Nov 20, 2022

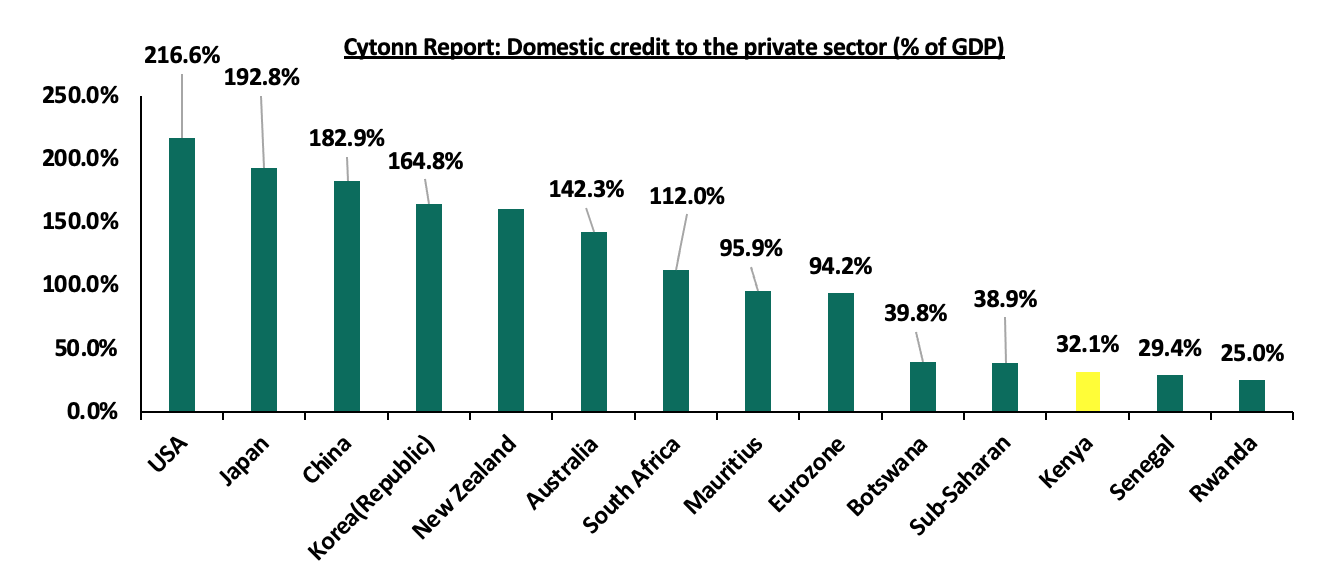

Last week, in our Cytonn weekly #45/2022, we took a look at Kenya’s Private Sector Credit growth, in which we highlighted that, currently at 26.1% of GDP, Kenya’s Private Sector Credit continues to lag behind other economies. In 2020, Kenya’s Private Sector Credit growth at 32.1% of the GDP was outperformed when compared to advanced economies such as the United States of America and Japan at 216.0% and 192.8%, respectively, as well as Sub-Saharan economies such as South Africa and Mauritius at 112.0% and 95.9%, respectively. The graph below shows the comparison of Kenya’s domestic credit extended to the private sector as a % of Gross Domestic Product (GDP) in 2020 against other select economies;

Source: World Bank

We recommended that, there is need to streamline the credit market for transparency and credibility to enhance credit uptake in the country, by reviewing the current credit rating framework. Similarly, the new administration has set it out to overhaul the credit rating system to increase access to credit. The Central Bank of Kenya (CBK) in November 2021, released an update to suspend for 12 months the listing of negative credit information for borrowers who had performing loans below Kshs 5.0 mn, and became non-performing on the beginning of October 2021. As such, defaulted loans during that year would not lead to blacklisting of the borrowers in the Credit Reference Bureaus (CRBs). Additionally, in a bid to increase credit uptake, the new administration through the CBK, has continued to update the CRB Framework. Notably, in November 2022, the CBK updated the Credit Information Sharing Framework, which mandated the CRBs to not use the negative credit score as the only reason to deny credit, and recommended the fast implementation of the risk based pricing model by commercial banks. Furthermore, on 14th November 2022, the CBK announced the rollout of the Credit Repair Framework, which waived off 50.0% of non-performing mobile phone digital loans by commercial banks, microfinance banks and mortgage finance companies outstanding at the end of October 2022 for six months, up to end of May 2023. In light of the ongoing credit sector reforms, we will analyse the current CRB framework in Kenya and its role in boosting the ability to access credit to promote financial inclusion. We shall cover the topic as follows;

- Introduction

- Evolution of the Credit Reference Framework in Kenya

- Kenya’s CRBs framework

- Developments from the 2020 CRB Regulations

- The role of CRBs in Kenya

- Recommendations to improve the CRB Framework and Conclusion

Section I: Introduction

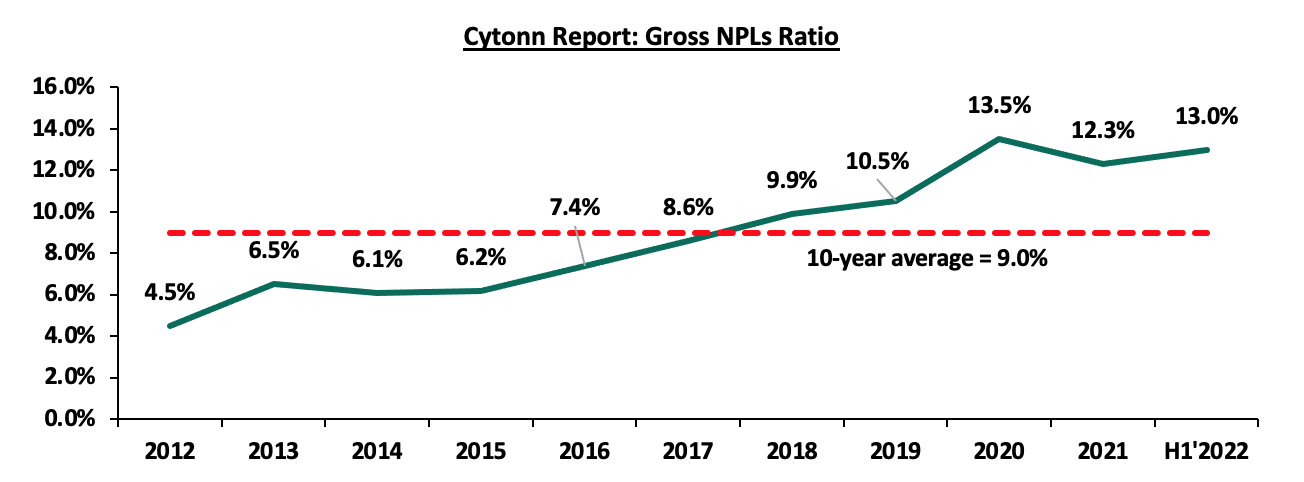

Credit is an agreement in which a borrower receives money from a lender and commits to pay it later, usually with some interest, while credit reference refers to a collection of historical credit information that is used to rate individuals or institutions seeking to borrow funds. As such, a Credit Reference Bureau (CRB) in Kenya is an agency that is licensed by the Central Bank of Kenya (CBK) to collect, compile and analyse a borrower’s credit history, and the information is shared at request of financial institutions to gauge the credit worthiness of borrowers. The main objective of credit reference is to collect data on previous loans issued to customers by different institutions, and from that information, they are able to draw the repayment patterns of the borrowers. Consequently, with the credit reports shared to those financial institutions, they are the able to avoid credit risk, which is the possibility of a borrower defaulting to repay back loans by determining if they will issue the borrower with a loan. Notably, credit risk has remained elevated in Kenya especially post COVID-19, evidenced by the increase of gross NPLs to gross loans ratio to 14.7% in the Q2’2022, from 14.0% in Q1’2022. Below is a graph showing the NPL ratio over the last 10 years;

Source: Cytonn Report

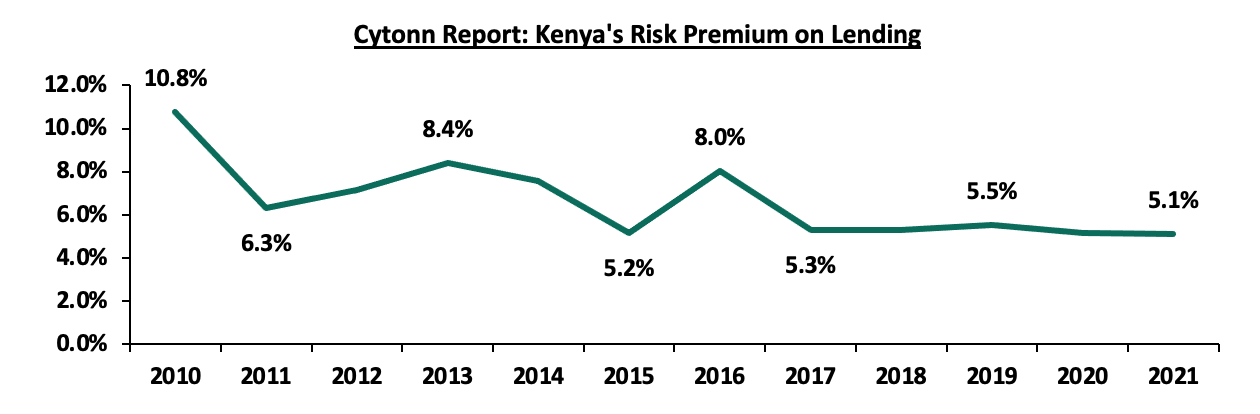

However, according to the World Bank, Kenya’s risk premium on lending, which reflects the overall country’s confidence on its lending sector, has declined to 5.1% in 2021 from 5.5% recorded in 2019, an indication of increasing confidence in the country’s credit sector, due to the measures the CBK has taken to make the sector more efficient. The graph below shows the Kenya’s risk premium on lending for the last 10 years;

Source: World Bank

Factors affecting credit risk

Kenya, like many other developing countries, has been facing a myriad of economic challenges that contribute to the decline in loan servicing determining the credit risk. The following are some of the factors affecting loan repayments in Kenya;

- Inflation rate: Inflation refers to the continued rise in the prices of commodities which increases the cost of living. Kenya’s y/y inflation rose to 9.6% in October 2022 from 9.2% recorded a month earlier, a historic high since May 2017, mainly due to increase in food and fuel prices. As inflation rises with incomes remaining constant, ability of individuals and businesses to service loans is impaired. Additionally, Kenya’s average Purchasing Managers Index (PMI) declined to 50.2% in October 2022 from 51.7% in September 2022 an indication towards deterioration of business operating environment, mainly due to concerns of high costs of living leading to low sales income to businesses,

- Economic growth: The rate of development of a country directly affects the ability of the citizens and organizations to service their loans. An increase in the Gross Domestic Product (GDP) indicates an increase in consumption of good and services, increase in exports which translates to an increase in revenue to businesses and increase in disposable income enabling repayment of obligations to such individuals,

- Interest rates: An increase in the Central Bank Rate (CBR) in a country leads to increase in the lending rates of financial institutions. The Central Bank of Kenya (CBK) increased the CBR rates by 75.0 bps to 8.25% in September 2022, which led to many commercial banks increasing their lending rates by up to 1.1% by October 2022. Such CBR hikes increases leads to costlier interest repayments to loans, thus impeding the ability to service the loans,

- Loan term: Short term loans are always characterised by small amounts especially from digital lending providers and attracting high interest rates, hence reducing the ability to service them. Contrarily, loans with longer periods of repayment such as mortgages require financial management and thorough credit analysis of the borrower, and therefore face low default rates,

- Random/irregular events: On the advent of COVID-19, many borrowers faced challenges to generate revenue, due to the supply chain disruptions and lock downs. This is evidenced by the rise in the NPLs ratio movement in 2020 to 13.5%, the highest in over 10 years. Additionally, political events in the country are always associated with a cautious stance by investors to invest and consumers to spend, and this reduces the ability of businesses to generate revenue to service loans,

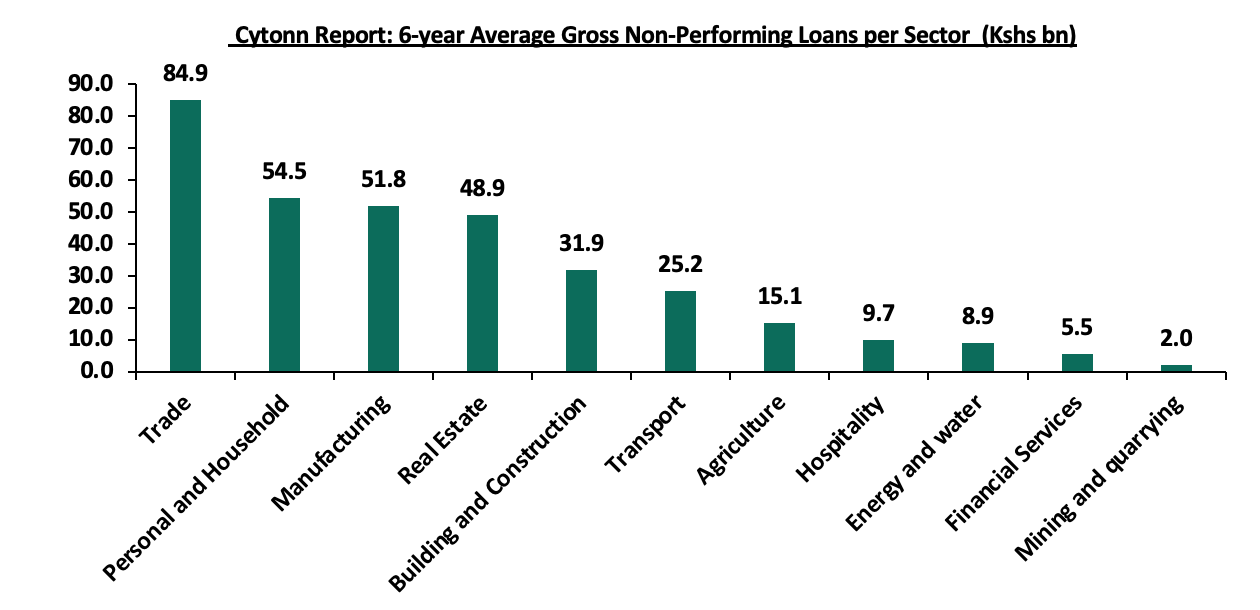

- Sector specific risk: The trade sector in Kenya has the highest average amount of non-performing loans for the last six years, amounting to Kshs 84.9 bn, representing 25.1% of the total NPLs in the banking sector, due to the deterioration of the business environment attributable to factors such as high inflation and delays in payments especially from government contracts. This reduces the ability of industry to service the loan repayments and increasing the sector’s credit risk. On the other hand, mining and quarrying has the lowest concentration of NPLs mainly due to low economic activity in the mining and quarrying industry. The graph below shows the 6- year average amount of non-performing loans in Kenya;

Source: Central Bank of Kenya

Section II: Evolution of Kenya’s Credit Reference framework

Before 2006, the Kenya Banking sector and credit sector in general lacked a system to gauge the credit worthiness of a borrower and as such banks, being the main lenders suffered high Non Performing Loans ratios, averaging 18.9% in 2006. However, assertion of the Banking and Finance Act of 2006 on 30th December 2006 allowed the establishment and operation of Credit Reference Bureaus (CRBs) for the purpose of collecting and disseminating customer information among financial institutions. To achieve more on the establishment of the CRBs and develop a sustainable information sharing system, the Banking (Credit Reference Bureau) Regulations 2008 were adopted to guide the sharing of credit information between lending institutions. This was followed by the roll out of the Credit Information Sharing Framework in July 2010, allowing the banking sector to share negative credit information from their borrowers to a licensed credit reference bureau. The first CRB, Credit Reference Bureau Africa was licensed in February 2010 with Metropol Credit Reference Bureau Limited and Creditinfo Credit Reference Bureau Kenya following in April 2011 and May 2015, respectively.

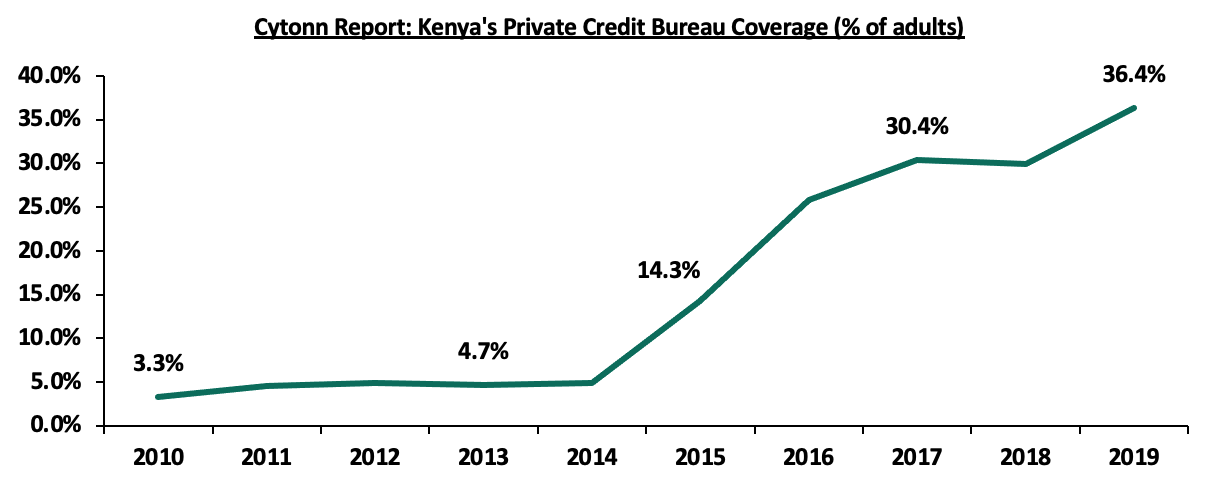

In 2013, the Credit Reference Bureau regulations of 2010 were amended to allow commercial banks and microfinance banks to share both positive and negative information to CRBs from the end of February 2014. Additionally, to enhance the CRB framework, the CBK then revised the 2013 CRB regulations, releasing the CRB regulations of 2020 that called for ceasing of listing of loan defaulters of amounts less than Kshs 1,000.0. According to the World Bank, the number of Kenyans that were covered by private credit bureau increased to 36.4% in 2019 of the adult population from 4.7% in 2013, majorly attributable to the new regulations, that put forth measures to improve credit risk management in the country. The graph below shows the growth of the Kenyans covered by the private credit bureau in Kenya;

Source: World Bank

- Components of Credit Rating

Credit rating refers to assigning a borrower a scale used to show the creditworthiness of the individual. There are three different aspects of the CRB,

- Credit score: Credit score is a rating between the range of 200-900, with a score below 400 showing a borrower is a defaulter, and therefore a high default risk is attached to the borrower. On the other hand, a score ranging between 800-900 indicates that a borrower has a high rating and that, creditors are confident for a repayment. A good credit score is very crucial as it improves the chances of a borrower getting a loan, a mortgage or any other form of financing from lenders. Several factors that affect one’s credit score include; commitment of payment of past loans, type and number of credit accounts that one holds, total debt outstanding, an event of filing for bankruptcy and any inquiries made from one’s credit report,

- Credit report: A credit report is a collection of information in a form of communication regarding one’s credit history usually from CRBs, and contains current information such as the borrower’s ability to repay a loan and current status of credit accounts and it is used to establish one’s eligibility for credit, and,

- Certificate of Clearance (CoC): A CRB clearance certificate is an official document from the CRBs that show a borrower has been fully committed to repay outstanding loans, and that, he does not have any non-performing account. Normally in Kenya, a CoC is normally issued upon request by a borrower at a cost of Kshs 2,200.0 and valid only on the date of issue. Currently, the CoC has become a vital document for employers and borrowers, as it forms part of the “Know Your Client (KYC)”.

- Licensed CRB Firms in Kenya

In Kenya, there are three licensed Credit Reference Bureaus which are;

- Credit Reference Bureau Africa Limited: Currently trading as TranUnion Africa, it was licensed by the CBK in February 2010 to offer credit rating and debt management services to banks, credit card companies, micro-finance institutions in order to reduce their credit risk. It operates in several African countries, which include Botswana, Namibia and Zambia,

- Metropol Credit Reference Bureau: It was established in Kenya in 1966 as a business Information and credit management company, and is located in Nairobi. It was licensed by the CBK in April 2011 to provide CRB services in Kenya to all banks, with the aim of improving the lending capacity of financial institutions. A CRB credit score, a credit report and a clearance certificate from Metropol usually costs Kshs 150.0, Kshs 250.0 and Kshs 2,200.0, respectively. Notably, in July 2014, through the CBK, Metropol CRB was licenced to launch the Metropol Consumer and SME Bureau credit scores. As of 30th September 2022, Metropol had over 19.0 mn Kenyans listed in their CRB system, with 6.0 mn blacklisted as loan defaulters, and,

- Credit Info Credit Reference Bureau: This was the third CRB to be licensed in Kenya in May 2015, to offer credit sharing services in Kenya as well as customer support in risk management. Its parent company, Credit Info International GmbH was established in 1997, has the largest stake in Credit Info CRB Kenya, and operates in other fifteen countries such as the Baltic States, Cape Verde, among others.

Section III: CRB Framework in Kenya

In Kenya, the Central Bank of Kenya (CBK) is mandated to license and regulate the CRBs. The first CRB regulations were published in 2013 which allowed CRBs to share both positive and negative information to lenders, In April 2020, the CBK amended and published the CRB regulations 2013, adopting the current CRB regulations 2020. Notably, in a major change from the 2013 CRB regulations, in the new regulations, the CBK mandated that;

- Default of amounts less than Kshs 1000.0 would not be submitted to the CRBs, and the borrowers that were blacklisted for defaulting of the loans less than Kshs 1000.0 would be then delisted,

- Saving and Credit Cooperatives (SACCOs) would be included as authorised subscribers of CRBs, and would then submit borrower’s information to the CRBs and would also receive reports from the CRBs, and,

- CRBs would process first time applications of the Certificate of Clearance (CoC) at no cost.

Additionally, in 2020, the CBK announced that;

- It had stopped the approvals given to the digital (mobile-based) and credit-only lenders as third party credit information providers to the CRBs, due to public complaints regarding the misuse of information by such parties, and therefore, the unregulated digital and credit-only providers would no longer submit credit information from their borrowers to the CRBs, and,

- It would suspend the listing of negative credit information from borrowers for six months from the beginning of April 2020 on the loans that were performing but had become non-performing on the date of commencement of the policy, and as such, the loans that fall in arears in the six months would not lead to blacklisting of the borrowers.

Section IV: Developments on the 2020 regulations

In November 2021, the CBK suspended for twelve months from the beginning of October 2021, the listing of negative credit information for borrowers with loans less than Kshs 5.0 mn, which were performing earlier and had becoming non-performing from the beginning of the suspension period. As such, the loans below Kshs 5.0 mn that fell in arrears during the one-year period suspension would not lead to blacklisting of the borrower by CRBs. Consequently, any negative credit information for the loans of less than Kshs 5.0 mn would be not be included in the credit report for that one year. This was in a bid to boost credit uptake especially to the Micro, Small and Medium Enterprises (MSMEs), and therefore boost economic recovery post COVID-19.

Since September 2022, there has been renewed conversations around changing the Credit Reference Framework in line with the new administration focus of increasing credit access and changing the current CRB Framework to a more accommodative structure from the current blacklisted-no credit framework. The government through the CBK has been updating the 2020 CRB regulations as follows;

- The CBK released in November 2022 an update on the Credit Information Sharing(CIS) Framework and mandated all existing CRBs to include that the credit score of a customer should be used as the sole reason to impede access to borrowing, and as such, the CBK noted that it was working with the CRBs to improve the scoring models thus improving the quality of the credit scores,

- Additionally, the CBK noted that it is supporting the banks with the implementation of the risk based credit pricing. This model is an improvement of the Annual Percentage pricing, refers to the application of different lending interest to borrowers, depending on the perception of default. This would mean that borrowers who have a positive credit history will be loaned at lower interest rates compared to the defaulters. If fully implemented, it would grant the already blacklisted borrowers access to credit at a higher cost, while at the same time getting access to credit. As of September 2022, 22 out of the 38 commercial banks had received approval to proceed and adopt the model. However, small businesses and start-ups, since they are considered riskier, will be charged more on their loans, and,

- The CBK released the Credit Repair Framework on 14th November 2022, announcing that institutions such as Commercial banks, microfinance banks and mortgage finance companies will provide a discount of 50.0% of the non-performing mobile digital loans offered for a repayment period of 30 days or less, and therefore update the credit standing of such borrowers from non-performing to performing for the period up to 31st May 2023. The credit score of the borrowers would then depend on their repayment for the period of the six months. The total value of loans restructured under this arrangement stands at Kshs 30.0 bn, approximately 0.8% of the gross banking sector portfolio of Kshs 3.6 tn as at end of October 2022.

Section V: Role of CRBs in Kenya

The main role of the Credit Reference Bureaus in Kenya is to perform credit risk rating for borrowers thus helping financial institutions such as banks, microfinance institutions and digital credit providers to reduce non-performing loans. The benefits and disadvantages of CRBs include;

- Benefits of CRBs to borrowers;

- Better negotiation terms during borrowing - Low risk borrowers receive better terms and repay loans at lower interest rates as compared to high risk borrowers, and therefore, they receive leverage to negotiate for good credit terms,

- It promotes debt management- Being aware that a default will lead to poor credit rating makes a borrower committed to service the loans, and this goes in hand in improving the credit score, and,

- Reduction in costs of sharing information - Although the cost to obtain CoC are considerably high, it reduces the charges of rating a borrower since the information is available from the different CRBs.

- Disadvantages to borrowers;

- Blacklisting of defaulters has denied many the ability to access of credit, and leaves them for exploitation by many middlepersons who charge exorbitant interest rates on borrowing,

- Credit repayment bias - The model only uses one’s credit repayment history, and does not consider other loans aspects such as, therefore denying the many blacklisted borrowers from access to credit, and,

- High certificate fees - The fees charged to access from CRBs are high, for example the clearance fee of Kshs 2,200.0 is high and this acts as hindrance for majority of Kenyans to get clearance.

- Advantages to lenders;

- It reduces the risk of default – As the main objective to the lending industry, financial institutions are able to ascertain the credit worthiness of the customers, therefore reducing the non-performing loans,

- CRBs minimizes rating costs – Adoption of the CRBs has saved lending institutions the cost that would be incurred for rating borrowers themselves and develop the systems to store and model the information collected, and,

- CRBs enhances the credibility of lending businesses and establishment of lenders – This is especially to the digital credit providers, who were initially cautious to start such business due to unreliable information to offer credit.

Section VI: Recommendations and Conclusion

In addition to the current reforms to the CRB framework, we note that there are areas of improvement to enhance the effectiveness of the framework consequently enhancing access to credit as discussed below;

- Adopt the risk based pricing model to the digital credit providers-The risk based pricing model is only being implemented to banks. The various digital credit providers will still continue using the credit rating to grant credit, which will deny access to the current negatively listed borrowers,

- Reduction of costs of obtaining a credit report and clearance certificate- Although the current 2020 CRB regulations abolished the charges to obtain a Certificate of Clearance from a CRB for first time applicants, the certificate obtained is only valid on the date of issue. This means further costs would be incurred for the subsequent certificates, which is expensive,

- Increase the number of CRBs in Kenya - Kenya’s Credit reference sector is underserved, and the CBK should make it easier for new entrants by removing the various regulatory barriers, which would spur competition and innovation of better credit rating models,

- Borrower education- The Central Bank as the sole regulator of CRBs should make it a priority to educate borrowers on the importance of having a positive credit score and debt management techniques, and this would spur growth in the borrowing sector,

- Lending rates ceiling- In addition to the introduction of the Risk Based pricing model to the banking sector, the CBK should introduce the ceiling of lending interest rate ceiling to prevent predatory lending to the high risky borrowers, who will be charged higher interest rates, and,

- Inclusion of other credit predictors in credit scoring- Loan repayment patterns have been used to determine a borrower’s creditworthiness in Kenya. However, the credit scoring system should also include other predictors such as a borrower’s utilities bill payments and non-traditional data like digital footprints as done in advanced economies, in order to make the credit scoring system more robust.

In conclusion, a sound CRB framework is key to boosting the access to credit by both individuals and businesses. We recommend continuous updating of the CRB framework depending on the prevailing economic conditions in the country. Going forward, we expect increased uptake and shift to risk based pricing models for lending, which will unlock necessary credit for individuals and businesses in the current tough prevailing macroeconomic environment which would in the long term enable them to repair their credit worthiness. However, in the short term, we expect credit risk is expected to remain elevated and non-performing loans to remain elevated in the short-term. Additionally, we recommend that in addition to improving the CRB framework to boost access to credit, the government should also create an enabling environment for alternative providers of capital such as capital markets to thrive which would also boost private sector credit growth.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor