Mar 11, 2018

In 2017, we released our Nairobi Commercial Office Report - 2017, which covered the performance of the office sector in Nairobi in 2016. According to the report, the commercial office sector was transitioning to a buyers’ market due to an oversupply of space that stood at 2.9 mn SQFT in 2016, expected to reach 3.2 mn SQFT in 2017. Rental yields had stagnated at 2015 levels of 9.3%, and occupancy rates reduced by 1.0% points to come in at 88.0% in 2016 from 89.0% in 2015. However, we noted that the commercial office theme had pockets of value in differentiated concepts such as Mixed-Use Developments (MUDs), serviced offices and also in Kenyan Counties due to devolution. This week, we update that report with our Nairobi Commercial Office Report - 2018. The report highlights the performance of the office sector in 2017, based on rental yields, prices, occupancy rates, demand and supply, all in comparison to 2016 and the years before to identify the trends, and hence outlook for the sector, and we give a recommendation for investment. In this focus note, we will highlight the key take-outs from the report, starting with a brief introduction to the commercial office sector in Nairobi, performance summary over time, by nodes and by grades, and conclude by highlighting the outlook and thus opportunity in the sector.

Introduction

Supported by robust GDP growth of more than 5.0% p.a, growth in professional services, financial services as well as the growth of Small and Medium Enterprises (SMEs), the commercial office sector boomed between 2011 and 2015. The sector recorded high returns with average rental yields of 10.0% and occupancy levels of on average 90.0% as at 2011. Attracted by the high demand for office space from the bodies above and the high returns, developers increased the supply of office space in the market with the stock of office space increasing from 6.7mn SQFT in 2011 to 22.9 mn SQFT in 2015, a 4 year CAGR of 27.9%. In 2016, largely as a result of the increase in supply the market’s performance started softening with occupancy rates declining by 1.0% points y/y, and rental yields stagnating at 2015 levels of 9.3%. In 2017, the commercial office performance softened further, with occupancy rates declining by 4.8% points from an average of 88.0% in 2016 to an average of 83.2%, the largest annual decline over the last five years. The rental yields also softened, reducing by 0.1% points from an average of 9.3% in 2016 to an average of 9.2% in 2017. The decline in performance is largely attributed to;

- An oversupply in the market – In 2017, the commercial office market had an oversupply of 4.7mn SQFT of office space, a 62.1% increase from the 2.9mn SQFT recorded in 2016, and 46.9% higher than our forecast of 3.2mn SQFT as at 2016, mainly as a result of the 4.8% points decrease in occupancy rates and increased supply with 3.5mn SQFT delivered in the market with commercial buildings such as FCB Mirhab and Vienna Court opening in Kilimani area, Dunhill Towers, Sanlam Towers, Westpark Suites and Westside Towers in Westlands, Britam Towers in Upperhill, among others,

- Reduced demand – There was a decline in demand for office space in 2017 as a result of a tough operating environment in the country characterized by;

- Low credit supply in the market as a result of implementation of the Banking Amendment Act, 2015, that saw private sector credit growth decline to 2.4% as at October 2017 from a five-year average of 14.4%. This affected the growth of SMEs in the country as some reduced the scale of operations and others cut down on expansion plans and thus reduced demand for office space. SMEs contribute to approximately 45% of Kenya’s GDP, 80% of employment in Kenya and constitute 98% of businesses locally, according to a CNBC News Report 2014 and are thus a key driver for the commercial office sector,

- Political Uncertainty – The election period in Kenya in 2017 was long and protracted and thus investors adopted a wait and see attitude waiting for its completion before investing. This reduced demand for office space during the year

The reduced demand thus led to a decline in occupancy rates and consequently an increase in oversupply as showed below;

|

Summary of Nairobi Commercial Office Demand and Supply Trends Over Time |

||||||||||||

|

Year |

2011 |

2013 |

2015 |

2016 |

2017 |

2018F |

3 Year CAGR (2013-2016) |

y/y ∆ 2016 |

y/y ∆ 2017 |

|||

|

Office Stock (SQFT) |

6.7mn |

9.7mn |

22.9mn |

28.9mn |

31.8mn |

35.5mn |

31.4% |

26.2% |

10.0% |

|||

|

Completions (SQFT) |

2.1 mn |

7.8 mn |

6.5mn |

3.5mn |

4.3mn |

32.6% |

(16.7%) |

(46.2%) |

||||

|

Vacancy Rates (%) |

11.0% |

10.0% |

11.0% |

12.0% |

16.8% |

16.8% |

|

1.0% |

4.8% points |

|||

|

*Demand (SQFT) |

1.9mn |

6.8mn |

5.6mn |

1.6mn |

3.7mn |

31.0% |

(17.6%) |

(71.4%) |

||||

|

** Supply ( SQFT) |

2.6mn |

8.8mn |

8.4mn |

6.3mn |

9.0mn |

34.1% |

(4.5%) |

(25.0%) |

||||

|

***Oversupply (SQFT) |

|

0.8mn |

2.1mn |

2.9mn |

4.7mn |

5.3mn |

38.0% |

38.1% |

62.1% |

|||

*Demand – It is computed by summing space absorbed during the year and depreciated office stock. Space absorbed is computed by subtracting occupied stock the previous year from occupied stock the current year. We assume depreciation at a rate of 2% on all available commercial office stock **Supply – It is computed by summing the vacant stock the previous period to the size of completed stock the current period **Oversupply – Computed by subtracting the supply from the demand, if supply exceeds demand, then the market has an oversupply |

||||||||||||

Source: Cytonn Research, Building Plan Approvals Data from the Nairobi City County

Market Performance

In our analysis of commercial office market performance in 2017, we will look at the performance i) over time, ii) based on nodes/ submarkets, iii) based on Classes/ Grades, and iv) a combination of Grades and Nodes

- Commercial Office Performance: Occupancy, Rents, Sales Price & Rental Yield

In 2017, the commercial office sector’s performance in Nairobi softened slightly with asking rental yields declining by 0.1% points to average at 9.2%, from 9.3% in 2016. Occupancy rates recorded the highest decline year on year over the last five-years, declining by 4.8% points to average at 83.2% from 88.0% in 2016. This is as a result of an increase in supply leading to an oversupply of 4.7 mn SQFT. Rents and prices remained stable mainly as higher quality office space came to the market attracting higher rents, and as office leases are normally long term (6 years) and subject to escalations, therefore relatively inelastic in the short run.

The table below summarizes the performance of the commercial office theme over time:

|

Nairobi Commercial Office Performance Summary Over Time |

|||||||

|

Year |

2011 |

2013 |

2015 |

2016 |

2017 |

y/y ∆ 2016 |

y/y ∆ 2017 |

|

Occupancy (%) |

91.0% |

90.0% |

89.0% |

88.0% |

83.2% |

(1.0%) |

(4.8% points) |

|

Asking Rents (Kshs/SQFT) |

78 |

95 |

97 |

97 |

99 |

0.0% |

1.8% |

|

Average Prices (Kshs/SQFT) |

10,557 |

12,433 |

12,776 |

12,031 |

12,595 |

(5.8%) |

4.7% |

|

Average Rental Yields (%) |

9.8% |

10.0% |

9.3% |

9.3% |

9.2% |

0.0% |

(0.1% points) |

|

|||||||

Source: Cytonn Research

- Submarket Analysis

For submarket analysis, we classified the main office nodes in Nairobi into 8 nodes: i) Nairobi CBD, covering the Central Business District, ii) Westlands, covering environs including Riverside, iii) Parklands, iv) Mombasa Road, v) Thika Road, vi) Upperhill, vii) Karen, and viii) Kilimani, covering space in Kilimani, Kileleshwa and Lavington. As was the case in 2015 and 2016, Parklands and Karen had the highest returns with average rental yields of 9.7% and 9.5%, respectively. This is attributed to their prime locations and high-quality office spaces enabling them to charge prime rents. Nairobi CBD, Thika Road, and Mombasa Road had the lowest returns with average rental yields of 8.7% for the CBD, and 8.5% for both Mombasa Road and Thika Road. The poor performance is attributed to two main reasons:

- Congestion and zoning regulations, for instance, in

- The CBD, there is insufficient development land, and high human and vehicular traffic leading to congestion. As a result of the congestion, the CBD has been relegated to playing mainly a retail function, due to the high foot fall, and, due to the centrality of its location, tertiary institutions have also taken up space. For instance, Jomo Kenyatta University of Agriculture and Technology (JKUAT) bought the ICEA Building along Kenyatta Avenue and established a campus. This has thus resulted in companies moving from the CBD to more prime business districts such as Upperhill and Westlands,

- For Mombasa Road, traffic congestion reducing the ease of movement to and from the node as well as zoning for industrial use in some areas limit its attractiveness as an office zone, and for

- Thika Road, its zoning as a low to middle income residential area lowers its attractiveness as commercial office zone, the area has very few commercial offices with a market share of just 0.6%, out of the total office space,

- Low quality office space in that, these areas have higher concentrations of Grade B and C offices. For instance, the CBD does not have a Grade A office space and thus lower rental rates. The nodal office performance is as summarized in the table below:

|

Commercial Office Performance in 2017 by Nodes |

||||||||||

|

Area |

Price (Kshs/ SQFT) |

Rent 2017 (Kshs/SQFT) |

Occupancy 2017(%) |

Yield 2017(%) |

Price 2016 (Kshs/SQFT) |

Rent 2016 (Kshs/SQFT) |

Occupancy 2016(%) |

Yield 2016 (%) |

% Change in Rents Y/Y |

|

|

Parklands |

12,729 |

103 |

85.7% |

9.7% |

11,771 |

102 |

80.0% |

10.0% |

1.3% |

|

|

Karen |

13,167 |

113 |

89.2% |

9.5% |

13,500 |

107 |

90.0% |

10.1% |

5.8% |

|

|

Kilimani |

12,901 |

101 |

84.5% |

9.5% |

12,667 |

99 |

90.5% |

9.5% |

2.2% |

|

|

Westlands |

12,872 |

103 |

88.5% |

9.4% |

12,482 |

102 |

92.1% |

9.3% |

1.1% |

|

|

UpperHill |

12,995 |

99 |

82.0% |

9.0% |

12,529 |

102 |

89.8% |

9.0% |

(3.0%) |

|

|

Nairobi CBD |

12,286 |

88 |

84.1% |

8.7% |

11,750 |

92 |

92.7% |

9.3% |

(4.2%) |

|

|

Thika Road |

11,500 |

82 |

73.6% |

8.5% |

11,700 |

91 |

80.3% |

8.3% |

(10.3%) |

|

|

Mombasa Road |

11,641 |

82 |

74.2% |

8.5% |

10,720 |

80 |

86.1% |

8.3% |

2.1% |

|

|

Average |

12,679 |

99 |

83.9% |

9.23% |

12,053 |

100 |

88.9% |

9.2% |

(0.6%) |

|

|

||||||||||

- Commercial Office Performance by Class/Grade

We also analyzed performance in terms of class and nodes where we classified commercial office buildings into three main categories based on size and quality of office spaces. These are:

- Grade A: Office buildings with a total area ranging from 100,001 - 300,000 square feet that are pacesetters in establishing rents and that generally have ample natural good lighting, good views, prestigious finishing and on-site undercover parking, and a parking ratio of 3:1000 SQFT,

- Grade B: Office buildings with a total area ranging from 50,000 to 100,000 SQFT. They have good (but lower than Grade A) technical services and ample parking space, and,

- Grade C: These are buildings of any size, usually older and in need of renovation, they lack lobbies and may not have on-site parking space. They charge below average rental rates.

Under this category, Grade A outperformed other classes recording yields of 9.8% as the offices are in prime business districts with superior amenities and are thus able to charge prime rents, which are on average Kshs 112 per SQFT per month, against a market average of Kshs 99 per SQFT per month. Despite the high returns, the increase in supply in the market constrained the performance of Grade A offices, leading to a 0.2% points decline in yields from the 10.0% recorded in 2016. Grade B offices are the most popular with the highest average occupancy of 85.1%. This is as they are of a better quality than Grade C offices and are more affordable than Grade A offices, with Grade B rents being 11.4% cheaper per SQFT compared to Grade A offices. They therefore bucked the downward trend of returns recording a 0.1%-point increase in yields from 9.3% in 2016 to 9.2% in 2017. Grade C offices had the lowest returns with average rental yields of 8.4% mainly due to low quality of office space and thus attract rents that are lower than market averages. Similar to Grade A offices, the performance of Grade C offices softened in 2017 as a result of an increase in supply and the economic slowdown. The yields declined by 0.2% points from 8.6% in 2016 to 8.4% in 2017. The performance according to grades / class is as summarized in the table below;

|

Commercial Office Performance in Nairobi 2017 by Grades |

||||||||||||

|

Typology |

Price Kshs/ SQFT |

Rent 2017 (Kshs/SQFT) |

Occupancy 2017(%) |

Yield 2017(%) |

Price 2016 (Kshs/SQFT) |

Rents 2016 (Kshs/SQFT) |

Occupancy 2016 (%) |

Rental Yields 2016(%) |

y/y Change in yields |

|||

|

Grade A |

13,053 |

112 |

81.5% |

9.8% |

12,889 |

112 |

85.7% |

10.0% |

(0.2%) |

|||

|

Grade B |

12,804 |

99 |

85.1% |

9.3% |

11,959 |

98 |

90.6% |

9.2% |

0.1% |

|||

|

Grade C |

11,929 |

84 |

83.1% |

8.4% |

11,245 |

82 |

87.5% |

8.6% |

(0.2%) |

|||

|

Average |

12,595 |

99 |

83.2% |

9.2% |

12,031 |

97 |

88.0% |

9.3% |

(0.1%) |

|||

|

||||||||||||

- Class and Node Analysis

Combining the analysis of performance by nodes and by class shows that for Grade A offices the opportunity is in Kilimani with high yields of on average 9.9%. For Grade B, the opportunity is in Parklands with average rental yield of 9.9%. For Grade C, the opportunity in lies in Kilimani with rental yields of on average 9.1% and 98.3% occupancy levels

|

Commercial Office Performance by Nodes and Grades in Nairobi 2017 |

||||||

|

Grade A |

Grade B |

Grade C |

||||

|

Area |

Yield |

Occupancy |

Yield |

Occupancy |

Yield |

Occupancy |

|

Karen |

9.4% |

92.9% |

9.7% |

86.7% |

||

|

Kilimani |

9.9% |

69.6% |

9.4% |

86.4% |

9.1% |

98.3% |

|

Msa Road |

10.1% |

84.9% |

9.7% |

79.8% |

7.3% |

67.6% |

|

Parklands |

9.7% |

59.8% |

9.9% |

87.8% |

8.9% |

90.0% |

|

UpperHill |

9.4% |

74.9% |

9.1% |

83.5% |

8.2% |

92.5% |

|

Westlands |

9.7% |

90.7% |

9.4% |

89.5% |

9.1% |

85.0% |

|

Thika Road |

9.1% |

65.3% |

8.0% |

81.8% |

||

|

Nairobi CBD |

|

|

8.7% |

83.7% |

8.3% |

86.1% |

|

||||||

Source: Cytonn Research

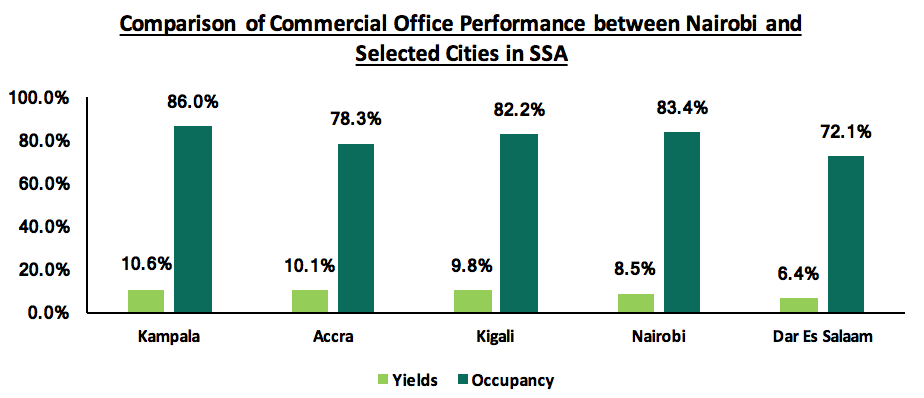

Commercial Office Performance in Select Sub Saharan African Cities

We also compared the performance of the commercial office market in Nairobi with selected cities in Sub Saharan African markets that we cover. These are; Accra- Ghana, Kampala- Uganda, Dar Es Salaam- Tanzania, and Kigali- Rwanda. Nairobi outperforms Dar Es Salaam generating an average rental yield of 8.5% to the dollar, against an average of 6.4% in Dar Es Salaam. Kampala - Uganda has the highest yields for commercial offices at 10.6%, followed by Accra and Kigali with average rental yields of 10.1%, and 9.8%, respectively.

Source: Cytonn Research

Office Market Conclusion and Outlook

|

Nairobi Commercial Office Outlook |

||||

|

Measure |

2016 Sentiment |

2017 Sentiment |

2017 Outlook |

2018 Outlook |

|

Supply |

|

|

Negative

|

Negative |

|

Demand |

|

|

Negative |

Positive |

|

Office Market Performance |

|

|

Neutral |

Negative |

|

General Outlook and Opportunity |

|

|||

For the 2017 commercial office outlook, we had two out of the three metrics as negative and one neutral and thus a negative outlook for the commercial office market in Nairobi. For 2018, two of the metrics under consideration are negative and one positive and thus we retain our negative outlook for the commercial office market in Nairobi. Investments in the sector should, therefore, be biased toward the long-term, for gains when the market picks up in 3-5 years. The pockets of value in the sector are in zones with low supply and high returns such as Karen and in differentiated concepts such a serviced offices and green buildings.

--------------------------

Disclaimer: The views expressed in this publication, are those of the writers where particulars are not warranted- as the facts may change from time to time. This publication is meant for general information only, and is not a warranty, representation or solicitation for any product that may be on offer. Readers are thereby advised in all circumstances, to seek the advice of an independent financial advisor to advise them of the suitability of any financial product for their investment purposes.