Nov 13, 2017

Kenya’s real estate and construction market has grown over the last 7-years, with its contribution to GDP increasing from 12.6% in 2010 to 13.6% in 2016.The growth has been fuelled primarily by (i) demand as a result of growing population at 2.7% per annum compared to the global average of 1.2%, (ii) a high rate of urbanization at 4.4%, compared to the global average of 2.1%, (iii) infrastructural development in various parts of the country, which has opened up areas for development, (iv) entrance of multi-national firms such as Wrigleys, who demand institutional grade commercial and residential real estate, (v) and Nairobi’s status as the regional hub for East Africa. The residential real estate market has seen development of housing to meet demand from the high-end, upper middle, lower-middle and the low income market segments. In this sense, opportunities exist for either investment or home-ownership purposes, whichever the user deems fit. Notably, residential units have become one of the key expressions of affluence and therefore, for this week, we look into the opportunities in the luxury residential apartments that target the high-end market.

Nairobi’s prime residential developments are mainly located in areas such as Karen, Lower Kabete, Runda and Kitisuru that are zoned for low rise residential developments only, restricting the development of apartments and thus are characterized by palatial villas and bungalows, developed on at least a 1/2-acre land parcel. Nonetheless, we have seen the development of luxury apartments for the up-market segment of the market in locations such as Kilimani, Riverside, Upperhill, Westlands and Kileleshwa, where zoning regulations have been relaxed due to increasing land prices. These developments still provide the prestige and exclusivity sought by affluent individuals in the context of high rise residential units. The main factors driving development of luxury apartments include;

- Changing Tastes and Sophisticated Lifestyles – Increasing incomes and exposure to international designs and trends has resulted in refined tastes and sophisticated preferences, thus creating demand for lifestyle products in Kenya, including housing,

- The Growth of High Net Worth Individuals - According to the Knight Frank Wealth report 2017, Kenya had 9,400 high net worth individuals in 2016 and the number is expected to increase to 16,900 over the next 10 years. High net-worth individuals, according to the report, are persons with a net worth exceeding USD 1.0 mn (Kshs 103.3 mn) excluding their primary residence. If such an individual invests at least 25.0% of their assets in real estate, they can afford a Kshs 25.8 mn house. The number of high net worth Kenyans grew by 93.0% between 2006 and 2016, and is projected to grow by 80.0% over 10 years to 2026 supported by entrepreneurial growth, and increased number of senior level employment in large and growing corporates, indicating the potential for increased demand,

- Safe Haven Investment Factors - Real estate continues to provide a safe haven for high net worth individuals with stable rental income and capital preservation thus acting as a hedge against inflation and other market risks. To support this, Knight Frank Wealth report 2017 on high net worth individual’s wealth allocation in Africa indicates that 25.0% of wealth is allocated to real estate investments (excluding primary residence and second homes) and another 25.0% is allocated to traditional investments such as equities and bonds. High net-worth individuals therefore allot a large portion of their assets into real estate given the long-term stability and returns of real estate investments, and

- Kenya as a regional Hub and Presence of Multinational Firms - The presence of multinational firms such as Google, General Electric and Hewlett Packard, as well as the entry of firms such as Wrigleys and Volkswagen, has created demand for up-market housing from expatriates.

The above factors therefore show the potential in housing for the up-market segment of the market.

The luxury market, however, is not without challenges that pose a risk to investment, including;

- Exit of Multi-National Firms- In the last 3 years, we have seen firms such as HSBC, Cadbury, Sameer’s Yana Tyres and Unilever cease operations in Kenya citing a tough operating environment in Kenya characterized by high productions costs, cost of credit and increased competition. This resulted in a decline in prices in prime residential properties by 2.1% in 2016, according to Knight Frank. In 2017, returns in the high-end segment of the market dipped by 2.8% points to 8.9% in 2017 from 11.7% in 2016, according to Cytonn Research, and

- Increased Supply - According to the World Bank, 35.0% of housing supply in Kenya is in the high-end market and another 48.0% in the upper middle income market whereas the highest demand is in the lower middle and low income segments, Increased development in the high end and upper middle segments of the market has resulted in increased supply, which has resulted in slowing down of price appreciation in areas such as Kileleshwa and Westlands changing to a 1.1% and 3.5% appreciation in 2017 compared to 4.7% and 6.4% appreciation in 2016, respectively.

Market Research

In tandem with the recent launch of the luxury apartments component of Cytonn Towers, a mixed use development, we are sharing market research that we undertook on prime residential properties in Nairobi to determine what differentiates luxury apartments and what the potential returns are.

The research is intended to answer the following key questions:

- What are the typical plinth areas for luxury apartments segment? and how does it compare to the apartments in the rest of residential sector (upper mid-end, lower middle suburbs and satellite areas)?

- What is the typical selling price and monthly rent for luxury apartments segment? and how does it compare to the rest of residential sector?

- How does the rate of uptake for luxury apartments compare to the rest of the residential sector?

- And how do returns in luxury apartments segment compare to the rest of residential sector?

Factors which characterize apartments for the high end markets include;

- Larger Unit Sizes: Residential developments in the luxury market segment generally provide more space compared to the standard house size due to additional rooms such as pantries, laundry room, TV-rooms, study area, walk-in closets and large balconies. For example, while the average size of standard 3 bedroom units in Nairobi and its metropolitan areas stands at 150.0 SQM, the average size of a 3-bedroom luxury apartments is 222.0 SQM,

- Relatively higher Prices: Luxury apartments tend to have higher prices per square metre compared to other housing. According to Cytonn Residential Report 2017, the average price of a standard apartment in Nairobi and its metropolitan areas is Kshs 106,840.8 per SQM. In the luxury market however, the average price per square metre is approximately 84.3% higher than the standard house at Kshs 193,261.3 on average, mainly due to provision of more amenities, higher quality designs and finishing which result in higher costs of construction. In addition, these properties are mostly developed in prime areas thus incurring high land costs, which are passed on to buyers,

|

Luxury Apartments Plinth Areas, Selling Prices and Rental Prices per SQM |

||||||||||

|

Unit Typology |

Plinth Area in SQM |

Selling Price per SQM |

Rental Price per SQM |

|||||||

|

|

Market Average |

Luxury Average |

Market Average |

Luxury Average |

Market Average |

Luxury Average |

||||

|

1 Bedroom |

57.0 |

69.0 |

99,083.1 |

180,252.1 |

457.4 |

1,627.7 |

||||

|

2 Bedroom |

102.0 |

110.0 |

95,353.5 |

206,510.9 |

440.8 |

1,504.1 |

||||

|

3 Bedroom |

150.0 |

222.0 |

97,080.9 |

185,315.9 |

473.2 |

1,151.5 |

||||

|

4 Bedroom |

250.0 |

413.0 |

135,845.8 |

200,968.5 |

674.2 |

1,089.6 |

||||

|

Average |

|

|

106,840.8 |

193,261.9 |

511.4 |

1,343.2 |

||||

|

Conclusions: · Luxury apartments have plinth areas approximately 35.5% higher than the standard unit as they provide additional rooms such as pantries, laundry rooms, large balconies, TV-rooms, walk-in closets etc · Luxury apartments also have higher selling prices and rents due to the provision of more sophisticated facilities, designs and finishing thus resulting in higher costs of construction. In addition, luxury apartments are mostly developed in prime areas with high land costs which are then passed on to buyers |

||||||||||

Source: Cytonn Research 2017

- Unique House Designs and Finishing: Luxury residential units exude exclusivity as they adhere to high and modern finishing standards and layout that resonates with and are appreciated by the targeted home owners. For example, while standard houses may be built using red-oxide or ceramic tiles for flooring, luxury apartments use above standard material such as natural marble, granite or wooden flooring, and

- The Amenities: Luxury residential developments offer comfort and convenience that comprehensively support the lifestyle of the buyers such as advanced security measures and recreational facilities such as a club house, swimming pool, a lounge for guests, gym, sauna and steam baths. In addition, they are located in close proximity to convenience stores, entertainment areas, shopping malls and hospitals among other social amenities which provide convenience for the residents.

We compared the prices and rents of luxury developments across Nairobi including The Montave in Upperhill, Le Mac in Westlands, Garden City Apartments along Thika Road, Signature Apartments in Kileleshwa and One, General Mathenge. The findings are summarised below;

|

(All values in Kshs unless stated otherwise) |

||||||||

|

1 Bedroom Units |

||||||||

|

Development |

Area in SQM |

Selling Price |

Price per SQM |

Projected Rent |

Number of Units |

Uptake |

Projected Rental Yield |

Price Appreciation |

|

Le Mac |

81 |

15.2m |

187,654.3 |

150,000.0 |

24 |

100% |

11.8% |

1.1% |

|

Montave |

57 |

9.9m |

172,849.8 |

80,000.0 |

39 |

100% |

8.0% |

13.2% |

|

Average |

69 |

12.5m |

180,252.1 |

115,000.0 |

|

100% |

9.9% |

7.2% |

|

2 Bedroom Units |

||||||||

|

Development |

Area in SQM |

Selling Price |

Price per SQM |

Projected Rent |

Number of Units |

Uptake |

Projected Rental Yield |

Price Appreciation |

|

Le Mac |

114 |

26.9m |

235,675.4 |

200,000.0 |

174 |

26% |

8.9% |

6.3% |

|

Garden City Duplex |

126 |

24.6m |

195,616.1 |

180,000.0 |

15 |

67% |

8.8% |

0.5% |

|

Montave |

90 |

17.0m |

188,241.2 |

120,000.0 |

178 |

85% |

8.5% |

6.5% |

|

Average |

110 |

22.8m |

206,510.9 |

166,666.7 |

|

59% |

8.7% |

4.4% |

|

3 Bedroom Units |

||||||||

|

Development |

Area in SQM |

Selling Price |

Price per SQM |

Projected Rent |

Number of Units |

Uptake |

Projected Rental Yield |

Price Appreciation |

|

Garden City |

178 |

36.2m |

182,714.6 |

195,000.0 |

15 |

67% |

6.8% |

0.6% |

|

One G. Mathenge |

396 |

72.0m |

181,818.2 |

350,000.0 |

10 |

70% |

5.8% |

3.2% |

|

Le Mac |

146 |

27.0m |

184,926.8 |

250,000.0 |

6 |

100% |

11.0% |

1.0% |

|

Signature |

213 |

40.7m |

191,595.4 |

200,000.0 |

12 |

80% |

7.5% |

6.5% |

|

Montave |

133 |

24.7m |

185,524.5 |

150,000.0 |

13 |

100% |

6.9% |

9.1% |

|

Average |

222 |

32.1m |

185,315.9 |

229,000.0 |

|

83% |

7.6% |

4.1% |

|

4 Bedroom Units |

||||||||

|

Development |

Area in SQM |

Selling Price |

Price per SQM |

Projected Rent |

Number of Units |

Uptake |

Projected Rental Yield |

Price Appreciation |

|

One G. Mathenge |

413 |

83.0m |

200,968.5 |

450,000.0 |

21 |

67% |

6.1% |

4.2% |

|

Average |

413 |

83.0m |

200,968.5 |

450,000.0 |

|

67% |

6.1% |

4.2% |

|

Total Average |

|

|

193,261.9 |

|

|

|

8.1% |

5.0% |

|

Conclusions: · One-bedroom apartment prices range from Kshs 9.0 Mn to Kshs 15.2 Mn depending on the area of the unit in square metres while the average monthly rent is Kshs 115,000 · Two-bedroom apartment prices range from Kshs 19.0 Mn to Kshs 26.0 Mn depending on the area of the unit in square metres while the average monthly rent is Kshs 166,000 · Three-bedroom apartment prices range from kshs 24.0 Mn to Kshs 40.0 Mn, with the exception of One General Mathenge whose unit costs Kshs 72.0 Mn due to its large size of 396 square metres. The average monthly rent for 3-bedroom apartments is Kshs 229,000 |

||||||||

Source: Cytonn Research 2017

Since most of our comparables are still under development and thus not renting out yet, we asked what the expected monthly income from the various unit typologies is likely to be, based on neighbouring existing developments. In summary, for an investor, luxury apartments generate higher rental yields of 8.1% compared to the 2017 yields from apartments in the rest of the residential market at 5.6% as shown below;

|

Luxury Apartments Returns 2017 |

||||||

|

Unit Typology |

Average Rent per SM |

Average Price per SM |

Annual Uptake |

Rental Yield |

Price Appreciation |

Total Return |

|

1 Bedroom |

1,627.7 |

180,252.1 |

54.8% |

9.9% |

7.2% |

17.1% |

|

2 Bedroom |

1,504.1 |

206,510.9 |

34.7% |

8.7% |

4.4% |

13.1% |

|

3 Bedroom |

1,151.5 |

185,315.9 |

37.3% |

7.6% |

4.1% |

11.7% |

|

4 Bedroom |

1,089.6 |

200,968.5 |

9.8% |

6.1% |

4.2% |

10.3% |

|

Average |

1,343.2 |

193,261.9 |

34.2% |

8.1% |

5.0% |

13.1% |

|

Residential Apartments 2017 |

511.4 |

106,840.8 |

23.6% |

5.6% |

3.8% |

9.4% |

|

Conclusions: · Luxury apartments have higher rental yields at 8.1% compared to apartments in the rest of the residential sector at 5.6% mainly attributed to higher rents per square metre charged due to prime locations and facilities provided · Luxury apartments also have higher annualized uptake at 34.2% compared to apartments in the rest of the residential sector at 23.6% on average · 1 bedroom units have the highest annual uptake at 54.8% given they are the lowest in supply in the developments. They have the highest returns at 17.1% and thus are most ideal for letting out to young professionals · 2 bedrooms and 3 bedroom units have annual uptake ranging from 34.7% to 37.3%. They attract persons with families and have returns of 13.1% and 11.1%, respectively · 4 bedroom apartments are not popular in the market and thus have slow uptake at 9.8% annually and relatively lower returns at 10.3% |

||||||

Source: Cytonn Research 2017

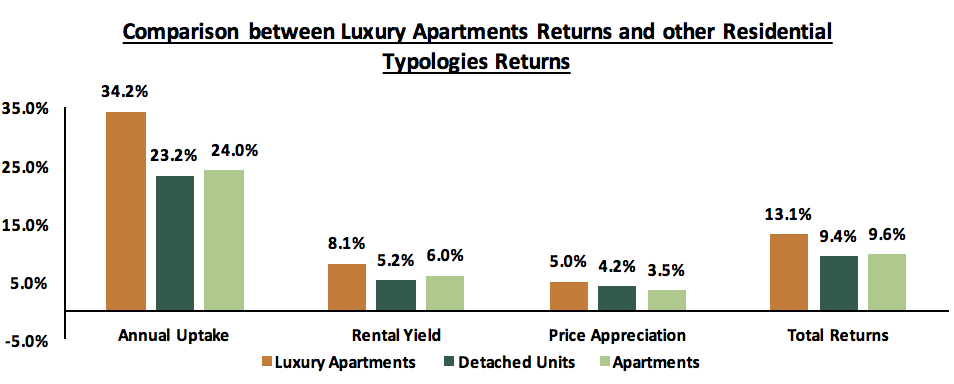

With a total return of 13.1%, luxury apartments are generating a return that is significantly higher by 40%, compared to the rest of the residential sector at 9.4%. The luxury apartments segment is suitable for investors aiming to preserve their capital and generate rental income with little variability. In addition, prospective home owners now have the chance to explore luxurious apartment-themed residential units which provide diversity from the usual luxury detached units thus, indulging in a new, affluent and unique user experience. Below is a comparison of returns between luxury apartments, detached units in the entire residential sector and standard apartments in the entire residential sector in 2017:

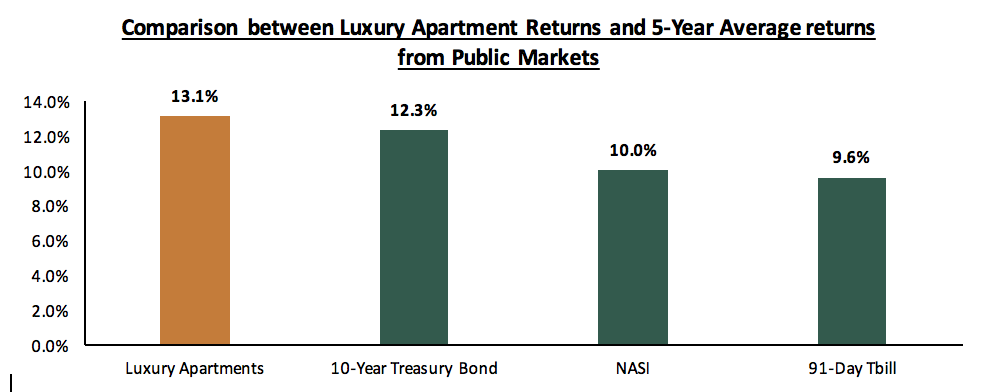

Below is a graph showing the comparison between returns of luxury apartments versus other investments in the public markets over the last 5-years:

Luxury apartments are therefore generating returns higher than the public markets instruments over the last 5-years.

Having seen that luxury apartments are the best returning part residential sector, for investors looking into luxury residential, we recommend the following:

- Buying prices in the range of Kshs 180,000.0 - Kshs 230,000.0 per square metre for a luxury house depending on the number of bedrooms, the size in square metres and the facilities provided.

- Plinth areas averaging at 69.0 SM for 1 bed-units, 110.0 SM for 2-bed units, 222.0 SM for 3-bed units and 413.0 SM for 4-bed apartments.

- The following neighbourhoods: Upperhill, Kilimani and Westlands due to the following;

- Proximity to commercial offices whose employees would be a target for luxury apartments

- Proximity to high-grade retail and recreational facilities enabling convenience for residents

- Good transport networks in this areas easing accessibility

- Relaxation of zoning regulations allowing developers to construct high-rise units which not only attract residents seeking good views on higher floors, but also enable developers to optimise returns by building more units per acre

- The following typologies: 1 bed, 2 bed and 3 bed apartments. 1-bed apartments are ideal for those looking to let to young professionals and have the highest yields at 9.9% while 2 and 3-bed apartments are ideal for families and have yields of 7.6% to 8.7%.