Mar 7, 2021

According to the Kenya National Bureau of Statistics (KNBS) FinAccess Report 2019, the pensions industry has witnessed significant growth with the number of registered members growing by a 10-year CAGR of 15.7% to 3.0 mn members in 2019, from 0.7 mn registered members in 2009. Additionally, Assets Under Management have grown by a 10-year CAGR of 15.8% to Kshs 1.3 tn as of December 2019, from Kshs 0.3 tn in 2009. This growth has been attributed to the mass education drives on the importance of retirement savings by the Retirement Benefits Authority and the industry players. Financial technology has also played a huge role by; i) making it easier for Kenyans to join and contribute to pension schemes, and, ii) improving the communication between the schemes and members.

This week, we turn our focus to the historical performance and asset allocation of pension schemes in Kenya with a key focus on 2020. We will also analyze some of the asset classes such as offshore investments and alternative investments that pension scheme performances can leverage more on in order to improve the welfare of their members. Therefore, we shall look at the topic in five different sections:

- Introduction to Retirement Benefits Schemes in Kenya,

- Historical Pension Schemes Allocation,

- Performance of Pension Schemes,

- Other Asset Classes that Pension Schemes can take advantage of,

- Challenges affecting Growth in the Pensions Industry in Kenya, and,

- Conclusion and recommendations;

Section 1: Introduction to Retirement Benefits Schemes in Kenya

A retirement benefits scheme is a savings avenue that allows contributing individuals to make regular contributions during their productive years into the scheme and thereafter get income from the scheme upon retirement. There are a number of benefits that accrue to retirement benefits scheme members, including:

- Income Replacement – Retirement savings ensure that your income stream does not stop even when you stop working. After retirement, many experiences a decline in the amount and stability of income relative to their productive years. Retirement savings ensure that this decline is manageable or is non-existent and enables you to be able to live the lifestyle you desire even after retirement,

- Compounded and Tax-free interest – Savings in a pension scheme earn compounded interest which means that your money grows faster as the interest earned is reinvested. Additionally, retirement schemes’ investments are tax exempt meaning that the schemes have more to reinvest,

- Tax-exempt contributions – Pension contributions enjoy a monthly tax relief of up to Kshs 20,000 or 30.0% of your salary whichever is less – this lessens the total PAYE deducted from your earnings,

- Avoid old age poverty – By providing an income in retirement, pension schemes ensure that the scheme members do not experience old age poverty where they have to rely on their family, relatives and friends for survival, and,

- Home Ownership - Savings in a pension scheme can help you achieve your dream of owning a home. This can be done through a mortgage or a direct residential house purchase using your pension savings. A member may assign up to 60.0% of their pension benefits or the market value of the property, whichever is less, to provide a mortgage guarantee. The guarantee may enable the member to acquire immovable property on which a house has been erected, erect a house, add, or carry out repairs to a house, secure financing or waiver, as the case may be, for deposits, stamp duty, valuation fees and legal fees and any other transaction costs required. On the other hand, a pension scheme member may utilize up to 40.0% of their benefits to purchase a residential house directly subject to a maximum allowable amount of Kshs 7.0 Mn and the amount they use should not exceed the buying price of the house.

There are different ways of categorizing pension schemes namely, based on type of membership, mode of investment, contribution and payment at retirement.

Section 2: Historical Pension Schemes Allocation

In Kenya, the Retirement Benefits (Forms and Fees) Regulations, 2000 provides investment guidelines for retirement benefits schemes in Kenya specifically on which asset classes to invest in and what the limits should be. Some of the investments assets include: government securities, fixed deposits, quoted equities and immovable property among others. In line with the regulators’ guidelines, pension schemes formulate their own Investment Policy Statements (IPS) that will act as guidance on how much they can invest in different assets and assists the trustees of the schemes to effectively supervise, monitor and evaluate the performance of the Fund’s investment assets. The IPS of the various schemes vary depending on the risk return profile and expectations largely determined by the demographic of the scheme members and the general economic outlook. For example, a pension scheme with a high ratio of members nearing the retirement age will not be heavily exposed to long-term and illiquid asset classes such as Immovable Property given that the scheme will need to pay out the retirement benefits to those retiring and such illiquid assets may be difficult to dispose. Therefore, such provisions will be reflected in the scheme’s IPS.

The table below shows how Kenyan pension funds have invested their assets in the past:

|

Kenyan Pension Funds Asset Allocation |

||||||||||

|

Asset Class |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

H1'2020 |

Average |

Allowable Limit |

|

Government Securities |

33.8% |

31.0% |

29.8% |

38.3% |

36.5% |

39.4% |

42.0% |

44.0% |

36.8% |

90.0% |

|

Quoted Equities |

25.5% |

26.0% |

23.0% |

17.4% |

19.5% |

17.3% |

17.6% |

14.2% |

20.1% |

70.0% |

|

Immovable Property |

17.2% |

17.0% |

18.5% |

19.5% |

21.0% |

19.7% |

18.5% |

18.6% |

18.8% |

30.0% |

|

Guaranteed Funds |

10.3% |

11.0% |

12.2% |

14.2% |

13.2% |

14.4% |

15.5% |

16.7% |

13.4% |

100.0% |

|

Listed Corporate Bonds |

4.4% |

6.0% |

5.9% |

5.1% |

3.9% |

3.5% |

1.4% |

0.7% |

3.9% |

20.0% |

|

Fixed Deposits |

4.9% |

5.0% |

6.8% |

2.7% |

3.0% |

3.1% |

3.0% |

3.4% |

4.0% |

30.0% |

|

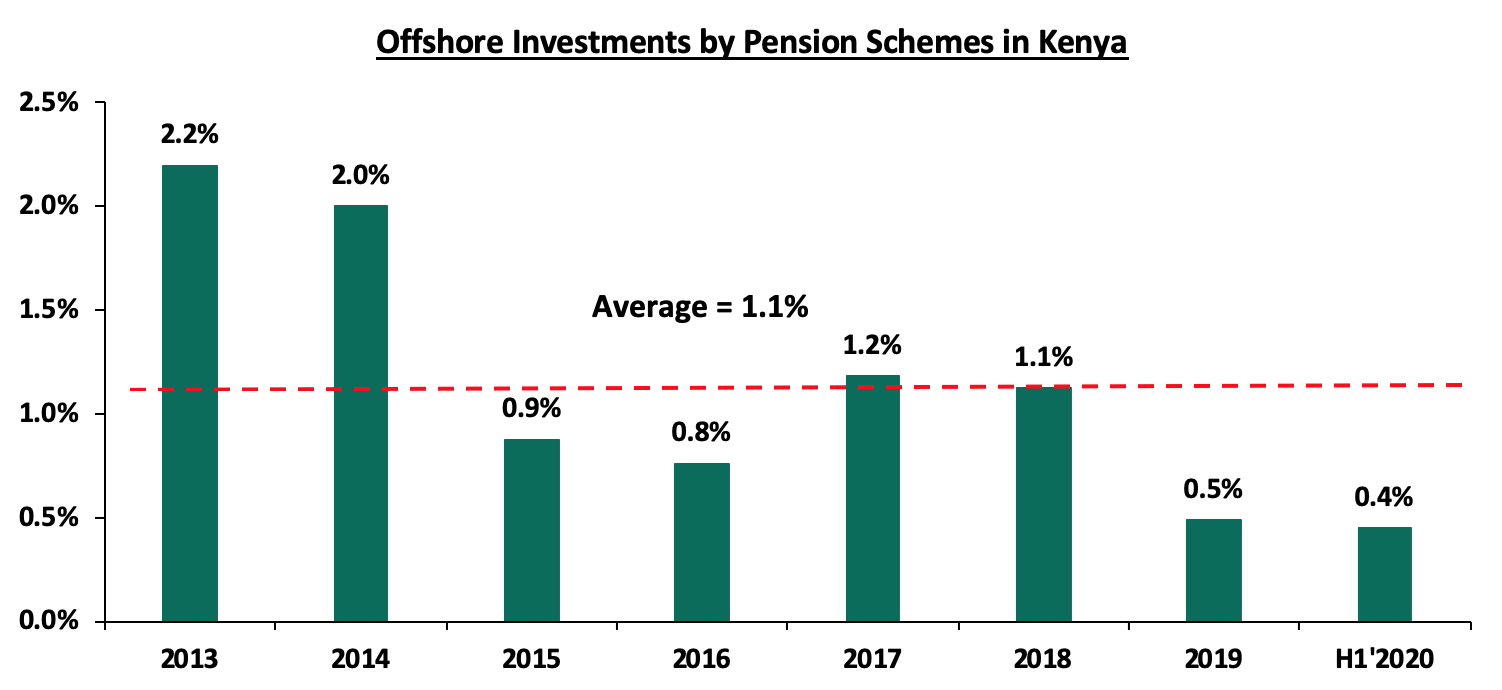

Offshore |

2.2% |

2.0% |

0.9% |

0.8% |

1.2% |

1.1% |

0.5% |

0.4% |

1.1% |

15.0% |

|

Cash |

1.3% |

1.0% |

1.4% |

1.4% |

1.2% |

1.1% |

1.2% |

1.6% |

1.3% |

5.0% |

|

Unquoted Equities |

0.6% |

1.0% |

0.4% |

0.4% |

0.4% |

0.3% |

0.3% |

0.2% |

0.5% |

5.0% |

|

Private Equity |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

10.0% |

|

REITs |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

0.0% |

0.0% |

30.0% |

|

Commercial Paper, non-listed bonds by private companies* |

- |

- |

- |

- |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0% |

|

Others e.g. Unlisted Commercial Papers |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0% |

|

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

||

|

Commercial paper, non-listed bonds, and other debt instruments issued by private companies were introduced as a new separate asset class category in 2016 through legal notice No. 107. |

||||||||||

Source: Retirement Benefits Authority (RBA)

Key Take-outs from the table above are:

- Historically, schemes in the country have allocated an average of 56.9% of their members’ funds towards Government securities and Quoted Equities over the period 2013 to H1’2020. The high allocation to government securities, an average of 35.9% over the last 7 years and highest among the asset classes invested in, can be attributed to the fact that pension schemes prioritize on safety of their members’ funds and prefer a high allocation to low risk investments,

- The allocation towards quoted equities declined to 14.2% in H1’ 2020, from 17.6% as of December 2019 as the equities markets were hit hard by the pandemic. This coupled with the increased allocation to government securities to 44.0% in H1’2020 from 42.0% and fixed deposits to 3.4% in H1’2020 from 3.0% recorded in December 2019, highlights capital flight towards safer investments as pension schemes fled the highly volatile equity markets, and,

- Pension schemes’ investments in offshore markets increased by 0.3% points to 1.6% in H1’2020 and 1.3% recorded in December 2019 attributable to the impressive performance of the asset class as it recorded 25.7% returns in the year 2019 as global markets performed better than expected especially in the United States and the currency depreciated as well.

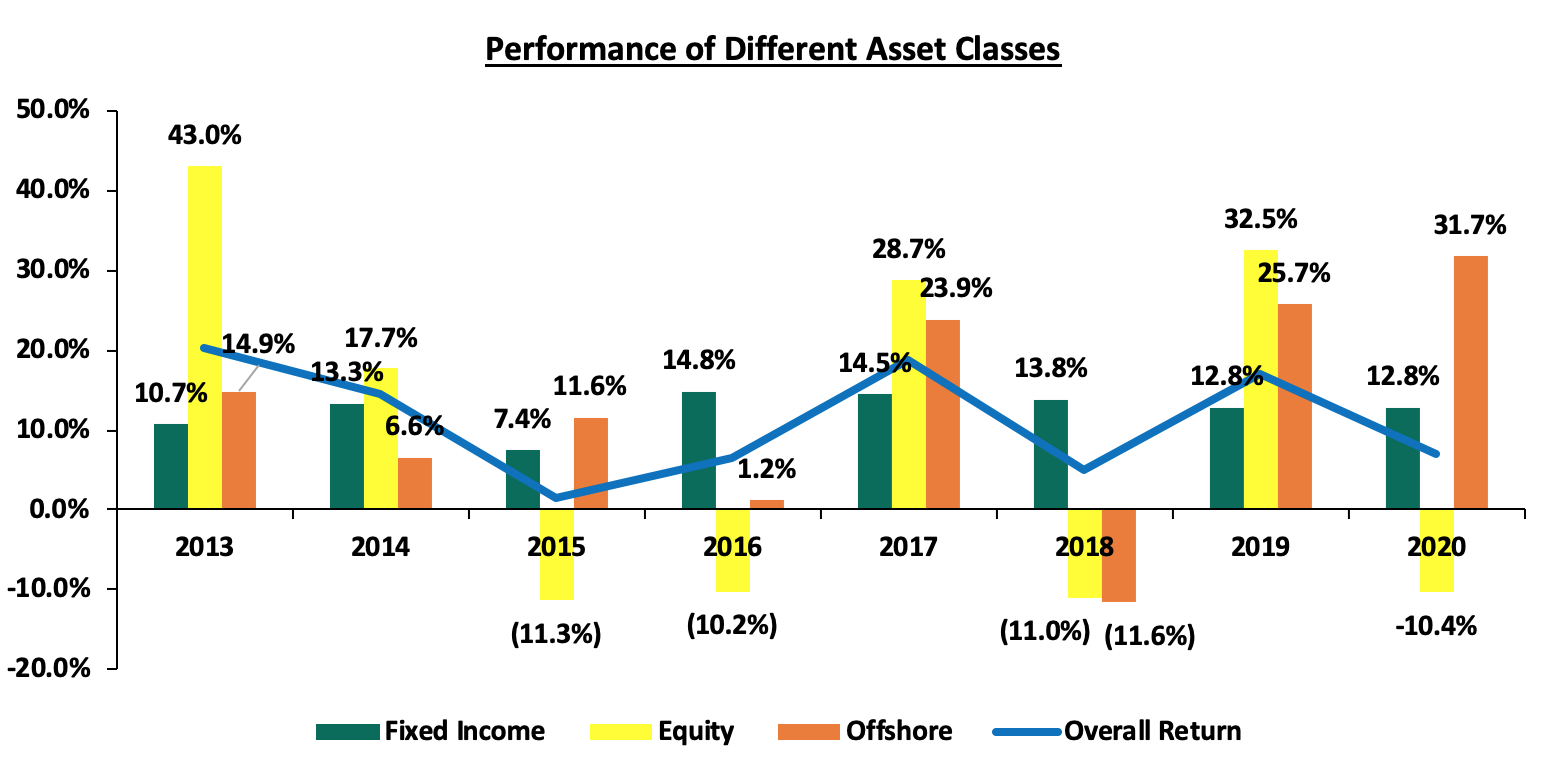

We switch gears now to the performance of the mentioned asset classes grouped in three broad groups, namely; Fixed Income, Equity and Offshore. Below is a graph for the performances over the period 2013 to 2020:

Source: ACTSERV Survey Reports (Segregated Schemes)

Key Take-outs from the graph above are:

- Offshore investments outperformed the other asset classes averaging 13.0% in the period 2013 to 2020 while investments made in fixed income and equity asset categories averaged 12.5% and 9.9%, respectively. Offshore investments recorded an impressive return of 31.7% in 2020, driven by the expected economic recovery, eased monetary policies and discovery of the Covid-19 vaccine coupled with the rally in tech stocks during the third and fourth quarters of the year. As the pandemic spread and made physical socializing and movement harder, many technology platforms became the go-to options for communication, shopping and working, for example, Google, Zoom and Amazon. Such stocks gained a lot of investors’ interest leading to their share prices being pushed up by the high demand. In Q3 and Q4 2020 there was an expectation of markets recovery in the global markets leading again to high demand for various listed shares leading to a bull run,

- Fixed income proved to be the source of stable returns with little volatility over the years, however, there has been a continuous decline of the returns over last 5 years to 12.8% from 14.8% recorded in 2016. This is mainly attributed to the Central Bank of Kenya’s (CBK’s) efforts over the years to maintain a stable interest rate environment. The yields on the 91-day, 182-day and 364-day T-bills declined to 6.9%, 7.4% and 8.3% in 2020 from 7.2%, 8.2% and 9.8% at the end of 2019, respectively, contributing in part to the lower overall pension scheme returns in 2020, as banks shied away from lending to the public due to the increased credit risks, and,

- The volatility of the equity markets was also mirrored in the pension schemes performance as it recorded a high of 43.0% in 2013 to lows of (11.3%) and (11.0%) in 2015 and 2018 respectively bringing the asset classes’ average performance to 9.9%. The continued volatility has led to pension schemes reduce their exposure to this asset class to 14.2% as of H1’2020, from 25.5% recorded in 2013. The poor performance in 2020 is attributed to the adverse effects of the pandemic which saw foreign investors turned net sellers, with a net outflow of USD 280.9 mn in 2020, compared to net inflows of USD 10.7 mn recorded in FY’2019, further exacerbating the negative performance. Notably, in 2020, NASI, NSE 25, and NSE 20 declined by 8.6%, 16.7%, and 29.6%, respectively.

Section 3: Performance of Pension Schemes

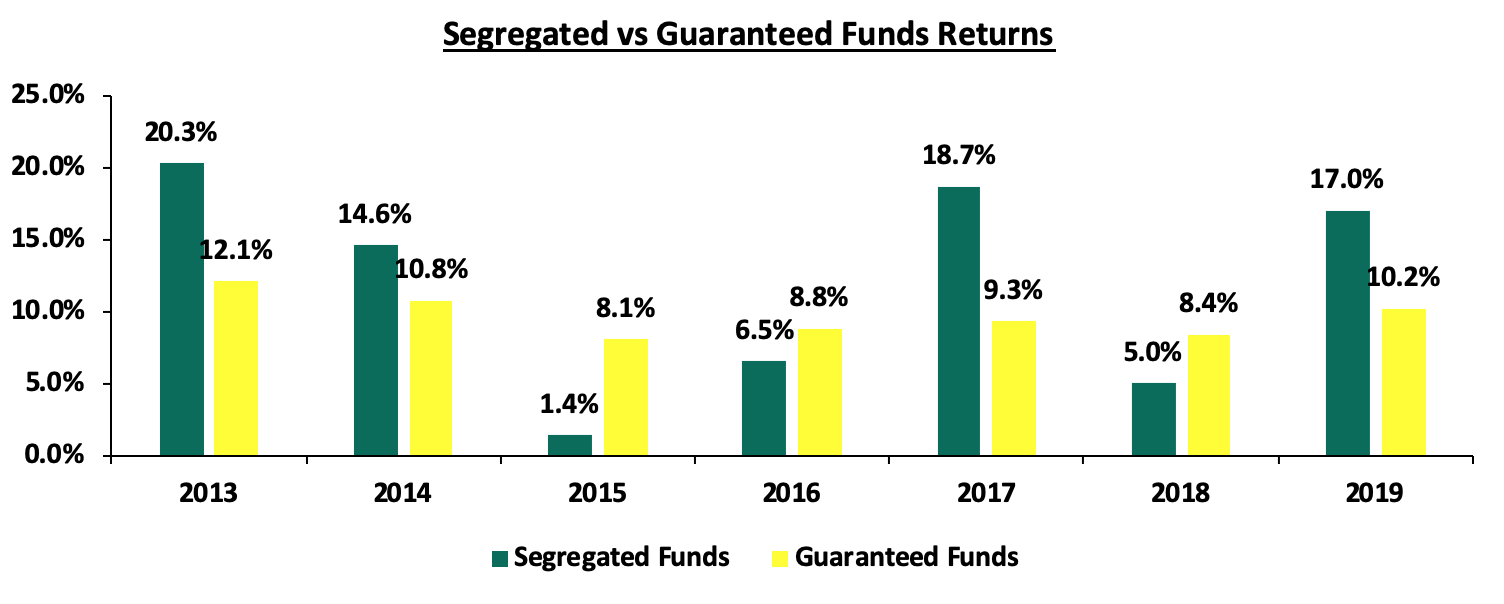

The average returns of the Guaranteed Funds over the period 2013 to 2019 was 9.7% whereas Segregated Schemes’ members enjoyed a higher return of 12.0% during the period. Key to note, segregated schemes performance fluctuates over the years reflective of the markets performance whereas guaranteed performance has remained somewhat stable over the years. The stability of returns is attributed to the fact that, unlike segregated funds, guaranteed funds do not have an obligation to distribute all the returns, net of fees, that they attain in a given year; instead they have an obligation to distribute the minimum guaranteed return regardless of their investments performance. The two types of schemes reflect the different risk profiles of Retirement Benefits Scheme members; those with a lower risk appetite prefer to join a Guaranteed Fund due to the fact that it guarantees a minimum return rate while those members with a relatively higher risk appetite can be found in segregated schemes as they are more comfortable with market fluctuations and seek higher interest rates. The chart below highlights the performance of the two types of pension schemes over a 7-year period:

Sources: ACTSERV Surveys, Cytonn Research

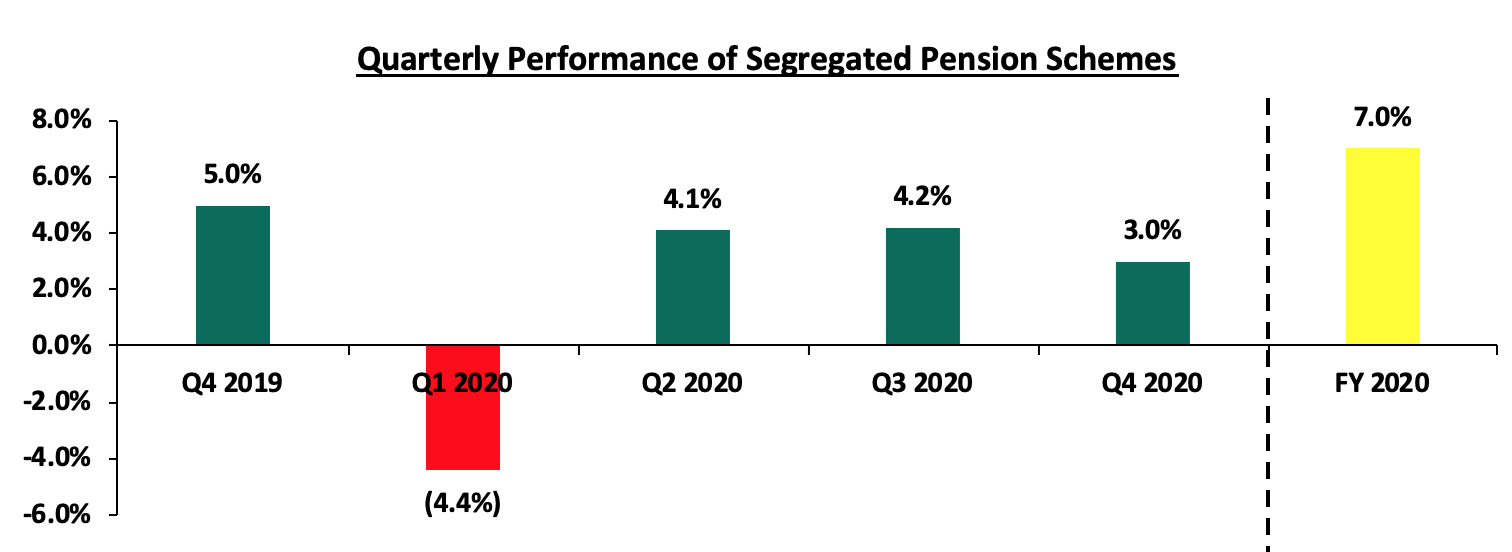

The poor performance of the Equity markets and the decline in the Fixed Income markets were mirrored in the Pension schemes’ performance given the high allocation in the two Markets. Some of the key impacts that the pandemic has had on retirement schemes include:

- A decrease in the value of assets in retirement savings accounts from falling financial markets;

- An increase in liabilities for guaranteed and defined benefits schemes – As many Kenyans lost their jobs, there were increased withdrawals to take care of day-to-day needs. This led to pension funds withdrawing some of their investments and in the process crystallize the losses made in the markets;

- A lower capability to contribute to retirement savings plans by individuals, and by both employers and employees. This is mainly attributable to lower disposable income at the hands of Kenyans in 2020 as many lost their jobs while others saw their salaries reduced as firms sought to reduce their expenses. According to the Kenya National Bureau of Statistics Quarterly Labour Force Survey Q2 2020, 1.7 million workers lost jobs in three months to June 2020 as the number of employed Kenyans dropped to 15.9 mn from 17.6 mn reported as of the end of March 2020, when Kenya first introduced lockdowns to curb the spread of Covid-19. It is key to note that employment levels bounced back in Q3 2020 to close at 17.7 mn;

- Low to negative returns which impacts the overall retirement income adequacy. In Kenya, according to the Retirement Benefits Authority, the income replacement ratio at retirement is below 40.0% compared to the recommended ratio of 75.0%. Income replacement ratio is a measure of the adequacy of your pension benefits to replace your last income before you retire. This remains a key concern that can be partly improved by positive returns and faster growth of scheme members’ funds

Source: ACTSERV Survey Reports (Segregated Schemes)

The overall return for segregated schemes during the year 2020 dropped to 7.0%, down from the 17.0% recorded in 2019. This was mainly attributable to the effects that the pandemic had on both the equity markets. We expect that as the gradual recovery of the economy as evidenced by the 6.3% YTD gain of the NASI and the upward shift of the yield curve will translate to improved returns for pension schemes in the country especially given the high allocation to equities and government securities.

Section 4: Other Asset Classes that Pension Schemes can take advantage of

Over the years, retirement benefits schemes have skewed their investments towards traditional assets, namely, Fixed Income and Equities Market, averaging 56.9% against the total allowable limit of 100.0% in these two asset classes. In terms of the Alternatives Market i.e. immovable property, Private Equity as well as Real Estate Investments Trusts (REITs), the industry has an average allocation of 18.8% against the total allowable limit of 70.0% in these asset classes. As such, we believe that this is an area that pension schemes can leverage their performance on by increasing allocation to these alternative asset classes.

- Offshore Investments

Offshore investments are investments made outside the jurisdiction or country in which the investor resides. The investor may be an individual, corporation or a fund looking to take advantage of tax incentives offered in other countries or to diversify their portfolio. Examples of offshore investments include (i) Mutual Funds, for the risk averse investors, (ii) Private Equity, for the investor with a high risk appetite, and (iii) Purchase of precious metals offshore.

Historically, pension schemes have consistently allocated over 75.0% over their assets in government securities, quoted equities and immovable property leaving alternative asset classes such as private equity, real estate investment trusts and offshore investments with little to work with. The average allocation to offshore investments in the period 2013 to 2019 is a mere 1.2% (Kshs 1.2 bn) of the total Kenyan retirement benefits industry assets. However, the Retirement Benefits Authority allows pension schemes to invest up to 15.0% of their assets in offshore investments in bank deposits government securities, listed equities, rated Corporate Bonds and offshore collective investment schemes reflecting these assets.

Source: Retirement Benefits Authority (RBA)

Key to note, the maximum allowable limit for offshore investments is 15.0%. Some of the reasons for the low allocation in the offshore investments in the pensions industry include; low financial awareness among pension trustees, high risk associated with the asset category and to a lesser extent high bureaucracy in investments decision making. Despite these challenges, we believe diversifying into offshore investments can help pension schemes by bolstering their returns by taking advantage of performances in the global markets and providing a hedge against local markets volatility. The optimal investment horizon is three to five years to fully take advantage of the returns.

Additionally, some offshore countries have laws that prevent the investor from certain legal actions such as seizure of assets and in this way, the offshore investment act as a type of “insurance”. Investing in offshore countries can also help to serve as a hedge against inflation and lower returns offered by asset categories in an investor’s home country.

- Alternative Investments (Immovable Property and Private Equity)

Alternative investments are supplemental strategies to traditional long-only positions in equities, bonds, and cash. They differ from the traditional investments on the basis of complexity, liquidity, and regulations. Alternative investments that pension schemes can invest in include immovable property, private equity and real estate investment trusts. The maximum allowable allocation to these assets is a total of 70.0% but historically pension schemes have allocated an average of only 18.8% in the period 2013 to H1’2020, with the vast allocation to immovable property, an average of 18.8% during the period.

Fund Managers’ low allocation in alternatives can be attributed to lack of expertise and experience with asset classes such as private equity and real estate, as investing in these asset classes requires detailed due diligence and evaluation as well as engaging legal, financial and sector-specific expertise.

We believe that there is value in the alternative markets that pension schemes can take advantage of. Some of the key advantages of alternatives include:

- Superior long term returns - Real Estate investments offer greater returns than traditional assets in the long term which is in line with pension schemes long term view. According to Cytonn Research, the average total return for Real Estate existing properties stands at 13.2% over the five-year period 2016 to 2020, with the government’s continued focus on affordable housing projects to serve the middle- and low-income earners with the aim of increasing home ownership, operationalization and licensing of the Kenya Mortgage and Refinance Company and Kenya’s economic recovery from the pandemic effects expected to be drivers of the industry in 2021. The returns also provide a hedge against the capital erosion brought about by inflationary pressures, and,

- Hedging against volatility – Immovable property has a low but positive correlation with equities and bonds such that in many instances should the traditional assets such as equities perform poorly, the performance of the Real Estate is not equally affected and this can help cushion the effects of the traditional asset’s performance.

Section 5: Challenges affecting Growth in the Pensions Industry in Kenya

As mentioned earlier, the pensions industry in Kenya has experienced commendable growth over the last 10 years. Some of the main factors that have contributed to this growth include:

- Demographic factors - Due to a young, rapidly growing population, the AUM of pension schemes has been growing as there is an almost continuous growth of people joining the workforce and saving for retirement. Further, according to the United Nations’ projections the corresponding population of youth aged 15-24 years and ready to join the workforce will increase from 9.5 mn to 18.0 mn over the period 2015 to 2065. This will likely increase pension scheme membership to a huge extent,

- Social Change - With globalization taking the centre stage, parents are now relieving their children of the burden of having to take care of them in old age. Additionally, more Kenyans are aware of the need to actively save for retirement,

- Legislation - The legislation around Pension funds has been beneficial to the industry driving growth. This includes tax reliefs, house ownership structures, access regulations and strict protection laws. The ability to reduce one’s tax liability by up to Kshs 20,000 or 30.0% of one’s salary by contributing to a pension scheme has served as a great incentive as Kenyans continue to take advantage of the current regulatory environment,

- Financial Awareness and inclusion – Increase in technology advancements, mobile penetration rate and internet connectivity in Kenya have led to more people being financially educated and have increased the ease of contributions and member communication, and,

- Trustees Certification programs – helps improve the management of the pension scheme and better equips the Trustees in carrying out their roles.

However, there still remains persistent challenges that have slowed down the growth rate, namely:

- Market Volatility – The uncertainty of investment returns has led to some Kenyans not being fully persuaded to contribute for their retirement in pension schemes for fear of losing their hard-earned cash. Pension schemes with high allocation to the Equity markets stand to lose as well due to the market volatility and risk of their members’ funds declining in value,

- Slowdown in economic growth and unemployment - According to data by the Kenya National Bureau of Statistics (KNBS) Quarterly Labour Force Survey Q4 2019, 39.8% (4.7 mn) of the 11.9 million Kenyan youth lacked some form of employment as of December 2019. Youth under 35 years are the worst hit by unemployment in an economy plagued with freezing of hires and struggling corporate earning with adults aged 20-34 accounting for 14.2% of the jobless people. This was further worsened by the pandemic in 2020 as millions of workers lost their jobs as many companies were forced to downsize. Reduced income levels hamper pension industry growth as there is reduced ability to save,

- Access of Pension savings before retirement –Employees have in the past opted to withdraw their pension savings immediately after leaving an employer. While withdrawing one’s pension savings especially after losing a job or experiencing financial trouble seems like a rational option, it is more self-defeating and short-sighted as we borrow money from our own future. This will negatively affect the adequacy of pensions upon retirement and lead to a lower quality of life after retiring. Withdrawing from pension schemes also slows down pension industry’s growth as it is money out of the schemes.

Section 6: Conclusion and Recommendations

Over the years, we have seen slight changes in the actual holdings of the retirement benefits schemes, with their allocation being skewed towards traditional assets. It is important for Fund Managers to have a well-balanced portfolio on a risk-return basis to ensure that they offer their members high returns and at the same time protecting their contributions. Ultimately, there are risks that pension funds cannot avoid such as systemic risk, however, diversification into other assets helps mitigate these risk and optimize returns. Overall, given the continued changes in the Retirement Benefits Industry and increased knowledge of investments, the sector is expected to do well both in terms of growth and returns offered to members. This can be further supported through:

- Increased education to Trustees: The RBA has also made it compulsory for Trustees of registered Retirement Benefits Schemes to be certified through the Trustee Development Program of Kenya (TDPK) which is commendable and will improve the trustees’ capability to manage schemes. We believe further education courses especially on the alternative and offshore investments will go a long way in demystifying the asset classes and enable schemes to increase their diversification,

- Increased Competition by the Various Players in the Market: The RBA has continued to issue licenses to new players in the market and this will beef up competition in the industry keeping the Fund Manager on their toes to ensure that they offer higher returns to their members, and,

- Innovation and Product Development: In 2020, the RBA and the Ministry of National Treasury released amendments to the Mortgage Regulations allowing pension scheme members to be able to buy houses using a portion of their benefits, and introduced a new asset class, Public-Private Partnership into the list of allowable list of asset classes to invest in. Through increased member education, we believe that schemes can leverage on these new regulations to the benefit of their members and draw more people into their schemes. Similar actions by the regulator and the continued interaction with the different service providers in the pensions industry will be key to increase the pension penetration rate in Kenya.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.