Mar 15, 2020

The novel coronavirus (COVID 19) has been the topic of discussion since the turn of the decade, with the first case of the virus being reported on 31stDecember 2019 in Wuhan, China. Initially, the virus was a major concern for the medical community since there was very little information about how the virus spread, the incubation period, or the severity of the disease. The rest of the world watched closely as China attempted to contain and eradicate the disease, which seemed like it would quickly be contained. With very little known about the virus at the time, it slowly spread to other nations and begun causing panic across the globe. Since then, the coronavirus has not only adversely affected the global community in matters of health but also, in terms of international trade, macroeconomic indicators, and financial markets. It is for this reason that we have chosen to discuss the impact the virus is likely to have on the Kenyan economy, with the first case reported in Kenya on 13thMarch 2020.

Therefore, we shall be discussing the following:

- Brief History on How the Pandemic Started and the Current State of Affairs

- How the Pandemic has Affected the Global Economy,

- Comparing Coronavirus & SARS – Impact So Far,

- The Effects in the Kenyan Economy,

- What Other Governments Have Done & What our Policy Makers Can do to Cushion the Impact, and,

- The Way Forward, Outlook and Conclusion.

- Brief History on How the Pandemic Started and the Current State of Affairs

The Coronavirus, better known as COVID-19 in the medical community, is a group of viruses that causes respiratory tract illnesses. The symptoms are severe cough, sneezing, and breathing difficulties. The virus broke out in the Wuhan district in China and slowly spread to other parts of the world. In 2020, China is already being defined by an outbreak of the Coronavirus with most economists forecasting the Q1’2020 GDP growth to come in at between 5.5% in an optimistic case and 4.5% in a pessimistic case, from the previously expected 5.9%. Currently, the disease has spread to over 104 countries with major economies such as Italy, Japan, South Korea, France, Spain, Australia, and the US having all reported multiple cases of the virus within their borders, and deaths related to the virus. The World Health Organization (WHO), on 11thMarch 2020, declared the outbreak a global pandemic raising the risk assessment of the outbreak to “very high”. A pandemic status is given to a disease epidemic that has spread across a large region across the globe and community spread is inevitable. China, the world’s second-largest economy, is a global manufacturing hub and with the country in lockdown, a majority of developed and developing economies are beginning to experience the negative effects of the virus due to the disruption of the global supply chain.

The fear of contracting the virus is also perceived to be spreading faster than the virus itself, having sparked fear across the globe with most people being driven by emotional contagion and rushing to stock up on items such as hand sanitizers, gloves and face masks, with online sales for these products having risen by 817.0% between January and February.

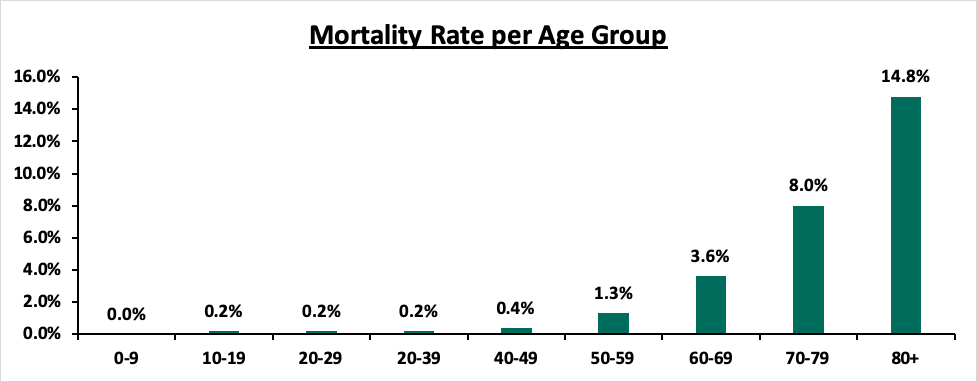

Most people are also stocking up on canned and non-perishable goods due to uncertainty about how the virus will affect the supply chain and fears of a lockdown. This emotional contagion has greatly amplified the effects of the pandemic on the global economy, even though a majority of people around the world remain largely unaffected. The medical practitioners put the mortality rate currently at 3.3% compared to other outbreaks such as the SARS virus, which had a mortality rate of approximately 9.6%. Mortality is more severe with those of age 60 and above with pre-existing medical conditions, with the younger population largely recovering.

The graph below shows mortality rate per age group;

Sources: China Centre for Disease Control & Prevention, Statista

- How the Pandemic has Affected the Global Economy

The rapid geographical spread of the coronavirus and the high infection rates have spread fear around the globe disrupting global economic activities. According to the Organization for Economic Cooperation and Development (OECD), the world economy is projected to grow by 2.4%, from an estimated 2.9% in 2019, the slowest pace since 2009, during the 2008/2009 financial crisis.

The virus has affected both developed and developing countries in terms of;

- International Trade

The virus has caused a lockdown in countries such as China, and now very recently Italy to contain the spread of the disease adversely affecting the global supply chain. China has been the world’s largest exporter since 2009 exporting USD 2.7 tn in 2018, which was approximately 10.8% of the world exports according to the World Bank. The disruption of the global supply chain is likely to cause input shortages causing most manufacturing plants and retailers to suspend operations. The demand for oil has also slowed down since the outbreak of the virus with major manufacturing hubs such as China and the US either shutting down or slowing down causing the oil prices to plummet down. As of 11thMarch, crude oil prices had declined by 48.0% YTD to USD 33.0 per barrel. In 2018, China and the US were the largest oil importers demanding 20.2% and 13.8% of the total global oil imports respectively. Despite being the largest exporter in the world, China is also a major importer of goods and services, importing 11.4% of the world’s total imports. Global economies that depend on China as a customer have already begun experiencing the effects of the lockdown due to the slowdown in demand.

- Financial and Commodity Markets

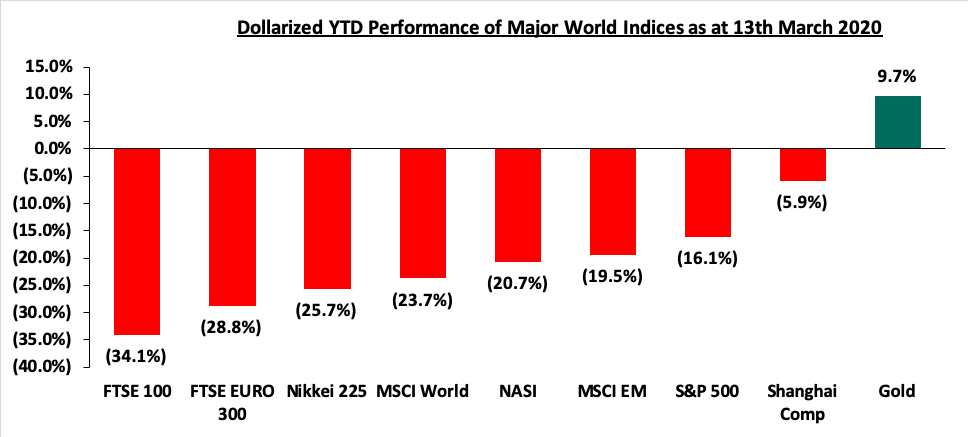

As the virus continues spreading to major economies around the world, most investors in the equities market have become net sellers, wiping out any year to date gains that major indices had made. Most investors have moved to place their money in safer haven assets such as gold, driving their prices upwards with the YTD performance of gold increasing by 9.7% as of 13th March 2020. The collapse of the oil prices mentioned earlier has also negatively affected the stock markets with investors rushing to dump stocks in the energy sector. The graph below shows the year to date performance, according to Reuters, of major indices as at 13th March 2019 with all the major world indices recording declines in their year to date performances. Companies focused on diagnosing, treating, and preventing the pandemic have however been recording gains in their stock prices. Some of these stocks include Vaxart Inc and Inovio Pharmaceuticals Inc, which have recorded YTD gains of 419.4%, and 196.0%, respectively.

The graph below shows the YTD performance of major world indices:

- Macroeconomic Indicators

As stated earlier, the global economic growth for 2020 is likely to come in at a slower pace due to the spread of the coronavirus. Most Central Banks around the world have taken a dovish monetary policy stance in a bid to boost the economy amid the negative macroeconomic effects emanating from the coronavirus outbreak. The table below shows how Central Banks of major global economies that have moved to cut interest rate so far;

|

No. |

Country |

Central Bank |

Reduction Margin |

Current. Rate |

|

1 |

USA |

Federal Reserve |

0.50% Points |

1.0%-1.25% |

|

2 |

Australia |

Reserve Bank of Australia |

0.25% Points |

0.5% |

|

3 |

China |

People’s Bank of China |

0.10% Points |

4.1% |

|

4 |

Malaysia |

Central Bank of Malaysia |

0.25% Points |

2.5% |

|

5 |

England |

Bank of England |

0.50% Points |

0.25% |

- Comparison of Coronavirus & SARS and the Impact So Far,

The SARS virus, which also originated from China in 2003 has striking similarities to the COVID-19 virus, with both being transmitted through respiratory droplets. Despite the mortality rate of the coronavirus being lower than other recent outbreaks, the virus is likely to affect the global economy in a major way mainly due to a longer incubation period and high infectious rate. The coronavirus has spread to all habitable continents of the globe affecting many more economies than the SARS virus hence, despite the low mortality rate, COVID-19 could affect the global economy more than the SARS virus.

When the SARS outbreak affected the globe, China was the sixth-largest economy accounting for only 4.2% of the world’s GDP as compared to now, when the country is the second-largest economy and accounting for 16.3% of the world’s GDP.

The table below shows the impact of Coronavirus so far and compares the impact on the SARS virus:

|

Measure |

Coronavirus |

SARS |

|

Global Cost of the Virus |

USD 43.0 bn of estimated Global economy loss |

USD 40.0 bn Global economy loss |

|

Impact on GDP |

0.25% decline in global GDP |

0.1% decline in global GDP |

|

Economy Recovery Time |

Potentially Longer than SARS |

5 Months |

|

Hotel Occupancy Rate |

85.0% decline in China |

82.0% decline in China |

|

Travel Disruption |

70.0% decline in passenger transport |

70.0% decline in passenger transport |

|

No. of Deaths so far |

5,602 |

774 |

|

Mortality Rate |

3.3% |

9.6% |

- The Effects so Far in the Kenyan Economy

The first case of Coronavirus infection within Kenya’s borders was reported on the 13th of March 2019. Despite this, the country had already begun experiencing the adverse economic effects of the pandemic.

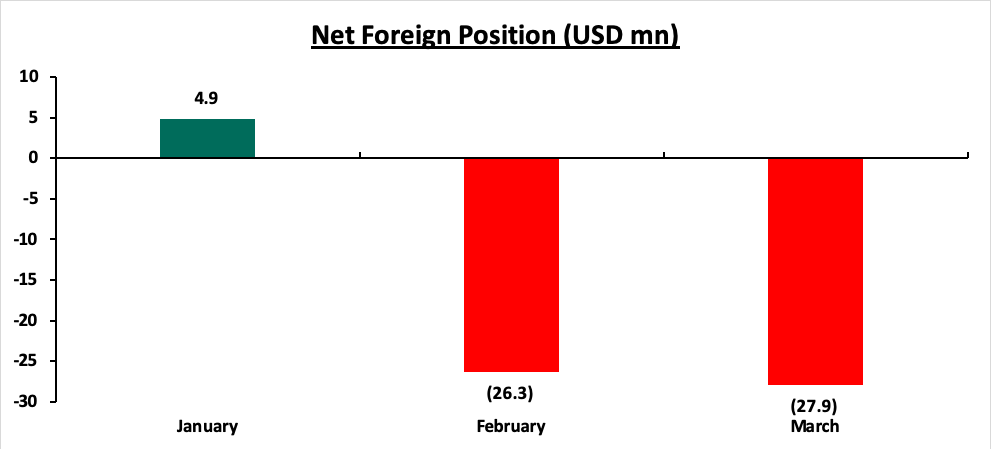

- Financial Markets: The first major hit the country experienced was the net selling position by investors in the stock markets. Most foreigners who had invested in the Kenyan stock market began selling their stocks as the virus began spreading to different parts of the globe. Many foreign investors, who often purchase blue-chip stocks, have been selling their equity holdings to purchase gold and fixed income securities due to the much uncertainty in the market. The graph below shows the net foreign position in the Kenyan equities market for the first three months of the year as of 12th March 2020;

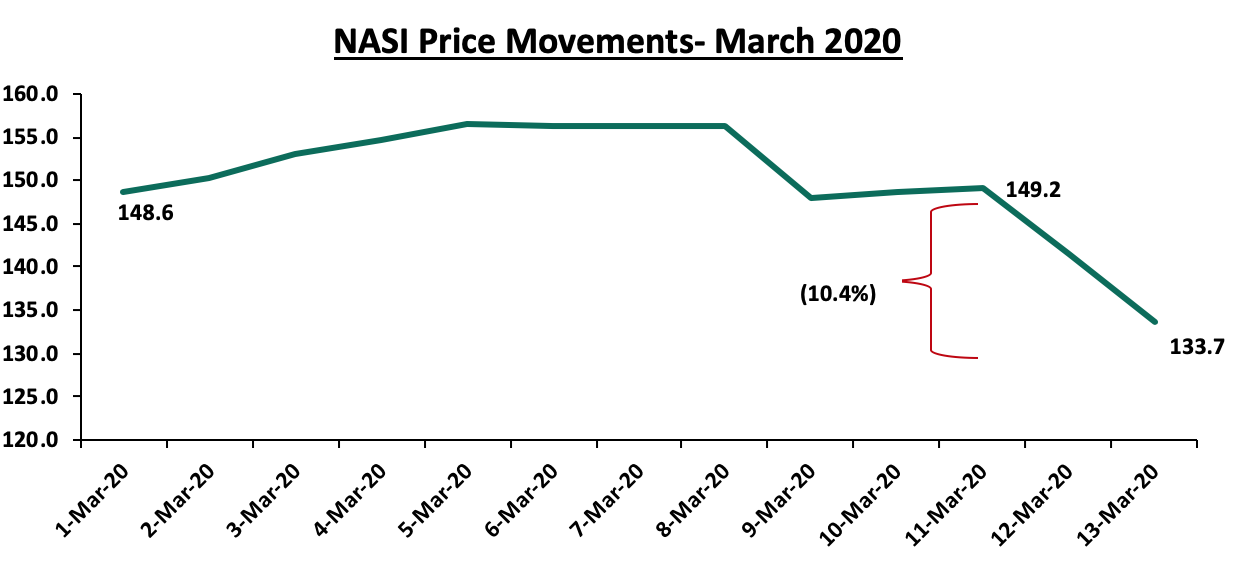

Immediately the first case of Coronavirus was reported in the country, the stock markets declined with stocks such as Safaricom and KCB declining by 5.4% and 7.0%, respectively, in one day. Trading in the NSE 20 was halted on 13th March 2020 after the NSE 20 dropped more than 5.0%, as per the provisions of Rule 9.4.1 (ii) of the NSE Equity Trading Rules. The graph below shows the NASI price movements in March 2020;

The NASI dropped by 10.4% between 11th March 2020 and 13th March 2020. The table below shows the performance on an YTD basis of large-cap stocks in Kenya as of 13th March 2020;

|

No |

Company |

Current Price (Kshs) |

YTD Performance |

|

1 |

Bamburi Cement Ltd |

50.00 |

(37.5%) |

|

2 |

Safaricom PLC |

24.35 |

(22.7%) |

|

3 |

Equity Group Holdings PLC |

41.90 |

(21.7%) |

|

4 |

KCB Group PLC |

42.65 |

(21.0%) |

|

5 |

British American Tobacco Kenya PLC |

401.50 |

(19.7%) |

|

6 |

The Co-operative Bank of Kenya Ltd |

13.25 |

(19.0%) |

|

7 |

NCBA Group PLC |

29.95 |

(18.7%) |

|

8 |

Diamond Trust Bank Kenya Ltd |

93.75 |

(14.0%) |

|

9 |

Absa Bank Kenya |

11.60 |

(13.1%) |

|

10 |

East African Breweries Ltd |

185.00 |

(6.8%) |

|

11 |

Standard Chartered Bank Kenya Ltd |

190.00 |

(6.2%) |

All large-cap stocks have recorded losses in terms of YTD performance majorly due to sell-off from investors moving to safer havens.

On the fixed income front, Government T-bills remained oversubscribed during the week with the subscription rate coming in at 264.0% with investors moving into the fixed income market to avoid uncertainty. All yields on shorter-dated government papers between the 1 and 7 years recorded YTD declines. On the other hand, Eurobond yields increased significantly this week, an indication that investors are now attaching a higher risk premium on the country due to the anticipation of slower economic growth attributable to the locust invasion, coupled up with the confirmation of the first case of the Coronavirus infection within Kenya’s borders. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased by 2.7% points to 7.2%, from 4.5% recorded the previous week while the yields on the 10-year and 30-year Eurobonds issued in 2018, increased by 2.6% points and 1.2% points to 8.3% and 8.4%, respectively, from 5.7% and 7.2% recorded previous week. Yields on the 7-year and 12-year Eurobonds issued in 2019 increased by 1.2% points and 2.8% points, to 6.6% and 9.3%, respectively, from 5.4% and 6.5% recorded the previous week.

- Disrupted Supply Chains: As mentioned earlier, the spread of the virus has also disrupted the global supply chain and Kenya has not been spared either. Imports from China account for approximately 21.0% of Kenya’s total imports and with the current lockdown, activities within the manufacturing sector are likely to be disrupted. The low supply of imports from China as well as South Korea especially in terms of electronics could see prices rise to exorbitant levels. Local supermarkets have already indicated that the prices of electronics, clothes, and furniture many of which are imported from China are likely to rise with media reports indicating that ships from China are yet to dock at the Mombasa port. The virus also affects the country’s exports of horticulture and agricultural goods mainly because of reduced consumer spending as well as shutdowns in major markets. The Kenya Association of Manufacturers has warned that the outbreak could cause a shortage of intermediate goods used to manufacture products that are exported. The decline in business conditions is already being felt according to Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI) report having declined to 49.0 in February 2020 from 49.7 recorded in January 2020 majorly due to a decline in business conditions. A reading of above 50 indicates an improvement in the business environment, while a reading of below 50 indicates a worsening outlook.

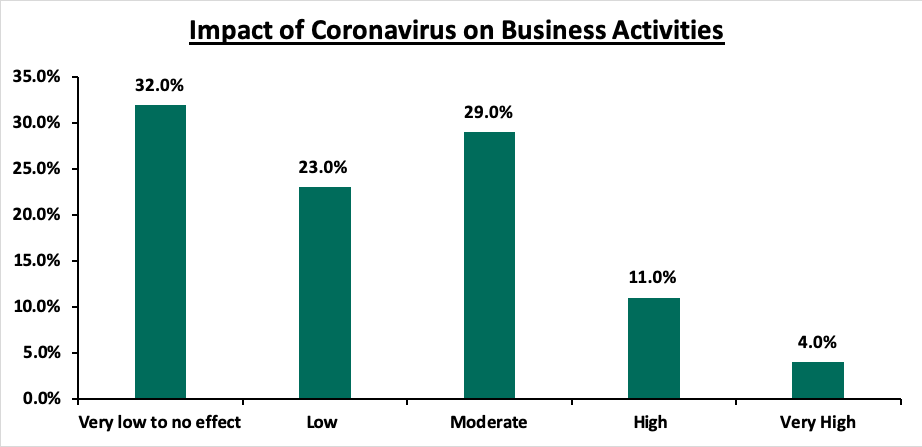

According to a report done by the Kenya Private Sector Alliance (KEPSA), 61.0% of businesses surveyed reported that the Coronavirus has had a direct negative impact on their businesses. The graph below shows the extent of impact on business activities from the coronavirus;

According to a report by KEPSA, most businesses expect to be disrupted in these various ways:

- Most companies foresee a situation where they will have to ask employees to work from home thus negatively affecting businesses in the service sector,

- Stock-outs and delayed deliveries due to the lockdown,

- Reduced demand for export products,

- Increased cost of goods which will consequently increase the overall cost of production,

- Reduced capital flows, restrictions on travel, and reduced staff time,

- Difficulty in obtaining credit from financial institutions as well as reduced ability to meet their loan interest payments, and,

- Slowed investment appetite from foreign and local investors.

- Macroeconomic Impact on Key Sectors of the Economy:

|

Key Sectors |

Impact |

Level of Impact |

|

Tourism Sector |

|

High |

|

Agricultural Sector |

|

High |

|

Manufacturing Sector |

|

High |

|

Health Sector |

|

High |

|

Wholesale and Retail Sector |

|

Moderate |

|

Finance and Insurance Sector |

|

Moderate |

|

Construction Sector |

|

Low |

|

Professional Services Sector |

|

Low |

From the above table the risk on 4 sectors is High, 2 Moderate and 2 Low, showing the significant impact of coronavirus on the Kenyan economy.

- Currency Volatility: The outbreak of the virus is likely to exert pressure on the shilling due to the lockdown in the global supply chains. The shortage of imports from China for instance, which accounts for an estimated 21.0% of the country’s imports, is likely to force local importers to look for alternative import markets, which may be more expensive and as such higher demand for the dollar from merchandise importers. The high demand for the dollar from foreigners exiting the market is also likely to cause the depreciation of the shilling, which we anticipate could be a 2.4% decline in the value of the shilling.

- Diaspora Remittances: We foresee reduced diaspora remittances as well, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country. Diaspora remittances, which stood at USD 2.8 bn in 2019, have recently become the largest contributor to forex reserves, which the Central Bank uses to stabilize the currency. In order to prop up the forex reserves in anticipation of currency volatility, the Central Bank of Kenya (CBK) indicated that they are looking to purchase Kshs 40.5 bn from banks in the next four months, to bolster its dollar reserves currently at Kshs 8.4 bn as at 13th March 2020 amid rising uncertainty on global markets due to the coronavirus outbreak.

- Monetary Policy: In terms of monetary policy, the Monetary Policy Committee is set to meet on 23rdMarch 2020 to review the outcome of its previous policy decisions and recent economic developments. During the last meeting, the MPC cut the Central Bank rate by 0.25% to 8.25% from the previous 8.5%. Similar to other Central Banks around the world, the MPC is likely to adopt the status quo and cut the Central Bank Rate in a bid to boost the economy amid the uncertainty and supply chain shortages caused by the Coronavirus. The shortage of imports may cause prices to rise in the local market, which may lead to cost-push inflation. The MPC may choose to cut the rate to avail more money to importers who can import goods from alternative markets, other than China, as they may be more expensive, in a bid to reduce the supply side shortages.

Based on the impact to other economies, we believe that coronavirus may have a 10.0% to 25.0% impact on GDP growth for the year 2020. The 10.0% impact is an optimistic case in the event the outbreak is contained, and a 25.0% impact in the event it is not contained. Credit has to be given to the Kenyan Government on their swift handling of the medical side of the pandemic. However, work needs to be done on the business angle to ensure as little disruption as possible.

As such, the coronavirus could reduce Kenya’s GDP growth to a range of 4.3% to 5.2% for the year 2020 depending on the severity of the outbreak and economic implications for Kenya.

- What Other Governments Have Done & What our Policy Makers Can do to Cushion the Impact:

Governments worldwide have instituted measures to combat the effects of the pandemic as well as support businesses. Some of the measures include:

|

Country |

Measures Taken by the Government |

|

UK |

|

|

USA |

|

|

China |

|

|

Korea |

|

|

Italy |

|

|

Germany |

|

|

Singapore |

|

We believe the Kenyan Government can borrow a leaf from the governments mentioned above and possibly;

- Grant tax breaks to companies seeking to increase their capacity to produce import substitute goods, which could even mean zero-rating VAT for the next 3-months,

- Release VAT refunds to assist businesses with managing their cash flow,

- Encourage banks to give concessionary loans at low rates to facilitate businesses, and as well provide moratoriums on loans that are due,

- Announce and provide for a Business Stabilization Fund to cushion the impact of the coronavirus, especially for Small & Medium Enterprises (SME’s),

- Consider reducing corporate tax for industries that have been highly affected by the virus such as the aviation industry, or waiving corporate tax for a 3-month period as well as a reduction in payroll tax for the next 3 months for the low income bracket workers, and,

- Strengthen the local supply chain for traders to be able to access import substitute goods.

As mentioned in the previous section, we applaud the Kenyan Government for the swift and effective measures taken to control the medical side of the pandemic. Government now needs to look into measures to sustain economic output and implement measures to support businesses.

- The Way Forward, Outlook and Conclusion:

We believe the emotional contagion has and will continue to inhibit rationality even from the investor’s perspective. We believe that the psychological factor has played a major role in driving the current impact of the pandemic globally. For instance, many investors holding equity stocks in their portfolios globally have been quick to sell off their holdings thus incurring losses due to the plummeting prices. The misinformation about the virus has also added to this, as most people are unaware of what exactly the disease entails, the symptoms, prevention measures, and steps to be taken if one suspects they are infected. Medical practitioners are yet to understand much about the disease as well as fueling further the emotional contagion among the general public. The uncertainty has caused and may continue to cause most people to make irrational decisions and spread fear all around.

We believe the Kenyan government in conjunction with the Ministry of Health should take these necessary precautions to prevent a full-blown outbreak:

- Clear and effective communication, which has already been done by the Kenyan Government, for the medical side of the pandemic,

- Swift responses including quarantine and broad travel restrictions are effective for containment, and adequate preparedness by all health agencies given that the first case has already been reported,

- Promote social distancing as much as possible to reduce community transmission,

- Increase awareness to the public on the impact of the virus and especially on how spreading can be curbed. As such nationwide sensitization of citizens and businesses on sanitization initiatives and control/prevention measures are key which will also demystify most of the misinformation around the virus effectively control the emotional contagion,

- Businesses can explore alternative markets from where they can source for necessary supplies or consider sourcing locally, and,

- Local businesses can also develop virtual workstations and enlightening employees to be prepared to offer virtual services from their home to avoid the high risk of infection.

On the business front, we believe the virus has clearly illustrated the need for the country to explore alternatives and diversifying the supply chains to reduce dependency on one region. However, this is easier said than done due to the economies of scale and the low costs of production in China resulting in cheaper goods as compared to alternative markets. The virus has also the need for the government to support key sectors such as Manufacturing hence cushioning the economy. We believe this is a golden opportunity to push Buy Kenya Build Kenya mantra especially on goods that the country has a comparative advantage compared to its trading partners e.g. expanding the textile industry to substitute the imports from China.

If the global community can contain the virus and a successful vaccine developed, the global economy may recover before the end of the year and businesses may be able to make up for lost revenue during the period of the pandemic. If, however, countries are unable to contain the virus, and no vaccine is developed soon, the spread of the virus will rise significantly. According to the World Bank, a serve pandemic could result in a 5.0% decline in global GDP. Experts fear that should the effects of the virus continue to cause economic disruptions, the world may end up losing all gains financial markets have made in the past decade. The plunge in the markets caused by the coronavirus has been unprecedented in the past decade, in fact, the last time such a global bear run was witnessed in the world was Black Monday during the 1987 financial crisis. The emergence of China as a superpower in the world has seen it play a crucial role in the global supply chain and its economic slowdown as a result of the virus has adversely affected the global market. The fix for the developing recession is governments of respective countries to use tools in their disposal: monetary and fiscal policies, to ensure the local economies are stimulated through expansive policies and look for local substitutes of imports from nations such as China.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.