Nov 24, 2024

In 2023, we published the Nairobi Metropolitan Area Serviced Apartments Report 2023, which highlighted that the average rental yield for serviced apartments within the NMA increased by 0.6% points to 6.8% in 2023 from 6.2% in 2022. The improvement in performance was primarily on the back of improved occupancy rates and monthly charges by 0.5% points and 10.9%, to 66.3% and Kshs 3,045 per SQM, respectively, in 2023. This week, we update our report using 2024 market research data and by focusing on;

- Overview of the Kenyan Hospitality Sector,

- Introduction to Serviced Apartments,

- Supply and Distribution of Serviced Apartments within the NMA,

- Performance of Serviced Apartments in the NMA,

- Serviced Apartments Performance by Node

- Comparative Analysis - 2023/2024 Market Performance

- Performance per Typology

- Recommendations and Outlook.

Section I: Overview of the Kenyan Hospitality Sector

In 2024, Kenya's hospitality sector continues to display remarkable resilience in the aftermath of the COVID-19 pandemic. Its performance is largely supported by Nairobi's emergence as a regional business hub, attracting multinational companies to set up offices and hosting major international conferences. Additionally, Kenya’s status as a leading tourist destination has further driven recovery and growth, with increased business travel and tourism playing a significant role in strengthening the sector's contribution to the economy.

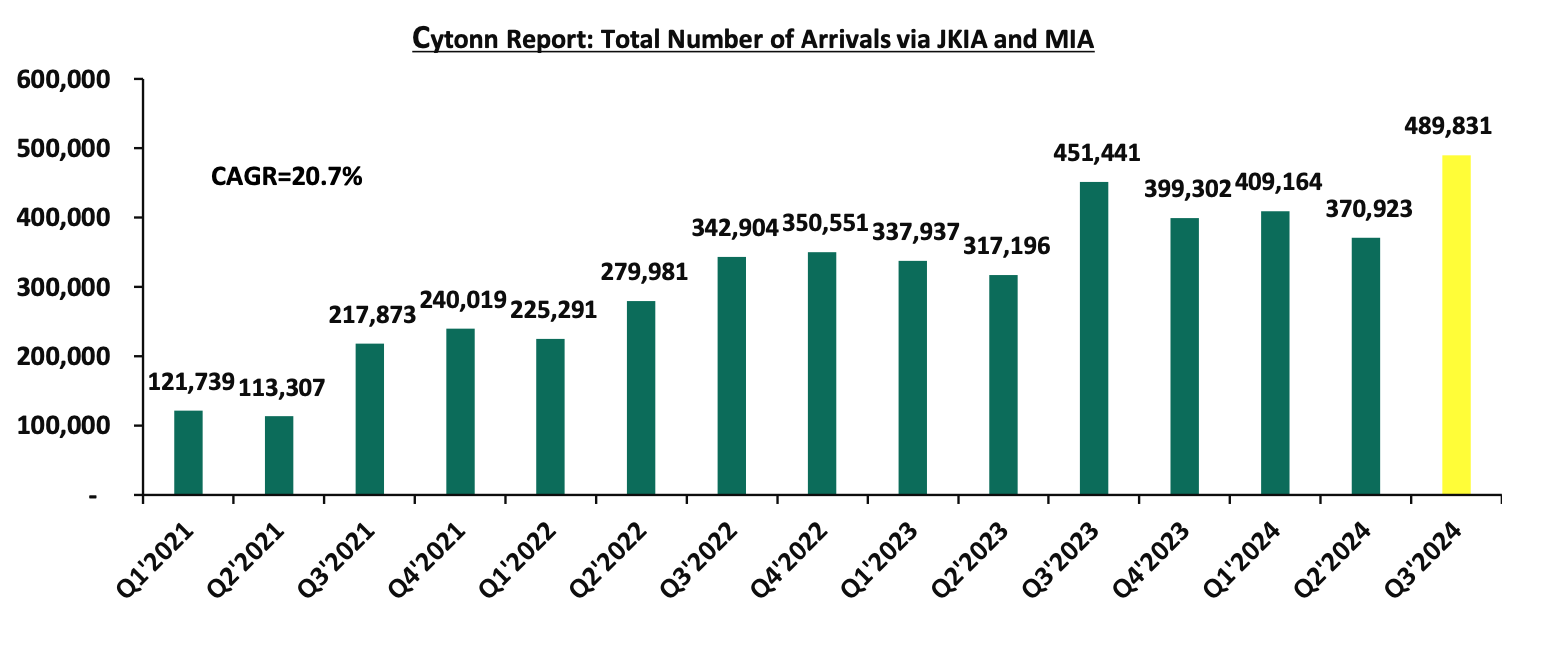

In terms of international arrivals, Kenya National Bureau of Statistics’ Leading Economic Indicators – September 2024 report highlighted that arrivals through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) registered an increase of 8.5% to 489,831 visitors in Q3’ 2024 from 451,441 visitors recorded in Q3’ 2023. This was a result of i) The country effecting a Visa free policy at the start of the year for all visitors in a bid to boost numbers, ii) Kenya Tourism Board (KTB) launching the ‘Ziara campaign’ seeking Kenyans in the Diaspora to help market their motherland through their networks in the host countries in exchange for incentives, iii) increased international marketing of Kenya’s tourism market by the Ministry of Tourism in collaboration with the Kenya Tourism Board, through platforms such as the Magical Kenya Loyalty Rewards Program, iv) Route marketing collaboration with low-cost carriers such as Air Asia X targeting visitors where the flights operates such as Southeast Asia, Northern Asia and Australia, v) continuous efforts to promote local and regional tourism, vi) development of niche products such as cruise tourism, adventure tourism, culture and sports tourism and, vii) an increase in corporate and business Meetings, Events, and Conferences from both the public and private sectors. For the months of August and September 2024, the number of international visitors arriving through Jomo Kenyatta International Airport (JKIA) and Moi International Airports (MIA) came in at a cumulative 320,109 persons, representing a 9.1% increase, compared to the 293,341 visitors recorded during a similar period in 2023. The graph below shows the number of international arrivals in Kenya between Q1’2021 and Q3’ 2024;

Source: Kenya National Bureau of Statistics

Some of the factors that continue to cushion the hospitality sector include;

- Active promotion of Kenya as a Tourist Hub: The government continues to market the country as leading tourist destination. Initiatives such as Magical Kenya Travel Expo, Ziara campaign and strategic partnership with airlines have been instrumental in attracting a broad range of visitors strengthening the industry.

- Diverse tourist attractions: The country boasts of rich variety of attractions—including its iconic wildlife reserves, cultural landmarks, and stunning landscapes—continues to draw global attention. Key sites such as the Lake Turkana National Parks, Lake Nakuru national park, Mount Kenya National Park, Lamu Old Town, and Fort Jesus remain popular due to ongoing conservation efforts and innovative tourism experiences that offer travelers authentic and immersive adventures.

- Lifting of all Travel Restrictions post-Covid 19: The lifting of travel restrictions related to the pandemic, both locally and internationally, has been pivotal in revitalizing Kenya's tourism and hospitality sector. This has re-established global and domestic connectivity, fostering a favorable environment for travel and driving a surge in tourist arrivals and related activities within the country.

- Hosting Global Sports Events: Kenya has continued to host various events such as the World Rally Championship (WRC) held in March-2024, These events continue to boost visitor arrivals, hotel bookings and the general performance of the hospitality industry,

- Recognition of Excellence in the Hospitality Industry: The hospitality sector in Kenya has earned notable recognition on the global stage, enhancing its reputation as a premier destination for leisure and business travel. Accolades in 2024 included Nairobi city being awarded Africa’s leading business travel destinations at the 2024 World Travel Awards. Also the country received honor at the Germany’s Annual Citizen’s Festival 2024 showcasing its culture and investment opportunities to over 130,000 attendees.

- Expansion of Key Hospitality Players: Kenya’s hospitality sector has witnessed notable growth, with both local and international investors demonstrating confidence in the market. In 2024, JW Marriott an International luxury hotel brand opened JW Marriott Nairobi at GTC building Westlands and Pullman Hotels & Resorts a subsidiary by Accor opened in Nairobi’s Upper Hill Area.

Nevertheless, the sector continues to face challenges, mainly;

- Escalating Costs of Operation: In 2024, rising operational expenses have created significant challenges for the hospitality sector, particularly in maintaining competitive pricing while preserving service quality and profitability. This is evidenced by Gross NPLs in the hospitality sector increasing by 78.5% on y/y basis to Kshs 21.6 bn in Q2’2024 from Kshs 12.1 bn in Q2’2023.

- Inadequate Reputational Management: Kenya’s hospitality sector remains vulnerable to the impacts of negative travel advisories issued during times of crisis, resulting in reduced international visitor numbers. Currently, there is no dedicated government strategy to proactively manage or mitigate these reputational risks. Consequently, the industry continues to face setbacks from travel advisories sometimes issued by foreign governments.

Section II: Introduction to Serviced Apartments

Serviced apartments, fully furnished for both short-term and extended stays, have firmly established themselves as a key segment of the hospitality industry within the Nairobi Metropolitan Area (NMA). Combining the comfort of a home with the convenience of hotel services, these residences offer a variety of amenities. They typically include spacious living areas, fully equipped kitchens, separate bedrooms, and en-suite bathrooms, creating a self-contained and adaptable living space for guests. As of 2024, serviced apartments continue to transform the hospitality experience by catering to a wide audience, such as business professionals, families, digital nomads, and vacationers, with customized offerings to meet diverse preferences. Their popularity stems from distinct advantages and features, including:

- Ample Space and Flexibility: Serviced apartments offer significantly more room than standard hotel accommodations, featuring separate areas for living, dining, and sleeping. This spacious setup provides a home-like atmosphere that enhances guest comfort,

- Personalized Services: These apartments deliver a variety of personalized services, such as housekeeping, concierge support, and amenities, ensuring guests’ unique needs and preferences are met.

- Technological Integration: Equipped with cutting-edge technology, including smart home features and intuitive apps, serviced apartments provide guests with greater convenience and control over their experience.

- Integration with Local Communities: Often situated within or near residential neighborhoods, serviced apartments allow guests to immerse themselves in the local culture, fostering a sense of belonging and community integration, and,

- Long-term Stay Options: With the growing popularity of remote work and long-term travel, serviced apartments cater to guests seeking longer stays, offering dedicated workspaces and amenities designed for extended comfort and productivity.

Section III: Supply and Distribution of Serviced Apartments in the Nairobi Metropolitan Area

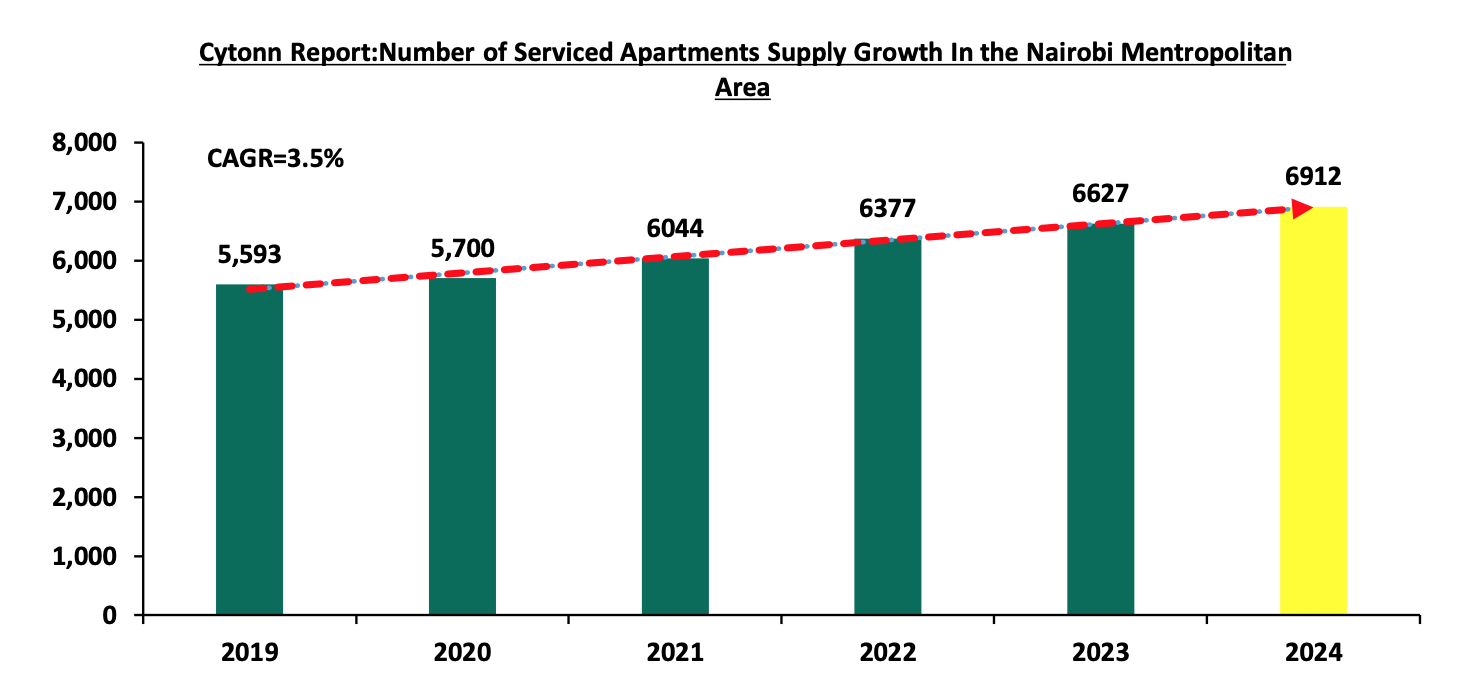

The number of serviced apartments within the Nairobi Metropolitan Area (NMA) has increased by a 9-year CAGR of 8.1% to 6,912 apartments in 2024, from 3,414 apartments in 2015. Notable apartment facility brought in the market in 2024 included DG West Apartments in Westland’s offering studio, 1 and 2-bedroom units across 25 floors. The table below shows the growth in supply of serviced apartments in the Nairobi Metropolitan Area over the last six years;

Source: Cytonn Research

In terms of distribution, Westlands and Kilimani have approximately the largest market share of serviced apartments within the Nairobi Metropolitan Area, at 38.0% and 25.0%, respectively attributable to;

- The growing presence of international organizations aiming to strengthen their operations in Africa, such as PricewaterhouseCoopers Kenya Headquarters, United Nations agencies, and various embassies, has resulted in an increasing number of expatriates and a rising demand for serviced apartments. The presence of premium serviced apartments commanding higher rents and rental yields, instilling confidence among investors in the region,

- Improved infrastructure, including projects like the Nairobi Expressway, enhances connectivity to Jomo Kenyatta International Airport (JKIA) and provides better road networks, making key locations more accessible,

- Premium serviced apartments in the region command higher rents and offer attractive rental yields, fostering greater confidence among investors.

- Vast social amenities, such as shopping centers and well-coordinated delivery service providers, further enhances the convenience and appeal of these areas.

The table provided below illustrates the market share of serviced apartments in the Nairobi Metropolitan Area in 2024;

|

Cytonn Report: Nairobi Metropolitan Area (NMA) Serviced Apartments Market Share 2024 |

|

|

Area |

Percentage Market share |

|

Westlands |

38.0% |

|

Kilimani |

25.0% |

|

Kileleshwa |

10.9% |

|

Limuru Road |

8.7% |

|

Upperhill |

7.6% |

|

Thika road |

5.4% |

|

Nairobi CBD |

4.3% |

|

Total |

100.0% |

Source: Cytonn Research

For the projects in the pipeline, serviced apartments and hotels with serviced apartments’ concepts currently under development in the Nairobi Metropolitan Area currently include;

For the projects in the pipeline, serviced apartments and hotels with serviced apartments’ concepts currently under development in the Nairobi Metropolitan Area currently include;

|

Cytonn Report: NMA Serviced Apartments Projects in the Pipeline 2024 |

|||

|

Name |

Location |

Number of Units |

Estimated Completion Date |

|

DG West Apartments |

Westland’s |

200 |

2026 |

|

Total |

200 |

||

Source: Cytonn Research

Section IV: Performance of Serviced Apartments in the Nairobi Metropolitan Area

In the development of the report, the performance of seven nodes within the Nairobi Metropolitan Area was tracked, and compared to the performance in 2023, with emphasis on the following metrics;

- Charged Rates: It is the daily, weekly and monthly rates that are charged to guests for serviced apartments in specific markets. This which form the basis for evaluation of the likely rental income to be received by investors in serviced apartments,

- Occupancy Rates: It measures the number of inhabited apartments as a percentage of the total number of units available. It also guides in determining the expected rental yields for various developments, and,

- Rental Yields: It measures the Real Estate investment return from the annualized collected rental income. It provides investors with an estimate of the returns expected from the property, as well as the time it will take to recover the investment. In the calculation of rental yields, we estimate annual income from monthly revenues and deduct operational costs (assumed as 40.0% of revenues).

In the estimations for the investment value, we have calculated development costs per SQM through factoring in land costs (location-based), costs of construction, equipping costs, professional fees and other costs relating to development. The formula thus used in the calculation rental yields is as follows;

Rental Yield=Monthly Rent per SQM x Occupancy Rate x 1 - 40.0% operational costx 12 monthsDevelopment Cost per SQM*

It is important to note that investors will generally incur varying costs depending on the actual land costs incurred, the plot ratios, and the level of finishing and equipping. In analyzing performance, we will start by the node during the year, followed by a comparison with 2023 then the performance by typology will then be covered;

- Serviced Apartments Performance by Node

The average rental yield for serviced apartments within the NMA increased by 0.5% points to 7.3% in 2024 from 6.8% recorded in 2023. Westlands and Limuru Road emerged the best performing nodes, with rental yields of 11.0% and 9.1% respectively, compared to the market average of 7.3%. The performance was attributed to, i) enhanced accessibility through well-developed infrastructure and road networks, making these areas more convenient for residents and visitors, ii) close proximity to Nairobi’s Central Business District (CBD) and other high-end neighborhoods further adds to their appeal and desirability, iii) availability of high-quality serviced apartments in these areas, allowing for premium pricing and attracting high-end clients, iv) proximity to international organizations and embassies, which has significantly boosted demand for serviced apartments due to an influx of expatriates and foreign nationals. On the other hand, Nairobi CBD was the least performing node, with an average yield of 3.9%, 3.4% points lower than the market average of 7.3%. The performance is attributed to, i) low demand for serviced apartments due to their unpopularity, ii) heavy traffic, which can deter potential tenants who prioritize convenience and ease of movement, iii) compared to other upscale nodes, the CBD has fewer premium social amenities like shopping malls and entertainment facilities, iv) the CBD primarily attracts short-term guests or those seeking budget-friendly options, which reduces the potential for higher rental yields for investors. The table below highlights the performance of the various nodes within the NMA;

|

Cytonn Report: NMA Serviced Apartments Performance per Node - 2024 |

||||||||

|

Node |

Studio |

1 Bed |

2 Bed |

3 bed |

Monthly Charge/ |

Occupancy |

Devt Cost/SQM (Kshs) |

Rental Yield |

|

Westlands |

199,462 |

294,768 |

337,647 |

374,765 |

4,148 |

77.1% |

209,902 |

11.0% |

|

Limuru Road |

6,271 |

236,265 |

329,655 |

314,565 |

4,768 |

62.6% |

231,715 |

9.1% |

|

Kilimani |

185,531 |

254,945 |

271,089 |

484,784 |

3,269 |

70.2% |

202,662 |

8.8% |

|

Kileleshwa & Lavington |

126,450 |

375,950 |

332,250 |

422,924 |

3,109 |

75.8% |

206,132 |

7.6% |

|

Upperhill |

196,370 |

333,071 |

351,000 |

2,339 |

66.7% |

209,902 |

5.4% |

|

|

Thika Road |

100,091 |

1,555 |

1,335 |

1,698 |

89.1% |

200,757 |

5.3% |

|

|

Nairobi CBD |

193,723 |

187,955 |

265,876 |

575,398 |

2,753 |

64.1% |

224,571 |

3.9% |

|

Average |

142,287 |

235,192 |

267,306 |

360,681 |

3,155 |

72.2% |

212,234 |

7.3% |

Source; Cytonn Research

- Comparative Analysis- 2023/2024 Market Performance

The performance of the serviced apartments improved on y/y, with the occupancy rates coming in at 72.2% in 2024, a 5.8%-points increase from the 66.4% recorded in 2023. The improvement in performance can be attributed to increase in the number visitor arrivals in the country by 8.5% to 489,831 visitors in Q3’ 2024 from 451,441 visitors recorded in Q3’ 2023 boosting the occupancy in the serviced apartments. The average monthly charges for 2024 increased by 4% to Kshs 3155 per SQM from 3,044 recorded in 2023. This was attributed to increased demand for serviced apartments in Westlands and Limuru nodes. Consequently, the average rental yield increased to 7.3% in 2024, a 0.5%- points increase from the 6.8% recorded in 2023. The improvement in performance was primarily on the back of; i) Increase in the number of visitors arriving in the country compared to a similar period in 2023, ii) The country effecting a Visa free policy at the start of the year for all visitors in a bid to boost number of arrivals in the country, iii) continued recovery of the Kenyan hospitality sector, iv) the intensive marketing of Kenya’s tourism market through platforms such as the Magical Kenya platform and various, v) Kenya continued efforts to host various events such as the World Rally Championship (WRC) held in March-2024, vi) Guests preference to stay within the city for extended periods. The table below shows the comparative analysis between 2023 and 2024;

|

All values in Kshs unless stated otherwise |

|||||||||

|

Cytonn Report: Comparative Analysis-2023/2024 Market Performance |

|||||||||

|

Node |

Monthly Charge/SQM 2023 |

Occupancy 2023 |

Rental Yield 2023 |

Monthly Charge/SQM 2024 |

Occupancy 2024 |

Rental Yield 2024 |

Change in Monthly Charges/SQM |

Change in Occupancy |

Change in Rental Yield |

|

Westlands |

4,059 |

74.6% |

10.2% |

4,148 |

77.1% |

11.0% |

2.2% |

2.5% |

0.8% |

|

Limuru Road |

4,699 |

58.1% |

8.2% |

4,768 |

62.6% |

9.1% |

1.5% |

4.5% |

0.9% |

|

Kilimani |

3,229 |

66.5% |

7.7% |

3,269 |

70.2% |

8.8% |

1.2% |

3.7% |

1.1% |

|

Kileleshwa & Lavington |

2,844 |

71.5% |

7.2% |

3,109 |

75.8% |

7.6% |

9.3% |

4.3% |

0.4% |

|

Upperhill |

2,309 |

65.8% |

5.2% |

2,339 |

66.7% |

5.4% |

1.3% |

0.9% |

0.2% |

|

Thika Road |

1,632 |

70.6% |

4.1% |

1,698 |

89.1% |

5.3% |

4.1% |

18.5% |

1.2% |

|

Nairobi CBD |

2,539 |

57.5% |

4.9% |

2,753 |

64.1% |

3.9% |

8.4% |

6.6% |

(1.0%) |

|

Average |

3,044 |

66.4% |

6.8% |

3,155 |

72.2% |

7.3% |

4.0% |

5.9% |

0.5% |

Source; Cytonn Research

Section V: Recommendations and Outlook

Having looked at the various factors driving the hospitality industry and with a particular focus on the serviced apartments sector, including challenges and current performance, we conclude with a recommendation of existing investment opportunities in the sector, and outlook as depicted below;

|

Cytonn Report: Serviced Apartments Sector Outlook 2024 |

||

|

Measure |

Sentiment |

Outlook |

|

Serviced Apartments Performance |

|

Neutral |

|

International Tourism |

|

Neutral |

|

Supply |

|

Positive |

Given that majority of our key metrics are neutral, we have a NEUTRAL overall outlook for the serviced apartments sector. The Investment opportunity lies in Westlands, Limuru Road, Kilimani, and Kileleshwa-Lavington which performed the best among all the nodes, with rental yields of 11.0%, 9.1%, 8.8% and 7.6% respectively, compared to the market average of 7.3%.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.