Jun 20, 2021

On 10th June 2021, the National Treasury presented Kenya’s FY’2021/2022 National Budget to the National Assembly highlighting that the total budget estimate is Kshs 3.0 tn, a 4.8% increase from the Kshs 2.9 tn final FY’2020/21 budget. The government projects that total revenue will increase by 10.3% to Kshs 2.0 tn, from the Kshs 1.8 tn in FY’2020/2021, the increase largely being projected to come from ordinary revenue, which is to grow by 11.4% to Kshs 1.8 tn in FY’2021/22 from Kshs 1.6 tn in the FY’2020/21 budget. The projected revenues are mainly pegged on Kenya’s economic recovery, broadening the tax base and tax reforms.

Uganda and Tanzania also released their FY’2021/2022 budgets with the Tanzanian budget expanding by 20.9%, mainly due to higher allocation in both recurrent and development expenditure, and the Ugandan Budget declining by 5.6%, mainly attributable to the Ugandan government’s fiscal consolidation efforts which will see a reduction in projected development expenditure by 4.5% in FY’2021/22. Kenya’s budget focuses mainly on economic recovery following the effects of the COVID-19 pandemic, tax reforms and reducing the fiscal deficit to 7.5% of GDP in the FY’2021/22, from 8.7% of GDP in the current Budget, while the Ugandan and Tanzania budgets focused on inclusive and sustainable economic empowerment of its citizens. The different budgets also include several proposals that will require approval from the respective countries Parliaments. As such, this week, we shall discuss the recently released budgets with a key focus on Kenya’s fiscal components. We shall do this in five sections, namely:

- FY’2020/2021 Budget Outturn as at May 2021

- Comparison between FY'2020/2021 and FY'2021/2022 Budgets,

- Analysis and House-view on Key Aspects of the 2021 Budget,

- Comparison between the East African FY'2021/2022 budgets, and,

- Conclusion

Section I: FY’2020/2021 Budget Outturn as at May 2021

The National Treasury recently gazetted the revenue and net expenditures for the first eleven months of FY’2020/2021, ending 31st May 2021. Below is a summary of the performance:

|

FY'2020/2021 Budget Outturn - As at 31st May 2021 |

|||

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Item |

12-months Revised Estimates |

11-months Actual |

Percentage Achieved |

|

Opening Balance |

48.0 |

48.0 |

100.0% |

|

Tax Revenue |

1,469.7 |

1,313.1 |

89.3% |

|

Non-Tax Revenue |

124.3 |

80.6 |

64.8% |

|

External Loans & Grants |

418.8 |

124.4 |

29.7% |

|

Domestic Borrowings |

853.8 |

770.6 |

90.3% |

|

Other Domestic Financing |

28.5 |

21.8 |

76.5% |

|

Total Revenue |

2,943.2 |

2,358.5 |

80.1% |

|

Recurrent Exchequer issues |

1,084.4 |

907.0 |

83.6% |

|

CFS Exchequer Issues |

1,073.7 |

899.6 |

83.8% |

|

Development Expenditure & Net Lending |

401.4 |

286.0 |

71.3% |

|

County Governments + Contingencies |

383.6 |

263.5 |

68.7% |

|

Total Expenditure |

2,943.2 |

2,356.1 |

80.1% |

|

Fiscal Deficit excluding Grants |

(418.8) |

(122.0) |

29.1% |

|

Total Borrowing |

1,272.6 |

895.0 |

70.3% |

The key take-outs from the report include:

- Total revenue collected as at the end of May 2021 amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised target of Kshs 2.9 tn and is 83.3% of the prorated estimates. Cumulatively, Tax revenues amounted to Kshs 1.3 tn, equivalent to 89.3% of the target of Kshs 1.5 tn,

- The revenue from the Consolidated Fund Services (CFS) Exchequer came in at 83.8% of target coming in at Kshs 0.9 tn compared to Kshs 1.1 tn target,

- The cumulative public debt servicing cost amounted to Kshs 820.9 bn which is 85.7% of the revised estimates of Kshs 958.4 bn,

- The total expenditure amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised budget of Kshs 2.9 tn and is 83.2% of the prorated expenditure estimates. Additionally, the net disbursements to recurrent and development expenditures came in at Kshs 907.0 bn and Kshs 286.0 bn, which is 83.8% and 71.3% of their respective FY’2020/2021 targets, respectively, and,

- Total Borrowings stood at Kshs 0.9 tn, equivalent to 70.3% of the revised target of Kshs 1.3 tn. The cumulative domestic borrowing amounted to Kshs 853.8 bn comprising of adjusted Net domestic borrowings of Kshs 491.9 bn and Internal Debt Redemptions (Roll-overs) of Kshs 362.0 bn. On the other hand, external loans and grants amounted to Kshs 124.4 tn, which is 29.7% behind its target of Kshs 418.8 tn.

The revenue underperformance was expected given the ravaging effects of the COVID-19 pandemic on the economy for most parts of 2020. However, the recent reversal of the tax incentives introduced earlier in 2020 has helped improve tax revenue collections, as seen by reported revenue out-performances in the first five months of 2021. Additionally, the Government received USD 410.0 mn (Kshs 44.4 bn) from the recently announced IMF credit facility in May 2021 to help in stabilizing Kenya’s economy and create a sustainable growth path. Looking at tax revenue, we expect revenue collection to pick up in the remaining month owing to the recovering business environment. In our view, however, we expect the government to fall short of its revenue target as it currently has Kshs 122.0 bn in deficits. With less than a month before the end of the current fiscal year, we believe that the government will continue to borrow aggressively to bridge the Kshs 122.0 bn deficit.

Section II: Comparison between FY’2020/2021 and FY’2021/2022 Budgets

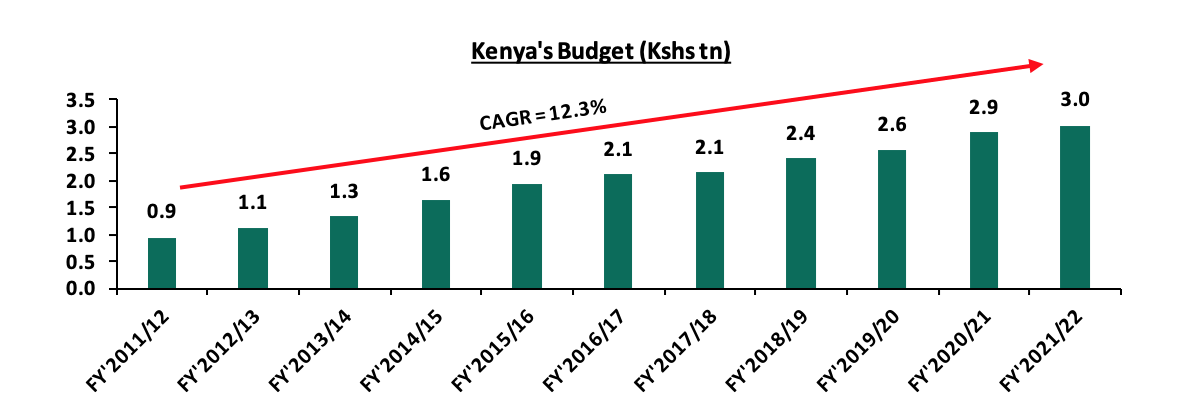

The Kenyan Government budget has been on the rise over the years as can be seen from the chart below:

For the coming financial year, the budget increased by 4.8% to Kshs 3.0 tn in FY’2021/22, from Kshs 2.9 tn in FY’2020/21 driven by an 8.4% growth in the Recurrent expenditure to Kshs 2.0 bn from Kshs 1.8 bn and a 6.9% increase in the country transfers to Kshs 370.0 bn from Kshs 346.2 bn but the Development expenditure is expected to decline by 5.9% to Kshs 655.9 bn from Kshs 696.6 bn in the FY’2020/21 budget. To fund this expenditure, increases shall be funded by an 11.4% growth projection in ordinary revenue to Kshs 1.8 tn in FY’2021/22 from Kshs 1.6 tn in the FY’2020/21 budget and 21.1% increase in the domestic borrowings. Overall, total revenues are expected to increase by 10.3% y/y to 2.0 tn, from Kshs 1.8 tn in FY’2020/21.

The table below summarizes the key buckets and the projected changes:

|

Item |

FY'2020/21 Revised Estimates I |

FY'2021/22 Estimates |

Change y/y (%) |

|

Total revenue |

1,848.0 |

2,038.7 |

10.3% |

|

Total grants |

73.0 |

62.0 |

(15.1%) |

|

Total revenue & grants |

1,921.0 |

2,100.7 |

9.3% |

|

Recurrent expenditure |

1,849.2 |

2,004.9 |

8.4% |

|

Development expenditure & Net Lending |

696.6 |

655.4 |

(5.9%) |

|

County Transfer & Contingencies |

346.2 |

370.0 |

6.9% |

|

Total expenditure |

2,892.0 |

3,030.3 |

4.8% |

|

Fiscal deficit inclusive of grants |

(970.9) |

(929.7) |

(4.2%) |

|

Deficit as % of GDP |

8.7% |

7.5% |

(1.2%) pts |

|

Net foreign borrowing |

427.0 |

271.2 |

(36.5%) |

|

Net domestic borrowing |

543.9 |

658.5 |

21.1% |

|

Total borrowing |

970.9 |

929.7 |

(4.2%) |

|

Source: Financial Statements for the fiscal year 2021/2022 – National Treasury of Kenya |

|||

Some of the key take-outs include;

- The FY’2021/22 Budget estimates point to a 4.8% increase of the budget, to Kshs 3.0 tn from Kshs 2.9 tn in the FY’2020/21 budget,

- Recurrent expenditure is set to increase by 8.4% to Kshs 2.0 tn in FY’2021/22, from Kshs 1.8 tn in FY’2020/21 budget, while development expenditure is projected to decline by 5.9% to Kshs 655.4 bn in FY’2021/22, from Kshs 696.6.0 bn as per the FY’2020/21 budget. Under recurrent expenditures, ministerial recurrent expenditure is set to increase by 0.9% y/y to Kshs 1,286.6 bn, from Kshs 1,275.1 bn, while interest payment and pension increased by 25.1% to Kshs 718.3 in the FY’2021/22 budget from Kshs 574.1 bn in the FY’2020/21 budget. The 25.1% growth in the Recurrent Consolidated Fund Services (CFS) is mainly attributable to the 22.1% rise in debt servicing expenses to Kshs 560.3 bn, from Kshs 458.7 bn in the FY’2020/21 budget,

- The budget deficit is projected to decline to Kshs 929.7 bn (7.5% of GDP) from the projected Kshs 970.9 bn (8.7% of GDP) in the FY’2020/21 budget; in line with the International Monetary Fund’s (IMF’s) recommendation, in a bid to reduce Kenya’s public debt requirements. Kenya plans in the current Budget to 7.5% of GDP in the FY’2021/22 and further decline to 3.6% of GDP in the FY’2024/25, to help reduce the growth in public debt. The average fiscal deficit level over the last 10 years to FY’2021/2022 has been 7.9%,

- Revenue is projected to increase by 9.3% to Kshs 2.1 tn, from Kshs 1.9 tn in the FY’2020/21 budget, with measures already in place to work towards increasing the amount of revenue collected in the next fiscal year,

- Total borrowing is expected to reduce by 4.2% to Kshs 929.7 bn in the FY’2021/22 from Kshs 970.9 bn as per the FY’2020/21 budget, in a bid to reduce Kenya’s public debt burden which is estimated to be at 69.6% of GDP putting it 19.6% points above the recommended threshold of 50.0%, and,

- Debt financing is projected to reduce the reliance on foreign debt for the financial year 2021/2022 to 29.2% from 44.0% this current financial year.

Section III: Analysis and House-view on Key Aspects of the FY’2021/2022 Budget

Below we give our analysis and view on various aspects of the 2021 Budget Estimates:

- Revenue

Revenue is projected to increase by 10.3% to Kshs 2.0 tn in FY’2021/22, from Kshs 1.8 tn in the FY’2020/21 budget on the back of the expected economic recovery. The increased revenue projections in the FY’2021/22 are mainly attributable to the projected 11.4% growth in ordinary revenue to Kshs 1.8 tn in FY’2021/22, from Kshs 1.6 tn in the FY’2020/21 budget. Value Added Tax (VAT) is projected to increase by 19.7% to Kshs 0.5 tn in FY’2021/22 budget from Kshs 0.4 tn in the FY’2020/21 budget. Income Tax is expected to remain the highest contributor to government revenue, contributing 40.9% of the total revenue projections of Kshs 2.0 tn.

To meet its revenue target for the, the government shall rely on an expanded tax base and increase in some taxes. Some of the suggested changes shall be include growing the digital base, increasing VAT for some products like bread and motorcycles and also increasing the excise tax.

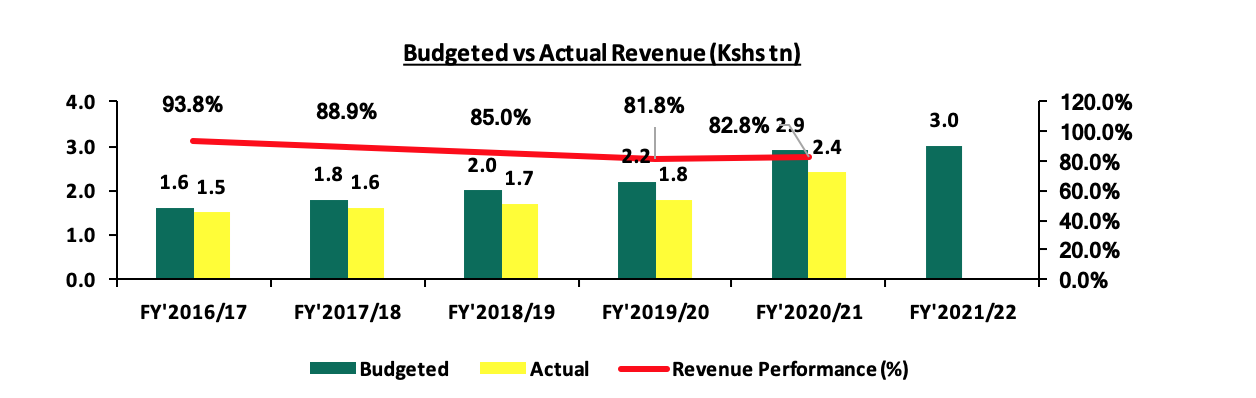

The government has been in the past struggled to raise the taxes and we think that with the ongoing pandemic these could be repeated this year. The chart below shows the revenue performance previously:

Source: National Treasury of Kenya

- Expenditure

The expenditure is expected to increase by 4.8% to Kshs 3.0 tn, from Kshs 2.9 tn in the FY’2020/21 budget. The higher expenditure level is attributable to the 8.4% increase in recurrent expenditure to Kshs 2.0 tn from Kshs 1.8 tn in FY’2020/21 and the 6.9% increase in County Transfers & Contingencies to Kshs 370.0 mn in FY’2021/22 Budget from Kshs 346.2 mn in FY’2020/21. However, Development Expenditure is expected to decline by 5.9% in FY’2021/22 to Kshs 655.4 bn from Kshs 696.6 bn in FY’2020/21, the first decline since FY’2017/18. The decline in development expenditure is in line with the government’s fiscal consolidation efforts where it intends to cut down on expenditure to help reduce the need to take on debt. The main concern from this budget is the growth of the recurrent expenditure by 8,4% increasing the proportion of recurrent expenditure to development spending at 75.4% from 72.6%, meaning that we are not investing much for the future.

In our view, the Government should increase its efforts in minimizing the recurrent expenditure growth in order to achieve its fiscal deficit of 3.6% in FY’2024/25. Development projects need to be prioritized and better planning incorporated to match fund availability to project execution, and measures taken to improve the public procurement process.

- Public Debt

The total public debt requirement for the FY’2021/22 is set to reduce by 4.2% to Kshs 929.7 bn, from Kshs 970.9 bn, in FY’2020/21, as per the revised budget. The public debt mix is projected to comprise of 29.2% foreign debt and 70.8% domestic debt, from 44.0% foreign and 56.0% domestic as per the FY’2020/21 budget. The debt servicing costs are set to rise by 22.1% to Kshs 560.3 bn in FY’2021/22, from Kshs 458.7 bn in the FY’2020/21 budget. The rise in debt servicing expenses may be partly attributable to the Debt Service Suspension (DSSI) agreement that Kenya entered into which temporarily suspended debt servicing costs, totaling Kshs 32.9 bn, in the last half of FY’2020/21. The increase in domestic debt mix to 70.8% from 56.0%, may lead to slow growth in the private sector lending as banks end up prefer lending in the government securities issued which are viewed to be low risk.

The higher domestic debt composition could have the following two results:

- A decline in Kenya’s exposure to external shocks, as the more we owe in foreign currency, the more exposed we are to any shocks in the foreign markets. The recent appreciation of the shilling against the dollar, at 1.3% YTD, is a noteworthy positive as this reduces the amount owed in foreign debt interest payments, and,

- Increase the crowding out of the private sector because the lower the government’s local debt appetite, the more banks have to lend to the private sector. Notably, appetite for domestic debt has been on a rise, concurrently, interruptions from the Covid-19 pandemic saw banks shy away from lending due to elevated credit risk on the borrowers and thus opting to lend to the government.

Debt sustainability continues to be a key concern, with the country’s public debt–to-GDP ratio having increased considerably over the past five years to 69.6% as at December 2020, from 44.3% as at the end of 2013 with half of the debt being external. The ballooning levels of public debt in the pandemic environment elevated the risk of debt sustainability, where in FY2020/21 the government received debt servicing suspension from ten Paris club members totaling to Kshs 32.9 bn which is 0.9% of the Kshs 3,769.9 bn of total external debt as at December 2020. The debt suspension helped in providing the much-needed relief as it reduced pressure on payments falling due from 1st January 2021 to 30th June 2021, as well as, a five-year repayment period with a grace period of one year.

Some of the actionable steps the government can take towards debt sustainability include (i) Restructuring the debt mix where the government should go for more concessional borrowing to reduce the amounts paid in debt service. Additionally, commercial borrowing should be limited to development projects with high financial and economic returns, to ensure that more expensive debt is invested in projects that yield more than the market rate charged, and (ii) The setting up of the Public Debt Management Authority (PDMA) – to monitor all public debt-related transactions, is a step in the right direction. However, Kenya’s debt problems have been more of a lack of fiscal discipline coupled with the inadequate political will to fight corruption so as to avoid pilferage. The authority should also be given the mandate to monitor expenditure and funds allocation to specific projects.

Section IV: Comparison between the East African FY’2021/2022 Budget

In line with the EAC, Uganda and Tanzania also presented their FY’2021/2022 Budgets for approval in their respective National Assemblies. Below we compare the two countries’ Budgets against Kenya’s proposed budget:

|

EAST AFRICA BUDGET COMPARISONS (Kshs Bn) |

||||||||||||||

|

|

Kenya |

Uganda |

Tanzania |

|||||||||||

|

Item |

FY'2020/21 |

FY'2021/22 |

Change y/y (%) |

% to GDP FY'2021/22 |

FY'2020/21 |

FY'2021/22 |

Change y/y (%) |

% to GDP FY'2021/22 |

FY'2020/21 |

FY'2021/22 |

Change y/y (%) |

% to GDP FY'2021/22 |

|

|

|

Total revenue |

1,848.0 |

2,038.7 |

10.3% |

16.7% |

593.1 |

684.4 |

15.4% |

13.8% |

962.1 |

1,169.9 |

21.6% |

15.0% |

|

|

|

External grants |

73.0 |

62.0 |

(15.1%) |

0.5% |

67.3 |

43.5 |

(35.4%) |

0.9% |

26.4 |

52.9 |

100.7% |

0.7% |

|

|

|

Total revenue & external grants |

1921.0 |

2100.7 |

9.3% |

17.2% |

660.4 |

727.9 |

10.2% |

14.7% |

988.5 |

1222.8 |

23.7% |

15.7% |

|

|

|

Recurrent expenditure |

1,849.2 |

2,004.9 |

8.4% |

16.4% |

579.4 |

578.9 |

(0.1%) |

11.7% |

981.5 |

1,069.3 |

8.9% |

13.8% |

|

|

|

Development expenditure & Net Lending |

696.6 |

655.4 |

(5.9%) |

5.4% |

471.4 |

450.3 |

(4.5%) |

9.1% |

415.8 |

619.5 |

49.0% |

8.0% |

|

|

|

Others Expenditures |

346.2 |

370.0 |

6.9% |

3.0% |

56.2 |

15.6 |

(72.2%) |

0.3% |

0.0 |

0.0 |

- |

0.0% |

|

|

|

Total expenditure |

2,892.0 |

3,030.3 |

4.8% |

24.8% |

1,106.9 |

1,044.8 |

(5.6%) |

21.1% |

1,397.3 |

1,688.8 |

20.9% |

21.7% |

|

|

|

Fiscal deficit |

(970.9) |

(929.7) |

(4.2%) |

(7.5%) |

(446.6) |

(316.9) |

(29.0%) |

(6.4%) |

(408.8) |

(465.9) |

14.0% |

(6.0%) |

|

|

|

Deficit as % of GDP |

8.7% |

7.5% |

(1.2%) |

(7.5%) |

9.9% |

6.4% |

(3.5%) |

(6.4%) |

5.7% |

6.0% |

0.3% |

(6.0%) |

|

|

|

Net foreign borrowing |

427.0 |

271.2 |

(36.5%) |

2.2% |

271.5 |

221.0 |

(18.6%) |

4.5% |

230.6 |

193.8 |

(15.9%) |

2.5% |

|

|

|

Net domestic borrowing |

543.9 |

658.5 |

21.1% |

5.4% |

175.1 |

95.9 |

(45.2%) |

1.9% |

228.0 |

231.9 |

1.7% |

3.0% |

|

|

|

Total borrowing |

970.9 |

929.7 |

(4.2%) |

7.6% |

446.6 |

316.9 |

(29.0%) |

6.4% |

458.6 |

425.8 |

(7.2%) |

5.5% |

|

|

|

GDP Estimate |

11,484.3 |

12,242.3 |

6.6% |

|

4,510.8 |

4,951.9 |

9.8% |

|

7,205.3 |

7,776.2 |

7.9% |

|

|

|

Some of the key take outs from the table above include:

- Kenya’s GDP is estimated to grow at a rate of 6.6% in 2021, while Uganda’s economy is expected to grow at a rate of 4.3% and Tanzania, 7.9%. The higher increase in Kenya’s GDP growth is attributed to its lower base as it grew by 0.6% in 2020, which was lower than Uganda’s growth of 3.3% in the same time period. Tanzania’s GDP is set to increase by 7.9% to Kshs 7.8 tn, from Kshs 7.2 tn in FY’2020/21, building on its impressive growth of 8.2% in FY’2020/21. Key to note, Tanzania did not impose COVID-related restrictions on its economy in 2020 and the nation’s government let business activities continue unhampered while urging observation of health safety measures,

- The three economies expect significant recovery from COVID-19-related negative effects, to boost their revenue. Kenya projects its total revenues plus grants to grow by 9.3% in FY’2021/22, while Uganda projects a 10.2% growth to Kshs 727.9 bn, from Kshs 660.4 bn in FY’2020/21. Tanzania’s revenue levels are also expected to increase by 21.6% to Kshs 1.2 tn, from Kshs 1.0 tn in FY’2020/21 mainly attributable to an expected 20.6% increase in tax revenue collections on the back of improved business activities especially as Tanzania’s trading partners recover and open up their economies,

- In terms of debt servicing, Tanzania’s debt service costs to total borrowing ranks highest at 96.8% compared to Kenya’s 60.3% and Uganda’s 45.2%. This indicates that Tanzania borrows relatively more expensive loans, and,

- In terms of borrowing, Kenya’s new borrowing is set to reduce by 4.2% to Kshs 929.7 bn in the FY’2021/22, from Kshs 970.9 bn as per the FY’2020/21 budget, in a bid to reduce Kenya’s public debt burden. Uganda has projected a 29.0% decline in its borrowings in the FY’2021/22 to Kshs 316.9 bn, from Kshs 446.6 bn as Uganda aims to prioritize borrowing from concessional sources which offer more generous terms, only borrow to fund economically viable projects and increase the maturity of its debt profile. This is a concern as Kenya’s public debt burden is 19.6% points above the East African Community (EAC) Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, and the IMF threshold of 50.0%. Key to note, as of December 2020, Kenya’s public debt burden stood at 69.6% compared to Uganda’s 49.8% and Tanzania’s 27.1%.

While Kenya’s total GDP remains significantly higher than Uganda’s, Kshs 12.0 tn against Uganda’s Kshs 5.0 tn and Tanzania’s 7.8 tn in the FY’2021/22 budget, Kenya’s increased borrowing levels and increasing recurrent expenditure are likely to slow down the country’s medium term growth.

Section IV: Conclusion

Kenya’s GDP is expected to rebound growing at a rate of 6.6% in 2021 from 0.6% growth in 2020. The performance in 2020 was mostly attributed to the effects of the COVID-19 pandemic, as movement restrictions adversely affected the demand in both the Kenyan and global economy. With this rebound in economic activity, the government projects increased revenue collections, which shall be supported by tax reforms as well. On the other hand, the Kenyan budget is expansionary as the government intends on spending more in the coming financial years to steer the country out of the pandemic driven economic. Kenya’s borrowing remains a major concern going forward with its current public debt burden at 69.6% compared to Uganda’s 49.8% and Tanzania’s 27.1%. Additionally, Kenya’s fiscal deficit is projected to stand at 7.5% in FY’2021/22, higher than both Uganda’s 6.4% and Tanzania’s 6.0%. The government of Kenya needs to seek more sustainable ways of minimizing their expenditure levels to help reduce the need for borrowing and leverage on the revenue generating bases to help service the existing debts. Kenya’s public debt mix is projected to comprise of 29.2% foreign debt and 70.8% domestic debt, from 44.0% foreign and 56.0% domestic as per the FY’2020/21 budget. The higher allocation to domestic borrowing may lead to slow growth in the private sector lending as banks end up prefer investing in the government securities issued which are viewed to be low risk and a stable source of returns.

It therefore remains a tough balance for the government and the emphasis should be on stimulating the economy and increasing tax collection efficiencies to reduce the debt burden.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.