Aug 12, 2018

In line with our regional expansion strategy, we continue to assess investment opportunities in various Kenyan Counties, to enable us to diversify our portfolio of real estate investments for our clients. So far we have covered 13 counties, including Nyeri, Laikipia, Meru, Mombasa, Narok, Homabay, Kisii and Uasin Gishu, and have subsequently released research notes such as the: Nyeri Real Estate Investment Opportunity 2017, Kisumu Real Estate Investment Opportunity 2016 and Kisumu Real Estate Investment Opportunity 2018, released last month. This week, we shift our focus to Nakuru County, specifically, the headquarters, Nakuru Town. We analyse the real estate investment opportunity in the town in terms of rental yields, capital appreciation, total returns, occupancy and uptake. The town has an average rental yield of 6.1%, a capital appreciation of 8.8%, hence a total return of 14.9%, with MUDs being the best performing theme, recording average rental yields of 8.9% and residential, being the theme with the lowest performance levels, recording average rental yields of 4.2%.

In our analysis of the investment opportunity in Nakuru Town, we will cover the following:

- Overview of Nakuru Town,

- Nakuru Town Market Performance,

- Comparative Analysis - Selected Counties in Kenya, and,

- Market Performance and Outlook.

Section 1: Overview of Nakuru Town

Nakuru is the fourth largest town in Kenya, and it is located approximately 160.0 km North West of Kenya’s capital, Nairobi. The town serves as the headquarters of Nakuru County, the fourth largest county in Kenya in terms of GDP per capita, with a GDP per capita of USD 1,413 after Kiambu, Nyeri and Kajiado, each having a GDP per capita of USD 1,785, USD 1,501 and USD 1,466, respectively.

The table below highlights the top 10 counties with the highest GDP per Capita in Kenya:

|

County |

GDP per Capita (USD) |

|

Kiambu |

1,785 |

|

Nyeri |

1,501 |

|

Kajiado |

1,466 |

|

Nakuru |

1,413 |

|

Kwale |

1,406 |

|

Laikipia |

1,226 |

|

Muranga |

1,090 |

|

Nairobi |

1,081 |

|

Mombasa |

935 |

|

Machakos |

913 |

Source: World Bank Survey 2015

Nakuru Town covers an area of 348.6 SQKM and has an estimated population of 376,979 people as at January 2018, according to the County Government of Nakuru. The town is multicultural and profoundly diverse comprising all major tribes in Kenya. In the last 5-years, the town has witnessed an increase in infrastructural developments with roads such as the Nairobi – Nakuru Highway and Nakuru – Nyahururu Highway being expanded and constructed, respectively, linking Nakuru Town to other towns in the country. In 2018, the town is set to benefit from further infrastructural development, with the Kenya Urban Roads Authority (KURA), announcing plans to upgrade 22 km of roads within the town at a cost of Kshs 1.8 bn. In terms of real estate, the town offers a blend of both high-end and mid-end residential developments, commercial offices, Mixed-Use Developments (MUDs), and retail centres, which mainly serve the Nakuru urban population.

The main factors driving the real estate market in Nakuru Town are:

- Positive Economic Growth – According to the World Bank Survey 2015, Nakuru County GDP per Capita stands at USD 1,413, which is 4th highest in Kenya after Kiambu, Nyeri and Kajiado, which have GDP per capita of USD 1,785, USD 1,503 and USD 1,466, respectively. In addition, the county recorded a 10-year GDP growth rate of 5.1% p.a, driven by the industrial sector, tourism, trade, energy and agriculture, thus higher per capita income that increases demand for real estate in Nakuru Town,

- Devolution – Devolution has opened up Nakuru Town and has placed an onus on the County Government to improve its real estate landscape. This has attracted entrepreneurs, private investors and government institutions such as public service boards to the county headquarters and thus created demand for housing units, retail spaces and office spaces, which host investors and government officials,

- Positive Demographics – Nakuru Town has a high population growth rate of on average 3.1% per annum, compared to a Kenyan average of 2.6%, which leads to sustained demand for real estate developments. Currently, Nakuru Town has an estimated population of 376,979 that has grown from 286,411 as at the 2009 census, and Nakuru County has a population of 1,891,739, according to the County Government of Nakuru. This creates demand for real estate developments, as the population seeks to purchase residential units and demand commercial and retail facilities,

- Infrastructural Development – Nakuru Town has seen increased focus on infrastructural development in the recent years. These projects are bound to open the town up for development. For instance, in 2018, the Kenya Urban Roads Authority (KURA) announced plans to upgrade 22 km of roads within the town at a cost of Kshs 1.8 bn. The project will link suburbs in the town including Naka, Industrial Area, Bondeni, Free Area and Mwariki. Additionally, in 2017, the County Government of Nakuru announced plans to upgrade Lanet Airstrip, to a fully-fledged airport that would accommodate huge passenger and cargo planes, details of completion timelines are yet to be disclosed. These initiatives will improve accessibility to the town and thus open it up to real estate development.

However, the town faces a few challenges, which if not properly addressed would pose a challenge to real estate development. They include:

- Infrastructure Development – Despite the growth of infrastructure and having several projects in the pipeline, some areas in Nakuru Town are still faced with inadequate infrastructure characterized by earth roads and undeveloped sewer systems in areas such as; Kaptembwa, Free Area and Lanet making it expensive to develop in these areas,

- Access to Funding – As is the case in other areas in Kenya, access to funding for development is one of the constraints facing the real estate sector in Nakuru Town. The banking amendment act that led to the capping of interest rates at 13.0%, as at July 2018, has resulted in a decline in private sector credit growth rate to 2.4% as at April 2018 from a 5-year average of 14.0%. The decline, which is attributable to structural reforms and a strict adherence to prudential guidelines in terms of loan book quality and adequate provisioning has locked out private stakeholders in the real estate sector and developers, thus limited construction activities in areas across the country, including Nakuru Town,

- Inadequate Planning – Inadequate planning that has been caused by limited adherence to key policies that guide planning in Nakuru Town and if unchecked, this will lead to reduced land use maximization and urban sprawl.

Section 2: Nakuru Town Market Performance:

We conducted real estate research in Nakuru Town in February 2018. Our market research focused on:

- Plinth Area - An analysis of the size of the units found in the market allows us to assess the current market offering, and gives an indication of what the market prefers,

- Prices - An analysis on prices will help benchmark our prices to market prices,

- Rental Rates - Research on rental income allows us to inform potential investors on the current rental rates in other developments and also inform the investors on the prospective rental yield they are bound to gain from investing in Nakuru Town, and,

- Annual Uptake - This allows the investor to appreciate the rate at which available homes are sold over a specific period. This helps them assess whether it is profitable to invest in a given area.

The key themes are covered below:

- Residential

The residential sector in Nakuru is at its emerging stages, with most of the developments being less than 5-years old as the market has begun welcoming institutional developers who are coming up with investment grade housing units and the urban population is appreciating them as evidenced by high uptakes of 39.7% for mid-end apartments and 22.9% for high-end apartments, additionally, indicating that developers can exit developments in 3 years. The main drivers of the residential sector in Nakuru are devolution, urbanization and positive demographics, which have increased demand for residential units for both selling and renting in the town, as well as positive economic growth increasing the capita income, and hence the ability to purchase houses. Residential units in Nakuru Town are concentrated in suburbs within a 10-km radius from the CBD such as Naka, Milimani, Section 58, Kiamunyi, Barnabas, Freehold and Ngata. The sector recorded average rental yields of 4.2%, price appreciation of 4.6%, and hence a total return of 8.8%.

In our residential sector analysis, we classified the various suburbs in Nakuru Town into two segments:

- High-End Segment – Consisting of prime suburbs in Nakuru Town such as; Milimani, Section 58 and Naka. Houses in these suburbs have price points of between Kshs 6.1 mn and Kshs 13.0 mn,

- Middle-Income Segment – Consisting of suburbs such as; Ngata, Free Area and Kiamunyi, and are characterized by both high and low-density houses, housing the middle class. Houses in this segment have price points of between Kshs 3.6 mn and Kshs 4.9 mn.

To note:

- Detached Units refer to stand-alone houses such as townhouses, maisonettes and bungalows, and,

- Apartments refer to a self-contained housing units occupying part of a building, also called flats.

The performance of the residential theme is Nakuru Town is as summarized below:

- High-End Segment

The high-end market segment in Nakuru Town comprises suburbs such as Milimani, Section 58, and Naka. These suburbs have both detached units and apartments. Exit prices for apartments and detached units in the segment stand at Kshs 62,094 per SQM and Kshs 107,466 per SQM, respectively. In terms of performance, apartments outperform detached units recording total returns of 11.7%, 4.9% points higher than detached units at 6.8%. The lower returns for detached units is due to the fact that they are less preferred as a result of high rental rates of Kshs 384 per SQM as compared to Kshs 300 per SQM for apartments and high price points at Kshs 107,466 per SQM, 73.1% more than apartments that have exit prices of Kshs 62,094 per SQM. This is attributable to detached units, which sit on relatively larger sizes of land. The high rental rates have thus led to lower occupancy rates of 68.8%, as compared to apartments at 88.2% and thus resulted in lower yields of on average 3.8%, as compared to 5.7% for apartments.

The performance of apartments and detached units in the high-end segment is as summarized below:

- Apartments

The main apartment typologies in the high-end market segment are 2 and 3-bed units. The average prices for 2 and 3-bed apartment units are Kshs 4.9 mn and Kshs 5.5 mn, respectively. These units have average monthly rents of Kshs 20,714 for 2-bed units and Kshs 30,833 for 3-bed units and average occupancy rates of 92.3% and 84.0%, respectively, translating to average rental yields of 4.3% and 5.7%, for 2 and 3-bed apartments, respectively. In terms of total return, 3-bed apartments in the high-end segment outperform 2-bed units, recording on average total returns of 13.8%, 4.2% points higher than returns of 9.6% for 2-beds. The higher returns for the 3-bed units are as a result of higher yields of 5.7%, 1.4% points higher than 4.3% for the 2-bed typologies. It is noted that 3-bed units attract higher yields due to higher rental rates per SQM of Kshs 333 as compared to Kshs 267 for 2-bed units, as property owners charge more rent per SQM for the extra space offered.

The performance of high-end apartments is as summarized below;

|

(all values in Kshs, unless stated otherwise) |

||||||||||||

|

Nakuru Town High-End Apartments Performance Summary and Analysis – February 2018 |

||||||||||||

|

Unit |

Unit Plinth Area in SQM |

Selling Price (mn) |

Selling Price per SQM |

Initial Rent (2016) |

Current Rent |

Monthly Rent per SQM |

Uptake |

Annualized Uptake |

Occupancy |

Price Appreciation |

Yields |

Total Return |

|

2-Bed |

80 |

4.9 |

63,879 |

18,500 |

20,714 |

267 |

66.6% |

31.5% |

92.3% |

5.3% |

4.3% |

9.6% |

|

3-Bed |

93 |

5.5 |

60,308 |

32,500 |

30,833 |

333 |

47.2% |

14.3% |

84.0% |

6.1% |

5.7% |

13.8% |

|

Average |

|

|

62,094 |

|

|

300 |

56.9% |

22.9% |

88.2% |

5.7% |

5.0% |

11.7% |

|

· Apartments in the high-end residential markets recorded a total return of 11.7%, with an average rental yield of 5.0% and price appreciation at 5.7% at an annual uptake of 22.9%. The high-end residential market for apartments outperform the middle-income segment, with the total return being 11.7%, 2.0% points higher as compared to 9.7% for residential developments in the middle-income segments, due to high price appreciation of 5.7%, 0.6% points higher than the mid end segment due to high demand from the high-end segment of the market prompting developers to increase prices. |

||||||||||||

|

· 3-bed apartments outperform 2-bed apartments recording total returns of 13.8%, 4.2% points higher than 9.6% for 2-bed apartments due to high demand, as the market prefers larger spaces and offering more bedrooms. This has prompted developers to raise prices with the units recording a price appreciation of 6.1%, 0.8% points higher than 2-beds at 5.3%. Additionally, the units record higher rental rates per SQM of on average Kshs 333 as compared to Kshs 267 for 2-bed, respectively, thus 1.4% points higher yields of 5.7%, compared to 4.3% for 2-bed. |

||||||||||||

Source: Cytonn Research 2018

- Detached Units

Detached units in the High End market in Nakuru Town are few, with only 4 notable developments in areas such as Milimani and London. Detached units in the area have an average total return of 6.8% with average rental yields and price appreciation of 3.8% and 3.0%, respectively. Annualized uptakes for detached 3-bed units is 21.5%. Meaning that developers can exit from a development in 5 years. On average developments have 73 units, meaning that developers can sell 14 units a year.

The performance of detached units is as summarized below:

|

(all values in Kshs, unless stated otherwise) |

||||||||||||

|

Nakuru Town 3-Bed Detached – High-End Units Performance Summary and Analysis – February 2018 |

||||||||||||

|

|

Plinth Area (SQM) |

Current Selling Price |

Selling Price per SQM |

Monthly Rent |

Rent /SQM |

Uptake |

Annualized Uptake |

Occupancy |

Price Appreciation (%) |

Yield (%) |

Total Return |

|

|

Average |

141 |

15.1 |

107,466 |

55,000 |

384 |

53.6% |

21.5% |

68.8% |

3.8% |

3.0% |

6.8% |

|

|

High |

180 |

20.0 |

139,130 |

60,000 |

435 |

84.7% |

35.0% |

90.0% |

5.4% |

3.5% |

8.7% |

|

|

Low |

115 |

10.3 |

82,400 |

50,000 |

333 |

29.8% |

14.9% |

50.0% |

1.8% |

2.4% |

4.2% |

|

|

· Standalone units in the area have an average return of 6.8% with average price appreciation and rental yields of 3.8% and 3.0%, respectively. The total return of 6.8% for standalone units is 4.9% points lower than 11.7% for apartments in the high-end segment because of lower occupancy rates of on average 68.8% for detached units as compared to 88.2% for apartments. This is attributed to the market preferring apartments to standalone units, as they are more affordable and with an average rent of Kshs 30,833 for 3-bed apartments compared to Kshs 55,000 for 3-bed-detached units, 43.9% lower. |

||||||||||||

Source: Cytonn Research 2018

- Mid-End Market Segment

The mid-end segment consists of estates such Ngata, Kiamunyi and Free Area. The area mainly comprises of apartments. This segment recorded an annual uptake of 39.7%, 16.8% points higher than the high-end segment at 22.9%, attributable to mid-end apartments affordability as they are 18.6% cheaper than in the high-end segment, with a price per SQM of Kshs 50,530, against an average of Kshs 62,094 per SQM for high-end apartments.

The performance of mid-end apartments in Nakuru Town is as summarized below:

|

(all values in Kshs, unless stated otherwise) |

||||||||||||

|

Nakuru Town Mid-End Apartments Performance Summary and Analysis – February 2018 |

||||||||||||

|

Unit |

Unit Plinth Area (SQM) |

Selling Price (mn) |

Selling Price per SQM |

Initial Rent (2016) |

Current Rent |

Monthly Rent per SQM |

Uptake |

Annualized Uptake |

Occupancy |

Price Appreciation |

Yields |

Total Return |

|

2-Bed |

74 |

3.8 |

49,777 |

14,833 |

16,000 |

223.5 |

96.0% |

38.0% |

97.3% |

2.0% |

4.8% |

6.5% |

|

3-Bed |

89 |

4.9 |

51,282 |

24,333 |

28,333 |

299.2 |

90.4% |

41.3% |

90.4% |

8.2% |

6.2% |

12.8% |

|

Average |

|

|

50,530 |

|

22,167 |

261.3 |

93.2% |

39.7% |

93.9% |

5.1% |

5.5% |

9.7% |

|

· The mid-end residential market recorded an average total return of 9.7%, with an average rental yield of 5.5% and an average price appreciation of 5.1%. The market’s total return of 9.7% is 2.0% points lower than high-end apartment’s return of 11.7% due to a slower price appreciation of 5.1% as compared to 5.7%, but high uptakes of 39.7%, 16.8% points higher than 22.9% for the high-end segment as the units are affordable to the middle-income segment leading to higher demand. |

||||||||||||

|

· 3-bed residential units outperform the 2-bed units in the mid-end market, recording average total returns of 12.8%, 6.3% points higher than 2-beds with average total returns of 6.5%, this is due to higher rental rates per SQM at Kshs 299.2, 33.9% higher than Kshs 223.5 per SQM for 2-bed units as the market is willing to pay more rent for larger units with more bedrooms, where on average 3-beds are 89 SQM in size while 2-beds are 74 SQM in size. |

||||||||||||

Source: Cytonn Research 2018

- Nakuru Town Residential Sector Performance Summary

In terms of overall market performance, the residential sector in Nakuru recorded on average total returns of 8.8%, with apartments and detached units having total returns of on average 10.7% and 6.8%, respectively. The lower returns for detached units can be attributed to a slower price appreciation of 3.8%, 1.6% points lower than 5.4% for apartments, as developers are sceptical about raising prices in attempt to boost sales and due to slow annualized uptakes of 21.5%, 9.8% point lower than apartments at 31.3%. Additionally, standalone units record lower occupancy rates of 68.8%, 22.3% points lower than 91.0% for apartments since the market prefers apartments as they attract lower rental rates thus more affordable with rents at on average Kshs 23,970, 56.4% lower than detached at Kshs 55,000.

The performance of the residential sector in Nakuru Town is as summarized below:

|

(all values in Kshs, unless stated otherwise) |

|||||||||

|

Nakuru Town Residential Sector Performance Summary – February 2018 |

|||||||||

|

Segment |

Typology |

Selling Price per SQM |

Monthly Rent per SQM |

Uptake |

Annualized Uptake |

Occupancy |

Price Appreciation |

Yields |

Total Return |

|

High-End |

Apartments |

62,094 |

300 |

56.9% |

22.9% |

88.2% |

5.7% |

5.0% |

11.7% |

|

Mid-End |

Apartment |

50,530 |

261 |

93.2% |

39.7% |

93.9% |

5.1% |

5.5% |

9.7% |

|

Apartments Average |

|

56,312 |

281 |

75.0% |

31.3% |

91.0% |

5.4% |

5.3% |

10.7% |

|

High-End |

Detached Units |

107,466 |

384 |

53.6% |

21.5% |

68.8% |

3.8% |

3.0% |

6.8% |

|

Average |

|

81,889 |

332 |

64.3% |

26.4% |

79.9% |

4.6% |

4.2% |

8.8% |

|

· The average return from residential units in Nakuru Town stands at 8.8% with apartments outperforming detached units, recording on average total returns of 10.7%, 3.9% points higher than the 6.8% recorded for detached units. The lower returns for detached units can be attributed to a slower price appreciation of 3.8%, 1.6% points lower than 5.4% for apartments, this is attributable to developers being sceptical about raising prices in attempt to boost sales and due to slow annualized uptakes of 21.5%, 9.8% point lower than apartments at 31.3% · Additionally, standalone units record lower occupancy rates of 68.8%, 22.3% points lower than 91.0% for apartments since the market prefers apartments as they attract lower rental rates of on average Kshs 281 per SQM, 15.5% lower than standalone units at Kshs 332 per SQM |

|||||||||

|

· Apartments have higher annualized uptakes of 31.3%, 9.8% points higher than detached units that recorded uptakes of 21.5%, this is due to the fact that, apartments are preferred as they are more affordable .On average exit prices for apartments are Kshs 56,312 per SQM 90.8% lower than the Kshs 107,466 for detached units. |

|||||||||

Source: Cytonn Research February 2018

- Commercial Properties

- Office and MUDs Developments

The commercial office buildings and MUDs (comprising of a blend of both commercial office and retail) are mainly located in the Nakuru CBD. Generally, Nakuru Town lacks Grade A office spaces with most of the buildings being Grade C. In terms of performance, office spaces in Nakuru Town record average rental yields of 5.4%, 3.5% points lower than the 8.9% for MUDs. MUD’s outperform purely office buildings in the town due to higher footfall as they combine both office and retail uses. This results in higher occupancy rates, and consequently higher rents. On average, MUD’s have an occupancy rate of 81.6%, 16.6% higher than purely office buildings that have an average occupancy rate of 65.0%. The rents charged by MUDs are 29.5% higher at Kshs 86 per SQFT compared to Kshs 66 per SQFT charged for purely office buildings.

The summary of the sector’s performance is as below:

|

(all values in Kshs, unless stated otherwise) |

|||||

|

Nakuru Town Commercial Office and MUD Performance Summary – February 2018 |

|||||

|

Development |

Rent (SQFT) |

Service Charge 2018 (SQFT) |

Total Rent (SQFT) |

Occupancy |

Yield |

|

Commercial Office |

66 |

17 |

83 |

65.0% |

5.4% |

|

MUD |

86 |

19 |

105 |

81.6% |

8.9% |

|

Average |

76 |

18 |

94 |

73.3% |

7.2% |

|

· Commercial office spaces record average rental yields of 5.4%, 3.5% lower than the 8.9% for MUDs, the lower yields are as a result of lower occupancy rates of 65.0% for commercial office as compared to 81.6% for MUDs and lower rental rates at Kshs 66, 16.6% lower than Kshs 86 for Mixed Use Developments. The lower occupancy rates are attributed to lower demand as the market prefers MUDs to purely commercial office space due to higher footfalls as MUDs combine the retail and office uses |

|||||

Source: Cytonn Research 2018

- Retail Space

Nakuru County has 4 malls of which 50% are community malls (Gross Floor Area (GFA) of 125,001 – 400,000 SQFT) and 50% are neighbourhood malls (Gross Floor Area (GFA) of 20,000 – 125,000 SQFT). On average, the retail space in Nakuru has rental yields of 5.8% as compared to Nairobi, Mombasa and Kisumu that have average rental yields of 9.7%, 10.0% and 9.9%, respectively. The relatively low yields are as a result of low rental rates of Kshs 91.7 per SQFT, 39.3% lower than areas such as Kisumu that have rental rates of Kshs 151.0, as the malls have just been completed

In terms of performance by grade, community malls outperform neighbourhood malls, recording on average rental yields of 6.8%, 2.0% higher than the 4.8% average rental yields recorded in neighbourhood malls. The lower yields for neighbourhood malls are attributable to lower occupancy rates of 65.0% for neighbourhood malls, 17.5% points lower than 82.5% for community malls, as retailers prefer the newer community malls that attract higher footfall.

The summary of the sector’s performance is as below:

|

All values in Kshs, Unless Stated Otherwise |

|

|||||

|

Nakuru Town Commercial Retail Space Performance Summary and Analysis - 2018 |

||||||

|

Retail Grade |

Anchor Rent |

Rent Ground Floor 2018 |

Average Rent Per SQFT |

Service Charge 2018 |

Occupancy Rate |

Rental Yield |

|

Community Mall |

55 |

115 |

85 |

23 |

82.5% |

6.8% |

|

Neighbourhood Malls |

50 |

115 |

73 |

21 |

65.0% |

4.8% |

|

Average |

53 |

115 |

79 |

22 |

73.8% |

5.8% |

|

· Average rent for commercial retail spaces in Nakuru stands at Kshs 79.0 per SQFT and average yield of 5.8% at an occupancy level of 73.8% |

||||||

|

· Community malls recorded higher yields of 6.8%, 2.0% points higher than neighbourhood malls due to higher occupancy rates that stand at 82.5% , 17.5% points higher than 65.0% for neighbourhood malls, as retailers prefer the newer community malls that attract higher footfall |

||||||

Source: Cytonn Research 2018

- Land Analysis Summary

An analysis of changes in asking land prices in Nakuru was conducted in areas such as Kiamunyi, Milimani, Nakuru CBD, Ngata and Naka. Over the last 3-years the areas have recorded growth in asking land prices of 11.6%, 10.7%, 8.9%, 7.4%, 7.1% and 6.8% per annum, respectively, thus Nakuru Town land sector recorded an annualized capital appreciation of 8.8% this is attributed to speculation and increased demand for land in residential zones.

The summary of the sector’s performance is as highlighted below:

|

(all values in Kshs, unless stated otherwise) |

||||||

|

Nakuru Town Land Performance Summary – February 2018 |

||||||

|

Location |

Price per Acre 2015 |

Price per SQM 2015 |

Price per Acre 2018 |

Price per SQM 2018 |

Price Change from 2015 |

3-Year CAGR |

|

Kiamunyi |

12,000,000 |

3,000 |

16,700,000 |

4,175 |

1.4x |

11.6% |

|

Milimani |

28,000,000 |

7,000 |

38,000,000 |

9,500 |

1.4x |

10.7% |

|

Nakuru CBD |

155,000,000 |

38,750 |

200,000,000 |

50,000 |

1.3x |

8.9% |

|

Ngata |

10,000,000 |

2,500 |

12,400,000 |

3,100 |

1.2x |

7.4% |

|

Naka |

16,000,000 |

4,000 |

19,640,000 |

4,910 |

1.2x |

7.1% |

|

Section 58 |

11,000,000 |

2,750 |

13,413,333 |

3,353 |

1.2x |

6.8% |

|

Average |

|

9,667 |

|

12,506 |

1.3x |

8.8% |

|

Average excluding CBD |

3,850 |

5,008 |

1.3x |

8.7% |

||

|

· Land in Nakuru Town has appreciated by 1.3x, translating to a 3-year CAGR of 8.8% |

||||||

|

· Areas such as Kiamunyi and Milimani have recorded the highest growth rates growing by a 3-Year CAGR of 11.6% and 10.7% as a result of increased demand due to their prime locations near the CBD thus considered as a preferred location for individuals working within the Nakuru CBD |

||||||

Source: Cytonn Research 2018

- Nakuru Market Summary Analysis

The Nakuru real estate sector records a total return of 14.9%, with an average rental yield of 6.1% and a capital appreciation at 8.8% p.a. In terms of yields, the MUD theme surpassed all the other themes to record yields of on average 8.9%, as compared to 4.2%, 5.4% and 5.8% for the residential, commercial office and retail themes, respectively.

The summary of the real estate sector performance is as below;

|

(all values in Kshs, unless stated otherwise) |

||||

|

Nakuru Town Real Estate Sector Performance Summary – February 2018 |

||||

|

Theme |

Occupancy Rates |

Rental Yield |

Capital Appreciation |

Total Return |

|

Residential |

79.9% |

4.2% |

|

|

|

Commercial offices |

65.0% |

5.4% |

|

|

|

MUD |

81.6% |

8.9% |

|

|

|

Retail Sector |

73.8% |

5.8% |

|

|

|

Land |

8.8% |

|

||

|

Average |

75.1% |

6.1% |

8.8% |

14.9% |

|

· Nakuru real estate sector has an average yield of 6.1% and a capital appreciation of 8.8%, bringing the total returns to 14.9% per annum |

||||

|

· The residential sector records rental yields of on average 4.2% and a price appreciation of on average 4.6%. While the commercial offices and retail space record yields of on average 5.4% and 5.8%, respectively. MUDs in the town recorded the highest yields of on average 8.9% due to high occupancy rates of 81.6% and higher rents of on average Kshs 86.0 per SQFT, 8.9% higher than the Kshs 79.0 per SQFT for purely retail spaces, 30.3%higher than the Kshs 66 per SQFT for purely office spaces. This is as they attract higher footfall, due to the combined offering of both retail and office spaces |

||||

Source: Cytonn Research February 2018

Section 3: Comparative Analysis – Selected Counties in Kenya

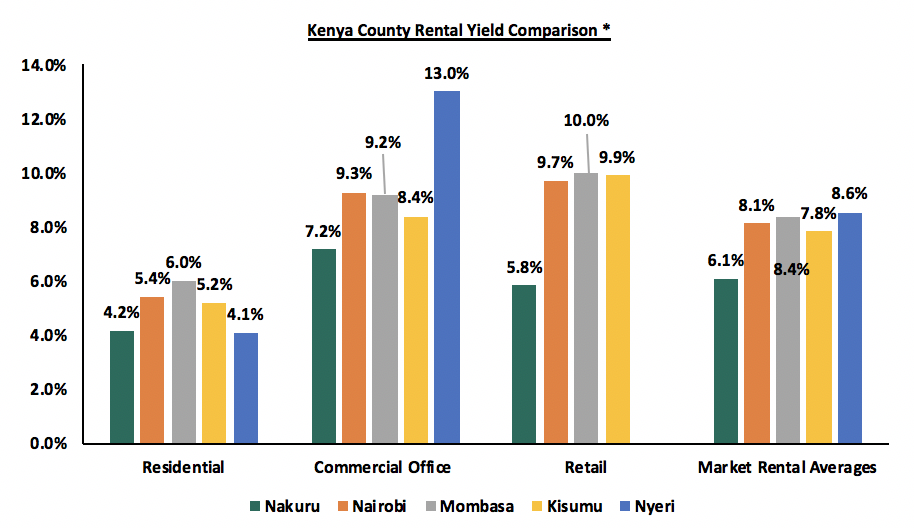

In comparison to research done in other counties within Kenya, Nakuru Town has an average rental yield of 6.1%, which is lower than other towns and cities such as Nairobi, Mombasa, Kisumu and Nyeri, that have average rental yields of 8.1%, 8.4%, 7.8% and 8.6%, respectively. For the residential sector, Nakuru has an average rental yield of 4.2%, 0.1% points higher than Nyeri that has an average yield of 4.1%, but lower than Mombasa, Kisumu and Nairobi with average rental yields of 6.0%, 5.2% and 5.4%, respectively. For the commercial office sector, Nakuru has average rental yield of 7.2%, and lower than the Nairobi, Mombasa, Kisumu and Nyeri with average rental yields of 9.3%, 9.2%, 8.4% and 13.0%, respectively

Below is a summary of the analysis;

Source: Cytonn Research

*Mombasa data is based on 2016 figures

Section 4: Market Performance and Outlook

We have analyzed and identified the investment opportunity in Nakuru Town, based on 2018 performance as shown below;

|

Theme |

Performance (2018) |

Investment Opportunity |

Outlook |

|

Residential |

The residential sector records annualized uptake of 26.4% with apartments outperforming detached units to record an annualized uptake of 31.3% as compared to 21.5% for detached units. However, average rental yields of 4.2% for the sector, are low as compared to other towns such as Kisumu, Mombasa and Nairobi at 5.2%, 6.0% and 5.4%, respectively. |

The opportunity in the sector lies in 3-bed apartments in both the high end and mid end segment in areas such as Milimani, Section 58 and Naka. The units record average rental yields of 5.0% and 5.5%, respectively, higher than the market average of 4.2% as well as high-annualized uptakes of 22.9% and 39.7%, respectively. |

|

|

Commercial Offices |

The commercial office sector records average rental yields of on average 5.4%, against an occupancy rate of 65.0%. At an average rent of Kshs 66.4 per SQFT, 29.5% lower than MUDs at Kshs 86.0 per SQFT, lower than the 9.3%, 9.2%, 8.4% and 13.0% rental yields recorded in Nairobi, Mombasa, Kisumu and Nyeri towns, respectively. |

Our outlook for commercial office spaces is negative given the low yields and occupancy rates of on average 5.4% and 65.0%, respectively as compared to themes such as the MUD with yields and occupancy rates of 8.9% and 81.6%, respectively. |

|

|

MUD |

MUDs record high yields of 8.9% as compared to 5.4% for the conventional office space sector and 5.8% for retail space. Retail spaces in MUDs have high yields of 10.7% and 5.3% points higher than conventional office space with yields of 5.4%. |

An opportunity lies in the sector given the high occupancy rates of on average 81.6%, 16.6% higher than conventional office space at 65.0%, thus high yields of on average, 8.9% as compared to office at 5.4%. |

|

|

Retail Space |

Retail spaces recorded yields of on average 5.8% and occupancy rates of 73.8%. The yields are lower than regions such as Mombasa, Kisumu and Nairobi that have average rental yields of 10.0%, 9.9% and 9.6%, due to competition from MUDs in Nakuru Town. |

Our outlook for the retail space is negative given the low yields of 5.8%, as compared to areas such as Kisumu, Nairobi and Mombasa that have average rental yields of 9.4%, 9.7% and 10.0% respectively, |

|

|

Land |

Land in Nakuru Town has grown by a 3-year CAGR of 8.8%, with land in areas such as Kiamunyi, Milimani and Nakuru growing by 11.6%, 10.7% and 8.9% respectively. |

The opportunity in the sector lies in site and service schemes in areas such as Kiamunyi and Milimani with capital appreciation of 11.6% and 10.7%, respectively as compared to a market average of 8.8%. |

Out of the five real estate themes under evaluation in Nakuru, two themes, that is MUDs and land have a positive outlook, two themes that is retail and the commercial office sectors have a negative outlook while one theme, that is residential has a neutral outlook, thus our outlook for the Nakuru real estate market is neutral. Therefore, the investment opportunity lies in site and service schemes, in areas such as Kiamunyi and Milimani that have a capital appreciation rate of 11.6% and 10.7%, respectively, as compared to a market average of 8.8% and in MUDs that have average rental yields of 8.9% as compared to a market average of 6.1%.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.