Oct 2, 2022

The Kenyan Economy is projected to grow at an average of 5.1% in 2022 lower than the 7.5% growth recorded in 2021 amid the elevated inflationary pressures, persistent geopolitical pressures and erratic weather conditions. The table below shows the projections according to various organizations:

|

No. |

Organization |

2022 GDP Projections |

|

1. |

International Monetary Fund |

5.7% |

|

2. |

National Treasury |

6.0% |

|

3. |

World Bank |

5.5% |

|

4. |

S&P Global |

4.5% |

|

5. |

Cytonn Investments Management PLC |

4.0% |

|

Average |

5.1% |

|

Source: Cytonn Research

Key to note, Kenya’s general business environment has continued to deteriorate with the average Purchasing Manager’s Index 45.3 in Q3’2022, compared to 50.7 recorded in the same period in 2021 mainly on the back of increased commodity prices which have seen reduced consumer spending.

Inflation:

The average inflation rate increased to 8.7% in Q3’2022, compared to 6.7% in Q3’2021, attributable to the increase in food and fuel prices in the period under review. Notably, the prices of super petrol, diesel and kerosene have increased by 38.2%, 49.2% and 42.9% to Kshs 179.3 per litre, Kshs 165.0 per litre and Kshs 147.9, from Kshs 129.7 per litre, Kshs 110.6 per litre and Kshs 103.5 per litre, year to date.

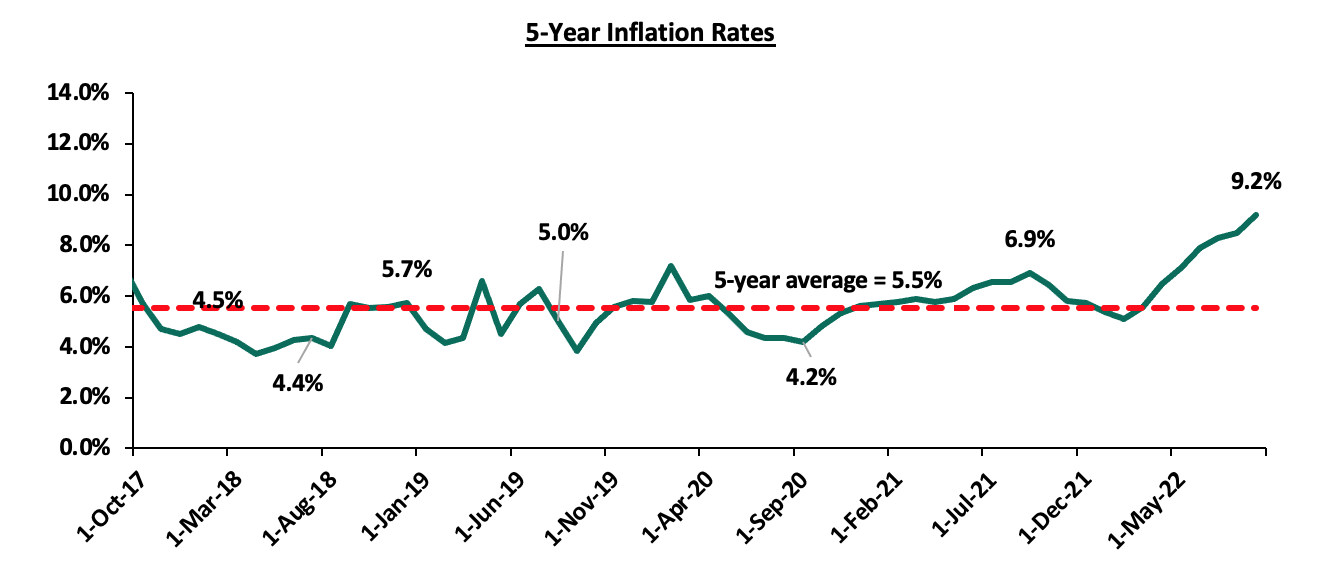

September 2022 Inflation - Inflation for the month of September 2022 came in at 9.2%, the highest since June 2017, and an increase from the 8.5% recorded in August 2022. The increase was mainly attributable to a 15.5%, 10.2% and 7.3%, increase in the food and non-alcoholic beverages index, transport as well as housing, water, electricity, gas and other fuels. Below is the chart showing the inflation trend for the last five years:

Going forward, we expect inflationary pressures to remain elevated primarily owing to the high fuel and food prices. Even as the global fuel prices decline, we do not expect the country’s prices to fall given the partial removal of the fuel subsidy which we expect to be completely eliminated in the coming months. Key to note is that the Monetary Policy Committee raised the Central Bank Rate to 8.25%, from the previous 7.50% with the aim of anchoring the inflation rate which has continued to increase over the last eight months. Despite the monetary stance, we still believe that the inflationary pressures are due to external shocks and a decline is largely pegged on how soon global supply chains stabilize.

The Kenyan Shilling:

The Kenyan Shilling depreciated against the US Dollar by 2.5% in Q3’2022, to close at Kshs 120.7, from Kshs 117.8 at the end of Q2’2022, partly attributable to increased dollar demand in the energy, oil and manufacturing sectors. Key to note, this is the lowest the Kenyan shilling has traded against the dollar. During the week, the Kenya Shilling depreciated against the US Dollar by 0.1% to close at 120.7, from 120.6 the previous week. We expect the shilling to remain under pressure in 2022 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand as most economies gradually recover,

- An ever-present current account deficit estimated at 5.2% of GDP in the 12 months to August 2022, same as that was recorded in a similar period in 2021, and,

- The aggressively growing government debt which continues to put pressure on forex reserves given that 68.1% of Kenya’s debt is US Dollar denominated as of July 2022.

The shilling is however expected to be supported by:

- Sufficient Forex reserves currently at USD 7.4 bn (equivalent to 4.2-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and,

- Sufficient diaspora remittances standing at a cumulative USD 3,992.0 mn as of August 2022, representing a 14.7% y/y increase from USD 3,481.0 mn recorded over the same period in 2021.

Monetary Policy:

The Monetary Policy Committee (MPC) met on September 29th 2022 to review the outcome of its previous policy decisions and recent economic developments, and to decide the direction of the Central Bank Rates (CBR). Notably, the MPC against our expectations, raised the CBR by 75.0 bps to 8.25% from 7.50% in their July 2022 sitting. Below are some of the key highlights from the meeting:

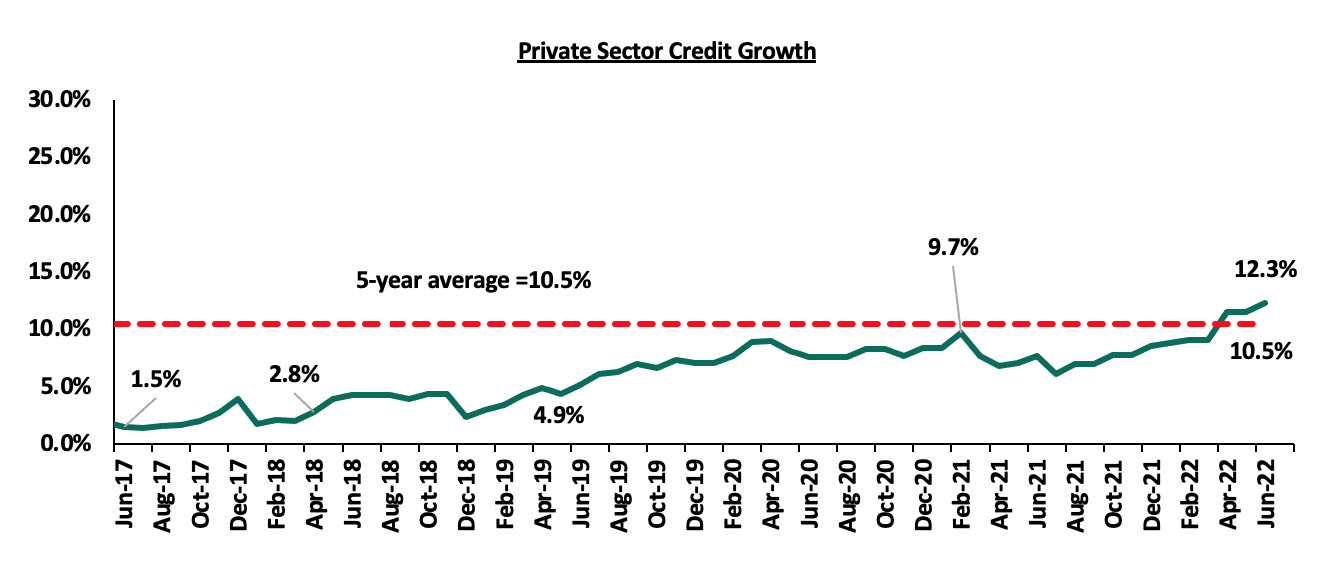

- Private sector credit growth continues to recover, having grown by 12.5% in August 2022, as compared to 7.0% over the same period in 2021. The key sectors that experienced increased lending were business services (16.1%), manufacturing (15.2%), consumer durables (14.3%) and trade (13.3%). The chart below shows the movement of the private sector credit growth of the last five years.

Source: Central Bank of Kenya

- Exports of goods have remained strong, growing by 11.0% in the 12 months to August 2022 compared to 11.5% growth in a similar period in 2021. Key to note, receipts from tea and manufactured goods exports increased by 10.9% and 20.8%, respectively, during the period reflecting improved prices attributable to demand from traditional markets. Additionally, imports of goods increased by 21.4% in the 12 months to August compared to 10.2% in the same period in 2021 mainly reflecting increased imports of oil and intermediate goods, and,

- The current account to GDP is estimated at 5.2% to the 12 months to August 2022, same as that was recorded in a similar period in 2021. Exports remained strong, growing by 11.0% in the 12 months to August 2022 compared to a similar period in 2021. Receipts from exports of manufactured goods and tea increased by 20.8% and 10.9% respectively, while horticulture exports declined by 12.0% in the period of review.

The MPC noted that the sustained inflationary pressures, the elevated global risks and their potential impact on the domestic economy and concluded that there was scope for tightening the monetary policy in order to anchor inflationary expectations. Therefore, the MPC decided to raise the CBR by 75.0 bps to 8.25% from 7.5% as they continue to monitor the impact of the policy measures, as well as developments in the global and domestic economy. The committee will meet again in November 2022, but remains ready to re-convene earlier if necessary.