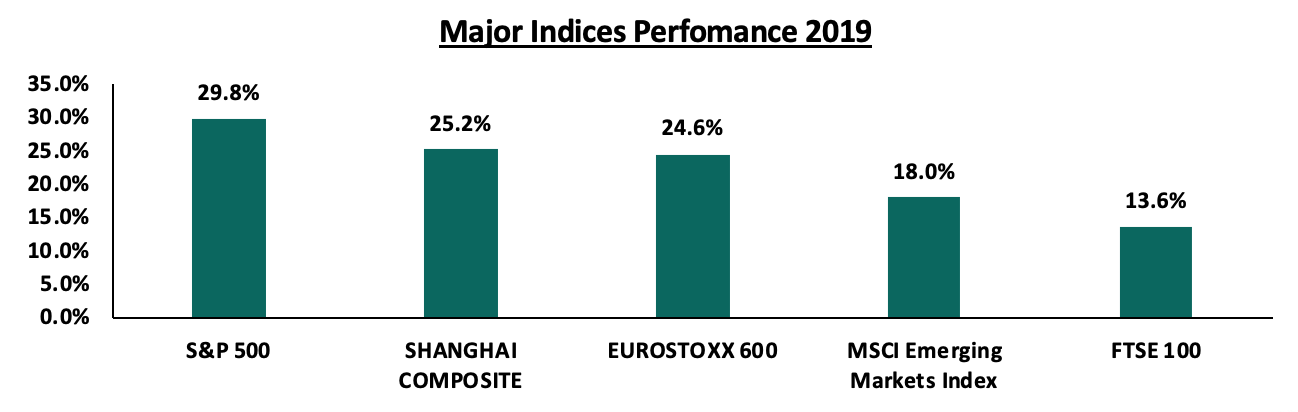

Global equity markets registered gains during the year, as shown in the chart below, as gains were realized by US technology giants, a recovery in the Eurozone supported by the late inflow of funds resulting from the December general election, and Asian stocks that have benefited from the government’s hiked spending on construction and infrastructure projects. Stock markets surged despite the ongoing trade disputes and warnings of a slowing growth in major economies such as Germany.

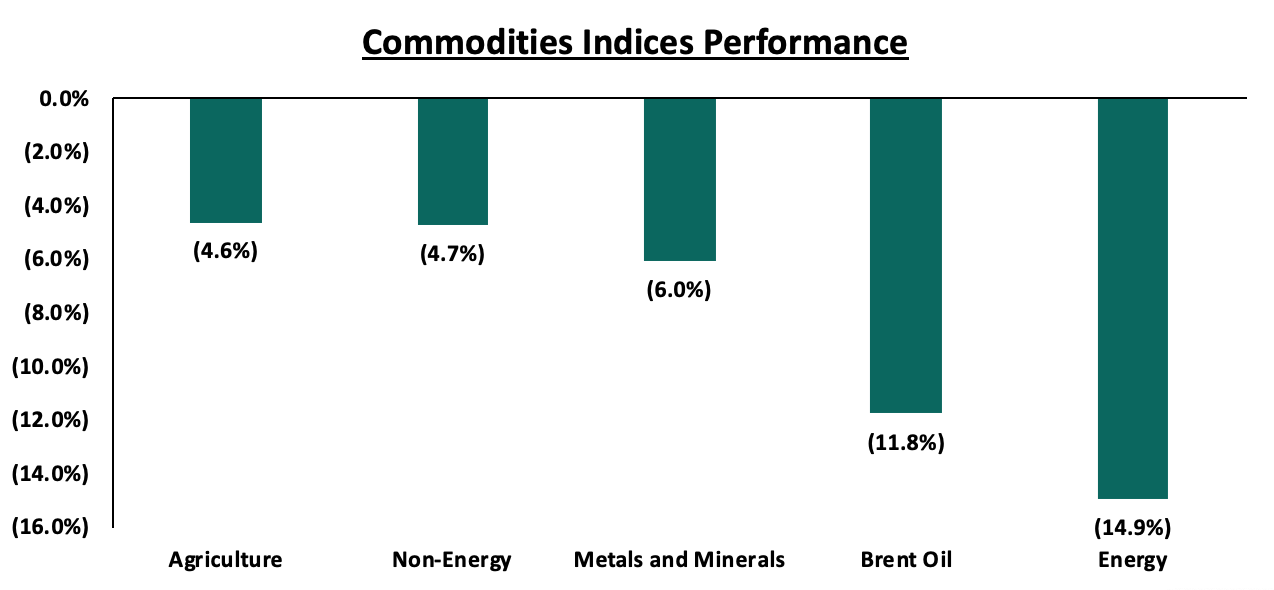

Global commodities registered declines in 2019, with agriculture, non-energy commodities, metals & minerals and Brent oil registering declines of 4.6%, 4.7%, 6.0%, and 11.8%, respectively, while energy was the biggest decliner falling by 14.9%, according to the World Bank Commodity Prices Index. The decline in energy was largely driven by slowing global demand during the year. Below is a chart highlighting the performance of select commodity indices:

United States

The US economy grew at a rate of 2.1% in Q3’2019, weaker than the 3.0% recorded in Q3’2018, and lower than the expected growth for 2019 at 2.6% (as per the IMF). This performance was driven by gains in the labor market, which picked up towards the end of the year. Also, trade tensions between the US and China cooled down as the UK elections cleared the uncertainty around the Brexit. The economy held-up well considering the economic slowdown is being experienced worldwide. Business investment was low during the year as a result of the global slowdown in manufacturing activity and the trade dispute with China. The labor market has remained strong, with Non-Farm Payroll (NFP) increasing by 266,000 in November 2019. This has seen the unemployment rate fall to a 49-year low of 3.6%.

The Federal Open Monetary Committee, for the first half of the year, maintained the Federal Funds Rate at a range of 2.25% - 2.50% and slashed the same in the July meeting to 2.00% - 2.25%, in the September meeting to 1.75% - 2.00% and in the December meeting to the current range of 1.50% - 1.75%. This was in an effort to spur spending amid the global economic uncertainty experienced through the year. Compared to 2018, where in the beginning of the year the range started at 1.25% - 1.50% and ended the year at 2.25% - 2.50%, there has been an easing in monetary policy evidenced by the lowering of the Federal Funds Rate. This move was driven by:

- Weakened business investment and international trade amid falling manufacturing as a result of slower global growth and trade policy tensions, and,

- Muted inflationary pressure with the November inflation rate of 1.8%, being below the government’s target of 2.0%

The stock market registered gains, with the S&P 500 gaining by 29.8% in 2019, which is the best performance since 2013. This performance was mainly supported by a surge in technology stocks and the renewed hope from the phase-one trade deal between the US and China, which is set to be signed early 2020. In terms of valuations, the Cyclically Adjusted Price/Earnings (CAPE) ratio is currently at 30.0x, 78.6% above the historical average of 16.8x, indicating the market remains overvalued relative to historical levels.

Eurozone

Economic growth in the Eurozone remained resilient towards the end of the year despite the expectations of a slowdown from the Brexit uncertainty and trade tensions. GDP expanded by 0.2% in Q3’2019, taking the expected growth to 1.1% in 2019, weaker than the 1.8% growth seen in 2018. This modest growth was underpinned by healthy consumer spending despite the significant drop in industrial production.

The European Central Bank (ECB) maintained the base lending rate at 0.0%, and the rates on the marginal lending facility at 0.25%, while it reduced its deposit rates by 10 bps to (0.5%) from (0.4%), and introduced a fresh stimulus package by restarting its bond purchases of EUR 20.0 bn a month from November.

The Stoxx 600 index gained by 24.6% in 2019. This performance was mainly supported by late inflows that came in after the General Election in the UK which aided in clearing uncertainties around the Brexit. Also, easing trade tensions as a result of the proposed phase-one trade deal between the US and China. The P/E ratio currently at 15.0x, is 23.1% below the historical average of 19.5x, indicating markets are currently trading at relatively cheaper valuations.

China

China’s economic growth slowed down to a near 30-year low of 6.0% in Q3’2019, lower than the expected GDP growth for 2019, 6.2% (according to the IMF), although still within the government’s target of 6.0% - 6.5%. This performance is partly attributable to the effects of the trade-conflicts with the US and poor volumes in-terms of industrial production.

The Shanghai Composite index gained by 25.2% during the year 2019. The gains were mainly supported by expectations of a positive outcome following resumption of trade talks with the United States, coupled with increased capital injection by the government, which improved investor confidence. The P/E ratio currently at 14.7x, is 0.2% above the historical average of 14.5x, indicating that the market is currently trading at slightly more expensive valuations.