Jan 5, 2025

Global Economic Growth:

According to the World Bank's June 2024 Global Economic Prospects report, the global economy is projected to grow at 2.6% in 2024, matching the growth rate recorded in 2023. This forecast marks a slight downward revision from earlier projections, reflecting continued economic headwinds, particularly in the emerging markets. The World Bank’s growth projection is 0.6 percentage points lower than the IMF’s 2024 forecast of 3.2%. The lower growth is attributable to global inflationary pressures and continued tightening by central banks for much of 2024. However, recent developments indicate that some central banks, such as those in the United States and England, have cut interest rates in response to easing inflation, which could stimulate economic activity going forward. Notably, advanced economies are expected to record a 1.5% growth in 2024, remaining unchanged from the 1.5% expansion recorded in 2023. However, emerging markets and developing economies are projected to expand by 4.0% in 2024, lower than 4.2% growth in 2023. The expected slowed down in global economic growth in 2024 as compared to 2023 is majorly attributable to;

- The elevated global inflationary pressures which have necessitated the hiking of interest rates by some central banks around the world with the aim of anchoring inflation. The global inflation is forecasted to ease slightly to 6.9% in 2024, from 8.7% in 2023,

- Tight global financial conditions occasioned by high cost of borrowing which have increased risks of debt distress in emerging economies. Although some central banks, including the U.S. Federal Reserve and Bank of England, have begun easing monetary policies, global financial conditions remain tight due to the lagging impact of past rate hikes, which continue to raise borrowing costs and heighten debt distress risks, especially in emerging economies, and,

- Persistent supply chain constraints worsened by the ongoing Russia-Ukraine conflict which has impacted global fuel and food prices. Consequently, the high energy prices have increased inflationary pressures as well as contributed to currency depreciation as dollar demand increases especially in Emerging Markets and Developing Economies.

The global economy is expected to remain subdued in the short term mainly as a result of persistent inflationary pressures as well as tightening of monetary policies which are expected to weigh down on economic activity. Furthermore, the global economy’s future performance is majorly dependent on how soon the inflationary pressures will ease, which will see central banks ease their monetary policies hence boosting economic activity.

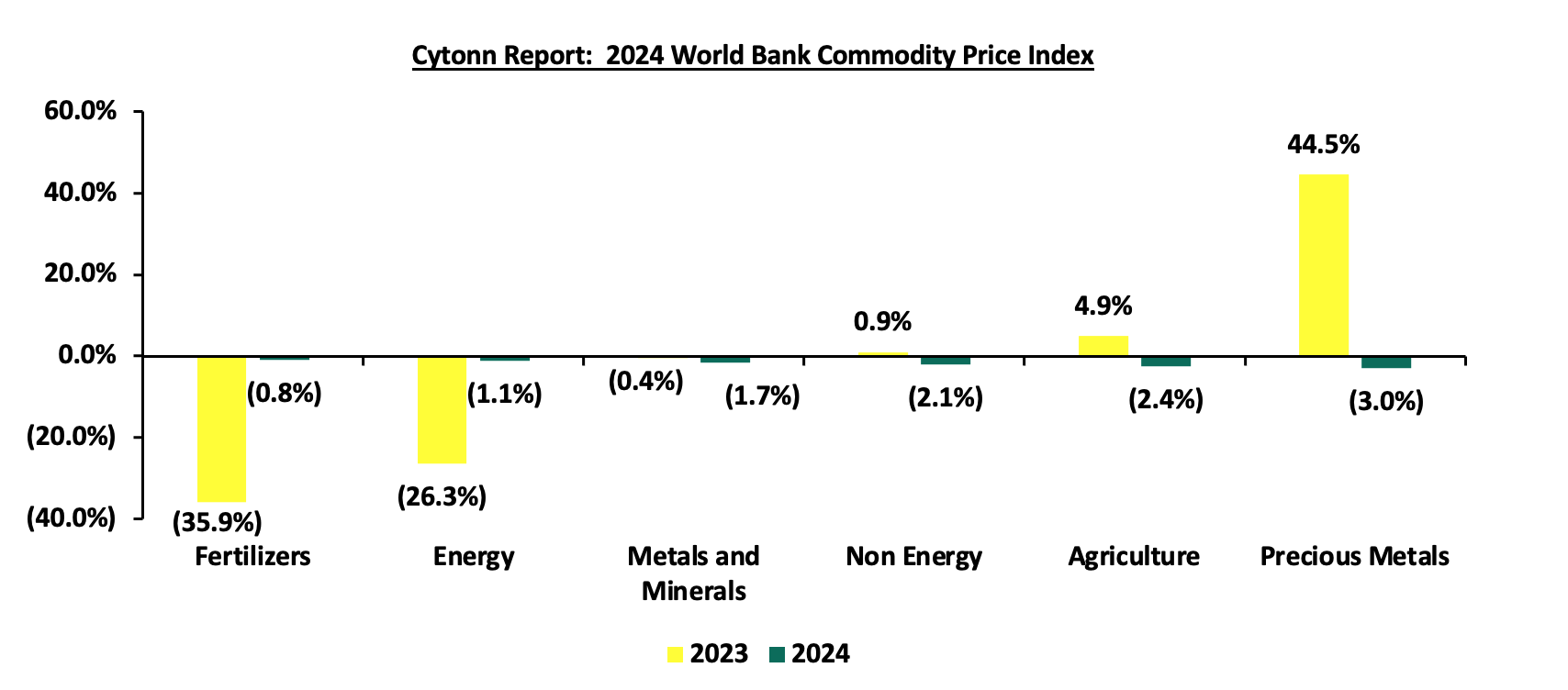

Global Commodities Market Performance:

Global commodity prices were on a downward trajectory in 2024, with prices of precious metals decreasing the most by 3.0% compared to the 44.5% increase recorded in 2023, mainly as a result of reduced demand from key markets, particularly China, and increased global production. Similarly, prices of agricultural commodities decreased by 2.4% in 2024, compared to a 4.9% increase in the same period last year, while prices of Non-Energy commodities, Metals & Minerals, Energy, and Fertilizers declined by 2.1%, 1.7%, 1.1%, and 0.8% respectively, on the back of ample supply due to strong harvests and increased production, coupled with subdued global demand. The chart below shows a summary of the performance of various commodities.

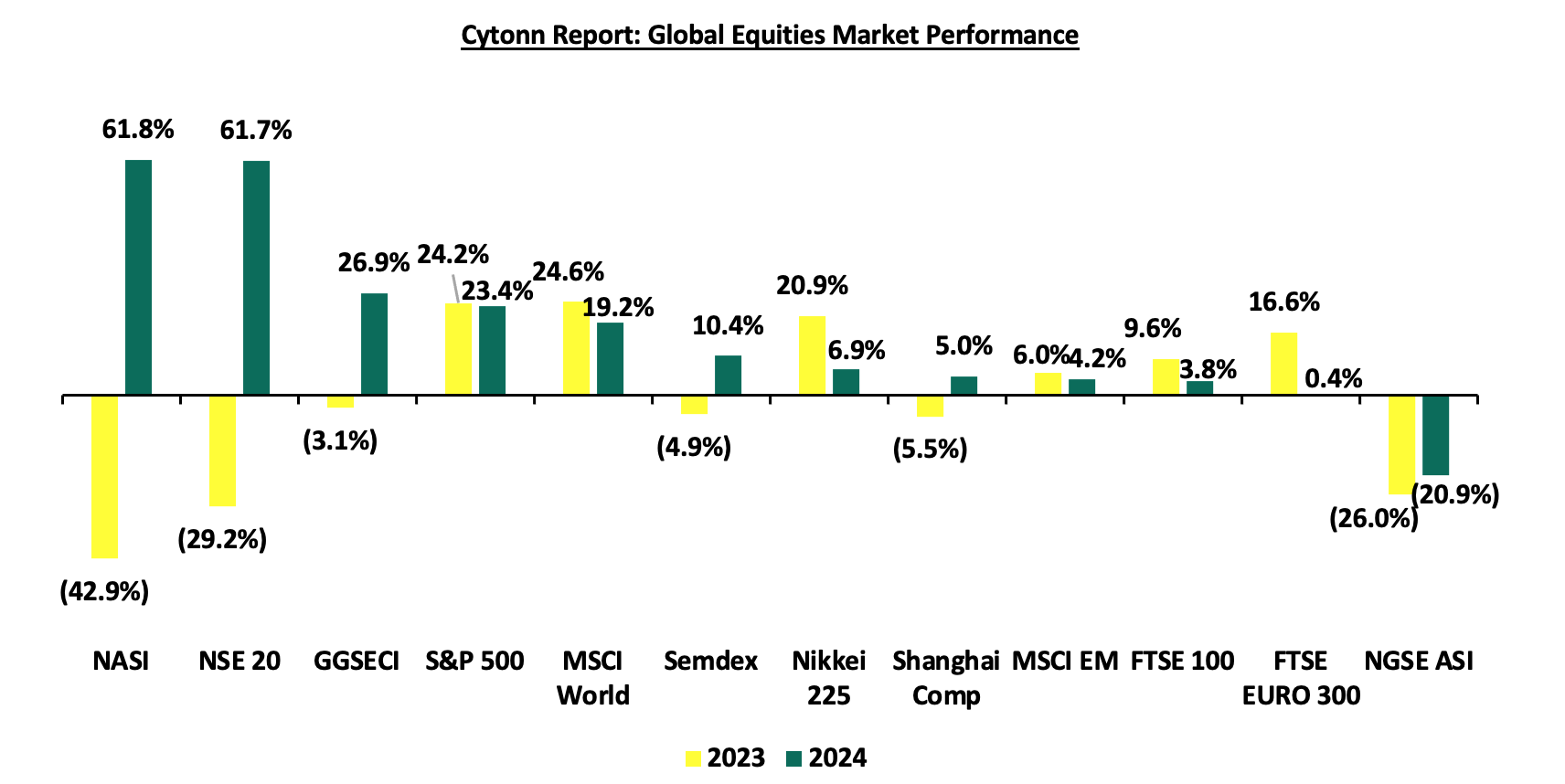

Global Equities Market Performance:

The global stock market recorded mixed performance in 2024, with most indices in the developed countries recording gains during the period, largely attributable to increased investor sentiments as a result of continued economic recovery following the full reopening of the economies coupled with investor preference for the stock markets in the developed countries. Notably, NASI was the best performer during the period, recording a gain at 61.8% in 2024 largely driven by gains in the large-cap stocks in the financial sector and a much stronger Shilling. NGSE ASI was the largest decliner, recording losses of 20.9% with the performance being skewed by the weakening of the Nigerian Naira following a recent decision by the Central Bank of Nigeria to adopt a floating exchange rate regime. Below is a summary of the performance of key indices as at the end of 2024;

*The index values are dollarized for ease of comparison