Jul 3, 2022

Introduction

According to the World Bank’s June 2022 Report, the global economy is projected to grow at a slower rate of 2.9% in 2022, 1.2% points lower than their initial growth outlook of 4.1%, largely driven by a projected 3.4% slow growth in emerging markets and developing economies, coupled with a 2.6% deceleration in advanced economies. The slow growth has been driven by rising energy prices, less favorable financial conditions, and supply chain disruptions, all of which have been exacerbated by the war in Ukraine. In emerging markets and developing economies, the economy is expected to grow at a slower rate of 3.4%. The slow growth is attributable to spill overs from the war in Ukraine causing commodity price volatility, higher input costs, trade disruptions, and weaker confidence. Going forward, there is no projected rebound next year with the global growth forecasted to slightly increase by 3.0% in 2023. The key challenges going forward are high commodity prices and continued monetary tightening.

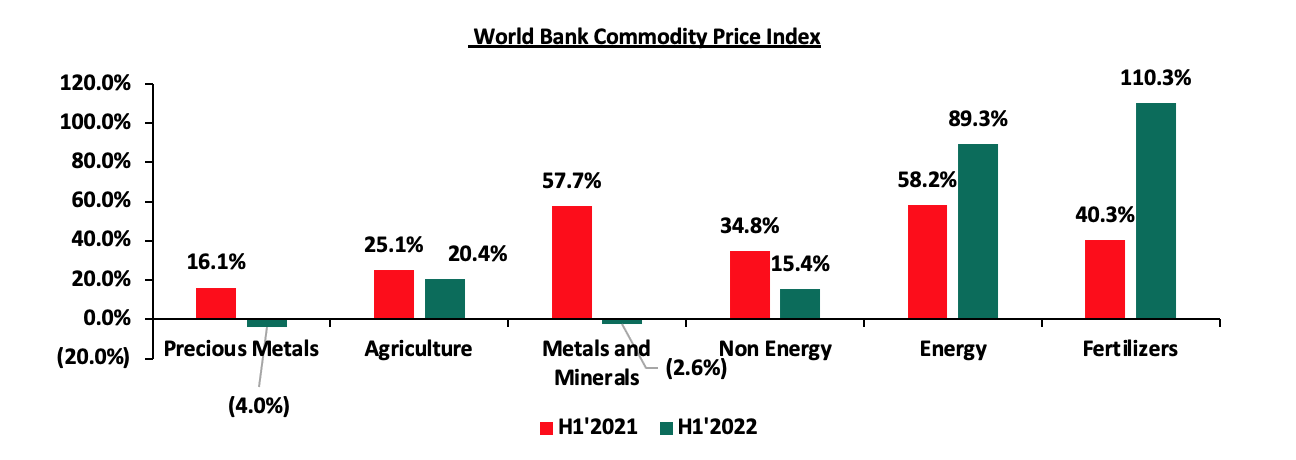

Commodity Prices:

Global commodity prices registered mixed performance in H1’2022, with prices of precious metals declining by 4.0% largely driven by reduced demand for safe haven assets, a situation accentuated by the United States interest rate hike that has seen investors opt for higher-yield-bearing assets. On the other hand, fertilizer prices recorded the highest increase, gaining by 110.3% in H1’2022, mainly attributable to mismatch between demand and supply arising from supply chain constraints, as a result of Russian government’s decision to halt fertilizer exports in retaliatory move following sanctions for their role in the Russia-Ukraine Conflict. Key to note, Russia is the single largest producer of fertilizers exporting fertilizers worth USD 12.5 bn, accounting for 15.1% of the total fertilizer exports in 2021. Below is a summary performance of various commodities:

Source: World Bank