Dec 23, 2018

Africa remains an attractive investment destination for investors seeking attractive, long-term returns for a number of reasons, including abundant natural resources, improving economic indicators, and a growing population leading to a rise in consumption. GDP growth in Africa is expected to average 3.1% in 2018, higher than the 2.4% growth expected in advanced economies, according to the IMF. With West Africa generally suffering from volatility in commodity prices, and Southern African Development Community (SADC) having low GDP growth (1.6% in 2017), East Africa, whose economy grew by 5.9% in 2017, has emerged as an important and vibrant investment region in Africa due to a relatively diversified economy that contributes to stable economic growth. In addition to its strategic location as a gateway to the East African Region, Kenya hosts the largest expatriate community in the continent, has the most diversified economy in East Africa, and leads in terms of technological innovation, cementing its place as the regional hub of East Africa. This is evident from the significant number of multinationals and NGO’s that have chosen Nairobi as either their regional hub. A sample of the global brands that have selected Nairobi to set up shop include Google, General Electric, LG, Standard Chartered, Coca-Cola and Citibank NA.

With the year 2018 coming to a close, a number of factors during the year have led us to review Kenya’s attractiveness as an investment destination for foreign capital and local investors, which include:

- The Emerging Market selloff due to rising U.S Treasury yields and a strengthening U.S Dollar. Emerging markets have been on a downward trajectory during the year, with the MSCI Emerging Markets index having declined 13.4% YTD. Kenya’s capital markets have also been on a downward trend during the year, a phenomenon occasioned by the selloffs by foreign investors, which brought asset prices down. This is particularly because foreign investors account for a huge chunk of equity market turnover, though this has been declining, coming in at 60.1% in the year to December 2018, from 0% in 2017, and 70.0% in 2016,

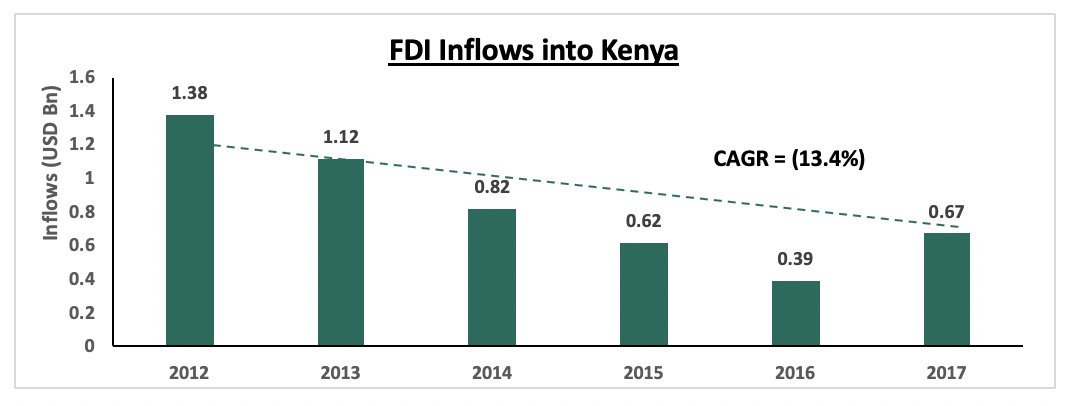

- In addition, foreign direct investment (FDI) into the country has declined at a compounded annual growth rate (CAGR) of (13.4%) in the five-year period from 2012 to 2017,

- The economy has been on a recovery trajectory, having expanded by 5.7% in Q1’2018 and 6.3% in Q2’2018, higher than the 4.8% and 4.7% growth in similar periods the previous year, respectively. The agriculture and manufacturing sectors are the main drivers of this growth, with a contribution of 23.2% and 9.6% in Q2’2018, respectively.

In this note, we analyse the Kenyan investment landscape in a bid to establish and review its attractiveness as an investment destination. The analysis will be broken down as follows:

- Macroeconomic Attractiveness,

- Foreign Direct Investments,

- Attractiveness of Kenyan Capital Markets,

- Ease of Doing Business,

- Other Investment Factors – Corruption Perceptions Index and Political Stability,

- Outlook on the Kenyan Investment Environment

Section I: Macroeconomic Attractiveness:

Macroeconomic fundamentals have remained positive during the year due to improved business environment and investor confidence. Factors contributing to the robust economic growth include:

- Macroeconomic Stability: Kenya has enjoyed relatively high GDP growth, with the economy having expanded by 5.7% in Q1’2018 and 6.3% in Q2’2018. The Central Bank has also remained disciplined in decisions relating to fiscal and monetary policy,

- Supportive Demographic Dividend: Kenya has a young population with increasing disposable income and growing demand for goods and services,

- Improvement in Governance: The Kenyan Government has enacted key political reforms that are strengthening governance. The Central Bank of Kenya adopted an expansionary monetary policy to encourage economic growth, while fiscal policies have also been expansionary as the country’s economic growth is mainly reliant on government spending, which has seen the expenditure side exceeding the revenue collections, leading to the budget deficits, which have been plugged in by borrowing.

- Inflation: Inflationary pressure has been relatively muted in 2018, with y/y inflation having averaged 4.5% in the 10-months to October, down from 8.7% recorded in a similar period in 2017, and well within the 2.5% - 7.5% government set target. The decline has mainly driven by a decline in the food prices on the back of improved food production due to improved weather conditions, which has mitigated the rise in fuel prices and other Consumer Price Index (CPI) components. Inflation in the remaining part of the year is expected to experience upward pressure due to the various tax amendments as per the Finance Bill 2018, but at a lower rate than earlier anticipated. This is due to the reduction of the VAT charge on fuel to 8.0% from 16.0% effective 21stSeptember 2018, affirming our expectations of a 7.0% inflation rate for the year from 8.0% last year, averaging within the government’s set target of 2.5% - 7.5%.

- Security: The political climate in the country has eased, with security maintained and business picking up. The handshake between the Kenyan President and the opposition leader served to calm any political tension. Kenya recently commenced direct flights to and from the USA, which is a sign of improving security in the country.

- Ease of Doing Business: It is considerably easier and quicker to do business than it was 10-years ago, with business opening up further to regional trade, and supportive infrastructure. Kenya has been improving steadily in the World Bank’s Doing Business Report, from position #136 in 2015 to position #61 in the 2019 report, with the score improving to 70.3 from 55.0, out of a possible 100 points.

- Investment in Infrastructure: There is a lot of investment in infrastructure including roads, rail, education etc.

With the above factors in play, we maintain a positive outlook on the Kenya’s macroeconomic environment.

Section II: Foreign Direct Investments

In 2017, global Foreign Direct Investment (FDI) inflows decreased by 23.0% to USD 1.43 tn, according to the World Investment Report by United Nations Conference on Trade and Development (UNCTAD). Despite the decline, Kenya saw FDI increase by 71.0% in 2017, to USD 672.3 mn, from USD 393.0 mn in 2016, buoyed by domestic demand and inflows into ICT industries, as well as additional tax incentives to foreign investors by the Kenyan Government, such as tax credit on foreign tax paid on business income. Since 2012, however, FDI into the country has been steadily decreasing at a CAGR of 13.4% since 2012. Most of the funds received by way of FDI in 2017 was channelled towards the ICT sector, with South Africa’s Naspers, MTN and Intact Software; as well as Boeing, Microsoft and Oracle from the U.S., expanding operations into Kenya. Other entrants into the Kenyan markets included UK beer company Diageo, and American pharmaceutical company Johnson & Johnson. FDI into Kenya is likely to grow, albeit at a slower pace, as the economy continues to recover from the ravages of 2017, as well as the need for foreign capital for infrastructure projects such as the Standard Gauge Railway, which will connect to East African countries when complete.

Section III: Capital Markets Attractiveness:

Kenya’s capital markets are the deepest and most sophisticated in East Africa, with 62 listed companies and a market capitalization of Kshs 2.1 tn (USD 20.0 bn) as at 18th November, 2018. Local regulators have made efforts to deepen liquidity and provide investment opportunities for foreign and domestic investors alike. Year-to-date (YTD), the Nairobi Securities Exchange All Share Index has declined by 17.0%, while the NSE 20 has declined by 25.1%, with the YTD turnover standing at USD 1.7 bn. There has been increased financial integration of the Kenyan capital market with the global financial system, which has exposed it to global liquidity and access to foreign capital. On the other hand, increased integration has rendered capital markets increasingly susceptible to global economic shocks hence increasing capital market volatility. Case in point is the trade spat between U.S and China that began in April, which prompted foreign investors to exit their holdings in emerging market assets in favour of rising U.S Treasury yields and a strengthening U.S Dollar.

Despite Kenya’s sophisticated capital markets relative to its East African peers, ease of entry and exit is hampered by restrictive regulation and low market liquidity, which contributes to high transaction costs. There is need for incremental structural improvements in order to make it more attractive as an investment destination. The Absa Africa Capital Markets Index Report, produced by Official Monetary and Financial Institutions Forum (OMFIF) in association with Absa Group Limited, provides insight into African capital markets and their strengths/weaknesses in attracting foreign investors. The report paints a picture of present positions and suggests how economies can improve market frameworks to meet yardsticks for investor access and sustainable growth. It focuses on six main pillars as a toolkit to strengthen financial markets:

- Market Depth - Examines size, liquidity and depth of markets and diversity of products in each market.

- Access to Foreign Exchange - Assesses the ease with which foreign investors can deploy and repatriate capital in the region.

- Market Transparency, Tax and Regulatory Environment - Evaluates the tax and regulatory frameworks in each jurisdiction, as well as the level of financial stability and of transparency of financial information

- Capacity of Local Investors - Examines the size of local investors, assessing the level of local demands against supply of assets available in each market

- Macroeconomic Opportunity - Assesses countries’ economic prospects using metrics on growth, debt, export competitiveness, banking sector risk and availability of macro data.

- Legality and Enforceability of Standard Financial Markets Master Agreements - Tracks the commitment to international financial market agreements, enforcement of netting and collateral positions and the strength of insolvency frameworks.

Kenya came out among the top countries in the Absa Financial Markets Index, attaining position #3 out of 20 countries ranked, behind South Africa and Botswana. The ranking, which improved from #5 in 2016, came on the back of a relaxation in capital controls, which augmented foreign investors’ ability to deploy and repatriate capital. Out of the 20 countries surveyed, Kenya comes as the second most active foreign exchange market with annual turnover of USD 34.0 bn, behind South Africa’s USD 1.2 tn in annual forex turnover. Despite the strengths, our capital markets can be improved to better attract and retain foreign capital for development purposes. Among the measures that can be taken to improve capital market attractiveness, include

- Encouraging more listings on the NSE, which may be done through privatization of state corporations, reviewing and amending restrictive rules to facilitate active participation in the capital markets, and engaging private equity firms to consider exits by listing.

- Innovation of structured products, that are tailor-made to meet different investors’ needs and expectations. There is need to reduce reliance on bank funding, currently at 95.0%, therefore structured products would assist in steering savings towards capital markets hence creating a more level playing ground and,

- Investor education to emancipate retail investors on investment products and the benefits of saving, in order to channel savings to the capital markets hence supporting market development.

Section IV: Ease of Doing Business in Kenya:

Kenya has made significant political and economic reforms that have driven sustained economic growth and social development over the past decade. Kenya’s economy remains among the most attractive business environments in Africa, according to the World Bank’s Doing Business Report 2019. In the 2018 report, Kenya’s ranking improved by 19 positions to #61 from #80 out of 190 countries ranked. In Africa, Kenya maintained its 4th position from last year’s report after Mauritius, Rwanda and Morocco. The score improved by 5.1 points to 70.3 from 65.2 in the 2018 Report. The improvement was because of improved protection of minority investors, access to credit, improved property registration and insolvency resolution. As highlighted in the report however, there exists room for Kenya to improve its business climate to attract more entrepreneurs and investors to start businesses and foreign direct investment. This can be achieved by;

- Streamlining the processes involved in starting a company by; (i) setting up a one-stop shop for all services required in starting a company, (ii) automating the processes involved, and (iii) eliminating minimum capital requirements.

- Improved sharing of credit information to facilitate lending decisions especially towards the private sector. Kenya should adopt additional sources of customer data, which generates incentives to improve borrower discipline especially following the enactment of Banking Act Amendment 2015 that effectively placed an interest rate cap on loans by commercial banks.

- The tax paying process can be made easier by (i) consolidating payments and filings of taxes, (ii) establishing taxpayer service centres, and (iii) allowing for more deductions, exemptions or lower tax rates.

- Kenya can improve on the efficiency of contract enhancement through (i) reducing the current case backlog by clearing inactive cases from the docket, (ii) automation of court and judicial procedures, (iii) complaints being filed electronically through a dedicated platform within the competent court, (iv) court fees being paid electronically within the competent court enforcing contracts, and (v) reducing the number of days taken to deliver case verdicts.

- There is need for further improvement on land and property registration, despite the marked improvements in this year’s report. For instance, the number of days required for property registration could be reduced from the current 49. The procedure should also be automated in order to reduce the complexity and timeline of registration.

- Corruption remains an adverse factor in the country and has had a great impact on the economy. We analysed this in detail in our Focus on Corruption. During the release of the Doing business report the World Bank gave a disclaimer that it does not factor in corruption in the ranking. As a result, the score does not indicate the extent to which corruption affects Kenya’s doing business environment. Comprehensive measures to handling corruption include (i) proper vetting of public officials by the Ethics and Anti-Corruption Commission, (ii) educating people on the effect corruption has on development, and (iii) independence of the judiciary in handling cases.

Section V: Other Investment Factors:

Kenya ranks position #143 in the Corruption Perception Index, out of 180 countries surveyed, with a score of 28 out of 100 possible marks. The Kenyan President, Uhuru Kenyatta, has been vocal in his appeal to Kenyans to join efforts in the fight against corruption and has also recently taken decisive steps to combat corruption. He has essentially changed leadership at all the key law enforcement agencies that are responsible for fighting corruption. Opportunities for improvement include:

- Political will, which appears as the single most important ingredient to fight corruption. The Kenyan President has demonstrated a political will to fight the vice, but the sustainability for the long haul remains important. It is also important that this political will is shared by all coalitions of the government and the opposition for it to cascade nationally,

- We need to develop and publicize a system where the public can anonymously report corrupt activities,

- Inculcate a sense of anticorruption spirit in the public, especially given that we tend to look at corruption from a tribal prism, where we look aside when our own is corrupt.

- We need to see real and high-level convictions to restore public confidence in the system and make the price high for high-ranking officials who engage in corruption.

The political climate in the country has eased, with security maintained and business picking up. The handshake between the Kenyan President and the opposition leader served to calm any political tension. Kenya recently commenced direct flights to and from the USA, which is a sign of improving security in the country. We expect security to be maintained in 2018, especially given that there is relative calm as the two principals, alongside other legislators across the political divide, work together towards combating corruption and promoting economic transformation agenda.

Section VI: Outlook on the Kenyan Investment Environment:

|

Factor |

Description |

Outlook |

|

Macroeconomic Attractiveness |

Macroeconomic fundamentals are robust, and are likely to keep improving with the continued economic recovery |

Positive |

|

Foreign Direct Investments |

FDI has been declining in Kenya since 2012, although there was an increase in FDI inflows in 2017. Concerns of slowing global growth hamper foreign investment, although robust growth is likely to keep attracting foreign capital |

Neutral |

|

Capital Markets |

Kenyan markets have improved in terms of access to foreign exchange, although more needs to be done to improve liquidity and depth |

Neutral |

|

Ease of Doing Business |

Kenya has been improving in ranking, signalling a more accommodative business environment |

Positive |

|

Other Investment Factors |

The Executive is showing commitment to the fight against corruption, there has also been relative security leading to the commissioning of direct flights between Nairobi and New York |

Positive |

Out of the factors analysed, three have a positive outlook while two are neutral. In conclusion, therefore, Kenya needs to boost capital market depth in order to attract foreign investors with the promise of more liquid markets. This may be achieved through development of new investment vehicles that suit investors’ needs, as well as encouraging more listings on the Nairobi Securities Exchange for improved liquidity and access to capital, as highlighted in our focus on Unlocking New Listings on the Nairobi Bourse. Such remedies, coupled with robust economic growth expected over the medium-term, will improve the investment landscape in the country, thereby making it more attractive to foreigners as a preferred investment destination.

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, CAML is regulated by the Capital Markets Authority. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor