May 12, 2019

The Retirement Benefits Industry plays a huge role in the economy. According to the Organization for Economic Co-operation and Development (OECD) in 2017, assets in Retirement Benefits Schemes totaled 50.7% of GDP in the OECD countries and 19.7% of total GDP in the non-OECD jurisdictions. It is clear that most non-OECD countries still have a long way to go in the growth of the sector. In Kenya, the Retirement Benefits Assets as a percentage of GDP stood at 13.4%, compared to more developed markets like the USA at 84.1% and the UK at 105.3%. Over the last decades, we have seen reforms and education initiatives by the Retirement Benefits Authority (RBA) to educate people on the importance of saving for retirement. The industry has registered great growth from both member contribution and good performances leading to the assets under management growing to Kshs 1,166.6 bn in 2018, from Kshs 287.7 bn 10-years ago, translating to a compound annual growth rate of 14.3% over the last 10-years.

We cannot emphasize enough on the importance of saving for retirement, as everyone will have needs at retirement. These needs may vary greatly for different people, but everyone will have basic needs and expenses such as home maintenance or rent, transportation, medical care etc. In order to enjoy your retirement years, one needs a stable source of income, and the primary way to achieve this is through disciplined saving, and investing these funds to grow by gaining interest and returns. This can be achieved by signing up to a registered Retirement Benefits Scheme and contribute to it during your working years, therefore, pension systems and retirement benefits schemes are necessary for developing countries like Kenya.

In this week’s note, we focus on understanding the Retirement Benefits Schemes in Kenya, and as such we shall cover the following;

- General Background and Governance of the Retirement Benefits Industry

- The Kenya Retirement Benefits System

- Types of Retirement Benefits Schemes

- Investments and Returns of Retirement Benefits Schemes

- Drivers of Change in the Retirement Benefits Industry

- Conclusion

Section I. General Background and Governance of the Retirement Benefits Industry

The Retirement Benefits Industry in Kenya has undergone major changes in the last few years which has led to a pension coverage of about 20% of the current working population. This is a significant improvement in comparison to the years leading up to 1997 where the industry was generally unregulated and thus characterized by lack of protection of the interests of the members in management of scheme affairs. In the absence of a clear regulatory framework, some of the challenges that faced the Retirement Benefits Industry, which led to the enactment of the Retirement Benefits Act in 1997 include;

- Arbitrary investment of funds without autonomous professional advice,

- Mismanagement and embezzlement of scheme funds by Trustees,

- Schemes not being satisfactorily funded thus unable to fulfill their promises to retirees in spite of members making their contributions, and,

- Records not being well kept.

The Retirement Benefits Act in 1997 created the Retirement Benefits Authority (RBA) whose mandate is to oversee and regulate the industry’s management as well as to develop and promote the Retirement Benefits sector. Since the enactment of the Retirement Benefits Act, the industry has experienced remarkable growth in terms of assets under management, which stood at Kshs 1.2 trillion in June 2018. The Retirement Benefits Authority has been keen in promoting good governance by continously updating the regulations and enforcing the same in the schemes. The regulations requires each scheme to have the following service providers;

- A Board of Trustees or a corporate Trustee who are the owners of the Scheme and are responsible for the running of the scheme affairs,

- An Administrator whose duties are to deal with the day to day accounting of the Scheme,

- Fund Manager who executes the Trustees’ Investment Policy Statement, and,

- A Custodian who holds all assets of the Scheme.

Administrators, Fund Managers, and Custodians must be registered by the RBA.

Section II: The Kenyan Retirement Benefits System

The Retirement Benefits System predominantly covers the working population in both the public and private sector. The system has three pillars;

- The Zero Pillar – it comprises the state funded pension for citizens over the age of 65 and provides a basic income. This is managed by the Ministry in charge of social protection,

- The First Pillar – is contributory and mandatory to all workers. The mandatory contribution is by both employer and employees and it targets workers in both the formal and informal sectors. This is where the National Social Security Fund (NSSF) comes in, and ,

- The Second Pillar – is mainly employer based and contributory except for the Civil Service Pension Scheme and County Schemes as are currently constituted.

Section III. Types of Retirement Benefits Schemes

Retirement Benefits Schemes allow their members to make regular contributions during their working life and once a member retires either after attaining the retirement age or earlier due to other factors, mainly ill-health, these contributions plus accrued interest are utilized to provide retirement income to the member. Retirement Benefits Schemes in the Kenyan market are broadly categorized into two, and the main difference between the two is the mode of payment at retirement. These categories are;

- Pension Schemes

At retirement, the contributions from both the employee and employer plus accrued interest are utilized to purchase a pension annuity from an insurance company/Approved Issuer with the provision that a member may take a maximum of one third of the amount as a Lump Sum and the balance is utilized to purchase an annuity. An annuity is an arrangement whereby a life office/insurance company, in exchange for purchase price/money, enters into a contract to pay a set amount of money every year while the annuitant (the person on whose life the contract depends) is still alive, and

- Provident Funds

At retirement, a member of a provident fund receives their contribution and contributions made on their behalf by the employer plus accrued interest as a lump sum. The member may decide to purchase an annuity with or use the money as he deems fit.

Retirement Benefit Schemes can also be classified based on modes of contribution and investment of the contributions:

- Mode of contribution

- Umbrella Retirement Benefits Schemes: These are schemes that pool the contributions of multiple employers and their employees thereby reducing the average cost per member and enhancing the overall returns and benefits to the members.

- Individual Retirement Benefits Schemes: These are schemes where individuals can contribute directly into the scheme towards saving for their retirement. The contributions are flexible in order to accomodate an individuals financial circumstances.

- Mode of investment of the contributions

- Segregated Funds: In these schemes, members’ contributions are invested directly by the Trustees via an appointed Fund Manager. The Trustees establish an appropriate Investment Policy which is then implemented by the Fund Manager. The scheme directly holds the investments and the returns are fully accrued to the scheme for the benefit of members

- Guaranteed Funds: This is a scheme offered by insurance companies where the members’ contributions are pooled together. The insurance company guarantees a minimum rate of return (the maximum by law being 4%) and should the actual return surpass the minimum guaranteed rate, the insurance company tops up the minimum rate with a bonus rate of return

Based on the risk profile of the Board of Trustees, a scheme could choose to either be in a Guaranteed Fund for the conservative schemes who are risk averse or a segregated fund for the more aggressive scheme who are seeking higher returns and are willing to take more risks. For individuals; the choice of whether to invest in an Umbrella Retirement Benefits Scheme or an Individual Retirement Benefits Scheme largely depends on your nature of employment and whether or not your employer offers this benefit as is in the case with Umbrella schemes because the employer will have to make contributions on behalf of their employees while and Individual determines and makes contributions on their own behalf.

Section IV. Investments and Returns of Retirement Benefits Schemes

Every Retirement Benefits Scheme must formulate an Investments Policy Statement (IPS) for the scheme that should be followed when investing the scheme's funds. The IPS outlines the process for a Retirement Benefits Schemes’ investment related decision making as well a the investment limits per each asset class for the schemes funds. The IPS should however not conflict with the limits dictated by the RBA Investment Guidelines (Table G) as highlighted below.

|

Retirement Benefits Authority Investment Guidelines |

|

|

Asset Classes |

RBA Max Limit |

|

East African Government Securities |

90% |

|

Fixed & Time Deposits |

30% |

|

Commercial Paper, Non-listed bonds and other debt instruments issued by private companies |

30% |

|

Corporate Bonds, Mortgage Bonds and Loan Stock |

20% |

|

Listed Equities |

70% |

|

Unlisted Equities |

5% |

|

Private Equity and Venture Capital |

10% |

|

Offshore |

15% |

|

Property |

30% |

|

Real Estate Investment Trusts |

30% |

|

All exchange-traded derivative contracts |

5% |

|

Cash & Cash Equivalents |

5% |

|

Any other assets |

10% |

Allocation of Retirement Benefits Schemes Assets

Returns for pension schemes have been plummeting over the years owing to the fact that traditional fund managers have been shy of the alternative investments, which offer higher returns. This is attributable to lack of expertise in the area and the unwillingness to get out of their comfort zone. Some of the general factors affecting returns include the size of the scheme, the asset class allocation strategy adopted by the Trustees as per the investment policy adopted and the prevailing economic environment in addition to the efficiency of the fund manager.

The Table below details the Investment allocation by schemes in the various asset classes in Kenya.

|

OVERALL INDUSTRY INVESTMENT VS STATUTORY MAXIMUM |

|||||

|

No |

Assets Category |

Jun-16 |

Jun-17 |

Jun-18 |

Statutory Maximum |

|

1 |

Government Securities |

25.5% |

36.7% |

36.3% |

90.0% |

|

2 |

Quoted Equities |

15.6% |

18.7% |

20.7% |

70.0% |

|

3 |

Immovable Property |

15.2% |

21.2% |

19.7% |

30.0% |

|

4 |

Guaranteed Funds |

12.2% |

10.8% |

13.7% |

100.0% |

|

5 |

Listed Corporate Bonds |

4.7% |

4.9% |

3.6% |

20.0% |

|

6 |

Fixed Deposits |

3.4% |

4.7% |

2.7% |

30.0% |

|

7 |

Offshore |

0.6% |

1.0% |

1.3% |

15.0% |

|

8 |

Cash |

1.0% |

1.4% |

1.6% |

5.0% |

|

9 |

Unquoted Equities |

7.5% |

0.4% |

0.3% |

5.0% |

|

10 |

Private Equity |

0.0% |

0.0% |

0.0% |

10.0% |

|

11 |

Real Estate Investment Trusts (REITS) |

0.0% |

0.1% |

0.1% |

30.0% |

|

12 |

Commercial paper by private companies |

0.0% |

0.0% |

0.0% |

30.0% |

|

13 |

Unclassified/Others |

14.1% |

0.0% |

0.0% |

10.0% |

|

|

TOTAL |

100.0% |

100.0% |

100.0% |

|

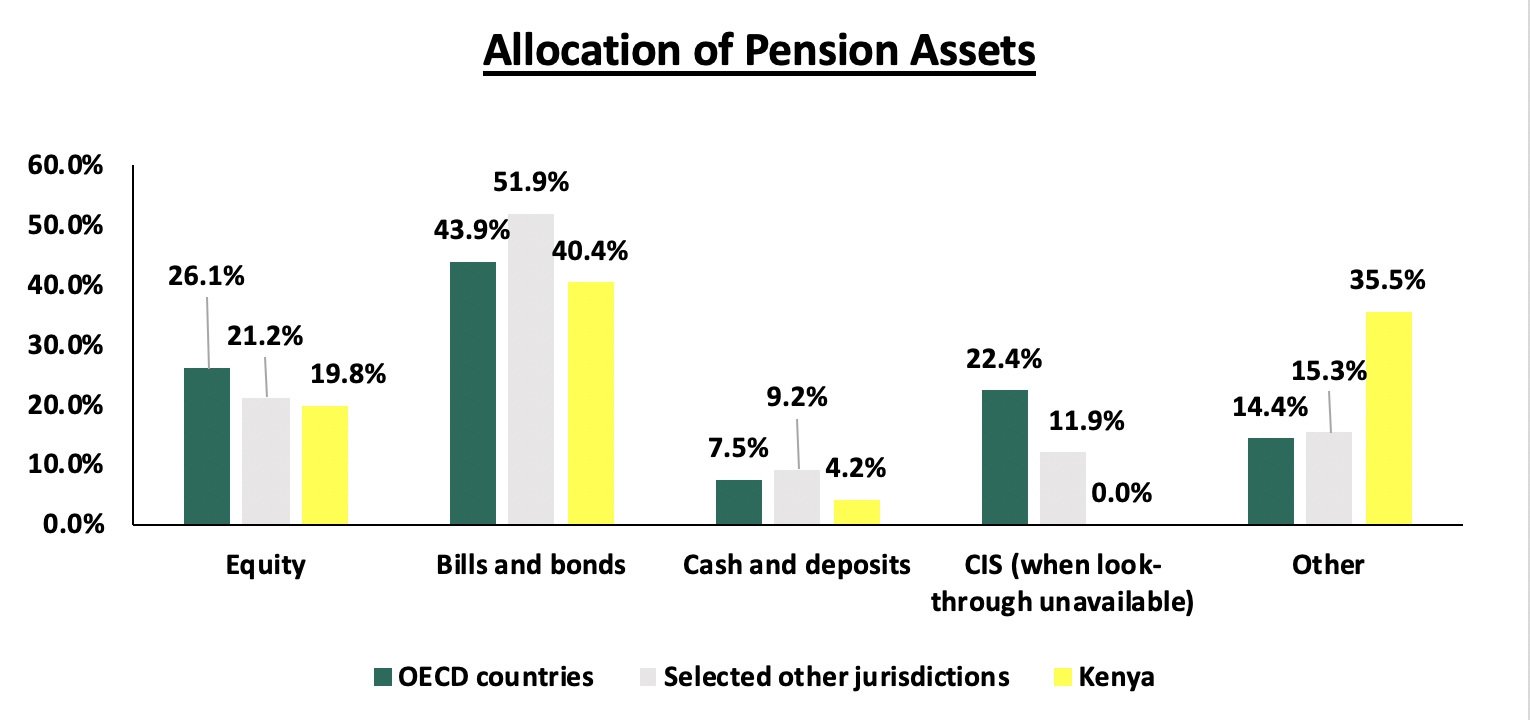

According to Organization for Economic Co-operation and Development (OECD), Retirement Benefits Schemes assets are mainly invested in fixed income securities and equities in over 80% of OECD reporting jurisdictions. On average Equities represented 26.1% of the investments of Retirement Benefits Scheme assets in OECD jurisdictions, and an average of 21.2% in non-OECD jurisdictions. This is in contrast to Kenya where representation in Equities accounts for 19.8% as shown in the chart below. Regulation may also require pension funds to hold a minimum proportion of pension assets in some instruments (e.g. in Poland, pension funds must hold at least 15% in equities in 2017 while investments in treasury bonds are banned). This is a clear indication that non-OECD countries have a bias towards allocating to government bonds.

As capital markets have grown and regulators have advanced, the Allocation of pension funds invested into equities has increased. According to IFC, South African Retirement Benefits Schemes whose combined Assets Under Management amount to USD 500.0 bn take up roughly 40% of the assets on the Johannesburg Stock Exchange. In Kenya, local currency bill and bonds prevail, this is despite the regulation allowing for a 10% and 30% allocation to Private Equity and REITs respectively. As at June 2018, the total Retirement Benefits Assets Allocated to Private Equity and REITs stand at 0.04% and 0.09% respectively. The asset allocation to Government Securities and Quoted Equities on the other hand stand at 36.3% and 20.7% respectively in the same period.

Returns of Retirement Benefits Schemes

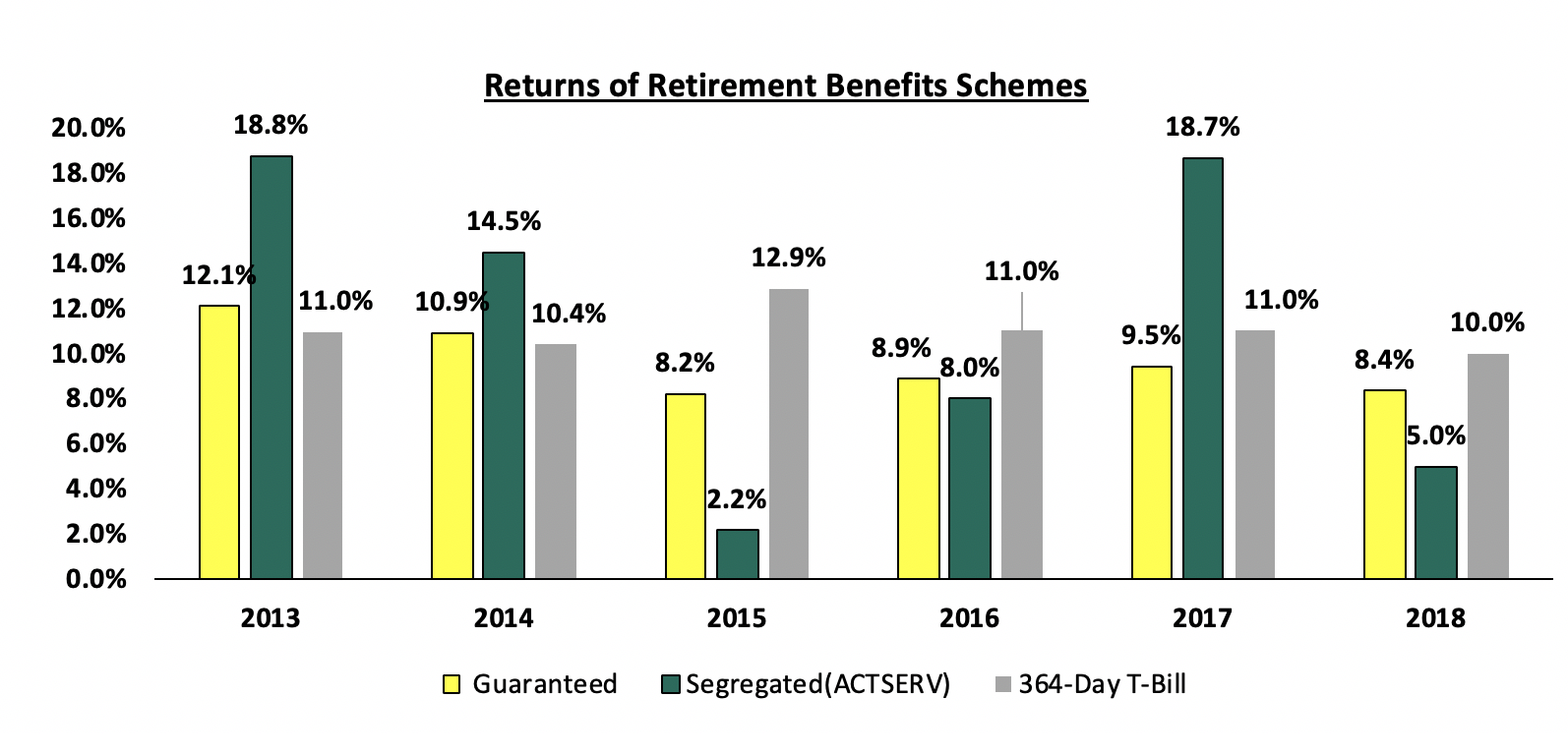

Segregated funds have mostly offered above market average returns, with the average yearly rate standing well above other instruments in the market. Below is a chart summarizing the returns offered by Guaranteed Funds and Segregated Funds over the last six years, compared to returns of a 364-Day treasury bill:

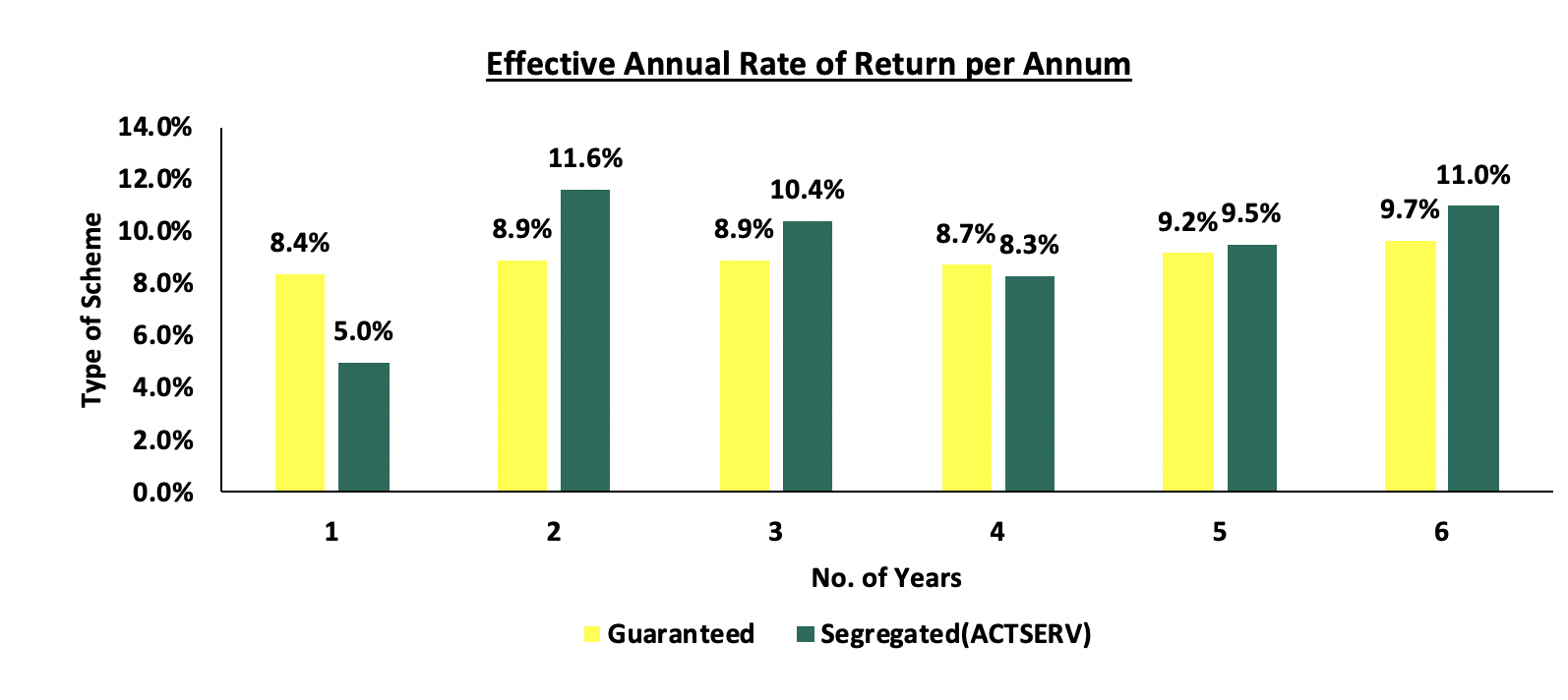

Below is a table of the effective annual rate of return per annum for the same period.

From the above chart, it is clear that if one invested in a segregated fund, the cumulative rate of return over the 6-year period would be more (i.e. 11.0%) than if invested in a Guaranteed Fund in the same period (9.7%). This is despite the low performance of segregated funds in 2015 and in 2018.

Section V. Factors Driving Growth of the Retirement Benefits Industry

Given that the Retirement Benefits Industry continues to evolve and there is increased knowledge of investments, the sector has and is expected to do well owing to the following factors:

- Demographic Factors. Due to a young, rapidly growing population, the Assets Under Management (AUM) of Retirement Benefits Schemes continue to increase steadily with the overall AUM standing at KShs 1.2 tn as at June 2018, from KShs 287.7 bn in 2008 as more people are joining the workforce and saving for retirement;

- Macroeconomics. Kenya has a compelling growth story which the Retirement Benefits Industry is set to enjoy. The country’s economic growth has continued to grow with Kenya recording a GDP growth of 6.3% in 2018 and a 5 year average growth of 5.4%. This brings about a conducive business environment with better returns. Furthermore, low-interest rates in the market as evidenced by the 2018 returns for the 182-day T-Bill and the 364-Day T-Bill at 9.0% and 10.0% respectively, fuel search for yield. This pushes more schemes to shift from the more traditional forms of investments to alternative investments, as evidenced by the growth in asset allocation in immovable property to 21.0% as at December 2017 from 18.5% as at December 2015;

- Social Change. As it is with the African Culture, the need to save for old age was deemed to be a foreign concept owing to the fact that your dependants are/were supposed to cater to your needs in the old age. However, with globalization taking the centre stage, parents are now relieving their children of the burden of having to take care of them in old age. This is in addition to the fact that more and more people are leaving the workforce much later than their predecessors did and are more aware of the need to actively save for retirement;

- Legislation. The legislation around Pension funds has been beneficial to the industry driving growth of the overall assets under management in the industry;

- Financial Awareness and Inclusion. Access to information has improved in the last decade, allowing for people to access information required via the use of technology enabling faster responses to queries and grievances. In addition to this, there are various training and education initiatives most notably, the Retirement Benefits Authority has created initiatives to increase pension penetration, by educating the public on the importance of saving for retirement, and,

- Trustees Certification programs Trustees of Retirement Benefits Schemes have to be certified Trustees through the Trustee Development Program Kenya(TPDK)

Updates and Trends in the Retirement Benefits Industry

There are various trends that have affected the Retirement Benefits Industry in Kenya and have forced the industry to change in order to cope with these trends. These include;

- Social insurance programs. Some countries have responded by introducing social insurance programs that do not require citizens during their working years to pay into them. These “social pensions”, also called universal minimum pensions, are entitlements financed entirely out of the government’s general revenue paid out to certain categories of individuals, In Kenya the ”inua jamii“ initiative under the Ministry of Labour and Social Protection, citizens over the age of 65 receive a monthly stipend of Kshs. 2000 payable bi-monthly and are also covered under the National Health Insurance Fund(NHIF);

- Changing nature of work. The changing nature of work is upending traditional employment and the gig economy, part-time jobs, contracts and other diverse and fluid forms of employment are growing. Most social protection systems are based on mandatory contributions and payroll (labour) taxes on formal wage employment but as the formal employment numbers continue to decline, the state of future social insurance requires more thought in terms of its framework and execution. Recently, the Retirement Benefits Authority has partnered with the Micro and Small Enterprise Retirement Benefits Authority to increase its membership and assets held by pension schemes by targeting small-scale enterprises in the informal sector (e.g. artisans, vegetable vendors, mechanics and other small entrepreneurs). Recent studies indicate that most jobs in Kenya are now found in the informal sector, where for long there was no defined pension arrangement;

- Technology. Technology in recent years has transformed from a luxury item to a necessary evil and is now a way of life. This has assisted in the improvement of delivery systems for social protection programs and is currently being used to facilitate tax collection by increasing the number of registered taxpayers and social security contributions. This is in addition to Mobile money which ensures that the ‘common mwananchi’ has a means of making regular payments to their pension scheme at their convenience;

- Regulatory Environment. Some of the regulatory changes that we have seen in the recent years include;

- The NSSF Act 2013 was passed into law on the 24th December 2014 with an effective date of 1st June 2015. The Law is however not in force due to an impending court ruling. Once the new Law is in force, NSSF contributions will go up to 12% of one’s pensionable salary shared between the employee and employer equally. Currently, the payments by each employee is 5% of their basic salary or Kshs. 200 whichever is less. The employer also currently matches the Employee contributions.

- Changes in investment asset classes. Pension schemes are expected to venture into investing in alternative assets classes, given the broadening of the allowable investment categories. Recently real estate investment trusts (development and income), private equity and venture capital, derivatives and exchange-traded funds were introduced as new products. The Retirement Benefits Authority undertakes regular reviews of investment asset classes to align them with market developments, enhance portfolio diversification, manage risks and boost returns. The Retirement Benefits Authority has proposed to the government that it allow for the 15th Investment Asset Class for debt financing of public-private partnership (PPP) projects approved under the PPP Act for infrastructure or housing to be utilized by schemes. This is expected to further diversify investment opportunities for pension schemes.

- Medical Fund. As part of resolving this growing challenge, in 2016 the government through the National Treasury introduced provisions in the retirement benefits regulations to facilitate savings for medical benefits in retirement;

- Mortgages Members of Registered Retirement Benefits Schemes can use their accumulated benefits (up to 60%) as collateral to secure a mortgage loan to own a home while at the same time saving towards a secured retirement. The Scheme Trustees’ only issue a guarantee to the Lending Institution as a secondary security and as such no funds are transferred from the scheme.

Section VI. Conclusion

In order to enjoy your retirement years, one needs a stable source of income and given that formal employment is no longer an option, it is important to sign up to a registered Benefits Scheme and make regular contributions in your employed years. Aside from reducing poverty in old age, some of the benefits of saving through a retirement benefits scheme include (i) Provision of regular income to replace earnings in retirement, (ii) Provision of lump sum benefit income for surviving dependants in the event of your passing, (iii) It serves as one of the most secure forms of savings, (iv) Retirement Benefits Schemes separate members’ retirement benefits assets from the Company’s assets and, (v) Retirement Benefits Schemes offers Tax reliefs which include; income tax relief on employee contributions as well as the fact that Retirement Benefits Schemes do not pay income or capital gains tax on investment returns. In addition to this, part of retirement benefits may be paid as a tax-free cash sum.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.