Feb 24, 2019

In line with our regional coverage strategy, we continue to carry out research on various markets in Kenya, with our focus areas being in counties such as Nakuru, Mombasa, Kisumu, Laikipia, Meru, Nyeri and Uasin Gishu. The exercise is aimed at identifying the best real estate investment opportunities for our investors outside Nairobi. In January 2018, we published the Nyeri Investment Opportunity 2017, highlighting that the area recorded an average rental yield and capital appreciation of 8.8% and 17.3%, respectively. This week, we update our findings on the Nyeri real estate market, having collected and analyzed our research data as at January 2019. In summary, we found that the Nyeri market improved in terms of investment returns with the average rental yield coming in at 5.1% for the residential sector from 4.1% in 2017, a slight decline in the commercial sector to 12.1%, from 13.5% in 2017, and a growth in capital appreciation to 19.1%, from 17.3% recorded in 2017. The improved performance is attributed to a continued increase in the property value fueled by demand and a general increase in economic activities, despite the limited number of institutional developers, especially in the residential sector.

To comprehensively review the real estate investment opportunity in Nyeri Town, we will cover the following;

- Overview of Nyeri Town,

- Factors Driving Real Estate Investment in Nyeri,

- Challenges Facing the Real Estate Sector in Nyeri,

- Nyeri Real Estate Market Performance,

- Regional Comparative Analysis, and,

- Investment Opportunity and Outlook.

- Overview of Nyeri Town

Nyeri Town is situated in the Central Highlands of Kenya, about 150 km north of Kenya's capital city Nairobi, between the eastern base of the Aberdare Range, which forms part of the eastern end of the Great Rift Valley, and the western slopes of Mount Kenya. It is the largest town and the headquarters of Nyeri County, and the former central administrative headquarters of Central Province.

In terms of demographics, Nyeri town recorded a population of 119,273 in 2009, thus being ranked 3rd in Nyeri County after Mathira and Kieni constituencies whose population stood at 192,294 and 175,812, respectively.

The population of Nyeri County has however been growing at a relatively low average growth rate of 0.5% p.a, compared to neighboring counties such as Nyandarua and Laikipia, with an annual growth rate of 3.3% and 2.5%, respectively, and the country’s average of 2.6%, attributed to birth control measures according to National Council for Population and Development (NCPD). The rate of urbanization has also been relatively low at 1.9%, compared to Nyandarua at 5.1%, and the country’s rate of 4.3%.

|

Nyeri County Population |

||

|

Constituency |

2009 |

2019F |

|

Mathira |

192,294 |

202,128 |

|

Kieni |

175,812 |

184,803 |

|

Nyeri Town |

119,273 |

125,373 |

|

Othaya |

87,374 |

91,842 |

|

Mukurwe-ini |

83,932 |

88,224 |

|

Tetu |

78,320 |

82,325 |

|

Total |

737,005 |

774,696 |

|

||

Source: Kenya National Bureau of Statistics (KNBS)

- Factors Driving Real Estate Investment in Nyeri

Nyeri is primarily an agricultural area, but over the last 5-years, the area has witnessed increased real estate activities in the town and its environs driven by:

- Devolution – Being a county headquarter, devolution has continued to open up Nyeri Town, attracting government institutions such as the Independent Policing Oversight Authority (IPOA) and private investors such as Davis & Shirtliff, an international company that deals with equipment and services in the water and energy sectors, thus creating demand for office space, retail space and residential units to host investors and government officials,

- Mt. Kenya Regional Headquarters – Nyeri is centrally located and borders over five counties in the Mt. Kenya Region, such as Nyandarua, Laikipia, Meru, Embu and Murang’a. This has attracted Mt. Kenya Regional offices for both local and international companies such as the Safaricom Mt. Kenya regional hub, National Construction Authority (NCA) Mt. Kenya Regional Office, and Coca Cola Mt. Kenya Bottlers Ltd, thus creating demand for office space, retail and in the housing sector,

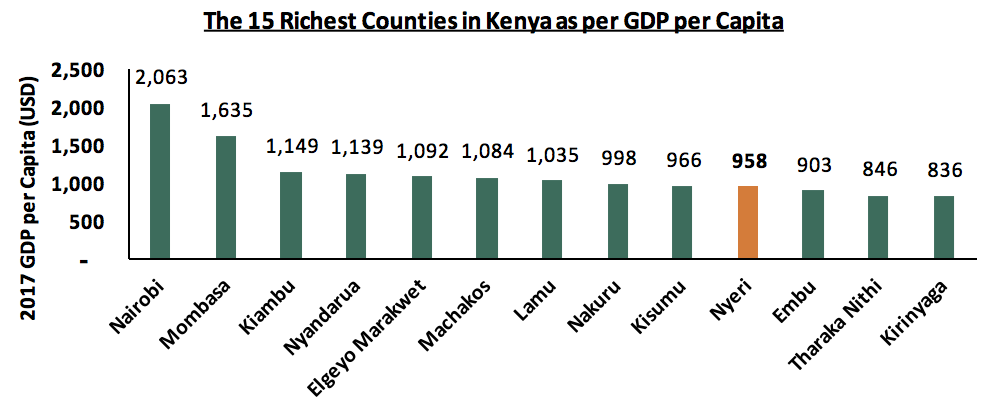

- Relatively High Income - According to the recently released Gross County Product report 2019 by the Kenya National Bureau of Statistics (KNBS), Nyeri was ranked the 12th richest county in terms of GDP per capita in the country at USD 958, with Nairobi coming in 1st with USD 2,063 per capita. The relatively high income, compared to the national average at USD 711, is mainly boosted by the agricultural sector, which accounted for 34.4% of the gross county product, and illustrates higher purchasing power thus a growing demand for property in Nyeri. Below is a graph showing the Top 15 Counties in Kenya as per their GDP per Capita:

*Conversion rate: USD 1= Kshs 103

Source: Kenya National Bureau of Statistics, 2019

- Tourism – Nyeri County hosts key tourist attractions such as the Lord and Lady Baden Powell graves, Mount Kenya and the Aberdare National Park. The county thus acts as a major tourist circuit to Mt. Kenya and the Northern Region, enhancing demand for hospitality services which continues to promote the hospitality sector,

- Growth of Small and Medium Enterprises (SMEs) – The ease of doing business, boosted by the short period of a maximum of 2 weeks for business registration, continues to result in an increase in the number of SMEs. Currently, Nyeri hosts many of these companies, and requires office space and housing for the employees, hence driving the demand for real estate, and,

- Improving Infrastructure - Nyeri County is expected to benefit from the improving infrastructure, i.e. the ongoing rehabilitation of Kuku Lane, the reconstruction of Baden Powell – Muhoya road in Nyeri town and the proposed construction of the Kenol-Nyeri-Isiolo Highway, which will result in an increased property value in areas served by the roads. In addition, the government has announced plans to re-carpet access roads in rural areas and we expect this to open up the areas for development and result in increased property value.

- Challenges Facing Real Estate in Nyeri

Despite the above factors supporting the real estate sector in Nyeri, the market continues to face challenges, which include;

- Lack of Structured Planning Regulations – The County currently lacks structured planning regulations outlining areas zoned for commercial, residential and special needs. This is likely to lead to urban sprawl in urban centers and thus reduced land use maximization. The County Government is however working on setting up zoning regulations to formulate land use standards, zoning schemes and ordinances for all urban settlements in the county,

- Inadequate Infrastructure - Most of the access roads in the county are earth roads making the areas they serve difficult to access during the rainy season, while the drainage systems in the town are not well maintained thus making the area unattractive to investors resulting in the slow growth of real estate,

- Unavailability of Development Land – Availability of land for development in Nyeri Town has been low thus resulting in relatively high land prices of up to Kshs 120 mn per acre in the CBD, compared to that in the outskirts at approximately Kshs 10 mn per acre. In addition, ownership of ancestral land has resulted in minimal land sales as people have sentimental attachment, thus leading to slow investment growth, and,

- Demand for Residential Units - Most of the prospective home-owners in Nyeri prefer to build their own houses. As a result, the build for sale model is still underdeveloped with the National Housing Corporation (NHC), probably being the only institutional developer. Given the fast uptake of these units with an annualized uptake of 23% having started selling in 2014, we expect the market to eventually embrace the model in the coming years.

- Nyeri Real Estate Market Performance

Our market research focused on;

- Plinth Area - Research on the size of the units found in the market allows us to gauge the current offering, and establish the home buyer’s preferences for sizes of houses,

- Annual Uptake - This allows the investor to appreciate the rate at which available property is sold over a specific period, thus helps him/her gauge how fast they can exit the market,

- Prices - Research on prices will be used in comparison with our products against the market prices,

- Rental Rates - Research on rental rates allows us to inform prospective investors on the rental yield they can gain from investing in the Nyeri Real Estate Market.

We covered the residential, commercial (mixed-use-developments and offices) and the land sectors. The performance per theme was as follows:

- Residential Sector

The residential housing sector in Nyeri has been slowly picking up, with most of the estates, having existed for less than 6-years, driven by among other factors; government decentralisation, urbanisation and growth of middle class in the region. In the county, some of the key residential areas are distributed in the outskirts of the CBD and include: Ring-road, Kamakwa and King’ong’o areas, with the key estates being Garden Estate, Mountain View Estate and Ring-road Estate, which comprise mainly of owner-built and occupied standalone houses.

The residential market is mainly rental, in and around Nyeri Town as the market, with majority of the residential houses being owner-built, and The National Housing Corporation (NHC) probably being the only institutional developer in Nyeri, having constructed residential bungalows for sale.

The performance was as follows:

All values in Kshs unless stated otherwise

|

Residential Detached Units Performance |

|||||||||||||

|

Typology |

Unit Plinth Area(SQM) |

Price per SQM 2017 |

Price per SQM (2019) |

Monthly Rent (2017) |

Monthly Rent (2019) |

Monthly Rent per SQM 2017 |

Monthly Rent per SQM 2019 |

Occupancy 2017 |

Occupancy 2019 |

Annual Sales 2019 |

Rental Yield (2017) |

Rental Yield (2019) |

|

|

1-bedroom |

42 |

76,190 |

76,190 |

10,000 |

15,000 |

238 |

357 |

80% |

80% |

20% |

3.8% |

4.5% |

|

|

2-bedroom |

54 |

74,074 |

74,074 |

20,000 |

20,000 |

370 |

370 |

71% |

80% |

25% |

4.3% |

4.8% |

|

|

3-bedroom |

69 |

63,768 |

63,768 |

28,000 |

28,000 |

406 |

406 |

67% |

100% |

25% |

5.1% |

7.6% |

|

|

Average |

71,344 |

71,344 |

338 |

378 |

73% |

87% |

23% |

4.4% |

5.6% |

||||

|

|||||||||||||

Source: Cytonn Research, 2019

- The units recorded an average rental yield of 5.6% in 2019, 1.2% points higher than the 4.4% recorded in 2017, attributed to the increase in the monthly rent charges from Kshs 338 per SQM in 2017 to Kshs 378 per SQM and occupancy rates from 73% to 87%, as most of the units have been enhanced by the owners before renting them out thus charging a higher rent price,

- Key to note, the exit prices remained constant at Kshs 71,344 per square, attributed to the unpopularity of the build to sell model with majority of the homes being owner-built, nevertheless, the homeowners’ willingness to adopt the concept is evidenced by the 23% annual uptake recorded by the existing development.

Apartments’ performance was as follows:

All values in Kshs unless stated otherwise

|

Residential Apartments Performance- Nyeri 2019 |

||||||||||||

|

Typology |

Unit Plinth Area (SQM) |

Monthly Rent (2017) |

Monthly Rent per SQM 2017 |

Monthly Rent (2019) |

Monthly Rent per SQM 2019 |

Monthly Rent/SQM ∆ |

Occupancy 2017 |

Occupancy 2019 |

Occupancy ∆ |

Rental Yield 2017 |

Rental Yield (2019) |

Rental Yield ∆ |

|

1-bedroom |

40 |

8,000 |

191 |

11,000 |

272 |

43% |

95% |

92% |

(3.0%) |

3.1% |

4.1% |

1.0% |

|

2-bedroom |

64 |

14,250 |

214 |

17,125 |

285 |

33% |

77% |

88% |

11.0% |

2.8% |

4.2% |

1.4% |

|

3-bedroom |

89 |

28,500 |

313 |

28,500 |

313 |

100% |

100% |

5.3% |

5.3% |

|||

|

Average |

239 |

290 |

38% |

91% |

93% |

3.8% |

3.7% |

4.5% |

1.2% |

|||

|

||||||||||||

* The calculation of the rental yield assumed an exit price of Kshs 71,344 per square metre, similar to that of the standalone units as the market lacks apartments for sale

Source: Cytonn Research, 2019

- The current average rent per month for apartments is approximately 290 per square metre, 38% higher than the Kshs 239 per square metre recorded in 2017, attributable to the entry of new developments in the market, which have been noted to be charging slightly higher rates,

- 3-bedroom apartments recorded the highest rental yield at 5.3%, attributed to the high rent per square metre and occupancy rates at an average of Kshs 313 and 100%, respectively, boosted by the low supply of the typology in the market,

- On the other hand, 1-bedroom apartments recorded a relatively low average rental yield of 4.1% at an average occupancy rate of 92%, attributable to a decline in occupancy rates by 3.0% from xx in 2017, attributable to the growing supply with the entry of new developments into the market.

All values in Kshs unless stated otherwise

|

Summary of the Residential Sector Performance |

|||||||||||

|

|

Price per SQM 2017 |

Price per SQM 2019 |

Rent Per SQM 2017 |

Rent per SQM 2019 |

Monthly Rent/SQM ∆ |

Occupancy 2017 |

Occupancy 2019 |

Occupancy ∆ |

Rental Yield 2017 |

Rental Yield (2019) |

Rental Yield ∆ |

|

Apartments |

239 |

290 |

21.3% |

91% |

93% |

3.0% |

3.7% |

4.5% |

0.8% |

||

|

Standalone |

71,344 |

71,344 |

338 |

378 |

11.8% |

73% |

87% |

14.0% |

4.4% |

5.6% |

1.2% |

|

Grand Average |

71,344 |

71,344 |

289 |

334 |

17.0% |

82% |

90% |

8.0% |

4.0% |

5.1% |

1.0% |

|

|||||||||||

Source: Cytonn Research, 2019

- Standalone units recorded the highest rental yield at 5.6%, compared to the 4.5% recorded by the apartments in the market, attributed to the relatively higher rental rates for standalone units, indicating higher demand, and,

- The residential market is still nascent and is yet to embrace the build for sale model with only one project currently offering units for sale.

- Commercial Sector

The commercial sector in Nyeri has continued to perform well over the years with a rental yield of above 10.0%, despite the fact that the market has no Grade A or B offices, with most of the offices being in a poor state of repair. In the last 2-years, we have seen the establishment of new buildings such as the County Mall and Khimji Deshi Shah (KDS) Centre and renovation of older buildings such as Lamesh Building. The market has low supply of formal shopping malls with only the recently built County Mall, which brought to the market 65,000 square feet of mixed-use space.

Currently, the key retailers serving the market include; Samrat, Naivas and Mathai Supermarket.

The performance was as follows:

All Values in Kshs Unless Stated Otherwise

|

Commercial Property (MUDs) Market Performance |

|||

|

2017 |

2019 |

Annualized ∆ |

|

|

Rent per SQFT (Retail) |

103 |

101 |

(1.4%) |

|

Rent per SQFT (Office) |

70 |

67 |

(3.2%) |

|

Occupancy (%) |

89% |

87% |

1.6% points |

|

Rental yield (%) |

13.5% |

12.1% |

1.0% points |

|

|||

Source: Cytonn Research, 2019

- The monthly rent for commercial office space in Nyeri, ranges from Kshs 50 to Kshs 100 per SQFT, while the monthly rent for retail space ranges from Kshs 70 to above Kshs 100 per SQFT,

- The slight change in rent charges per square foot, for both commercial office and retail space, is mainly attributed to an increase in the sample set compared to those considered in 2017,

- Commercial properties in the market recorded a 1.0%-points decline in rental yield attributed to the decline in occupancy rates to 87% from 89% recorded in 2017, with some of the new buildings such as the County Mall off Baden Powell’s Road and KDS Centre along Kimathi Street, recording lower occupancy levels of about 30%, having been introduced into the market within the last 1 year

- Land Sector

Land prices in Nyeri are highly dependent on the proximity to the roads, the level of servicing and proximity to the CBD. In the CBD, the land price is relatively high at an average price of up to Kshs 120 mn per acre, while an acre in the outskirts costs approximately Kshs 1.8 mn. Most of the land in Nyeri is ancestral, thus, minimal sales are recorded as people have sentimental attachment. In the last 3-years, however, the market has embraced the site and service concept with several developers having entered the market, some of whom include; Madiba Properties, Optiven Limited and Mhasibu Housing Company Limited.

The most common plots for sale in the market are ¼ acre and 1/8 acres, whose price ranges from Kshs 0.4 mn to 1.4 mn, and Kshs 2.0 mn to Kshs 4.5 mn, respectively, and recorded average annual sales of 30%, attributed to a growing demand for the development of residential houses.

All Values in Kshs Unless Stated Otherwise

|

Site & Service Scheme Performance |

||||||

|

Size of Plots (Acres) |

Selling Price(Kshs) 2017 |

Sale price (Kshs) 2019 |

Annual Sales Achieved 2017 |

Annual Sales Achieved 2019 |

Annualized Capital App. 2017 |

Annualized Capital App. 2019 |

|

1/8 |

0.8 mn |

0.9 mn |

30.8% |

29.2% |

17.5% |

20.9% |

|

1/4 |

2.4 mn |

3.9 mn |

24.3% |

30.8% |

17.0% |

17.3% |

|

Average |

27.6% |

30.0% |

17.3% |

19.1% |

||

|

||||||

Source: Cytonn Research 2019

- The plots for sale in the market are mainly in 1/8 acres and 1/4 acres at an average price of Kshs 0.9mn and Kshs 3.9mn, respectively,

- On average, the plots recorded an annual capital appreciation of 19.1% in 2019, 1.8% points higher than the 17.3% recorded in 2017, attributable to the growing demand for development land.

Nyeri Real Estate Market Performance Summary

|

Nyeri Real Estate Market Performance 2019 |

|||

|

Theme |

Occupancy Rates |

Rental Yield |

Capital Appreciation |

|

Residential |

90% |

5.1% |

|

|

Commercial Properties |

87% |

12.1% |

|

|

Site & Service |

19.1% |

||

|

Average |

88% |

8.6% |

19.1% |

Source: Cytonn Research

- The average rental yield stood at 8.6%, 0.2% points lower than the 8.8% recorded in 2017, attributed to a decrease in rent prices in the commercial sector resulting from a growing supply of commercial space in the market,

- The market recorded a capital appreciation of 19.1%, 1.8% points higher than the 17.3% recorded in 2017, attributed to the increased demand for property, fuelled by the positive demographics and devolution.

- Regional Comparative Analysis

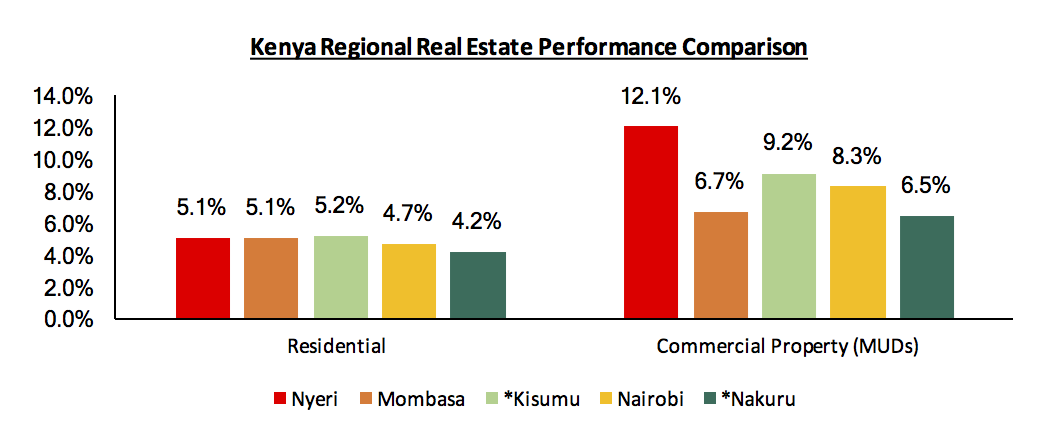

Comparing across the five counties we have tracked so far;

- In the residential sector, yields are generally similar across all counties, with Kisumu recording the highest at 5.2%, followed by Nyeri and Mombasa at 5.1%. Nakuru County recorded the lowest at 4.2%,

- For commercial property, Nyeri recorded the highest rental yield of 12.1%, while Kisumu, Nairobi, Mombasa and Nakuru recorded yields of 9.2%, 8.3%, 6.7% and 6.5%, respectively. This indicates that, in comparison to the other four regions, Nyeri offers a better investment opportunity for commercial property, and we attribute this to low supply of quality office spaces in the market.

Below is the comparison of the performance of the five counties:

*2017 Data

Source: Cytonn Research

- Investment Opportunity & Outlook

We have a positive outlook for two sectors; commercial and land sector and a neutral outlook for the residential sector in Nyeri. The opportunity is in both the commercial and land sectors (site and service schemes), supported by the increasing demand for development land and an existing market gap for quality commercial buildings.

The table below shows a summary of the outlook and investment opportunity:

|

Thematic Performance and Outlook |

||||

|

Theme |

Performance (2017) |

Performance (2019) |

Investment Opportunity |

Outlook |

|

Residential |

The residential sector recorded total returns of 8.3% on average with rental yield of 3.9% and price appreciation of 4.4% |

The residential sector has an average rental yield of 5.1% and a 90% occupancy rate. The sale of residential units is still at a nascent stage, with prospective homeowners preferring to build their own houses. |

There’s an opportunity for investment in stand-alone units for sale, given the low supply, and relatively high annual uptake of 23% and higher yields of 5.6% compared to apartments For apartments, the focus should be on the rental units given the high demand for the same evidenced by the average occupancy rates of approximately 93% |

Neutral |

|

Commercial Properties |

The commercial properties sector had an average rental yield of 13.5% and average occupancy of 89%. |

The commercial properties sector has yields of 12.1% and average occupancy of 87%. |

The market lacks grade A and B offices with most the offices being in a poor state of repair and lack facilities such as lifts. This thus presents an investment opportunity for quality commercial buildings supported by the relatively high rental yield of above 10.0% and occupancy rates of above 80% |

Positive |

|

Site and service schemes |

Site and service schemes recorded an average annual capital appreciation of 17.3% at an annual uptake of 27.6% |

Site and service schemes recorded an average annual capital appreciation of 19.1% at an annual uptake of 30.0% |

Site and service schemes present an investment opportunity in Nyeri, with increased demand for development land mainly for building their own homes |

Positive |

We have a positive outlook for the Nyeri real estate market, driven by devolution, positive demographics, and the growing housing demand in addition to the improving infrastructural development. For investment, we recommend investment in site and service sector, and the commercial sector given the relatively high capital appreciation and existing market gap for quality commercial buildings.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.