Aug 18, 2024

In July 2023, we released the Nairobi Metropolitan Area Land Report 2023, which highlighted that the Nairobi Metropolitan Area (NMA) land sector recorded an improvement in performance with the average annual price appreciation coming in at 4.5% in FY’2022/23, 1.3% points higher than the 3.2% appreciation recorded in FY’2021/22. The performance represented an 11-year average price appreciation CAGR of 9.1%, with the average selling price for land coming in at Kshs 128.5 mn in FY’2022/23, from Kshs 47.9 mn in 2011.

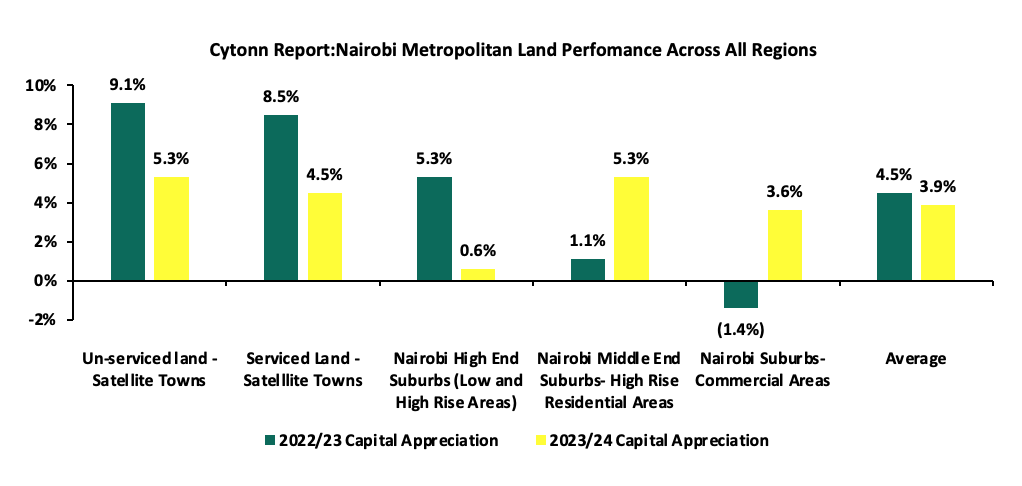

The performance during this period was mainly driven by the increased demand for Un-serviced land in satellite towns of the Nairobi Metropolitan and serviced land in Satellite Towns which recorded the highest annualized change in capital appreciation both at 9.1% and 8.5% respectively, compared to a market average change of 4.5%. The performance was supported by; i) ample infrastructure such as the various bypasses and the Thika Superhighway, ii) rising demand for residential developments on the back of positive demographics, and, iii) convenient access to the city thereby allowing increased investments. Conversely, Land in the Nairobi commercial zones realized a price correction of 1.4% in their average asking prices which came in at Kshs 397.3 mn in FY’2022/23, from the Kshs 403.4 mn that was recorded in FY’2021/22. This is mainly on the back of declined demand owing to high land prices.

This week, we update our report by discussing the overall performance of the NMA land sector over time, and examining various factors that influence its performance based on selling prices and annual capital appreciation. Additionally, we identify investment opportunities for the sector, using 2024 market research data. As such, in this topic we shall focus on;

- Introduction to the Nairobi Metropolitan Area (NMA) Land Sector,

- NMA Land Sector Performance in 2024 Based on Various Locations, and,

- Summary and investment opportunities in the sector, and,

- Conclusion and Outlook for the Sector.

Section I: Introduction to the Nairobi Metropolitan Area (NMA) Land Sector

The land sector in the Nairobi Metropolitan Area (NMA) has continued to demonstrate resilience, showing consistent improvement in performance despite challenges such as continuous rising of construction costs, constrained access to financing for Real Estate projects, and an oversupply in certain real estate sectors e.g. commercial offices and the retail sectors. These factors have continued to impact demand for land in certain Nairobi areas such as commercial zones and High-end suburbs. Nevertheless, the sector registered improving performance in FY'2023/24, supported by several key factors. These include:

- Demographics: Kenya continues to record positive demographics shown by high population growth and urbanization rates of 9% p.a and 3.7% p.a, respectively against the global averages 0.9% p.a and 1.6% p.a, respectively, as at 2023. Given this, the demand for residential and commercial spaces continues to soar, which in turn boosts demand for development land,

- Government’s Continued Investment in Infrastructural Developments: The Kenyan government has persistently continued to launch and implement various infrastructure projects to boost economic performance and position the country as a preferred regional hub. This has in turn supported the growth of the Real Estate Sector through opening up areas e.g. satellite towns for Real Estate investment. Some of the key notable projects include Makupa Bridge, Nairobi Expressway, Nairobi Western, southern and expansion of the Eastern Bypass among others. These projects enhance connectivity, driving demand for land, particularly in satellite towns e.g. Athi River and making these areas attractive to investors which contributes to rising property prices,

- Government Affordable Housing Initiatives: The Kenyan government in line with its affordable housing agenda has continued to support and launch several projects in an attempt to reduce the housing deficit in the country and subsequently offer job opportunities to the youth. This has increased demand for development land in areas earmarked for development. Some noteworthy projects include; Moke Gardens Athi River, Kings Boma Estate Ruiru, Pangani affordable housing project, and Kings Orchid Thika, and,

- Limited Supply of Land Particularly in Urban Centers: As Nairobi continues to face high rates of urbanization, the demand for housing and commercial spaces increases, and the fixed supply of land becomes increasingly scarce. This scarcity, coupled with factors like population growth and infrastructure improvements leads to an appreciation in land prices.

However, despite the aforementioned supporting elements, the sector's optimal performance in FY’2023/24 was hampered by;

- Increased Construction Costs: In 2023, the cost of construction increased by 0% to an average of Kshs 71,200 per SQM from an average of Kshs 56,075 per SQM recorded in 2022. The sharp increase was mainly due to a hike in prices of key building materials such as cement, steel, paint, and aluminium, on the back of rising inflation and taxation rates. These higher costs are expected to continue impeding development hence reducing the demand for land,

- Oversupply in Select Real Estate Sectors: Nairobi continues to experience an excess supply of commercial office space, with approximately 5.8 mn SQFT available, and retail space both in Nairobi and the rest of Kenya is oversupplied by 3.0 mn SQFT and 1.7 mn SQFT respectively. This surplus has resulted in prolonged vacancy rates across these real estate sectors, and,

- Inadequate infrastructure: Despite the government’s efforts to improve infrastructure across the country, some areas are still lacking essential infrastructure such as water, roads, and sewer. As a result, this lowers land values by deterring development, reducing desirability, and increasing development costs.

Notably, going forward, some of the factors expected to shape the performance of the sector include;

- Continued Efforts in Digitization of Land Records: The Ardhisasa platform developed jointly by the Ministry of Land and Physical Planning (MoLPP) and the National Land Commission (NLC) and key partners in Government allows other stakeholders and interested parties to interact with land information held and processes undertaken by Government. It allows the lodgement of applications for various services offered by the Ministry and the Commission. Digitization will continue assist curb fraud cases and ease land transaction processes by reducing protracted timelines, and,

- Increase in Capital Gains Tax (CGT): Effective 1st January 2023, the CGT rate was increased from previously chargeable 5% of the net gain to 15% of the net gain. We expect the tax to continue to drive mixed performance in the land sector. The tax may prompt investors to continue increasing land prices, which may dampen property transaction volumes. Ultimately this may lead to a decline in land transaction volumes and liquidity gaps in the market.

Section II: NMA Land Sector Performance in 2024 Based on Various Locations

For the analysis, we conducted research on various major towns within the NMA and classified them as follows;

- High Rise Residential Areas: They comprise of areas such as Dagoretti, Embakasi, and Kasarani, and are majorly characterized by the numerous high-rise buildings such as the apartments found within,

- High End Residential Suburbs: These are areas which generally consist of low-rise buildings such as the bungalows, maisonettes and villas and also high-end apartments. They include; Kitisuru, Runda, Ridgeways, Kileleshwa, Karen, and Spring Valley,

- Commercial Zones: They comprise of areas such as Kilimani, Westlands, Riverside, and Upper Hill, and are popular because of the numerous commercial office buildings that they have, and,

- Satellite Towns: Land in the area was categorized into serviced (site and service schemes) and unserviced land. It comprises of areas such as Syokimau, Ruiru, Rongai, Juja, Utawala, Limuru, Athi River, and, Limuru.

The NMA land sector continues to show resilience in performance with the average Year-on-Year (YoY) price appreciation coming in at 3.9% in FY’2023/24, 0.6% slower than the 4.5% appreciation recorded in FY’2022/23. This is as the average asking prices came in at Kshs 132.7 mn in FY’2023/24 from Kshs 128.6 mn in FY’2022/23. The performance also represented a 13-year average price appreciation CAGR of 8.2%, with the average selling price for land coming in at Kshs 132.7 mn in FY’2023/24, from Kshs 47.9 mn in 2011. This signifies the continued rise in the demand for development land mainly driven by; i) government significant investments in infrastructure particularly road networks and utilities which in turn stimulates growth in Satellite towns e.g. the Southern and Eastern Bypass, ii) heightened construction activity, especially in the residential sector, driven by the government’s affordable housing agenda, which in turn boosts demand for land, iii) limited supply of land especially in urban areas which has contributed to rising land prices as demand from buyers outpaces availability, iv) growing demand for housing which is driven by positive demographics such as high population and urbanization, which currently stands at 1.9% and 3.7% respectively, and, v) Growth in popularity of satellite towns by investors and buyers which provide affordable land options in comparison to the suburbs and key commercial zones.

The graph below shows the capital appreciation of land in the NMA from FY’2022/23 to FY’2023/24;

The table below shows the performance summary of the NMA land sector based on the average asking prices, CAGR and capital appreciation;

|

Cytonn Report: NMA Land Sector Performance Summary |

||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24

|

13-Year CAGR |

2022/23 Capital Appr. |

2023/24 Capital App. |

∆ in Capital Appreciation |

|

Unserviced land - Satellite Towns |

3.6 |

8.4 |

11.6 |

12.6 |

12.8 |

13.2 |

13.5 |

14.7 |

15.4 |

16.3 |

12.0% |

9.1% |

5.3% |

(3.7%) |

|

NMA High Rise Residential Areas |

31.0 |

64.3 |

71.7 |

77.7 |

75.7 |

77 |

76.7 |

76.3 |

76.1 |

80.4 |

7.6% |

1.1% |

5.3% |

4.2% |

|

Serviced Land - Satellite Towns |

5.6 |

13.8 |

15.2 |

16 |

16 |

16 |

16.7 |

17 |

18.34 |

19.2 |

10.0% |

8.5% |

4.5% |

(4.0%) |

|

Nairobi Suburbs- Commercial Areas |

145.0 |

359.3 |

421.8 |

433 |

421 |

419 |

404.6 |

403.4 |

397.4 |

411.5 |

8.4% |

(1.4%) |

3.6% |

5.0% |

|

Nairobi High End Suburbs (Low and High Rise Areas) |

54.5 |

94.3 |

113 |

119.7 |

119.3 |

120.7 |

123.8 |

130.5 |

135.5 |

136.2 |

7.0% |

5.3% |

0.6% |

(4.7%) |

|

Average |

47.9 |

108 |

126.6 |

131.8 |

129 |

129.2 |

127.1 |

128.4 |

128.5 |

132.7 |

9.0% |

4.5% |

3.9% |

1.3% |

Source: Cytonn Research

Performance per node:

- Satellite Towns - Unserviced Land

Unserviced land in the satellite towns of Nairobi recorded an average YoY capital appreciation of 5.3%, with average asking prices coming in at Kshs 16.3 mn in FY’2023/24, from the Kshs 15.4 mn recorded in FY’2022/23. Additionally, the performance grew by a 13-year average CAGR of 12.0%, to average asking prices of Kshs 16.3 mn in FY’2023/24 from the Kshs 3.6 mn recorded in 2011. The performance was supported by; i) Ongoing and planned infrastructure improvements, such as the Eastern bypass, and other utilities have made satellite towns more accessible and appealing for investment, and, ii) Investors looking for capital gains have been buying land in these towns, anticipating future appreciation as the areas develop and urbanize.

In terms of performance per node, Juja was the best performing with a Year-on-Year (YoY) capital appreciation of 7.2% attributed to; i) proximity to the Thika Superhighway significantly improves accessibility from Nairobi and other regions making the area more attractive for residential and commercial developments, ii) presence of higher learning institution such as Jomo Kenyatta University of Agriculture and Technology (JKUAT) contributes to population growth which in turn creates a steady demand for land for the development of residential housing and rental properties, iii) positive demographics fuelling demand for land. The table below shows the performance of unserviced land in satellite towns within the NMA;

|

All values are Kshs mn per Acre unless stated otherwise |

|||||||||||||||

|

Cytonn Report: NMA Satellite Towns - Unserviced Land Performance |

|||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

13-Year CAGR |

2022/23 Capital Appreciation |

2023/24 Capital Appreciation |

∆ in Capital appreciation |

|

|

Juja |

3 |

7 |

9 |

10 |

10 |

10 |

10.6 |

12.2 |

14.5 |

15.5 |

13.5% |

14.8% |

7.2% |

(7.6%) |

|

|

Rongai |

2 |

10 |

18 |

18 |

18 |

19 |

19.0 |

18.9 |

17.3 |

18.3 |

18.6% |

(0.7%) |

5.6% |

6.3% |

|

|

Limuru |

5 |

13 |

17 |

20 |

20 |

21 |

21.2 |

24.1 |

23.5 |

24.8 |

13.1% |

13.8% |

5.4% |

(8.4%) |

|

|

Utawala |

6 |

9 |

10 |

11 |

12 |

12 |

12.4 |

14.1 |

16.7 |

17.4 |

8.5% |

13.8% |

4.3% |

(9.5%) |

|

|

Athi River |

2 |

3 |

4 |

4 |

4 |

4 |

4.5 |

4.4 |

5.2 |

5.3 |

7.8% |

(2.7%) |

1.8% |

4.5% |

|

|

Average |

4 |

8 |

12 |

13 |

13 |

13 |

13.5 |

14.7 |

15.4 |

16.3 |

12.3% |

7.8% |

5.3% |

(2.5%) |

|

Source: Cytonn Research

- Nairobi Suburbs – High End (Low and High Rise) Residential Areas

High end residential areas of Nairobi suburbs registered an average YoY capital appreciation of 0.6%, with the average asking prices coming at Kshs 136.2 mn in FY’2023/24, from Kshs 135.5 mn in FY’2022/23. Additionally, the performance represented a 13-year average CAGR of 8.0%, with average asking prices coming in at Kshs 136.2 mn in FY’2023/24 from the Kshs 54.5 mn recorded in 2011. These areas continue to remain attractive to investors due to; i) their serene and green environments, combined with larger plots offering a tranquil environment away from the bustling city center, ii) their proximity to the Central Business District(CBD) making them ideal for professionals who want to live in a serene area while still being close to their workplace, iii) relatively affordable prices at Kshs 136.2 mn per acre compared to the commercial zones averaging at Kshs 411.5 mn per acre.

In terms of performance per node, Kileleshwa was the best performing with an average YoY price appreciation of 4.9%, 4.3% points higher than the market average of 0.6.% due to; i) strategic location near Nairobi Central Business District (CBD) and other key areas, like Westlands, Kilimani, and Lavington hence desirable for both commercial and residential purposes, ii) availability of development land due to low population, iii) benefits from improved infrastructure including well-maintained roads, better drainage systems, and access to essential services like water and electricity making the area more accessible and livable, iv) proximity to adequate amenities malls such the Hub, and Waterfront, schools such as St Christopher’s International School among others.

The table below shows the performance of land in high end (low and high rise) suburbs within the NMA;

|

All values are Kshs mn per Acre unless stated otherwise |

|||||||||||||||

|

Cytonn Report: NMA High End Suburbs (Low- and High-Rise Areas) Land Performance |

|||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

13-Year CAGR |

2022/23 Capital Appreciation |

2023/24 Capital Appreciation |

∆ in Capital appreciation |

|

|

Kileleshwa |

149 |

227 |

286 |

306 |

311 |

303 |

300.9 |

305.8 |

301.9 |

316.8 |

6.0% |

(1.3%) |

4.9% |

6.2% |

|

|

Runda |

33 |

58 |

67 |

68 |

68 |

70 |

74.3 |

81.7 |

87.9 |

89.7 |

8.0% |

7.6% |

2.0% |

(5.6%) |

|

|

Ridgeways |

24 |

51 |

62 |

68 |

65 |

66 |

68.8 |

81.4 |

87 |

86.4 |

10.4% |

6.8% |

(0.7%) |

(7.5%) |

|

|

Karen |

25 |

40 |

46 |

52 |

53 |

56 |

59.6 |

62 |

64.5 |

63.6 |

7.4% |

4.2% |

(1.4%) |

(5.6%) |

|

|

Kitisuru |

32 |

59 |

70 |

70 |

71 |

73 |

77.9 |

90.3 |

95 |

92.5 |

8.5% |

5.2% |

(2.6%) |

(7.8%) |

|

|

Spring Valley |

64 |

131 |

147 |

154 |

148 |

156 |

161 |

161.7 |

176.5 |

168.3 |

7.7% |

9.2% |

(4.7%) |

(13.9%) |

|

|

Average |

55 |

94 |

113 |

120 |

120 |

120 |

123.8 |

130.5 |

135.5 |

136.2 |

8.0% |

5.3% |

0.6% |

(4.7%) |

|

Source: Cytonn Research

- Satellite Towns - Serviced Land

Serviced land in the satellite towns of Nairobi recorded an average YoY capital appreciation of 4.5%, with the average asking prices coming in at Kshs 19.2 mn in FY’2023/24, from Kshs 18.4 mn in FY’2022/23. Additionally, the performance represented a 13-year average CAGR of 11.0%, with average asking prices coming in at Kshs 19.2 mn in FY’2023/24 from the Kshs 5.6 mn recorded in 2011. The performance was supported by; i) Continuous improvement of infrastructure such as the Eastern bypass and Thika Superhighway, ii) relatively quick access to the city, increasing investor appeal for development of residential and commercial units, and, iii) rapid urbanization and population growth increasing the demand for housing.

In terms of performance per node, Athi River was the best performing with a relatively high average YoY price appreciation of 21.1%. This was mainly driven by; i) its strategic location along the recently completed Nairobi Expressway easing access to the city and the planned expansion of Mombasa road, ii) presence of amenities such as Kitengela, Crystall Rivers and Signature malls, iii) growth of industries around the area has led to job creation which is increasing demand for housing and commercial properties, and, iv) relatively affordable land price at Kshs 17.4 mn which is lower than the market average of Kshs 19.2 mn. On the other hand, Rongai recorded a price correction of 4.8% attributed to reduced land transactions within the period under review. The table below shows the performance of serviced land in satellite towns within the NMA;

|

All values is Kshs mn per Acre unless stated otherwise |

||||||||||||||

|

Cytonn Report: NMA Satellite Towns - Serviced Land Performance |

||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

13-Year CAGR |

2022/23 Capital Appreciation |

2023/24 Capital App. |

∆ in Capital appreciation |

|

Athi River |

2 |

11 |

13 |

13 |

12 |

12 |

13.1 |

13.3 |

14.4 |

17.4 |

18.1% |

8.2% |

21.1% |

13.0% |

|

Syokimau |

3 |

12 |

12 |

12 |

12 |

12 |

11.8 |

13.9 |

17.2 |

18.5 |

15.0% |

23.9% |

7.6% |

(16.0%) |

|

Ruiru & Juja |

8 |

18 |

19 |

21 |

23 |

24 |

25.3 |

25.9 |

28.1 |

29 |

10.4% |

8.6% |

3.0% |

(6.0%) |

|

Ruai |

8 |

12 |

13 |

15 |

14 |

14 |

13.5 |

11.6 |

12.5 |

12.4 |

3.4% |

7.7% |

(0.7%) |

(8.0%) |

|

Rongai |

7 |

16 |

19 |

19 |

19 |

18 |

20.0 |

20.4 |

19.1 |

18.9 |

7.9% |

(6.1%) |

(4.8%) |

1.0% |

|

Average |

6 |

14 |

15 |

16 |

16 |

16 |

16.7 |

17 |

18.3 |

19.2 |

11% |

8.5% |

4.5% |

(4.0%) |

Source: Cytonn Research

- Nairobi Suburbs - Commercial Zones

Land in Nairobi suburbs recorded an average YoY capital appreciation of 3.6%, with the average asking prices coming in at Kshs 411.5 mn in FY’2023/24, from Kshs 397.3 mn in FY’2022/23. Additionally, the performance represented a 13-year average CAGR of 8.5%, with average asking prices coming in at Kshs 411.5 mn in FY’2023/24 from the Kshs 145.0 mn recorded in 2011. This is mainly due to: i) availability of desirable amenities such as hospitals, schools, supermarkets and fitness centers making the area ideal for residential development, ii) good road network improving the connectivity to the Central Business District and other parts of NMA, and iii) availability of individuals who are willing to pay premium prices for land in these areas.

In terms of performance per node, Kilimani was the best performing with a relatively high average YoY price appreciation of 10.2% owing to: i) availability of ample amenities ideal for residential development, ii) proximity to the city centre and connectivity to other Nairobi surburbs e.g. Westland’s and a surging middle class in the area. Conversely, Riverside recorded the highest price correction at 4.4%, resulting from a stiff competition from neighboring areas such as Westlands

The table below shows the performance of land in commercial zones within the NMA;

|

All values in Kshs mn per Acre unless stated otherwise |

|

|

|

|||||||||||

|

Cytonn Report: NMA Suburbs - Commercial Zones Land Performance |

|

|

|

|||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

13-Year CAGR |

2022/23 Capital App. |

2023/24 Capital App. |

∆ in Capital appreciation |

|

Kilimani |

114 |

294 |

360 |

387 |

403 |

398 |

381.7 |

380.4 |

375.9 |

414.3 |

10.4% |

(1.2%) |

10.2% |

11.4% |

|

Westlands |

150 |

350 |

453 |

474 |

430 |

421 |

413.6 |

418.3 |

413.2 |

433.2 |

8.5% |

(1.2%) |

4.8% |

6.0% |

|

Upper Hill |

200 |

450 |

512 |

510 |

488 |

506 |

487.3 |

471.9 |

458.1 |

471.4 |

6.8% |

(2.9%) |

2.9% |

5.8% |

|

Riverside |

116 |

343 |

362 |

361 |

363 |

351 |

335.7 |

343.1 |

342.1 |

327.1 |

8.3% |

(0.3%) |

(4.4%) |

(4.1%) |

|

Average |

145 |

359 |

422 |

433 |

421 |

419 |

404.6 |

403.4 |

397.3 |

411.5 |

8.5% |

(1.4%) |

3.6% |

5.0% |

Source: Cytonn Research

- Nairobi Suburbs – High Rise Residential Areas

High rise residential areas of Nairobi realized an average YoY capital appreciation of 5.3%, with the average asking prices coming in at Kshs 80.4 mn in FY’2023/24 from Kshs 76.3 mn recorded in FY’2022/23. Additionally, the performance represented a 13-year average CAGR of 7.6%, with average asking prices coming in at Kshs 80.4 mn in FY’2023/24 from the Kshs 31.0 mn recorded in 2011. The performance was supported by; i) Rising population and urbanization in Nairobi increasing demand for housing in the subject areas, ii) unrestricted zoning regulations offering flexibility and growth potential to investors, and, iii) relatively affordable land prices compared to other investment areas.

In terms of performance per node, Dagoretti was the best performing, with an average YoY price appreciation of 6.0%, 0.7% points higher than the 5.3% market average. This was mainly driven by; i) Nairobi’s rapid urbanization and population growth pushing residents to seek affordable housing options, leading to increased demand in Nairobi peripheral areas, ii) availability of infrastructure with the area being served by the Waiyaki way Road, Lang’ata road and Southern Bypass hence easily accessible, and iii) an increasing middle class in the area. The table below shows the performance of land in high rise residential areas within the NMA;

|

All values is Kshs mn per Acre unless stated otherwise |

|

|

||||||||||||

|

Cytonn Report: NMA Middle End Suburbs – High Rise Residential Areas Land Performance |

|

|

||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

13-Year CAGR |

2022/23 Capital Appreciation |

2023/24 Capital Appreciation |

∆ in Capital appreciation |

|

Dagoretti |

28 |

81 |

95 |

99 |

100 |

103 |

95.2 |

95.2 |

85.6 |

91.1 |

9.5% |

(10.1%) |

6.0% |

16.1% |

|

Embakasi |

33 |

61 |

60 |

70 |

61 |

63 |

67.2 |

66.9 |

71.5 |

75.8 |

6.6% |

6.9% |

5.6% |

(1.3%) |

|

Kasarani |

32 |

51 |

60 |

64 |

66 |

65 |

67.7 |

66.9 |

71.3 |

74.4 |

6.7% |

6.6% |

4.2% |

(2.4%) |

|

Average |

31 |

64.3 |

71.7 |

77.7 |

75.7 |

77 |

76.7 |

76.1 |

76.3 |

80.4 |

7.6% |

1.1% |

5.3% |

4.2% |

Source: Cytonn Research

Section III: Summary and Investment Opportunity in the Sector

The table below summarizes the performance in capital appreciation of the various areas:

|

Summary and Conclusions - y/y Capital Appreciation Nairobi Metropolitan Area |

|

|

Land Capital Appreciation |

|

|

FY’2023/24 |

Areas |

|

>5.0% |

Dagoretti, Embakasi, Syokimau, Athi River, Limuru, Kilimani |

|

1.0%- 4.9% |

Kileleshwa, Westlands, Kasarani, Upper Hill |

|

<1.0% |

Ruai, Rongai, Riverside, Ridgeways, Kitusuru, Karen, Spring Valley |

|

Un-serviced Land Capital Appreciation |

|

|

FY’2023/24 |

Areas |

|

1.0% -4.9% |

Utawala, Athi River |

Source: Cytonn Research

Investment Opportunity

- Satellite Towns (Unserviced land) - The investment opportunity in this segment lies in Juja, Rongai, and Limuru submarkets which registered the highest YoY capital returns at 7.2%, 5.6%, and 5.4%, respectively, against a market average of 5.3% owing to relative affordability of land and good access to the city center thereby drawing investments,

- High End Residential Suburbs - The investment opportunity in this segment lies in Kileleshwa and Runda which recorded the highest YoY capital appreciations of 4.9% and 2.0%, respectively, against the market average of 0.6%. The impressive performance was driven by the relatively high demand resulting from their serene environment, prime locations attracting high net worth investments, availability of adequate infrastructure and various amenities,

- Satellite Towns (Serviced Land) - The investment opportunity in the segment lies in Athi River and Syokimau which recorded the highest YoY capital appreciations of 21.1% and 7.6%, respectively, against the market average of 4.5%. The performance was supported by; rapid demand driven by the existing growing middle income class earners, availability of infrastructure networks such as the commuter train station in Syokimau and Expressway to Athi River area relatively affordable prices,

- Commercial Zones – The investment opportunity in the segment lies in Westlands and Kilimani which recorded the highest YoY capital appreciations of 10.2% and 4.8%, respectively, against the market average of 3.6%. driven close proximity to Nairobi’s Central Business District (CBD) and availability of essential amenities, and

- High Rise Residential Areas - The investment opportunity in the segment lies in Embakasi and Dagoretti which recorded the highest YoY capital appreciations of 5.6% and 6.0%, respectively, against the market average of 5.3%, driven by increased demand for development land to cater for the rapidly dense population in the areas.

Section IV: Conclusion and Outlook for the Sector

|

Cytonn Report: Nairobi Metropolitan Area (NMA) 2024 Land Sector Outlook |

||||

|

Indicator |

2023 Projections |

2024 Projections |

2023 Outlook |

2024 Outlook |

|

Infrastructure Development |

We expect the infrastructure sector in Kenya to continue to play a crucial role in promoting economic activities, which in turn will drive the growth and performance of the Real Estate sector, with better and improved road, railway and air transport networks, and other support facilities that make it easier for delivery of people, goods, and services efficiently, thereby increasing demand for Real Estate properties. Additionally, the government has increased budget allocation to the infrastructure sector by 16.9%, to Kshs 286.6 bn in FY’2023/2024 from Kshs 245.1 bn in FY’2022/2023, with key focus in development and expansion, rehabilitation, and maintenance of major roads and bridges across the country, extension of the Standard Gauge Railway (SGR) Phase 2B from Naivasha to Kisumu and Phase 2c to Malaba, development of Dongo Kundu Special Economic Zone, development of Nairobi Railway City, and construction of airports, airstrips and a Kshs 1.3 bn modern cruise ship terminal in Mombasa.

Additionally, the government is actively pursuing the completion of major infrastructure projects that were previously halted by the current regime and execution of newer plans in existing projects, signaling a renewed commitment to infrastructural developments. Such projects include the dualling of Rironi- Mau Summit Highway at a cost of Kshs 180.0 bn, Kenol-Sagana-Marua highway Phase 3 and 4 at a cost of Kshs 8.0 bn, and the Eastern Bypass Highway Phase 2, Limuru and UN Avenue roads Phase 1, extension of the SGR from Mariakani to Lamu to Isiolo and further connect to the border town of Moyale. From Isiolo, the government will extend the SGR to Nairobi, connecting the country’s capital city and commercial hub to northern Kenya and finally to Ethiopia. The updated SGR plan is part of the Kshs 3.4 tn Lamu Port South Sudan-Ethiopia Transport (Lapsset) aimed at opening up northern Kenya and revamping the northern corridor by spurring movement within Kenya, South Sudan and Ethiopia. However, the bulk of financing these additional major projects will be from external financiers such as the African Develop Bank (AfDB), EXIM Bank of China and many more As a result, we expect boost in development of more habitable areas for settlements, increased developments of Real Estate in the new upcoming regions, and rising up property prices across the country. |

We expect the government continued efforts to launch infrastructural projects such as tarmac roads, sewer lines, water supply, and electricity connectivity will stimulate the economic growth. These factors will in turn lead to growth in Real Estate market and drive up land values Goods and services move to new areas. Additionally, the government increased infrastructure budget allocation by 16.9%, to Kshs 286.6bn in FY’ 2023/2024 from Kshs 245.1 bn in FY’2022/2023. The allocation will be distributed as follows Kshs 113.9 bn to Construction of Roads and Bridges, Kshs 50.9 bn to Maintenance of Roads, and Kshs 80.1 bn for rehabilitation of Roads. However, we foresee the pace of infrastructure development slowing down, considering that the funding for road construction was reduced by Kshs 55.6 bn in the recent mini-budget. The budget for roads in the financial year 2023/24 has been decreased to Kshs 177.1 bn from the initially allocated Kshs 232.7 bn for the State Department for Roads.

Some of the notable projects in focus include development of Nairobi railway city, rehabilitation of locomotives, extension of standard gauge railway (SGR) and expansion of airports and airstrips. Additionally, the government plans to complete various infrastructural projects in the country including Riruta – Lenana – Ngong Railway Line, phase I of Nairobi Railway City, the Meter Gauge Railway (MGR) Link from Mombasa SGR Terminus to Mombasa MGR Station, and the Railway Bridge across Makupa Causeway.

As a result of this projects we expect the opening up of satellite towns to Real Estate development and a subsequent rise in property prices.

|

Positive |

Neutral |

|

Credit Supply |

Lenders continue to tighten their lending requirements as they demand more collateral from developers due to the high credit risk in the Real Estate sector on the back of the tough economic environment. This is evidenced by 12.2% increase in Gross Non-Performing Loans (NPLs) in the Real Estate sector to Kshs 88.1 bn in Q1’2023, from Kshs 78.5 bn in Q1’2022. In addition, on a q/q basis, the increase in NPLs represented a 9.7% increase from Kshs 80.3 bn realized in Q4’2022,

Additionally, the economic recovery from the pandemic and the rising global interest rates caused by inflation which has forced widespread adoption of credit risk-based pricing models on loans by local lenders and the recent hike of the Central Bank Rate (CBR) by 100 basis points from 9.5% to 10.5% by the Monetary Policy Committee (MPC) will push more lenders to increase their interest rates on loans borrowed by Real Estate investors

As a result, we expect these factors will continue raising the cost of credit for most developers seeking to invest in land purchases and property developments through debt. This is even when the government through the Kenya Mortgage Refinance Company (KMRC), which is the only refinancing company in the country and just formed in 2018, strains to support the credit supply among the local banks and SACCOs by providing affordable mortgages to the ever-rising demand of Kenyans seeking to cheaper loans to finance their homeownership projects on land. It is important to note that the capital markets in Kenya, which could serve as an alternative means to source funds, are already undermined. |

The government has continued to promote access to affordable credit through the Kenya Mortgage Refinance Company (KMRC) which has been crucial in providing Kenyans with low cost loans increasing home ownership. However, lenders continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector as evidenced by the gross Non-Performing Loans (NPLs) in the Real Estate sector realized a q/q increase of 15.0% to Kshs 117.1 bn in Q1’2024, from Kshs 101.7.0 bn in Q4’2023. As a result, we expect these factors to slow down developers seeking to invest in land purchases and property developments |

Negative |

Negative |

|

Legal Reforms |

We anticipate that both the national and county governments will continue to make adjustments to their legal policies and introduce new regulations to enhance transparency, efficiency, compliance, and increased land transactions in the Real Estate sector. Furthermore, the recently assented Finance Act 2023 to law in 26 June 2023, with introduction of the Housing Levy and reduced Monthly Rental Income Tax, and, the Finance Act 2022, which became effective as of 1 January 2023, with the Capital Gains Tax (CGT) chargeable on net gains upon transfer of property tripling to 15.0% from the 5.0% previously chargeable are expected to stimulate activities in the Real Estate sector such as; i) the government having the much-needed capital to finance affordable housing projects across the country, ii) incentives outlined in the Legislation supporting the private sector's efforts to construct affordable housing units and price them within reach of Kenyan homeowners, and, iii) encouraging collaborations and partnerships between the government and private developers, further boosting the supply of affordable housing in the country.

Consequently, there will be an increase in land transactions as the government's direct involvement and partnerships with the private sector in the residential sector will encourage streamlining of more reforms that benefit its projects’ execution. These efforts also aim to enhance Kenya's competitive advantage in the region for Real Estate investments.

|

We expect continued streamlining of the Real Estate Sector through new legal policies and regulations to ensure transparency and efficiency in the land sector.

The high court declined to issue orders stopping the imposition of the affordable housing levy that is currently at the rate of 1.5% of gross salary.Additionally as of 1stJanuary 2023 the government tripled the Capital Gains Tax (CGT) upon transfer of property to 15.0% from the 5.0% previously chargeable. This is expected to provide the government with much needed capital

|

Neutral |

Neutral |

|

Real Estate Activities |

We expect the Real Estate sector to record an improvement in performance driven by factors such as; rapid expansion in the retail sector, increased infrastructure and housing developments by the government, increased investor confidence in the housing and hospitality market, and, KMRC efforts to provide affordable home loans to potential buyers

However, setbacks such as oversupply in the retail and office sectors, increasing construction costs, and, limited investor knowledge on Real Estate Investment Trusts is expected to weigh down the overall performance of the sector |

We expect the Real Estate sector to record increased and continuous performance on the back of support from; i) government infrastructural development initiatives and focus on affordable housing, ii) continuous focus on mortgage financing through the KMRC, iii) aggressive expansion by both local and international retailers, and, iv) Kenya's positive demographics driving housing demand However, factors such as increased construction costs on the back of inflation, constrained financing to developers with increased underdeveloped capital markets, oversupply in select sectors and low of investor appetite in Real Estate Investments Trusts (REITs) are expected to continue impeding performance of the sector |

Neutral |

Neutral |

|

Land Sector Performance |

Land sector in the NMA has proven to be resilient and a viable investment hence we expect it to continue recording impressive performance mainly attributed to rapid infrastructure developments opening areas for investments, and positive demographics driving demand for development land |

Land sector in the NMA continued to record improved performance as a reliable investment opportunity. We expect that the sector's performance to be supported by; i) infrastructural developments opening up satellite towns to real estate investment and development. ii) rising demand for development land facilitated by positive population demographics, ii) ongoing efforts by the government to streamline land transactions creating a more efficient and accessible market, iii) notable increase in the initiation and completion of affordable housing projects owing to both government and private sector involvement, and, iv) rapid expansion of satellite towns, accompanied by substantial infrastructural developments resulting in elevated property prices |

positive |

positive |

|

We have three Neutral outlooks; for infrastructure development, legal reforms and Real Estate activities and one negative outlook for credit supply and one positive for the land sector performance thereby bringing our overall outlook for the sector to NEUTRAL. We expect the performance to be further boosted by factors driving demand for development land such as; i) Increased infrastructure developments which has improved and opened up areas for investment, ii) Roll out of numerous affordable housing projects by both the public and private sectors, iii) Affordability of land in the satellite towns, iv) Limited supply of land especially in urban areas which has contributed to exorbitant prices, and, v) Positive demographics driving demand for land upwards, facilitated by high population growth and urbanization rates of 1.9% p.a and 3.7% p.a, respectively against the global averages 0.9% p.a and 1.6% p.a, respectively. |

||||

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor