Jul 5, 2020

Introduction

According to the International Monetary Fund (IMF) World Economic Outlook (WEO) Update June 2020, dubbed “A Crisis Like No Other, An Uncertain Recovery”, the global economy is projected to contract at a rate of (4.9%) in 2020, 1.9% lower than their initial outlook of (3.0%) in April 2020, largely driven by an 8% decline in developed markets and a 3% decline in emerging markets’ GDP growth. Some of the themes underpinning the outlook include:

- Continued worsening of the pandemic in some economies despite levelling in others, which has led to more stringent lockdowns, leading to even larger disruptions in business activity than expected,

- Decline in consumption and services as people have had to rely on their savings as they adhere to social distancing and movement restrictions set in place to reduce the Virus spread,

- Labour markets have been hit hard as a result of job losses and/or reduced pay; According to the International Labour Organization, the global decline in work hours seen in Q1’2020 compared to Q4’2019 was equivalent to the loss of 130 million full-time jobs and its projected to increase to 200 mn fulltime jobs in Q2’2020,

- Depressed mobility as travel is impacted,

- A contraction in global trade which can be attributed to the subdued business activity in the global economy, and

- Lower Inflation due to subdued demand in most economies coupled with the current low oil prices.

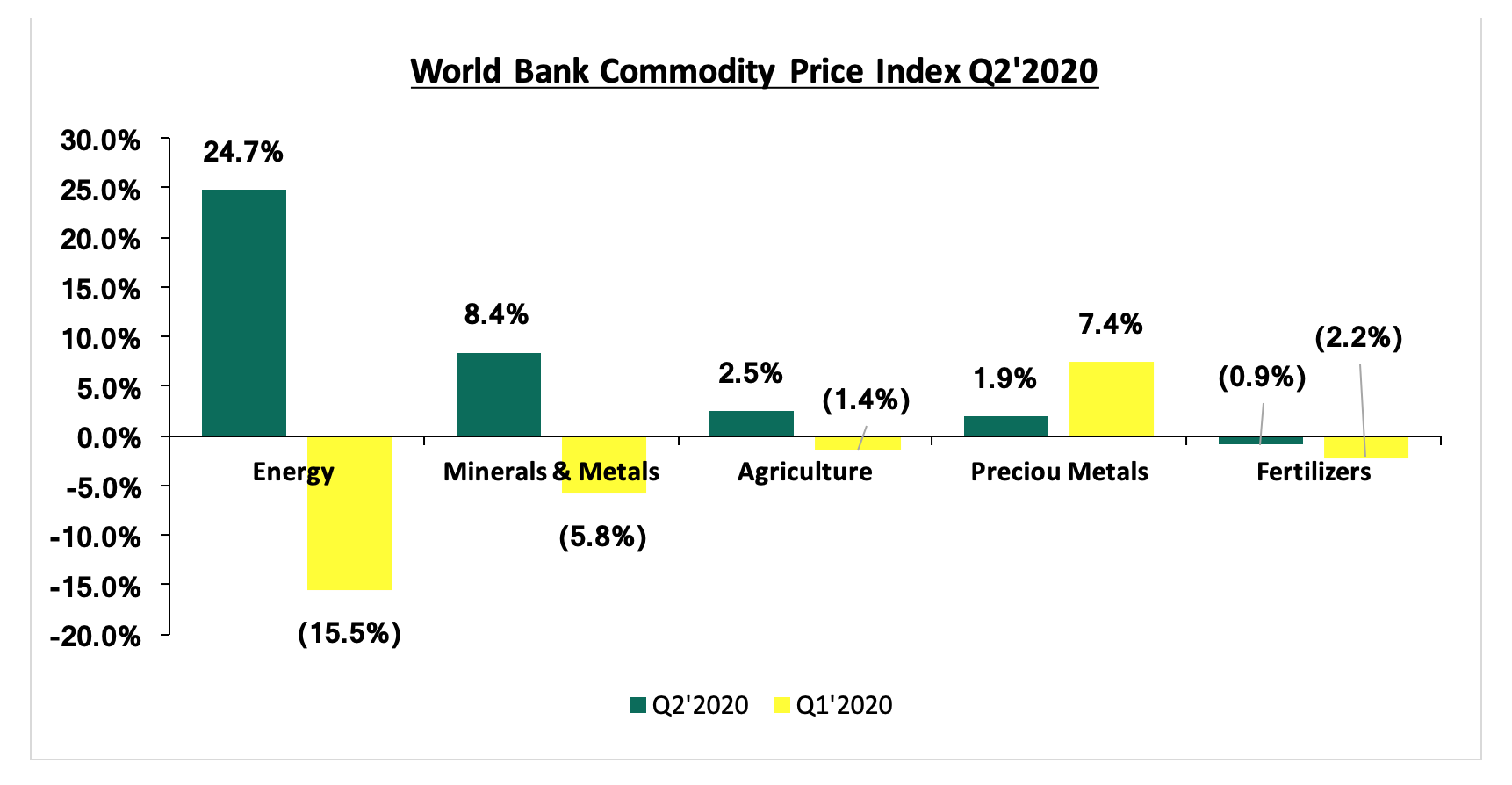

Commodity Prices:

Global commodity prices improved in Q2’2020 after they had been adversely affected by the spread of COVID-19 as evidenced by the lower prices in Q1’2020 due to the easing of movement restrictions in some countries such as China. Below is a summary performance of various commodities: