Jul 4, 2021

Following an economic contraction in 2020, The Kenyan Economy is projected to grow at an average of 5.4% in 2021 according to various organizations as shown below:

|

No. |

Organization |

2021 Projections |

|

1. |

International Monetary Fund |

7.6% |

|

2. |

National Treasury |

6.6% |

|

3. |

World Bank |

4.5% |

|

4. |

S&P Global |

4.4% |

|

5. |

Cytonn Investments Management PLC |

4.0% |

|

Average |

5.4% |

|

Source: Cytonn Research

The growth is largely supported by the gradual recovery of the business environment more so in sectors such as trade and tourism which were the worst hit by the pandemic in 2020. According to the recently released Kenya Economic Update report on Kenya by the World Bank, economic growth is expected to be driven by;

- An upturn in economic activity attributable to the reopening of the economy,

- Moderate recovery in the service sector as the vaccine rollout continues to pick up pace, and,

- Adequate agricultural output and sales, aided by rising external demand from the gradually reopening global economy.

There was a general optimism in the first half of the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first five months averaging 49.7, which is higher than the 42.4 recorded in H1’2020, pointing to a solid improvement in the private sector.

Inflation:

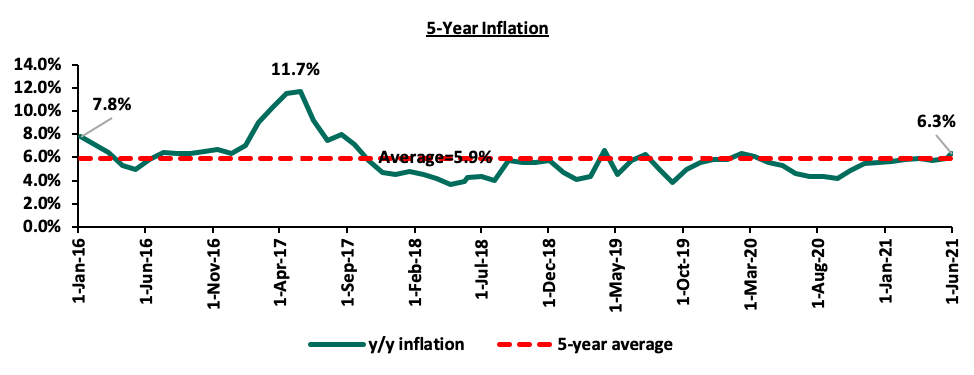

The average inflation rate increased to 5.9% in H1’2021, compared to 5.6% in H1’2020, attributable to the sharp increase in oil prices in H1’2021, which are up 43.3%. Inflation for the month of June 2021 came in at 6.3%, the highest since February 2020, and an increase from the 5.9% recorded in May, attributable to a 13.5% increase in the fuel index, an 8.5% increase in the food and beverages index and a 2.6% increase in the Non-food and fuel index during the month. Going forward, we expect inflation to remain within the government’s target range of 2.5% - 7.5%, mainly due to the rising global fuel prices and the expiry of the tax measures at the start of the year.

Below is the inflation chart for the last five years:

The Kenya Shilling:

The Kenya Shilling appreciated against the US Dollar by 1.2% in H1’2021, to close at Kshs 107.9, from Kshs 109.2 at the end of Q4’2020, partly attributable to dollar inflows from the Eurobond issue in addition to IMF and World Bank loan disbursements in Q2’2021. During the week, the Kenya Shilling depreciated against the US Dollar by 0.2% to close at 108.0, from 107.8 the previous week. Despite the appreciation witnessed in the first half of 2021, we expect the shilling to remain under pressure as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities, and,

- Demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 9.5 bn (equivalent to 5.8-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. Key to note, there was an increase in the forex reserves attributable to proceeds of the Eurobond issue coupled with the USD 407.0 mn IMF disbursement and the USD 130.0 mn World Bank loan financing received during the week,

- The stable current account position which is estimated to remain at a deficit of 5.2% of GDP in 2021, and,

- Improving diaspora remittances evidenced by a 22.3% y/y increase to USD 315.8 mn in May 2021, from USD 258.2 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Monetary Policy:

The Monetary Policy Committee (MPC) met thrice in H1’2021, maintaining the Central Bank Rate (CBR) at 7.00% for the nine consecutive sitting. The MPC held that the current accommodative monetary policy measures are still needed and are sufficient to support the economy.

Fiscal Policy:

The Kenyan budget for the FY’2021/2022 National Budget is projected at Kshs 3.0 tn, a 4.8% increase from the Kshs 2.9 tn final FY’2020/21 budget. The government projected that total revenue will increase by 10.3% to Kshs 2.0 tn, from the Kshs 1.8 tn in FY’2020/2021, with the increase largely being projected to come from ordinary revenue. The projected revenues were mainly pegged on Kenya’s economic recovery, broadening the tax base and tax reforms. For more information, see our note on Kenya’s FY’2021/2022 Budget Review,

On the FY’2021/2022 outturn, it is projected that the government shall be below its budget having spent Kshs 2.4 tn, equivalent to 80.1% of the revised budget of Kshs 2.9 tn and the total collections stood at Kshs 2.4 tn, equivalent to 80.1% of the revised target of Kshs 2.9 tn for the first 11 months of FY’2021/2022. The total borrowings stood at Kshs 895.0 bn as at 31st May 2021, equivalent to 70.3% of the revised borrowing target of Kshs 1.3 bn.

Going forward, we still expect the government will continue to lag behind in collections in the current fiscal year due to the low economic activity.

Weekly Highlights:

- World Bank Loan

During the week, the World Bank Board of Executive Directors approved a USD 130.0 mn (Kshs 14.0 bn) additional loan financing for the Kenya COVID-19 Health Emergency Response Project to facilitate affordable and equitable access to COVID-19 vaccines for Kenyans. The funding will enable Kenya to procure more vaccines through the African Vaccine Acquisition Task Team (Avatt) and the COVID-19 Vaccines Global Access (Covax) facilities in addition to supporting the deployment of the vaccines by boosting the country’s cold-storage capacity. The funding is the second additional financing for the Kenya COVID-19 Health Emergency Response Project, bringing World Bank’s total contribution to USD 140.0 mn (Kshs 15.1 bn) under the project. Since the start of the pandemic, World Bank’s total contribution to Kenya’s COVID-19 response now stands at USD 246.0 mn (Kshs 26.5 bn).

The World Bank funding will enhance the country’s COVID-19 response by financing the acquisition of additional vaccines and establishment of 25 county vaccination stores in addition to boosting the vaccines storage capacity. In our view, the financing will also facilitate the country’s target of 10 mn fully vaccinated Kenyans by December 25th 2021, which will in turn boost the country’s economic recovery.