Jul 24, 2022

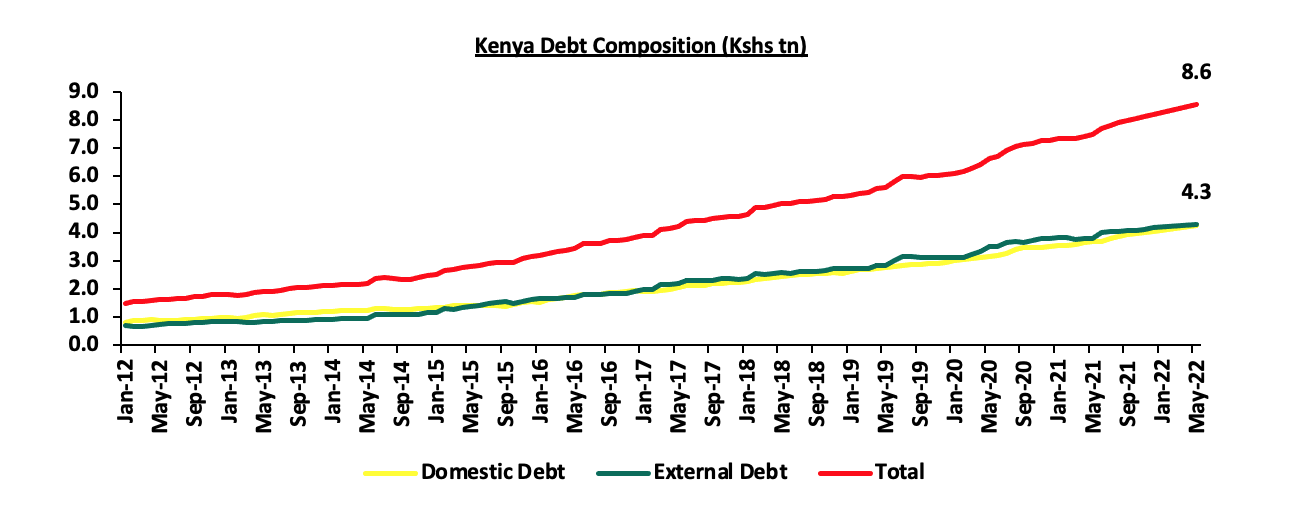

Kenya’s public debt has been on the rise, increasing by a 10-year CAGR of 18.2% to Kshs 8.6 tn in May 2022, from Kshs 1.6 tn in May 2012 owing primarily to the government’s significant borrowing to fund infrastructural projects and bridge the fiscal deficit which has averaged 7.4% of GDP over the last 10 years coupled with the increasing debt servicing costs especially for US Dollar denominated commercial loans given the shilling’s continuous depreciation. Additionally, the continued guaranteeing of state corporations that have been performing poorly has placed a burden on the government to support them. The debt mix, as at May 2022 stood at 50:50 external to domestic debt, compared to 45:55 external to domestic debt in May 2012. Notably, Kenya’s debt stock has increased significantly due to advances from multilateral lenders with the debt to GDP ratio coming in at 69.1% as of May 2022, 19.1% points above the IMF recommended threshold of 50.0% for developing countries and higher than the 42.1% as of 2012. As such, the Kenyan Senate approved an increase of the debt ceiling to an absolute figure of Kshs 10.0 tn from the initial 9.0 tn in October 2021 providing the government with a headroom to borrow an additional Kshs 0.4 tn before the current debt ceiling is exceeded.

We have been tracking the evolution of Kenya’s public debt with the most recent topical being Kenya’s Public Debt: On a path to Distress?, which was done in October 2021. Here we highlighted the state of affairs concerning the country’s public debt profile and levels and concluded that Kenya’s risk of debt distress remained elevated. In this week’s topical, we shall focus on the current status of Kenya’s public debt as we begin the FY’2022/2023 and highlight some of the economic consequences resulting from high debt levels. We shall do this by taking a look into the following:

- The Current State of Kenya’s Public Debt,

- Kenya’s Debt Servicing Cost,

- Economic Consequences of high Debt levels, and

- Conclusion and Recommendations

Section 1: The Current state of Kenya’s Public Debt

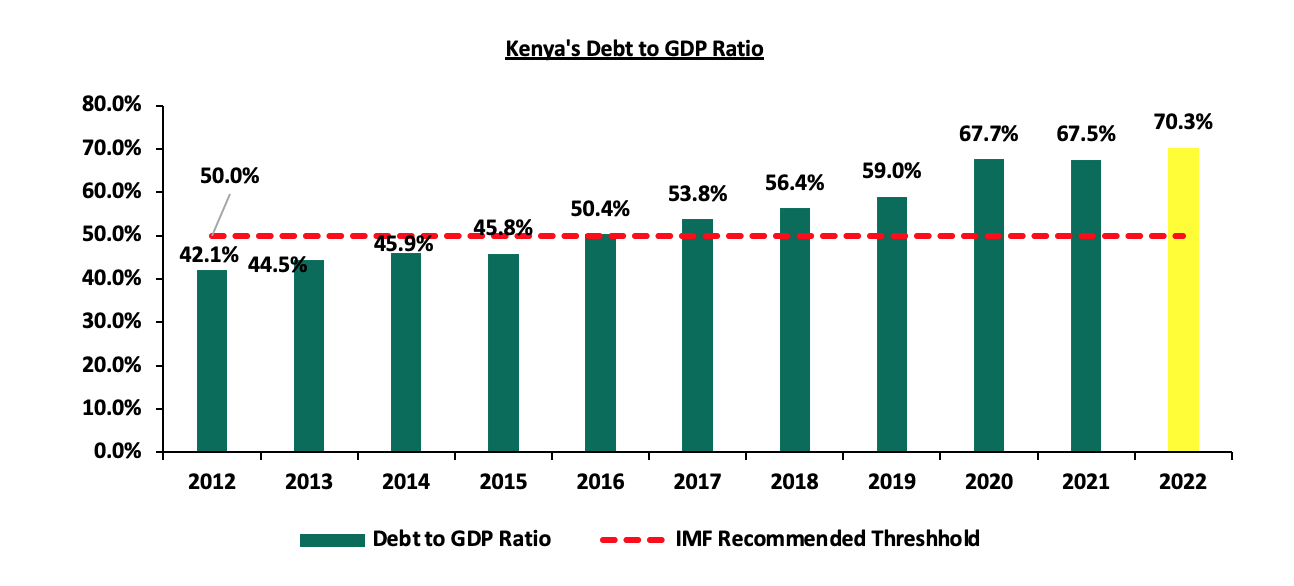

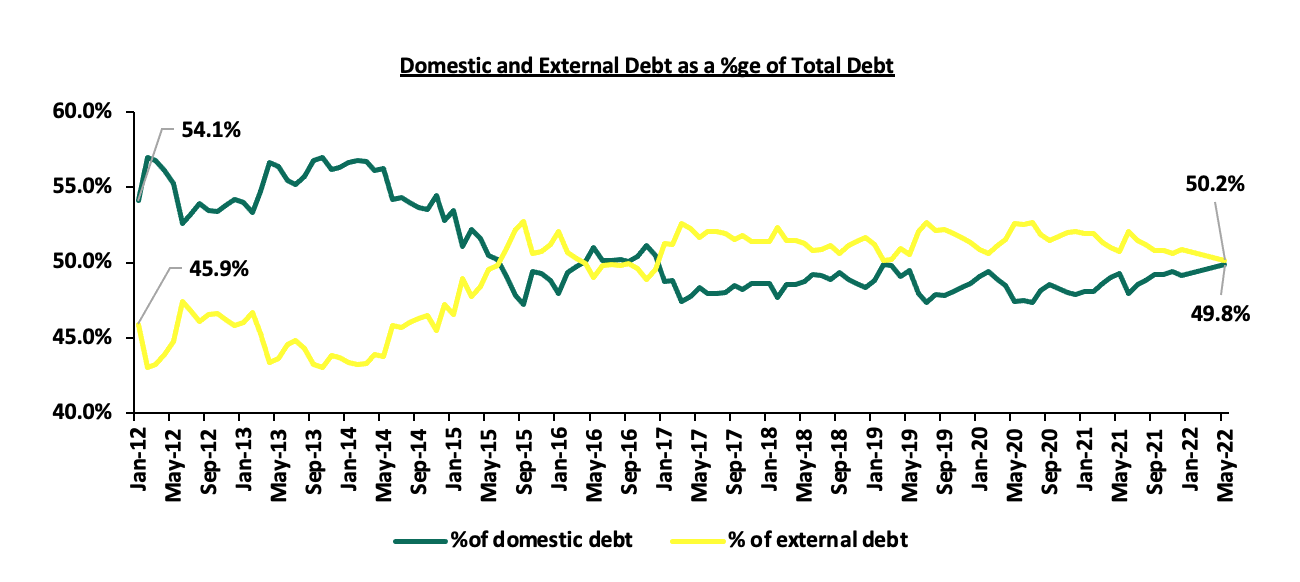

Kenya’s Public Debt stands at Kshs 8.6 tn, (equivalent to 69.1% of GDP) as of May 2022, a 14.4% increase from the Kshs 7.5 tn (equivalent to 66.4% of GDP) recorded in May 2021. The government debt is expected to marginally increase to 70.3% of GDP in 2022 on the back of rising debt levels which continues to outpace the economic growth. Kenya’s debt mix shifted to 50:50 domestic to external debt as of May 2022, from 49:51 in May 2021, an indication of increasing domestic borrowing in a bid to reduce exposure to external shocks stemming from foreign exchange risks. Notably, banking institutions account for the highest percentage of domestic debt in terms of government securities holdings, at 48.4% as at July 2022.

Below is a graph highlighting the trend in the Kenya’s debt to GDP ratio;

Source: National Treasury

- The Nature of Kenya’s Debt Composition (Domestic vs External)

As of May 2022, Kenya’s domestic borrowing stood at Kshs 4.27 tn, equivalent to 34.4% of GDP while external debt stood at Kshs 4.30 tn, equivalent to 34.7% of GDP. Over time, the country’s debt composition has evolved, with the government increasing foreign borrowing to Kshs 4.30 tn as at May 2022 compared to Kshs 0.7 tn in May 2012, representing a 10-year CAGR of 19.6%. Below is a graph highlighting the trend in the external and domestic debt composition over the last 10 years:

Source: Central Bank of Kenya

Over time, Kenya’s domestic debt has continued to grow, coming in at Kshs 4.27 tn as at May 2022 compared to Kshs 0.9 tn in May 2012, representing a 10-year CAGR of 16.8%, a slower rate as compared to external debt, highlighting the government’s continued preference for external debt. This can be attributed to advances from multilateral lenders such as the World Bank and IMF to boost the country’s COVID-19 recovery efforts and respond to global shocks such as the geopolitical pressures from the Russian-Ukrainian conflict. The chart below shows the external debt versus domestic debt as a percentage of total debt:

Source: Central Bank of Kenya

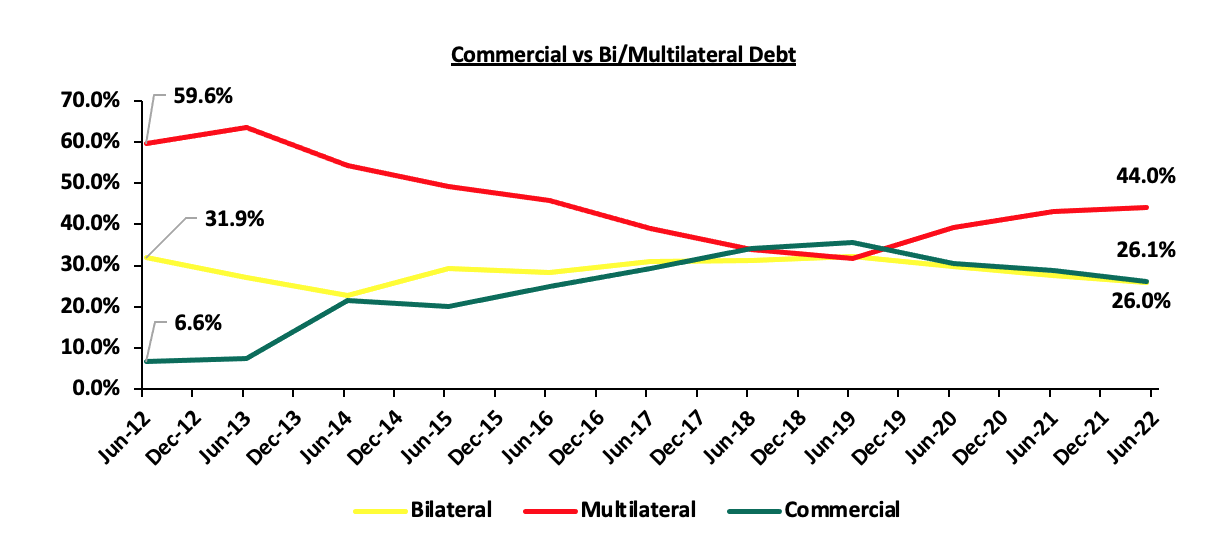

- Kenya’s External Debt Mix (Bilateral, Multilateral, and Commercial Banks)

Foreign debt comprises of multilateral loans, bilateral loans and commercial loans. Multilateral loans are debts issued by international institutions such as the World Bank and the IMF to member nations to promote social and economic development while bilateral loans are loan agreements between individual nations. Multilateral and bilateral loans are categorized as concessional loans due to the favorable terms offered in terms of either below-market interest rates, long grace periods or a combination of both. Commercial loans, on the other hand, are loans agreed between a country and an external commercial bank or an external financial debt instrument. Commercial loans typically have higher rates and shorter grace periods.

Kenya’s exposure to bilateral and multilateral loans has been declining in favour of a much more commercial funding structure comprising of Eurobonds and syndicated loan facilities offered by lenders who work together to avail funds to a single borrower. Concessional loans (Bilateral and Multilateral) have been increasing by a 10-year CAGR of 16.6% to Kshs 3.0 tn in May 2022 from Kshs 0.7 tn in June 2012 while commercial loans, which are deemed more expensive, have grown at a 10-year CAGR of 36.3% to Kshs 1.1 tn as at May 2022 from Kshs 50.5 as at June 2012.

It is key to note that:

- The portion of multilateral debt increased by 0.8% points to 44.0% in May 2022, from 43.2% in June 2021 due to loans worth received from the IMF and the World Bank during the period. Bilateral debt on the other hand decreased by 1.7% points to 26.0% in June 2020, from 27.7% in June 2021, and,

- Commercial debt as a percentage of external debt has reduced by 2.7% points to 26.1% of total external debt in May 2022 from 28.8% in June 2021, mainly attributable to Kenya’s government opting against borrowing commercially as they are expensive and have shorter repayment duration contrary to concessional loans. This is illustrated in the Chart below;

Source: National Treasury

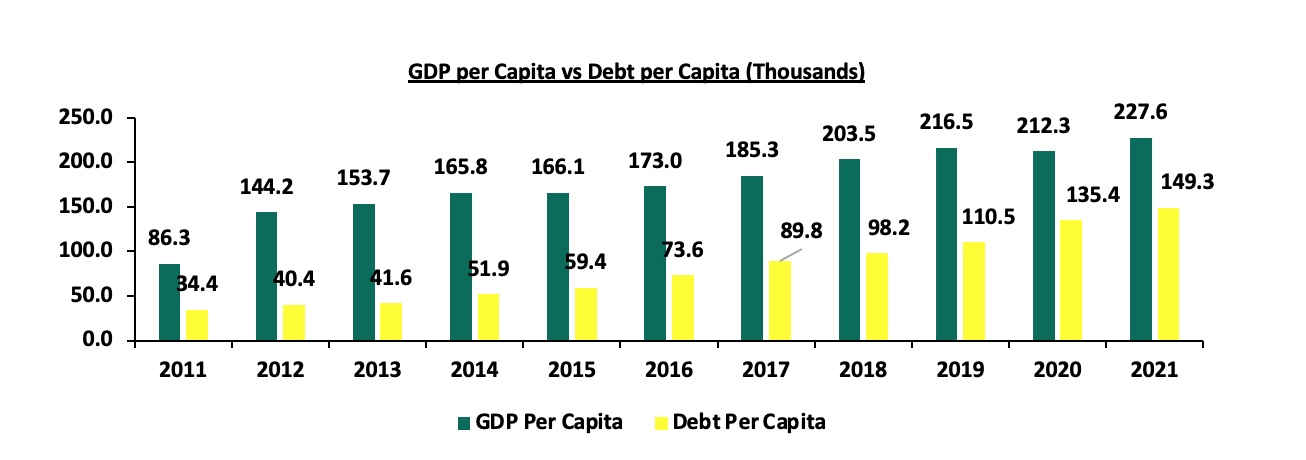

- GDP per Capita vs Debt per Capita

According to the World Bank, Kenya’s Public Debt per Capita has increased at a 10-year CAGR of 15.8% to Kshs 149,252.3 in 2021 from Kshs 34,400.0 in 2011. On the other hand, GDP per Capita has grown at a slower 10-year CAGR of 10.2% to Kshs 227,597.0 in 2021 from Kshs 86,300.0 in 2011, an indication that the debt being incurred is not translating into economic growth. The chart below compares Kenya’s GDP per capita to the debt per capita:

Source: World Bank and CBK

Section 2: Kenya’s Debt Servicing Cost

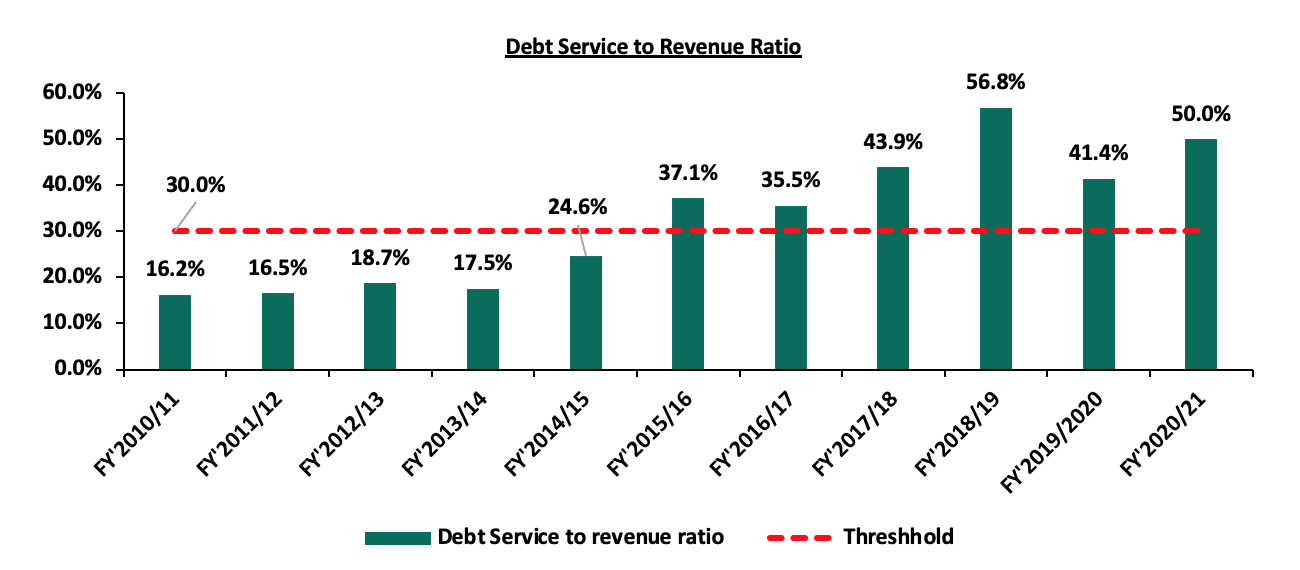

According to the National Treasury’s Annual Debt Management Report 2021, the debt service to revenue ratio was estimated at 50.0% for the FY’2020/2021, 20.0% points higher than IMF’s recommended threshold of 30.0% and 8.6% points higher than FY’2019/2020’s debt service to revenue ratio of 41.4%, attributable to increased debt service obligations during the year. The sustained level of debt service to revenue ratio above the recommended threshold is a worrying sign, elevating the refinancing risk following shocks arising from the pandemic and global supply disruptions accelerated by the ongoing Russian-Ukrainian conflict. Below is a chart showing the debt service to revenue ratio for the last ten fiscal years;

Source: National Treasury

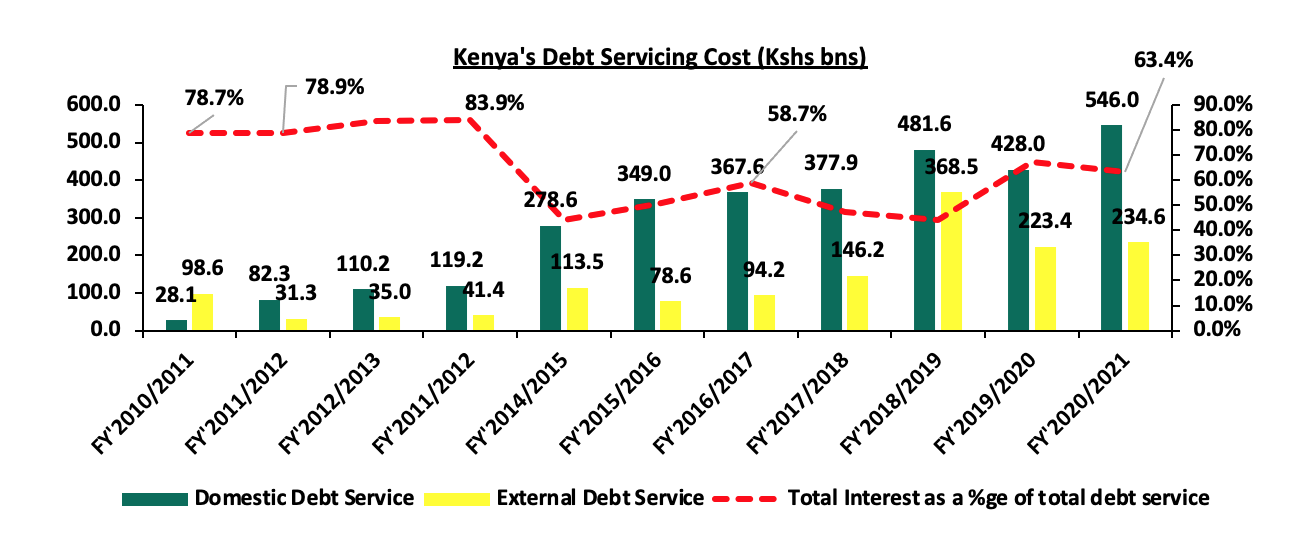

We note that Kenya’s debt servicing costs have continued to increase over time growing at a 10-year CAGR of 23.0% to Kshs 780.6 bn in FY’2020/2021, from Kshs 98.6 bn in FY’2010/2011. The graph below compares the domestic debt servicing cost to the external debt servicing cost over the last ten fiscal years:

Source: National Treasury

The key take-outs from the chart include:

- Total debt service for the FY’2020/2021 stood at Kshs 780.6 bn, a 19.8% points increase from Kshs 651.5 bn in FY’2019/2020. Domestic debt service remains the highest representing 69.9% of the total debt service while external debt service represented 30.1% in FY’2020/2021, and,

- Interest payments carry the bulk of Kenya’s debt servicing cost coming in at 63.4% in FY’2020/2021. Notably, domestic debt interest payments incur the highest cost, contributing an average of 53.8% of the total debt servicing costs over the period under review. For the FY’2020/2021, the domestic interest payments came in at Kshs 388.8 bn, equivalent to 49.8% of the total debt servicing costs.

Section 3: Economic Consequences of High Debt Levels

The ongoing global shocks continue to present economic challenges such as the rising global energy and commodity prices, which are expected to create new spending needs thus affecting any fiscal consolidation efforts. However, we note that a strong fiscal outlook is essential for a growing and thriving economy. Some of the consequences of high debt levels include;

- High Cost of Debt Servicing - Elevated cost of debt servicing due to debt obligations in foreign currencies despite a weakening shilling, resulting to increased taxation as the government tries to meet its debt obligations,

- Elevated Cost of New Borrowings – High debt levels are likely to lead to increased cost of additional borrowing as lenders will demand higher rates for new debts considering the heightened risk of debt distress which stifles the private sector and economic growth,

- Limited Fiscal Space –High debt levels in most cases lead to a Narrow fiscal space hence reduced resources for undertaking infrastructure and capital expenditure,

- Crowding Out of the Private Sector - Because of the increased domestic borrowing, the government crowds out the private sector which leads to a subdued private sector, subsequently impacting revenue collections, and,

- Reduction in Economic Activities - Fiscal consolidation and austerity measures undermine particular economic activities, development objectives and decrease the government’s ability to effectively respond to emergencies. The government usually borrow to tackle unexpected events and fund infrastructure projects.

Section 4: Conclusions and Recommendations

Given the high debt levels and the fiscal challenges the country continues to face, it is advisable that the government works on strategies to reduce the economic consequences of high debt levels and increased risk of debt distress. We however commend the government on the continuous efforts to boost revenue collection but we believe a lot needs to be done. Below are some actionable steps that the government can take to reduce the debt overhang;

- Enhance Fiscal Consolidation – High fiscal deficit attributable to higher expenditure as compared to revenue collections is the main driver of the high borrowing levels. The government can bridge the deficit gap by implementing robust fiscal consolidation through expenditure reduction by introducing austerity measures and reducing amounts extended to recurrent expenditure. The strategy would also enable the Government to refinance other essential sectors such as agriculture which would raise more revenues. Additionally, the government can also limit capital expenditure to projects with either high social impact or have a high Economic Rate of Return (ERR), and high economic benefits outweighing costs,

- Promote Capital Markets - The government should channel efforts towards strengthening the Capital Markets structure to ease the pooling of funds by investors to undertake development projects. Key to note, our capital markets remain dormant with banking markets having mobilized Kshs 4.7 tn in deposits compared to Collective Investment Schemes at only Kshs 0.1 tn, hence the need to increase support to the sector,

- Improving the Country’s Exports – The government should formulate export and manufacturing favourable policies to improve the current account while lowering imports to preserve our foreign exchange reserves. This would stabilize the exchange rate and stop our foreign denominated debt from increasing as the shilling depreciates,

- Diversification of Funding of Projects – The government should fully operationalize and remove bottlenecks to Private Public Partnerships (PPPs) and joint ventures to attract more private sector involvement in funding development projects such as infrastructure instead of borrowing,

- Enhancing Parliament’s Oversight Role – Parliament is an independent body mandated to oversee the operations of the executive. Therefore, it should ascertain that future debt uptake is well interrogated, is feasible and will bring economic benefit to the country. Legislators should ensure that fiscal deficits are sustainable at the budget approval stage to reduce the need for borrowing,

- Spur Economic Growth – it is critical that the government implement policies that will spur economic growth such as enhancing ease of doing business, promoting tourism, entrepreneurship and innovation so that there is more revenue to growth the economy and pay down debt, and,

- Addressing Financial Weaknesses of Parastatals - The government should revive economic performance of parastatals or privatize poorly performing ones to release capital, lower debt and also to prevent the widening of debt from losses and inefficiencies.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.