Apr 23, 2022

On 7th April 2022, the National Treasury presented Kenya’s FY’2022/2023 National Budget, to the National Assembly two months earlier than the usual June date in a bid to provide Parliament with ample time to discuss and approve the Budget, before it winds down ahead of the upcoming August 9th elections. Additionally, the Cabinet Secretary for the National Treasury tabled the Finance Bill 2022 in Parliament for consideration and if the Parliament approves the bill, it will be forwarded for presidential assent, after which the proposals will come into effect. Notably, the total budget estimates for FY’2022/23 will increase by 10.3% to Kshs 3.3 tn from the Kshs 3.0 tn in FY’2021/2022 while the total revenue will increase by 20.0% to Kshs 2.4 tn from the Kshs 2.0 tn in FY’2021/2022. The increase is mainly due to a 25.4% increase in ordinary revenue to Kshs 2.1 tn for FY’2022/2023, from the Kshs 1.8 tn in FY’2021/22.

Kenya’s budget focuses mainly on economic recovery from the effects of the COVID-19 pandemic, increasing revenues and reducing the fiscal deficit to 6.2% of GDP in the FY’2022/23, from the estimated 8.1% of GDP in the FY’2021/2022. As such, this week, we shall discuss the recently released budget and the tabled Finance Bill 2022 with a key focus on Kenya’s fiscal components. We shall do this in four sections, namely:

- FY’2021/2022 Budget Outturn as at February 2022

- Comparison between FY'2021/2022 and FY'2022/2023 Budget estimates,

- Analysis and House-view on Key Aspects of the 2021 Budget,

- Key tax changes in the Finance Bill 2022 and their impact, and,

Section I: FY’2021/2022 Budget Outturn as at February 2022

The National Treasury gazetted the revenue and net expenditures for the first eight months of FY’2021/2022, ending 28th February 2022. Below is a summary of the performance:

|

FY'2021/2022 Budget Outturn - As at 28th February 2022 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated Estimates |

% achieved of prorated |

|

Opening Balance |

- |

21.3 |

- |

- |

- |

|

Tax Revenue |

1,707.4 |

1,126.4 |

66.0% |

1,138.3 |

99.0% |

|

Non-Tax Revenue |

68.2 |

45.1 |

66.1% |

45.5 |

99.2% |

|

Total Ordinary Revenues |

1,775.6 |

1,192.8 |

67.2% |

1,183.8 |

100.8% |

|

External Loans & Grants |

379.7 |

50.0 |

13.2% |

253.1 |

19.7% |

|

Domestic Borrowings |

1,008.4 |

631.1 |

62.6% |

672.3 |

93.9% |

|

Other Domestic Financing |

29.3 |

5.5 |

18.8% |

19.5 |

28.2% |

|

Total Financing |

1,417.4 |

686.6 |

48.4% |

944.9 |

72.7% |

|

Recurrent Exchequer issues |

1,106.6 |

709.3 |

64.1% |

737.7 |

96.2% |

|

CFS Exchequer Issues |

1,327.2 |

750.9 |

56.6% |

884.8 |

84.9% |

|

Development Expenditure and Net Lending |

389.2 |

191.8 |

49.3% |

259.5 |

73.9% |

|

County Governments and Contingencies |

370.0 |

193.7 |

52.3% |

246.7 |

78.5% |

|

Total Expenditure |

3,193.0 |

1,845.7 |

57.8% |

2,128.7 |

86.7% |

|

Fiscal Deficit excluding Grants |

(1,417.4) |

(652.9) |

46.1% |

(944.9) |

69.1% |

|

*Fiscal Deficit as a % of GDP |

8.1% |

5.3% |

|

|

|

|

Total Borrowing |

1,388.1 |

681.1 |

49.1% |

925.4 |

73.6% |

|

*Projected Fiscal Deficit as a % of GDP |

|||||

The key take-outs from the report include:

- Total ordinary revenues collected as at the end of February 2022 amounted to Kshs 1,192.8 bn, equivalent to 67.2% of the original estimates of Kshs 1,775.6 bn and is 100.8% of the prorated estimates of Kshs 1,183.8 bn. Notably, the performance is a decline from the 103.8% outperformance recorded in the first seven months to January 2021, mainly attributable to a 26.9% decline in the monthly revenue collection to Kshs 117.6 bn in February 2022, as compared to a monthly average of Kshs 160.9 bn in the first seven months to January 2021. Cumulatively, tax revenues amounted to Kshs 1,126.4 bn, equivalent to 66.0% of the original estimates of Kshs 1,707.4 bn and 99.0% of the prorated estimates of Kshs 1,138.3 bn,

- Total financing amounted to Kshs 686.6 bn, equivalent to 48.4% of the original estimates of Kshs 1,417.4 bn and is equivalent to 72.7% of the prorated estimates of Kshs 944.9 bn. Additionally, domestic borrowing amounted to Kshs 631.1 bn, equivalent to 62.6% of the original estimates of Kshs 1,008.4 bn and is 93.9% of the prorated estimates of Kshs 672.3 bn,

- The total expenditure amounted to Kshs 1,845.7 bn, equivalent to 56.5% of the original estimates of Kshs 3,193.0 bn, and is 84.7% of the prorated expenditure estimates of Kshs 2,128.7 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 709.3 bn, equivalent to 64.1% of the original estimates and 96.2% of the prorated estimates of Kshs 737.7 bn, and development expenditure amounted to Kshs 191.8 bn, equivalent to 49.3% of the original estimates of Kshs 389.2 bn and is 73.9% of the prorated estimates of Kshs 259.5 bn,

- Consolidated Fund Services (CFS) Exchequer issues lagged behind their targets of Kshs 1,327.2 bn after amounting to Kshs 750.9 bn, equivalent to 56.6% of the original estimates, and are 84.9% of the prorated amount of Kshs 884.8 bn. The cumulative public debt servicing cost amounted to Kshs 667.2 bn which is 57.1% of the original estimates of Kshs 1,169.2 bn, and is 85.6% of the prorated estimates of Kshs 779.4 bn, and,

- Total Borrowings as at the end of February 2022 amounted to Kshs 681.1 bn, equivalent to 49.1% of the original estimates of Kshs 1,388.1 bn and are 73.6% of the prorated estimates of Kshs 925.4 bn. The cumulative domestic borrowing target of Kshs 1.0 tn comprises of adjusted Net domestic borrowings of Kshs 661.6 bn and Internal Debt Redemptions (Roll-overs) of Kshs 346.8 bn.

The revenue performance in the first eight months of the current fiscal year point towards continued economic recovery following the ease of COVID-19 containment measures and the effectiveness of the KRA in revenue collection. We believe that the current measures such as the implementation of the Finance Act 2021 which led to the upward readjustment of the Excise Duty Tax, Income Tax as well as the Value Added Tax will continue playing a big role in expanding the tax base and consequently enhance revenue collection. We expect the government to ramp up its revenue collection initiatives in the remaining months of the current fiscal year as well as look increasingly to the domestic market to plug in the deficit. The emergence of new COVID-19 variants both locally and with trading partners globally continues to pose risks to the economic recovery, should they necessitate imposition of tighter containment measures.

Section II: Comparison between FY’2021/2022 and FY’2022/2023 Budgets estimates

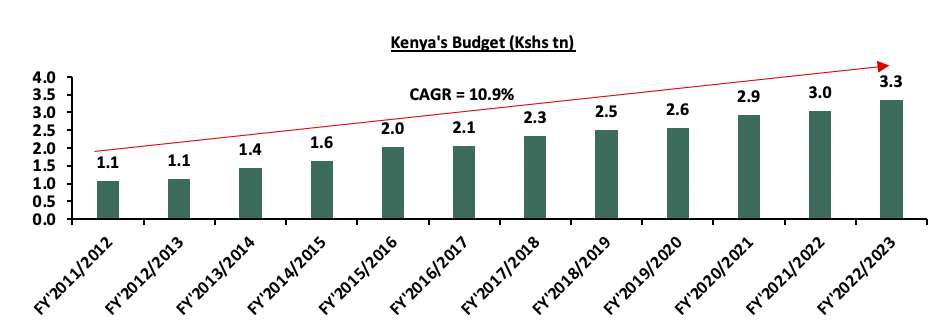

The Kenyan Government budget has been on the rise over the years on the back of increasing recurrent and development expenditure. The chart below shows the evolution of the government budget over an eleven-year period:

For the FY’2022/2023, the budget increased by 10.3% to Kshs 3.3 tn, from Kshs 3.0 tn in FY’2021/22. The expenditure will be funded by revenue collections of Kshs 2.4 tn and borrowings amounting to Kshs 862.4 bn.

The table below summarizes the key buckets and the projected changes:

|

Item |

FY'2021/22 Budget Estimates |

FY'2022/23 Budget Estimates |

Change y/y (%) |

|

Total revenue |

2,038.7 |

2,447.0 |

20.0% |

|

Total grants |

62.0 |

33.3 |

(46.3%) |

|

Total revenue & grants |

2,100.7 |

2,480.3 |

18.1% |

|

Recurrent expenditure |

1,286.6 |

1,387.9 |

7.9% |

|

Development expenditure & Net Lending |

655.4 |

711.5 |

8.6% |

|

County Transfer & Contingencies |

370.0 |

374.0 |

1.1% |

|

CFS Exchequer Issues |

718.3 |

869.3 |

21.0% |

|

Total expenditure |

3,030.3 |

3,342.7 |

10.3% |

|

Fiscal deficit inclusive of grants |

(929.7) |

(862.4) |

(4.2%) |

|

Projected Deficit as % of GDP |

8.1% |

6.2% |

(1.9%) pts |

|

Net foreign borrowing |

271.2 |

280.7 |

3.5% |

|

Net domestic borrowing |

658.5 |

581.7 |

(11.7%) |

|

Total borrowing |

929.7 |

862.4 |

(7.2%) |

|

Source: Financial Statements for the fiscal year 2021/2022 , Budget Mwananchi Guide– National Treasury of Kenya |

|||

Some of the key take-outs include;

- The government projects total revenue for FY’2022/23 to increase by 20.0% to Kshs 2.4 tn (equivalent to 17.5% of GDP), from the Kshs 2.0 tn (equivalent to 16.3% of GDP) FY’2021/2022 estimates. The increase is mainly due to a 25.4% increase in ordinary revenue to Kshs 2.1 tn (equivalent to 15.3% of GDP), from the Kshs 1.8 tn (equivalent to 14.4% of GDP) target in FY’2021/22,

- Total expenditure is set to increase by 10.3% to Kshs 3.3 tn (equivalent to 23.9% of GDP), from Kshs 3.0 tn (equivalent to 24.0% of GDP) in the FY’2021/22 Budget estimates,

- Recurrent expenditure is set to increase by 7.9% to Kshs 1.4 tn in FY’2022/23, from Kshs 1.3 tn in the FY’2021/22 budget estimates, while Consolidated Funds Services (CFS) expenditure is expected to increase by 21.0% to Kshs 869.3 bn, from Kshs 718.3 bn in the FY’2021/2022 budget estimates. Development expenditure increased by 8.6% to Kshs 711.5 bn from Kshs 655.4 bn in the FY’2021/2022 budget estimates,

- Public debt is expected to continue growing in FY’2022/23, as the approximate Kshs 862.4 bn fiscal deficit will be financed through domestic debt totaling Kshs 581.7 bn and foreign debts totaling Kshs 280.7 bn. However, total borrowing is expected to reduce by 7.2% to Kshs 862.4 bn in the FY’2022/23 from Kshs 929.7 bn as per the FY’2021/22 budget, in a bid to reduce Kenya’s public debt burden which was estimated to stand at 66.2% of GDP as of December 2021, surpassing the 50.0% recommended threshold by 16.2% points, and,

- The budget deficit is projected to decline to 6.2% of GDP from the projected 8.1% of GDP in the FY’2021/22 budget, mainly as growth in revenues outpace growth in expenditure.

Section III: Analysis and House-view on Key Aspects of the FY’2022/2023 Budget

Below we give our analysis and view on various aspects of the FY’2022/2023 Budget Estimates:

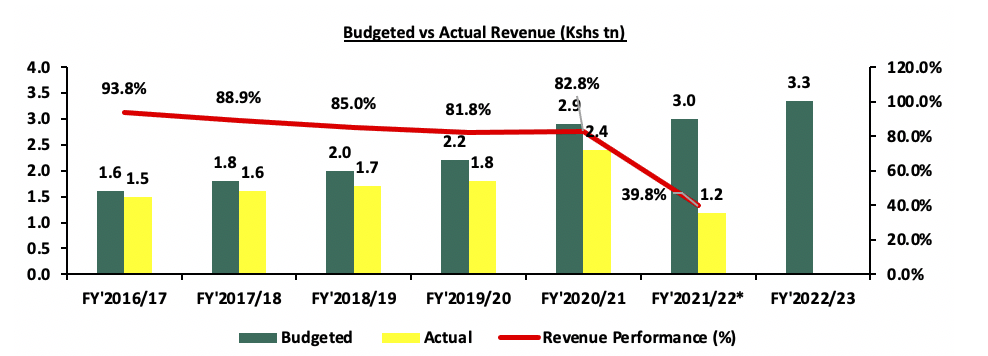

a. Revenue

Revenue is projected to increase by 20.0% to Kshs 2.4 tn in FY’2022/23, from Kshs 2.0 tn in the FY’2021/22 budget attributable to the continued economic recovery and the easing of COVID-19 containment measures following an increase in vaccination rates and reduced infections. The increased revenue projections in the FY’2022/23 are mainly attributable to the projected 25.4% growth in ordinary revenue to Kshs 2.1 tn in FY’2022/23, from Kshs 1.8 tn in the FY’2021/22 budget. The main sources of revenue will be:

- Income Tax which remains the highest contributor to government revenue, contributing 40.8% of the total revenue projections of Kshs 2.4 tn, is expected to increase by 19.5% to Kshs 997.3 bn in FY’2022/2023, from Kshs 834.5 bn in FY’2021/2022,

- Value Added Tax (VAT) contributing 23.9% of the projected revenue collections is projected to increase by 23.6% to Kshs 584.7 bn in FY’2022/23 budget, from Kshs 472.9 bn in the FY’2021/22 budget, and,

- Excise Duty contributing 12.1% to the projected revenues for the FY’2022/2023 is expected to increase by 23.3% to Kshs 297.2 bn, from Kshs 241.0 bn in FY’2021/2022 budget estimates.

The government relies on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as increase in some of the existing taxes to meet its revenue target. Historically, the government has struggled to meet its target revenue collections resulting to an ever-present fiscal deficit. As such, there are still concerns about the government's ability to meet its revenue collection targets in FY’2022/2023, in light of the already high cost of living. The chart below shows the revenue performance in the previous fiscal years:

Source: National Treasury of Kenya

*Total Revenue collection as of 28th February 2022

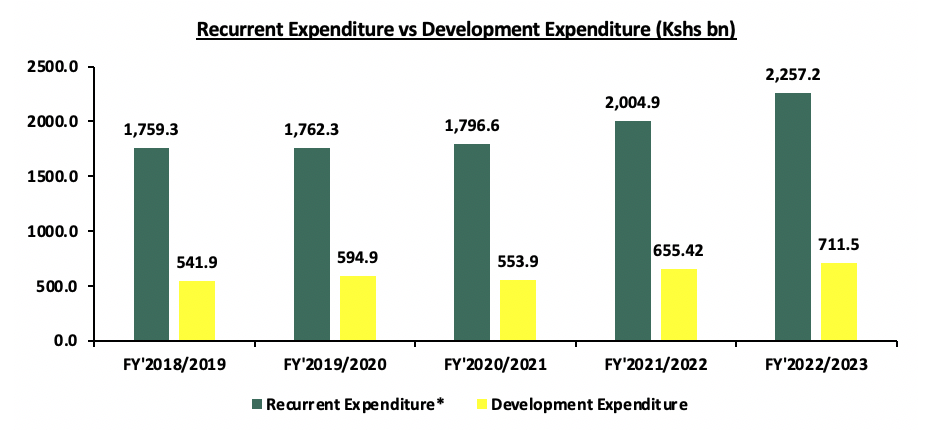

b. Expenditure

Expenditure is expected to increase by 10.3% to Kshs 3.3 tn, from Kshs 3.0 tn in the FY’2021/22 budget with recurrent expenditure taking up 67.5% of the total expenditure for FY’2022/2023, in comparison to the 66.2% in FY’2021/2022. The chart below shows the comparison between the recurrent expenditure allocations and development expenditure allocations over the past five fiscal years:

*Recurrent Expenditure includes the Consolidated Fund Services (CFS) Expenditure

Some of the key take-outs include;

- Recurrent expenditure takes the largest chunk of expenditure over the last five fiscal years growing at a 5-year CAGR of 5.1% to Kshs 2.3 tn in FY’2022/2023, from Kshs 1.8 bn in FY’2018/2019. For the FY’2022/2023, the recurrent expenditure increased by 12.6% to Kshs 2.3 tn, from Kshs 2.0 tn in FY’2022/2023 mainly due to a 21.0% increase in Consolidated Fund Services (CFS) expenditure to Kshs 869.3 bn from Kshs 718.3 bn in FY’2022/2023. The increase can be mainly attributed to the increased debt servicing cost which represented 88.1% of the CFS FY’2021/2022 budgetary allocation as of December 2021. We expect the debt servicing cost to continue increasing as the Kenyan shilling depreciates against the dollar, given that 67.0% of the country’s external debt is denominated in US Dollars, and,

- Development expenditure on the other hand continues to lag behind contributing only 21.3% of the FY’2022/2023 expenditure estimates. Allocation to infrastructure remains the highest taking 58.5% of the development expenditure. In the FY’2022/2023, infrastructure expenditure is set to increase by 8.6% to Kshs 416.4 bn, from Kshs 383.3 bn in FY’2021/2022 in line with the government’s agenda of increasing the development of critical infrastructure in the road, rail, energy, and water sectors in a bid to facilitate the movement of people and goods, lower the cost of doing business, improve access to social amenities, and increase Kenya's competitiveness. The table below shows the sectors with the highest expenditure allocation over the last five fiscal years:

|

Item |

FY'2018/2019 |

FY'2019/2020 |

FY'2020/2021 |

FY'2021/2022 |

FY'2022/2023 |

y/y Change |

5-Year CAGR |

|

Interest Payments, pensions & Net Lending |

493.0 |

553.3 |

586.5 |

718.3 |

869.3 |

21.0% |

12.0% |

|

Education |

444.1 |

494.8 |

505.1 |

503.9 |

544.4 |

8.0% |

4.2% |

|

Infrastructure |

418.8 |

435.1 |

363.3 |

383.3 |

416.4 |

8.6% |

(0.1%) |

|

County shareable Revenue |

314.0 |

310.0 |

316.5 |

370.0 |

370.0 |

0.0% |

3.3% |

|

Public Admin & Int. Relations |

270.1 |

298.9 |

289.3 |

299.7 |

342.2 |

14.2% |

4.8% |

Notably, the allocation to agriculture and food security declined by 9.6% to Kshs 66.8 bn, from Kshs 73.9 bn in the FY’2021/2022. This is despite food security being one of the government’s big four agenda and the erratic weather conditions that have led to an increase in food prices in the country. As such, we expect the prices of food items to continue increasing and consequently lead to an increase in inflation, given that food is a key contributor to the inflation basket.

In our view, the Government should increase its efforts in minimizing the recurrent expenditure growth in order to achieve its fiscal deficit target of 3.6% in FY’2024/25. Key to note, development expenditure accounted for only 20.6% of the total expenditure in comparison to the 67.5% allocation to recurrent expenditure, an indication that we are not investing much for the future. As such, development projects need to be more prioritized and better planning incorporated to match fund availability to project execution, and measures taken to improve the public procurement process.

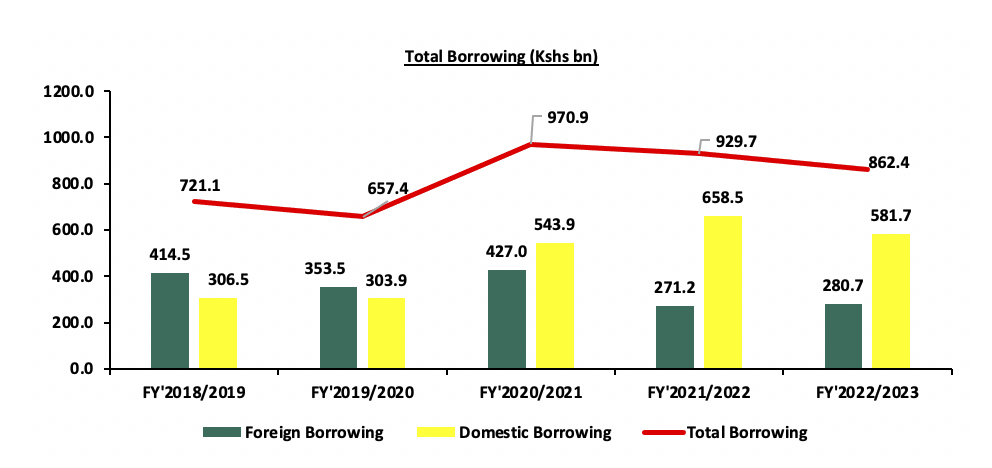

c. Public Debt

The total public debt requirement for the FY’2022/23 is set to reduce by 7.2% to Kshs 862.4 bn, from Kshs 929.7 bn, in FY’2021/22 budget estimates. The public debt mix is projected to comprise of 32.5% foreign debt and 67.5% domestic debt, from 29.2% foreign financing and 70.8% domestic financing as per the FY’2021/2022 budget. The debt servicing costs are set to rise by 17.7% to Kshs 659.2 bn in FY’2022/23, from Kshs 560.3 bn in the FY’2021/22 budget. The rise in debt servicing expenses may be partly attributable to the depreciation of the Kenyan shilling given that 67.5% of debt was denominated in US dollars as of December 2021. The chart below shows the evolution of public borrowing to fill the fiscal deficit gap over the last five years:

The key take-outs from the chart include:

- The proportion of foreign financing has been declining over time standing at 32.5% in FY’2022/2023 from 57.5% in FY’2018/2019. The decline is expected to reduce Kenya’s exposure to external shocks, as the less we owe in foreign currency, the less exposed we are to any shocks in the foreign markets. However, the increased domestic borrowing by the government may lead to slow growth in the private sector lending as banks prefer lending to the government as opposed to the private sector which is considered riskier, and,

- The total borrowing has been declining in the last two years, reflecting the government’s fiscal consolidation efforts aimed at reducing the fiscal deficit and dependence on debt through rationalization of tax expenditures and ensuring the sustainability and value for money from the available resources.

The main driver of the growing public debt is the fiscal deficit occasioned by the lower revenues as compared to expenditure. As such, implementing robust fiscal consolidation would help the government bridge the deficit gap. This can be achieved by minimizing spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. Fiscal consolidation would also allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue. Capital expenditure should also be restricted to projects with a high social impact or a high Economic Rate of Return (ERR), indicating that the economic benefits outweigh the costs. Additionally, we expect that the government will fully explore alternative means of funding the ambitious development agenda such as Private Public Partnerships (PPPs) which do not necessitate the incurring of additional debt.

Section IV: Key Tax changes in the Finance Bill and their impact

The Cabinet Secretary for the National Treasury tabled the Finance Bill 2022 in Parliament for discussion and consideration. The proposed tax measures in the Finance Bill, 2022, are expected to add Kshs 50.4 bn to the exchequer for the fiscal year 2022/23 and if Parliament approves the finance bill, it will be forwarded for presidential assent, after which the proposals will come into effect. Some of the proposals include;

Under the Income Tax Act;

- The Finance Bill 2022 proposes to increase digital service tax (DST) to 3.0% from the current 1.5% of either consideration received in respect of the service provided in the case of a digital service provider or the commission or fee paid for the use of the platform in the case of a digital marketplace provider excluding VAT charged for the service. The bill also proposes to exempt non-resident entities with a permanent establishment in Kenya from DST. Key to note, the global proliferation of digital platforms, products and services, have played a big role in the growth of businesses as such things like advertising costs have declined, making it easier for small businesses to reach their target audiences. Simultaneously, digital services have enabled small, local businesses to achieve a global reach that would previously have required much more expensive advertising options in more competitive national outlets. As much as the increase in DST by the government is impressive, the increase is likely to raise the overall cost of doing business, as large tech companies may raise their ad prices to recoup the cost of these taxes. As such, we expect the increased taxes to be borne by domestic consumers and markets rather than the tech giants targeted as the costs will be passed on to the end users,

- The Finance bill proposes to increase the Capital Gains Tax (CGT) on transfer or sale of property by an individual or company to 15.0% from the current 5.0%. Key to note, the government had proposed to increase capital gains tax to 12.5% in the Finance Bill 2019, but the proposal was rejected by parliament. An increase in CGT rate would be unfavorable for individuals and companies dealing in sale of property and would result in increased dealing and transaction costs. The Bill also proposes to tax gains from financial derivatives for foreigners under the CGT rate of 15.0%. We expect that taxing gains from financial derivatives for foreigners will worsen their uptake, which has been slow since their introduction in 2019, and,

- The Finance Bill 2022 seeks to limit the allowable deductions on investments made outside Nairobi and Mombasa Counties to expenditure on investments in hotel buildings, buildings used for manufacturing and machinery used for manufacturing, from the current 100.0% of start-up expenditure. The incentives were in place to encourage investments outside Nairobi and Mombasa Counties in order to spur economic growth. Rolling back of the incentives is expected to reduce the attractiveness of investments outside the two counties.

Under the Excise Duty Act;

- The Finance Bill proposes to empower the Kenya Revenue Authority’s Commissioner General to exempt specific excisable products from the annual inflation adjustments depending on the economic circumstances in the relevant year. Key to note, KRA had gazetted an inflationary adjustment of 5.0% in November 2021 on specific products in a bid to raise Kshs 3.7 bn in excise duty tax. However, the inflation adjustment was frozen by the High Court of Kenya. We expect that this provision will allow the Commissioner general to exempt critical products like fuel from inflationary adjustment particularly for periods when fuel prices are high, in order to prevent further increase in the cost of living,

- The Finance Bill 2022 seeks to increase excise duty on various goods such as bottled water and non-alcoholic beverages by 9.5% to Kshs 6.6 per litre, from the current Kshs 6.0 per litre. Excise duty on fruit and vegetable juices will increase by 9.3% from Kshs 13.3 per litre from Kshs 12.2 per litre. The bill further proposes to increase excise duty on items such as cosmetic and beauty products, powdered beer and spirits, among others. Should the bill be passed, we expect the contribution of excise duty tax to total tax revenue to increase from the current 13.8% as estimated for the Fiscal Year 2022/2023 in the Budget Statement and consequently aid in narrowing the gap between revenues and expenditure, and,

- The Finance Bill 2022 seeks to add various goods such as hatching eggs imported by licensed hatcheries, neutral spirits imported by registered pharmaceutical manufacturers and locally manufactured passenger motor vehicles to the list of tax exempt items. Currently, hatching eggs contribute 25.0% in excise duty while locally manufactured motor vehicles contribute 20.0% - 35.0% depending on the cc rating. We expect this to have a downward effect on excise duty collected but act as an incentive to local manufacturers of passenger motor vehicles. In general, the move will aid in boosting the manufacturing and health sectors which are part of the big four agenda.

Under the Value Added Tax Act;

- The Finance Bill 2022 proposes to remove maize flour, cassava flour, wheat and meslin flour from the list of tax exempt goods under the Second Schedule to the Value Added Tax (VAT) Act 2013. This would see the named goods subjected to the VAT at a rate of 16.0% and a subsequent increase in food prices. The implication of this increase will be an increase in the already high cost of living with maize flour being a staple meal in Kenyan households. We also expect this changes to exert upward pressure on the inflation basket as food is a headline contributor to Kenya’s inflation.

The proposed tax measures in the Finance Bill 2022 and the FY’2022/2023 budget, are in consistence with the government’s focus on reducing the fiscal deficit from the current 8.1% of GDP to the targeted 6.2% in FY’2022/2023, which is key in the path towards fiscal consolidation. All the taxes that contribute to the ordinary revenues are expected to increase with income tax, the largest contributor increasing by 19.5% to Kshs 997.3 bn, from Kshs 834.5 bn while the Value Added Tax (VAT) is projected to increase by 23.6% to Kshs 584.7 bn in FY’2022/23 budget, from Kshs 472.9 bn in the FY’2021/22 budget. The net import duty is also expected to increase by 21.7% to Kshs 144.9 bn from Kshs 119.0 bn in FY’2021/2022 while the excise duty is expected to increase by 23.3% to Kshs 297.2 bn, from Kshs 241.0 bn. Additionally, the Finance Bill 2022 proposes additional reporting requirements for Multinational Enterprises (MNEs) with operations in Kenya in reporting their activities within Kenya and in other jurisdictions to the Commissioner General, Kenya Revenue Authority (KRA). The proposal follows the ratification and deposit of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (MAC) with the Global Forum on Transparency and Exchange of Information on Tax Matters in July 2020 and which became effective in November 2020. We expect the exchange of information between participating member countries to result in greater tax transparency among MNEs and consequently effective tax collection. We further expect the increase to significantly contribute to the projected Kshs 50.4 bn in additional tax revenue for the FY’2022/23 and consequently reduce over-reliance on debt financing.

Section IV: Conclusion

Kenya’s GDP is estimated to have grown at a rate of 7.6% in 2021 and is expected to grow at a rate of 6.0% in 2022. The performance is pegged on the global recovery, reduced COVID-19 infections and increased vaccination. With the expected rebound in economic activity, the government projects increased revenue collections, which shall be supported by tax measures aimed at reducing funding from debt. However, the Kenyan budget is expansionary as the government intends on spending more in the coming financial year to accelerate economic recovery and improve the livelihoods of Kenyans. The key concern remains on how the government will be able to meet its revenue collection targets given the already high cost of living, the resurgence of COVID-19 infections in the country’s trading partners and the fact that the budget will be implemented in an electioneering period. Additionally, the country’s borrowing appetite remains elevated with its current public debt burden at 66.2% as of December 2021. As such, we expect the government to perform a balancing act on the expenditure and revenues collected to ensure that we do not rely too much on borrowings to finance our expenditure. The government can also seek alternative ways of funding rather than concentrating solely on domestic borrowing to ensure that it does not crowd out the private sector as banks will prefer lending to the government to minimize their risks of losses.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.