Dec 26, 2021

In November 2019, we released the Nairobi Metropolitan Area (NMA) Infrastructure Report, which highlighted that approximately Kshs 717.1 bn was required to finance the construction of 463.4 Km of ongoing road projects in the NMA. Water and sewer coverage realized 0.2% and 0.1% points increase to 61.0% and 18.0% in 2018 from 59.0% and 17.0% in 2017, respectively. Since 2019, NMA’s infrastructure sector has witnessed more development activities. Currently, there are 939.6 Km ongoing construction and rehabilitation of road projects valued at Kshs 162.4 bn, whereas 99.7 Km road projects worth Kshs 4.3 bn have been completed so far in 2021, according to the Kenya Rural Roads Authority. Water and sewer network coverage both recorded 1.0% points increase to 55.8% and 19.0% in 2020, from 54.8% and 18.0%, respectively in 2019.

This week, we update our report by highlighting the state of infrastructure in the Nairobi Metropolitan Area, ongoing infrastructural projects, and as well as identifying the potential areas for Real Estate investment. Therefore, this topical will cover the following:

- Introduction,

- Factors Influencing the Infrastructure Sector in Kenya,

- The State of Infrastructure in the Nairobi Metropolitan Area,

- Impact of Infrastructure on Real Estate, and,

- Conclusion.

Section I: Introduction

Infrastructure refers to fundamental facilities and structures required by a country or an organization in order to function properly. They mainly involve production of public monopolies such as energy, communication systems, transport network, water systems, and, sewer and drainage systems. They are therefore of vital importance to the development and growth of an entity or a country. Additionally, presence of well-developed infrastructure also determines the performance of the Real Estate sector. For instance, the presence of transport systems in an area will facilitate ease of access to properties, rapid investments, as well as boosting prices of existing properties, and vice versa. Other utilities such as electricity and water systems among others are also essential to Real Estate thus their presence or lack of will dictate the performance of an area.

The Kenyan Government has been aggressively supporting and implementing various infrastructural development projects, with a major focus on the transport sector with the key beneficiaries being road construction. This is evident in the country’s road network coverage which is currently at 161,451 Km and valued at over Kshs 3.5 tn as at 2021, signifying heavy investment towards the sector, according to Kenya Roads Board’s Annual Public Roads Programme 2021/2022. In the Nairobi Metropolitan Area (NMA), there are 939.6 Km ongoing construction and rehabilitation projects valued at Kshs 162.4 bn, whereas 99.7 Km road projects worth Kshs 4.3 bn have been completed so far in 2021. Both water and sewer connectivity increased by 1.0% points to 55.8% and 19.0% in 2020 from 54.8% and 18.0% in 2019, respectively in the NMA. Kenya’s electricity coverage also currently stands at 70.0%, which represents a 0.3% points increase from the 69.7% realized in 2019. These instances among many others signifies government’s efforts to better the country through improved infrastructure developments.

Section II: Factors Influencing the Infrastructure Sector in Kenya

Kenya has been witnessing massive infrastructural developments as part of the government’s efforts towards positioning Kenya as a regional hub in Africa. This is evident in the infrastructure sector contribution to Gross Domestic Product (GDP) which came in at 11.8% in Q2’2021, 0.6% points higher than the 11.2% in Q2’2020. Some of the factors that have been supporting the development of Kenyan infrastructure sector include;

- Positive Demographics;

According to the World Bank, Kenya’s urbanization and population growth rates are relatively high at 4.0% p.a and 2.3% p.a, respectively, compared to the world’s 1.8% p.a and 1.0% p.a, respectively, as at 2020. These have necessitated the government to initiate and implement various projects in order to meet the needs of the growing population in the country, `

- Government Support;

The government of Kenya has been aggressively supporting and implementing numerous infrastructure projects in the recent past through various ways;

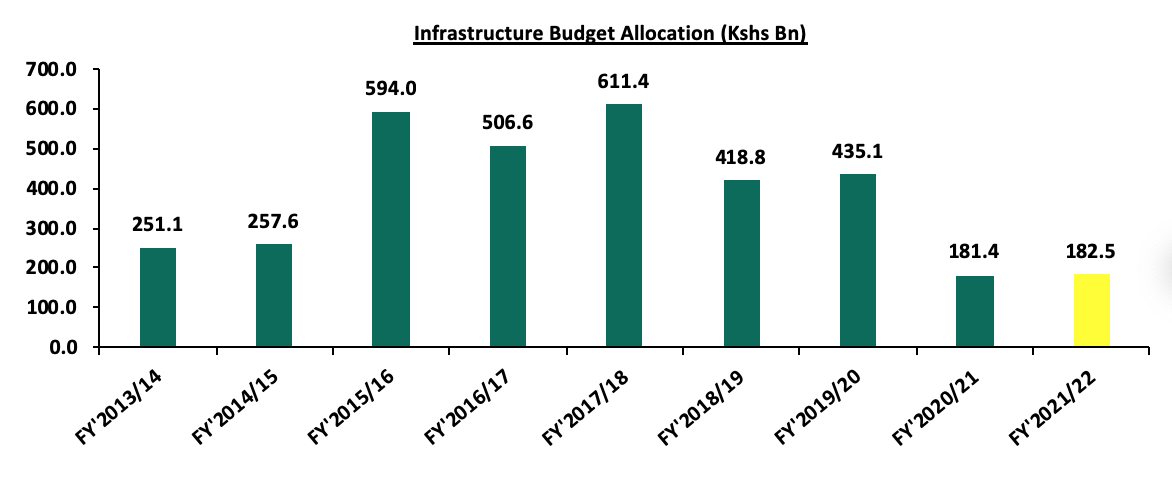

- Increased Budgetary Allocation - In the FY’2021/22 Budget Statement, infrastructure sector received a total of Kshs 182.5 bn to support construction of roads and bridges as well as the rehabilitation and maintenance of roads, which is a 0.6% increase from the Kshs 181.4 bn allocation in FY’2020/21. This shows government’s efforts in financing projects after having had to drastically cut its expenses in the FY’2020/21 as most funds were shifted towards COVID-19 response. Despite the heavy focus on the sector funding, the budget allocation towards it has been generally declining over the last 6 years due to government increasing priority on other major sectors aiming to actualize the Big 4 Agenda. For instance, in the FY’2021/22 budget, the Housing, Urban Development and Public Works were allocated a total of Kshs 21.8 bn, a 33.9% increase from FY’2020/21. The graph below shows the budget allocation to the infrastructure sector over last nine financial years;

- Issuing of Infrastructure Bonds - In a bid to fund infrastructure projects in the country, the National Government of Kenya through its various entities have issued various bonds in order to realize its objective, which also provides savings and investment opportunities. In August 2021, the government through the National Treasury, floated the IFB1/2021/21 infrastructure bond valued at Kshs 75.0 bn in an aim to complete infrastructure projects in the pipeline. The primary bond recorded an oversubscription of 201.7%, with bids worth Kshs 106.8 bn accepted by CBK. The high subscription signifies investors greater appetite for the bond which was mainly driven by its tax free nature and the high market liquidity,

- Project Partnership Strategies- Partnership strategies such as Public Private Partnership (PPPs) and Joint Ventures (JV) have proven to be cost effective ways of delivering infrastructural projects within the country. In line with this, the Nairobi Expressway project, which is a PPP project between the national government through the Kenya National Highways Authority (KENHA), and the China Road and Bridge Construction Corporation (CRBC), will be Kenya’s first road to be tolled under strategy upon its completion. Other PPP projects include; i) Nairobi Bulk Water Supply Project, ii) Nairobi-Western bypass, iii) Kajiado – Imaroro and Ngong – Kiserian – Isinya roads project, and, iv) Solid Waste Treatment in Nairobi City County Project. Additionally, tarmacking of the Mbaraki-Nyerere Road, and Kipevu Road in Mombasa County commenced in November 2021, with financing being done through the JV strategy inclusive of Mombasa County Government, Kenya Ports Authority, Danish and United Kingdom (UK), and,

- Government’s Aggression towards Development of Roads- The government has initiated and implemented numerous road projects in the past years in a bid to improve the road network in the country. According to the Kenya Roads Boards, the country’s road network coverage is currently at 161,451 Km and valued at Kshs 3.5 tn, which is a sign of heavy investment towards the sector by the government. Some of the major ongoing projects include; i) Nairobi Expressway, ii) Nairobi Western Bypass, iii) Mto Mwagodi-Mbale-Wundanyi-Bura road, and, iv) Eastern Bypass Dualing, among many others.

Despite the above supporting factors, there exists challenges that continue to impede the growth of the infrastructure sector which include;

- Financial Constraints - Infrastructural projects require massive capital in order to plan and execute. If the government decides to rely heavily on borrowing in order to initiate and develop projects, the high capital outlay will lead to Kenya running into debt since the revenues generated are usually over a long period of time and cannot cover the deficits created. The government has come on the limelight due to the ballooning levels of public debt which stood at Kshs 7.7 tn as at 30th June 2021, a 14.9% increase from the Kshs 6.7 tn debt recorded in June 2020. The government has to also play a balancing act in terms of allocations especially in the COVID-19 period where finances are now being shifted to finance medical supplies and other COVID-19 related expenses. Notably, since the first reported case of COVID-19 on 13th March 2020 in Kenya, the total public debt has grown by 22.8% to Kshs 7.7 tn from Kshs 6.3 tn,

- Longer Transaction and Approval Timelines - This mainly originates from government institutions in charge of approvals and in turn leads to longer project timelines. This also discourages investors from taking up the infrastructure projects due to the tedious processes involved,

- Insecurity - Safety challenges such as theft and vandalism of infrastructural equipment like fiber cables, petroleum, and electric cables, have impeded the sector’s growth overtime. Moreover, tribal clashes have also caused various infrastructure road projects to be stalled such as the ongoing Nadapal River Section A1 road project that began in March 2017, and was expected to be completed by 2020, however, construction works stalled due to quarrels among the communities settled along the border, and,

- Site Challenges - In the course of construction, developers have had to halt operations due to challenges such as moving water pipes, power lines and also traders settled along the road. A good case example is the 9.8 Km Ngong Road whose works stalled midway due to such irregularities. The same road also experienced engineering challenges in road markings, landscaping and abrupt end of lanes which caused the Kenya Urban Roads Authority to get back to the drawing board and take time to sort the issues out.

Section III: State of Infrastructure in the Nairobi Metropolitan Area (NMA)

For our analysis, we covered the current supply of infrastructure in the Nairobi Metropolitan Area and projects that are currently underway with a focus on roads, railways, water, sewerage, electricity and airports. The counties of focus within the NMA include Nairobi, Kiambu, Machakos, and Kajiado Counties. Below is the analysis of the infrastructure provision in the Nairobi Metropolitan Area;

- Roads

Roads are the most commonly used mode of transport by citizens within Kenya, evidenced by Kenya National Bureau of Statistics’ Economic Survey 2021 report where they accounted for 78.4% of the total value output of transport sector in the country, as at 2020. In the Nairobi Metropolitan Area, a total of 97.7 Km roads worth Kshs 4.3 bn were completed in 2021 as a result of government’s continued focus towards implementation and completion of projects. The completed projects included; i) Imaroro-Mashru-Isara Road in Kajiado County, ii) Indian Bazaar-Ndumberi-Ting’Ang’A-Riabai Road in Kiambu County, and, iii) Kimutwa - Makaveti - Kwa Mutisya Road in Machakos County.

Below is a summary of completed road network coverage in the Nairobi Metropolitan Area (NMA) in 2021;

|

Roads Completed in Nairobi Metropolitan Area in 2021 |

||

|

County |

Coverage (KM) |

Cost (Kshs bns) |

|

Kajiado |

70.0 |

3.0 |

|

Kiambu |

15.7 |

0.7 |

|

Machakos |

12.0 |

0.6 |

|

Total |

97.7 |

4.3 |

Source: KeRRA

Aside from the completed road projects, there exists construction and rehabilitation projects in the pipeline within the Nairobi Metropolitan Area such as; i) 27.1 Km Nairobi Expressway project, ii) 70 Km Ngong-Suswa road project, and, iii) 92 Km Gatundu Muthaiga project, among many others. Currently, the total ongoing network coverage for the projects are at 939.6 Km valued at Kshs 162.4 bn. Below is a summary of the ongoing road network coverage in the NMA;

|

Summary of Nairobi Metropolitan Area Ongoing Road Projects |

|||

|

County |

Total Coverage (KM) |

Average Completion Status |

Total Cost (Kshs bns) |

|

Nairobi |

141.0 |

43.4% |

113.7 |

|

Kiambu |

475.2 |

54.4% |

26.3 |

|

Machakos |

181.0 |

28.4% |

15.0 |

|

Kajiado |

142.4 |

53.8% |

7.3 |

|

Total/ Average |

939.6 |

45.0% |

162.4 |

|

· Nairobi County has got the highest value of roads due to the presence of high net worth ongoing projects such as the Nairobi Expressway project worth Kshs 63.0 bn |

|||

Source: KENHA, KURA, KeRRA,

- Railways

As per the Economic Survey 2021, rail transport accounted for 0.6% of the total value output of transport sector in the country, a sign of limited use of the mode for transport. This is attributed to the limited network coverage in comparison to road transport network. Below are the main railway routes within the Nairobi Metropolitan Area and their immediate stops;

|

Main Railway Routes in Nairobi Metropolitan Area |

|

|

Railway Routes |

Intermediate Stops |

|

Nairobi Town - JKIA |

Nairobi Town, Embakasi, JKIA |

|

Nairobi - Syokimau |

Nairobi Town, Makadara, Imara Daima, Syokimau |

|

Nairobi - Ruiru |

Nairobi Town, Makadara, Dandora, Mwiki, Githurai, Kahawa West, Ruiru |

|

Nairobi – Kahawa West |

Nairobi Town, Makadara, Dandora, Mwiki, Githurai, Kahawa West |

|

Nairobi – Athi River |

Nairobi Town, Makadara, Imara Daima, Embakasi, Mlolongo, Athi River |

|

Nairobi - Kikuyu |

Nairobi Town, Kibera, Dagoretti, Kikuyu |

Source: Kenya Railways Corporation

In addition to the above services, the government of Kenya has also strived hard to implement and conclude various railway projects in a bid to enhance efficient transport of goods, passengers and services to various parts of the country aside from the NMA. This has been majorly facilitated by prioritizing of the projects in the infrastructure budget allocation, external borrowing, as well as raising funds through infrastructure bonds. In return trade activities, property investments, and tourism activities have been boosted in the surrounding regions. The completed projects include; i) Nairobi – Nanyuki Railway, ii) Nairobi – Mombasa Standard Gauge Railway, and, iii) Nairobi – Naivasha Standard Gauge Railway. Moreover, the government is currently in the process of rehabilitating the Nairobi Commuter Rail Project. Outside the Nairobi Metropolitan Area, the government has completed the rehabilitation of the Nakuru-Kisumu railway from August 2020. The 217.0 Km route leads to the Kisumu Railway Station from the Nakuru Railway Station and has 18 stations such as Njoro and Molo stations, with 46 bridges and 27 viaducts.

- Water and Sewer Systems

Most sources of water in the Nairobi Metropolitan Area’s (NMA) come from piped water systems and boreholes. According to Impact Report Issue No. 13 by the Water Services Regulator Board (WASREB), Nairobi NMA’s average water coverage increased by 1.0% points to 55.8% in 2020 from 54.8% in 2019 due to increased development projects. Nairobi County having the most established developments registered the highest water coverage at 79.0%, whereas Kajiado County recorded the least coverage at 31.0% as result of inadequate water supply surpassed by the high population growth rate at 4.6% compared to Kenya’s 2.1%.

For sewer systems, the average network coverage realized a 1.0% points increase to 19.0% in 2020 from 18.0% in 2019. Nairobi County led with a 51.0% coverage whereas counties such as Kajiado had negligible connectivity, with majority of the population relying on sources such as pit latrines, septic tanks, and bio digesters. The table below shows the water and sewer coverage of various counties within the NMA as at 2020;

|

Nairobi Metropolitan Area Water and Sewer Coverage 2020 |

||||

|

|

Water Coverage |

Sewer Coverage |

||

|

County |

2020 |

2019 |

Sewer Coverage 2020 |

Sewer Coverage 2019 |

|

Nairobi |

79.0% |

77.0% |

51.0% |

51.0% |

|

Kiambu |

67.0% |

67.0% |

11.0% |

10.0% |

|

Machakos |

46.0% |

33.0% |

14.0% |

11.0% |

|

Kajiado |

31.0% |

42.0% |

0.0% |

0.0% |

|

Average |

55.8% |

54.8% |

19.0% |

18.0% |

Source: Water Service Regulatory Board

In a bid to bridge the gap of inadequate water and sewer systems in the Nairobi Metropolitan Area, the government has initiated various projects in order to realize its objectives. Some of the ongoing projects include;

- Nairobi Bulk Water Supply Project, to service Nairobi city,

- Solid Waste Treatment Project to service Nairobi city,

- Rehabilitation of Ndarugu and Thiririka Water Treatment Plant Project in Kiambu County,

- Karimenu and Karure Water Systems Development in Kiambu County,

- Westlands Water and Trunk Sewers Development Project in Nairobi County,

- Kilimani Trunk Sewers Development Project in Nairobi County,

- Kajiado and Kitengela Sewerage System Project,

- Mwala Constituency Water and Sanitation Project Phase 3 in Machakos County, and,

- Machakos Water Supply and Sewerage Project, among many others.

- Electricity Supply

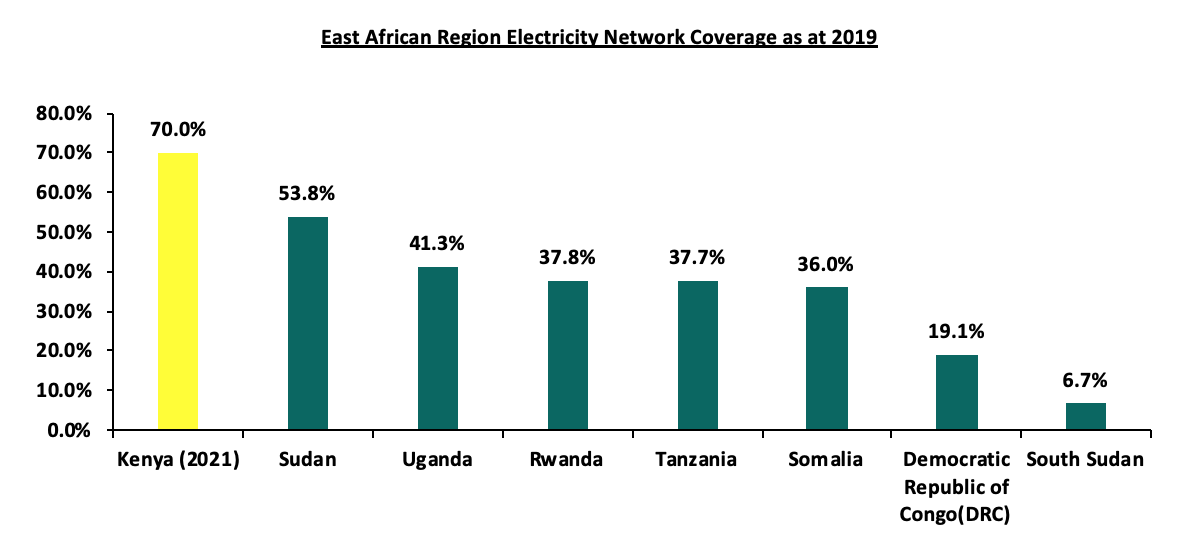

According to 2021 Kenya Power and Lighting's Annual Report, the current electricity coverage in Kenya stands at 70.0% which represents 86,986 Km of connectivity installed in the country. The current coverage represents a 0.3% points increase from the 69.7% realized in 2019. Kenya’s electricity coverage is therefore also the highest in East African region, signifying the government’s remarkable efforts to enable electricity access to Kenyans. The graph below shows the electricity network coverage for various East African Countries as at 2019

Source; World Bank

In order to achieve efficient electricity coverage in the country, the government in collaboration with development partners such as KPLC and African Development Bank, has initiated programs in order to realize its objectives, with some of the programs being;

- The Kenya National Electrification Strategy (KNES) which was launched in December 2018 in partnership with the World Bank, in an aim to achieve universal access to electricity in Kenya, by identifying cost effective solutions for bringing electricity to households and businesses throughout the country,

- Last Mile Connectivity Programme- The program was initiated in October 2016 with an aim of increasing electricity access to low and middle income Kenyans. This will be achieved through expansion of low voltage distribution system to the entire country where electricity access rate is low,

- Kenya Electricity Modernization Project (KEMP)- The program was initiated in 2015 in a bid to scale up Kenya’s electricity access rate, as well as ensuring reliability and quality electricity services to citizens, and,

- Rural Electrification Programme- This is an initiative that was established in 1975 in order to provide electricity to the rural areas of the country.

In the Nairobi Metropolitan Area, some of the ongoing projects aimed at ensuring efficient coverage of electricity include:

|

Nairobi Metropolitan Area Ongoing Electricity Connection Projects |

|||

|

Project |

County |

Length |

Volt |

|

Kamburu – Embu – Kibirigwi – Thika |

Kiambu |

148 Km |

220kV |

|

Machakos – Konza – Isinya – Namanga |

Machakos |

109 Km |

400 kV |

|

Nairobi Ring and associated substation |

Nairobi |

103 Km |

400 kV |

|

System Reinforcement (Isinya substation) |

Machakos |

N/A |

400/220kV |

Source: KETRACO

- Airports

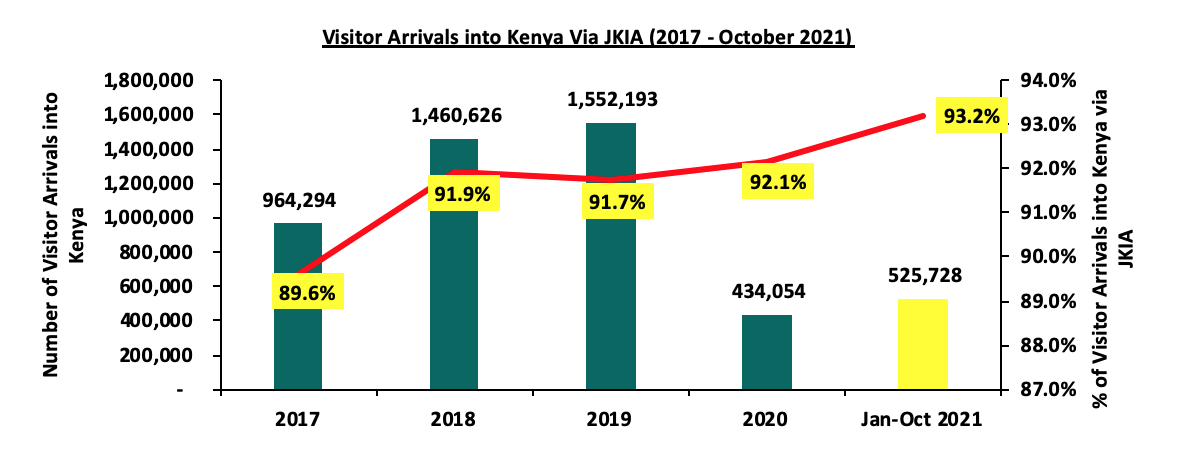

The Economic Survey 2021 by the Kenya National Bureau of Statistics (KNBS) highlights that flight travels accounted for 5.6% of the total value output of transport sector in the country. This makes air transport the second most used mode of transport in the country after road transport. In the Nairobi Metropolitan Area (NMA), the Jomo Kenyatta International Airport (JKIA) is the main airport servicing the area and accounts for 93.2% of the total visitors arriving into the country, as per the October 2021 Leading Economic Indicators Report by KNBS. This is also a sign of NMA being the main point of entry of visitors into the country. The graph below shows the visitor arrivals through JKIA between 2017 and October 2021;

Source: Kenya National Bureau of Statistics

Besides the Jomo Kenyatta International Airport (JKIA), there are other airports serving the Nairobi Metropolitan Area (NMA) such as;

- Wilson Airport which accounted for 0.4% of the total visitor arrivals in the country in H1’2021 according to Tourism Research Institute,

- Amboseli Airport serving the Amboseli National Park in Kajiado County, and,

- Moi Airbase serving the military personnel in Nairobi County.

Section IV: Impact of Infrastructure on Real Estate

Infrastructure plays a vital role in the development and performance of the Real Estate sector in Kenya. This is mainly achieved through developing roads, airports and railways, as well as establishment of adequate electricity, water, and sewer connection systems. Some of the impact that infrastructure development has includes;

- Opening up Areas for Investments: Establishment of infrastructure such as roads and railway transport network opens up surrounding areas to property investments by promoting ease of accessibility. Some of the developments launched around major roads include the Crystal Rivers Mall, and Imaara Mall, both located along the ongoing Nairobi Expressway project,

- Boosting of Property Prices: The presence of infrastructure amenities such as water, sewer and electricity have proven to boost property prices such as land. For instance, according to Cytonn Q3’2021 Markets Review, serviced land in the satellite towns of the Nairobi Metropolitan Area (NMA) recorded higher average selling prices at Kshs 15.5 mn, compared to the average selling prices of the unserviced land in the satellite towns of the NMA which came in at Kshs 13.3 mn. Moreover, the presence of transport networks such as the Nairobi-Thika Super Highway, Waiyaki Way, and the ongoing construction of the Nairobi Expressway among others have contributed to various property prices appreciating,

- Reducing Development Costs: According to the Centre for Affordable Housing Finance in Africa, infrastructure accounts for approximately 14.0% of construction costs in Kenya, hence their presence eases the burden of construction to developers by reducing the costs which could otherwise be incurred by them, and,

- Boosting Tourism Activities and Serviced Apartments Performance: This has been facilitated by the presence of air transport networks, and roads, as they enable accessibility into the country as well as to tourist destinations. In return, the presence of both local and international tourists within the NMA benefits Real Estate sector through improved performance of the serviced apartments and hotels.

Section V: Conclusion

To gauge investment opportunities based on infrastructure, we looked at the key infrastructural sectors ranking them in terms of 2021 performance as follows;

- Roads; Accessibility of an area is the most important factor for property owners and users hence the county with the highest ongoing roads got the highest rank, and vice versa,

- Water and Sewer; Their availability is one of the key factors that buyers look for when investing in a property thus also vital, and the more connected an area has been, the more reliable hence given the higher rank,

- Number of railway stations; plays a significant role in pulling real estate clients as it provides an alternative means of transport to the commonly used roads. However, an area has to have a railway station for this to be effective, thus, the region with the highest number of railway stations got the highest rank, and,

- Proximity to airports; This is especially crucial for commercial real estate. The proximity to the Jomo Kenyatta Airport, therefore, gave highest ranking compared to regions that are farther away from the airport.

|

County Ranking based on the State of Infrastructure Development 2021 |

|||||||

|

County |

Roads |

Water Connectivity |

Sewer Connectivity |

Railway Stations |

Airport Proximity |

Average Points |

Rank |

|

Nairobi |

1 |

4 |

4 |

4 |

4 |

3.4 |

1 |

|

Kiambu |

4 |

3 |

2 |

2 |

3 |

2.8 |

2 |

|

Machakos |

2 |

2 |

3 |

3 |

2 |

2.4 |

3 |

|

Kajiado |

3 |

1 |

1 |

1 |

1 |

1.4 |

4 |

|

* Ranking for roads was based on the ongoing and complete road network coverage within the various counties * Ranking for water and sewer was based on the current network coverage, * Ranking for airports was based on proximity of the various counties to JKIA * Ranking for railways was based on the number of railway stations available within the various NMA counties |

|||||||

Nairobi County presents the best investment opportunity supported by the availability of infrastructure amenities such as; i) efficient water supply and sewer connection, ii) adequate road networks with paved sidewalks, and iii) closest proximity to airports and train stations compared to other counties within the Nairobi Metropolitan Area (NMA). Some of the best areas for investments within Nairobi due to adequate infrastructure include Karen, Westlands, Kilimani, and Upper Hill.

Kiambu County follows with most road networks in the NMA which support real estate investment opportunities. This is in addition to adequate supply of water in the region with a current coverage of 67.0% thus being second best after Nairobi County Some of the best investment opportunity within Kiambu County include; Ruiru, Kikuyu, Kahawa Sukari, and Thika, due to the presence of most projects within them.

We expect the infrastructure sector of Nairobi Metropolitan Area (NMA) to continue recording more developments mainly supported by government’s aggressiveness to initiate and implement projects. However, financial constraints continue to remain a major factor impeding the progress of the projects as they require massive funds to establish.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.