Dec 19, 2021

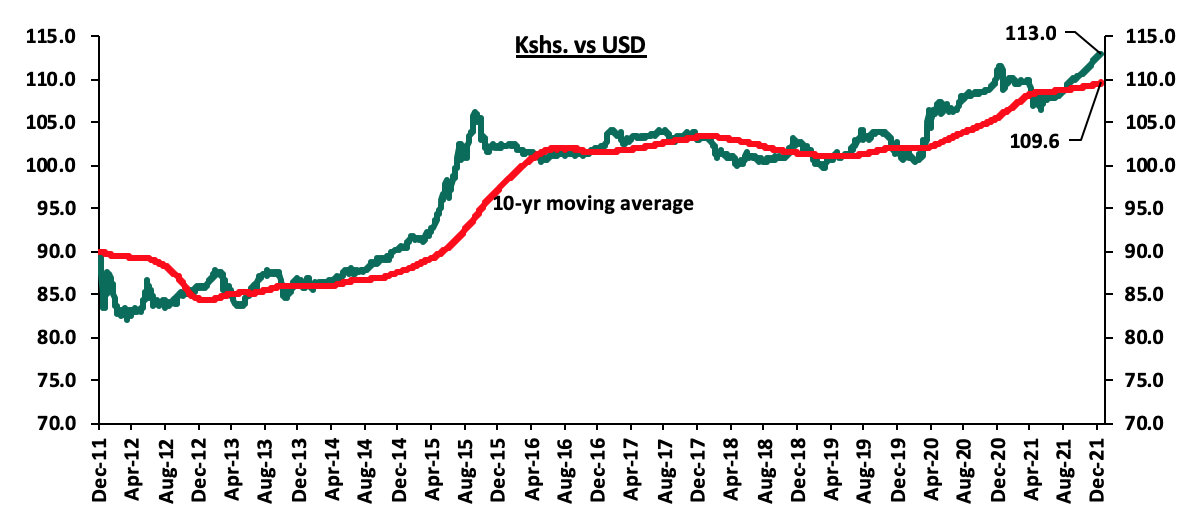

In 2021, the Kenyan shilling has depreciated by 3.5% against the US Dollar (USD), mainly attributable to the increased dollar demand by energy and general importers with Kenya largely being a net importer. Key to note, this decline, though lower than the 7.7% depreciation in 2020, has pushed the Kenyan Shilling to new all-time lows, with the shilling closing at Kshs 113.0 as at 17th December 2021. This poor performance of the shilling is mainly attributable to the increased dollar demand by energy and general importers, with Kenya largely being a net importer. Global oil prices have also increased during the year, attributable to the reopening of economies globally, which has seen demand outpace fuel supply, further inflating the country’s import bill and consequently weakening the shilling.

In the East African region, the currency markets have recorded a mixed performance, with the Ugandan and Tanzanian shillings gaining against the USD by 2.2% and 0.1% YTD, respectively, while the Rwandan Franc has recorded a YTD depreciation of 3.6%. With the Ugandan and Tanzania shillings appreciating amid the COVID-19 environment while the Kenyan shilling continues to depreciate is a cause for concern as Kenya has traditionally been the region’s economic powerhouse. Various concerns have also been raised on the country’s currency being overvalued, with the International Monetary Fund (IMF) in 2018 stating that the Kenyan currency is overvalued by 17.5%, based on several macroeconomic factors such the widening current account.

In this focus, we shall be focusing in detail the factors that have driven the performance of the Kenyan shilling in 2021. We shall cover the following:

- Historical Performance of the Kenyan Shilling,

- Factors driving the recent currency Performance,

- Outlook, and,

- Conclusion and recommendation.

Section I: Historical Performance of the Kenyan Shilling

In the period 2013-2019, the Kenyan shilling remained relatively stable against the USD, however, the economic shocks occasioned by the COVID-19 pandemic in 2020 caused volatility of the shilling leading to a depreciation of 7.7% in 2020 and a further 3.5% in 2021, on a YTD Basis. The 2020 depreciation was mainly on the back of increased dollar demand as investors preferred holding onto hard currencies during the period, coupled with a decline in dollar inflows from both exports of goods and services like tourism. The chart below illustrates the performance of the Kshs against the USD over the last 8 years;

Source: Central Bank of Kenya

Below are some of the factors that have been supporting the shilling from further depreciation;

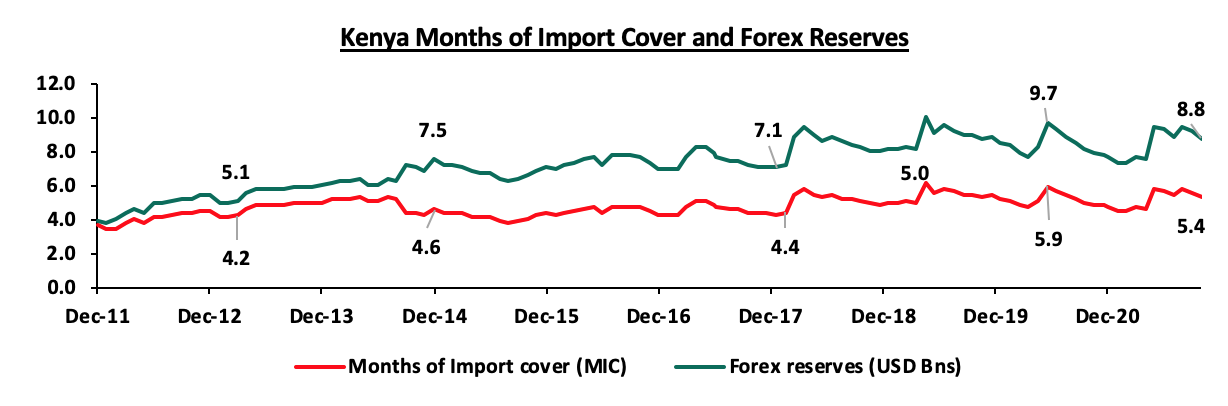

- Forex reserves held by the Central bank which are above the statutory requirement of 4.0-months of import cover, having grown by a 10-Year CAGR of 8.5% to USD 8.7 bn, equivalent to 5.4 months of import cover in November 2021, from USD 3.9 bn, equivalent to 3.4 months of import cover in November 2011.

The chart below shows the trend of the evolution of the forex reserves:

Source: Central Bank of Kenya

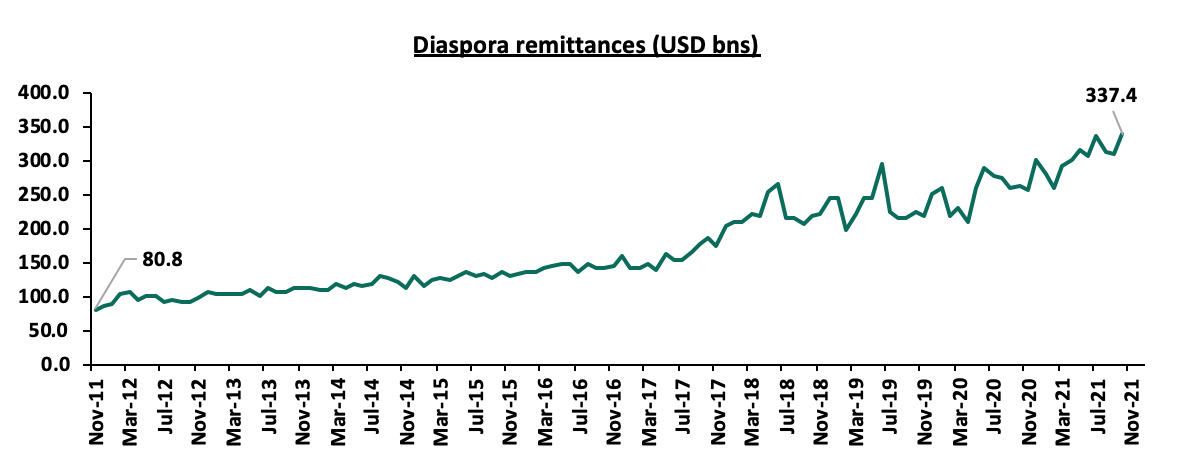

- Improving diaspora remittances, which have grown by a 10-year CAGR of 14.8% to USD 320.1 mn in November 2021, from USD 80.8 mn recorded in November 2011, attributable to the increasing Kenyan population in the diaspora and advancing technology that makes transfer of money easier and faster. The chart below shows the trend of the evolution of the Diaspora Remittances:

Source: Central Bank of Kenya

- Increase in value of some of the country’s principal exports such as horticulture exports which have grown by a 10-year CAGR of 7.9% to an estimate of Kshs 14.4 bn in September 2021, from Kshs 7.8 bn recorded in September 2011,

- Improved investment into the country as measured by the FDI flows into the country which had grown significantly by a 4-year CAGR of 16.4% to USD 1.1 bn in 2019, from USD 0.6 bn in 2015. However in 2020, FDI flows into the country declined by 34.7% to USD 0.7 bn mainly attributable to muted investor activity during the COVID-19 peak and tightened ownership rules that required companies such as those in the technology sector to have a 30.0% local ownership, and,

- Inflows from the Multilateral lenders for various loan facilities such as the USD 750.0 mn (Kshs 8.2 bn) from the World Bank and the USD 2.3 bn (Kshs 256.0 bn) from the IMF advanced to the country to boost COVID-19 recovery efforts.

Despite these factors, the shilling has been put under pressure mainly by fluctuating Global oil prices leading to a high dollar demand from energy and oil suppliers which outweighs supply, and a growing import bill, that has grown by a 10-year CAGR of 5.6% to Kshs 190.3 bn in September 2021, from Kshs 123.7 bn in September 2011.

Section III: Factors behind current currency performance

In 2021, the shilling has recorded an YTD depreciation of 3.5% against the USD, after a 7.7% depreciation in 2020. The shilling has been recording all-time lows against the USD since November 9th 2021. In this section, we will analyze the key factors behind the performance of the Kenyan Shilling in 2021:

- Increased global oil prices

The main reason behind the current Kenyan shilling performance can be attributed to the increasing global crude oil prices, with crude oil accounting for 17.7% of total imports as of September 2021. The high prices have increased the demand for dollars from oil and energy importers who have to increase the amounts they pay for oil imports and hence depleting dollar supply in the market. As a result, this has continued to exert downward pressure on the shilling. On a YTD basis, the Murban Oil that Kenya imports has increased by 45.0% to USD 74.7 per barrel, from USD 51.5 per barrel recorded on 31st December 2020, mainly attributable to reopening of economies as COVID-19 infection rates reduced during the year and supply chain bottle necks.

However, following discovery of new strains around the globe, oil prices have slightly reduced from levels witnessed in October when the price of Murban Oil was at USD 85.6 per barrel. The slight reduction in prices is mainly attributable to reduced oil demand in Europe as a result of the Omicron COVID-19 variant that has necessitated lockdowns and restrictions in some economies. Prices of crude oil are expected to remain relatively high and as such will continue to exert downward pressure on the shilling.

- Shortage of the USD following reopening of economies in 2021

Following the peak of COVID-19 pandemic in 2020, most global economies went on a slowdown due to restrictions and lockdowns that curbed economic growth. However, in 2021, following the discovery of vaccines, vaccine accessibility and vaccine inoculation, most economies have continued to rebuild hence increasing the global demand for the USD for global trade. Dollar demand around the globe has starved dollar supply in developing markets leading to depreciation of most currencies against the dollar.

- Balance of payments

According to the Q2’2021 Balance of Payments report released by the Kenya National Bureau of Statistics (KNBS), Kenya’s current account deficit expanded by 28.1% in Q2’2021, to Kshs 110.1 bn, from Kshs 85.9 bn recorded in a similar period of review in 2020. This was attributed to a robust increase in merchandise imports by 38.9% to Kshs 451.0 bn in Q2’2021, from Kshs 324.6 bn in Q1’2020 as compared to a 29.0% increase in merchandise exports to Kshs 179.7 bn, from Kshs 139.1 bn in Q2’2020. Though the exports gradually increased in Q2’2021 on account of increase in value of exports of horticulture which recorded increase of 47.0%, they were weighed down by declines in exports of other commodities such as tea and coffee which declined by 7.5% and 3.0%, respectively. The more aggressive growth in imports is still worrying and continues to put pressure on the shilling. Moreover, the high fuel prices currently witnessed in the country are likely to increase the import bill. During the period from January to September 2021, the import bill surged by 28.0% to Kshs 1.5 tn as compared to Kshs 1.2 tn in January to September 2020. We believe that this high import bill will continue weighing on the improving current account balance and as such, we expect the shilling to continue destabilizing against other currencies.

- Government debt

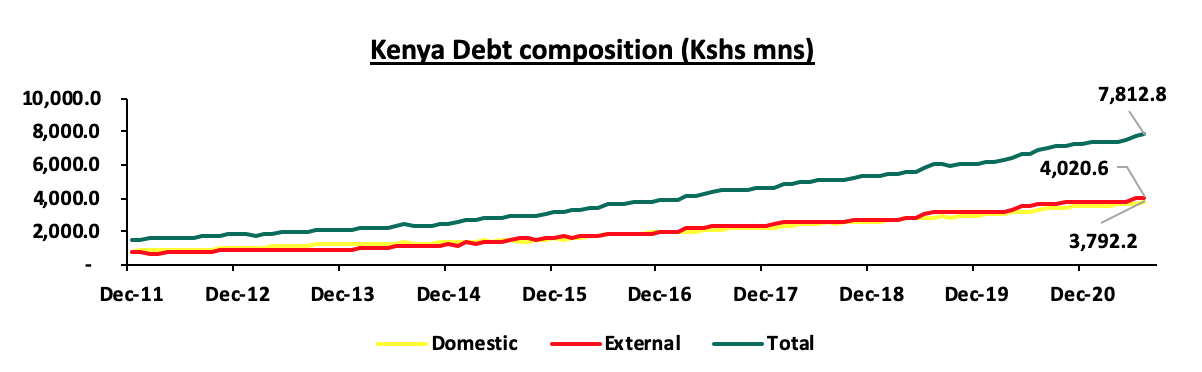

Kenya’s public debt has continued to grow aggressively, increasing at a 10-year CAGR of 17.7% to Kshs 7.8 tn in July 2021, from Kshs 1.5 tn in July 2011. Out of the current loan stock, external debt has grown at a faster 10-year CAGR of 18.4% to Kshs 4.0 tn in July 2021, from 0.7 tn in July 2021 as compared domestic debt, which has grown at a 10-year CAGR of 17.1% to Kshs 3.8 tn in July 2021, from Kshs 0.8 tn in July 2011. The rising external debt, whose composition is currently 66.6% USD denominated, has continued to weigh down on the shilling as the government through the CBK has to continually dig into its forex reserves for external debt servicing. Also, demand for hard dollars to meet debt servicing requirements is bound to increase upon formal expiry of the Debt Servicing Suspension Initiative (DSSI) in December 2021. Currently, Kenya’s debt stands at Kshs 7.8 tn, of which Kshs 4.0 tn is external debt as highlighted in the chart below:

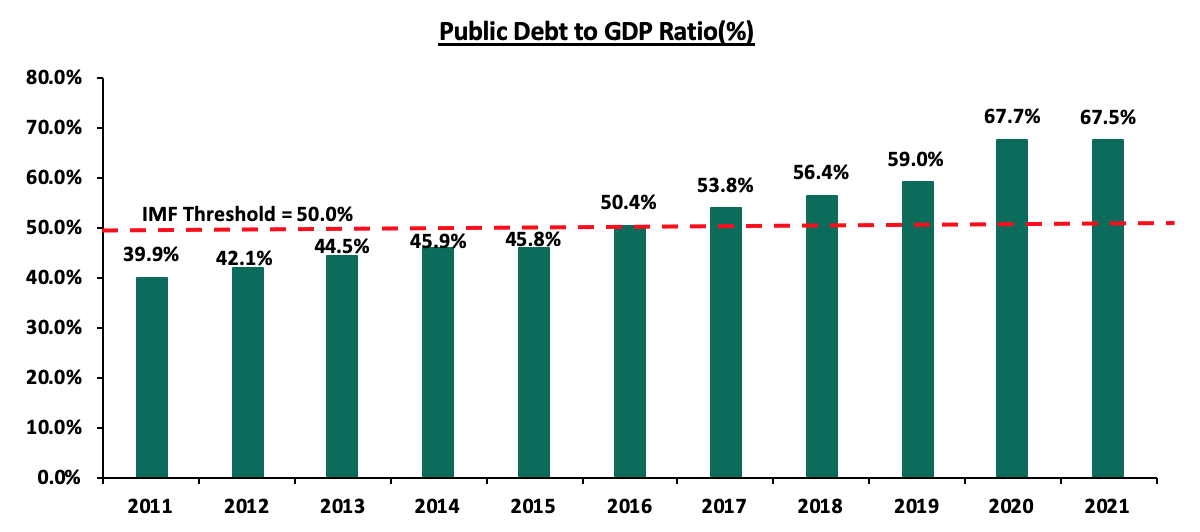

Kenya’s debt to GDP ratio came in at 67.5% in June 2021, 17.5% points above the IMF’s recommended threshold of 50.0% for developing countries. Below is a graph highlighting the trend in the country’s debt to GDP ratio;

Source: Central Bank of Kenya, Kenya National Bureau of Statistics

- Forex Reserves

In the period leading to May 2021, Kenya’s Forex Reserves were dwindling, with May 2021 recording a 9.4% decline to USD 7.5 bn (4.6 months import cover), from USD 8.3 bn (5.2 months imports cover) in May 2020. The dwindling forex reserves seen during the period can be attributed to low inflows from key sectors such as tourism. However, the USD 314.0 mn disbursement from the International Monetary Fund (IMF) to the government earlier in April and the USD 407.0 mn approved by the IMF under the Extended Fund Facility and Extended Credit Facility in June 2021 supported the reserves as they increased by 26.4% to Kshs 9.5 bn in June 2021 from Kshs 7.5 bn in May 2021. However, the reserves have come under increasing pressure partly due to debt service obligations and release of dollars into the market to act as buffers against volatility of the shilling.

Currently, the forex reserves stand at Kshs 8.6 bn as at 16th Dec 2021, equivalent to 5.3 months of import cover, which is an 8.0% decline from the Kshs 9.5 bn in June 2021, equivalent to 5.8 months of import cover. Going forward, the elevated debt levels witnessed in the country are likely to put forex reserves under pressure as a significant amount will be used to repay the debts. As a consequence, the Kenyan shilling will be exposed to foreign exchange volatility causing it to weaken. However, we expect the reserves to be supported by increasing diaspora remittance inflows, continued investor capital inflows and increasing exports as the key trading partners continue to contain the virus and re-open their economies.

- Monetary Policy

The Central Bank Rate (CBR) was revised down to 7.00% from 8.25% in January 2020 to support the local economy. Despite this, the yields on government securities have remained high and attractive. Inflation rates have also remained relatively stable and within the government’s target of 2.5% - 7.5%. This is mainly attributable to fuel prices having remained stable due to the application of fuel subsidies under the Petroleum Development Fund despite increase in global fuel prices. As such, we do not expect the CBK to increase the rates as the Central Bank is mainly focused on the continuous recovery of the economy.

Outlook:

|

Driver |

Outlook |

Effect on the currency |

|

Balance of Payments |

·We expect gradual improvement in the export sector as Kenya’s trading partners continue to reopen. However, the high import bill is expected to weigh down on the Current Account balance due to an increase in merchandise trade deficit attributable to the increase in global fuel prices, persistent disruptions in supply chains and logistical bottlenecks. |

Neutral |

|

Government Debt |

·We expect the government to borrow aggressively to plug in the high fiscal deficit which is projected at 7.5% of GDP for the FY’2021/22 budget. Also, Kenya’s debt to GDP ratio came in at an estimated 71.7% as of June 2021, 21.7% points above the IMF recommended threshold of 50.0% for developing nations. Slow revenue growth amid weak fiscal consolidation places the country at risk of debt distress, and, ·The high debt burden especially external debt will continue to expose the shilling to exchange rate shocks and will, in turn, emanate pressure on the shilling to weaken during the repayment period. |

Negative |

|

Forex Reserves |

·Elevated debt levels witnessed in the country are likely to put forex reserves under pressure as most of it will be used to finance the debts and the expiry of the Debt Service Suspension Initiative is set to increase amounts due and put the shilling under more pressure, and, ·In our view, forex reserves will continue to be supported by; debt relief from institutions such as the IMF, increasing diaspora remittance inflows, continued investor capital inflows with hope for an economic recovery and increasing exports as the key trading partners continue to re-open their economies, |

Negative |

|

Monetary Policy |

·Inflation rates have remained within the government’s target of 2.5% - 7.5% despite the high fuel prices and as such, we do not expect the CBK to increase the rates as the Central Bank is mainly focused on reviving the economy, and, ·Domestic investment activities have declined as Kenya’s financial and capital assets have become less appealing to investors on account of the lower real rate of return. |

Neutral |

From the above currency drivers, 2 are negative (Government Debt, Forex reserves), while 2 are neutral (Balance of Payment, Monetary Policy) indicating that currency rates remain uncertain and will likely edge upwards.

Section V: Conclusion and our view going forward

Based on the factors discussed above and factoring in the discovery of new strains of COVID-19 that continue to hamper economic development;

- We expect the Kenyan shilling to weaken within a range of Kshs 109.1 and Kshs 116.6 against the USD in the medium term based on the Purchasing Power Parity (PPP) and Interest Rate Parity (IRP) approach. In 2021, we expect the shilling to close the year at a range of Kshs 112.1 to Kshs 114.1, with a bias of a 3.9% depreciation on account of:

- High global oil prices which continue to lead to high costs of oil imports,

- Persisting supply chain bottle neck constraints that continue to increase the costs of imports, and,

- Ever present current account deficit due to an imbalance between imports and exports.

In our view, the current pressure on the shilling is a cause of concern and is unlikely to reduce in the near term. Continuous depreciation of the shilling is set to have a negative effect on the economy as imports costs will continue to increase, and this will be passed on to consumers hence elevating the current inflation levels. In as much as most of the factors contributing to depreciation of the shilling during the year are external, we are of the opinion that the Government and the CBK should take actionable steps to mitigate further depreciation of the shilling. These include;

- Building an export driven economy - This can be achieved by promoting export oriented policies and manufacturing to increase exports, thus improving the current account while at the same time reducing imports to preserve our foreign exchange reserves. Exports should also undergo value addition before leaving the country in order to increase purchase value and competitiveness. This will go a long way to stabilize the exchange rate,

- Reducing the mix of commercial loans which attract high interest rates - The Kenyan government should move towards reducing the share of commercial borrowing as compared to concessional borrowing so as to reduce amounts paid in debt service. Reduced debt service amounts would greatly help to bring down demand for the greenback and stabilise the exchange rate,

- Diversification of the economy to avoid over-reliance on agriculture and tourism - Kenya’s brand, location and skilled workforce uniquely positions the country to be a financial hub, but we will have to fundamentally rethink our capital markets infrastructure and regulatory frameworks. We have seen Mauritius, which is primarily a financial hub, benefit greatly from the diversification of their economy. Mauritius has a developed mixed economy hinged on different sectors such as manufacturing, financial services which have been increasing their share of GDP and has constantly been diversifying from agriculture and tourism unlike earlier years,

- Capital Markets Authority to encourage local capital formation rather than foreign capital, which has to be repatriated – The current Capital markets structure in Kenya is foreign investors and capital dominated and as such, companies have to repatriate profits and dividend in dollars which starves the market dollars and further weakens the shilling, and,

- Work with the private sector to encourage Kenyan’s living abroad to invest back in the country - Despite the fact that the remittances have increased, there is potential for much more to come into the country if we develop and implement an active diaspora investment strategy and engagement.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.