Apr 5, 2020

Introduction

According to the United Nations Department of Economic and Social Affairs (UN-DESA), the global economy is expected to contract by 0.9% in 2020 as a result of the spread of the coronavirus, lower than the expectation of a 1.5% growth at the beginning of the year and the estimated 2.9% recorded in 2019. Further to this, the International Monetary Fund (IMF) Managing Director, Mrs. Kristalina Georgieva, highlighted in a press release that the ongoing COVID-19 pandemic has had an immeasurable human cost and emphasized that countries need to work together to protect people and limit the economic damage. Despite this, the IMF believes that recovery is expected in 2021 but this is dependent on how fast the virus is stopped. They advise that this can be done by (i) prioritizing containment, and (ii) strengthening health systems everywhere. Also, they are advocating for extraordinary fiscal actions by governments, such as easing monetary policy, in the best interests of the respective countries and the global economy. Several countries have undertaken the same to spur their economies with the hope of mitigating the economic effects. Headwinds to global growth include the drop in international trade owing to lockdowns in major economies such as China who are among the major players, which has resulted in global supply chain disruptions across the globe. The demand for oil has also slowed down since the outbreak of the virus, mainly because of the shutdown or slowdown in major manufacturing hubs such as China and the US, causing the oil prices to plummet. Financial and commodity markets have similarly experienced adverse effects from the spread of the virus. Most investors in equities markets, for example, have become net sellers, wiping out any year to date gains that major indices had made, as investors move away from the equities market towards fixed income safe havens such as government treasuries and bonds. In addition, investors have moved capital to safe-haven assets such as gold, driving the price upwards, with the YTD performance of gold increasing by 4.2% as at 31st March 2020, trading at USD 1,587.7 from USD 1,523.0 at the start of the year.

United States:

The estimated 2019 GDP growth for the US according to the IMF came in at 1.3%, compared to the expected growth of 2.5%. In January, the IMF projected the GDP growth for the year to come in at 2.0%, down from 2.5% in 2019. The Congressional Budget Office (CBO) on April 2nd 2020 revised the country’s growth expectations for Q2’2020 to a 7% decline where they expect the unemployment to rise above 10%, and this is attributable to layoffs and closure of businesses related to the spread of the novel coronavirus. Similarly, Fitch Ratings expects the lockdowns to result in a recession with the GDP for the second quarter of 2020 expected to contract by 7.0% - 8.0%. This drastic change can be attributed to the rapid spread of the virus, as at 31st March 2020, the number of infections in the country stood at 140,640 with the death toll at 17,987 making it the country with the most infections globally.

Over the past two months, the Federal Open Monetary Committee (FOMC) has been pro-active with regards to policy actions targeted at mitigating the effects of the Coronavirus pandemic. On 15th March 2020, the FOMC lowered the federal funds rate target range to 0.0% to 0.25% to achieve maximum employment and price stability in the markets. Further to this, the committee will use its full range of tools to support the flow of credit to households and businesses by:

- Supporting the smooth functioning of markets for Treasury securities and agency mortgage-backed securities that are central to the flow of credit to households and businesses, by increasing its holdings of Treasury securities by at least USD 500.0 bn and its holdings of agency mortgage-backed securities by at least USD 200.0 bn,

- The Committee will also reinvest all principal payments from the Federal Reserve's holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities,

- Supporting the flow of credit to employers, consumers and businesses by establishing new programs that will provide up to US Dollar 300.0 bn (Kshs 31.4 trillion) in new financing,

- Establishment of two facilities to support credit to large employers namely, the Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF), for the new bond and loan issuance and to provide liquidity for outstanding corporate bonds, respectively,

- The establishment of the Term Asset-Backed Securities Loan Facility (TALF), which is meant to support the flow of credit to consumers and businesses,

- Expanding the Money Market Mutual Fund Liquidity Facility (MMLF) to include a wide range of securities to facilitate the flow of credit to municipalities, and,

- Expanding the Commercial Paper Funding Facility (CPFF) to include high-quality, tax-exempt commercial paper as eligible securities to facilitate the flow of credit to municipalities.

The stock market has been on a downward trend, with the S&P 500 declining by 21.8% during the first quarter of 2020, compared to an 11.9% gain in the same period in 2019, making it the worst quarter since the last quarter of 2008. The decline was largely attributable to investors exiting the equities market because of Coronavirus. US valuations declined with the Shiller Cyclically Adjusted P/E (CAPE) multiple currently at 23.9x, which is 20.0% below the 29.9x recorded a similar period in 2019.

Eurozone:

According to the IMF in January 2020, the Eurozone was expected to grow at a rate of 1.3% and 1.4% in 2020 and 2021, respectively, lower than the 1.2% growth recorded in 2019. The latter projection was based on expectations of improved external demand. The growth for the region has since then been revised downwards by several agencies such as Fitch Ratings, who expect the Eurozone GDP for the year to contract by 4.2%, lower than the expected growth of 1.6%. This can be attributed to the spread of the novel coronavirus which has resulted to various factors such as; weaker export growth due to deteriorating activity in China and other affected counties and strict containment measures that have resulted to reduced business activity affecting certain sectors such as tourism and transport. In the near term, economic activity has deteriorated sharply as several counties such as Italy have gone into lockdown. As at 31st March, the number of infections in Europe stood at 423,946 with the death toll at 31,131.

The European Commercial Bank (ECB) maintained the base lending rate at (0.5%), a negative rate meant to incentivize banks borrow from the Central Bank to lend to businesses and people. This move is contrary to what other central banks have done such as the Bank of England, which cut its rate by 50 basis points to 0.25% in an attempt to limit the economic impact of the virus. The ECB, however, opted to support bank lending by expanding its asset purchase program by EUR 120.0 bn.

The Stoxx 600 index declined by 25.4% in Q1’2020, compared to a 12.0% gain in the same period in 2019, as declines in the equities markets were driven by the exit of investors in fear of the coming recession and uncertainty attributable to the spread of the novel coronavirus. Despite this, stocks in the health sector recorded gains of 0.7% during the first quarter of the year. The P/E ratio is currently at 13.8x, 21.1% below the 17.5x recorded in Q1’2019, indicating markets are currently trading at relatively cheaper valuations.

China:

The Chinese economy is estimated to have grown by 6.1% in FY’2019, the slowest growth rate since 1990, and was projected to grow by 6.0% in 2020, attributable to the then ongoing trade dispute between them and the US. In March, the IMF revised the country’s growth downwards to 5.6%, 0.4% points below their initial projection, based on the geographical spread of the novel coronavirus. They highlight that their previous assumptions were that the virus would stay limited to China and be contained which hasn’t materialized. As at 31st March 2020, the number of infections in the country stood at 82,545 with the death toll at 3,314, though broad market commentary suspects that these numbers are under-reported.

The Shanghai Composite has declined by 9.4% during the first quarter of the year as investors in most global markets dump equities fearing the coming recession. Despite the current state of affairs, stocks in the health sector and non-cyclical consumer products recorded gains of 1.1% and 0.5% in Q1’2020, respectively. All other sectors recorded declines with the largest decliners being the technology, energy, industrial and financial sectors which had declines of 1.6%, 1.3%, 0.8% and 0.7%, respectively.

Commodity Prices:

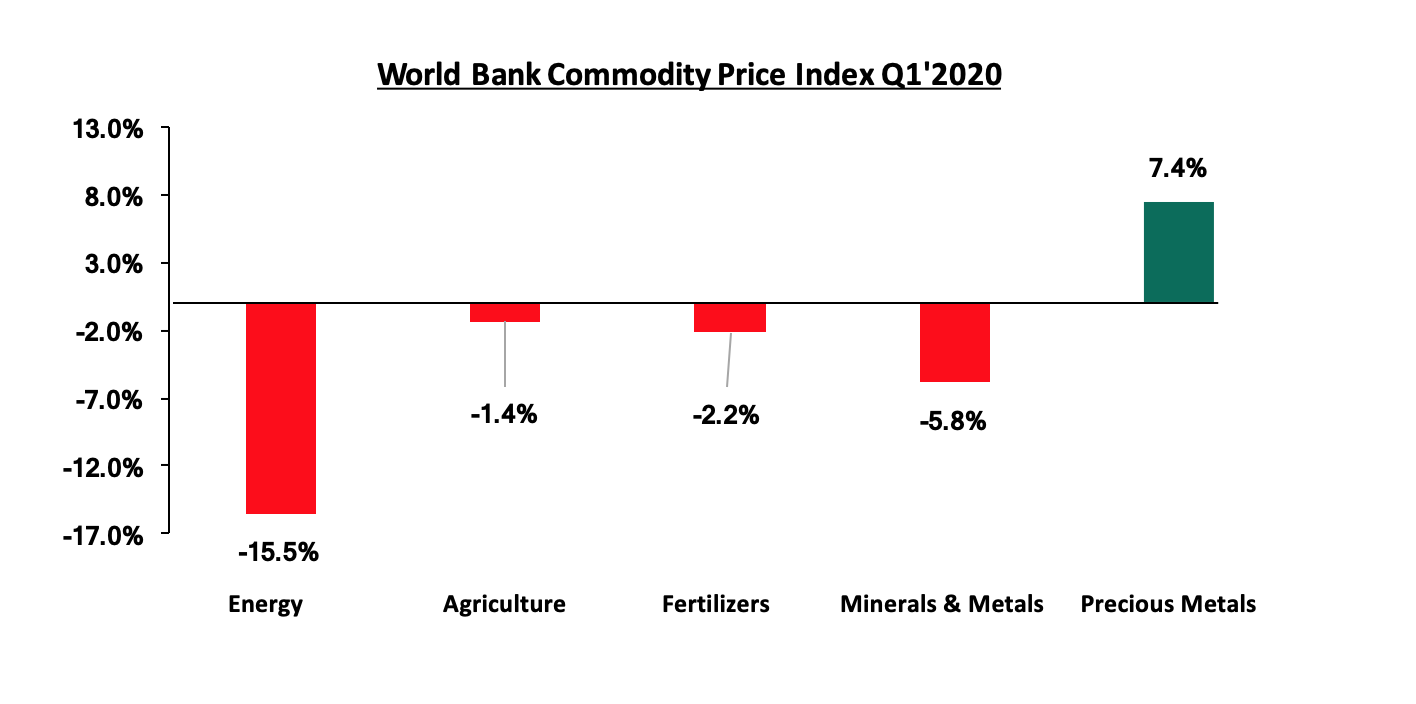

Global commodity prices were on a downward trend in Q1’2020, with the exception of precious metals. This can be attributed to the adverse effects of the ongoing pandemic with the gain in precious metals being attributed to investors resorting to gold and other precious commodities, which are considered to be safe haven assets. According to the World Bank Commodity Prices Index, energy, metals and minerals, fertilizers and agriculture segments declined by 15.5%, 5.8%, 2.2% and 1.4%, respectively, during the quarter, while precious metals gained by 7.4%. Below is a chart showing the performance of select commodity groups for Q1’2019.