Aug 21, 2022

Kenya, like many other countries world over, has faced unprecedented challenges in the recent years which has had a major setback on the economy. One major issue; supply chain bottlenecks remains apparent and continues to worsen with new challenges such as geopolitical pressures and anticipation of increased demand as economies recover. Where we stand, the country is dealing with several issues including a high cost of living stemming from the prevailing inflationary pressures and local currency depreciation, rising debt levels currently at 69.1% of GDP as of May 2022 and a deteriorating business environment as consumers continue to cut back on spending. As such, we expect the incoming government to roll up its sleeves, perform a balancing act, and devise ways to stabilize key macroeconomic indicators while also supporting the ongoing economic recovery.

We recently covered a topical on the “Effects of Elections on the Investment Environment in Kenya” where we concluded that economic development and investment performance are heavily reliant on continuity and a stable macroeconomic environment, both of which have a significant impact on investor sentiment. We expected the out-going government to ensure a peaceful transition as well as provide the incoming government ample ground to implement its manifesto and improve the country’s economic prospects. This week we look at what has been happening under the outgoing government and discuss some of the economic areas to be focused on by the next government, now that the elections are over. The analysis will be broken down as follows:

- Introduction,

- Background and overview of the topic,

- Key focus areas for the next government, and,

- Conclusion.

Section I: Introduction

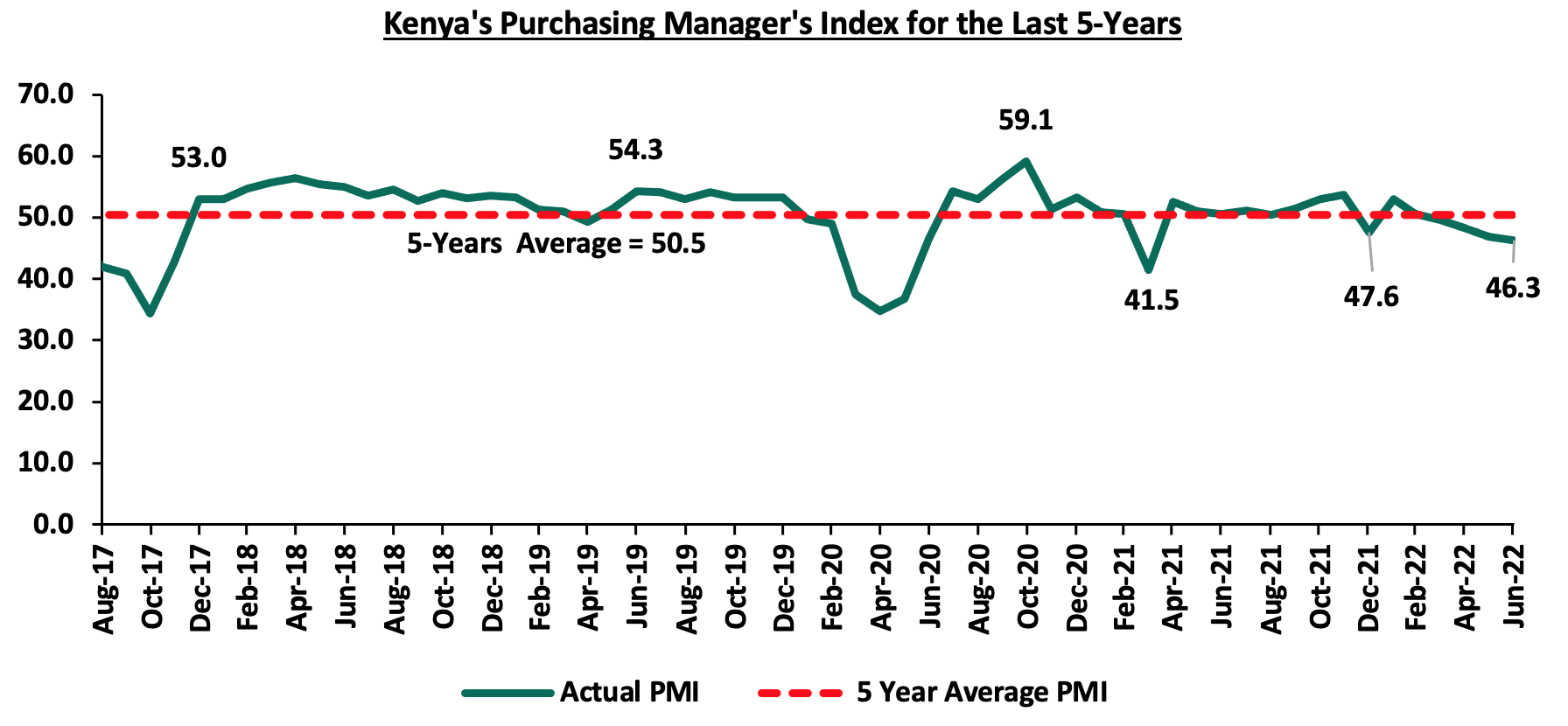

The Kenyan economy has continued to record steady recovery, with the GDP having grown by 6.8% in Q1’2022, up from the 2.7% growth recorded in Q1’2021, mainly driven by the resumption of most economic activities following the lifting of all COVID-19 related measures. Despite the recovery, the country’s general business environment has continued to deteriorate majorly due to persistent inflationary pressures, that have led to reduced consumer spending. The Purchasing Manager’s Index (PMI), which measures business activity came in at an average of 48.8 for the first seven months of 2022, indicating a deteriorating business environment in Kenya’s private sector. The chart below summarizes the evolution of the PMI in the last five years;

*** Key to note, a reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration.

Section II: Background and overview of the topic

Every new government seeks to implement its manifesto with the aim of improving the country’s economic conditions as well as address the key economic issues affecting the citizens. In this section, we examine Jubilee's achievements and failures, with a particular emphasis on the major macro-economic indicators that shape a country’s economic prospects, as follows;

- Economic Growth

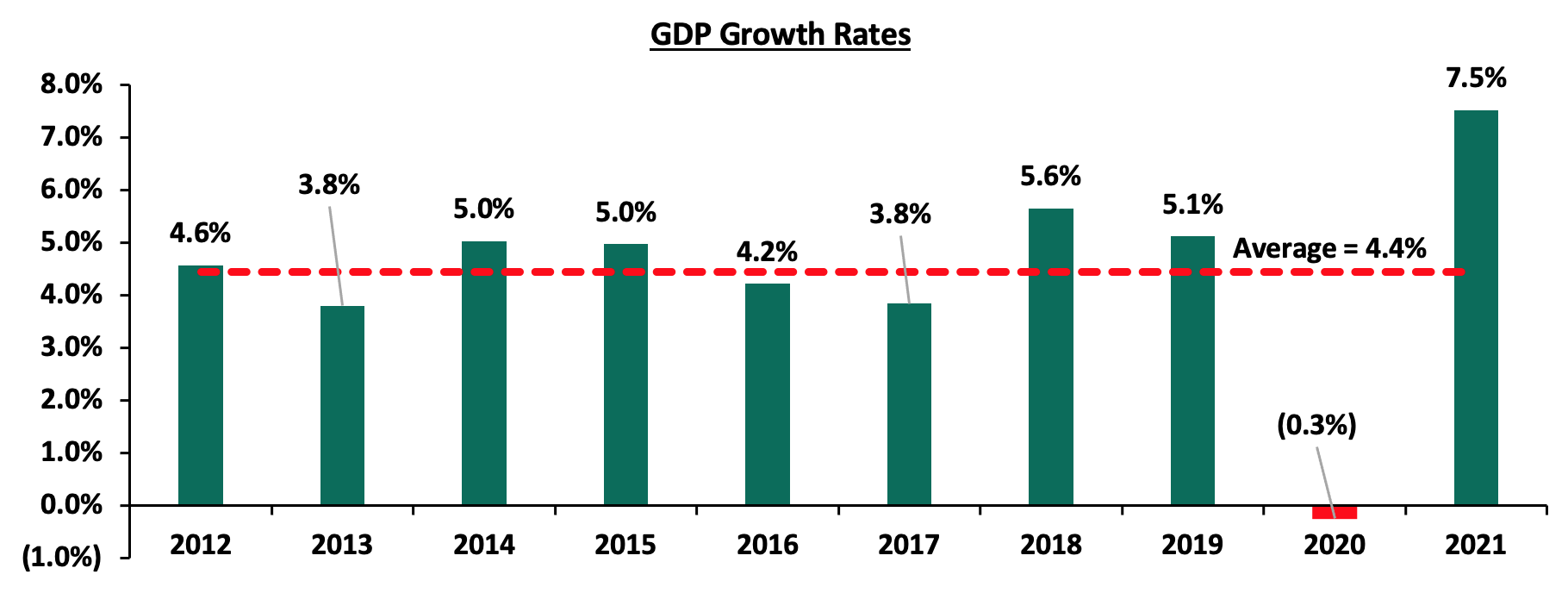

Over the last ten years, the Kenyan economy has recorded relative growth with the average GDP growth rate coming in at 4.4%, primarily driven by robust domestic demand emanating from private consumption and continuous increase in government investment. However, the growth has been weighed down by external shocks such as elevated inflationary pressures and the Covid-19 pandemic in 2020 which resulted in extreme economic disruptions. The graph below shows the GDP growth rates since 2012:

Source: World Bank

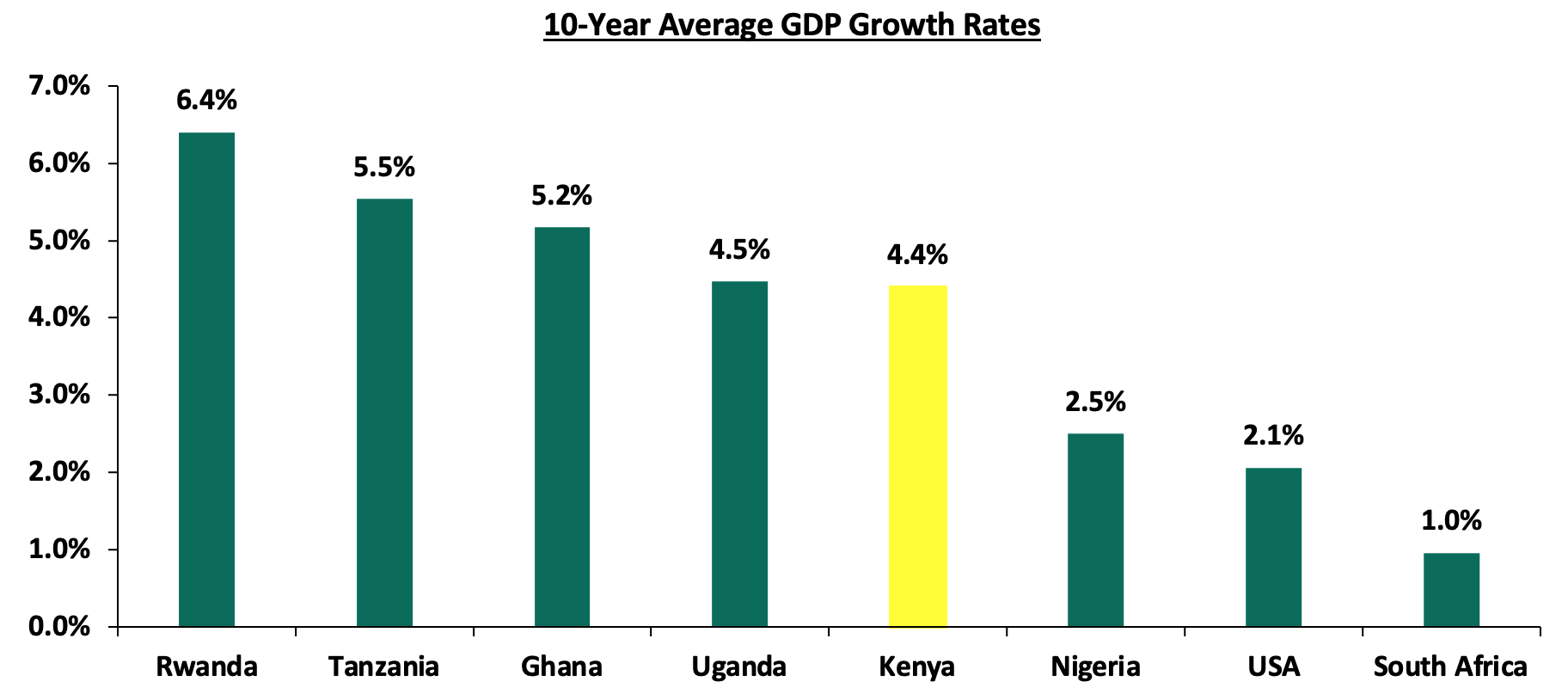

The Kenyan economy recorded the highest growth rate in 2021, having expanded by 7.5%, up from the 0.3% contraction recorded in 2020, mainly driven by the resumption of most economic activities following the lifting of most COVID-19 related measures. However, Kenya’s 10-year average GDP growth lags behind most of the African countries as shown in the chart below;

Source: World Bank

- Public Debt

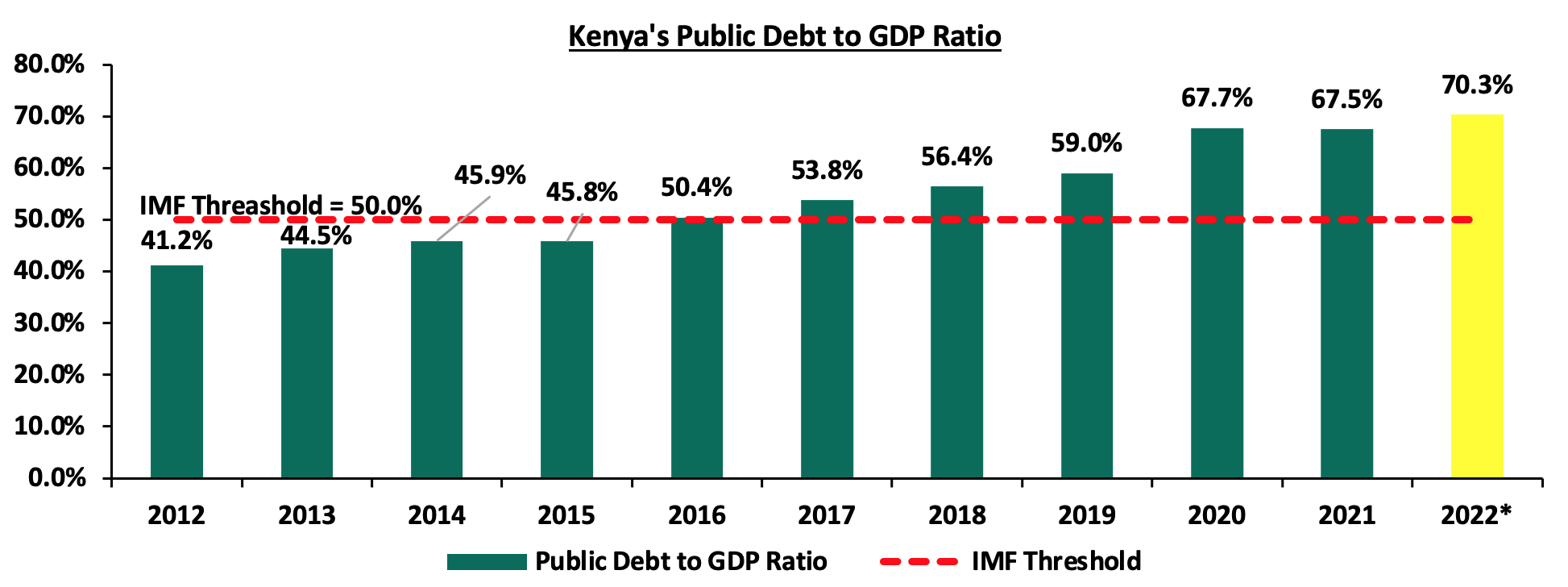

Over the last ten years, Kenya’s public debt has grown at a CAGR of 18.2% to Kshs 8.6 tn in May 2022, from Kshs 1.7 tn in May 2012 in comparison to the 4.4% average GDP growth an indication that the increase in debt is not translating into GDP growth. The increase in debt stock has been partly driven by huge spending on large infrastructure projects as well as widening fiscal deficit which stood at 8.1% of GDP in FY’2021/2022. Over the 10-year period that Jubilee has been in government, Kenya’s debt to GDP ratio increased to 67.5% in 2021, 26.3% points higher than the 41.2% ratio recorded in 2012 and 17.5% points above the IMF’s recommended threshold of 50.0% for developing countries. The chart below highlights the trend in the country’s debt to GDP ratio over the last ten years:

Source: The National Treasury, *Projected figures

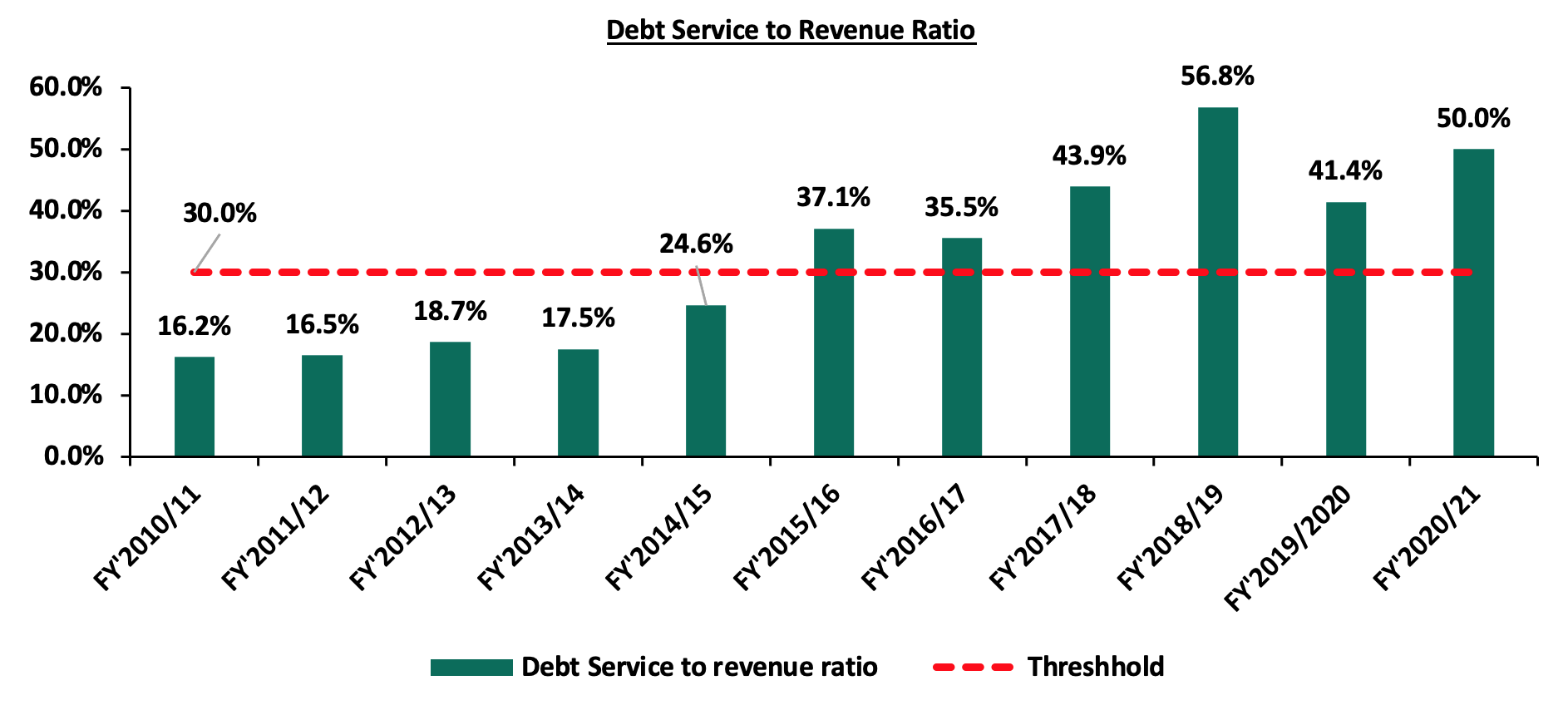

It is worth noting that Kenya’s debt servicing costs have continued to increase over time growing at a 10-year CAGR of 23.0% to Kshs 780.6 bn in FY’2020/2021, from Kshs 98.6 bn in FY’2010/2011The debt service to revenue ratio has also increased significantly in the ten years to 50.0%, from 16.2% in FY’2010/2011 posing a refinancing risk given the existing external shocks that further increase the servicing costs. This is also an indication that a larger percentage of the revenues collected will be used to pay back debt as opposed to steering economic development. Below is a chart showing the debt service to revenue ratio for the last ten fiscal years;

Source: National Treasury

- Currency Performance

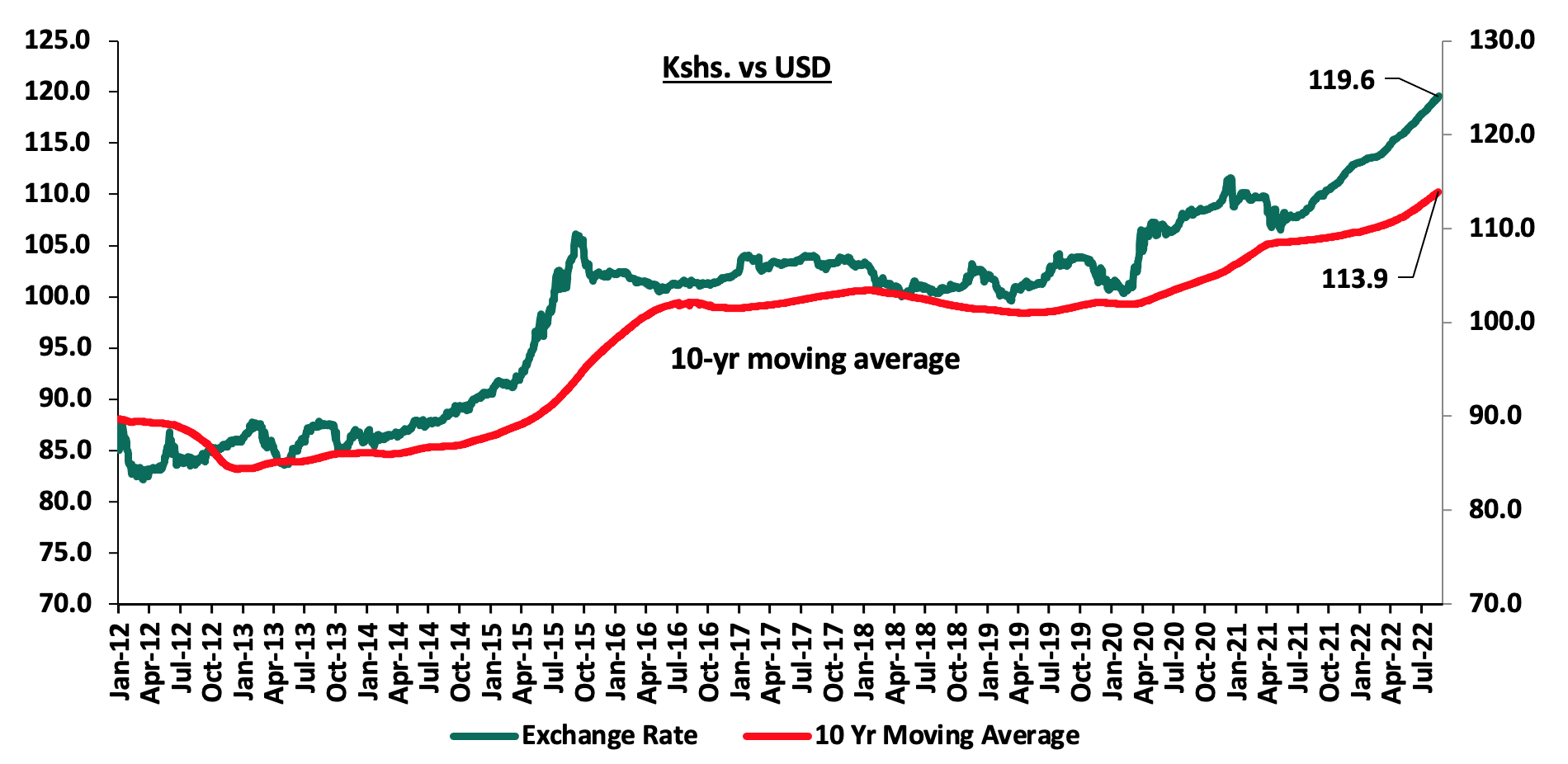

Ove the 10-year period, the Kenyan shilling has depreciated by 42.7% to an all-time low of Kshs 119.3 in August 2022 from Kshs 83.6 over the same period in 2012, attributable to various factors such as increasing debt levels, an ever present current account deficit and the rising prices of commodities such as crude oil prices as Kenya remains a net importer. The economic disruptions occasioned by the COVID-19 pandemic in 2020 also caused volatility of the shilling leading to a depreciation of 7.7% in 2020 and a further 3.6% in 2021. On a YTD basis, the shilling has depreciated by 5.7% against the USD, to close at Kshs 119.6, from Kshs 113.1 recorded on 3rd January 2022. The steep depreciation in 2022 is mainly attributable to increased dollar demand from commodity and energy sector importers as a result of the high global crude oil prices occasioned by supply chain constraints worsened by the geopolitical pressures at a time when the economy has continued to witness increasing demand. The chart below illustrates the performance of the Kshs against the USD over the last 10 years:

Source: Central Bank of Kenya

- Revenue Collection

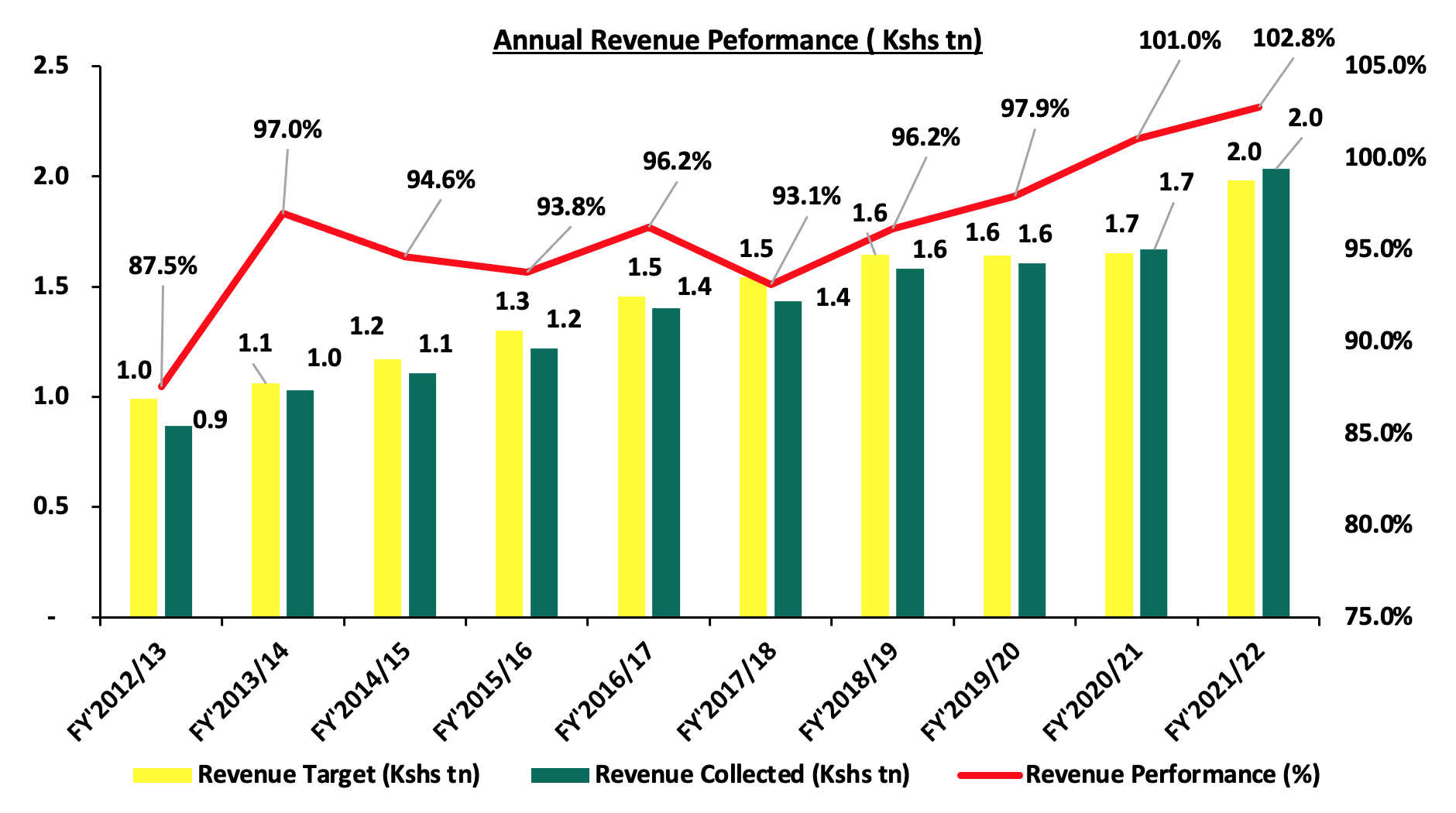

Over the 10-year period that Jubilee has been in government, Kenya’s revenue collection more than doubled to grow at a 10-year CAGR of 8.9% to Kshs 2.0 tn in FY’2021/2022, from Kshs 0.9 tn in FY’2012/2013 following expansion of the tax base as well as implementation of tax measures that have aided in efficient collection of tax revenues. However, the government has only surpassed its revenue collection target twice in the ten years under review. The graph below shows a summary of Kenya’s revenue performance over the last 10 years:

Source: Kenya Revenue Authority

- Unemployment rate

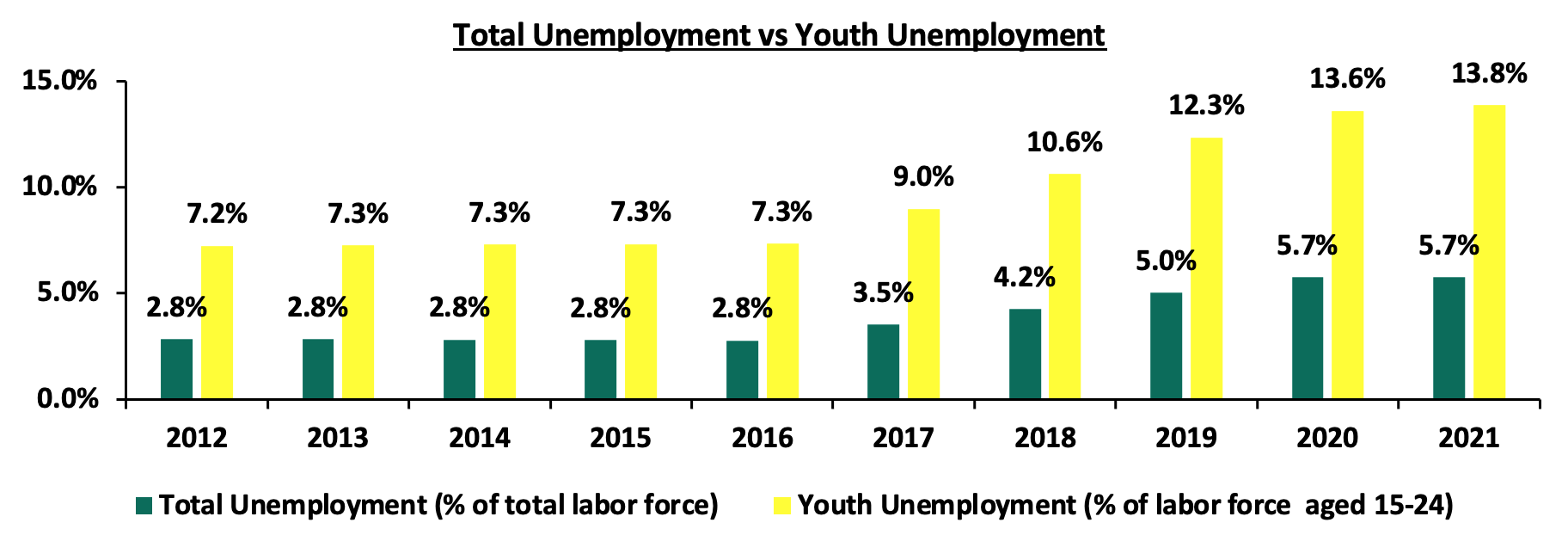

According to the World Bank, unemployment rate in Kenya recorded a 2.9% points increase during the period under review to 5.7% in 2021, from 2.8% in 2012 manly attributable to the challenges facing the county’s economic development coupled the rising youth population in Kenya, whose unemployment rate stood at 13.8% in 2021. The chart below shows a summary of total and youth unemployment over the last 10 years:

Source: World Bank

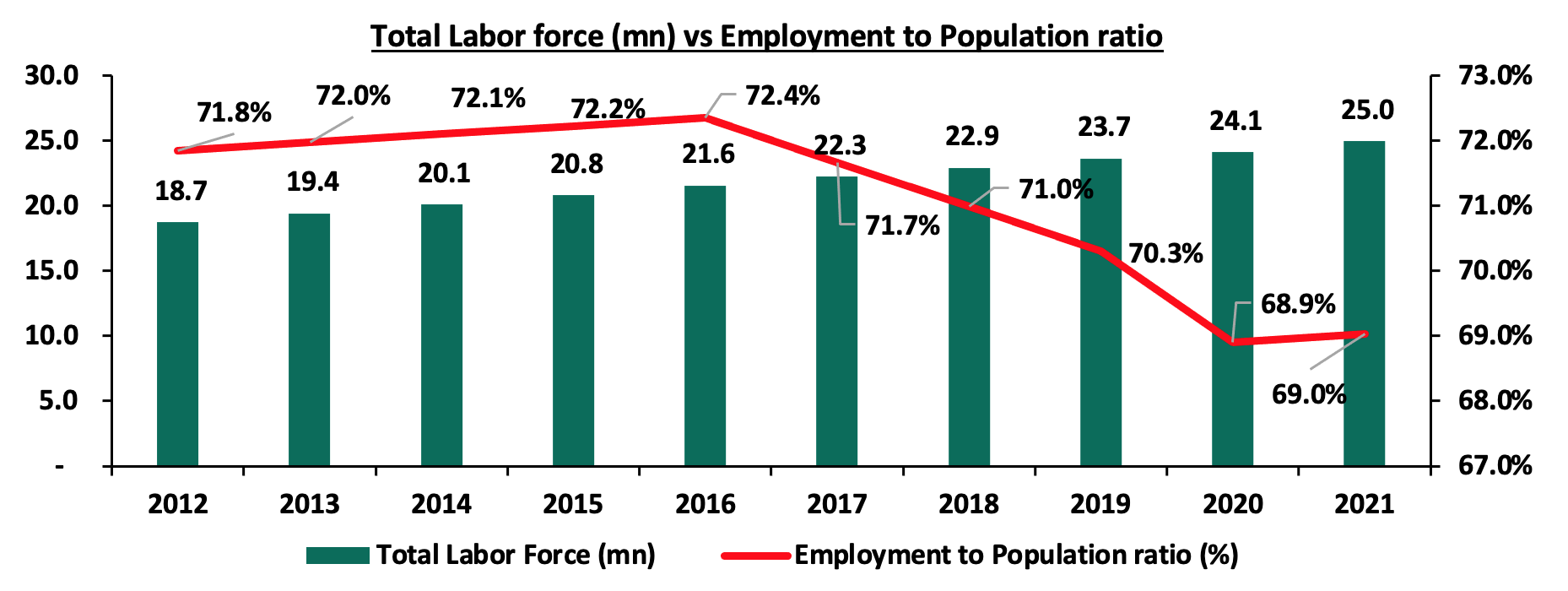

The total labor force increased by 33.3% to 25.0 mn people in 2021 from 18.7 mn people in 2012 as many people continue to acquire the relevant skills needed in the job market. Additionally, the employment to population ratio declined to 69.0% in 2021 from 71.8% in 2012 as the country continues to recorded rapid population growth to close 2021 at 55.0 mn people, from 44.3 mn in 2012. The graph below shows a summary of total labor force verses employment to population ratio over the last 10 years:

Source: World Bank

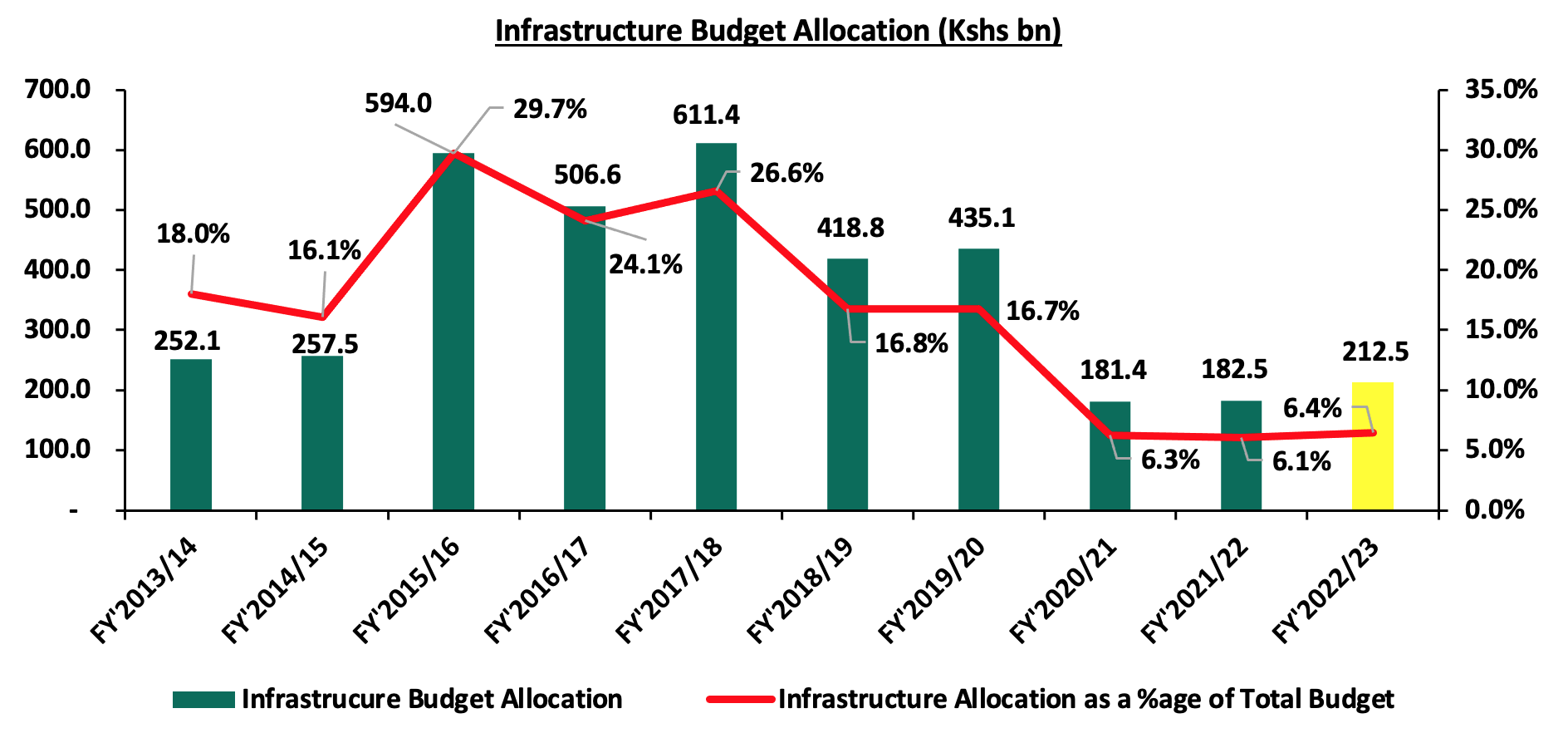

- Infrastructural development

Over the last 10 years, the Kenyan infrastructural sector has witnessed rapid developments aimed at improving connectivity and the economic performance. This has been supported by governments’ aggressiveness in implementing projects through various strategies such as; Public-Private Partnerships (PPPs) and Joint Ventures(JVs), floating of infrastructure bonds in order to raise construction funds, and, high priority in the budget allocations. As such, the government allocated to the sector a total of Kshs 3.7 tn in the last ten financial years, representing an average of 16.7% of the total budget with the highest allocation at 29.7% of the total budget in FY’2015/2016. However, the allocation has been on a downward trajectory, an indication that we are not investing much into the future. The graph below shows the budget allocation to the infrastructure sector over last ten financial years:

Source: The National Treasury

Section III: Key focus area for the next government

In light of the above, we expect the incoming government to implement its manifesto bearing in mind the key areas that need immediate and full attention to ensure that the country does not lag behind or suffer the consequences of delayed action. The following are the key economic areas we expect the incoming government to focus on, in a bid to steer development:

- Economic growth

The Kenya’s economy is projected to grow at a rate of 5.5% and 5.0% in 2022 and 2023 respectively, which are lower rates than the 7.5% growth recorded in 2021 amid the continued rise in global fuel prices which have adverse effects on input cost for major sectors such as manufacturing, transport and energy. To support the growth, we expect the new government to;

- Put in place measures to support the Agricultural sector, which is Kenya’s largest contributor to GDP, having accounted for an average of 20.2% of the GDP in the last ten years. This can be accomplished by allocating more funds for development of irrigation schemes given the climatic changes that have seen erratic weather patterns leading to drought in most parts of the country. Additionally, we expect the government to support the sector by providing affordable inputs such as fertilizers, quality seeds as well as beneficial and reliable markets to sell the products,

- Formulate policies to enhance a more diversified economy with a key focus on improving the Kenya’s manufacturing sector in order to create an economy that is less dependent on agriculture. Key to note, the manufacturing sector contributes less than 10.0% to the country’s GDP, despite the fact that it could contribute more given the various opportunities available. This will consequently create more job opportunities as well as improve the country’s current account deficit through the increased exports as well as preserve our foreign exchange reserves,

- Increase access to affordable credit by continuous implementation of policy measures such as the Micro Small and Medium Enterprises (MSMEs) Credit Guarantee Scheme aimed at supporting small and medium enterprises,

- Enhance ease of doing business in the country by eliminating unnecessary through incorporating use of technology in registration of businesses as well as tax remittances. We also expect the government to balance effective tax revenue collections and promote a business-friendly environment, and,

- Promote entrepreneurship and innovation aimed at increasing development of new businesses in order to stimulate more output and expand the number of transactions of goods and services in the economy.

- Government borrowing and debt sustainability

The country’s debt stock stood at Kshs 8.6 tn as of May 2022, equivalent to 69.1% of GDP and 19.1% points above the IMF recommended threshold of 50.0% for developing nations. Given the high debt levels as well as the ever present fiscal deficit, we expect the incoming government to work on strategies to reduce the over-reliance on debt by;

- Enhancing fiscal consolidation efforts aimed at addressing the high fiscal deficit arising from the higher government expenditure as compared to the revenue collections which has continued to be the main driver of the high borrowing levels. The incoming government can bridge the deficit gap by instituting austerity measures, reducing amounts extended to recurrent expenditure and focus on developments that will give back to the economy,

- Diversification of funding of projects by removing bottlenecks to Private Public Partnerships (PPPs) and joint ventures in order to attract more private sector involvement in funding development projects such as infrastructure instead of borrowing,

- Continue implementation of tax measures aimed at expanding the tax base as well as compliance in order to increase revenue collection and reduce dependence on debt as high level of debt reduces the prospects of economic growth since large portion of revenues go to servicing of the existing debts, and,

- Strengthening our Capital Markets in order to ease the pooling of funds by investors to undertake development projects given that capital markets remain dormant as banks continue to dominate the market.

- Currency performance

The Kenya shilling has remained under pressure as a result of increased dollar demand from the oil and energy sectors as well as general importers given that Kenya is predominantly a net importer. Despite the fact that the current pressure on the Kenyan shilling is unlikely to abate in the near term, there are actionable steps that can be taken by the incoming Government to mitigate further depreciation of the shilling. These include;

- Reduction of commercial loans which attract high interest rates as compared to concessional borrowing so as to reduce debt servicing costs. Reduced debt service amounts would greatly help to bring down demand for the dollar and stabilize the exchange rate,

- Improve economic self-sufficiency in areas such as agriculture so that we reduce the amount of imports only to goods that we must import,

- Building an export driven economy by formulating and implementing robust export oriented policies and manufacturing to increase exports aimed at reducing the current account while reducing overreliance on imports to preserve our foreign exchange reserves, and,

- Work with the private sector to maximize Kenyans living abroad investments in the countryin a bid to develop, promote and implement an active diaspora investment strategy and engagement.

- Private sector growth

The private sector continues to provide employment opportunities in the country as well as provide more sources for revenue collection. The government can support the sector by making credit more accessible and providing a business-friendly environment. Below are some of the initiatives that the government can adopt to support private sector growth;

- Customer education aimed at educating the public and providing guidelines on financial decisions as well as the available funding sources. This will enable borrowers to acquire knowledge on issues like how to access credit, the use of collateral, and establishing a strong credit history. The move will also increase financial literacy which will help borrowers analyse credit in terms of the costs associated and terms given by the lending institutions. This can be achieved by means such as introducing a website that breaks down the key fundamentals and guidelines on the basic information that consumers need to be able to make informed financial decisions,

- Increase competition to reduce over-reliance on banks given that banks account for 99.0% of all funding, while only 1.0% comes from non-bank institutional funding. The incoming government can balance funding sources by diversifying non-bank funding, allowing borrowers to access more flexible and cost-effective funding options, and,

- Establishment of a strong consumer protection agency and frameworkthat implements and enforces consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. This will promote robust disclosures on credit costs, free and accessible consumer education, and enforcement of disclosures on borrowings and interest rates, as well as the handling of consumer complaints and concerns.

Conclusion

We applaud the Jubilee government for the various accomplishments it has made over the last ten years, with emphasis on infrastructural development, steady economic growth, and increased revenue collection. However, we note that the incoming government has a significant role to play in stabilizing the country’s debt sustainability levels as well as lowering the elevated cost of living. Additionally, the increasing debt levels pose a risk of debt distress as the country continues to face unprecedented external shocks. In our view, the incoming government has limited choices but to focus on ways to boost economic growth, in a bid to reduce the over reliance on debt which stands out as the most critical issue for the country. However, the government will still be faced by various challenges such as the persistent supply chain bottlenecks, high debt servicing costs and the resurgence of COVID-19 infections which continue to disrupt the country’s and its trading partner’s economies.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.