Feb 7, 2021

With the emergence of COVID-19, measures to reduce the spread of the virus such as: social distancing, working from home and minimizing physical touch, have been put in place by most governments and consequently, this has led to the adoption of cashless payment systems. According to the Central Bank of Kenya (CBK), since March 2020, the country has witnessed a rapid increase in mobile and digital payments with the monthly volume of Person-to-person transactions increasing by 87.0% to hit Kshs 684.5 bn. On 28th December 2020, CBK circulated the draft Kenya National Payment System Vision and Strategy 2021-2025, a strategy document which sets out the vision and strategic initiatives for the National Payment System for the next five years (2021-2025) for comments from the public up to 29th January 2021. This move by the Central Bank is aimed at beefing up regulations around digital payment services, which include mobile money. The regulator’s main objective is to formulate and implement policies that best promote the establishment, regulation and supervision of efficient and effective payment, clearing and settlement systems.

In our previous weekly on FinTech amid COVID-19, we briefly discussed how the FinTech industry has been affected by the pandemic and concluded that the pandemic had hastened the trend towards digitization of financial services. It was clear that the trend towards greater digitalization of financial services is here to stay, and that to build inclusive societies and address rising inequalities during and after the ongoing crisis, there needs to be concerted efforts to close the digital divide across and within countries to reap the benefits of digital financial services.

This week, we will focus on mobile payment platforms where we will look at:

- The Evolution of Mobile Payments,

- Current Regulation around Mobile Payment Platforms in Kenya,

- Factors driving the Growth of Mobile Payment Platforms and their Benefits, and

- Conclusion

Section I: The Evolution of Mobile Payments

Payment systems have existed for a while and have been evolving, in the 20th Century we saw the invention of credit card payments. The most recent developments in the payments industry is the use of mobile phones to transact, the first being PayPal in 1998, followed by the idea of digital wallets whose popularity has grown quite fast. Mobile phones can do so much more today than they could about 10 years ago, and due to their near-universal presence, the adoption of mobile payment platforms comes as no surprise. Aside from this, the pandemic has certainly accelerated the adoption of mobile payments and according to a study done by Juniper Research on alternative payments and the evolving e-commerce landscape, e-commerce payments are forecasted to reach USD 3.1 tn in 2025, from the USD 2.1 tn recorded in 2020.

In Africa, mobile payment platforms are becoming more common and there has been significant investment into the industry due to its growth potential with more than USD 50.0 bn having been put into the industry since 2010. The huge investment in Africa is due to the huge opportunity that has been brought about by the positive demographics, for example, according to a report by the Global System for Mobile Communications Association (GSMA), the number of unique mobile subscribers in Sub-Saharan Africa as at the end of 2019 was 477 mn subscribers, and is projected to grow at a CAGR of 4.3% over the next five years to 614.0 mn subscribers. Africa still has a lot of unbanked population estimated at 66.0% as at 2019, and therefore there is still significant room to improve on financial services penetration.

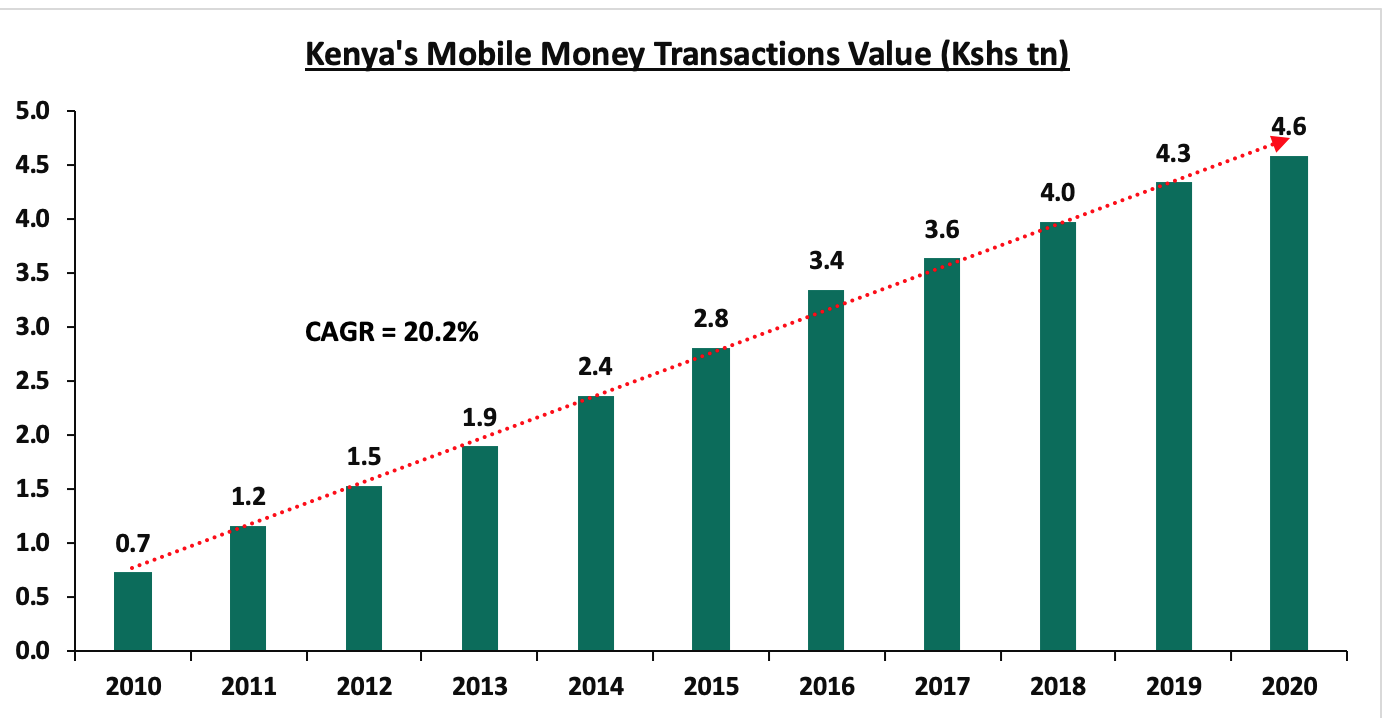

Closer home, the central government has been instrumental in the development of payment platforms which started with the modernization program in 2005, which led to the establishment of the Kenya Electronic Payment and Settlement System (KEPSS) or the Kenya RTGS system. This was meant to help resolve several weaknesses that the system suffered such as; the limited interoperability and coordination across payment infrastructure where there was limited sharing of information. In 2007, through the Central Bank of Kenya’s facilitation, mobile money was introduced in the country through the birth of M-PESA, which has been instrumental in the development of the industry to a global level. The amount of cash transacted has continued to increase growing at a CAGR of 20.2% over the last 10 years with Safaricom having a market share 98.8%. The progress made in mobile money can be seen from the below graph which highlights the growth of transaction values over the past 10 years:

Source: Central Bank of Kenya

As a result of the increasing importance of mobile payment platforms, the Central Bank is set to tighten oversight of mobile money in a bid to curb the increased risks of fraud or cybercrime that could lead to a potential loss of clients’ funds.

Section II: Current Regulation around Mobile Payment Platforms in Kenya

The first National Payment System (NPS) framework in Kenya was developed in 2004 with the main objective being modernizing the existing payment system and providing a basis for a new legal and regulatory framework, which would later enable the development of the NPS Act, 2011 and NPS Regulation, 2014. Back then, some of the challenges had been; (i) the lack of a real-time settlement system, (ii) lack of trust on cheque payments especially for high values, and, (iii) the lack of coordinated public awareness among key stakeholders.

In 2003, only two out of every ten Kenyans had access to prudentially regulated financial service. Today, that number stands at eight out of every ten Kenyans, providing not only a means of holding monetary value but also a safe way of transmitting it. The NPS has improved and comprises of payment service providers (PSPs), clearing and settlement participants and users (individuals, businesses, corporate and government institutions), who interact based on rules and procedures that govern different parts of the payments system.

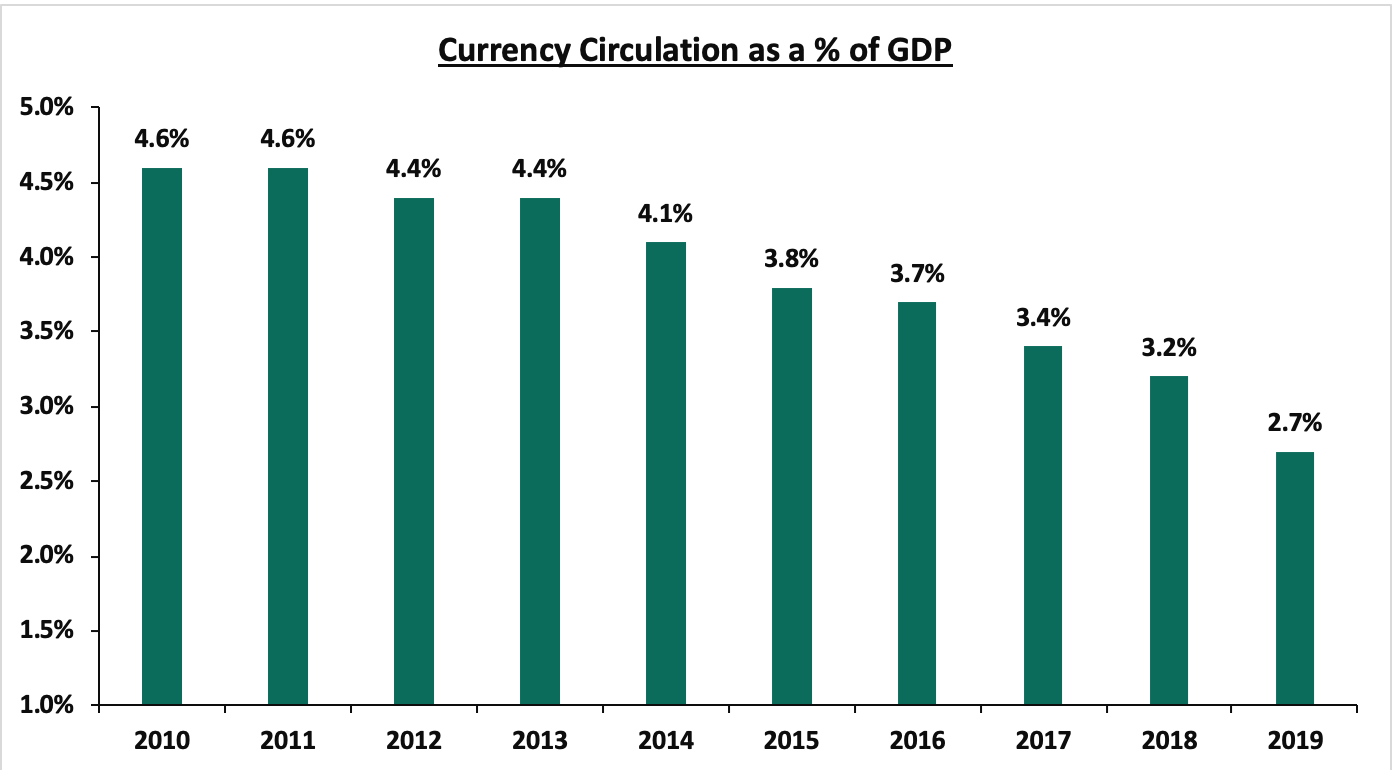

Following the continued advancement in financial and digital inclusion, the dominance of cash, even in low-value transactions, is reducing although at a slow pace. Below is a graph highlighting the trend since 2010:

Source: Central Bank of Kenya

It is important to note that there have been some significant developments in the payments system over the past 5 years, particularly in the growth of digital payments where, in 2013, government-to-person (G2P) payments was launched, (e-Citizen). This has enabled a range of public services to be offered online and paid for through mobile money. Despite the progress, one of the areas of concern is the pricing of payment services which are quite high sometimes or too complex to understand, leading users to lose trust. The government is keen to change the narrative and intends to gradually roll out pricing principles such as those introduced in December 2020 across the payment ecosystem.

The CBK is still aware of the fact that a significant part of the population still finds it hard to access the NPS and this is one of the main motivations behind the draft Kenya National Payment System Vision and Strategy 2021-2025. According to the document, the foundational element of the payment system is the legal and regulatory framework as outlined in the NPC Act of 2011, and the NPS Regulation of 2014. For example, the Kenya RTGS system (Kenya Electronic Payment and Settlement System - KEPSS) has its own set of rules that govern how the participants relate with each other. Some of the strategic objectives from the CBK document include;

- To facilitate the establishment of payment systems that will meet the diverse needs of users and supports the country’s development agenda,

- To ensure payment systems are secure through influencing industry and global standards and adopting safe technologies,

- To implement a supportive policy, legal and regulatory framework that is firmly enforced across all existing and emerging players, and,

- To power an ecosystem based on collaboration leading to the launch of premier and globally competitive innovations.

Based on the ongoing discussions around the NPS vision and strategy 2021-2025, Central Bank intends to review the NPS Act, 2011 and Regulations, 2014 to make the laws future-proof. This will ultimately pave way for the development of any further guidelines and give the regulator (CBK) the necessary powers for enhanced oversite of the payments system. In our view, the initiative by the CBK is very timely and it will go a long way in helping them achieve their goal of enhancing the country’s leadership in digital payments. Enhanced regulation around this area will bring clarity in terms of the rules to be followed and fast track the development of the industry.

Section III: Factors driving the Growth of Mobile Payment Platforms and their Benefits

One of the main factors that has driven the growth of mobile payment platforms over the past year is the pandemic, as people now prefer using mobile or card payments as opposed to traditional cash transactions in line with the social distancing restrictions that were introduced. Further to this, governments have been advocating for the same in a bid to curb the spread of the Covid-19 virus. Aside from this, transitioning into a cashless economy is a topic that has been on our minds for a few years now. The factors that have supported the growth of mobile payment platforms include:

- The growth of E-commerce – many businesses today are opting for an online-based business model which has proven to be more cost effective due to the low setup and overhead costs. As more people continue to embrace this, more transactions are being done through mobile phones and applications with these businesses. According to the e-commerce foundation, more than 25.0% of consumers purchase weekly through mobile platforms. Ordering food through an app and paying for it remotely is becoming a norm and with the increasing number of data analysis tools, this is helping business owners everywhere to customize their offerings to increase sales. The increase in number of ecommerce businesses means higher volumes for mobile payment platforms,

- The increasing number of mobile phone subscribers – as highlighted earlier, the growing number of mobile phone subscribers, currently at 5.2 bn subscribers according to the Global System for Mobile Communications - GSMA, has made it easy for these mobile platforms to access a wider customer base compared to traditional payment methods. For example, in countries like Kenya where mobile phone penetration is high, a large portion of the population is able to transact with ease through a mobile platform. In areas with low penetration, it is takes a longer time for mobile payment platforms to gain traction, and,

- Government Initiatives - the involvement of government in the development of payment systems has proven to be a key factor when it comes to the growth of mobile payments. In Kenya for example, the central bank was involved during the inception of M-PESA and also other initiatives such as e-Citizen have promoted the growth of mobile payment platforms in the country. Additionally, proper guidelines and regulation is important since it provides a clear mode of operation for the various players in the ecosystem. The involvement of the government also builds trust in the system and ultimately, more users will be willing to use the service,

During the advent of the coronavirus, the CBK announced and rapidly implemented several emergency measures to support the financial sector in its role of financing the economy. The government did so to encourage the use of contactless modes of payment, to prevent the spread of the virus through handling banknotes. Consequently, a significant increase in the use of mobile money was noted during the period the measures were in place; person-to-person transactions increased by 87.0% between February and October 2020.

Benefits of mobile payment platforms:

Some of the major benefits of using mobile payments include:

- Convenience – by using mobile payment platforms to make payments, consumers find it easier to pay for any goods or services since the process is not only faster but it increases the engagement between the seller and the buyer. A vendor can send coupons to his/her customers and recommend other products or even just collect feedback on the use of the product. This ultimately promotes customer loyalty,

- Security – using mobile payment platforms are considered to be a more secure way to transact because it eliminates the need to carry hard cash or cards which can be stolen. Additionally, the extra layers of authentication such as the use of biometrics or two-step verification helps ensure the payments being made are not fraudulent,

- Cost-Effective – as a result of the already existing infrastructure, i.e. mobile phones, it is relatively cheaper to set up and transact over a mobile-based platform than traditional methods. For example, to be able to transact using a card, one has to acquire the same through a third party and the vendor also needs to support payments through the same by setting up the necessary infrastructure. For mobile platforms, on the other hand, one might only have to download and register on an app and transacting is a few button presses away, and,

- Easy tracking – the use of mobile payment platforms make tracking one’s transactions easier and helps when it comes to household budgeting and tracking ones spending. Further to this, it reduces paper waste and is more cost-effective for businesses.

Section IV: Conclusion

In conclusion, mobile payment platforms in the country have grown significantly mainly supported by the increasing number of mobile phone users, coupled with the rapid growth in ecommerce where businesses make use of the same platforms for ease of transacting. The move by the government to set up the National Payment Service Vision and Strategy 2021-2025 is a step in the right direction, given the collaborative approach the CBK has taken by including both industry experts and other stakeholders. This means that for mobile payments, there will be: (i) increased regulation where we might see changes like the possible rationalization of transaction fees and other charges related to mobile transactions. This will ultimately improve the quality of services that users will be receiving and help provide financial services to the unbanked population in the country.

We recommend that the government provide incentives to help encourage service providers to participate to encourage competition in the sector where M-PESA controls more than 95.0% of the market.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.