Nov 17, 2019

Following the release of the H1’2019 results by Kenyan insurance firms, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed insurance companies and the key factors that drove the performance of the sector. In this report, we assess the main trends in the sector, and areas that will be crucial for growth and stability going forward, seeking to give a view on which insurance firms are the most attractive and stable for investment. As a result, we shall address the following:

- Key Themes that Shaped the Insurance Sector in H1’2019,

- Industry Highlights and Challenges,

- Performance of The Listed Insurance Sector in H1’2019, and,

- Conclusion & Outlook of the Insurance Sector.

Section I: Key Themes that Shaped the Insurance Sector in H1’2019

The Kenyan economy expanded by 5.6% in H1’2019, lower than the growth of 6.4% recorded in H1’2018, with the financial services sector and insurance sector registering the most improved growth of 2.1% points, to 6.7% in H1’2019, from 4.6% in H1’2018. Key highlights from the industry performance for the Insurance sector in H1’2019 are as below:

The insurance sector has benefited from (i) convenience and efficiency through adoption of alternative channels for both distribution and premium collection such as Bancassurance and improved agency networks, (ii) advancement in technology and innovation making it possible to make premium payments through mobile phones, and (iii) a growing middle class, which has led to increased disposable income, thereby increasing demand for insurance products and services. These factors have been key in driving growth of the sector.

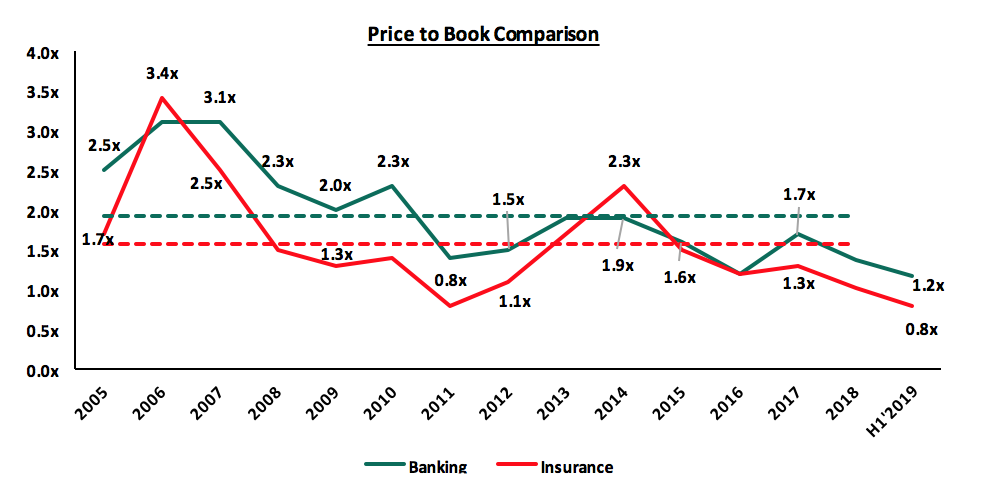

On valuations, listed insurance companies are trading at a price to book of 0.8x, lower than listed banks at 1.2x, with both lower than their historical averages of 1.6x for the insurance sector and 1.9x for the banking sector. This indicates that both sectors are attractive for long-term investors supported by the strong economic fundamentals and favourable investment environment.

In the last five years, the life insurance market in Kenya has experienced growth in both the level of direct premiums as well as in the equity held by the industry constituents shaped by the following themes;

A.Technology and Innovation

Although the industry has been slow in adopting digital trends, H1’2019 has seen insurance companies increasingly take advantage of digital transformation to drive growth and increase insurance penetration in the country. Below are some of the digital trends in the insurance sector;

- Innovation - Insurance underwriting involves evaluating the risk and exposures of prospective clients and thus, through technology, insurers are able to automate manual processes and duplicity of information across data gathering, risk profiling and pricing of the policy. Mobile phones also offer a new way of distributing insurance products to consumers who are not online and cannot be served through traditional distribution methods such as agents. The current number of mobile subscribers, according to Communications Authority of Kenya (CAK), stands at 51.0 mn and is expected to grow to 60.0 mn subscribers in 5 years. This implies that insurance companies have potential to increase market reach through mobile phones. East Africa has seen innovation such as M-tiba which primarily operates via mobile phones to reach the masses, and,

- Big Data and Artificial Intelligence - Artificial Intelligence (AI) is applied in the insurance industry in areas such as customer experience, process optimization and product innovation. By leveraging on AI, insurance companies are able to optimally use the data they collect to identify and recognize patterns, and anticipate actions. AI is also used to provide personalized insurance products by analysing behaviours of customers and improving customer experience by offering a seamless automated buying experience. The use of AI to curb fraud has also seen traction in the global insurance space in investigating the legitimacy of claims and identifying those that are fraudulent. The process of handling and inspecting claims manually is cumbersome and imperfect. However, insurance companies can mirror the steps taken by Kenindia Assurance in the use of AI to fast-track claims resolution through anomaly detection, sentiment detection, text analytics and a self-service portal. The use of Big Data and Artificial Intelligence is expected to increase significantly over the coming years at par with the pace at which the digital space in Kenya is increasing, with insurance companies leveraging on the opportunities created.

B. Regulation

To ensure that the sector benefits from a globally competitive financial services sector, the sector has to remain efficient, flexible and responsive to emerging trends through effectively addressing identified problems. Regulations used for the insurance sector in Kenya include the Insurance Act cap 487 and its accompanying schedule and regulations. In H1’2019, regulation remained a key aspect affecting the insurance sector and the key themes in the regulatory environment include;

- IFRS 9 - IAS 39, Financial Instruments Recognition and Measurement was replaced with IFRS 9, Financial Instruments to address, classification and measurement of financial instruments, impairment and hedge accounting. The guideline recommends an entity to measure the loss allowance at an amount equal to lifetime expected credit losses for receivables. Large players such as Jubilee Insurance and Kenya Re, who implemented IFRS 9 experienced increased impairments between 5.0% and 40.0%, with many insurance companies using a simplified loss rate approach in determining the provisions for premium receivables, with most opting to delay implementation of IFRS 9 to January 2022. IFRS 9 will enable insurance companies develop appropriate models for their customer debtors and develop plans that will help them lower their credit risk in the future,

- IFRS 17- The standard establishes the principle for recognition, measurement, presentation and disclosure of insurance contracts with the objective of ensuring insurance companies provide relevant information that faithfully represents the contracts with an effective date of January 2022 or earlier. The standard is expected to give better information on profitability by providing more insights about current and future profitability of insurance contracts. Separation of financial and insurance results in the income statement will allow for better analysis of core performance for the entities and allow for better comparability of insurance companies,

- Risk Based Supervision - IRA has been implementing risk-based supervision through guidelines that require insurers to maintain a capital adequacy ratio of at least 200.0% of the minimum capital by 2020. The regulation requires insurers to monitor the capital adequacy and solvency margins on a quarterly basis, with the main objective being to safeguard the insurer’s ability to continue as a going concern and provide shareholders with adequate returns. We expect more mergers within the industry as smaller companies struggle to meet the minimum capital adequacy ratios. We also expect insurance companies to adopt prudential practices in managing risk and reduction of premium undercutting in the industry as insurers will now have to price risk appropriately, and,

- Amendments to the Kenya Insurance Act - In June 2019, IRA made amendments under valuation of technical provisions for life insurance business and capital adequacy guidelines. The assumption under interest rate risk for life valuation was revised from 20.0% to 10.0%, and the insurance risk factors relating to interest rate risk margin for capital adequacy was revised from 10.0% to 18.0%. The implication of this amendment is that that insurers will need to be wary and look out for and manage various interest rate stress factors to remain well within the assumptions set forth in the guidelines.

C. Capital Raising

The move to a risk based capital adequacy framework is likely to lead to capital raising initiatives by some players in the sector to shore up capital. The solvency margins on the listed insurance space have declined to 26.9% in H1’2019 from 27.9% recorded in 2018, indicating that assets have been growing faster than shareholder’s funds. With the new capital adequacy assessment framework, capital is likely to be critical to ensuring stability and solvency of the sector to ensure the businesses are a going concern. In 2018, Swiss RE acquired 50.0 mn shares in Britam Holdings equivalent to a 13.8% stake, bringing the total stake at Britam to stands at 15.8%. Although the parties did not disclose the value of transaction, the market valued the transaction of Kshs 425.0 mn.

Section II: Industry Highlights and Challenges

Following the stable growth achieved by the insurance sector over the last decade, we expect the sector to transition into a more stable sector on the back of an improving economy and heightened regulations, which will enhance the capacity of the sector to sustain profitability. The following activities were undertaken by the Insurance Regulatory Authority (IRA), in line with their mandate of regulating and promoting development of the insurance sector;

I. Merger & Acquisition activity

The insurance sector is booming with mergers and acquisitions mainly with companies trying to protect their market share in a competitive environment. Some of the M&A deals include the acquisition of a 13.8% stake in Britam by Swiss Re, acquisition of Kenya First Assurance by Barclays Africa Group for USD 29.0 mn and Africa Merchant Assurance seeking to raise USD 5.0 mn - USD 7.0 mn through a stake sale. The insurance sector is likely to experience more mergers and acquisitions with many insurers trying to meet the solvency requirements by June 2020.

II. Override Commissions

Overriding commission is commission paid by the insurer to an agent for premium volume produced by other agents. The IRA, through a circular in January, cautioned insurers and brokers against the payment of commissions and administrative fees above the limits prescribed by the Insurance Act, in order to win and retain businesses. This was aimed at promoting fair competition within the sector.

III. Industry Circulars

IRA issued circular no. IC/04/2019 - Implementation of Integrated Custom Management Systems (iCMS), which informed insurance companies on roll out of iCMS by KRA and requested them to provide KRA with details of persons who will be created in iCMS. The aim of iCMS is to improve trade facilitation and meeting increased needs for compliance.

IV. Recently Developed or Repackaged Insurance Products

In Q2’2019, 8 new or repackaged insurance products were filed by various insurance companies and approved by IRA. Britam had three products approved in the period of review. Under general insurance, Britam’s Milele health plan, Britam’s group critical illness product under life assurance and group last expense also under life assurance. Other insurance companies with new products in the period included Monarch and Geminia under general insurance. Sanlam and Barclays life had products under long term insurers.

Industry Challenges:

- Fraud: Insurance fraud is an intentional deception committed by an applicant or policy holder for financial gain. Fraud is still one of the biggest challenges faced by the insurance industry. Estimates indicate that 25.0% of insurance industry income are fraudulently claimed, with motor and medical claims being the most common. Medical fraud was particularly prevalent perpetrated in various ways such as collusion between policy holders and health service providers, inflated medical bills and hospitals making patients take unnecessary tests. In Q2’2019, 30 fraud cases were reported, with 27 cases pending investigation, 2 cases pending before court and 1 had already been finalized, the sector has been adopting the use of block chain and artificial intelligence to curb fraud within the sector,

- Premium Undercutting: Premium undercutting is the practice where an insurance company secretly offers clients unrealistically low premiums in order to gain competitive advantage and to protect their market share is the major driver of underwriting losses suffered by the industry. Increased cut throat competition resulting from low insurance penetration and low product differentiation has led to industry players undercutting product pricing despite the risk that comes with product mispricing, and,

- Regional regulators: Subsidiaries of Kenyan insurance companies are facing challenges in the areas of operation. For instance, in Tanzania, insurance brokers are required to be at least two-thirds (66%) owned and controlled by citizens of Tanzania. In Kenya, regulation on capital has made it difficult for smaller insurance companies to continue operating without increasing their capital or merging in order to raise their capital base.

Section III: Performance of the Listed Insurance Sector in H1’2019

The table below highlights the performance of the listed insurance sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Listed Insurance Companies H1'2019 Earnings and Growth Metrics |

||||||||

|

Insurance Company |

Core EPS Growth |

Net Premium Growth |

Claims Growth |

Loss Ratio |

Expense Ratio |

Combined Ratio |

ROaA |

ROaE |

|

Britam Holdings |

50.0% |

(0.4%) |

(12.1%) |

59.3% |

70.5% |

129.8% |

(1.4%) |

(6.1%) |

|

Liberty Holdings |

45.8% |

3.4% |

(0.5%) |

80.3% |

71.7% |

152.0% |

1.7% |

8.3% |

|

Jubilee Holdings |

(1.6%) |

7.7% |

(8.5%) |

94.1% |

31.4% |

125.5% |

3.5% |

14.8% |

|

Kenya Re |

(12.5%) |

16.6% |

48.8% |

67.3% |

41.0% |

108.3% |

4.7% |

7.4% |

|

CIC Group |

(95.2%) |

0.4% |

7.9% |

70.9% |

49.9% |

184.8% |

(0.9%) |

(3.7%) |

|

Sanlam Kenya* |

N/A |

10.8% |

(18.8%) |

72.1% |

63.4% |

135.5% |

0.7% |

10.0% |

|

H1'2019 Weighted Average** |

3.2% |

5.7% |

0.0% |

77.2% |

49.1% |

133.7% |

1.6% |

5.7% |

|

H1'2018 Weighted Average** |

(0.6%) |

(8.2%) |

(1.8%) |

84.2% |

60.2% |

144.4% |

0.9% |

3.9% |

|

*Sanlam's EPS cannot be calculated since it has registered losses in H1'2018 |

||||||||

|

**The weighted average is based on Market Cap as at 22nd October 2019 |

||||||||

The key take-outs from the above table include;

- The average core EPS growth increased by 3.8% points in H1’2019 to 3.2%, from (0.6%) in H1’2018,

- The premiums grew by 5.7% in H1’2019, compared to a decline of 8.2% in H1’2018, while claims remained flat on a weighted average basis,

- The loss ratio across the sector decreased to 77.2% in H1’2019, from 84.2% in H1’2018, owing to introduction of tough measures by market players to reduce fraudulent claims,

- The expense ratio decreased to 49.1% in H1’2019, from 60.2% in H1’2018, owing to a decrease in operating expenses through cost rationalization and awareness,

- The insurance core business still remains unprofitable, with a combined ratio of 133.7% as at H1’2019, compared to 144.4% in H1’2018, and,

- On average, the insurance sector has delivered a Return on Average Equity of 5.7%, an increase from 3.9% in H1’2018.

Based on the Cytonn H1’2019 Insurance Report, we ranked insurance firms from a franchise value and from a future growth opportunity perspective with the former getting a weight of 40% and the latter a weight of 60%.

Important to note is that Kenya Re was not considered in the below rankings given it is a re-insurance company, and not a listed insurance company that undertakes traditional life & general underwriting business.

The ranking is as follows;

|

Cytonn Listed Insurance Companies H1’2019 Comprehensive Ranking |

||||

|

Insurance Company |

Franchise Value Total Score |

Intrinsic Value Total Score |

Weighted Score |

Rank |

|

Jubilee Holdings |

9 |

1 |

4.2 |

1 |

|

Sanlam Kenya |

13 |

2 |

6.4 |

2 |

|

Liberty Holdings |

17 |

3 |

8.6 |

3 |

|

Britam Holdings |

16 |

5 |

9.4 |

4 |

|

CIC Group |

20 |

4 |

10.4 |

5 |

From the above table:

- Jubilee Holdings took the Top Position, ranking top in the franchise score category on the back of a strong combined ratio, indicating better capacity to generate profits from its core business. The only factor holding Jubilee back is its loss ratio, which is the highest among listed companies,

- Sanlam Kenya took 2nd Position, on the back of a strong franchise score, driven by the highest Return on Average Equity,

- Liberty & Britam Holdings came in 3rd and 4th Position, respectively, with weaker franchise scores, as a result of lower returns on assets and equity for (Britam Holdings) and high loss and expense ratios for (Liberty), and,

- CIC came in 5th Position on the back of weak franchise rankings scores.

For the H1’2019 Insurance Report, please download it here

Section IV: Conclusion & Outlook of the Insurance Sector

The sector continues to undergo transition mainly on the digital transformation and regulation front, which is critical for stability and sustainability of a conducive business environment for one of the key sectors of Kenya’s economy. We are of the view that insurance companies have a lot they can do in order to register considerable growth and improve the level of penetration in the country to the 2018 continental average of 3.5%, namely:

- We expect the synergy between banks and insurance companies to offer Bancassurance to continue, with penetration levels in insurance companies still low. Insurance companies will still want to leverage on the penetration of bank products to also push insurance products. Integration of mobile money payments to allow for policy payments is also expected to continue because of convenience which it provides and also mobile phone penetration in the country is high therefore insurance companies will want to leverage this to improve penetration,

- Technology and innovation capabilities are set to continue being the key anchors of growth for Sub-Saharan Africa in the coming years and thus it would be a great move for the sector to continue adopting mobile and online underwriting platforms enhancing convenience to customers in taking insurance policies thus raising the uptake of insurance products, and,

- We also expect that there will be increased regulation in the sector, as well as increased consolidation to reduce duplication of products by insurance companies. These efforts will improve revenue channels for insurance firms and uptake of insurance products to enhance the sustainability of profitability.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.