Jul 7, 2024

On 13 June 2024, the National Treasury presented Kenya’s FY’2024/2025 National Budget to the National Assembly highlighting that the total budget estimates for FY’2024/25 increased by 3.1% to Kshs 4.0 tn from the Kshs 3.9 tn in FY’2023/2024 while the total revenue inclusive of grants increased by 15.2% to Kshs 3.4 tn from Kshs 2.9 tn in FY’2023/2024. The increase is mainly due to an 18.5% increase in ordinary revenue to Kshs 2.9 tn for FY’2024/2025, from the Kshs 2.5 tn in FY’2023/24.

The FY’2024/2025 budget focuses mainly on providing solutions to the heightened concerns on the high cost of living, the measures put in to accelerate economic recovery as well as undertaking a growth-friendly fiscal consolidation to preserve the country’s debt sustainability. Notably, the government projects to narrow the fiscal deficit to 3.3% of GDP in FY’2024/25, from the estimate of 5.7% of GDP in FY’2023/24. As such, this week, we shall discuss the recently released budget and the withdrawn Finance Bill 2024 with a key focus on Kenya’s fiscal components. We shall do this in four sections, namely:

- FY’2023/2024 Budget Outturn as at May 2024,

- Comparison between FY'2023/2024 and FY'2024/2025 Budget estimates,

- Analysis and House-view on Key Aspects of the 2024 Budget,

- The Withdrawn Finance Bill 2024, and,

- Conclusion and Our View.

Section I: FY’2023/2024 Budget Outturn as at May 2024

The National Treasury gazetted the revenue and net expenditures for the eleventh month of FY’2023/2024, ending 31st May 2024. Below is a summary of the performance:

|

Amounts in Kshs billions unless stated otherwise |

||||||

|

Cytonn Report: FY'2023/2024 Budget Outturn - As at 31st May 2024 |

||||||

|

Item |

12-months Original Estimates |

Revised Estimates I |

Actual Receipts/Release |

Percentage Achieved of the Revised Estimates |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

|

|

2.6 |

|

|

|

|

Tax Revenue |

2,495.8 |

2,495.83 |

1,928.8 |

77.3% |

2,287.8 |

84.3% |

|

Non-Tax Revenue |

75.3 |

80.9 |

94.2 |

116.3% |

74.2 |

126.9% |

|

Total Revenue |

2,571.2 |

2,576.8 |

2,025.6 |

78.6% |

2,362.0 |

85.8% |

|

External Loans & Grants |

870.2 |

849.8 |

527.5 |

62.1% |

779.0 |

67.7% |

|

Domestic Borrowings |

688.2 |

851.9 |

704.7 |

82.7% |

780.9 |

90.2% |

|

Other Domestic Financing |

3.2 |

3.2 |

3.5 |

111.1% |

2.9 |

121.2% |

|

Total Financing |

1,561.6 |

1,704.9 |

1,235.7 |

72.5% |

1,562.8 |

79.1% |

|

Recurrent Exchequer issues |

1,302.8 |

1,360.1 |

1,112.8 |

81.8% |

1,246.8 |

89.3% |

|

CFS Exchequer Issues |

1,963.7 |

2,078.8 |

1,594.7 |

76.7% |

1,905.6 |

83.7% |

|

Development Expenditure & Net Lending |

480.8 |

457.2 |

261.1 |

57.1% |

419.1 |

62.3% |

|

County Governments + Contingencies |

385.4 |

385.4 |

287.1 |

74.5% |

353.3 |

81.3% |

|

Total Expenditure |

4,132.7 |

4,281.6 |

3,255.8 |

76.0% |

3,924.8 |

83.0% |

|

Fiscal Deficit excluding Grants |

1,561.6 |

1,704.9 |

1,230.2 |

72.2% |

1,562.8 |

78.7% |

|

Total Borrowing |

1,558.4 |

1,701.7 |

1,232.2 |

72.4% |

1,559.9 |

79.0% |

Source: National Treasury of Kenya

The Key take-outs from the release include;

- Total revenue collected as at the end of May 2024 amounted to Kshs 2,025.6 bn, equivalent to 78.6% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024, and is 85.8% of the prorated estimates of Kshs 2,362.0 bn. Cumulatively, tax revenues amounted to Kshs 1,928.8 bn, equivalent to 77.3% of the revised estimates of Kshs 2,495.8 bn and 84.3% of the prorated estimates of Kshs 2,287.8 bn,

- Total financing amounted to Kshs 1,235.7 bn, equivalent to 72.5% of the revised estimates of Kshs 1,704.9 bn and is equivalent to 79.1% of the prorated estimates of Kshs 1,562.8 bn. Additionally, domestic borrowing amounted to Kshs 704.7 bn, equivalent to 82.7% of the revised estimates of Kshs 851.9 bn and is 90.2% of the prorated estimates of Kshs 780.9 bn,

- The total expenditure amounted to Kshs 3,255.8 bn, equivalent to 76.0% of the revised estimates of Kshs 4,281.6 bn, and is 83.0% of the prorated target expenditure estimates of Kshs 3,924.8 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 1,112.8 bn, equivalent to 81.8% of the revised estimates of Kshs 1,360.1 and 89.3% of the prorated estimates of Kshs 1,246.8 bn,

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 1,594.7 bn, equivalent to 76.7% of the revised estimates of Kshs 2,078.8 bn, and are 83.7% of the prorated amount of Kshs 1,905.6 bn. The cumulative public debt servicing cost amounted to Kshs 1,455.8 bn which is 78.0% of the revised estimates of Kshs 1,866.0 bn, and is 85.1% of the prorated estimates of Kshs 1,710.5 bn. Additionally, the Kshs 1,455.8 bn debt servicing cost is equivalent to 71.9% of the actual revenues collected as at the end of May 2024, and,

- Total Borrowings as at the end of May 2024 amounted to Kshs 1,232.2 bn, equivalent to 72.4% of the revised estimates of Kshs 1,701.7 bn for FY’2023/2024, and are 79.0% of the prorated estimates of Kshs 1,559.9 bn. The cumulative domestic borrowing of Kshs 851.9 bn comprises of Net Domestic Borrowing Kshs 471.4 bn and Internal Debt Redemptions (Rollovers) Kshs 380.5 bn.

The government has been unable to meet its prorated revenue targets for the eleven months of the FY’2023/2024, attaining 85.8% of the revenue targets in May 2024, mainly on the back of the tough economic situation exacerbated by higher taxes and high interest rates. Notably, the cost of living remains elevated in the country, despite an ease inflation, with the inflation rate easing to 4.6% in June 2024 from 5.1% in May 2024 which continues to impede revenue collection. Additionally, the business environment worsened in June 2024 to 47.2 from 51.8 in May 2024 mainly on the back of the anti-Finance Bill 2024 protests. In light of this, the government is yet to fully benefit from the strategies put in place to improve revenue collection such as expanding the revenue base and sealing tax leakages, and suspension of tax relief payments. The coming months' revenue collection performance will largely depend on how quickly the country's business climate stabilizes. This stabilization is expected to be aided by the ongoing appreciation of the Shilling, and a further ease in inflationary pressures in the country.

Section II: Comparison between FY’2023/2024 and FY’2024/2025 Budgets estimates

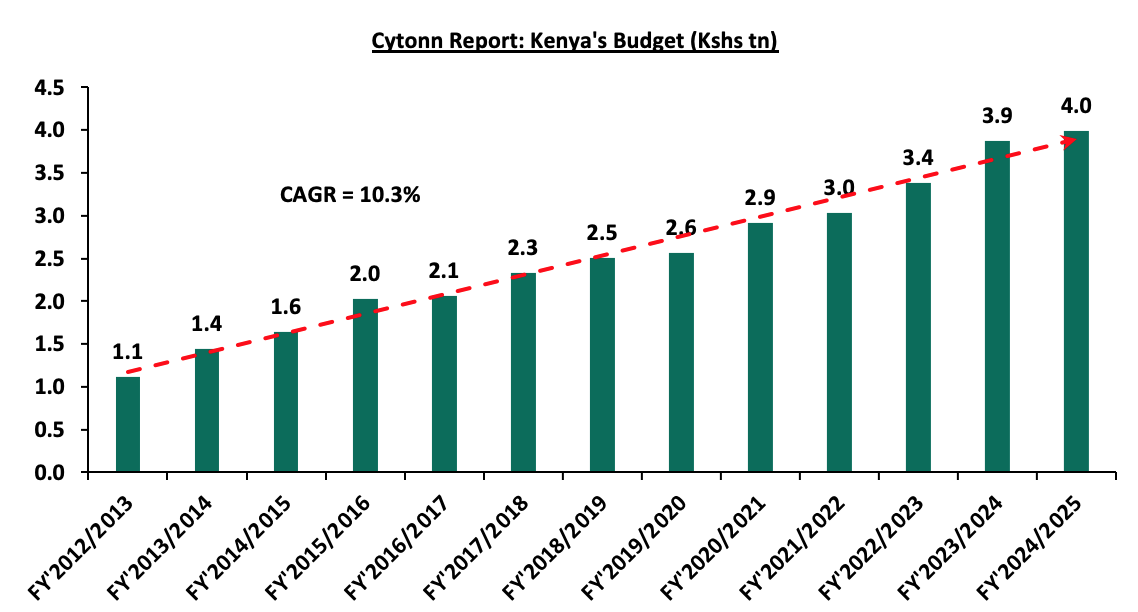

The Kenyan Government budget has been growing over the years on the back of increasing recurrent and development expenditures. The chart below shows the evolution of the government budget over a thirteen-year period:

Source: National Treasury of Kenya

For the FY’2024/2025, the budget is projected to increase by 3.1% to Kshs 4.0 tn, from Kshs 3.9 tn in FY’2023/2024. The expenditure will be funded by revenue collections of Kshs 3.4 tn and borrowings amounting to Kshs 597.0 bn.

The table below summarizes the key buckets and the projected changes:

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Cytonn Report: Comparison between FY’2023/2024 and FY’2024/2025 Budgets Estimates |

|||

|

Item |

FY'2023/24 Supplementary Budget II |

FY'2024/25 Estimates |

Change y/y (%) |

|

Ordinary Revenue |

2,461.0 |

2,917.2 |

18.5% |

|

Total Appropriation-in-Aid |

446.5 |

426.0 |

(4.6%) |

|

Total grants |

38.4 |

51.8 |

34.7% |

|

Total Revenue & Grants |

2,946.0 |

3,395.0 |

15.2% |

|

Recurrent expenditure |

1,719.9 |

1,628.6 |

(5.3%) |

|

Recurrent Consolidated Funds Services (CFS) |

1,057.7 |

1,213.4 |

14.7% |

|

Development expenditure |

669.3 |

745.9 |

11.4% |

|

County Transfer & Contingencies |

425.1 |

404.1 |

(4.9%) |

|

Total expenditure |

3,872.0 |

3,992.0 |

3.1% |

|

Fiscal deficit inclusive of grants |

(926.1) |

(597.0) |

(35.5%) |

|

Projected Deficit as % of GDP |

(5.7%) |

(3.3%) |

(2.4%) pts |

|

Net foreign borrowing |

319.3 |

333.8 |

4.5% |

|

Net domestic borrowing |

606.8 |

263.2 |

(56.6%) |

|

Total borrowing |

926.1 |

597.0 |

(35.5%) |

Source: Financial Statement For the FY 2024/2025-Budget , The Mwananchi Guide for the FY’2024/25, National Treasury of Kenya

Some of the key take-outs include;

- The government projects total revenue inclusive of grants for FY’2024/25 to increase by 18.5% to Kshs 3.4 tn (equivalent to 18.8% of GDP), from the Kshs 2.9 tn in FY’2024/2025 (equivalent to 18.3% of GDP). The increase is mainly due to a 18.5% increase in ordinary revenue to Kshs 2.9 tn (equivalent to 16.2% of GDP) for FY’2024/2025, from the Kshs 2.5 tn in FY’2023/24 (equivalent to 15.3% of GDP),

- Total expenditure is set to increase by 3.1% to Kshs 4.0 tn (equivalent to 22.2% of GDP), from Kshs 3.9 tn (equivalent to 24.0% of GDP) in the FY’2023/24 Budget estimates,

- Recurrent expenditure is set to decrease by 5.3% to Kshs 1.6 tn in FY’2023/2024, from Kshs 1.7 tn in the FY’2023/2024 budget estimates, while Consolidated Funds Services (CFS) expenditure is expected to increase by 14.7% to Kshs 1,213.4 bn, from Kshs 1,057.7 bn in the FY’2023/2024 budget estimates. Also, Development expenditure is set to increase by 11.4% to Kshs 745.9 bn, from Kshs 669.3 bn in the FY’2023/2024 budget estimates,

- Public debt is expected to continue growing in FY’2024/25, as the approximate Kshs 597.0 bn fiscal deficit will be financed through domestic debt totaling Kshs 263.2 bn and foreign debts totaling Kshs 333.8 bn. However, the total borrowing is expected to reduce by 35.5% to Kshs 597.0 bn in the FY’2024/25, from Kshs 926.1 bn as per the FY’2023/2024 supplementary budget II, in a bid to reduce Kenya’s public debt burden which was estimated at 73.4% of GDP as of December 2023, surpassing the 50.0% recommended threshold by 23.4% points, and,

- The budget deficit is projected to decline by 2.4% points to 3.3% of GDP, from the 5.7% of GDP in the FY’2023/2024 budget, mainly as growth in revenues outpace growth in expenditure.

Section III: Analysis and House-view on Key Aspects of the FY’2022/2023 Budget

- Revenue

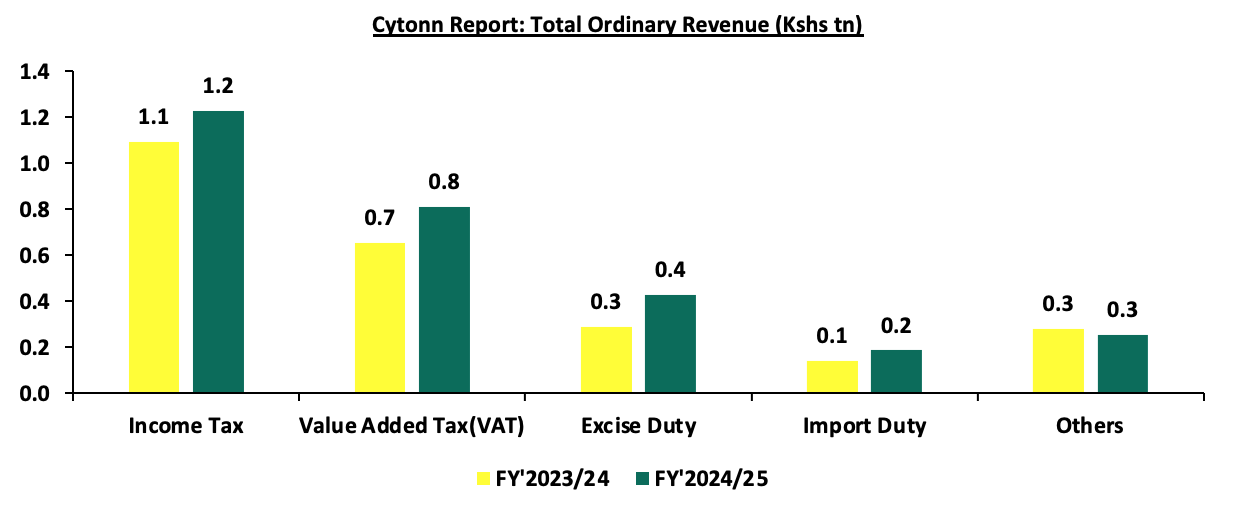

Revenue is projected to increase by 15.2% to Kshs 3.4 tn in FY’2024/25, from Kshs 2.9 tn in the FY’2023/24 supplementary budget II. The increased revenue projections in the FY’2024/25 are mainly attributable to the projected 18.5% growth in ordinary revenue to Kshs 2.9 tn in FY’2024/25, from Kshs 2.5 tn in the FY’2023/24 budget. The main sources of revenue will be:

- Income Tax, which remains the highest contributor to government revenue, contributing 36.2% of the total revenue projections of Kshs 3.4 tn, is expected to increase by 12.5% to Kshs 1.2 tn in FY’2024/25, from Kshs 1.1 tn in FY’2023/2024,

- Value Added Tax (VAT) contributing 23.9% of the projected total revenue is projected to increase by 24.0% to Kshs 812.2 bn in FY’2024/25 budget, from Kshs 654.8 bn in the FY’2023/24 budget,

- Excise Duty contributing 12.7% to the projected revenues for the FY’2024/25 is expected to increase by 48.1% to Kshs 429.6 bn, from Kshs 290.1 bn in FY’2023/24 budget estimates, and,

- Import Duty contributing 5.5% to the projected revenues for the FY’2024/25 is expected to increase by 31.6% to Kshs 187.4 bn, from Kshs 142.4 bn in FY’2023/24 budget estimates.

The chart below compares ordinary revenue projections for FY’2024/25 and FY’2023/24:

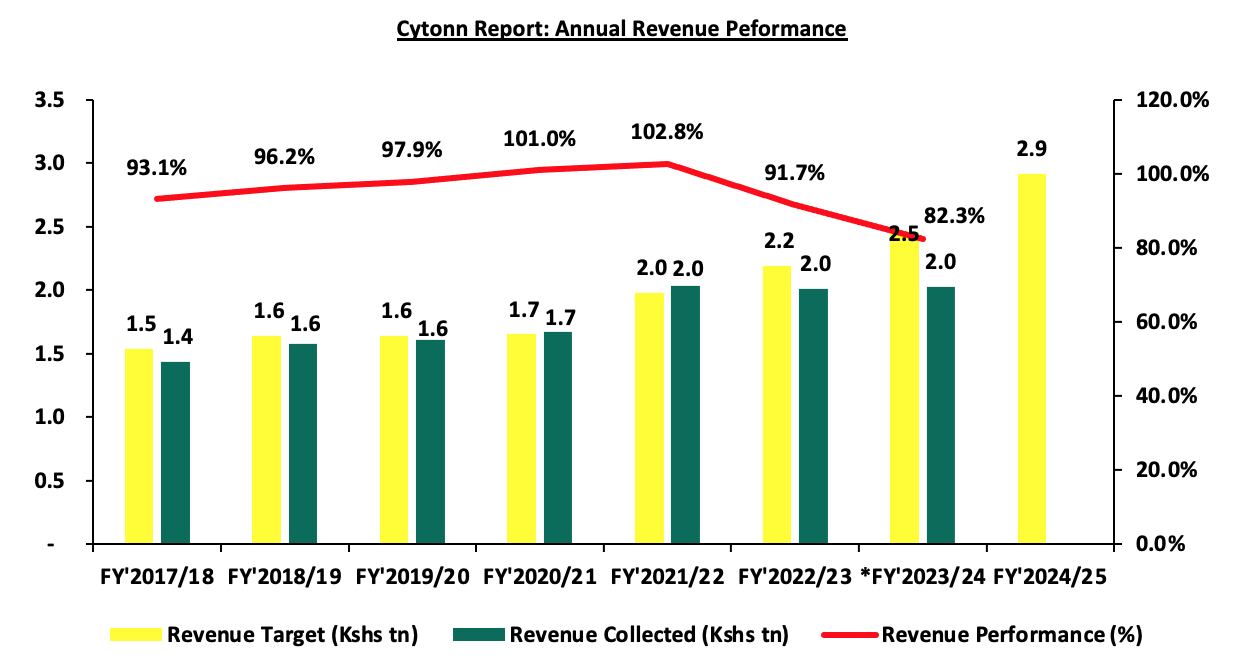

The government relies on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as increase in some of the existing taxes to meet its revenue target. Historically, the government has struggled to meet its target revenue collections resulting to an ever-present fiscal deficit. As such, there are still concerns about the government's ability to meet its revenue collection targets in FY’2024/2025, mainly on the back of the withdrawal of the Finance Bill 2024, which sought to raise an additional Kshs 302.0 bn, as well as the current operating environment, where the cost of living remains elevated despite an ease in inflationary pressures. The chart below shows the ordinary revenue performance in the previous fiscal years:

Source: National Treasury of Kenya and Kenya Revenue Authority

*Total Revenue collection as of 31 May 2024

- Expenditure

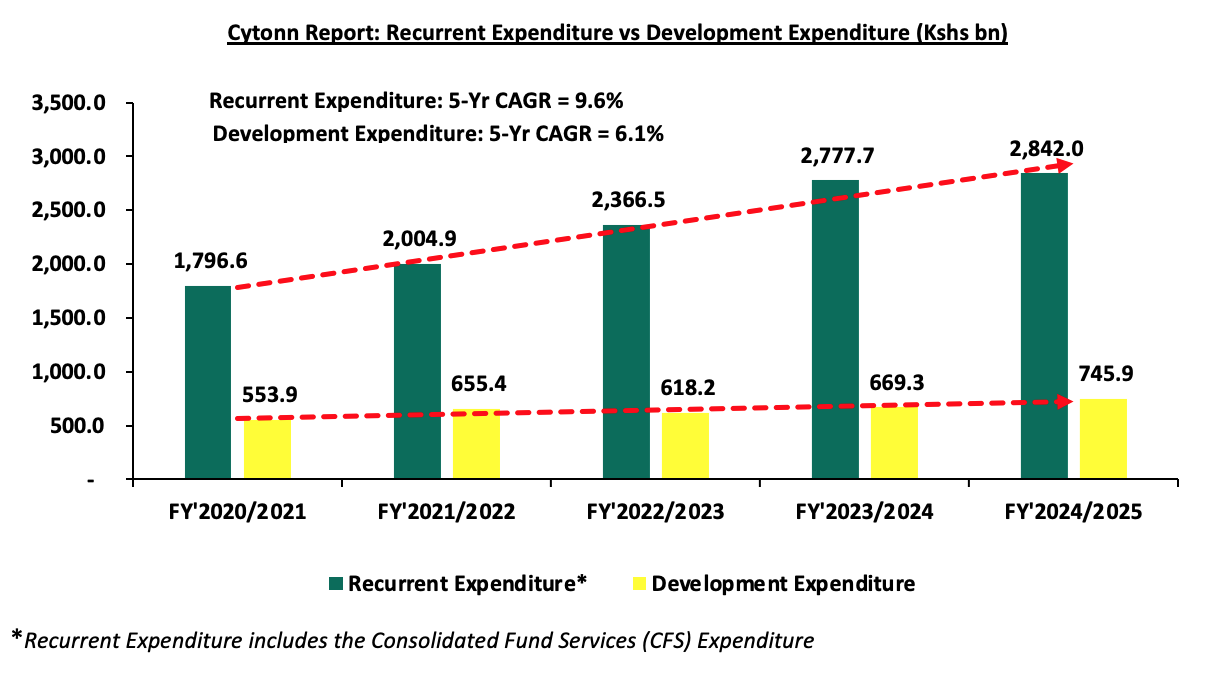

Expenditure is expected to increase by 3.1% to Kshs 4.0 tn, from Kshs 3.9 tn in the FY’2023/24 budget with recurrent expenditure taking up 71.2% of the total expenditure for FY’2023/2024, in comparison to the 71.7% in FY’2023/2024. The chart below shows the comparison between the recurrent expenditure allocations and development expenditure allocations over the past five fiscal years:

Some of the key take-outs include;

- Recurrent expenditure takes the largest proportion of government expenditure over the last five fiscal years growing at a 5-year CAGR of 9.6% to Kshs 2,842.0 bn in FY’2024/25, from Kshs 1,796.6 bn in FY’2020/2021. For the FY’2024/2025, the recurrent expenditure is estimated to increase by 2.3% to Kshs 2,842.0 bn, from Kshs 2,777.7 bn in FY’2023/2024 mainly due to a 14.7% increase in Consolidated Fund Services (CFS) expenditure to Kshs 1,213.4 bn from Kshs 1057.7 bn in FY’2023/2024. The increase can be mainly attributed to the increased debt servicing cost which represented 91.3% of the CFS expenditure in FY’2023/2024 as of 31st May 2024. We expect the debt servicing cost to continue increasing as the government is expected to borrow more to close the revenue gap following the withdrawal of Finance Bill 2024, and,

- Development expenditure on the other hand continues to lag behind contributing only 18.7% of the FY’2024/25 expenditure estimates. Allocation to infrastructure remains the highest taking 64.0% of the development expenditure. In the FY’2024/2025, infrastructure expenditure is set to increase by 1.9% to Kshs 477.2 bn, from Kshs 468.2 bn in FY’2023/2024 in line with the government’s agenda of increasing the development of critical infrastructure in the road, rail, sea, and airport sectors in order to open many areas to economic activities and spur growth in cross border trade and regional integration. The table below shows the sectors with the highest expenditure allocation over the last five fiscal years:

|

Amounts in Kshs billions unless stated otherwise |

|||||||

|

Cytonn Report: Kenya Budget Highest Expenditure Allocations |

|||||||

|

Item |

FY'2020/2021 |

FY'2021/2022 |

FY'2022/2023 |

FY'2023/2024 |

FY'2024/2025 |

Change |

CAGR |

|

Interest Payments, Pensions & Net Lending |

586.5 |

718.3 |

867.8 |

1,057.7 |

1,213.4 |

14.7% |

15.7% |

|

Education |

505.1 |

503.9 |

544.4 |

628.6 |

656.6 |

4.5% |

5.4% |

|

Infrastructure |

363.3 |

383.3 |

416.4 |

468.2 |

477.2 |

1.9% |

5.6% |

|

County Shareable Revenue |

316.5 |

370.0 |

399.6 |

423.9 |

400.1 |

(5.6%) |

4.8% |

|

Public Admin & Int. Relations |

289.3 |

299.7 |

342.2 |

327.0 |

322.4 |

(1.4%) |

2.2% |

|

Total |

2,060.7 |

2,275.2 |

2,570.4 |

2,905.4 |

3,069.7 |

5.7% |

8.3% |

Source: The Mwananchi Guide for the FY’2024/25 National Treasury of Kenya

Notably, the allocation to interest payment, pension and net lending increased by 14.7% to Kshs 1,213.4 bn in FY’2024/25 from Kshs 1,057.7 bn in FY’2023/24, partly attributable to high cost of servicing debt.

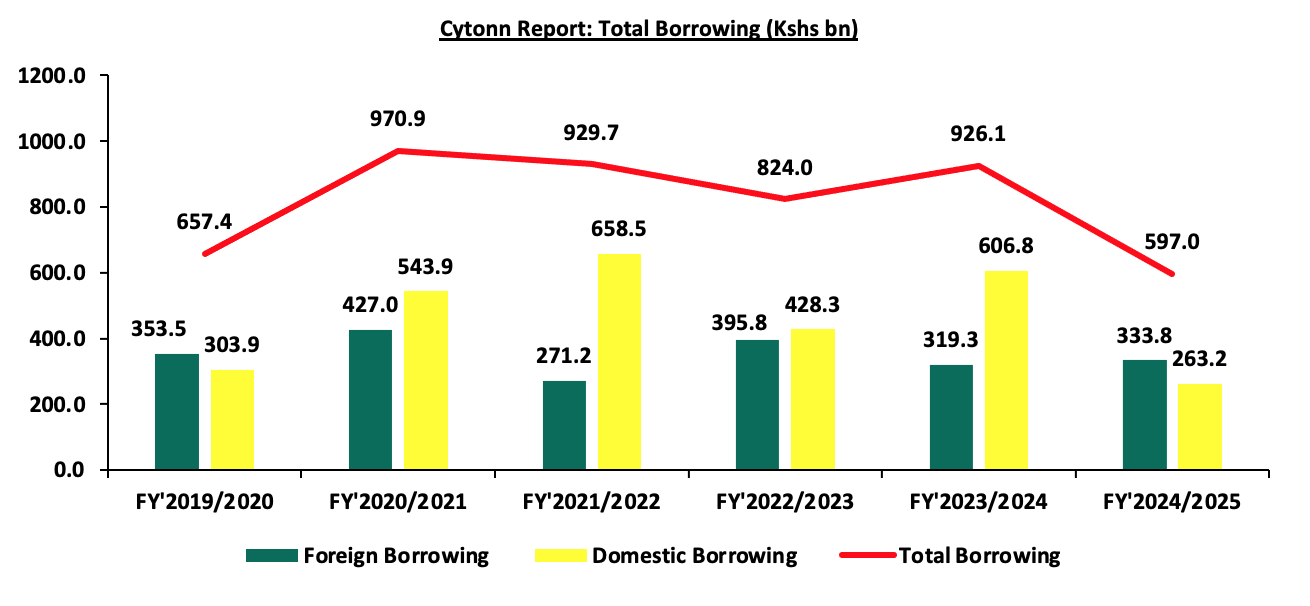

- Borrowing

The total borrowing for the FY’2024/25 is set to reduce by 35.5% to Kshs 597.0 bn, from Kshs 926.1 bn, in FY’2023/24 budget estimates. The public debt mix is projected to comprise of 55.9% foreign debt and 44.1% domestic debt, from 34.5% foreign financing and 65.5% domestic financing as per the FY’2023/24 Supplementary Budget II. The rise in debt servicing expenses can be partly attributed to the government’s high affinity for debt to finance the wide budget deficits, partly fueled by the ballooning recurrent expenditure and debt costs. The chart below shows the evolution of public borrowing to fill the fiscal deficit gap over the last five years:

The key take-outs from the chart include:

- The proportion of domestic financing is estimated to decrease to 44.1% in FY’2024/25 from 65.5% in FY’2023/24. The decline is expected to reduce the crowding out of the private sector by the government as banks prefer lending to the government as opposed to the private sector which is considered riskier, with a possible decline in interest rates, and,

- The total borrowing is expected to decline by 35.5% to Kshs 597.0 bn, from 926.1 bn in FY’2023/24, reflecting the government’s fiscal consolidation efforts aimed at reducing the fiscal deficit and dependence on debt through rationalization of tax expenditures and ensuring the sustainability and value for money from the available resources.

We therefore note the persistent fiscal deficit is mainly on the back of low revenue collection and high expenditure. As such, the government needs to minimize spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. This would allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue.

Section IV: Withdrawal of the Finance Bill 2024

Following nationwide protests that peaked on Tuesday 25th June 2024, President William Ruto, on Wednesday 26th June 2024 conceded to pressure from the public and declined to sign the controversial Finance Bill 2024 into law.

The proposed raft of tax changes in the Finance Bill 2024 were geared towards expanding the tax base and increasing revenues, with an expectation of raising Kshs 302.0 bn. This revenue was intended to support the government's budget of Kshs 4.0 tn for the FY’2024/2025, and to address a budget deficit of Kshs 597.0 bn. The deficit is planned to be financed through external borrowing of Kshs 333.8 bn and domestic borrowing of Kshs 263.2 bn. Kenya’s total public debt to GDP ratio currently stands at 69.7%, which is higher than the 55.0% preferred by the World Bank and the International Monetary Fund (IMF). Below we highlight some of the key tax proposals contained in the Finance Bill 2024, changes made and the implications of the withdrawal of the Bill:

- Under the Income Tax Act:

- Motor vehicle tax: The Bill proposed a new 2.5% tax on the value of motor vehicles, payable when issuing insurance cover,

- Withholding Tax on Goods Supplied to Public Entities: The Bill suggested a withholding tax on goods supplied to public entities by residents and non-residents without a permanent establishment. The rate is 3.0% for resident suppliers and 5.0% for non-residents,

- Taxation of Digital Marketplaces and Content Monetization: The Bill proposed taxing income from digital marketplaces or platforms and digital content monetization at 20.0% for non-residents and 5.0% for residents,

- Repeal of Digital Service Tax and Introduction of Significant Economic Presence Tax: The Bill sought to repeal the digital service tax (DST) and introduce a significant economic presence tax at 30.0% of deemed taxable profit for non-residents earning income from services provided through digital marketplaces in Kenya,

- Tax Deductibility of Contributions to Medical Funds and Housing Levy: The Bill proposed making contributions to the Social Health Insurance Fund, post-retirement medical fund, and affordable housing levy deductible expenses when calculating taxable income,

- Investment Deduction on Spectrum Licence Purchases: The Bill introduced an investment deduction for capital expenditure on spectrum licenses by telecommunications operators at 10% in equal installments. For licenses purchased before 01 July 2024, the deduction is limited to the unamortized portion over the remaining useful life, and,

- Tax on Interest Income from Infrastructure Bonds: The Bill proposed taxing interest income from infrastructure bonds for resident persons, while non-residents' interest income remains exempt. Interest from previously listed infrastructure bonds will continue to be exempt.

- Under the Excise Duty Act:

- Introduction of Excise Duty on Digital Services by Non-Residents: The Bill proposed a 20.0% excise duty on services provided by non-residents through digital platforms in Kenya. This applies to; Telephone and internet data services, fees for money transfer services by banks, money transfer agencies, and other financial service providers, betting, lottery, gaming, and prize competitions, and fees on digital lending,

- Increase of Excise Duty on Money Transfer Services: The Bill suggested raising excise duty from 15.0% to 20.0% on fees for money transfer services provided by banks, money transfer agencies, and other financial service providers, and cellular phone service providers or payment service providers licensed under the National Payment Systems Act, 2011,

- Extension of Timeline for Excise Duty Payment by Alcoholic Beverage Manufacturer: The Bill proposed extending the payment timeline for excise duty by licensed alcoholic beverage manufacturers to five working days after removing goods from the stockroom. The previous requirement was to pay within 24 hours, and,

- Repeal of Automatic Adjustment for Inflation: The Bill proposed removing provisions for the automatic adjustment of excise duty rates on excisable goods for inflation.

- Under the Value Added Tax (VAT) Act

- VAT on Financial Services: The Bill proposed removing VAT exemptions for several financial services, making them subject to the standard VAT rate of 16.0%. These services include: Issuing credit and debit cards, telegraphic money transfers, foreign exchange transactions, cheque handling and processing, issuing securities for money, debt assignment for consideration, financial services provided on a commission basis,

- Increase of VAT Registration Threshold: The Bill proposed raising the threshold for mandatory VAT registration from Kshs 5.0 mn to Kshs 8.0 mn,

- Exemption for Transfer of Business: The Bill proposed exempting the transfer of a business as a going concern from VAT, which is currently taxed at 16.0%,

- VAT on Insurance Premiums: The Bill proposed limiting VAT exemptions to insurance and reinsurance premiums only, subjecting other related services to the standard VAT rate of 16.0%.

- VAT on Betting, Gaming, and Lotteries: The Bill proposed removing the VAT exemption for betting, gaming, and lotteries, making them subject to the standard VAT rate of 16.0%,

- Removal of VAT Exemptions in Tourism: The Bill proposed deleting the following VAT exemptions in the tourism sector: Goods for the construction of tourism facilities and recreational parks of 50 acres or more, locally assembled vehicles for transporting tourists, purchased by tour operators, services for the construction of tourism facilities and recreational parks of 50 acres or more, and,

- Removal of VAT Exemptions in Manufacturing and Construction: The Bill proposed deleting the following VAT exemptions for the manufacturing and construction sectors: Capital goods promoting investment in manufacturing with a value of at least Kshs 2.0 bn, plant, machinery, and equipment for constructing plastics recycling plants, and goods and services for constructing and equipping specialized hospitals with a minimum bed capacity of 50, approved by the Cabinet Secretary for Health

Changes effected to the Finance Bill 2024 included:

- Removal of VAT on Bread: The Finance Committee scrapped the proposed 16.0% VAT on bread following public backlash,

- Excise Duty on Vegetable Oil: The President approved the removal of a proposed 25.0% excise duty on vegetable oil,

- VAT on Sugar Cane Transportation: The State House eliminated the proposed 16.0% VAT on transporting sugar cane to factories, which could have led to higher sugar prices,

- VAT on Financial Services: The Committee removed VAT on financial services and foreign exchange transactions, preventing a potential increase from 15.0% to 40.0% that could have affected forex transactions,

- Mobile Money Transfer Charges: The proposed increase of excise duty on mobile money transfer charges from 15.0% to 20.0% was reversed,

- Motor Vehicle Tax: The proposed annual motor vehicle tax of 2.5% of car value, with a minimum of Kshs 5,000 and a maximum of Kshs 100,000, was removed due to public outcry,

- Housing Fund and Social Health Insurance Levies: These proposed levies were converted to tax-deductible expenses, exempting them from income tax and benefiting employees,

- Eco Levy Adjustments: The Eco Levy will now apply only to imported finished products, not locally manufactured goods, addressing concerns about stifling local manufacturing growth,

- Exemptions on Locally Manufactured Products: The Eco Levy will not apply to locally made products, including sanitary towels, diapers, phones, computers, tyres, and motorcycles,

- VAT Registration Threshold: Small businesses with a turnover of less than Kshs 8.0 mn are exempt from VAT registration, up from the previous threshold of Kshs 5.0 mn,

- eTIMS Exemption: Farmers and small businesses with a turnover below Kshs 1.0 mn are exempt from registering for the electronic Tax Invoice Management System (eTIMS),

- Excise Duty on Imported Agricultural Products: The Committee imposed excise duty on imported table eggs, onions, and potatoes to protect local farmers, scrapping the proposed 16.0% VAT,

- Excise Duty on Alcoholic Beverages: Excise duty will be based on alcohol content rather than volume, encouraging the production of safer and more affordable alcohol,

- Pension Contributions: The exemption threshold for pension contributions was increased from Kshs 20,000 to Kshs 30,000,

- Funding for Junior Secondary School Interns: The budget for recruiting Junior Secondary School interns was increased from Kshs 13.4 bn to Kshs 18.0 bn, and,

- Teacher Intern Recruitment: Funds have been allocated to hire 20,000 teacher interns, with a policy shift to transition these teachers to permanent and pensionable terms.

The withdrawal of the Finance Bill 2024 in Kenya has significant implications for the country's economy and investment landscape. The withdrawal of the Bill will create a revenue shortfall for the FY’2024/2025 budget, and will likely result in Kenya missing the 3.3% fiscal deficit target this year and lead to a possible cut in development expenditure, increased borrowing, higher interest rates, and a potential rise in public debt. Furthermore, after reaching a staff-level agreement with the IMF, the proposed tax measures reversal will possibly impede the disbursement of future IMF funds. Uncertainty about the budgetary trajectory and the IMF program would further complicate the government's efforts to increase external funding.

The Finance Bill's withdrawal may affect investor confidence, especially if the market perceives it as a sign of political or economic instability, and could impact both domestic and foreign investment inflows. Investors may adopt a wait-and-see approach, leading to decreased market activity.

Section V: Conclusion and Our View

The Kenyan economy has continued to remain resilient despite recording a slowdown in growth to 5.0% in Q1’2024 compared to a growth of 5.5% recorded in Q1’2023. We expect the economy to grow at a slower pace given the restrained business as a result of the difficult economic environment caused by increasing taxes, and an overall rise in the cost of living. Additionally, the Central Bank of Kenya’s Monetary Policy Committee’s (MPC) decision on 5th June 2024 to maintain the Central Bank Rate (CBR) at 13.0% in a bid to curb inflation and maintain price stability is expected to curtail economic growth. The higher CBR is set to maintain the cost of credit issued by lenders high, hence discouraging borrowing, which will in turn lead to reduced investment spending in the economy by both individuals and businesses. However, the economy is expected to record a growth rate of 5.4% in 2024, mainly supported by private sector growth, continued strong growth of the financial services sector, and recoveries in the agricultural sector. Furthermore, in the FY’2024/2025 budget, the government has allocated Kshs 10.0 bn for the fertilizer subsidy program aimed at lowering the cost of farm input and enhancing food supply in the country.

The government has reduced its appetite for debt, projecting to borrow Kshs 597.0 bn in total debt in the FY’2024/25, a 35.5% decrease from 926.1 bn in the FY’2023/24. The move is expected to lower the cost of debt servicing, given that both foreign and domestic debt has been ballooning as a result of wide budget deficits. Additionally, the government's shift to borrow less domestically, by projecting to decrease its domestic borrowing by 56.6% to Kshs 263.2 bn in FY’2024/25, from Kshs 606.8 bn in FY’2024/25, is expected to increase credit to the private sector, with reduced credit demand by the government.

Overall, we are of the view that the main driver of the growing public debt is the fiscal deficit occasioned by lower revenues as compared to expenditures. As a result, implementing robust fiscal consolidation would help the government bridge the deficit gap. This can be achieved by minimizing spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. Fiscal consolidation would also allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue. However, the overall risk to the economy remains high, owing to the high debt servicing costs in the next fiscal year.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.