Jun 30, 2024

According to the Kenya National Bureau of Statistics (KNBS) 2024 Economic Survey, the Kenyan economy recorded a 5.6% expansion in FY’2023, faster than the 4.9% growth recorded in FY’2022. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 6.5% in FY’2023 compared to a contraction of 1.5% in FY’2022. All sectors in FY’2023, except Mining and Quarrying, recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to FY’2022, with Agriculture, Forestry and Fishing, Accommodation and Food Services, and Real Estate Sectors recording the highest growth improvements of 7.9% points, 6.8% points, and 2.8% points, respectively. Notably, the improved growth in the economy highlighted the economy’s resilience following multiple shocks such as supply chain constraints, soaring global fuel prices, elevated inflationary pressures and currency depreciation. The Kenyan Economy is projected to grow at an average of 5.3% in 2024 according to various organizations as shown below:

|

Cytonn Report: Kenya 2024 Growth Projections |

||

|

No. |

Organization |

2024 GDP Projections |

|

1 |

International Monetary Fund |

5.3% |

|

2 |

National Treasury |

5.5% |

|

3 |

World Bank |

5.2% |

|

4 |

Fitch Solutions |

5.2% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.3% |

|

Source: Cytonn Research

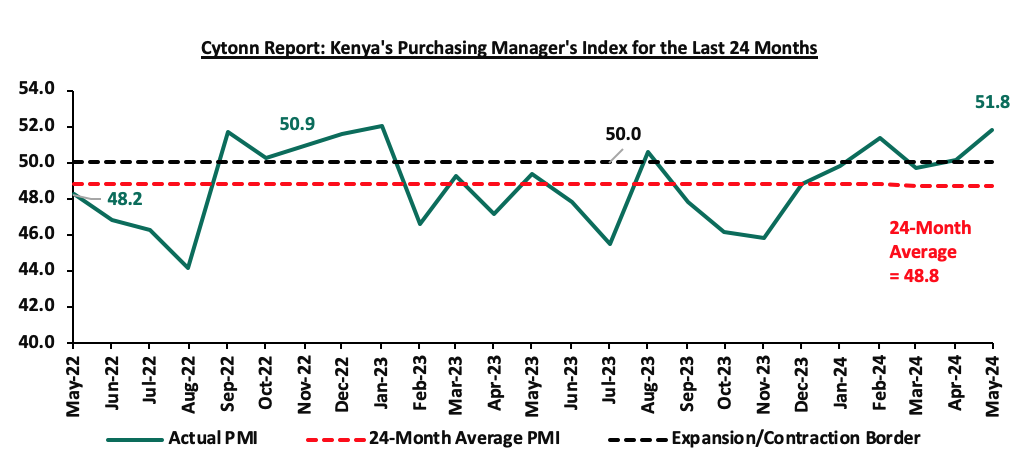

Key to note, Kenya’s general business environment improved in the first half of 2024, with the average Purchasing Manager’s Index for the first five months of the year coming at 50.5, compared to 48.9 recorded in a similar period in 2023. The improvement was mainly on the back of the eased inflationary pressures experienced in the country, which have seen consumers increase their spending, coupled with aggressive appreciation of the Kenyan shilling which has contributed significantly to the reduced cost of inputs and production by most businesses. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Inflation:

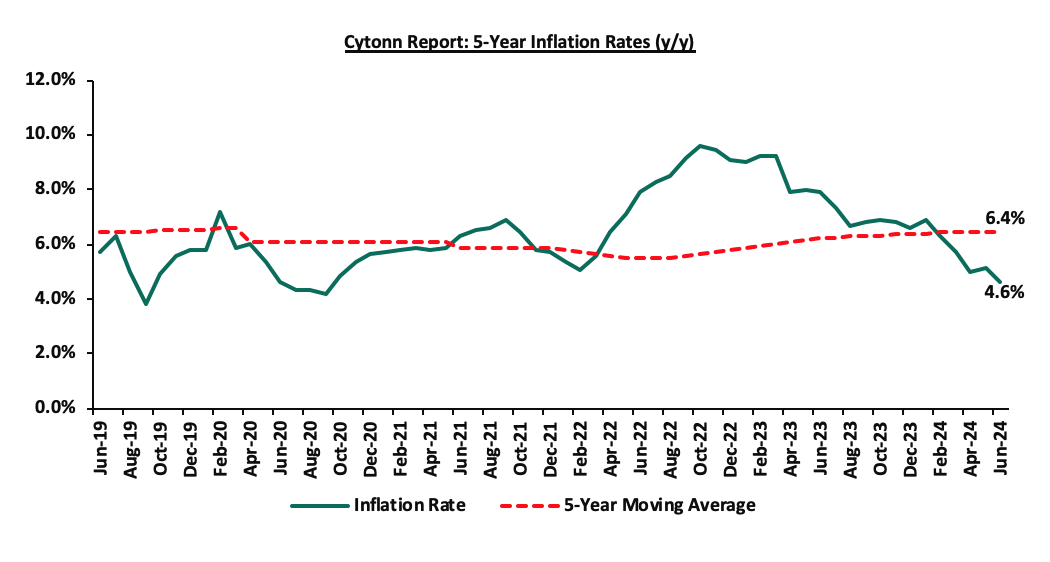

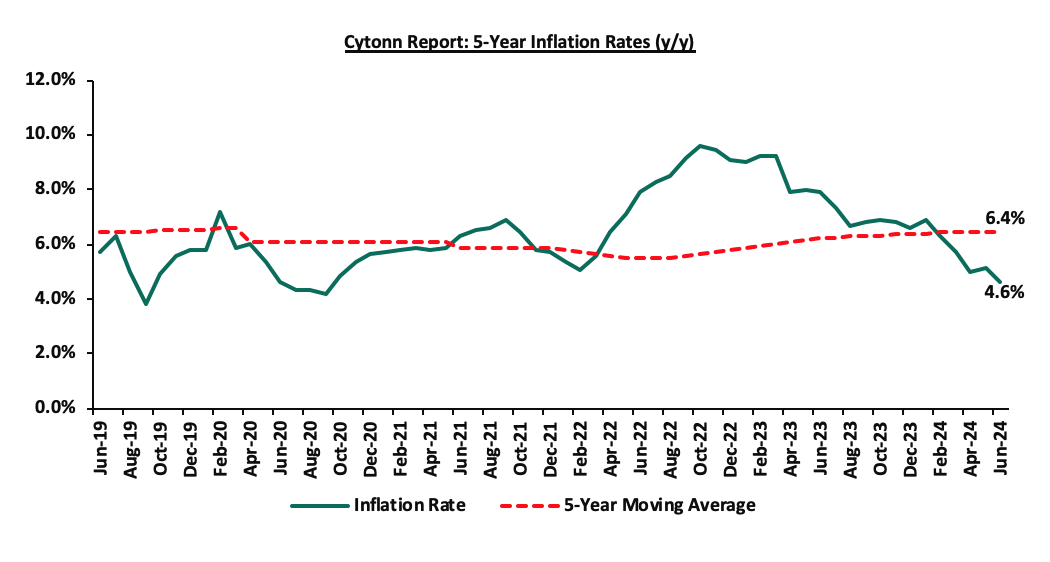

The average inflation rate decreased to 5.6% in H1’2024, compared to 8.5% in H1’2023, attributable to an appreciating Shilling, leading to reduced fuel prices. Notably, fuel prices decreased by 2.9%, 3.7% and 6.0% in June 2024 to Kshs 189.8, Kshs 173.1 and Kshs 163.1, from Kshs 195.5, Kshs 179.7, and Kshs 173.4 per liter in June 2023 for Super petrol, Diesel, and Kerosene, respectively. Inflation for the month of June 2024 eased to 4.6%, from 5.1% recorded in May 2024, mainly driven by a 0.2% decrease in the transport index. Below is a chart showing the inflation trend for the last five years:

For the last 12 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling, reduced fuel and electricity prices, and efforts by the Monetary Policy Committee (MPC) to contain the rise by raising the Central Bank Rate (CBR) by cumulative of 250 bps in June to 13.0% in June 2024 from the 10.5% CBR rate that was set in June 2023. Going forward, we expect the inflationary pressures to remain within the CBK’s preferred target, mainly on the back of stronger Shilling, reduced fuel and electricity prices. However, the high VAT on petroleum products of 16.0% is meant to hold the fuel prices elevated in the country.

June 2024 Inflation

The y/y inflation in June 2024 decreased by 0.5% points to 4.6%, from the 5.1% recorded in May 2024. This was within our expectation of a decline, but slightly below our projected range of 4.7% to 5.1%. The headline inflation in June 2024 was majorly driven by increase in prices of commodities in the following categories; transport, food and non-alcoholic beverages, and housing, water, electricity, gas and other fuels by 7.7%, 5.6% and 3.1%, respectively. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – June 2024 |

|||

|

Broad Commodity Group |

Price change m/m (June-2024/May-2024) |

Price change y/y (June-2024/June-2023) |

Reason |

|

Transport |

(0.2%) |

7.7% |

The m/m decrease recorded in the transport Index was mainly attributable to the decline in the prices of diesel and petrol by 3.4% and 1.6% per litre respectively. |

|

Food and non-alcoholic beverages |

0.7% |

5.6% |

The m/m increase was mainly driven by the increase in prices of commodities such as cabbages, spinach and Sukuma wikiby 14.8%, 11.3%, and 10.7%, respectively. However, the increase was weighed down by decrease in prices of oranges, sugar and maize flour-sifted by 2.5%, 2.4%, and 2.0%, respectively |

|

Housing, water, electricity, gas and other fuels |

0.4% |

3.1% |

The m/m performance was mainly driven by the increase in prices of Electricity of 50kWh and 200kWh by 3.4% and 2.9% respectively. However, the price of gas/LPG and kerosene dropped by 0.2% and 3.4% respectively. |

|

Overall Inflation |

0.4% |

4.6% |

The m/m decrease was mainly attributable to the 0.2% decrease in transport. |

Notably, June’s overall headline inflation was back on the decline after increasing marginally in May 2024. This resumes the declining trend seen in the three consecutive months up to April 2024. Furthermore, it has remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the twelfth consecutive month. The decrease in headline inflation in June 2024 comes amid the decline in the prices for Super Petrol, Diesel and Kerosene which decreased by Kshs 3.0, Kshs 6.1 and Kshs 5.7 each respectively, and will retail at Kshs 189.8, Kshs. 173.1 and Kshs. 163.1 per litre respectively, for the period between 15th June 2024 to 14th July 2024. The chart below shows the inflation rates for the past 5 years:

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency, tight monetary policy and reduced fuel prices. The risk, however, lies in the fuel prices which despite their decline in June 2024, still remain elevated compared to historical levels.. Key to note is that the Monetary Policy Committee maintained the Central Bank Rate at 13.0% in its June 2024 meeting, with the aim of anchoring the inflation rates further. In our view, the rate will be pegged on whether the shilling will sustain its appreciation against the dollar, resulting in a decline in the import bill and costs passed to consumers through hiked consumer prices. Additionally, favourable weather conditions may also contribute to stabilizing food prices, further supporting lower inflation rates.

The Kenyan Shilling:

The Kenyan Shilling appreciated against the US Dollar by 17.2% in H1’2024, to close at Kshs 129.5, from Kshs 156.5 as at the end of FY’2023, mainly attributable to the February buyback of the June maturity Eurobond, which alleviated the credit risk on the country, coupled with the infrastructure bond issue which attracted foreign investors as well as panic selling of dollars by investors which increased dollar supply in the market. During the week, the Kenya Shilling depreciated against the US Dollar by 0.8% to close at 129.5, from 128.6 the previous week, partly attributable to the last maturity payment of the June Eurobond.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,509.8 mn in the 12 months to May 2024, 12.8% higher than the USD 3,997.3 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the May 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period, and,

- High Forex reserves currently at USD 7.8 bn (equivalent to 4.1-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, albeit lower than EAC region’s convergence criteria of 4.5-months of import cover. Notably, the reserves were boosted by the USD 1.2 bn inflow under Development Policy Operations (DPO) from the World Bank in the previous week, with part of it being used to settle the last payment of the June maturity Eurobond, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 27.2% to 2.1 mn in the 12 months to March 2024, from 1.6 mn recorded during a similar period in 2023.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 4.0% of GDP in FY’2023 from 5.1% recorded in FY’2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.3% of Kenya’s external debt was US Dollar denominated as of December 2023, and,

Monetary Policy:

The Monetary Policy Committee (MPC) met three times in H1’2024 and for the first time since October 2012, the Central Bank Rate was set at 13.0% in the first sitting in February 2024, owing to the sustained depreciation of the Kenyan Shilling and elevated inflationary pressures in the country on the back of high fuel and commodity prices. Additionally, the MPC has retained the CBR at 13.0% during its last two meetings despite a gaining Shilling, eased inflation, and an improved global outlook for growth, owing to continued stickiness in inflation in advanced economies, and persistent geopolitical tensions. Below are some of the Key highlights from the June meeting:

- The overall inflation tightened marginally to 5.1% in May 2024, from 5.0% in April 2023, positioning it at the mid-point of the preferred CBK range of 2.5%-7.5%, mainly driven by the high fuel prices, despite the decrease in fuel inflation. Fuel inflation decreased to 7.8% in May 2024 from 8.3% in April 2024, largely attributable to a downward adjustment in pump prices and lower electricity tariffs. The food inflation increased to 6.2% in May 2024 from 5.6% in April 2024, attributable largely to higher prices of a few vegetables i.e. onions, kales, tomatoes and Irish potatoes, following a decline in supply due to the recent heavy rains and floods in some parts of the country. The increase was however mitigated by a decrease in the prices of a few non-vegetable food items, particularly maize, sugar, and wheat flour. The non-food non-fuel inflation slightly decreased to 3.4% in May 2024 from 3.6% in April 2024. We expect the overall inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency, tight monetary policy, reduced fuel prices and reduced electricity prices,

- The recently released Economic Survey 2024 for FY’2023 showed continued strong performance of the Kenyan economy, with real GDP growing by 5.6%, from a growth of 4.9% in 2022. This was attributable to a strong rebound in the agriculture sector due to favorable weather conditions that boosted crop and livestock production and a resilient performance of the services sector. Leading indicators of economic activity pointed to continued strong performance in the first quarter of 2024. Despite the recent flooding in some parts of the country, the economy is expected to continue to strengthen in 2024, supported by the resilient services sector, the rebound in agriculture, and the implementation of measures to boost economic activity in priority sectors by the Government.

- Goods exports increased by 2.9% in the 12 months to April 2024, compared to a similar period in 2023, reflecting a rise in exports of agricultural commodities and re-exports. Receipts from tea and fruits and vegetables exports increased by 5.6% and 10.5% respectively, while re-exports grew by 38.1% in the period. Notably, exports increased 15.2% in the first four months of 2024 compared to the same period in 2023. Imports declined by 7.7% in the 12 months to April 2024 compared to a similar period in 2023, mainly reflecting lower imports across all categories except machinery and transport equipment. However, imports increased by 2.2% in the first four months of 2024 compared to the same period in 2023. Tourist arrivals improved by 27.2% in the 12 months to March 2024, compared to a similar period in 2023. Remittances totaled USD 4,457 mn in the 12 months to April 2024 and were 11.9% higher compared to USD 3,985 mn in a similar period in 2023. The current account deficit is estimated at 4.1% of GDP in the 12 months to April 2024, down from 4.8% of GDP in a similar period in 2023, and is projected at 4.0% of GDP in 2024, reflecting improvement in exports of agricultural products, sustained remittances, recovery in imports supported by stable exchange rate and effects of regional trade integration initiatives.

- The CBK foreign exchange reserves, which currently stand at USD 6,979 mn representing 3.6 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans increased to 16.1% in April 2024 compared to 15.5% in February 2024. Increases in NPLs were noted in the agriculture, real estate, tourism, restaurant and hotels, trade, and building and construction sectors. Banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed a positive outlook on business activity for the next year. Participants of the survey expressed concerns about fiscal policies, high interest rates, and the impact of geopolitical uncertainties on the economy. Despite this, they remained optimistic that economic growth would remain resilient and improve in 2024, supported by increased agricultural production, a resilient service sector and stable macroeconomic activity,

- The Survey of the Agriculture Sector revealed an expectation by respondents that the prices of key food items were expected to remain unchanged or increase in the next three months due to an expected rise in food supply due to favorable weather conditions, stable exchange rate, and lower fuel prices,

- Global growth is expected to increase by 0.1% points to 3.2% in 2024 from 3.1% in 2023, attributable to higher-than-expected growth in the United States and high growth in several large and emerging markets, particularly India. Additionally, headline inflation rates have moderated, though some persistence remains in advanced economies. Food inflation has continued to decline due to an improved supply of key food items, particularly sugar and cereals. International oil prices have moderated because of a reduced risk premium from the Middle East conflict and increased supply from non-OPEC+ oil producers.

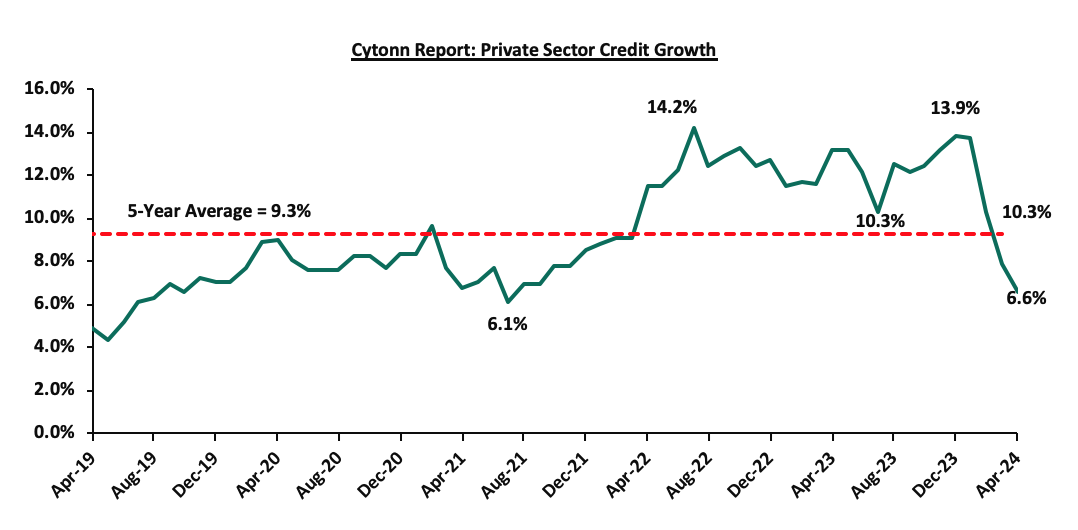

- Growth in private sector credit decreased to 6.6% in April 2024 from 7.9% in March 2024, mainly attributed to exchange rate valuation effects on foreign currency-denominated loans due to the appreciation of the Shilling. In April, local currency loans increased by 14.3%, while foreign currency loans, which make up around 26.0% of total loans, decreased by 14.2%. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee noted the ongoing implementation of the FY2023/24 Government Budget, as well as the proposed FY2024/25 Budget which are expected to continue to reinforce fiscal consolidation.

- The Committee observed that the new monetary policy implementation framework, adopted on August 9, 2023, has led to better functioning of the interbank market, reduced interest rate spreads with decreased market segmentation and improved monetary policy transmission. To further enhance the effectiveness of this framework, the MPC considered and approved a recommendation to narrow the width of the interest rate corridor around the CBR from the current 250 basis points (bps) to 150 bps. Additionally, the MPC approved a recommendation to adjust the applicable interest rate on the Discount Window from the current 400 bps above the CBR to 300 bps above the CBR.

The MPC noted that its previous measures have successfully reduced overall inflation to the mid-point of the target range of 2.5% - 7.5%, stabilized the exchange rate, and anchored inflationary expectations. The Committee also observed that NFNF inflation has remained persistent in recent months and that interest rates in major economies are expected to stay higher for longer due to persistent inflation. The MPC concluded that the current monetary policy stance will maintain overall inflation around the mid-point of the target range in the short term while ensuring continued exchange rate stability. The MPC will closely monitor the impact of its policy measures, as well as developments in the global and domestic economy, and stands ready to take further action as necessary in line with its mandate. The Committee will meet again in August 2024.

Fiscal Policy:

The total Kenyan budget for the FY’2024/2025 National Budget increased by 7.2% to Kshs 4.0 tn from the Kshs 3.7 tn in FY’2023/2024 while the total revenue inclusive of grants increasing by 15.9% to Kshs 3.4 tn from the Kshs 2.9 tn in FY’2023/2024. The increase is mainly due to an 18.8% increase in ordinary revenue to Kshs 2.8 tn for FY’2024/2025, from the Kshs 2.5 tn in FY’2023/2024 with the increase largely dependent on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as an increase in some of the existing taxes to meet its revenue target. However, there are still concerns about the government's ability to meet its revenue collection targets in FY’2024/2025, on the back of the withdrawal of the Finance Bill 2024 after the president declined to assent to it, which was meant to increase revenue by Kshs 302.0 bn, coupled with a tough operating environment.

For the FY’2023/2024, we do not expect the government to meet its revenue collection target having collected Kshs 1,928.8 bn, equivalent to 78.7% of the revised estimates of Kshs 2,452.1 bn for FY’2023/2024 and 85.8% of the prorated estimates of Kshs 2,247.8 bn in the first eleven months of FY’2023/2024. Notably, the total expenditure amounted to Kshs 3,255.8 bn, equivalent to 85.4% of the revised estimates of Kshs 3,813.3 bn, and 93.1% of the prorated expenditure estimates of Kshs 3,495.5 bn, an indication of modest spending by the government. The total borrowings as at the end of May 2024 amounted to Kshs 1232.2 bn, equivalent to 72.4% of the revised estimates of Kshs 1,701.7 bn and 79.0% of the prorated estimates of Kshs 1,559.9bn.

Going forward, we believe that the withdrawn Finance Bill will force the government to borrow more to finance the fiscal deficit owing to reduced revenue collection. We therefore expect the government to cut on its expenditure, mostly the development expenditure in order to finance the growing debt maturities and the ballooning recurrent expenditure.

Weekly Highlights:

- Withdrawal of the Finance Bill 2024

Following nationwide protests that peaked on Tuesday 25th June 2024, President William Ruto, on Wednesday 26th June 2024 conceded to pressure from the public and declined to sign the controversial Finance Bill 2024 into law.

The proposed raft of tax changes in the Finance Bill 2024 were geared towards expanding the tax base and increasing revenues, with an expectation of raising Kshs 302.0 bn. This revenue was intended to support the government's budget of Kshs 4.0 tn for the fiscal year 2024/2025, and to address a budget deficit of Kshs 597.0 bn. The deficit is planned to be financed through external borrowing of Kshs 333.8 bn and domestic borrowing of Kshs 263.2 bn. Kenya’s total public debt to GDP ratio currently stands at 69.7%, which is higher than the 55.0% preferred by the World Bank and the International Monetary Fund (IMF). Below we highlight some of the key tax proposals contained in the Finance Bill 2024, changes made and the implications of the withdrawal of the Bill:

- Under the Income Tax Act:

- Motor vehicle tax: The Bill proposed a new 2.5% tax on the value of motor vehicles, payable when issuing insurance cover

- Withholding Tax on Goods Supplied to Public Entities: The Bill suggested a withholding tax on goods supplied to public entities by residents and non-residents without a permanent establishment. The rate is 3.0% for resident suppliers and 5.0% for non-residents.

- Taxation of Digital Marketplaces and Content Monetization: The Bill proposed taxing income from digital marketplaces or platforms and digital content monetization at 20.0% for non-residents and 5% for residents.

- Repeal of Digital Service Tax and Introduction of Significant Economic Presence Tax: The Bill sought to repeal the digital service tax (DST) and introduce a significant economic presence tax at 30.0% of deemed taxable profit for non-residents earning income from services provided through digital marketplaces in Kenya.

- Tax Deductibility of Contributions to Medical Funds and Housing Levy: The Bill proposed making contributions to the Social Health Insurance Fund, post-retirement medical fund, and affordable housing levy deductible expenses when calculating taxable income.

- Investment Deduction on Spectrum Licence Purchases: The Bill introduced an investment deduction for capital expenditure on spectrum licenses by telecommunications operators at 10% in equal installments. For licenses purchased before 01 July 2024, the deduction is limited to the unamortized portion over the remaining useful life.

- Tax on Interest Income from Infrastructure Bonds: The Bill proposed taxing interest income from infrastructure bonds for resident persons, while non-residents' interest income remains exempt. Interest from previously listed infrastructure bonds will continue to be exempt.

b. Under the Excise Duty Act:

- Introduction of Excise Duty on Digital Services by Non-Residents: The Bill proposed a 20.0% excise duty on services provided by non-residents through digital platforms in Kenya. This applies to: Telephone and internet data services, fees for money transfer services by banks, money transfer agencies, and other financial service providers, betting, lottery, gaming, and prize competitions, and fees on digital lending.

- Increase of Excise Duty on Money Transfer Services: The Bill suggested raising excise duty from 15.0% to 20.0% on fees for money transfer services provided by banks, money transfer agencies, and other financial service providers, and cellular phone service providers or payment service providers licensed under the National Payment Systems Act, 2011

- Extension of Timeline for Excise Duty Payment by Alcoholic Beverage Manufacturer: The Bill proposed extending the payment timeline for excise duty by licensed alcoholic beverage manufacturers to five working days after removing goods from the stockroom. The previous requirement was to pay within 24 hours.

- Repeal of Automatic Adjustment for Inflation: The Bill proposed removing provisions for the automatic adjustment of excise duty rates on excisable goods for inflation.

c. Under the Value Added Tax (VAT) Act

- VAT on Financial Services: The Bill proposed removing VAT exemptions for several financial services, making them subject to the standard VAT rate of 16.0%. These services include: Issuing credit and debit cards, telegraphic money transfers, foreign exchange transactions, cheque handling and processing, issuing securities for money, debt assignment for consideration, financial services provided on a commission basis

- Increase of VAT Registration Threshold: The Bill proposed raising the threshold for mandatory VAT registration from Kshs 5.0 mn to Kshs 8.0 mn.

- Exemption for Transfer of Business: The Bill proposed exempting the transfer of a business as a going concern from VAT, which is currently taxed at 16.0%.

- VAT on Insurance Premiums: The Bill proposed limiting VAT exemptions to insurance and reinsurance premiums only, subjecting other related services to the standard VAT rate of 16.0%.

- VAT on Betting, Gaming, and Lotteries: The Bill proposed removing the VAT exemption for betting, gaming, and lotteries, making them subject to the standard VAT rate of 16.0%.

- Removal of VAT Exemptions in Tourism: The Bill proposed deleting the following VAT exemptions in the tourism sector: Goods for the construction of tourism facilities and recreational parks of 50 acres or more, locally assembled vehicles for transporting tourists, purchased by tour operators, services for the construction of tourism facilities and recreational parks of 50 acres or more

- Removal of VAT Exemptions in Manufacturing and Construction: The Bill proposed deleting the following VAT exemptions for the manufacturing and construction sectors: Capital goods promoting investment in manufacturing with a value of at least Kshs 2.0 bn, plant, machinery, and equipment for constructing plastics recycling plants, and goods and services for constructing and equipping specialized hospitals with a minimum bed capacity of 50, approved by the Cabinet Secretary for Health

Changes effected to the Finance Bill 2024 included:

- Removal of VAT on Bread: The Finance Committee scrapped the proposed 16.0% VAT on bread following public backlash.

- Excise Duty on Vegetable Oil: The President approved the removal of a proposed 25.0% excise duty on vegetable oil.

- VAT on Sugar Cane Transportation: The State House eliminated the proposed 16.0% VAT on transporting sugar cane to factories, which could have led to higher sugar prices.

- VAT on Financial Services: The Committee removed VAT on financial services and foreign exchange transactions, preventing a potential increase from 15.0% to 40.0% that could have affected forex transactions.

- Mobile Money Transfer Charges: The proposed increase of excise duty on mobile money transfer charges from 15.0% to 20.0% was reversed.

- Motor Vehicle Tax: The proposed annual motor vehicle tax of 2.5% of car value, with a minimum of Kshs 5,000 and a maximum of Kshs 100,000, was removed due to public outcry.

- Housing Fund and Social Health Insurance Levies: These proposed levies were converted to tax-deductible expenses, exempting them from income tax and benefiting employees.

- Eco Levy Adjustments: The Eco Levy will now apply only to imported finished products, not locally manufactured goods, addressing concerns about stifling local manufacturing growth.

- Exemptions on Locally Manufactured Products: The Eco Levy will not apply to locally made products, including sanitary towels, diapers, phones, computers, tyres, and motorcycles.

- VAT Registration Threshold: Small businesses with a turnover of less than Kshs 8.0 mn are exempt from VAT registration, up from the previous threshold of Kshs 5.0 mn.

- eTIMS Exemption: Farmers and small businesses with a turnover below Kshs 1.0 mn are exempt from registering for the electronic Tax Invoice Management System (eTIMS).

- Excise Duty on Imported Agricultural Products: The Committee imposed excise duty on imported table eggs, onions, and potatoes to protect local farmers, scrapping the proposed 16.0% VAT.

- Excise Duty on Alcoholic Beverages: Excise duty will be based on alcohol content rather than volume, encouraging the production of safer and more affordable alcohol.

- Pension Contributions: The exemption threshold for pension contributions was increased from Kshs 20,000 to Kshs 30,000.

- Funding for Junior Secondary School Interns: The budget for recruiting Junior Secondary School interns was increased from Kshs 13.4 bn to Kshs 18.0 bn.

- Teacher Intern Recruitment: Funds have been allocated to hire 20,000 teacher interns, with a policy shift to transition these teachers to permanent and pensionable terms.

The withdrawal of the Finance Bill 2024 in Kenya has significant implications for the country's economy and investment landscape. The withdrawal of the Bill will create a revenue shortfall for the FY2024/2025 budget, and will likely result in Kenya missing the 3.3% fiscal deficit target this year and lead to a possible cut in development expenditure, increased borrowing, higher interest rates, and a potential rise in public debt. Furthermore, after reaching staff-level agreement with the IMF, the proposed tax measures reversal will possibly impede the disbursement of future IMF funds. Uncertainty about the budgetary trajectory and the IMF program would further complicate the government's efforts to increase external funding.

The Finance Bill's withdrawal may affect investor confidence, especially if the market perceives it as a sign of political or economic instability, and could impact both domestic and foreign investment inflows. Investors may adopt a wait-and-see approach, leading to decreased market activity.