Jul 14, 2024

Special interest group funds in Kenya, such as the Financial Inclusion Fund (Hustler Fund) and the Youth Enterprise Fund (YEF), aim to promote financial inclusivity and support economic growth by providing accessible credit to marginalized communities. However, recent audits reveal significant issues with these funds, casting doubts on their transparency, accountability, and overall effectiveness. The Hustler Fund, for instance, faced scrutiny for its management and loan recovery processes, with inconsistencies in financial statements and systemic deficiencies in its loan management system. Similarly, the Youth Enterprise Fund has struggled with high default rates, unserviced loans, and questionable financial transactions, leading to concerns over its sustainability and operational integrity. These challenges highlight the critical need for robust oversight and improved governance to ensure these funds fulfill their intended purpose of empowering underserved populations and fostering economic development.

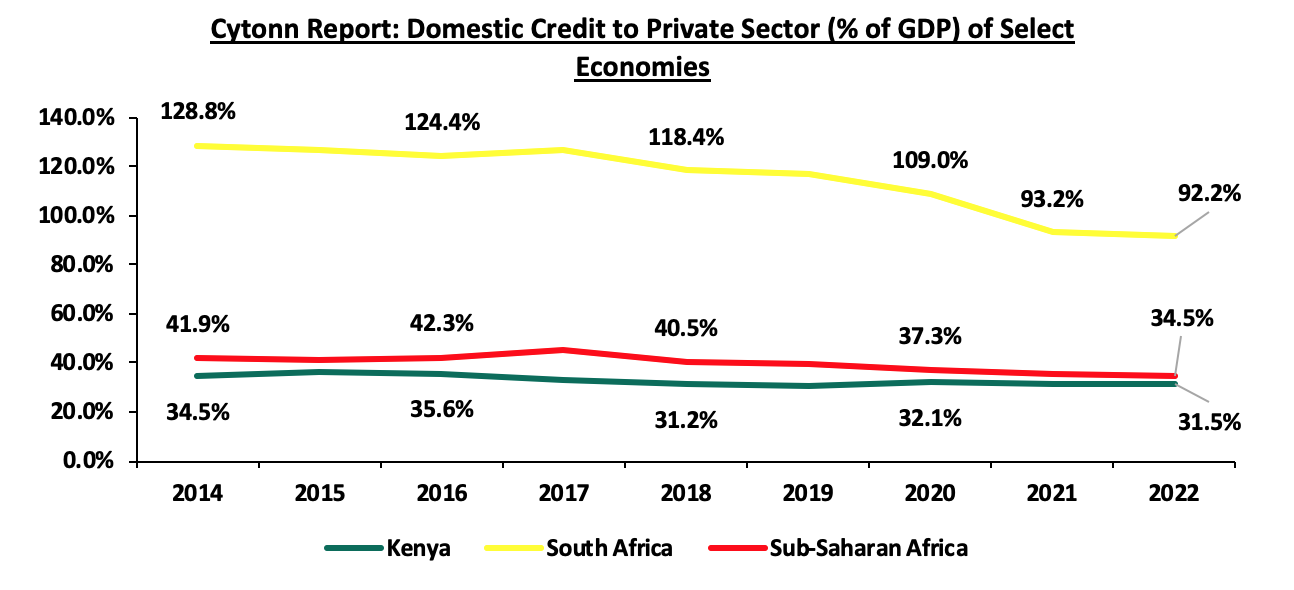

Kenya’s domestic credit extended to the private sector as a percentage of GDP was at 31.5% in 2022, compared to the 34.5% average for the Sub-Saharan African region and notably, 92.2% for South Africa, highlighting the gap in credit availability for businesses. This gap in credit availability underscores the importance of special interest group funds like the Hustler Fund and YEF. However, despite their potential, these funds only partially address the problem. If we take South Africa as an example, then we need to reach at least 90.0% credit to GDP to start to resolve the credit problem. That means an additional Kshs 6.1 tn in credit is needed. The graph below shows domestic credit extended to the private sector for select economies over the years

Source: World Bank

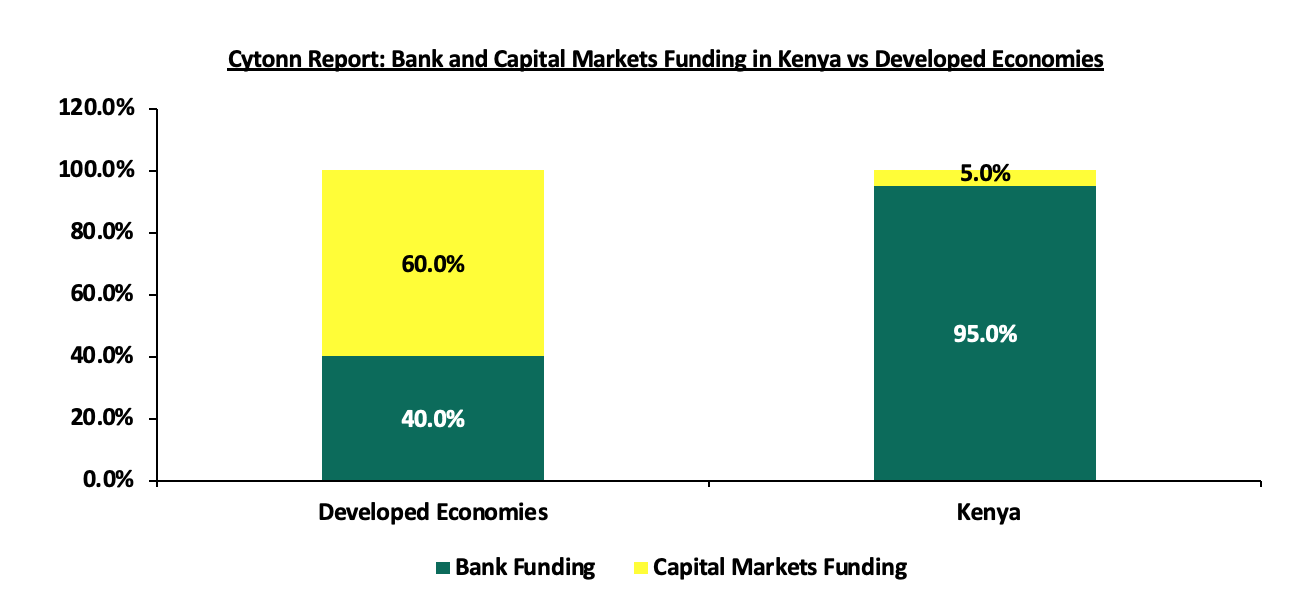

One of the key inhibitors to credit growth has been the fact that in Kenya, banks provide 95.0% of credit, as compared to other developed economies at 40.0%. Key to note, individuals at the bottom of economic pyramid have suffered more in terms of access to credit mainly because of bureaucratic measures in borrowing from banks coupled with the high interest rates charged. When credit has been advanced by digital credit providers, it has been equally as expensive, with often punitive terms. The chart below shows the comparison of development funding in Kenya against developed economies;

Source: World Bank, Capital Markets Authority (CMA)

In a bid to bridge the credit gap and in line with pre-election promises, the Kenya Kwanza Administration launched the Financial Inclusion Fund (Hustler Fund) on 30th November 2022, with the fund’s main objective being to improve the credit access to citizens at the bottom of the pyramid who have often struggled to obtain affordable credit. Key to note, the previous governments had introduced various special funds such as Uwezo Fund, Women Enterprise Fund, and Youth Enterprise Development Fund in a bid to increase credit access to various target groups. This topical will delve into the various special funds, with a focus on the Hustler Fund and the Youth Enterprise Development Fund, to have a deeper understanding of the funds by looking at the progress they have made, potential impact, and their sustainability. We shall undertake this by looking into the following;

- Introduction,

- Performance of Government Special Funds,

- Review of Fund Structure and Features,

- Review of Fund Operational Sustainability, and,

- Conclusion and Recommendations

Section 1: Introduction

In Kenya, Special Interest Groups Funds refer to fund allocation initiatives by the Government of Kenya aimed at improving economic equality and financial inclusion targeting the youth, women, and people with disabilities (PWDs).

The Financial Inclusion Fund, commonly known as the Hustler Fund, is one of several special interest group funds in Kenya designed to enhance financial inclusivity by providing accessible credit to marginalized communities. Launched on November 30, 2022, with a start-up capital of Kshs 50.0 bn, the Hustler Fund aims to offer affordable loans to individuals who have been excluded from the formal credit system for an extended period. The fund provides loans at an annual interest rate of 8.0%, which is the lowest in the country, and promotes a savings culture by allocating 5.0% of the borrowed amount to a savings account. The fund includes four products: Personal Finance, Micro Loan, SME Loan, and Start-Up Loan, with the Personal Finance component offering amounts between Kshs 500 and Kshs 50,000.

In addition to the Hustler Fund, the Kenyan government operates three other similar funds: The Youth Enterprise Development Fund (YEDF), the Women Enterprise Fund (WEF), and the Uwezo Fund. These funds target youth, women, and people with disabilities, providing affordable loans and grants to support their economic activities. Despite their noble objectives, recent audits and reviews have highlighted significant management issues within these funds, raising concerns about their transparency, accountability, and overall effectiveness.

Key to note, the main objectives of the funds are:

- Promote Financial Inclusion - The funds aim to expand access to credit by individuals, MSMEs, SACCOs, and start-ups to foster economic growth and job creation,

- Ensure Responsible Lending Culture - Addressing the qualitative dimension of financial inclusion by ensuring responsible lending and borrowing, ethical practices, offering financial literacy, and promoting consumer rights,

- Promote Affordable Credit - Implementing market interventions to enhance the supply of affordable credit to MSMEs, including creditworthiness-based lending, risk pricing, business and financial management skills, and reducing the cost of doing business, and,

- Enhance Health Coverage and Social Security - Improving participation in health insurance and retirement benefit schemes to ensure universal health coverage and social security.

Section 2: Performance of Government Special Funds

Previous regimes have rolled out three main avenues targeting SIGs which include; Uwezo Fund, Women Enterprise Fund, and Youth Enterprise Development Funds. Below is a summary of the performance of the existing special funds;

- Uwezo Fund - Founded on Legal Notice No. 21 under the Public Finance Management Regulations in September 2013 to enable women, youth, and persons with disabilities (PWDs) to access finance and promote enterprises at the constituency level. Since inception, the fund has disbursed a total of Kshs 7.5 bn to 79,274 groups, resulting in an average loan size of Kshs 91,207. As of June 2023, the fund’s cumulative repayment in the period under review stood at Kshs 2.9 bn, equivalent to a 38.3% repayment rate against a corresponding default rate of 61.7%,

- Women Enterprise Fund – Established under the Legal Notice No. 147 of 2007, the fund has disbursed a cumulative loan amounting to Kshs 26.4 bn to 136,721 self-help groups and 2,063,147 individuals since inception, resulting in an average loan size of Kshs 12,805.8. Key to note in the FY’2022/2023, the fund disbursed Kshs 1.8 bn to more than 60,000 individuals. Notably, in the period under review, the fund disbursed loans worth Kshs 1.7 bn under the Constituency Women Enterprise Scheme (CWES), and recovered Kshs 1.7 bn translating to a repayment rate of 97.0%. However, lending was stopped in the second half of the year as the fund was expected to transition to offer loans through the Financial Inclusion Fund platform. Furthermore, the fund has cumulatively trained 1,773,355 women on entrepreneurship and supported 50,153 women by providing market access and linkages, and,

- Youth Enterprise Development Fund (YEDF) – The YEDF was founded in May 2007 by the Legal Notice No. 63, under the Ministry of ICT, Innovation, and Youth Affairs. Since inception to June 2022, the fund had advanced loans amounting to 14.2 bn to 2.0 mn youth with the average loan size coming in at Kshs 7,100. For FY’2021/2022, the fund disbursed Kshs 370.1 mn and recovered Kshs 276.8 mn, translating to a repayment rate of 74.8% and a corresponding default rate of 25.2%. Additionally, the fund has facilitated and trained 97,880 youth on entrepreneurial skills, and supported 3,490 youth to market their products in trade fairs.

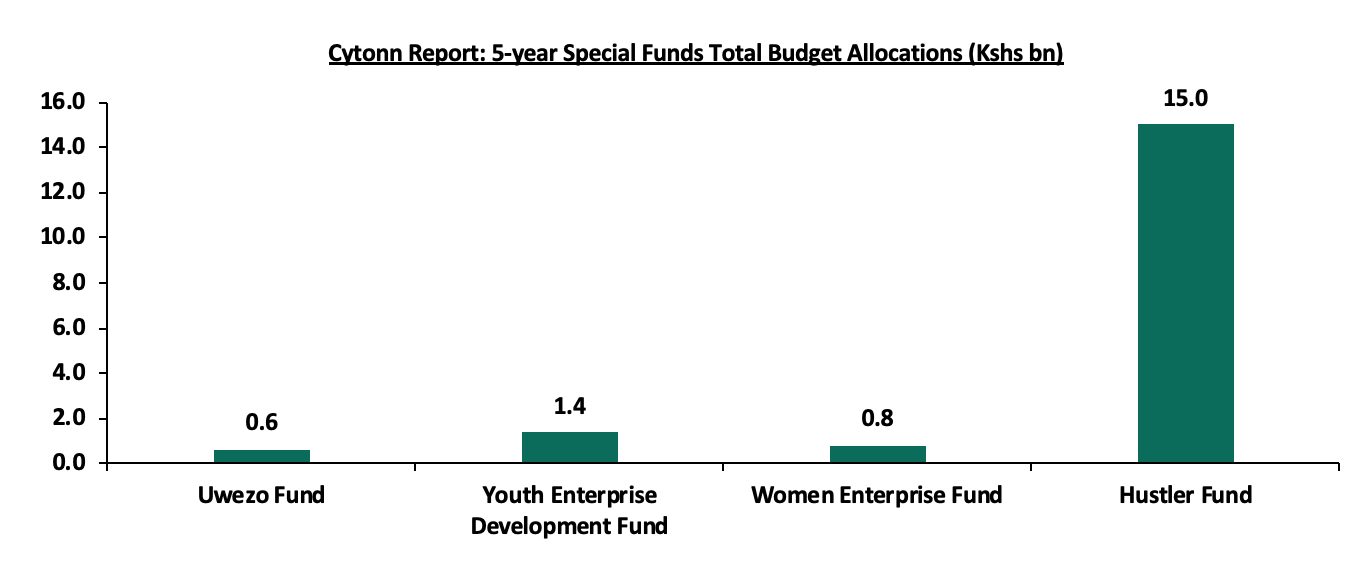

For the FY’2024/2025, the government has allocated Kshs 5.0 bn for the Hustler Fund, Kshs 200.0 mn for the Youth Enterprise Development Fund, Kshs 200.0 mn for the Uwezo Fund and Kshs 182.8 mn for the Women Enterprise Fund. Below is a table showing the funds’ budget allocations in the last five financial years;

|

Cytonn Report: Special Interest Group Funds Budgetary Allocations (Ksh mn) |

|||||

|

Special Group Fund |

Years |

||||

|

2020/21 |

2021/22 |

2022/23 |

2023/24 |

2024/25 |

|

|

Uwezo Fund |

82.0 |

62.0 |

92.0 |

192.0 |

200.0 |

|

Youth Enterprise Development Fund |

359.0 |

454.0 |

175.0 |

175.0 |

200.0 |

|

Women Enterprise Fund |

150.0 |

120.0 |

170.0 |

182.8 |

182.8 |

|

Hustler Fund |

- |

- |

- |

10,000.0 |

5,000.0 |

|

Total |

591.0 |

636.0 |

437.0 |

10,549.8 |

5,582.8 |

Source: Mwananchi Budget Guides, Budget Statements

The chart below shows the total budget allocations for the four special interest group funds in the last five years;

Source: Mwananchi Budget Guides, Budget Statements

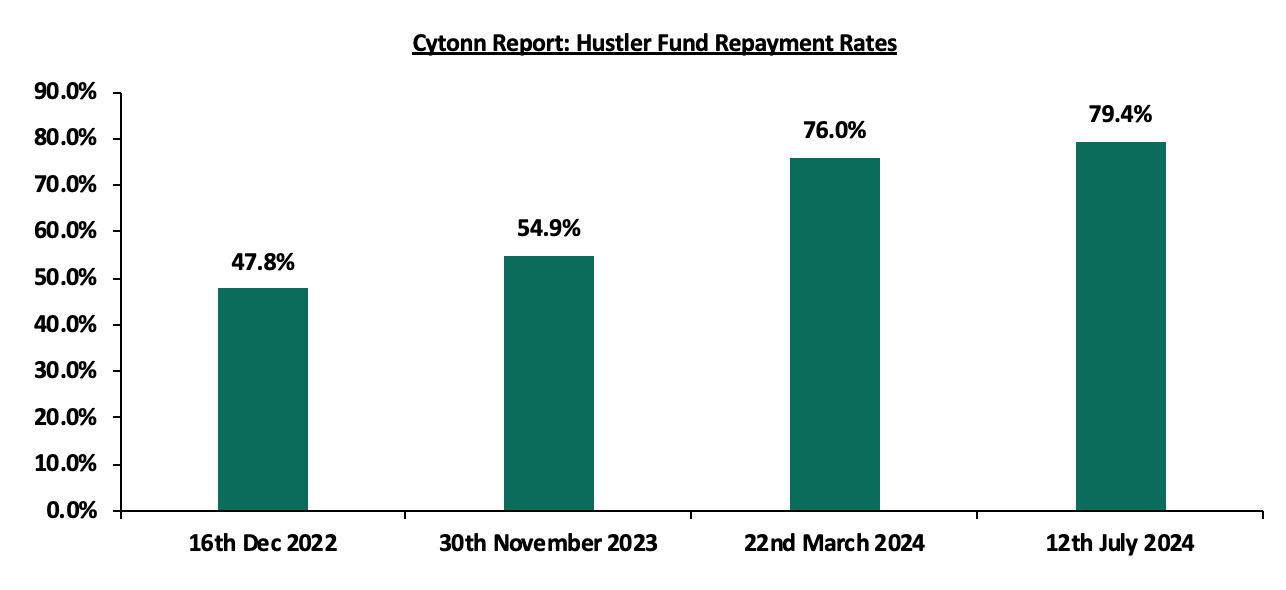

However, success of these funds have been crippled by low recovery rates on advanced amounts. Only the Hustler Fund has recorded a relatively high recovery rate, at 79.4%. The table below shows the performance of the various funds;

|

Cytonn Report: Special Interest Group Funds’ Performance |

||||

|

Fund |

Amount disbursed (Kshs bn) |

Amount recovered (Kshs bn) |

Amount pending recovery (Kshs bn) |

Recovery Rate |

|

Uwezo Fund |

7.5 |

2.9 |

4.6 |

38.3% |

|

Women Enterprise Fund |

2.9 |

0.9 |

2.0 |

31.9% |

|

Youth Enterprise Fund |

2.7 |

0.1 |

2.6 |

3.8% |

|

Hustler Fund* |

52.9 |

42.0 |

10.9 |

79.4% |

*The performance of the Hustler Fund has been taken cumulatively since their inception to 12th July 2024, while the performance of the other Funds has been taken cumulatively since their inception to the period ending June 2023

Source: Cytonn Research

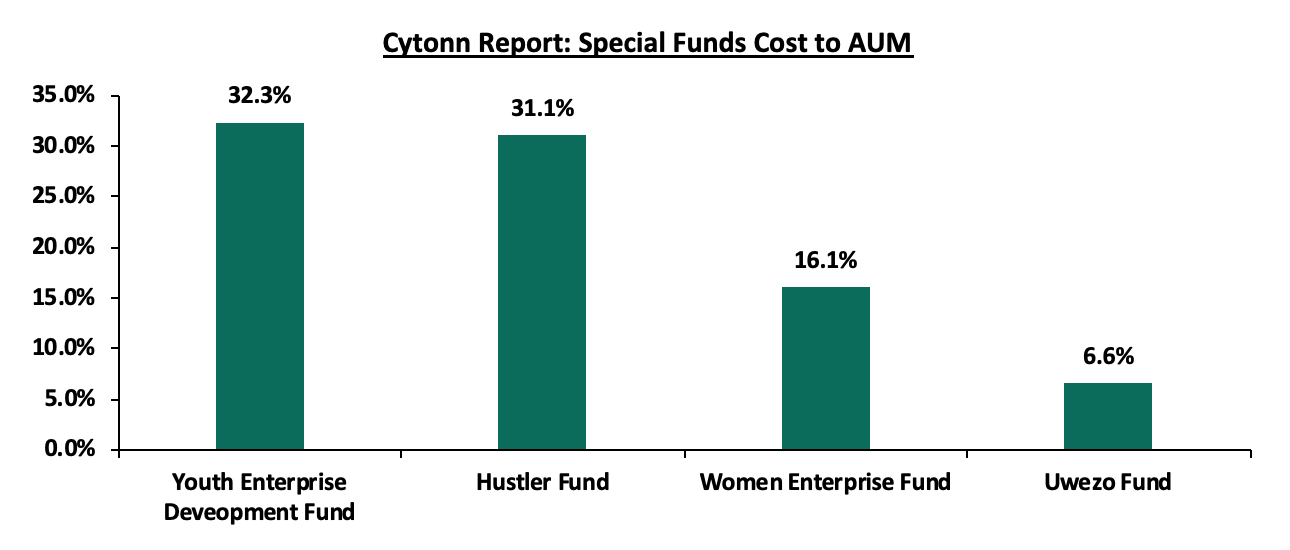

The funds have experienced significant financial challenges over the years, primarily due to high operating expenses and provisions for bad loans. These issues have led to substantial annual losses, which are further compounded by the outstanding loans. The Uwezo Fund, for example, has notable operating costs but lacks provisions for bad loans, while the Youth Fund shows a considerable provision for bad loans, contributing to its overall financial loss. Similarly, the Hustler Fund and the Women Enterprise Fund exhibit significant annual losses driven by their respective operational costs. The table below shows the estimated amount lost by the Special Funds per year;

|

Cytonn Report: Estimated Amount Lost per year (Kshs mn) |

||||

|

|

Hustler Fund |

Youth Fund |

Uwezo Fund |

Women Enterprise Fund |

|

Operating Expenses* |

232.8 |

387.6 |

169.9 |

534.5 |

|

Provision for bad loans* |

- |

395.5 |

- |

25.9 |

|

Total cost and provisions |

232.8 |

783.0 |

169.9 |

560.4 |

|

Doubtful loan balances** |

8,219.1 |

2,644.0 |

4,826.6 |

1,982.6 |

|

Years since inception |

2 |

10 |

16 |

16 |

|

Doubtful loans/year |

4,109.5 |

264.4 |

301.7 |

123.9 |

|

Estimated amount lost per year |

5,707.8 |

1,047.4 |

471.5 |

560.6 |

|

Total net assets |

13,966.7 |

3,238.6 |

7,135.1 |

4,251.3 |

|

Cost to assets |

31.1% |

32.3% |

6.6% |

16.1% |

*Figures for Hustler fund, Uwezo fund and Women enterprise fund as of June 2023 while for Youth Fund as of June 2022

**Cumulative figures since inception to June 2023

The chart below shows the special funds’ estimated cost to Assets Under Management (AUM);

Section 3: Review of Fund Structures and Features

- Hustler fund

As aforementioned, the Hustler Fund was established to realize the economic model of the new regime by offering a credit line to individuals at the bottom of the economic pyramid. Key to note, the government, through the Cabinet Secretary for the National Treasury and Economic Planning tabled the PFM-Financial Inclusion Fund Regulation, 2022 as a guideline towards the operations of the Hustler Fund. The draft regulation provides information on the eligibility to qualify for the fund, the management structure and features of the fund as discussed below;

- Eligibility Criteria

The government removed many of the administrative bottlenecks when applying for the fund by soliciting already established platforms by liaising with telecoms such as Safaricom, Airtel, and Telkom in addition to banking institutions such as KCB Bank and Family Bank. However, it is important to note that for one to borrow, he/she must meet the prerequisites as stipulated below;

- Natural Person – For a natural person, that is, an individual and not an entity, the applicant should be eighteen years of age and above and a holder of a Kenyan national identity card and satisfy any other requirements that may be deemed necessary by the Board, and,

- MSMEs, SACCO Societies, Chama, Group, table banking group or any relevant association – The applicant within these categories should have all members aged eighteen and above, be registered by the appropriate government institution, and comply with any set obligation as may be determined by the Board.

Additionally, an applicant must have a registered mobile number from a recognized mobile operator in Kenya and have a mobile money account such as M-Pesa, Airtel Money, or T-Kash. The SIM card to be used during the loan application must have been active for more than 90 days. Importantly, no collateral is required for the loan.

- Management of the Hustler Fund

The fund is managed by a board headed by a non-executive chairperson appointed by the President and should perform an oversight role and further help in formulation of new policies. The board consists of;

|

Cytonn Report: Hustler Fund Board Membership |

|

|

1 |

Chairperson (Non-Executive) |

|

2 |

Principal Secretary to the National Treasury or Representative |

|

3 |

The Principal Secretary of the State Department or his representative |

|

4 |

The Principal Secretary of the State Department for MSMEs or his representative |

|

5 |

The Attorney-General or his representative, |

|

6 |

Two non-public officers appointed by the Cabinet Secretary MSMEs |

|

7 |

Fund Administrator-Ex-officio member (Secretary to the board) |

Key to note, the chairperson and all members should serve for a term of three years and can be appointed for another one term depending on their performance. Additionally, the Fund has a Chief Executive Officer who is competitively appointed by Cabinet Secretary to MSMEs upon recommendations by the board and meeting the relevant requirements.

- Features of the Hustler Fund

The hustler fund principal loan structure for the Personal Finance product ranges between Kshs 500 - Kshs 50,000 and an individual will only be eligible upon meeting the conditions stated above. According to the Terms and Conditions of the Fund, the term of the loan should be 14 days with interest charged at annual rate of 8.0% which should be accrued daily until the full repayment of the loan amount and should be advanced through the relevant Mobile Money Wallets.

Upon approval of the loan requested by an individual, the loan product has a savings component as discussed below;

- Savings Deduction - The fund will deduct 5.0% of the loan advanced that goes towards savings,

- Short-Term Savings – Key to note, 30.0% of the 5.0% savings deduction is applied to a savings account which will be available to borrowers after 365 days from the disbursement date unless there is a default upon which the borrower can access the funds earlier,

- Pension Remittance – Notably, 70.0% of the 5.0% savings deduction is applied towards the customer pension that will be accessible to the borrower upon attainment of the prerequisite age, and,

- Government Contributions – Additionally, the Government of Kenya matches the pension remittance of a borrower who has not defaulted at a ratio of 2:1. Here, for every Kshs 2.0 saved, the government adds Kshs 1.0 to a maximum government contribution of Kshs 6,000.0 annually.

Notably, the Hustler Fund has come up with the following precautionary measures to minimize the default rate;

- If the customer fails to pay within 14 days from the date of disbursement, the loan will attract a higher interest of 9.5% annually with effect from the 15th If the customer further fails to repay by the 30th day from the disbursement date, the bank will review the customer’s credit rating thus affecting the assigned credit limit. Key to note, the interest rate applies daily from the date of loan disbursement for a year, or such earlier date when the repayment should have been completed,

- In case the customer fails to repay the loan by the 30th day from the date of disbursement, he/she will not be eligible to borrow until the repayment of all outstanding debt obligations,

- Further, the fund should retain 30.0% meant for short-term savings in a suspense account until full repayment of the loan to mitigate against the risk of total default by borrowers, and,

- Once the customer has settled the outstanding debt, he/she should have access to the amount in the suspended account and will be at liberty to withdraw or keep it in the savings account.

- Youth Enterprise Development Fund

The Youth Enterprise Development Fund (YEDF) was established to champion the creation of employment for youth through enterprise development. In 2007, the Fund was transformed into a State Corporation under the then Ministry of State for Youth Affairs. The Fund is currently domiciled at the State Department for Youth Affairs and the Creative Economy. The draft regulation provides information on the management structure and features of the fund as discussed below;

- Management of the Youth Enterprise Development Fund

The fund is managed by a board headed by a non-executive chairperson appointed by the President and should perform an oversight role and further help in formulation of new policies. The board consists of;

|

Cytonn Report: Youth Fund Board Membership |

|

|

1 |

Chairperson (Non-Executive) |

|

2 |

Secretary to the Board and Chief Executive Officer (CEO) |

|

3 |

The Permanent Secretary, State Department of Youth Affairs and Creative Economy |

|

4 |

The Inspector of State Corporations or his representative |

|

5 |

The Permanent Secretary, National Treasury and Economic Planning or his representative, |

Key to note, the Fund has a Chief Executive Officer who will be competitively appointed by Cabinet Secretary to MSMEs upon recommendations by the board and meeting the relevant requirements.

- Features of the Youth Enterprise Development Fund

The Fund provides diverse financial products tailored to empower Kenyan youth entrepreneurs. The Fund aims to address youth unemployment through its loan products, comprehensive business support, and financial assistance.

Loan Products:

The Fund offers a variety of loan products designed to support the financial needs of youth-owned enterprises in Kenya. The loan offerings are divided into two main categories: group loans and individual loans.

- Group Loans:

- Rausha: A startup loan offering Kshs 100,000 with a three-month grace period and twelve-monthly repayments,

- Inua: Expansion loans ranging from Kshs 200,000 to Kshs 1,000,000, with varying repayment periods of up to 36 months, and,

- Special: Targeted loans for agriculture, livestock, and other periodic income-generating projects, with amounts up to Kshs 500,000.

- Individual Loans:

- Vuka: Startup and expansion loans up to Kshs 5,000,000, secured by conventional means, and tailored to support diverse business needs,

- Trade Finance: Financing for youth awarded tenders under AGPO, with loans up to Kshs 5,000,000 secured by guarantees and conventional security, and,

- Agri-Bizz Loan: Support for agricultural ventures with loans up to Kshs 2,000,000, featuring no interest but a management fee, and secured based on the loan amount.

The Fund also provides comprehensive support services to enhance the success and sustainability of youth-owned enterprises in Kenya. These services include;

- Entrepreneurship Training: Comprehensive programs covering business development, mentorship, and coaching,

- Market Support: Facilitation in establishing linkages with larger enterprises to enhance market access, and,

- Infrastructure: Provision of trading premises and worksites to foster business growth and stability.

Section 4: Review of Fund Operational Sustainability

- Hustler Fund

Since its inception, Hustler Fund has disbursed more than Kshs 52.9 bn as at 12th July 2024, up by 6.6% from the Kshs 49.6 bn as reported by Cabinet Secretary to the Co-operatives and MSME Development Ministry; in March 2024. The table below details the data on the fund’s transactions:

|

Cytonn Report: Hustler Fund Transactions Data as of 12th July 2024 |

|

|

Amount Disbursed |

Kshs 52.9 bn |

|

Repayment Amount |

Kshs 42.0 bn |

|

Savings Amount |

Kshs 2.3 bn |

|

Opted in Customers |

23.3 mn |

Source: www.hustlerfund.go.ke

Further, the chart below shows the repayment rates as provided by the Co-operatives and MSME Development Ministry;

Source: Co-operatives and MSME Dev. Ministry

The Hustler Fund was established to offer holistic financial solutions targeting people at the bottom of the economic pyramid, emphasizing the importance of its long-term sustainability. As such, we shall analyze the fund’s operational sustainability based on the following metrics;

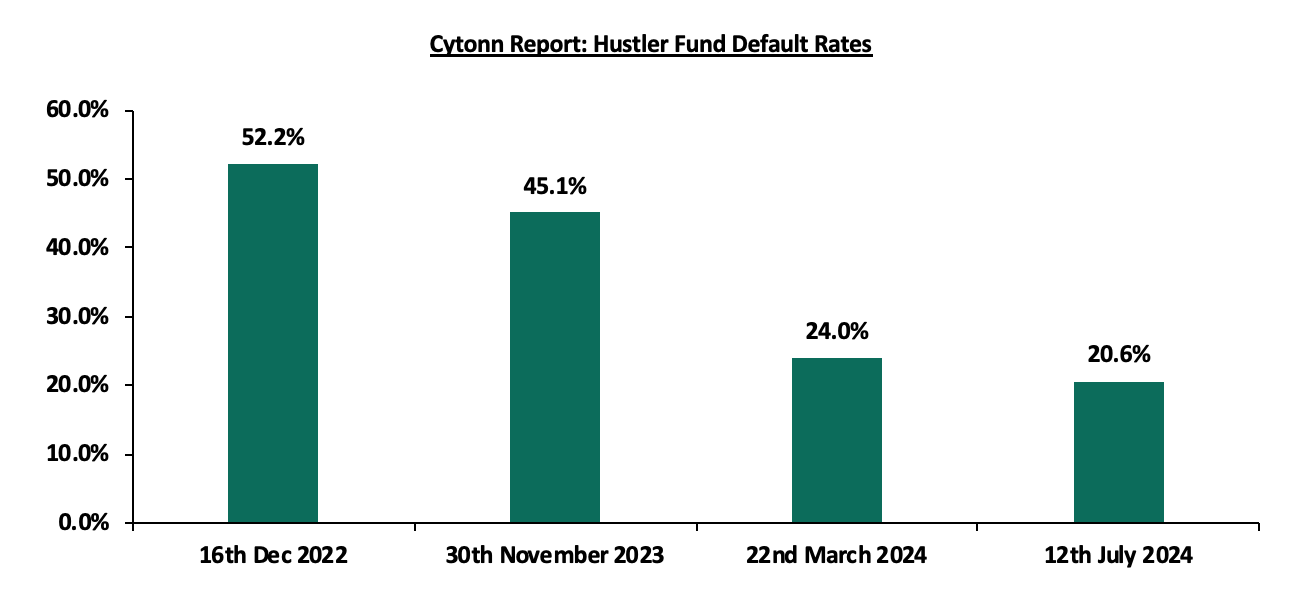

Cost of Bad Loans –The cost of bad loans significantly impacts the sustainability of the fund’s operation, resulting in reduced available capital for future lending and loss of expected interest income. Based on the provided data on the performance of the fund, the average default rate is currently at 20.6%. This indicates that averagely, for every Kshs 100 lent out, Kshs 20.6 is lost through bad loans. Although the default rates have been declining since December 2022, the fund has still not been able to achieve a 100.0% repayment rate on the amounts disbursed. The chart below shows the default rates as provided by the Co-operatives and MSME Development Ministry;

Sources: Co-operatives and MSME Dev. Ministry

- Cost of Operations – The fund has set the cost of operations at 3.0% of the approved budget for a financial year indicating that for every Kshs 100.0 lent out, Kshs 3.0 will be used to cover for administration cost and various operations, and,

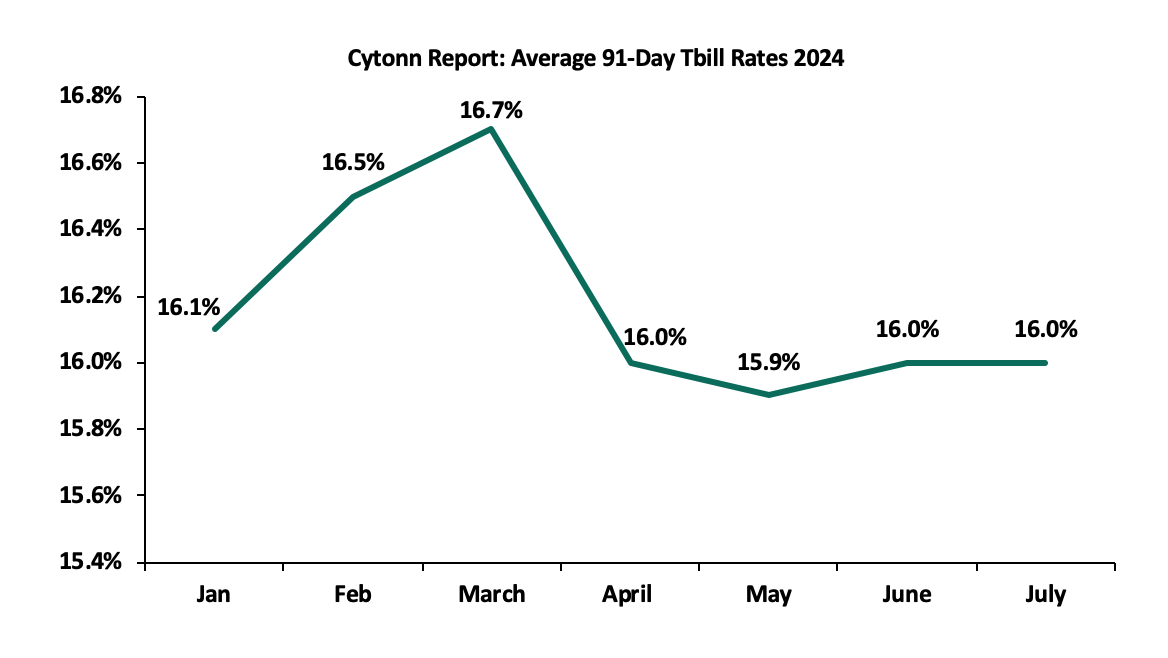

- Cost of Money – The cost of money refers to the expense that the government will incur when sourcing for funds. With Kenya already having a projected fiscal deficit of 5.7% of GDP in FY’2024/2025, it implies that financing the Hustler Fund is largely going to be financed through borrowing. Currently, the cost of short-term borrowing for the government, when using 91-day T-bill average is 16.2% for the year 2024. This indicates that for every Kshs 100.0 lent out, the government will use an estimated Kshs 16.2 to source for funds. The chart below shows the 91-day T-Bill rates for 2024;

Source: CBK

Key to note, summing up 20.6% for cost of bad loans, 3.0% for cost of operations, and 16.2% for cost of money brings the cost of fund to 49.8%. This indicates that the government is lending out money at a cost of 49.8% compared to the interest rate of 8.0% charged on the fund. The table below highlights the cost of funding for the fund;

|

Cytonn Report: Cost of Funds - Hustler Fund |

|

|

Cost of Bad loans |

20.6% |

|

Cost of Operations |

3.0% |

|

Cost of Money |

16.2% |

|

Cost of Funds |

49.8% |

|

Interest Rate |

8.0% |

|

Net Loss |

41.8% |

As such, the government will have a net loss of 41.8% meaning that out of the Kshs 50.0 bn lent out, the government’s cost of funds will stand at Kshs 24.9 bn. The analysis indicates that the Hustler Fund is unsustainable in its current state unless the government reduces the risk of bad loans caused by high default rates to ensure the fund's sustainability.

- Youth Enterprise Development Fund

According to the Report of the Auditor-General on Youth Enterprise Development Fund for the year ended 30th June 2022, the fund disbursed Kshs 370.0 mn across the country. Out of the total amount disbursed, Kshs 276.8 mn was recovered translating to a repayment rate of 74.8% and a corresponding default rate of 25.2%. Additionally, the fund attracts an interest rate of 6.0% and a one-off management fee of 1.0% netted off from the loans at disbursement. As a revolving fund designed to enhance economic opportunities and job creation for Kenyan youth through innovative, affordable financing, enterprise development, and strategic partnerships, it is crucial to emphasize the importance of its long-term sustainability. The table below highlights the cost of funding for the fund:

|

Cytonn Report: Cost of Funds – Youth Enterprise Development Fund |

|

|

Cost of Bad loans |

25.2% |

|

Cost of Operations |

1.0% |

|

Cost of Money (Average for the 91-day T-bill rates in 2024) |

16.2% |

|

Cost of Funds |

42.4% |

|

Interest Rate |

6.0% |

|

Net Loss |

36.4% |

The analysis above indicates that the Youth Enterprise Development Fund is unsustainable as it stands.

Furthermore, the Auditor-General's report for the year ending 30 June 2023 indicates that the fund has faced persistent financial difficulties, threatening its long-term viability. A major issue is the high cost associated with non-performing loans. The report reveals that a significant portion of the fund's receivables from exchange transactions, amounting to Kshs 2.5 bn, has not been serviced for over three years. This situation not only raises concerns about the accuracy and completeness of the fund's financial position but also signifies a substantial risk of bad debts. Additionally, the provision for bad and doubtful debts, set at Kshs 395.5 mn appears inadequate, further worsening the fund's financial instability.

The fund's poor financial performance over the past seven years has also eroded its capital base, impairing its ability to fulfill its mandate. Continuous losses and ineffective recovery mechanisms for outstanding loans cast doubt on the fund's ability to sustain its operations in the foreseeable future. To ensure the sustainability of the YEDF, it is crucial for the government to address these financial challenges. This includes improving loan recovery processes, increasing the provision for bad debts to accurately reflect the actual risk, and implementing stringent measures to minimize the occurrence of non-performing loans. Without these interventions, the fund's ability to support youth enterprises and contribute to job creation will remain compromised.

Section 6: Conclusion and Recommendations

As aforementioned, the funds experience particular challenges while trying to meet their objectives. As such, we have provided the following recommendations to mitigate such challenges and improve the quality of services offered by the funds;

- Stimulate Capital Markets to Contribute to Credit Markets – The capital market in Kenya is under-developed as it contributes about 5.0% of total funding to businesses while the banking sector is already maxed out contributing 95.0% of funding. As such, improving the capital markets framework will unlock a key financing avenue that businesses can tap into. It is, thus, prudent for the government, in conjunction, with the financial sector regulators to develop a sound legal framework to promote transparency of the corporate bond market bonds, as well as investor education on key legislations that apply to the specific bond market,

- Sustainability – The funds’ models are likely to fail because of the low interest rates, higher cost of bad loans, cost of operations and cost of money. To ensure long-term sustainability, the fund should develop partnerships and collaborations with other public sectors and NGOs and use their competency, financial capacity and established networks to meet the objectives of the fund at cost-effective rates,

- Governance Framework – The government should ensure that the funds are professionally managed and free from political interference to ensure transparency and avoid mismanagement of funds which has been witnessed in the past. Any person found guilty of misappropriation of funds should be charged and prosecuted as spelt out in the draft regulations. The government can also set up an independent oversight body to ensure accountability at any point in time and ensure that the operations cost is maintained at a minimum level, and,

- Establish a Legal Framework to Recover Loans – The funds currently have no legal framework to recover loans except for the option of using the defaulter’s savings. This is ineffective since it will not lead to sufficient recovery hence unsustainability. As such, the government needs to cushion itself against excessive default rate by setting up procedures to legally follow up on defaulters for the continuity of the funds.

The operational sustainability of both the Hustler Fund and the Youth Enterprise Development Fund is currently at risk due to high default rates, significant costs of operations, and the substantial cost of money. To ensure these funds can continue to fulfill their mandates, we firmly believe that the implementation of these recommendations will not only address the current challenges hindering the growth of the special funds, but also pave the way for a more vibrant and resilient financial ecosystem. These measures are crucial to reduce the financial burdens and enhance the long-term sustainability of these vital funds

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.