Dec 9, 2018

Last year, we released the Nairobi Metropolitan Area Hospitality Report 2017, which covered the performance of hotels and serviced apartments during that year. According to the report, the hospitality sector was temporarily affected by political tension during the electioneering period, and thus serviced apartments recorded 9.8% points decline in occupancy to an average of 72.0% in 2017, compared to 81.8% in 2016. Given the conclusion of the elections, the improved political environment in 2018 and increased marketing efforts by the Kenyan Government, we have seen an 8.3% growth in international arrivals into the country during the first 8-months of the year, and this is expected to positively impact on the hospitality sector. This week we therefore update our report findings on serviced apartments by covering the following;

- Overview of the Kenyan Hospitality Sector,

- Introduction to Serviced Apartments,

- What they are

- Factors driving the growth of serviced apartments

- Challenges facing serviced apartments

- Supply and distribution of serviced apartments in the Nairobi Metropolitan Area,

- Performance of Serviced Apartments in the Nairobi Metropolitan Area, and,

- Investment Recommendations and Conclusion.

- Overview of the Kenyan Hospitality Sector

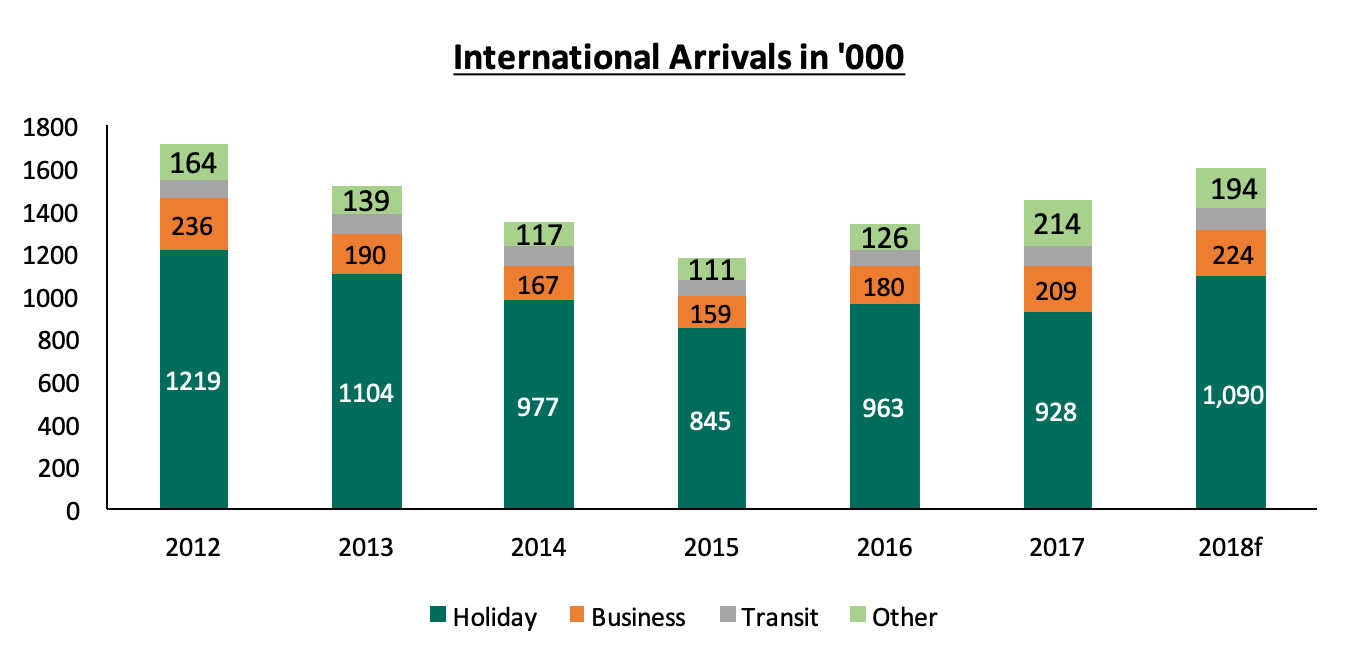

Kenya’s hospitality sector has been on a recovery path since 2016, recording a growth of 13.3% from accommodation and food services in 2016, a 14.7% in 2017, 13.5% in Q1’2018, and 15.7% in Q2’2018, according to the Kenya National Bureau of Statistics (KNBS), up from the 5-year slump caused by insecurity challenges between 2011 and 2015. The sector has seen continued investment by both local and international players looking to provide 4 main products; a) accommodation, b) foods and beverages, c) meetings and conferencing space, and d) leisure and entertainment. As a result, we have seen an increase in development of hotels, serviced apartments and other accommodation facilities such as holiday homes, as investors race to meet the rising demand for hospitality services fueled mainly by the growth of business and travel tourism. According to KNBS, the number of international arrivals grew by 8.0%, from 1.3 mn in 2016 to 1.4 mn in 2017 and have grown by 8.3% between January and August 2018 to 685.7 mn, compared to 632.9 mn during the same period in 2017. Mirroring this growth, the total number of hotel bed nights grew by 11.3%, to 7.2 mn in 2017, from 6.4 mn in 2016.

In our view, the key factors driving the sector include:

- Travel Tourism - Holiday travelers are the main drivers of Kenya’s hospitality sector, accounting for 70.5% of international arrivals over the last 5-years, attracted mostly by features such as wildlife, coastal beaches and natural sceneries. Between 2015 and 2016, holiday travelers increased by 14.0% to 0.9 mn, from 0.8 mn persons in 2015, as shown below, thus creating demand for accommodation and other hospitality services. Despite the 3.7% drop noted in 2017, mainly due to traveler wariness over the political tension in the country, holiday travelers remained to be most at 64.0% out of the total international arrivals.

Source: Kenya National Bureau of Statistics

- Meetings, Incentives, Conferences and Exhibitions Tourism (MICE) – MICE tourism has continued to drive the hospitality sector, evidenced by the 2.4% and 17.1% increase in local conferences and delegates, respectively, with 3,844 conferences in 2017, from 3,755 recorded in 2016, while the number of delegates came in at 623,749 in 2017, up from 536,674 in 2016, according to the KNBS Economic Survey 2018. This increase was attributed to political strategy activities held during the year. The number of international conferences and delegates declined by 15.9% and 36.8%, respectively, in 2017, with 191 conferences from 227 conferences held in 2016, while the number of delegates came in at 64,167 in 2017, up from 101,599 in 2016. The decline was attributed to the prolonged electioneering period in addition to travel advisories by some countries such as the United States. However, with the return of political calm in 2018, there has been increased conferencing with the hosting of international events such as the East Africa Property Investment Summit (EAPI) earlier in the year,

- Political Stability and Improved Security - The country has continued to enjoy political calm, following the completion of the prolonged electioneering period, and this has been evidenced by the number of international arrivals, which we expected to come in at 1.6 mn in 2018, compared to 1.4 mn in 2017,

- Recognition of Nairobi as a Regional Hub - This has put Kenya on the map as a business destination and is evidenced by the hosting of international events such as the East Africa Property Investment Summit (EAPI) in April this year, the Sustainable Blue Economy Conference in November, in addition to multinational companies setting up offices in the country. This has resulted in continued demand for short and mid-term accommodation, as evidenced by the number of business travelers, who accounted for 14.4% of international arrivals in Kenya in 2017, having grown by 16.3% to 0.21 mn in 2017 from 0.18 mn in 2016,

- Increased Air Connectivity - Airlines operating in Kenya continue to increase their flights frequency with the most recent ones being: i) Air France, which increased its flights from Paris-Nairobi from 3 per week to 5, ii) Jambo Jet, which increased its Nairobi-Kisumu flights from 20 to 24 per week, and iii) the introduction of direct flights from Kenya to the United States. This has enhanced convenience in travel thus boosting business and holiday travel, and consequently boosting the hospitality sector,

- Positive Reviews and Accolades - Positive reviews from travel advisories such as Trip Advisor. who ranked Nairobi as the 3rd best place to visit in 2018, the ranking of Jomo Kenyatta International Airport (JKIA) as the best airport in Africa and 38th globally according to Worldwide rankings by Airhelp, and issuance of global awards to local hotels for best facilities and service excellence such as DusitD2, a 5-star hotel in Riverside, Nairobi, being ranked the best luxury business hotel in East Africa in 2018, are likely to boost confidence and attract more guests into the country, both for business and holiday. In March this year, the Executive Residency by Best Western, a serviced apartments development in Riverside, was awarded the prize for Best Property 21 to 70 units improving recognition for the brand.

Despite the resilience of the sector, some of the setbacks include:

- Negative Publicity of Some Parts of Kenya - Despite improved security in Kenya and restoration of political calm following the end of the electioneering period, some parts of Kenya such as Mandera, Wajir, Lamu and Eastleigh in Nairobi continue to suffer negative publicity due to instances of terrorist attacks and this has continued to hamper tourism in these areas, and,

- Slow Infrastructural Development and Delays in the Completion of the Same - This continues to cripple the opening up of areas for development and access. For instance, the expansion of the JKIA runway. The Kshs 21.9 bn project, set to be financed by the African Development Bank (AfDB), has been put on hold by the Ministry of Transport as they re-evaluate its economic value. The project, which is yet to kick off, was intended to meet the needs of the increasing number of passengers passing through Kenya’s main airport and attract global airlines.

- Introduction to Serviced Apartments

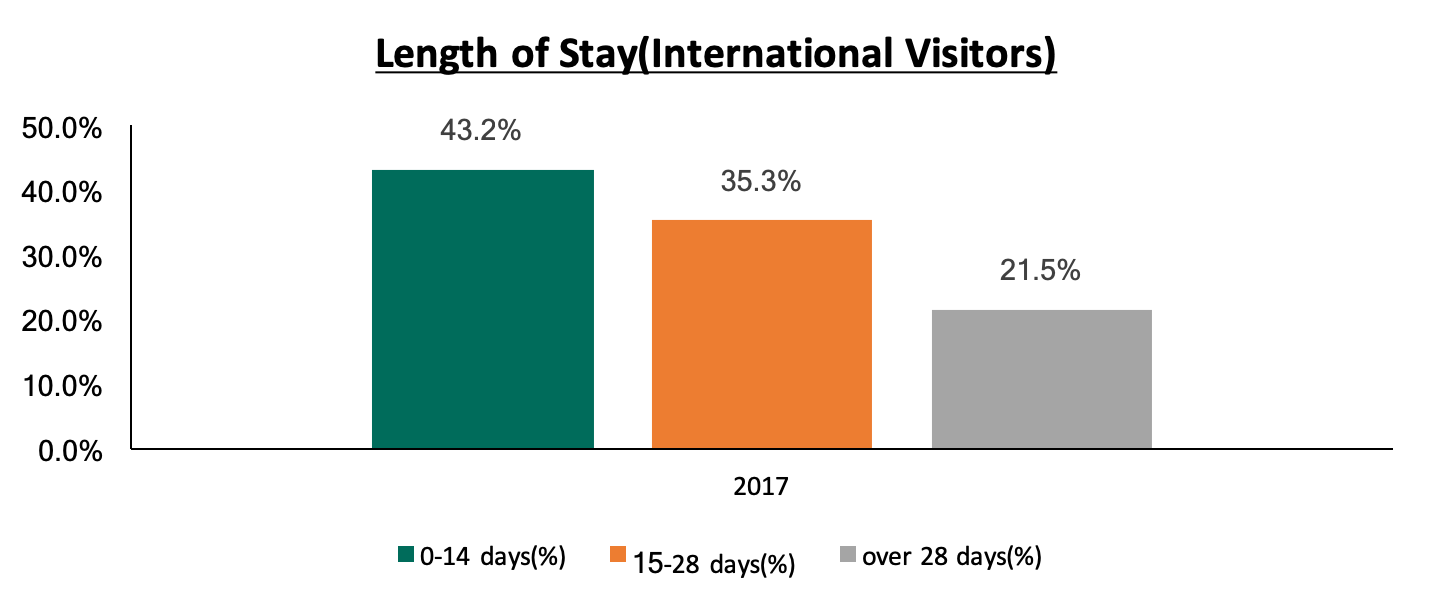

Over the past few years we have seen the growing popularity of serviced apartments as an alternative to hotel accommodation, especially for guests looking for an extended stay. These are fully furnished apartments that provide hotel-like resources such as housekeeping, room service, fitness centres, and restaurants. They have home comforts such as a personal kitchenette, a living room and a dining room. Serviced apartments, unlike hotel rooms, bear close resemblance to apartment-style living and are therefore preferred by guests who want a homely feel or who travel as families. Demand for serviced apartments has been on the rise and thus they record relatively high occupancy rates of above 70.0%, compared to hotels in Nairobi at 35.5%, according to Kenya National Bureau of Statistics Statistical Abstract 2018, and this we attribute to the large number of international guests who stay for more than 2-weeks in the country. According to the KNBS statistics, while 43.2% of international visitors in 2017 stayed for less than 14-days, 56.8% of the international guests to Kenya in 2017, stayed for at least 15-days.

The concept of serviced apartments has continued to become increasingly popular in the market, with the Nairobi Metropolitan Area having approximately 3,414 serviced apartments as at 2015, and an additional 1,174 set to be complete by 2020. In our view, investment in serviced apartments has been fueled by:

- The Higher Demand - As firms aim to optimize their travel budgets, more travelers are choosing to stay at serviced apartments as they are less expensive in the long-run, resulting in the high demand and thus high occupancy rates at above 70.0% in Nairobi,

- Lower Operating Expenses as Compared to Hotels - Operating serviced apartments requires less number of staff and lower ancillary costs for amenities and foodstuffs, and are thus cheaper to run compared to hotels,

- Convertibility - Serviced apartments can be easily converted to normal apartments, in the case where the former is not performing well, and,

- Relatively Longer Tenancy Compared to Hotels - The clientele for serviced apartments are mainly on long-term stays as compared to those who prefer hotel rooms, and thus the guarantee of a more stable income.

In addition to the growth in supply, the demand for serviced apartments has continued to increase evidenced by the 8.0% points increase in occupancy levels in 2018 to an average of 80.0%, from 72.0% in 2017, supported by benefits that come with the theme such as:

- Bigger Spaces Compared to Hotels - Serviced apartments often have bigger room sizes than hotels. For instance, in Nairobi, while the standard hotel room size is 30-50 SQM, the average size of serviced apartments is 75 SQM for 1-bedroom units, 110 SQM for 2-bedroom units, and 140 SQM for 3-bedroom units,

- Lower Rates - Serviced apartments are considered more affordable given their relatively lower charges compared to hotels. For instance, a standard 3-star hotel in Nairobi charges on average Kshs 14,000 per night for a suite, while a studio serviced apartments charges on average Kshs 8,000 per night and a 1-bedroom apartment charges on average Kshs 11,000 per night,

- Home Away from Home Feel - Unlike a hotel, a serviced apartment can easily accommodate a family, in addition to allowing someone to cook and hence creating the home away from home experience that is sought after by many long-term travelers, and,

- Easy Integration- Serviced apartments are located within or in close proximity to other residential developments, hence guests are able to integrate with the community.

Challenges facing Serviced Apartments

Despite the growing popularity of serviced apartments, the main challenge facing the theme is competition from well-known international hotel brands such as Movenpick, Kempinski and Park-Inn by Radisson that are preferred for accommodation by visitors given their track record on service excellence, whereas there is only one internationally branded serviced apartments development in Kenya, the Executive Residency by Best Western. Going forward, serviced apartments are also likely to compete with the growing Airbnb accommodation, which is found to be even more affordable and is increasingly attracting the millennial generation. Managers of serviced apartments will therefore have to set themselves apart through strategies such as hiring of professional personnel, providing extra amenities, and better security mechanisms compared to Airbnb.

Supply and Distribution of Serviced Apartments in the Nairobi Metropolitan Area

Nairobi’s hospitality sector has seen an increase in development of serviced apartments, with supply increasing with a 23.6% CAGR between 2011 and 2015 to 3,414 apartments from 1,462 apartments in 2011. In the last 2-years there has been completion of at least 86 additional units, including; The Executive Residency by Best Western, a 48-unit project in Westlands, and the 38-unit Gem Suites development also situated in Westlands, off Riverside Lane.

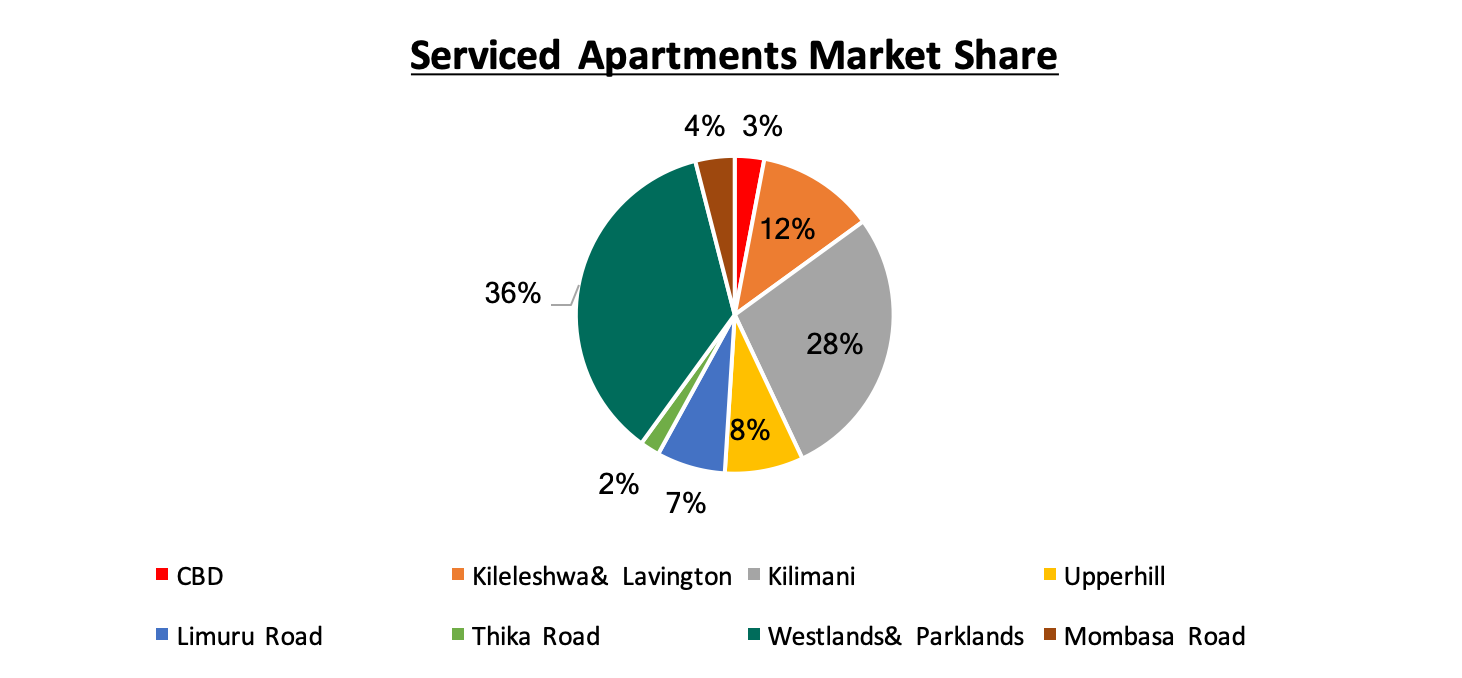

In terms of distribution in the Nairobi Metropolitan Area, Westlands and Kilimani have the highest supply of serviced apartments at 36.0% and 28.0%, respectively, of the total developments, attributed to their close proximity to commercial nodes and the expatriate community who constitute the majority of serviced apartments’ clientele. On the other hand, locations within the Thika Road node, namely Muthaiga North, Mirema and Garden Estate have the least supply, with a market share of only 2.0%, as they are predominantly residential areas located approximately 15-km Nairobi’s commercial zone, in addition to not being mapped within the UN Blue Zone, thus not preferred by expatriates.

Source: Cytonn Research

Currently, there are at least 1,189 apartments in the development pipeline set for completion by 2020, with most being constructed in Westlands and Kilimani. Important to note is that there is currently only 1 internationally branded serviced apartments development, the Executive Residency by Best Western, thus highlighting the opportunity for entry of more global brands.

Some of developments in the pipeline include:

|

Serviced Apartments Development Pipeline |

||||

|

Name |

Developer |

Location |

Number of Units |

Completion Year |

|

Skynest |

Elegant Properties |

Westlands |

250 |

2019 |

|

Britam |

Britam |

Kilimani |

163 |

2020 |

|

Habitat |

Ekco Investments |

Kilimani |

160 |

2020 |

|

Montave |

Green-Field |

Upperhill |

147 |

2020 |

|

Radisson Blu Residency |

Carlson Rezidor |

Kileleshwa |

123 |

2019 |

|

9 Oak |

Mifta Holdings |

Kilimani |

120 |

2019 |

|

Soho |

Soho |

Kilimani |

88 |

2019 |

|

Avic |

Avic |

Westlands |

50 |

2020 |

|

Elsie Ridge |

Intime Group |

Spring Valley |

40 |

2020 |

|

Ariana |

Trianum |

Westlands |

28 |

2019 |

|

Ole Sereni |

Ole sereni |

Mombasa Road |

20 |

2019 |

|

Hilton (Pinnacle Towers) |

Hass Petroleum |

Upperhill |

Undisclosed |

2020 |

|

Total |

1,189 |

|||

|

· There are approximately 1,189 serviced apartment units in the pipeline, set for completion by 2020, with majority of the expected supply being in Westlands and Kilimani |

||||

Source: Cytonn Research

- Performance of Serviced Apartments in the Nairobi Metropolitan Area

We tracked the performance of serviced apartments in 8 nodes in the Nairobi Metropolitan Area and compared this to the performance in 2017. The key metrics we looked at include:

- Charged Rates: This is the amount guests pay for an apartment in a specific market, on a daily basis, weekly and/or monthly. It informs potential investors on the rental income they are likely to gain from investing in serviced apartments,

- Occupancy Rates: This measures the number of apartments that are let out of the total available, in order to inform on the expected rental yield of the developments, and,

- Rental Yields: This refers to the measure of return on the real estate investment, from the rental income collected annually. The rental yield informs potential investors on the return they are likely to get from a property and hence the time it will take an investor to get back the money invested. To calculate this, we have estimated annual income from monthly revenues having deducted operational costs assumed to be at 40% of revenues. To estimate the investment value, we have calculated development cost per SQM by factoring in land costs based on the location, construction costs, equipping costs, professional fees and other development-related costs. The formula to calculate rental yield is as follows;

Rental Yield= Monthly Rent per SQM x Occupancy Rate x (1-40% operational cost) x 12 months

Development Cost per SQM

*Important to note, however, is that depending on the actual incurred land cost, plot ratios, the level of finishing and equipping, investors will generally incur varying costs.

In our analysis of the serviced apartments market performance in 2018, we will start by covering the performance by node, compare this with 2017 performance, then cover the performance by typology.

Serviced Apartments Performance by Node

From our research, in overall, serviced apartments recorded improved performance with the average rental yield coming in at 7.4%, which is 2.1% points higher than 5.3% recorded in 2017, and this we attribute to the increased demand, which has triggered an increase in charge rates, as well as increased occupancy rates with an average of 80.0% in 2018, compared to 72.0% in 2017. We attribute the improved performance to the stable political environment and improved security, making Nairobi an ideal destination for both business and holiday travelers.

In 2018, Kilimani area was the best performing node recording high occupancy rates of 86%, and a rental yield of 10.9%, and this we attribute to its easy access from Jomo Kenyatta International Airport (JKIA), proximity to business nodes such as Westlands and Upperhill, and the good transport network thus ease of accessibility. Developments in the Thika Road node (Muthaiga North, Mirema and Garden Estate) recorded the lowest rental yield at 4.4%, and this we attribute to its unpopularity, given the distance from main commercial zones, the lack of modern and quality serviced apartments, in addition to not being mapped within the UN Blue Zone, thus not attractive to expatriates due to security concerns.

(all values in Kshs unless stated otherwise)

|

2018 Serviced Apartments Performance |

||||||||||||

|

|

Sizes(SQM) |

Monthly Rates 2018 |

||||||||||

|

Node |

Studio |

1-Bed |

2-Bed |

3-Bed |

Studio |

1-Bed |

2-Bed |

3-Bed |

Occupancy 2018 |

Monthly Charge per SM |

Devt Cost per SM |

Rental Yield |

|

Kilimani |

39 |

69 |

110 |

149 |

197,850 |

266,915 |

319,304 |

361,421 |

86% |

3,567 |

202,662 |

10.9% |

|

Westlands& Parklands |

33 |

85 |

115 |

177 |

282,938 |

260,928 |

300,492 |

340,000 |

76% |

4,044 |

209,902 |

10.6% |

|

Limuru Road |

51 |

137 |

107,438 |

193,621 |

84% |

3,685 |

231,715 |

9.7% |

||||

|

Kileleshwa& Lavington |

38 |

70 |

134 |

100,000 |

231,000 |

285,750 |

337,000 |

83% |

2,686 |

206,132 |

7.8% |

|

|

Nairobi CBD |

51 |

90 |

115 |

137 |

120,000 |

199,500 |

294,917 |

320,000 |

74% |

2,374 |

224,571 |

5.7% |

|

Upperhill |

75 |

110 |

156 |

274,680 |

300,492 |

310,000 |

60% |

2,580 |

209,902 |

5.3% |

||

|

Msa Road |

34 |

90 |

107 |

151 |

114,912 |

120,000 |

201,096 |

258,552 |

85% |

1,642 |

200,757 |

5.0% |

|

Thika Road |

70 |

100 |

144 |

100,646 |

128,375 |

90% |

1,361 |

200,757 |

4.4% |

|||

|

Average |

39 |

75 |

116 |

152 |

153,856 |

205,911 |

261,489 |

321,162 |

80% |

2,742 |

210,800 |

7.4% |

|

High |

51 |

90 |

137 |

177 |

282,938 |

274,680 |

319,304 |

361,421 |

90% |

4,044 |

231,715 |

10.9% |

|

Low |

33 |

51.11 |

100 |

137 |

100,000 |

100,646 |

128,375 |

258,552 |

60% |

1,361 |

200,757 |

4.4% |

|

· Serviced apartments recorded an 80% occupancy rate in 2018, compared to 72% recorded in 2017, and this we attribute to the improved security and political stability · Kilimani recorded the highest rental yields at 10.9%, and this we attribute to increased demand for accommodation in the area, supported by the proximity to key amenities such as the Jomo Kenyatta International Airport, the Nairobi CBD and business nodes such as Westlands and Upperhill, and the good transport network thus ease of accessibility · Thika Road node (Muthaiga North, Mirema and Garden Estate) recorded the lowest rental yield at 4.4%, and this we attribute to its unpopularity, given the distance from main commercial zones, the lack of modern and quality serviced apartments, in addition to not being mapped within the UN Blue Zone thus not attractive to expatriates due to security concerns |

||||||||||||

Source: Cytonn Research

2017/2018 Comparative Analysis

Compared to 2017, serviced apartments performed better in 2018, with the rental yields coming at 7.4%, compared to 5.3% in 2017, in addition to 8.0% points increase in occupancy rates to 80.0% in 2018, from 72.0% in 2017, and this is attributable to a better political climate in 2018, resulting in increased international arrivals thus higher demand for accommodation.

All values in Kshs unless stated otherwise

|

2017/2018 Comparative Analysis |

||||||||||

|

Node |

Occupancy 2017 |

Occupancy 2018 |

Occupancy rates ∆ |

Monthly Charge per SQM 2017 |

Monthly Charge per SM 2018 |

∆ in Monthly Charge Per SQM |

Devt Cost per SM |

Rental Yield 2017 |

Rental Yield 2018 |

∆ in Rental Yield |

|

Kilimani |

74% |

86% |

12% |

2,592 |

3,567 |

37.6% |

202,662 |

7.2% |

10.9% |

3.7% |

|

Westlands& Parklands |

78% |

76% |

(1%) |

2,519 |

4,044 |

60.6% |

209,902 |

7.3% |

10.6% |

3.3% |

|

Limuru Road |

80% |

84% |

4% |

1,686 |

3,685 |

118.6% |

231,715 |

4.5% |

9.7% |

5.2% |

|

Kileleshwa& Lavington |

70% |

83% |

13% |

2,369 |

2,686 |

13.4% |

206,132 |

7.0% |

7.8% |

0.8% |

|

Nairobi CBD |

70% |

74% |

4% |

1,684 |

2,374 |

40.9% |

224,571 |

4.2% |

5.7% |

1.5% |

|

Upperhill |

60% |

2,333 |

2,580 |

10.6% |

209,902 |

6.6% |

5.3% |

-1.3% |

||

|

Msa Road |

64% |

85% |

21% |

1,367 |

1,642 |

20.1% |

200,757 |

3.1% |

5.0% |

1.9% |

|

Thika Road |

69% |

90% |

21% |

901 |

1,361 |

51.0% |

200,757 |

2.6% |

4.4% |

1.8% |

|

Average |

72% |

80% |

11% |

1,931 |

2,742 |

44.1% |

210,800 |

5.3% |

7.4% |

2.1% |

|

High |

80% |

86% |

6% |

2,592 |

4,044 |

231,715 |

7.3% |

10.9% |

5.2% |

|

|

Low |

64% |

60% |

-4% |

1,367 |

1,642 |

200,757 |

3.1% |

5.0% |

-1.3% |

|

|

· In 2018, the rental yields increased by 2.1% points to 7.4% from 5.3% recorded in 2017, and this we attribute to the political stability, increased popularity of the serviced apartments concept, thus an increase in the occupancy · The monthly charges recorded a 44.1% increase to Kshs 2,742 per SQM from Kshs 1,931 per SQM in 2017, and this we attribute to the increased popularity of serviced apartments evidenced by the significant increase in occupancies by 8.0% points to 80.0% in 2018, from 72.0% in 2017 |

||||||||||

Source: Cytonn Research

Performance Per Typology

We also compared the performance of the different typologies offered in the market, and from our research, studios recorded the highest monthly charges at Kshs 3,965 per SQM, thus a resultant relatively high yield of 13.5%, while 3-bedroom units recorded the lowest at Kshs 2,109 per SQM and an average rental yield of 7.2%. In terms of occupancy, the studio recorded the highest occupancy rates of 82.0%, and this we attribute to the low supply of the typology in the market.

|

Serviced Apartments Performance Per Typology - 2018 |

||||

|

Typology |

Average Size (SQM) |

Monthly Charges per SQM (Kshs) |

Occupancy |

Rental Yield |

|

Studio |

39 |

3,965 |

82% |

13.5% |

|

1-bedroom |

75 |

2,745 |

79% |

9.4% |

|

2-bedroom |

116 |

2,253 |

73% |

7.7% |

|

3-bedroom |

152 |

2,109 |

66% |

7.2% |

|

Average |

2,768 |

75% |

9.5% |

|

|

· Studios recorded the highest rental yield at 13.5%, and this we attribute to the relatively high monthly charges per SQM compared to other typologies · The studio recorded the highest occupancy rates of 82.0%, and this we attribute to the low supply of the typology in the market. |

||||

Source: Cytonn Research

- Recommendations and Conclusion

|

Measure |

Sentiment |

Outlook |

|

Serviced Apartments Performance |

Serviced apartments recorded relatively high occupancy at 80.0% in 2018, 8.0% points increase from 72.0% recorded in 2017. Given the growing popularity of the concept, and recovery following the end of the prolonged electioneering period that spilled over to H1’ 2018, we expect the theme to continue recording improved performance going forward |

Positive |

|

Supply |

There were approximately 3,414 serviced apartment units in Nairobi as at 2015 with an additional 1,189 apartments set for completion by 2020, thus increased competition especially in areas such as Westlands and Kilimani which have the majority of the units in the pipeline |

Negative |

|

International Tourism |

International arrivals grew by 8.0% in 2017 and is expected to increase by 10.8% in 2018 given improved security, increased air connectivity, the increased marketing efforts by the government and the industry players and the introduction of free visa on arrival policy for all Africans |

Positive |

|

MICE Tourism |

MICE tourism has been on an upward trajectory, with the number of conferences recording a 1.3% increase from 3,982 conferences (both local and international) in 2016, to 4,035 conferences recorded in 2017. However, with the return of political calm in 2018, there has been increased conferencing with the hosting of international events such as the East Africa Property Investment Summit (EAPI) earlier in the year, and several others expected in 2019 thus we expect continued growth of the MICE tourism |

Positive |

Based on the above metrics, we had 3 positive factors and only 1 negative factor, thus our overall outlook for the serviced apartments theme is positive, with the investment opportunity lying in Kilimani and Westlands, which are the best performing areas with average rental yields of above 10.0%.

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, CAML is regulated by the Capital Markets Authority. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.