Oct 3, 2021

Introduction

According to the July 2021 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to expand by 6.0% in 2021, unchanged from the April 2021 projections. IMF projects that the new COVID-19 variants as well as the slow vaccine distribution continue to pose a risk on the global economic recovery. Advanced Economies are projected to expand by 5.6%, while Developing and Emerging Markets are projected to expand by 6.3% in 2021. The recovery of the Advanced Economies has been revised up to 5.6% from 5.1% due to the continued expected fiscal support especially in the US while that of the Developing and Emerging Markets has been revised downwards from 6.7% to 6.3% due to the lower speed of the vaccine rollout. Close to 40.0% of the population in advanced economies has been vaccinated, compared to less than 20.0% of the Developing and Emerging economies’ population. Some of the key challenges facing global growth include; increase in food prices, increasing energy prices, supply shortages and logistical bottlenecks, and, currency volatility.

Commodity Prices:

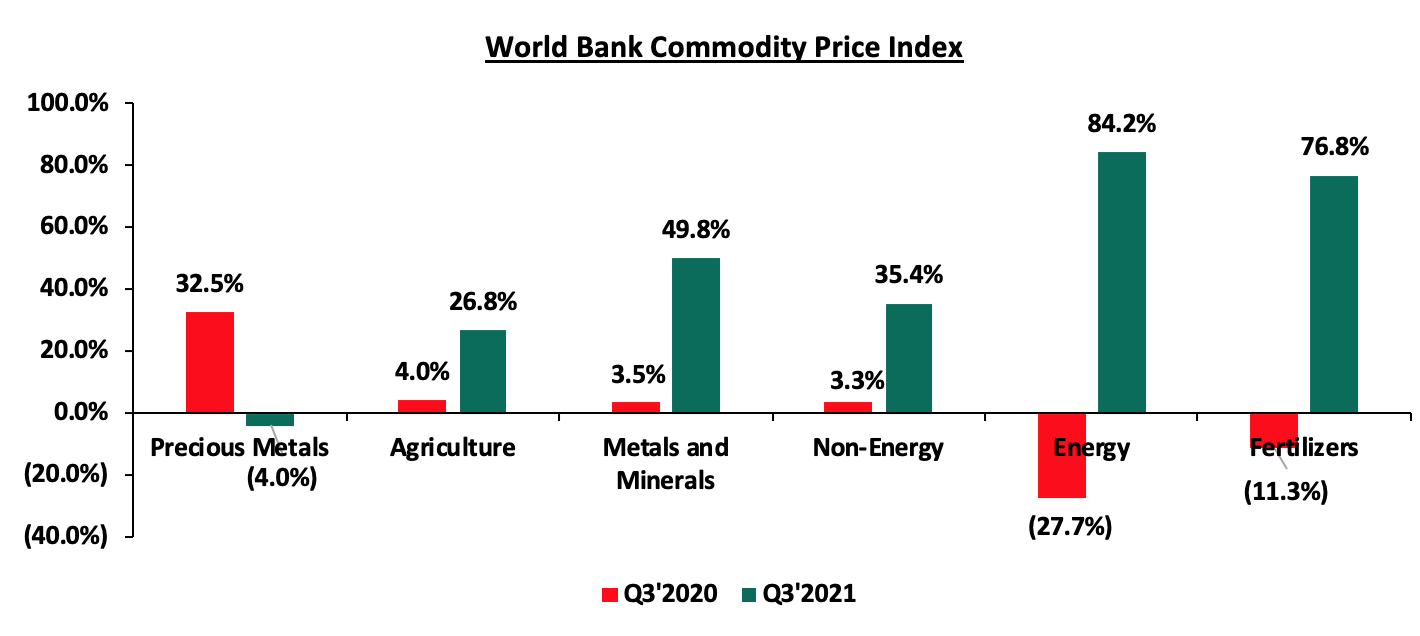

Global commodity prices registered a mixed performance, with the prices for energy and fertilizers increasing by 84.2% and 76.8% respectively, in Q3’2021, driven by the mismatch of supply and demand. The prices of precious metals however registered muted growth during the quarter, as investors participated in other attractive asset classes like long-term bonds. Below is a summary performance of various commodities:

Source: World Bank

The Stock Markets Performance

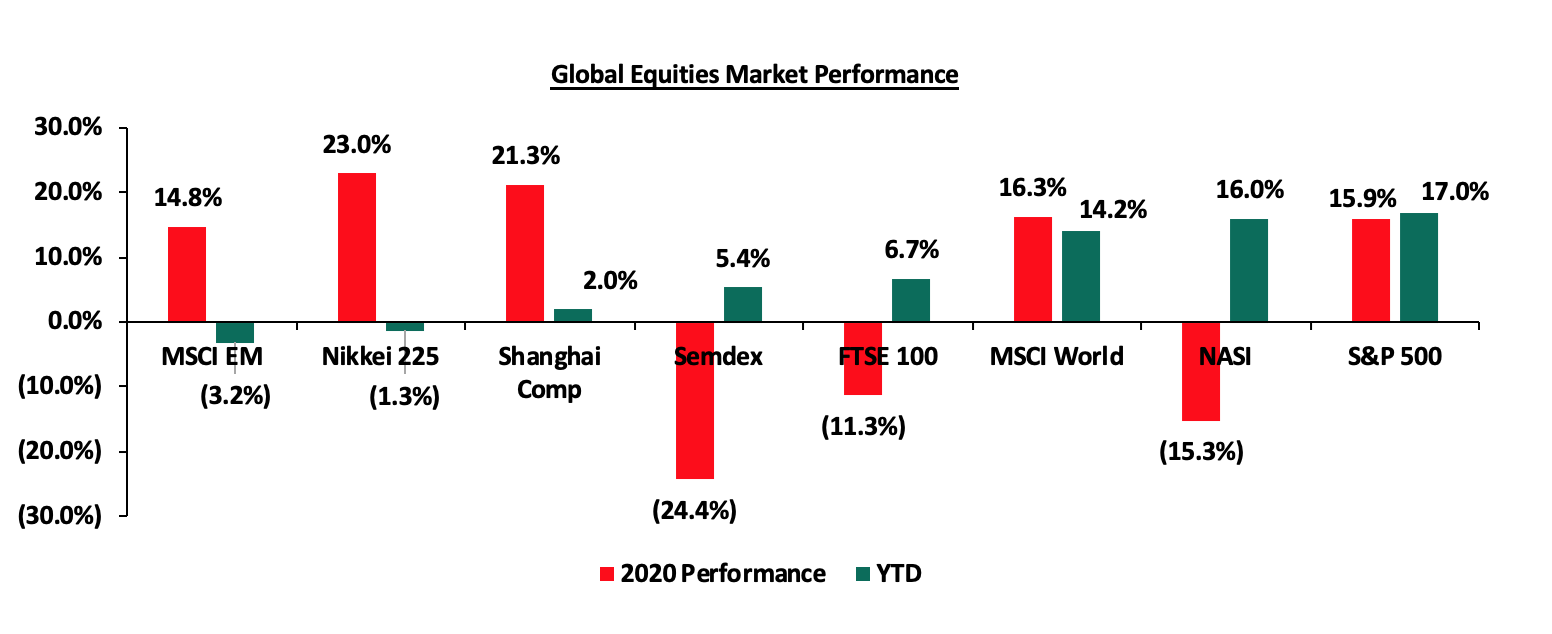

Global stock markets recorded mixed performance in Q3’2021, with most of the markets recording positive returns, attributable to the improved investor confidence in the stock markets. The S&P 500 index was largest gainer, recording a 17.0% year to date gain as at 30th September, while the MSCI EM index was the worst-performing index with losses of 3.2% YTD. Below is a summary of the performance of key indices: