Sep 28, 2025

In July 2024, we released the Nairobi Metropolitan Area Land Report 2024, which highlighted that the Nairobi Metropolitan Area (NMA) land sector recorded an improvement in performance with the average annual price appreciation coming in at 3.9% in FY’2023/24, 0.6% points lower than the 4.5% appreciation recorded in FY’2022/23. The performance represented a 13-year average price appreciation CAGR of 8.2%, with the average selling price for land coming in at Kshs 132.7 mn in FY’2023/24, from Kshs 47.9 mn in 2011.

The performance during this period was mainly driven by the increased demand for Un-serviced land in satellite towns of the Nairobi Metropolitan and serviced land in Satellite Towns mainly driven by; i) the government’s significant investments in infrastructure particularly road networks and utilities which in turn stimulated growth in Satellite towns e.g. the Southern and Eastern Bypass, ii) heightened construction activities, especially in the residential sector, driven by the government’s affordable housing agenda, which in turn boosted demand for land, iii) limited supply of land especially in urban areas which contributed to rising land prices as demand from buyers outpaced availability, iv) growing demand for housing which was driven by positive demographics such as high population and urbanization, which by then stood at 1.9% and 3.7% respectively, and, v) growth in popularity of satellite towns by investors and buyers which provided affordable land options in comparison to the suburbs and key commercial zones.

This week, we update our report by discussing the overall performance of the NMA land sector over time, and examining various factors that influence its performance based on selling prices and annual capital appreciation. Additionally, we identify investment opportunities for the sector, using 2025 market research data. As such, in this topic, we shall focus on;

- Introduction to the Nairobi Metropolitan Area (NMA) Land Sector,

- NMA Land Sector Performance in 2025 Based on Various Locations, and,

- Summary and investment opportunities in the sector, and,

- Conclusion and Outlook for the Sector.

Section I: Introduction to the Nairobi Metropolitan Area (NMA) Land Sector

The land sector within the Nairobi Metropolitan Area (NMA) has remained notably resilient, continuing to post consistent improvements in performance despite prevailing challenges. These include persistent increases in construction costs, limited access to development financing, and oversupply in specific real estate segments such as commercial offices and retail spaces. As a result, demand for land has been subdued in select areas, particularly within commercial zones and high-end suburbs. Nevertheless, the sector recorded improved performance in FY’2024/25, underpinned by several key drivers, including:

- Demographics: Kenya continues to record positive demographics shown by high population growth and urbanization rates of 2.0% p.a and 3.8% p.a, respectively compared to the global averages 1.0% p.a and 1.8% p.a, respectively, as at 2024. Given this, the demand for residential and commercial spaces continues to soar, which in turn boosts demand for development land,

- Continued government investment in infrastructure: In 2025, the Kenyan government has sustained momentum in implementing strategic infrastructure projects aimed at accelerating economic development and enhancing regional connectivity. Key ongoing and completed projects include the dualling of the Mombasa Road-Athi River stretch, the expansion of Kiambu Road, progress on the LAPSSET Corridor, and utility extensions (water, electricity, sewer) to satellite towns. These projects have enhanced accessibility and opened up new investment frontiers in towns such as Joska, Kamulu, and Thika, resulting in increased land demand and value appreciation.

- Acceleration of affordable housing projects: The government's Affordable Housing Programme has gained notable traction in 2025, with more than 40,000 new units launched or under construction across Nairobi Metropolitan Area. Major developments include the Kibera Soweto B and Starehe AHPs in Nairobi, and others in Ruaka, Thika, and Mavoko. These initiatives continue to drive demand for land in areas earmarked for housing development and surrounding regions benefiting from complementary infrastructure upgrades.

- Diminishing land availability in urban centers: As Nairobi’s urban center becomes increasingly built-up, scarcity of available land parcels has driven investors and developers to the outskirts and emerging satellite towns. This limited land supply—especially within serviced zones—has contributed to upward pressure on prices, particularly in areas with infrastructure access and proximity to key commercial centers.

- Diaspora and institutional investor interest: There has been a marked increase in land acquisitions by diaspora investors, facilitated by improved transparency in land transactions through digitization, and greater interest by institutional players seeking strategic land banks. This trend is further supported by capital flight from more volatile investment classes amid global uncertainty.

However, the sector’s full potential in 2025 has continued to be constrained by a number of challenges:

- Elevated construction costs: Although inflation slightly eased by 1.9% points to average at 3.7% in H1’2025 from 5.6% in H1’2024 , construction costs remain high, averaging Kshs 73,400 per SQM in 2025, up from Kshs 71,200 in 2024 representing a 3.1% increase. Prices of key inputs; cement, steel, glass, and fittings, remain elevated due to import costs and VAT policies, which continue to impede development activity and temper land absorption rates.

- Persistent oversupply in certain Real Estate segments: The glut in commercial offices (estimated oversupply at 5.7 mn SQFT) and retail space (oversupply at 3.6 mn SQFT nationally) has continued to depress land demand in Nairobi’s high-end and commercial zones, with developers shifting focus to mixed-use and residential-led masterplans.

- Infrastructure gaps in periphery zones: Despite major infrastructure investments, certain peripheral areas still lack essential amenities such as sewerage systems, storm drainage, and water connections. These limitations have held back land uptake in areas with otherwise high potential due to increased development costs and project risks.

Looking ahead, some key trends expected to shape the land sector include:

- Continued Expansion of Ardhisasa and Digitization of Land Processes: The digitization of land records under the Ardhisasa platform has expanded to cover more counties within the Nairobi Metropolitan Area in 2025. This initiative is expected to further improve transaction transparency, reduce fraud, and shorten approval timelines, which will boost investor confidence and streamline land acquisition processes.

- ISK's Push for Credible Listings: The Institution of Surveyors of Kenya (ISK) launched a Multi-Listing Service (MLS) platform in April 2025, allowing only verified estate agents to list properties. The platform ensures genuine, transparent listings with detailed documentation and analytics, boosting buyer trust and reducing fraud in Kenya’s real estate market.

- Increased Regulation and Compliance Costs: Enforcement of existing land-use plans, zoning regulations, and environmental impact assessments has tightened in 2025. While this is a step toward sustainable urban development, it has introduced new costs and approval complexities for developers, potentially affecting investment timelines.

- Impact of Capital Gains Tax (CGT): The 15% CGT rate continues to influence investor behavior, with some sellers increasing asking prices to offset tax obligations. While this has slowed down transaction volumes in high-value areas, it has also spurred more structured investment planning and bundling of land parcels to realize economies of scale.

Overall, the Nairobi Metropolitan Area's land sector is expected to remain attractive due to ongoing urban sprawl, infrastructure-led growth, and strong demographic fundamentals, although policy headwinds and high development costs may continue to shape investment decisions moving forward.

Section II: NMA Land Sector Performance in 2025 Based on Various Locations

For the analysis, we conducted research on various major towns within the NMA and classified them as follows;

- High Rise Residential Areas: They comprise of areas such as Dagoretti, Embakasi, and Kasarani, and are majorly characterized by the numerous high-rise buildings such as the apartments found within,

- High End Residential Suburbs: These are areas which generally consist of low-rise buildings such as the bungalows, maisonettes and villas and also high-end apartments. They include; Kitisuru, Runda, Ridgeways, Kileleshwa, Karen, and Spring Valley,

- Commercial Zones: They comprise of areas such as Kilimani, Westlands, Riverside, and Upper Hill, and are popular because of the numerous commercial office buildings that they have, and,

- Satellite Towns: Land in the area was categorized into serviced (site and service schemes) and unserviced land. It comprises of areas such as Syokimau, Ruiru, Rongai, Juja, Utawala, Limuru, Athi River, and, Limuru.

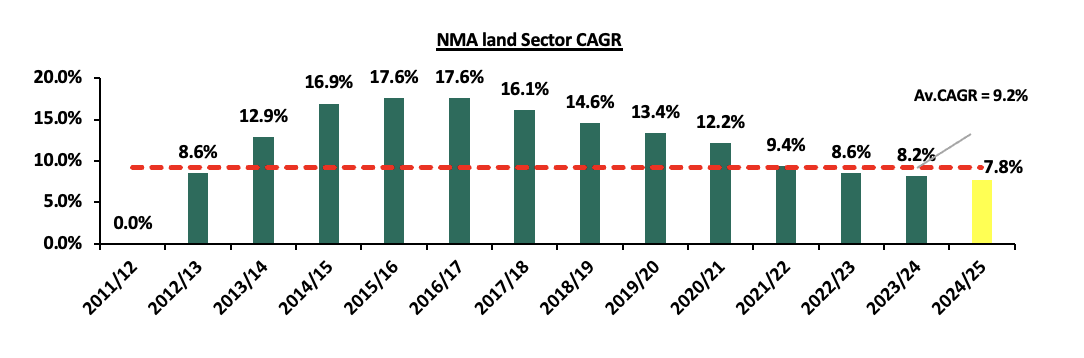

The NMA land sector continues to show resilience in performance with the average Year-on-Year (YoY) price appreciation coming in at 3.4% in FY’2024/25, 0.4% faster than the 3.0% appreciation recorded in FY’2023/24. This is as the average asking prices came in at Kshs 136.7 mn in FY’2024/25 from Kshs 132.7 mn in FY’2023/24. The performance also represented a 14-year average price appreciation CAGR of 7.8%, with the average selling price for land coming in at Kshs 136.7 mn in FY’2024/25, from Kshs 47.9 mn in 2011/12. The below graph shows CAGR from 2011/12 to 2024/25.

Source: Cytonn Research

This signifies the continued rise in the demand for development land mainly driven by; i) the government’s significant investments in infrastructure particularly road networks and utilities which in turn stimulates growth in Satellite towns e.g. the Southern, Western and Eastern Bypass, ii) heightened construction activity, especially in the residential sector, driven by the government and private sector affordable housing agenda, which in turn boosts demand for land, iii) limited supply of land especially in urban areas which has contributed to rising land prices as demand from buyers outpaces availability, iv) growing demand for housing which is driven by positive demographics such as high population and urbanization, which currently stands at 2.0% and 3.7% respectively, and, v) growth in popularity of satellite towns by investors and buyers which provide affordable land options in comparison to the suburbs and key commercial zones.

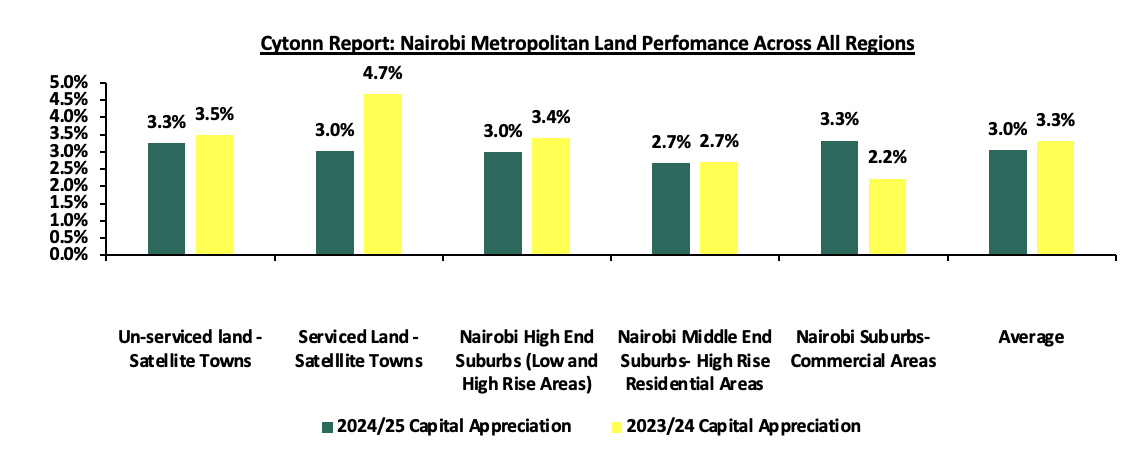

The graph below shows the capital appreciation of land in the NMA from FY’2023/24 to FY’2024/25;

Source: Cytonn Research

The table below shows the performance summary of the NMA land sector based on the average asking prices, CAGR and capital appreciation;

|

Location |

*Price in 2011 |

*Price in 2012 |

*Price in 2013 |

*Price in 2014 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 18/19 |

*Price 19/20 |

*Price 20/21 |

*Price 21/22 |

*Price 22/23 |

*Price 23/24 |

*Price 24/25 |

14-Year CAGR |

23/24 Capital Appreciation |

24/25 Capital Appreciation |

∆ in Capital Appreciation |

|

Serviced Land - Satellite Towns |

5.6 |

6.8 |

8.3 |

11.1 |

13.8 |

15.2 |

16.8 |

18.4 |

19.2 |

20.4 |

17 |

18.3 |

19.24 |

20.2 |

10.5% |

3.0% |

4.9% |

1.9% |

|

Unserviced land - Satellite Towns |

3.6 |

5.1 |

6.5 |

7.5 |

8.4 |

11.6 |

12.3 |

13.2 |

14.1 |

15 |

14.7 |

15.7 |

17.0 |

17.6 |

12.4% |

3.5% |

3.3% |

(0.2%) |

|

Nairobi Suburbs- Commercial Areas |

145 |

173.1 |

215.3 |

291.4 |

359.3 |

421.8 |

452.6 |

470.3 |

485.7 |

492.1 |

403.4 |

397.3 |

411.5 |

424.4 |

8.1% |

2.2% |

3.3% |

1.1% |

|

Nairobi High End Suburbs (Low and High Rise Areas) |

54.5 |

62.3 |

71.2 |

83.5 |

94.3 |

113 |

125 |

133 |

139 |

145 |

130.5 |

135.5 |

136.3 |

138.9 |

7.6% |

3.4% |

3.0% |

(0.4%) |

|

NMA High Rise Residential Areas |

31 |

35.2 |

43.7 |

54.8 |

64.3 |

71.7 |

75.2 |

79.3 |

82.6 |

85.9 |

76.3 |

78.3 |

80.4 |

82.6 |

7.2% |

2.7% |

2.7% |

0.0% |

|

Average |

47.9 |

56.5 |

69.0 |

89.7 |

108.0 |

126.7 |

136.4 |

142.8 |

148.1 |

151.7 |

128.4 |

129.0 |

132.9 |

136.7 |

9.2% |

3.0% |

3.4% |

0.5% |

Source: Cytonn Research

Performance per node:

- Satellite Towns -Unserviced Land

Unserviced land in the satellite towns of Nairobi recorded an average iiipYoY capital price appreciation of 3.3%, with average asking prices coming in at Kshs 17.6 mn in FY’2024/25, from the Kshs 17.0 mn recorded in FY’2023/24. Additionally, the performance grew by a 14-year average CAGR of 12.4%, to average asking prices of Kshs 17.6 mn in FY’2024/25 from the Kshs 3.6 mn recorded in 2011. The performance was supported by; i) Ongoing and planned infrastructure improvements, such as the Western, South and Eastern bypass, commuter railways and other utilities have made satellite towns more accessible and appealing for investment, and, ii) Investors looking for capital gains have been buying land in these towns, anticipating future appreciation as the areas develop and urbanize.

In terms of performance per node, Limuru was the best performing with a Year-on-Year (YoY) capital appreciation of 7.0% attributed to; i) Infrastructure upgrades enhancing roads e.g Waiyaki way and Western bypass, utilities, and overall accessibility, ii) Strategic proximity to Nairobi making commuting and settlement easier iii) Rising demand driven by urbanization, population growth, and housing needs, iv) Relative affordability compared to inner Nairobi suburbs attracting buyers v) Speculative investment as investors anticipate rapid future development. The table below shows the performance of unserviced land in satellite towns within the NMA;

|

All values is Kshs mn per Acre unless stated otherwise |

|

||||||||||||||||

|

Cytonn Report: NMA Satellite Towns - Unserviced Land Performance |

|

||||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 18/19 |

*Price 19/20 |

*Price 20/21 |

*Price 21/22 |

*Price 22/23 |

*Price 23/24 |

*Price 24/25 |

14-Year CAGR |

2023/24 Capital Appreciation |

2024/25 Capital Appreciation |

∆ in Capital appreciation |

||

|

Limuru |

5 |

13 |

17 |

20 |

20 |

21 |

21.2 |

24.1 |

23.9 |

24.8 |

26.5 |

12.7% |

3.8% |

7.0% |

3.3% |

||

|

Utawala |

6 |

9 |

10 |

11 |

12 |

12 |

12.4 |

14.1 |

16.7 |

17.4 |

18.2 |

8.2% |

4.2% |

4.6% |

0.4% |

||

|

Juja |

3 |

7 |

9 |

10 |

10 |

10 |

10.6 |

12.2 |

14.6 |

15.5 |

16.0 |

12.7% |

6.2% |

3.2% |

(2.9%) |

||

|

Rongai |

2 |

10 |

18 |

18 |

18 |

19 |

19 |

18.9 |

17.9 |

18.3 |

18.5 |

17.2% |

2.2% |

1.1% |

(1.1%) |

||

|

Athi River |

2 |

3 |

4 |

4 |

4 |

4 |

4.5 |

4.4 |

8.8 |

8.9 |

8.9 |

11.3% |

1.1% |

0.3% |

(0.8%) |

||

|

Average |

3.6 |

8.4 |

11.6 |

12.6 |

12.8 |

13.2 |

13.5 |

14.7 |

16.4 |

17.0 |

17.6 |

12.4% |

3.5% |

3.3% |

(0.2%) |

||

Source: Cytonn Research

- Nairobi Suburbs – High End (Low and High Rise) Residential Areas

High end residential areas of Nairobi suburbs registered an average YoY capital appreciation of 3.0%, with the average asking prices coming at Kshs 138.9 mn in FY’2024/25, from Kshs 136.3 mn in FY’2023/24. Additionally, the performance represented a 14-year average CAGR of 7.6%, with average asking prices coming in at Kshs 138.9mn in FY’2024/25 from the Kshs 54.5 mn recorded in 2011. These areas continue to remain attractive to investors due to; i) their serene and green environments, combined with larger plots offering a tranquil environment away from the bustling city center, ii) their proximity to the Central Business District(CBD) making them ideal for professionals who want to live in a serene area while still being close to their workplace, iii) relatively affordable prices at Kshs 138.9 mn per acre compared to the commercial zones averaging at Kshs 424.4 mn per acre.

In terms of performance per node, Karen was the best performing with an average YoY price appreciation of 6.6%, 3.6% points higher than the market average of 3.0.% due to; i) Proximity to Nairobi CBD and key nodes like Kilimani, Lavington and Kileleshwa, making it attractive for both residential and institutional investors, ii) Improved infrastructure, especially the expansion and maintenance of Ngong Road and Lang’ata Road, enhancing accessibility, iv) Growing middle- and upper-middle-class demand for gated residential developments and townhouses, v) Presence of key amenities, including shopping malls (The Hub and Galleria Malls), international schools, and hospitals, vi) Lower land saturation compared to older high-end suburbs, providing room for strategic investments, vii) Security and exclusivity, contributing to sustained demand from high-net-worth individuals and developers.

The table below shows the performance of land in high end (low and high rise) suburbs within the NMA;

|

All values is Kshs mn per Acre unless stated otherwise |

|

|

|||||||||||||||

|

Cytonn Report: NMA High End Suburbs (Low- and High-Rise Areas) Land Performance |

|

|

|||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

*Price 2024/25 |

14-Year CAGR |

2023/24 Capital Appreciation |

2024/25 Capital Appreciation |

∆ in Capital appreciation |

||

|

Karen |

25 |

40 |

46 |

52 |

53 |

56 |

59.6 |

62 |

62.5 |

63.6 |

67.8 |

7.4% |

1.7% |

6.6% |

4.9% |

||

|

Kitisuru |

32 |

59 |

70 |

70 |

71 |

73 |

77.9 |

90.3 |

90.5 |

92.5 |

98.0 |

8.3% |

2.2% |

6.0% |

3.7% |

||

|

Runda |

33 |

58 |

67 |

68 |

68 |

70 |

74.3 |

81.7 |

85.9 |

90.2 |

92.5 |

7.6% |

5.1% |

2.5% |

(2.6%) |

||

|

Spring Valley |

64 |

131 |

147 |

154 |

148 |

156 |

161 |

161.7 |

164.5 |

168.3 |

172.4 |

7.3% |

2.3% |

2.5% |

0.2% |

||

|

Ridgeways |

24 |

51 |

62 |

68 |

65 |

66 |

68.8 |

81.4 |

83 |

86.4 |

87.1 |

9.6% |

4.1% |

0.7% |

(3.4%) |

||

|

Kileleshwa |

149 |

227 |

286 |

306 |

311 |

303 |

300.9 |

305.8 |

301.9 |

316.8 |

315.4 |

5.5% |

4.9% |

(0.4%) |

(5.4%) |

||

|

Average |

54.5 |

94.3 |

113 |

119.7 |

119.3 |

120.7 |

123.8 |

130.5 |

135.5 |

136.3 |

138.9 |

7.6% |

3.4% |

3.0% |

(0.4%) |

||

Source: Cytonn Research

- Satellite Towns - Serviced Land

Serviced land in the satellite towns of Nairobi recorded an average YoY capital appreciation of 3.0%, with the average asking prices coming in at Kshs 20.2 mn in FY’2024/25, from Kshs 19.2 mn in FY’2023/24. Additionally, the performance represented a 14-year average CAGR of 10.5%, with average asking prices coming in at Kshs 20.2 mn in FY’2024/25 from the Kshs 5.6 mn recorded in 2011. The performance was supported by; i) Continuous improvement of infrastructure such as the Eastern bypass and Thika Superhighway, ii) relatively quick access to the city, increasing investor appeal for development of residential and commercial units, and, iii) rapid urbanization and population growth increasing the demand for housing.

In terms of performance per node, Syokimau was the best performing with a relatively high average YoY price appreciation of 4.3%. This was mainly driven by; i) Enhanced transport connectivity, particularly via the Nairobi Expressway, Mombasa Road upgrades, and SGR commuter services, improving access to Nairobi CBD and JKIA, ii) presence of amenities such as Kitengela, Crystall Rivers and Signature malls,iii) Proximity to major economic hubs, such as the Industrial Area, JKIA, and Mombasa Road corridor, attracting both residential and logistics-related investments. and iv) growth of industries around the area has led to job creation which is increasing demand for housing and commercial properties. On the other hand, Ruai recorded the lowest price appreciation of 0.1 % attributed to reduced land transactions within the period under review. The table below shows the performance of serviced land in satellite towns within the NMA;

|

All values is Kshs mn per Acre unless stated otherwise |

||||||||||||||||

|

Cytonn Report: NMA Satellite Towns - Serviced Land Performance |

||||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

*Price 2024/25 |

14-Year CAGR |

2023/24 Capital Appreciation |

2024/25 Capital Appreciation |

∆ in Capital appreciation |

|

|

Syokimau |

3 |

12 |

12 |

12 |

12 |

12 |

11.8 |

13.9 |

17.2 |

18.5 |

19.3 |

14.2% |

7.6% |

4.3% |

(3.2%) |

|

|

Athi River |

2 |

11 |

13 |

13 |

12 |

12 |

13.1 |

13.3 |

15.9 |

17.4 |

18.1 |

17.0% |

9.4% |

3.9% |

(5.5%) |

|

|

Ruiru & Juja |

8 |

18 |

19 |

21 |

23 |

24 |

25.3 |

25.9 |

28.1 |

29 |

30.1 |

9.9% |

3.2% |

3.8% |

0.6% |

|

|

Rongai |

7 |

16 |

19 |

19 |

19 |

18 |

20 |

20.4 |

19.8 |

20.6 |

21.2 |

8.2% |

4.0% |

2.9% |

(1.1%) |

|

|

Ruai |

8 |

12 |

13 |

15 |

14 |

14 |

13.5 |

11.6 |

12.5 |

12.4 |

12.4 |

3.2% |

(0.8%) |

0.1% |

0.9% |

|

|

Average |

5.6 |

13.8 |

15.2 |

16 |

16 |

16 |

16.7 |

17 |

18.3 |

19.6 |

20.2 |

10.5% |

4.7% |

3.0% |

(1.7%) |

|

source: Cytonn Research

- Nairobi Suburbs - Commercial Zones

Land in Nairobi suburbs commercial zones recorded an average YoY capital appreciation of 3.3%, with the average asking prices coming in at Kshs 424.4 mn in FY’2024/25, from Kshs 411.5 mn in FY’2023/24. Additionally, the performance represented a 14-year average CAGR of 8.1%, with average asking prices coming in at Kshs 424.4 mn in FY’2024/25 from the Kshs 145.0 mn recorded in 2011. This is mainly due to: i) availability of desirable amenities such as hospitals, schools, supermarkets and fitness centers making the area ideal for residential development, ii) good road network improving the connectivity to the Central Business District and other parts of NMA, and iii) availability of individuals who are willing to pay premium prices for land in these areas.

In terms of performance per node, Riverside was the best performing with a relatively high average YoY price appreciation of 6.9% owing to: i) availability of ample amenities ideal for residential development, ii) proximity to the city centre and connectivity to other Nairobi surburbs e.g. Westland’s and a surging middle class in the area. Conversely, Kilimani recorded the lowest price appreciation of 0.0 %, resulting from a stiff competition from neighboring areas such as Riverside and Westlands

The table below shows the performance of land in commercial zones within the NMA;

|

All values is Kshs mn per Acre unless stated otherwise |

|

|

|

|||||||||||||||

|

Cytonn Report: NMA Suburbs - Commercial Zones Land Performance |

|

|

|

|||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

*Price 202425 |

14-Year CAGR |

2023/24 Capital Appreciation |

2024/25 Capital Appreciation |

∆ in Capital appreciation |

|||

|

Riverside |

116 |

343 |

362 |

361 |

363 |

351 |

335.7 |

343.1 |

342.1 |

327.1 |

349.7 |

8.2% |

(4.4%) |

6.9% |

11.3% |

|||

|

Westlands |

150 |

350 |

453 |

474 |

430 |

421 |

413.6 |

418.3 |

423.2 |

433.2 |

447.2 |

8.1% |

2.4% |

3.2% |

0.9% |

|||

|

Upper Hill |

200 |

450 |

512 |

510 |

488 |

506 |

487.3 |

471.9 |

468.1 |

471.4 |

486.1 |

6.5% |

0.7% |

3.1% |

2.4% |

|||

|

Kilimani |

114 |

294 |

360 |

387 |

403 |

398 |

381.7 |

380.4 |

375.9 |

414 |

414.5 |

9.7% |

10.2% |

0.0% |

(10.2%) |

|||

|

Average |

145 |

359.3 |

421.8 |

433 |

421 |

419 |

404.6 |

403.4 |

397.3 |

411.5 |

424.4 |

8.1% |

2.2% |

3.3% |

1.1% |

|||

Source: Cytonn Research

- Nairobi Suburbs – High Rise Residential Areas

High rise residential areas of Nairobi realized an average YoY capital appreciation of 2.7%, with the average asking prices coming in at Kshs 82.6 mn in FY’2024/25 from Kshs 80.4 mn recorded in FY’2023/24. Additionally, the performance represented a 14-year average CAGR of 7.2%, with average asking prices coming in at Kshs 82.6 mn in FY’2024/25 from the Kshs 31.0 mn recorded in 2011. The performance was supported by; i) Rising population and urbanization in Nairobi increasing demand for housing in the subject areas, ii) unrestricted zoning regulations offering flexibility and growth potential to investors, and, iii) relatively affordable land prices compared to other investment areas.

In terms of performance per node, Kasarani was the best performing, with an average YoY price appreciation of 5.2 %, 2.5% points higher than the 2.7% market average. This was mainly driven by; i) Nairobi’s rapid urbanization and population growth pushing residents to seek affordable housing options, leading to increased demand in Nairobi peripheral areas, ii) availability of infrastructure with the area being served by Thika super highway hence easily accessible, iii) proximity to various amenities such as JKIAA, and SGR via Eastern bypass and iv) an increasing middle class in the area. The table below shows the performance of land in high rise residential areas within the NMA;

|

All values is Kshs mn per Acre unless stated otherwise |

|

|

|||||||||||||||

|

Cytonn Report: NMA Middle End Suburbs – High Rise Residential Areas Land Performance |

|

|

|||||||||||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

*Price 2018/19 |

*Price 2019/20 |

*Price 2020/21 |

*Price 2021/22 |

*Price 2022/23 |

*Price 2023/24 |

*Price 2024/25 |

14-Year CAGR |

2022/23 Capital |

2023/24 Capital Appreciation |

∆ in Capital appreciation |

||

|

Appreciation |

|||||||||||||||||

|

Kasarani |

32 |

51 |

60 |

64 |

66 |

65 |

67.7 |

66.9 |

72.45 |

74.4 |

78.3 |

6.6% |

2.8% |

5.2% |

2.5% |

||

|

Dagoretti |

28 |

81 |

95 |

99 |

100 |

103 |

95.2 |

95.2 |

88.6 |

91.1 |

93.9 |

9.0% |

2.8% |

3.1% |

0.3% |

||

|

Embakasi |

33 |

61 |

60 |

70 |

61 |

63 |

67.2 |

66.9 |

73.9 |

75.8 |

75.5 |

6.1% |

2.5% |

(0.4%) |

(2.9%) |

||

|

Average |

31 |

64.3 |

71.7 |

77.7 |

75.7 |

77 |

76.7 |

76.1 |

78.3 |

80.4 |

82.6 |

7.2% |

2.7% |

2.7% |

(0.0%) |

||

Source: Cytonn Research

Section III: Summary and Investment Opportunity in the Sector

The table below summarizes the performance in capital appreciation of the various areas:

|

Summary and Conclusions - y/y Capital Appreciation Nairobi Metropolitan Area |

|

|

Land Capital Appreciation |

|

|

FY’2024/25 |

Areas |

|

>5.0% |

Limuru, Kitisuru, Karen, Kasarani and Riverside |

|

1.0%- 4.9% |

Upper Hill, Athi River, Rongai, Syokimau, Ridgeways, Spring Valley, Ruiru and Juja, Ruai, Dagoretti, Westlands |

|

<1.0% |

Kileleshwa, Embakasi, Kilimani |

|

Un-serviced Land Capital Appreciation |

|

|

FY’2024/25 |

Areas |

|

>5.0% |

Limuru |

|

1.0% - 4.9% |

Utawala, Rongai, Juja, Athi River, Rongai |

Source: Cytonn Research

Investment Opportunity

- Satellite Towns (Unserviced land) - The investment opportunity in this segment lies in Limuru, Utawala, and Juja submarkets which registered the highest YoY capital returns at 7.0%, 4.6% and 3.2%, respectively, against a market average of 3.3% owing to relative affordability of land and good access to the city center thereby drawing investments,

- High End Residential Suburbs - The investment opportunity in this segment lies in Karen and Kitisuru which recorded the highest YoY capital appreciations of 6.6% and 6.0%, respectively, against the market average of 3.0%. The impressive performance was driven by the relatively high demand resulting from their serene environment, prime locations attracting high net worth investments, availability of adequate infrastructure and various amenities,

- Satellite Towns (Serviced Land) - The investment opportunity in the segment lies in Syokimau, Ruiru& Juja and Athi River which recorded the highest YoY capital appreciations of 4.3%,4.0% and 6%, respectively, against the market average of 3.0%. The performance was supported by; rapid demand driven by the existing growing middle-income class earners, availability of infrastructure networks such as the commuter train station in Syokimau and Thika superhighway and Tatu City to Ruiru and Juja area relatively affordable prices,

- Commercial Zones – The investment opportunity in the segment lies in Riverside, westlands and Upperhill which recorded the highest YoY capital appreciations of 6.9%, 3.2% and 3.1%, respectively, against the market average of 3.3 %. driven close proximity to Nairobi’s Central Business District (CBD) and availability of essential amenities, and

- High Rise Residential Areas - The investment opportunity in the segment lies in Kasarani and Dagoretti which recorded the highest YoY capital appreciations of 5.2% and 3.1%, respectively, against the market average of 2.7%, driven by increased demand for development land to cater for the rapidly dense population in the areas.

Section IV: Conclusion and Outlook for the Sector

|

Cytonn Report: Nairobi Metropolitan Area (NMA) 2025 Land Sector Outlook |

||||

|

Indicator |

2024 Projections |

2025 Projections |

2024 Outlook |

2025 Outlook |

|

Infrastructure Development |

We expect the government continued efforts to launch infrastructural projects such as tarmac roads, sewer lines, water supply, and electricity connectivity will stimulate the economic growth. These factors will in turn lead to growth in Real Estate market and drive up land values Goods and services move to new areas. Additionally, the government increased infrastructure budget allocation by 16.9%, to Kshs 286.6bn in FY’ 2023/2024 from Kshs 245.1 bn in FY’2022/2023. The allocation will be distributed as follows Kshs 113.9 bn to Construction of Roads and Bridges, Kshs 50.9 bn to Maintenance of Roads, and Kshs 80.1 bn for rehabilitation of Roads. However, we foresee the pace of infrastructure development slowing down, considering that the funding for road construction was reduced by Kshs 55.6 bn in the recent mini-budget. The budget for roads in the financial year 2023/24 has been decreased to Kshs 177.1 bn from the initially allocated Kshs 232.7 bn for the State Department for Roads.

|

Infrastructure development in the NMA is expected to intensify, with the government targeting completion of key road corridors such as Eastern Bypass, Kenol–Marua Highway, and Phase II of Nairobi Railway City. The anticipated connection of SGR to Isiolo and onward to Moyale under LAPSSET will further elevate investment appeal in Northern satellite towns. Additionally, utility infrastructure (water, sewer, electricity) is likely to improve with increased allocation for service delivery in underserved peri-urban zones. The government has allocated Kshs 217.3 bn to road development in FY’2025/26, covering Kshs 30.9 bn for construction of new roads and bridges, Kshs 70.8 bn for rehabilitation, and Kshs 115.6 bn for road maintenance. This represents a continued prioritization of the transport sector, although the State Department for Roads’ overall budget stands at Kshs 195.0 bn, reflecting fiscal consolidation pressures. While the allocations signal commitment to sustaining infrastructure growth, the sector still faces funding gaps and a reliance on supplementary financing to meet obligations to contractors.

Some of the notable projects in focus include development of Nairobi railway city, rehabilitation of locomotives, extension of standard gauge railway (SGR) and expansion of airports and airstrips. Additionally, the government plans to complete various infrastructural projects in the country including Riruta – Lenana – Ngong Railway Line, phase I of Nairobi Railway City, the Meter Gauge Railway (MGR) Link from Mombasa SGR Terminus to Mombasa MGR Station, and the Railway Bridge across Makupa Causeway.

As a result of this projects we expect the opening up of satellite towns to Real Estate development and a subsequent rise in property prices.

|

Neutral |

Neutral |

|

Credit Supply |

The government has continued to promote access to affordable credit through the Kenya Mortgage Refinance Company (KMRC) which has been crucial in providing Kenyans with low cost loans increasing home ownership. However, lenders continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector as evidenced by the gross Non-Performing Loans (NPLs) in the Real Estate sector realized a q/q increase of 15.0% to Kshs 117.1 bn in Q1’2024, from Kshs 101.7.0 bn in Q4’2023. As a result, we expect these factors to slow down developers seeking to invest in land purchases and property developments |

Credit conditions may marginally ease in 2025 as inflation stabilizes and the CBR adjusts downward. However, traditional credit channels will remain tight for land developers. Developers may increasingly seek capital through non-traditional financing options like green bonds, land-backed securities, or joint ventures with capitalized institutional investors. KMRC may expand its scope to cover more SACCOs and tier II banks, unlocking limited access for residential land buyers. |

Negative |

Neutral |

|

Legal Reforms |

We expect continued streamlining of the Real Estate Sector through new legal policies and regulations to ensure transparency and efficiency in the land sector.

The high court declined to issue orders stopping the imposition of the affordable housing levy that is currently at the rate of 1.5% of gross salary. Additionally, as of 1st January 2023 the government tripled the Capital Gains Tax (CGT) upon transfer of property to 15.0% from the 5.0% previously chargeable. This is expected to provide the government with much needed capital

|

The government is expected to implement land digitization programs across counties, especially in Nairobi, Machakos, Kiambu and Kajiado. These efforts will streamline e-conveyancing, enhance transaction security, reduce fraud and shorten due diligence periods. Additionally, legal frameworks may be introduced to enable fractional land ownership and securitization of land assets, improving liquidity and transparency in the land market. |

Neutral |

Positive |

|

Real Estate Activities |

We expect the Real Estate sector to record increased and continuous performance on the back of support from; i) government infrastructural development initiatives and focus on affordable housing, ii) continuous focus on mortgage financing through the KMRC, iii) aggressive expansion by both local and international retailers, and, iv) Kenya's positive demographics driving housing demand However, factors such as increased construction costs on the back of inflation, constrained financing to developers with increased underdeveloped capital markets, oversupply in select sectors and low of investor appetite in Real Estate Investments Trusts (REITs) are expected to continue impeding performance of the sector |

The real estate sector's focus on affordable housing will drive up demand for low-cost development land. A shift in investor appetite toward residential and mixed-use land parcels will emerge, particularly in towns like Juja, Athi River, Kamulu, and Ngong. Additionally, speculative buying driven by diaspora remittances and youth-led cooperative models is likely to increase land uptake. The rise of modular construction and land-leasing models may reshape traditional land investment preferences. |

Neutral |

Positive |

|

Land Sector Performance |

Land sector in the NMA continued to record improved performance as a reliable investment opportunity. We expect that the sector's performance to be supported by; i) infrastructural developments opening up satellite towns to real estate investment and development. ii) rising demand for development land facilitated by positive population demographics, ii) ongoing efforts by the government to streamline land transactions creating a more efficient and accessible market, iii) notable increase in the initiation and completion of affordable housing projects owing to both government and private sector involvement, and, iv) rapid expansion of satellite towns, accompanied by substantial infrastructural developments resulting in elevated property prices |

The NMA land sector is expected to remain the most resilient real estate sub-sector, with an estimated 10–20% capital appreciation in well-serviced satellite towns. Demand will be driven by infrastructure-led access, digital land reforms, affordable housing rollouts, and increased interest from diaspora investors. The rise of planned communities and land banking strategies by SACCOs and cooperatives will further deepen the market. However, zoning restrictions, land fragmentation, and delayed approvals may continue to pose moderate structural risks. |

positive |

positive |

|

We have three Positive outlooks; for Real Estate activities, legal reforms and Land sector performance and two neutral outlooks for credit supply and for the infrastructure development thereby bringing our overall outlook for the sector to POSITIVE. We expect the performance to be further boosted by factors driving demand for development land such as; i) Increased infrastructure developments which has improved and opened up areas for investment, ii) Roll out of numerous affordable housing projects by both the public and private sectors, iii) Affordability of land in the satellite towns, iv) Limited supply of land especially in urban areas which has contributed to exorbitant prices, and, v) Positive demographics driving demand for land upwards, facilitated by high population growth and urbanization rates of 2.0% p.a and 3.7% p.a, respectively against the global averages 1.0% p.a and 1.7% p.a, respectively. |

||||

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor