Jan 13, 2019

In 2018, the Kenyan economy recorded an average growth of 6.0% for the first three quarters of 2018, compared to an average of 4.7% in a similar period in 2017. The growth was mainly supported by (i) recovery in agriculture due to improved weather conditions, (ii) increased output in the manufacturing, and wholesale & retail trade sectors, and (iii) continued recovery of the tourism sector.

We project 2019 GDP growth to come in between 5.7% and 5.9%, supported by:

- Continued growth of the agricultural sector, as a result of expected improvement of weather conditions and increased budgetary allocation to the sector for ongoing irrigation projects, strategic food reserves, cereal and crop enhancement and crop insurance schemes, in order to enhance food security and nutrition, which is a key pillar on the “Big 4 Agenda”,

- Continued strong growth in the real estate and tourism sectors. Tourism has continued to record doubled digits growth, having averaged 15.1% in the first three quarters of 2018 mainly boosted by a rise in the number of visitors’ arrivals as well as a notable rise in conference activities. We expect growth in the sector to continue, driven by the introduction of direct flights to and from the US and the continued efforts of marketing of the country’s tourist attraction sites. Growth in the real estate sector is expected to be supported by improved infrastructure, as well as the increased focus on the affordable housing initiative,

- Public infrastructural investments are expected to be driven by the budgetary allocations in infrastructural projects, with the highest allocation being on road constructions at Kshs 87.5 bn (domestically financed) and Kshs 34.2 bn (foreign financed), as well as allocations in energy, rail and ports construction, ICT and on sustaining water supplies, and,

- Growth in the manufacturing sector driven by the Kenyan Government’s initiatives, like reducing the cost of energy, aimed towards supporting the various industries, such as textile, leather and agro-business.

Private sector credit growth improved in 2018, averaging 3.4% in the 10-months to October, compared to 2.3% in a similar period in 2017, but remained below the 5-year average of 12.4%. The low credit growth has persisted since the enactment of the Banking (Amendment) Act, 2015, with banks finding it difficult to adequately price risk, prompting banks to reassess their risk assessment framework, preferring to lend to the government at the expense of the private sector, as returns are higher on a risk-adjusted basis. With the rate cap still in place coupled with the implementation of IFRS 9, which requires banks to be more prudent in terms of provisioning for bad loans, we expect private sector credit growth to remain well below the government target of 18.3%.

Currency:

The Kenyan Shilling remained resilient in 2018, appreciating by 1.3% against the USD during the year to close at Kshs 101.3, from Kshs 103.2 in 2017. This saw the shilling reclassified to a stabilized arrangement from floating by the IMF, necessitated by the fact that Kenya Shilling has remained within a margin of 2.0% against its “de facto” anchor exchange rate with the US Dollar for at least 6-months. On an YTD basis, the Kenyan Shilling has gained by 0.1% against the US Dollar, and we expect it to remain stable within a range of Kshs 101.0 and Kshs 104.0 against the USD in 2019, with the underlying fundamentals still similar to the previous year, supported by:

- The CBK’s intervention activities, as they have sufficient forex reserves to protect the shilling against any instability, currently at USD 8.0 bn, equivalent to 5.2-months of import cover,

- Improving diaspora remittances, having increased by 42.5% to USD 2.2 bn during the first 10-months of 2018, from USD 1.6 bn during the same period in 2017, with the largest contributor being North America at USD 1.2 bn attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient,

- The continued narrowing of the current account deficit to 5.3% in the 12-months to September 2018, compared to 6.5% in September 2017. The narrowing of the current account deficit is largely due to increased exports of tea and horticulture, increased diaspora remittances, strong receipts from tourism, and lower imports of food and SGR-related equipment in 2018, relative to 2017. Come 2019, the current account is likely to come under pressure mainly due to the continued rise of the oil’s import bill mainly attributed to increased domestic demand, coupled with an expected recovery of global oil prices, and,

- A decline in food imports and improved agricultural exports as production improves due to improved weather conditions.

Inflation:

In 2018, inflation averaged 4.7% compared to the 2017 average of 8.0%. Inflation rose towards the tail end of the year to 5.7% in December, mainly due to rising fuel prices due to the implementation of the 8.0% VAT on fuel. We expect inflation to average 5.4% in 2019, within the government target range of 2.5% - 7.5% with inflationary pressure gradually picking up, due to the base effect and the uptick in international oil prices. We also expect the effects of the 8.0% VAT on petroleum products as well as other tax policy measures introduced in a bid to raise revenue in line with the government’s efforts of fiscal consolidation to continue being felt in 2019, especially in the first half of the year. Inflationary pressure is however, expected to be mitigated by the continued decline in food prices following favorable weather conditions, as well as lower energy prices due to the recent downward revision in electricity tariffs.

Interest Rates:

We expect monetary policy to remain relatively stable in 2019, and lean to a possible easing, as the CBK monitors Kenya’s inflation rate and the currency. The inflation rate is expected to remain within the government target of 2.5% - 7.5% due to improved weather conditions, leading to relatively lower food inflation, while the currency is expected to remain stable supported by improved diaspora remittances and a narrowing current account deficit.

The table below summarizes the various macro-economic factors and the possible impact on the business environment in 2018. With three indicators being positive, three at neutral and one negative, the general outlook for the business environment in 2019 is POSITIVE. The only change from last year’s outlook is on investor sentiment to neutral from positive in 2018, necessitated by the increased sell-offs by foreign investors in the equity markets as well as the increased risk perception, which has seen the country’s debt distress raised from low to moderate.

|

Macro-Economic & Business Environment Outlook |

||

|

Macro-Economic Indicators |

2019 Outlook |

Effect |

|

Government Borrowing |

•With the expectations of KRA not achieving the revenue targets, we expect this to result in further borrowing from the domestic market to plug in the deficit. This coupled with heavy maturities might lead to pressure on domestic borrowing •The government has a net external financing target of Kshs 272.0 bn to finance the budget deficit, coupled with the need to retire 3 commercial loans maturing in H1’2019. We expect this to put pressure on yields on Eurobond yields coupled with the higher country risk perception by investors, partly attributed to the International Monetary Fund (IMF) raising the risk of Kenya’s debt distress from low to moderate on October |

Negative |

|

Exchange Rate |

•We project that currency will range between Kshs 101.0 and Kshs 104.0 against the USD in 2018, with continued support from the CBK in the short term through its sufficient reserves of USD 8.0 bn (equivalent to 5.2-months of import cover) |

Neutral |

|

Interest Rates |

•We expect slight upward pressure on interest rates in H1’2019, as the government falls behind its domestic borrowing targets for the fiscal year coupled with heavy domestic maturities of Kshs 586.1 bn for the current financial year. This is however expected to be mitigated by the increased demand for government securities due to improved liquidity in the market and crowding out of the private sector |

Neutral |

|

Inflation |

•We expect inflation to average 5.4% and within the government target range of 2.5% - 7.5% |

Positive |

|

GDP |

•5.8% growth projected in 2019, lower than the expected growth rate of 6.0% in 2018, but higher than the 5-year historical average of 5.4% |

Positive |

|

Investor Sentiment |

•We expect 2019 to register improved foreign inflows from the negative position in 2018, mainly supported by long term investors who enter the market looking to take advantage of the current low/cheap valuations in select sections of the market |

Neutral |

|

Security |

•We expect security to be maintained in 2019, especially given that the political climate in the country has eased, with security maintained and business picking up |

Positive |

Eurobond Yields:

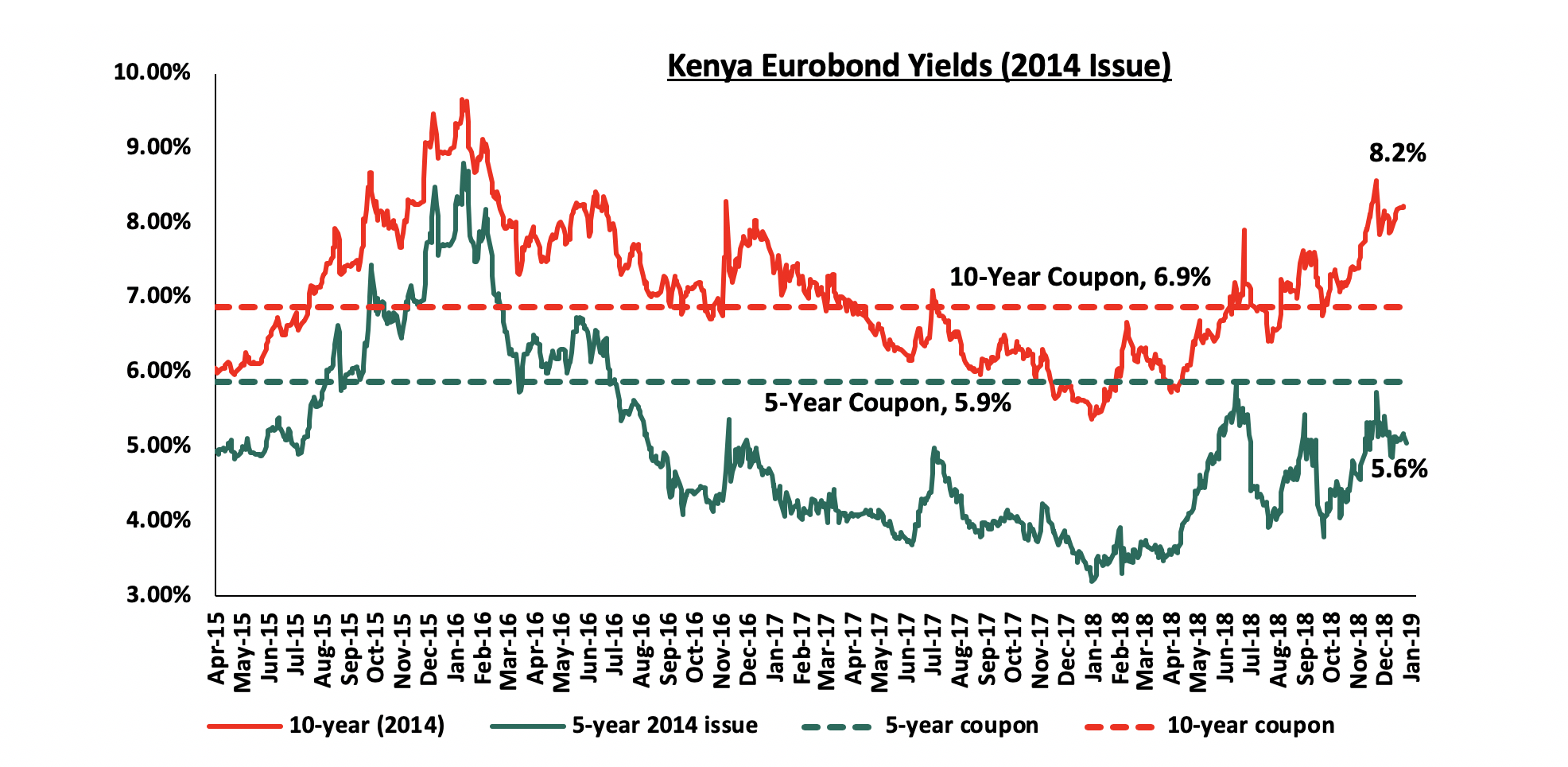

According to Bloomberg, yields on the 5-year and the 10-year Eurobond issued in 2014 increased by 2.2% points and 3.2% points to close at 5.6% and 8.2% at the end of 2018, from 3.4% and 5.0% at the end of 2017, respectively. We expect the trend in rising yields to continue mainly due to higher country risk perception by investors, partly attributed to the International Monetary Fund (IMF) raising the risk of Kenya’s debt distress from low to moderate in October. This coupled with the aggressive tightening monetary policy regime adopted by the U.S Federal Open Market Committee (FOMC), and with the prospects of additional hikes in 2019, is expected to exacerbate the rise in yields as most foreign investors continue pulling out their capital in the wake of rising US treasury yields. Furthermore, the government has a foreign borrowing target of Kshs 272.0 bn, and needs to retire three commercial loans maturing in H1’2019 totaling to Kshs 200 bn, including the repayment of about Kshs 78.3 bn of the debut Eurobond in June. As such, investors will require higher yields to match the risk profile.

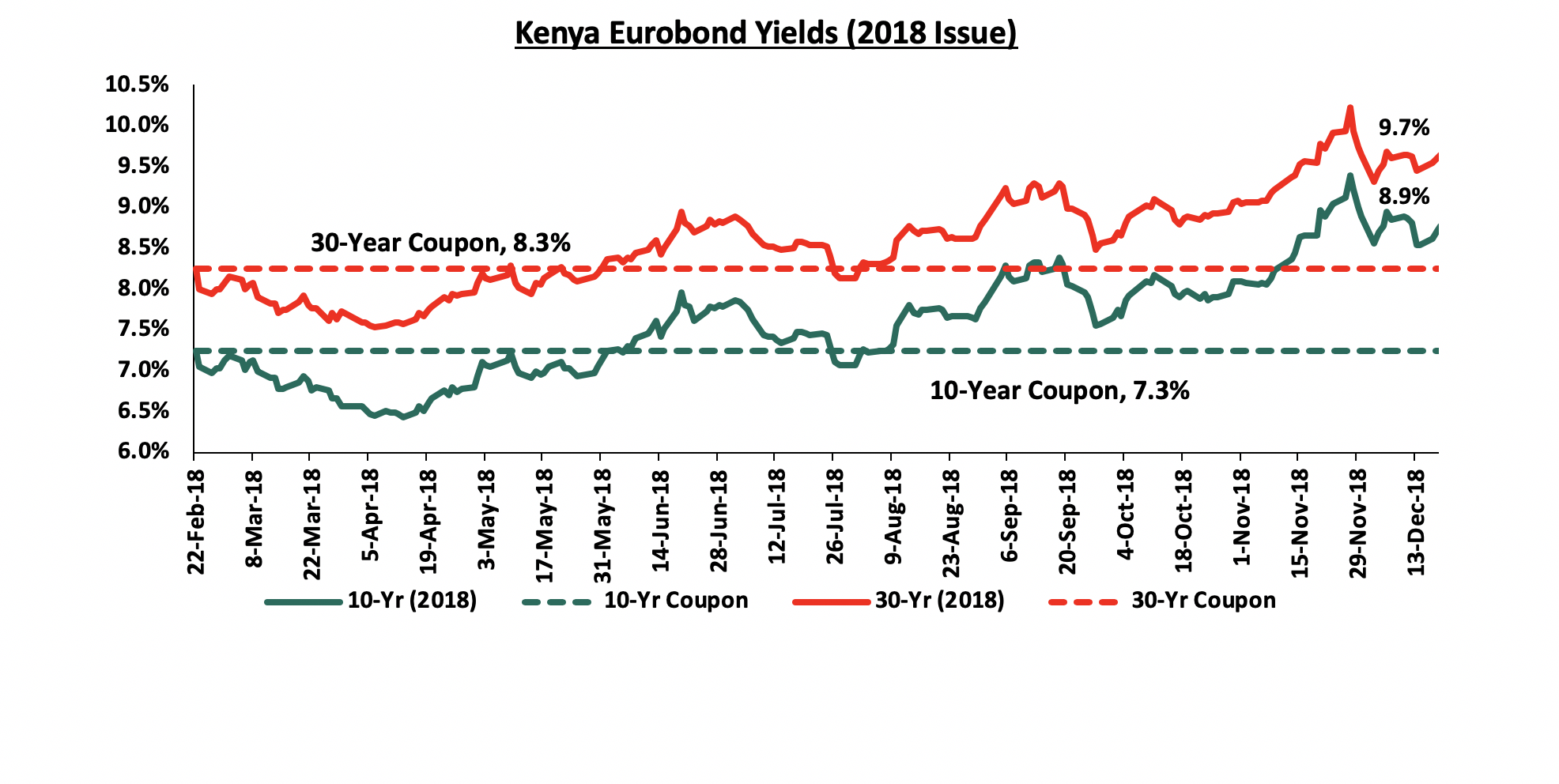

For the February 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond have increased by 1.7% points and 1.5% points to close the year at 8.9% and 9.7% from a yield of 7.3% and 8.3% when they were issued in February 2018, respectively.