Jan 19, 2025

Insolvency refers to a financial situation where an individual, business or entity, such as a fund, is unable to meet their financial obligations or settle their debts as they become due. In most cases, the state of insolvency occurs due to an increase in business expenses, poor cash management, law suits, poor budgeting, fraud, business expansion, or a reduction in sales. In Kenya, insolvency proceedings are primarily governed by the Insolvency Act of 2015. The act provides for how insolvent companies can be assisted to service creditors obligations and protect the interests of all stakeholders. The options available for such an insolvent company include Administration, Receivership, voluntary arrangements, and liquidation. In this week’s focus, we shall look into the following;

- Introduction,

- The Insolvency Act of 2015

- Financial health of a company and warning signs,

- Business restructuring options under the insolvency act,

- Case Study,

- Challenges affecting insolvency practice, and,

- Recommendations and Conclusion.

Section I: Introduction

Insolvency refers to a financial situation whereby an individual or business is unable to meet its financial obligations or settle its debts as they become due. In most cases, the state of insolvency occurs due to an increase in business expenses, poor cash management, law suits, poor budgeting, fraud, business expansion, or a reduction in sales. Consequently, these situations may lead to:

- Cash flow insolvency – whereby the company does not have enough cash or assets that can be easily converted into cash to settle its short-term obligations. This means that the company is struggling to pay its bills, creditors, and operating expenses on time. It occurs due to a delay in customers settling their invoices, cash disruption due to seasonality (for example, in the tourism industry), or a sudden increase in operating costs. However, the company’s total asset value may exceed its total liabilities, or,

- Balance sheet Insolvency – also known as technical Insolvency, whereby the company’s total liabilities exceed the value of its total assets and the company owes more than it owns. Therefore, the sale of all the company’s assets will not be sufficient to settle all the company’s liabilities. It usually occurs when the value of total assets decreases while the value of total liabilities increases or remains unchanged. However, balance sheet insolvency only looks at the current balance sheet position and fails to account for the business's cash flows. Therefore, the company may have a positive cash flow and be able to settle its short-term obligations.

In Kenya, insolvency proceedings are primarily governed by the Insolvency Act of 2015. This act provides for various mechanisms to address insolvency situations, including bankruptcy for individuals and winding up for companies. It aims to promote the efficient and fair resolution of insolvency cases while at the same time protecting the rights of creditors and debtors.

Prior to the enactment of the Insolvency Act in 2015, insolvency proceedings of both corporate entities and individuals were dealt with under the winding-up provisions of the Companies Act and the Bankruptcy Act. For corporations, the resolution of insolvency proceedings often involved the commencement of a winding-up proceeding, which involved the liquidation of the company under financial distress and paying the firm’s creditors. This effectively meant that creditors and other stakeholders in firms ran the risk of failing to recover total amounts of interest, especially in the event the company’s assets failed to cover the total amounts due. Thus, in an attempt to remedy this, the Insolvency Act was enacted in 2015. The Act consolidated the insolvency proceedings for both incorporated and unincorporated companies, previously under the Companies Act, and those of individuals, previously under the Bankruptcy Act, into one document. The Act focuses more on assisting insolvent corporate bodies whose financial position is deemed redeemable to continue operating as going concerns so that they may be able to meet their financial obligations to the satisfaction of their creditors.

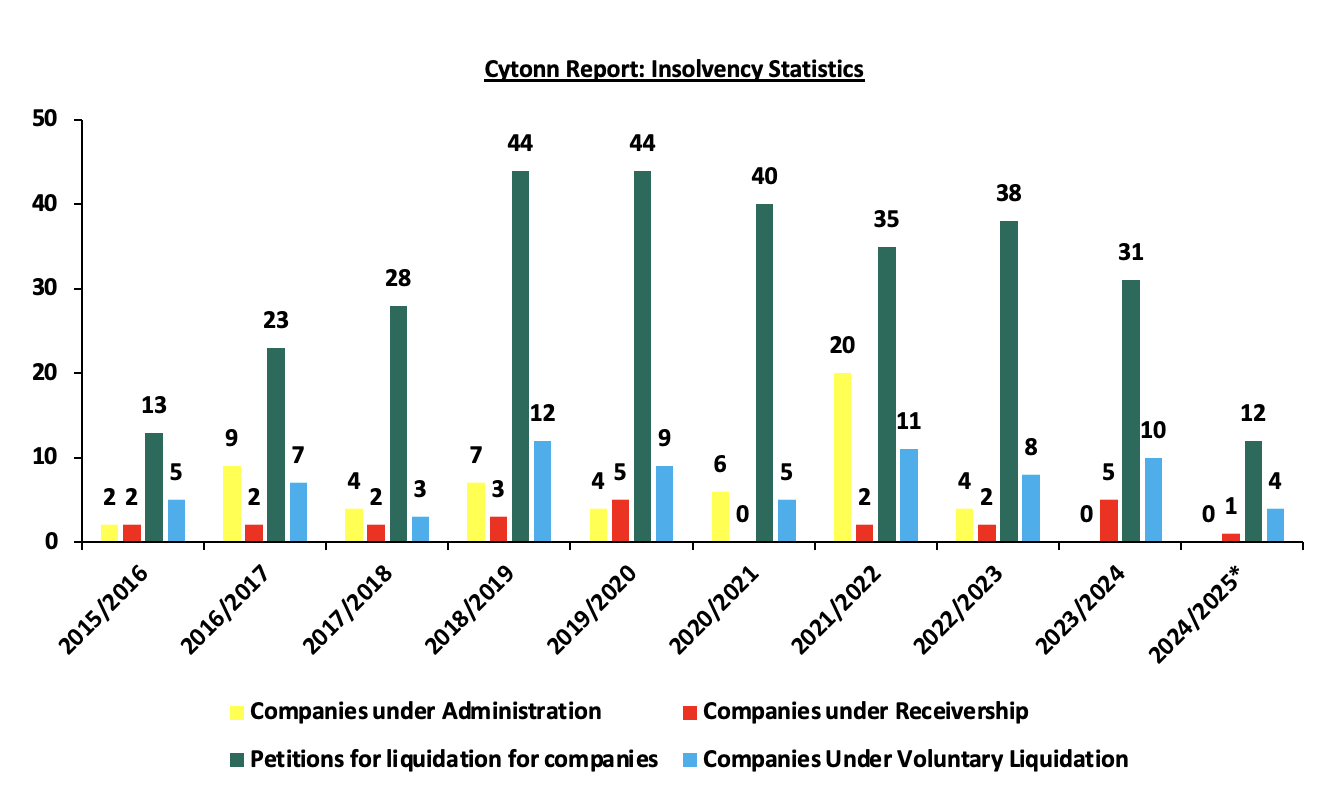

According to the latest statistics by the Kenya’s State Receiver’s office, the total number of petitions for liquidation of companies by courts has averaged 31 every year. Additionally, on average, the total number of companies under administration, companies under receivership, and companies under voluntary liquidation during each year is 6, 2, and 7, respectively. This situation is partly attributable to the increase in Gross non-performing loans, with the banking sector recording a 5-year CAGR growth of 14.4% to Kshs 670.6 bn in September 2024 from Kshs 342.5 bn in September 2019. Similarly, the Gross Non Performing Loans (NPL) ratio has increased to 16.3% as of June 2024, from 14.5% in Q2’2023. Additionally, the tough business operating environment characterized by the 5.7% decrease in average Purchasing Manager’s Index (PMI) to 49.6 in 2024 from 52.6 average recorded in 2019 has led to a significant increase in business operating expenses, which has affected the profitability of the business. The graph below shows the trend in the number of applications for insolvency during each year:

Source: Office of the Official Receiver

*data up to November 2024

Section II: The Insolvency Act of 2015

The Insolvency Act was assented into law in September 2015 and came in to assist insolvent companies in strategizing on the best possible solution to bring the company back to financial stability rather than liquidation, with a view to preserving businesses, jobs and tax base as much as possible. Prior to 2015, stakeholders faced the possibility of losing a significant amount, especially in the event that the company’s liability value was higher than the total assets held. The Insolvency Act of 2015 seeks to create a more robust and effective insolvency framework in Kenya by:

- Focusing on rehabilitating struggling businesses rather than liquidating them, allowing viable companies to recover and continue operations, which helps preserve jobs and economic value,

- Enhancing transparency and predictability in the insolvency process, promoting trust among creditors, investors, and the public, which is vital for attracting foreign investment.

- Offering options for business restructuring, the Act helps maintain access to credit, especially for SMEs, fostering economic growth and enabling businesses to repay debts.

- Ensuring fair treatment of both creditors and debtors, providing clear guidelines for asset distribution and allowing creditors a more active role in the restructuring process, and

- Aligning Kenya's insolvency laws with international best practices, improving the legal framework's efficiency and enhancing Kenya's attractiveness for cross-border trade and investment.

Some of the key features and provisions in the act include:

- Types of Insolvency Proceedings - The Act outlines various insolvency proceedings such as administration, receivership, liquidation, and company voluntary agreements. It provides procedures for initiating and filling claims in insolvency proceedings.

- Appointment of Insolvency Practitioners - Licensed insolvency practitioners are appointed to oversee insolvency cases. They are responsible for managing the assets and liabilities of the insolvent party, ensuring fair distribution to creditors, and facilitating the resolution process. They include the Official receiver, Bankruptcy Trustee, Liquidator and Administrator.

- Powers of Insolvency practitioners – The Insolvency practitioners have a fiduciary duty of acting in the best interest of the creditors and stakeholders involved in the insolvency process. The Act provides for the powers of insolvency practitioner with regard to carrying out the business of the insolvent company. Additionally, it also highlights some of the powers that can be excised with or without the approval of the courts or the creditors.

- Moratoriums - The Act allows for the issuance of a moratorium period during which creditors cannot take legal action against the debtor. This allows for an opportunity to reorganize and rehabilitate the debtor's financial position.

- Priority of payment to preferential creditors - In insolvency proceedings, claims are ranked based on their priority level and this is important in determining the order in which the claim will be paid from the available assets of the insolvent debtor to the stakeholders

- Cross-Border Insolvency - The Act provides mechanisms for dealing with cross-border insolvency cases, including cooperation with foreign courts and recognition of foreign insolvency proceedings.

- Role of the Courts in Insolvency Proceedings – The act has provided for the powers of the court to review, rescind the appointment of an insolvent practitioner, allow the substitution of the creditor, and stay the application of insolvency, among others.

Section III: Financial health of a company and warning signs

Assessing the financial health of a company is crucial for investors, creditors, and other stakeholders to understand the company’s ability to meet its financial obligations, manage risks, and sustain long term operations. It helps in identifying warning signs of potential financial distress and allows stakeholders to take corrective actions before the situation worsens. There are a number of indicators that are used in accessing the financial health of a company, which include:

- Profitability – This indicator measures the company’s ability to generate profit relative to its assets, equity, expenses, and revenue. It shows an investor whether the company can survive on its own in the long run without having to rely on additional financing from alternative sources. Some of the ratios used to assess profitability include Return on Assets (ROA), Return on Equity (ROE), EBITDA (Earnings Before Interest Income, Taxes, Depreciation, and Amortization), and Net Profit Margins. A positive ratio is an indication of a profitable company, and vice versa.

- Liquidity – This indicator measures the company’s ability to settle its short-term obligations relative to its available cash and the assets that can be easily converted to cash. A company should be able to settle its expenses and debts without delay. Some of the ratios used to assess liquidity include the current ratio and the quick ratio. A value greater than 1.0 indicates that the company can easily settle its short-term obligations without delays.

- Solvency - This indicator measures the company’s ability to settle its long-term obligations relative to its total assets, or equity. In the event of the winding up of a company, it is expected that both creditors and shareholders will be able to get back the funds they have lent and invested. Some of the ratios include the debt-to asset ratio and the debt-to Equity ratio. A value less than 1.0 indicates that the company is highly solvent and is able to meet all its long-term obligations.

- Efficiency – This indicator measures how well a company is able to utilize its assets to generate income and the management's ability to control the company’s expenses and liabilities. Efficiency has a high correlation with profitability, given that the more efficiently the company's resources are used, the more profitable the company becomes.

- Cash flow – This indicator measures the company’s ability to generate and manage cash to cover operational expenses, investments, and other financial obligations. Cash flow provides insights into a company's liquidity, solvency, and overall financial stability. A positive cash flow is an indication that the company is able to generate sufficient cash to run its operations, as it is generating more than it is spending.

These indicators provide a comprehensive view of a company's financial health. However, they only give relevant insight about the company when compared with the indicators of companies within the same industry or compared to the historical indicator values of the company. The analysis of the financial health of the company is crucial in identifying potential risks and enabling one to take the appropriate actions to address those risks. Some of the warning signs of Insolvency include:

- Persistent loss-making trend: A sustained loss trend over multiple periods can erode a company's equity base, thereby reducing its ability to cover its financial obligations and indicating a potential deterioration of its financial position.

- Increase in debt levels - Rapidly growing debt, especially short-term debt, will lead to the possibility of overextending loans and credit facilities, which will strain a company's finances, thus increasing the default risk.

- Delayed payments - Consistent delaying of payments to suppliers and employees can be an indication that the company is facing cash flow problems and is struggling to meet its short-term liabilities.

- Negative cash flow – When the company's operating cash flow is consistently negative, it indicates that it's not generating sufficient cash from its core operations. This could be partially attributable to the high level of obsolete or slow-moving inventory, which hinders the company's ability to generate cash from sales.

- Numerous legal actions – Lawsuits can have significant negative impacts on a company's financial health, reputation, operations, and overall stability. They can be expensive to defend, requiring legal fees, court costs, and potential settlement payments. The financial burden can strain a company's resources, affecting its cash flow and profitability.

- A low Credit score - A downgrade of a credit score by a Credit rating agency's company is a result of the company's deteriorating financial condition and indicates a higher default risk. This will lead to either the company taking more expensive risks, which will overburden its finances, or the company facing challenges in obtaining new loans.

It's important to note that while these indicators and warning signs can provide insights into a company's financial health and potential risk of insolvency, a comprehensive assessment should consider the company's industry, competitive landscape, and overall economic conditions. However, experiencing one or a few of these warning signs does not necessarily mean a company is insolvent. A combination of these indicators, especially if they persist over time, warrants careful analysis and consideration by stakeholders. In the event the company becomes insolvent, the Insolvency Act contains provisions for corporate rescue mechanisms to help financially troubled businesses restructure and avoid liquidation. The advantages of these provisions include:

- Preservation of the value of the assets - By addressing the financial issues and restructuring the company's operations, assets, and liabilities, it may be possible to preserve the underlying value of the business. This can prevent a complete collapse and potential liquidation, which could result in significant losses for all stakeholders

- Debt Reduction and Negotiation - Restructuring often involves negotiating with creditors to restructure debt repayment terms. This can lead to reduced debt burdens, extended payment periods, or even partial forgiveness of debt, making it more manageable for the company to recover.

- Continued Operations - A well-planned restructuring can enable the company to continue its operations, maintain relationships with customers and suppliers, and honor existing contracts. This can be especially important for businesses with ongoing projects or long-term partnerships.

- Improved Efficiency - Restructuring provides an opportunity to assess and optimize the company's operations, streamline processes, eliminate inefficiencies, and allocate resources more effectively. This can lead to improved profitability and competitiveness.

- Access to New Capital - In some cases, restructuring may attract new investors or lenders who are willing to provide capital to support the company's recovery efforts. This injection of funds can help stabilize the company's finances and fuel its growth.

- Creditor Satisfaction - Creditors may benefit from a structured repayment plan that is more likely to lead to higher recovery rates compared to liquidation. This can lead to more favorable outcomes for both secured and unsecured creditors.

Key to note is that the overall success of a restructuring process depends on various factors, including the severity of the financial distress, the willingness of stakeholders to cooperate, the expertise of the professionals involved, and the overall economic environment.

Section IV: Business Restructuring options under the Insolvency Act

Business restructuring for an insolvent company involves a series of strategic and operational changes aimed at improving the company's financial health, addressing its insolvency, and ensuring its long-term viability. The goal of a restructuring is to reorganize the company's operations, debt, and assets in a way that enables it to overcome financial challenges and continue its business activities. In Kenya, insolvency proceedings are primarily governed by the Insolvency Act of 2015. The act provides for how insolvent companies can be assisted to service creditor’s obligations and protect the interests of all stakeholders. The options available for such an insolvent company include;

- Administration –The primary objective of administration is to rescue the company as a going concern, preserve its value, and maximize returns for creditors rather than immediately liquidate its assets. It is headed by an Administrator, a certified Insolvency Practitioner, who may be appointed by an administration order of the court, unsecured creditors, or a company or its directors. Once an administration application is filed, an automatic moratorium (legal stay order) is imposed, preventing creditors from taking legal action to recover debts or seize assets. This moratorium allows the company and the administrator time to assess the situation, develop a restructuring plan, and implement necessary changes without immediate pressure from creditors. Once the administrator has achieved the objectives of administration, the company can exit administration, which could involve returning control of the company to its directors, implementing a restructuring plan, or transitioning to another form of insolvency proceedings if necessary.

- Company Voluntary Arrangements - This arrangement is entered into when a company is insolvent and the directors propose to the company’s creditors the best way to save the company from liquidation. The proposal consists of repayment plans where the company seeks to extend its repayment period and the debt is repaid through regular installments as opposed to settling the payment dues in full. The directors appoint an insolvency practitioner to supervise the voluntary arrangement. Once the proposal is approved by both the company, the creditors, and the Courts, the voluntary agreement remains binding on the company and the creditors until it ceases. Important to note: banking and insurance companies are not legally allowed to pursue this option.

- Receivership – In this process, the primary objective is to realize and sell the firm’s assets and help settle the outstanding debts. A firm’s creditors may appoint an independent certified Insolvency Practitioner to act as a fiduciary (a receiver’) for the firm to realize and sell the firm’s assets and help settle the outstanding debts. In the banking sector, the CBK can put banks under receivership, as in the case of Imperial Bank and Chase Bank. The Kenya Deposit Insurance Act, No. 10 of 2012, allows the CBK to appoint the Kenya Deposit Insurance Corporation (KDIC) as the sole and exclusive receiver of any institution.

- Liquidation – Liquidation is a common insolvency proceeding whereby a company is wound up after all its assets and liabilities are identified in order to pay off creditors to the greatest extent possible. Liquidation proceedings can be initiated by a court in Kenya or can be voluntary in nature, where the company members or creditors make a liquidation application.

During the insolvency process, the debts of a company are paid out in order of priority. The purpose of prioritization is to ensure that essential debts are settled before other claims are addressed. Under the Insolvency Act, the priority of payment for preferential creditors in Kenya is as follows:

- First Priority Claims – These consist of the expenses incurred in procuring the orders for the insolvency. They Include the fees for the Insolvency practitioner, the costs incurred by the person who applied to the court, and the costs incurred in protecting, preserving, and recovering the value of the assets.

- Second Priority Claims – These are paid out after the first priority claims are settled. They consist of all the wages and other compensations of the employees of the companies. They are given a second priority to ensure that employees are not left without their due compensation.

- Third Priority Claims – These claims rank third after the first and second priority claims have been settled. They consist of tax liabilities of the company, such as Income tax, Value Added Tax (VAT), and Excise tax, among others.

After preferential creditors have been paid, any remaining assets are used to settle the claims of secured creditors (those with collateral) and then the claims of unsecured creditors (those without collateral). Shareholders and equity holders are usually at the bottom of the priority list and are often the last to receive any remaining funds, if there are any left after satisfying higher-ranking claims.

Section V: Case studies

- Blueshield Insurance Company

Blue Shield Insurance Company Ltd was established on December 4, 1982, and quickly became a key player in Kenya’s insurance sector. In September 2011, due to significant financial challenges, Blue Shield was placed under statutory management by the Insurance Regulatory Authority (IRA). This intervention aimed to address the company's inability to meet its obligations to policyholders and other creditors. Mr. Eliud Muchoki Muriithi served as the first statutory manager from September 15, 2011, to July 4, 2014.

On May 22, 2017, the Insurance Regulatory Authority (IRA) filed a petition, to liquidate Blueshield Insurance Company Limited, citing that the company was insolvent and unable to meet its financial obligations to policyholders and creditors. They argued that Blueshield's liabilities far exceeded its assets, rendering it incapable of continuing operations as a going concern. Furthermore, they asserted that statutory management, which had been instituted to address the financial challenges and stabilize the company, had failed to yield any viable turnaround strategies.

In 2021, the shareholders submitted evidence suggesting that the company had become solvent again, claiming that it had Kshs 547.0 million in assets. They argued that the company could be revived by injecting new capital, aided by the potential sale of its prime property. They further argued that the company’s building, estimated to be worth Kshs 1.5 billion, was viewed as a potential asset to be liquidated and reinvested into the business. This was seen as a key element in the shareholders' argument that the company could be revived and its debts settled. Despite these claims, the company had verified liabilities amounting to Kshs 855.0 million, which included court judgments, service provider vouchers, and other financial obligations. This starkly contrasted with the company’s solvency claim and contributed to the call for liquidation. In addition, according to court documents, the statutory managers presented evidence from audits by the Auditor General and Parker Randall, which revealed that Kshs 767.5 million was improperly accounted for, coupled with Ksh 512.5 million relating to mismanagement in rent collection. Furthermore, as of 2013, the company’s capital was below this threshold by Kshs 23.0 million, contributing to its financial troubles. According to the Insurance Act, 11 assets are excluded from consideration when determining an insurer’s capital adequacy. This includes all fixed assets. In this regard, the company’s building valued at Kshs.1.5 billion could be taken into consideration.

On July 3, 2024, the High Court issued a liquidation order against Blueshield Insurance Company Ltd, concluding that the company could not be resuscitated. Mr. Long'et Terer, MBS, was appointed as the liquidator to manage the company's affairs, including securing and preserving its assets.

In our view, the 13 years of administration without a clear and effective restructuring plan for Blueshield Insurance reflect a failure in management and a missed opportunity for recovery. Despite considering several proposals, none were implemented, and shareholders did not inject the necessary capital to meet regulatory requirements. This lack of decisive action raises concerns about the transparency and accountability of the administration process.

- Mastermind Tobacco

Mastermind Tobacco (K) Ltd. is a Kenyan tobacco company that was established in 1986 by the late Wilfred Murungi. Over the years, it grew to become one of the largest tobacco manufacturers in Kenya, producing a range of well-known brands such as Dunhill, Marlboro, and Rothmans under license. The company is known for its dominance in the East African market, not only in Kenya but also across the region, with a significant market share in the tobacco sector. Mastermind Tobacco became one of Kenya's largest private companies, operating in a competitive market and employing a substantial workforce.

However, the company faced significant financial challenges over the years, both from Kenya Revenue Authority (KRA) and its lenders. In a gazette notice dated 22nd December 2023, I&M Bank placed Mastermind Tobacco under administration due to the company's inability to meet its debt obligations of an undisclosed amount effectively halting its operations and leading to the termination of approximately 1,000 employees. Pongangipalli Rao was appointed an insolvency practitioner in a bid to recover the amounts owed to them

The company’s troubles were further compounded by tax disputes with the Kenya Revenue Authority (KRA). In 2019, Mastermind agreed to sell prime assets to settle a KES 2.9 bn tax arrears. Additionally, in October 2024, the company lost an appeal against a decision by the Tax Appeals Tribunal that upheld a Kshs 517.8 mn tax demand issued by the KRA.

As of December 2024, assets owned by Mastermind Tobacco, including its head office and factory in Syokimau, Kimathi House in Nairobi, and various tracts of land, are scheduled for auction on January 24, 2025. This auction is anticipated to mark the end of an era for the tobacco manufacturer.

In our view, Mastermind Tobacco’s collapse highlights missed opportunities to address its financial challenges earlier, including negotiating with I&M Bank and resolving tax disputes with KRA, which might have prevented asset auctions and safeguarded value. Additionally, the auctioning of assets like the Syokimau factory and Kimathi House will likely yield less value than expected due to the short notice and the nature of distressed sales, leaving both creditors and other stakeholders with substantial losses, while the termination of 1,000 employees underscores the broader economic impact. The insolvency practitioner must ensure a transparent auction process to maximize recoveries and fairly allocate proceeds.

- Kaluworks

Kaluworks was set up in 1929 and was one of Kenya’s leading aluminium products such as utensils and roofing sheets, before the country started to see an influx of imports of similar materials. This came at a time when Kaluworks was on an aggressive expansion drive and had invested Kshs 1.8 bn to upgrade its factory in Mariakani Mombasa, both initiatives largely funded through debt from Commercial banks. This was also followed by interruptions brought about by the COVID-19 pandemic, which saw a slowdown in building activities in the country. In a gazette notice dated 18th June 2021, one of the main creditors, placed Kaluworks under receivership on May 27th 2021 by virtue of being holders of a qualifying floating charge. The creditors include NCBA Banks which was owed Kshs 4.3 bn, Cooperative Bank, which was owed Kshs 4.8 bn, while other unsecured lenders such as I&M Bank, commercial paper holders such as Sanlam Kenya held a combined of Kshs 3.5 bn. Pongangipalli Rao was appointed an insolvency practitioner in a bid to recover the amounts owed to them. On 25th August 2022, the High Court of Kenya in Nairobi, consented to the termination of administration of Kaluworks Limited under the Company Voluntary Agreement between Kaluwork’s and the secured creditors, with Orlando Mario da Costa-Luis appointed as the supervisor in the gazette notice dated 16th September 2022, effective 26th August 2022. NCBA Group and Cooperative Bank agreed with the administrator and Kaluworks Limited to write off a total Kshs 6.4 bn out of the total Kshs 9.1 bn owed to them, equating to a 70.0% haircut. In the agreement, NCBA was to receive Kshs 580.0 mn while Cooperative bank received Kshs 680.4 mn. In the tabled agreement, Kaluworks shareholders agreed to a Kshs 1.2 bn capital injection.

In our view, the Insolvency act gave Kaluworks Limited a fighting chance, which may not have been achieved through liquidation given that the company owed a total of Kshs 12.6 bn against its realizable assets worth Kshs 1.3 bn. Additionally, the restructuring plan gives the other unsecured creditors future hope of realizing the amounts once the company is back on its feet. Key to note, its successful exit from administration highlights how collaborative efforts from all stakeholder are crucial in saving a business.

- Mobius Motors

Mobius Motors, a Kenyan automobile manufacturer founded in 2011 by British entrepreneur Joel Jackson, aimed to produce affordable, rugged SUVs tailored for Africa's challenging terrains. Despite initial success and backing from investors like Playfair Capital and Chandaria Industries, the company faced significant financial challenges leading to its liquidation in August 2024.

Mobius Motors struggled with escalating debts, including tax demands from the Kenya Revenue Authority (KRA). The company's financial strain was exacerbated by high taxation and interest rates in Kenya, which dampened vehicle demand. Efforts to secure additional capital from existing shareholders and attract new investors were unsuccessful, further hindering the company's ability to sustain operations and pursue profitability. Operationally, Mobius faced difficulties in settling supplier payments and employee salaries, which complicated its viability. Additionally, the company contended with stiff competition from imported second-hand vehicles, which were often more affordable for consumers. This competition made it challenging for Mobius to capture a significant market share.

On August 5, 2024, during a shareholders' meeting, it was resolved to place Mobius Motors under liquidation. KVSK Sastry was appointed as the liquidator to oversee the winding-up process, and a meeting with the company's creditors was scheduled to consider the insolvency and approve the appointment of the liquidator. However, in a turn of events, Mobius Motors accepted a takeover bid from an undisclosed buyer on August 14, 2024, effectively preventing its voluntary liquidation. The transaction was expected to close within 30 days, offering a potential lifeline for the company's operations.

Despite the acquisition, the challenges that led to Mobius Motors' financial difficulties highlight the complexities of automotive manufacturing in Africa, including funding constraints, market competition, and operational hurdles.

In our view, the case of Mobius Motors highlights the importance of proactive decision-making during financial distress. The shareholders’ resolution for voluntary liquidation allowed for a controlled process that ultimately facilitated a last-minute acquisition, averting the company’s dissolution. This underscores the flexibility of voluntary liquidation compared to court-ordered processes, as it creates opportunities for alternative outcomes such as restructuring or attracting buyers.

Summary of Various Insolvencies:

The table below shows a summary table of various recent insolvencies in Kenya;

|

Cytonn Report: Data on Various Insolvencies |

||||

|

Company |

Amount Owed (Kshs bn) |

Amount Recovered (Kshs bn) |

Recovery % |

Total Haircut |

|

Blueshield Insurance Company |

0.9 |

-* |

0.0% |

100.0% |

|

Mastermind Tobacco |

3.4 |

-* |

0.0% |

100.0% |

|

Kaluworks Limited |

12.6 |

6.2 |

49.2% |

50.8% |

|

Average |

|

|

|

87.7% |

|

*Not disclosed |

||||

Source: Cytonn Research

Below is a list of recently announced insolvencies;

|

Cytonn Report: Recently announced insolvencies |

|

|

Company |

Date announced |

|

Presbyterian Foundation - Milele Beach Hotel (Under receivership) |

19-Dec-24 |

|

Countryside dairy limited (In liquidation) |

21-Nov-24 |

|

Put Sarajevo General Engineering Company (In liquidation) |

10-Nov-24 |

|

The Vodacom Business Kenya (In liquidation) |

28-Oct-24 |

|

Sky Food Limited (Under administration) |

25-Oct-24 |

|

Multiple Hauliers Limited (Under administration) |

18-Oct-24 |

|

Avo Distribution Group Limited (In liquidation) |

7-Oct-24 |

|

Nebange Limited (Under administration) |

9-Sep-24 |

|

Global Supply Solutions Limited (Under receivership) |

25-Jul-24 |

|

Skyplus Solutions Limited (In liquidation) |

9-Jul-24 |

Source: Kenya Gazette, Various issues

Section VI: Challenges facing insolvency practice

Insolvency practice in Kenya has evolved significantly with the enactment of the Insolvency Act, 2015. This legislation was intended to streamline insolvency processes and offer a more structured framework for handling financial distress in both corporate and personal contexts. However, practitioners and stakeholders continue to grapple with a variety of challenges that hinder the effective realization of the Act's objectives. Below are some of the key challenges facing insolvency practice:

- Corruption – Insolvency is seen as an avenue to dismantle companies and sell their assets for cheap, usually to pre-identified individuals rather than an avenue to resuscitate struggling businesses as was the original statutory intent.

- Poor track record- The greatest challenge facing insolvency in Kenya today is its poor track record, with no notable examples of successful restructuring. The Insolvency Act was intended to deliver better outcomes for creditors and stakeholders by preserving value, safeguarding jobs, and maintaining the tax base. However, the insolvency framework has largely functioned as a process for orderly winddowns or bankruptcies. While the current regime ensures a more organized process compared to the previous system, the anticipated benefits of business survival and continuity have yet to materialize,

- Lengthy and Costly Processes-The insolvency process in Kenya is often characterized by delays and high costs. Court processes, which form a significant part of insolvency proceedings, are typically slow due to backlog and procedural complexities. Additionally, insolvency process often involves engaging professionals such as lawyers and accountants, whose fees can be substantial. These costs, which are given first claim during asset realization, can significantly reduce the value available for creditors. For example, the administration cost of ARM Cement incurred a total of Kshs 2.5 billion which was too high considering it was over 40.3% of the total amount recovered. Keeping administration costs low ensures creditors recover meaningful amounts and aligns service providers with the interests of creditors,

- Liquidation being most popular option- Many creditors, regulators, and businesses lack sufficient knowledge about administration, leading to hesitation in accepting it as a viable restructuring option. In contrast, liquidation is often preferred because of its simplicity, providing a clear and definitive process for realizing and distributing value. This straightforwardness appeals to creditors, suppliers, and stakeholders. Additionally, liquidation is typically faster than other restructuring methods, making it more attractive to creditors. For instance, the administration of ARM Cement, which began in 2018 and concluded in 2022, almost 5 years,benefiting service providers rather than creditors. Accelerating the administration process would ensure better outcomes for creditors,

- Weak Corporate Governance and Financial Reporting- Poor corporate governance and inadequate financial reporting are common issues in Kenya. These problems often come to light during insolvency proceedings, complicating the efforts of administrators or liquidators to assess the true financial position of a distressed entity. The case of Chase Bank Kenya revealed significant gaps in governance and accounting practices, for example, two differing FY’2015 statements were released. The bank’s initial FY’2015 statements showed that Chase Bank had loaned out a total of Kshs 5.7 bn to employees, directors and shareholders while the restated statements indicated the insider loan amounts were Kshs 13.6 bn, Kshs 7.9 bn higher than the previously published statements,

- Managing Stakeholders Interests – Insolvency practitioners need to manage the task of balancing the interests of diverse stakeholders, including creditors, shareholders, employees, and regulators. These conflicting interests can complicate decision-making and negotiations. For example, in Nakumatt case, retail creditors holding commercial paper resisted collaboration with the administrator, demanding either full repayment or liquidation. This approach resulted in a total loss for the creditors, whereas an equity restructuring could have preserved value, now being capitalized on by competitors like Carrefour,

- Lack of good will from companies in distress –Transparent and accurate information is essential for informed decision-making and effective strategy development. However, insolvency practitioners often report a lack of cooperation from distressed companies in sharing critical information. This hinders practitioners' ability to fully understand the company’s financial situation, leading to potentially flawed decisions. Additionally, the Office of the Official Receiver has observed an increase in cases where company owners secure court injunctions to delay proceedings, using the time to strip company assets while litigation drags on,

- Negative publicity around administration-Administration, particularly when not fully understood by all stakeholders, can jeopardize business continuity. The process often generates negative publicity and uncertainty, which can significantly harm the business and potentially lead to its total collapse, and,

- Complexity of Cases - Insolvency cases are often highly complex, involving numerous stakeholders, intricate financial arrangements, and a range of legal and operational challenges. Successfully managing these complexities demands significant expertise and experience. Moreover, insolvency practitioners must manage large volumes of information, which can be time-consuming and potentially delay progress toward their objectives.

Section VII: Recommendations and Conclusions

Improving insolvency practice involves addressing various aspects of the process to enhance efficiency, transparency, stakeholder cooperation, and overall effectiveness. These include:

- Effective Oversight: Parliament should play a more effective oversight role. Its now 10 years of the Insolvency Act 2015 without anything concrete to show in terms of realizing the statutory intent of the legislation. Parliament should review the 10 year track record versus the statutory intent.

- Early Intervention: Taking timely action to address financial distress can lead to more viable and cost-effective solutions. Proactive measures might prevent the situation from deteriorating further and becoming more complex.

- Need for a Success Story to Change the Narrative: The industry urgently requires a success story to counter the negative perception of insolvency professionals as "business undertakers" and highlight their role in fostering business recovery and continuity.

- Transparent Communication: Clear and open communication among stakeholders and insolvency professionals helps streamline processes and avoids misunderstandings that could lead to additional costs.

- Encourage Out-of-Court Settlements: Establishing mechanisms to promote mediation and out-of-court agreements between creditors and debtors can significantly reduce the time and cost associated with formal restructuring processes.

- Efficient Asset Realization: Developing a well-planned strategy for selling assets ensures maximum returns and minimizes associated costs. Streamlined marketing and sales processes reduce unnecessary expenses.

- Incorporating Debt-to-Equity Swaps: Promoting the use of debt-to-equity swaps for companies with strong recovery potential can be highly effective. Businesses with solid market positions, promising revenue streams, or strategic assets can benefit from this approach. Creditors, in turn, gain a stake in the company’s future success, incentivizing their support for turnaround efforts.

- Appropriate Professional Selection: Selecting experienced and reputable insolvency professionals with relevant expertise in restructuring ensures high-quality service delivery while managing costs effectively.

- Streamline Regulatory Frameworks: Governments and regulatory bodies should focus on creating clear and consistent insolvency regulations that facilitate efficient processes, protect creditors, and ensure fair treatment of stakeholders.

The Insolvency Act of 2015 aims to establish a robust and effective insolvency framework in Kenya, fostering a conducive business environment and safeguarding the interests of all stakeholders involved in the insolvency process. By restructuring debts, reducing financial pressures, and maintaining business continuity, the Act provides mechanisms to help businesses recover. However, the success of any restructuring process depends on the company’s ability to adhere to repayment plans, secure creditor support, and implement restructuring strategies effectively.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor