May 8, 2022

In December 2021, we released the Nairobi Metropolitan Area (NMA) Infrastructure Report 2021, which highlighted that there were 939.6 Km of ongoing road construction and rehabilitation projects valued at Kshs 162.4 bn. On the other hand, there were 99.7 Km road projects worth Kshs 4.3 bn completed in 2021. Both water and sewer connectivity increased by 1.0% points to 55.8% and 19.0% in 2020 from 54.8% and 18.0% in 2019, respectively in the NMA. Kenya’s electricity coverage also stood at 70.0%, which represents a 0.3% points increase from the 69.7% realized in 2019. These instances among many others signifies government’s efforts to better the country through infrastructure developments.

As a follow up to the aforementioned infrastructure report, we shall focus on highlighting the status of infrastructure in the Nairobi Metropolitan Area (NMA), with a major focus on roads, water and sewer network coverage. This is so because infrastructure continues to be a major priority in government’s economic agenda. Therefore, this topical will cover the following:

- Introduction,

- Infrastructure Trends in Kenya,

- The State of Infrastructure in the Nairobi Metropolitan Area (Roads, Water & Sewer),

- The Importance and Challenges of Infrastructure to the Real Estate Sector, and,

- Conclusion and Recommendation.

Section I: Introduction

Infrastructure refers to basic fundamental structures needed by a nation or entity in order to function properly. They include systems such as water, transport, energy, internet, sewer and drainage networks, among many others. These infrastructure systems are critical to a country’s performance and survival and their inadequacy lead to a stagnating economy. In Kenya, the government has aggressively initiated and implemented various financial strategies in order to support the development of infrastructure, as they are capital intensive. These financial strategies include: Public Private Partnerships (PPPs), issuing of infrastructure bonds, debt financing, and, massive Year on Year (YoY) budgetary allocation, among others.

For the specific infrastructure sectors, road construction projects continue to be the key beneficiary of Government’s expenditure. This is evident in the Kenya Roads Board’s Annual Public Roads Programme 2021/2022, which highlighted that the country’s road network coverage stood at 161,451 Km and valued at over Kshs 3.5 tn as at 2021, signifying heavy investment towards the sector. In the Nairobi Metropolitan Area (NMA), a total of 132.8 Km road networks worth Kshs 93.1 bn have been so far completed, between January 2021 and May 2022, whereas there are a total of 940.5 Km ongoing construction and rehabilitation projects worth Kshs 97.3 bn. (Key to note is that the completed projects are more costly compared to the projects in pipeline which have longer distance, as a result of the Nairobi Expressway project which costed Kshs 88.0 bn yet just 27.1 Km – Kshs 3.2 bn per Km compared to an average of Kshs 91.5 mn spent on the other completed projects).

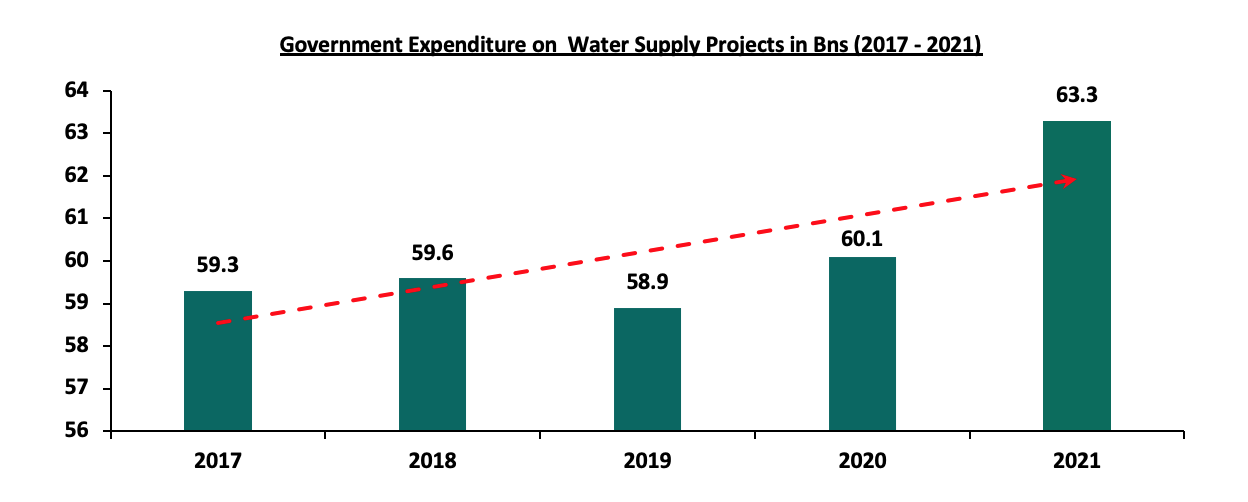

For water systems, the government spent a total of Kshs 63.3 bn towards the development of water supply projects in 2021, according to the Economic Survey 2022 report by the Kenya National Bureau of Statistics (KNBS). This is a 5.5% increase from the Kshs 60.1 bn that was spent in the 2020. In the NMA, water coverage currently stands at 55.8% as at 2020, which is a 1.0% points increase from the 54.8% recorded in 2019. For sewer systems, the current coverage is at 19.0% as at 2020 in the NMA, a 1.0% points increase from the 18.0% that was recorded in 2019, according to the Impact Report Issue No. 13 report by the Water Services Regulator Board (WASREB).

Section II: Infrastructure Trends in Kenya

In this section, we will discuss the various trends that have been shaping the development and performance of the infrastructure sector in Kenya. They include:

- Roll Out of Numerous Development and Rehabilitation Projects

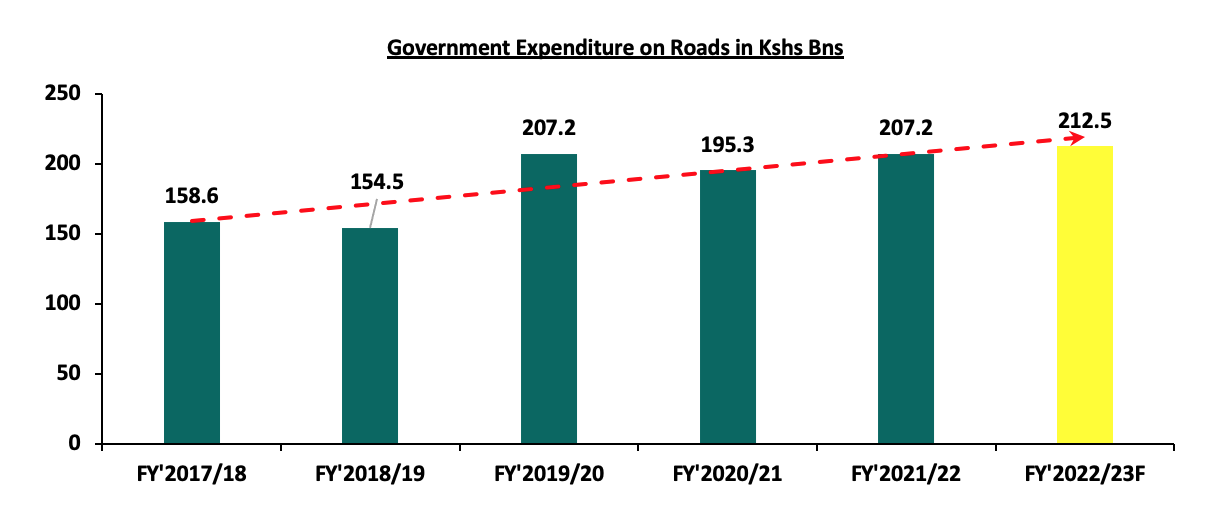

Over the years, Kenyan infrastructure sector has had numerous projects initiated and implemented, in a bid to better the economy. This has mainly been enhanced by government’s aggressiveness and continued focus to develop the projects in various parts of the country especially road projects. Case in point, KNBS highlights that the government is expected to spend an estimated Kshs 207.2 bn for the FY’2021/22 on road projects, which is a 6.1% increase from the Kshs 195.3 bn that was spent for the FY’2020/21.

- Involvement of the Private Sector in the Infrastructure Projects

Infrastructure projects are always public monopolies developed for the use of citizens in a country. Therefore, the government is mandated with role of ensuring the availability of infrastructural facilities and equipment in the country. However, we have witnessed the private sector also partner with the government in order to develop the projects. Some of these private sector organizations include: China Road and Bridge Construction Corporation (CRBC), which was involved in the construction of the Nairobi Expressway, and, China Exim Bank which is involved in the construction of the Nairobi Western Bypass Project, among many others. Through their involvement, the infrastructure sector gets to benefit from additional financing for projects, as well as the construction of the planned projects. The involvement of private sector players also eases pressure on Kenya’s budget and borrowing needs.

- Green Infrastructure

Green infrastructure is an environmentally friendly technique that is slowly taking shape in the construction of infrastructure projects in Kenya. They mainly involve installation of plant boxes, heat absorbing pavements, and planting trees in the urban areas which in turn improve the quality of air in the areas. An example is the Nairobi Expressway project, whose design incorporates plant materials such as trees and flowers, and so far has been implemented.

- Financing Strategies:

-

- Budgetary Allocations:

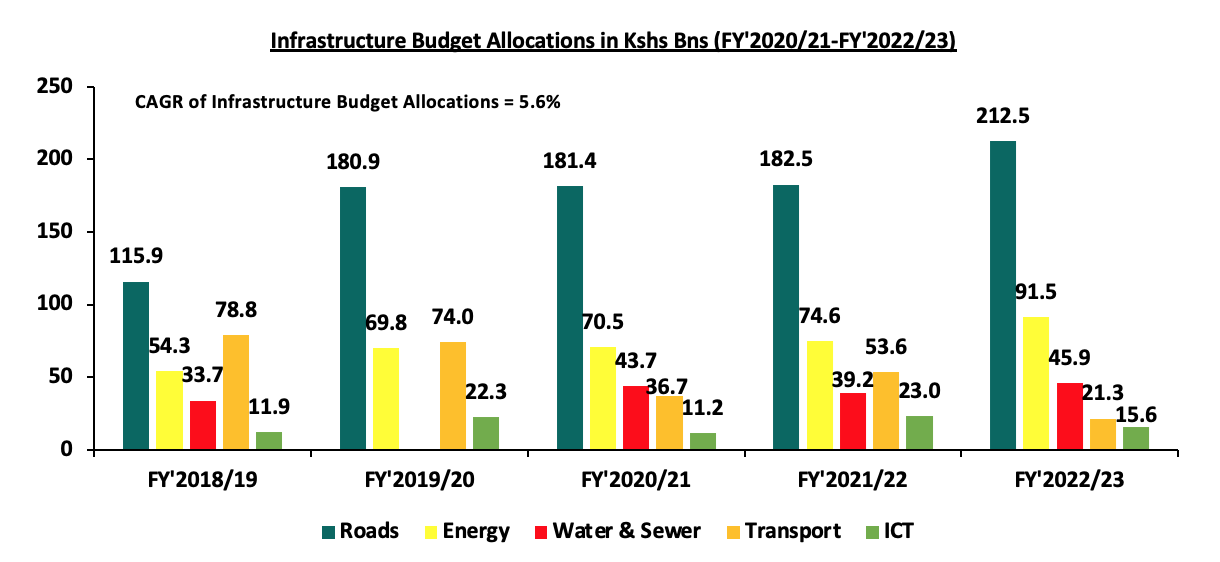

The Kenyan infrastructure sector has always been given much priority in the Year on Year (YoY) budget allocations. This is due to the capital-intensive nature of the infrastructural projects coupled with its direct impact on the economy through job creation and opening up different regions for business. In support of this, the yearly budget allocations for the sector grew by a 5.6% CAGR, with the total budget allocation for the FY’2022/23 coming in at Kshs 386.8 bn, from the Kshs 294.6 bn that was recorded for the FY’2018/19. The graph below shows the infrastructure sector budget allocation in the last five fiscal years;

Source: National Treasury of Kenya

-

- Roll Out of Infrastructure Bonds:

Infrastructure developments require massive funding in order to implement all through to completion and exit. This has therefore made the government to realize various avenues of getting finances to implement the projects besides the annual budget allocation, such as issuing of infrastructure bonds. In February 2022, the national government through the Central Bank of Kenya (CBK) floated the IFB1/2022/19 infrastructure bond worth Kshs 75.0 bn, which later realized an oversubscription rate of 176.3%. This comes barely six months after the Central Bank of Kenya (CBK) also floated the IFB1/2021/21 infrastructure bond worth Kshs 75.0 bn in September 2021, and later realized an oversubscription rate of 201.7%, signifying a high investor appetite for the bonds as well. The investor appetite is also attributable to the fact that infrastructure bond coupons are tax exempt thus offering better value for investors.

-

- Public Private Partnerships (PPPs):

As per our Public Private Partnerships topical, PPPs are generally agreements between the public sector and the private sector formed with a sole purpose of implementing public projects. This project partnership strategy has been realized to be a cost effective and technological way of implementing projects in Kenya, especially major infrastructure and housing projects. For the NMA infrastructure sector, various projects are currently underway with the Nairobi Expressway, which is a PPP project between the national government through the Kenya National Highways Authority (KENHA), and the China Road and Bridge Construction Corporation (CRBC) being the first project to be implemented using the strategy. Other projects include; i) the Western Bypass, ii) Nairobi Bulk Water Supply Project, iii) Nairobi Commuter Rail Project, iv) Kajiado – Imaroro and Ngong – Kiserian – Isinya roads project, and, v) Solid Waste Treatment in Nairobi City County Project, among many others.

-

- Debt Financing of Projects:

Infrastructural projects require colossal capital in order to implement all through to completion, whereas financial constraints continue to be a major challenge faced while executing the projects. Moreover funding sources such as budget allocations and infrastructure bonds are not enough to finance the projects. The government has therefore had to seek debt from international financial institutions such as World Bank in order to supplement the available funds for financing the projects. In order to ensure that the debt funds are utilized properly, it is vital for the government to ensure the undertaken projects are financially viable – that the project can generate sufficient revenues directly or indirectly to repay its financing costs. This is so because Kenya’s Public Debt is already currently standing at Kshs 8.2 tn as at December 2021, which 12.3% higher than the Kshs 7.3 tn recorded in December 2020, and current revenue collection serves to meet the country’s recurrent expenditure with little left for development spending.

Section III: State of Infrastructure in the Nairobi Metropolitan Area (NMA)

In this section we take a look at the current state of infrastructure in the Nairobi Metropolitan Area (NMA), which is a major beneficiary of the infrastructure developments implemented by the Government of Kenya. This is also supported by NMA’s high contribution to the country’s Gross Domestic Product, evidenced by the 37.3% of Gross County Product that it currently accounts for. The counties of focus within the NMA include; Nairobi, Kiambu, Machakos, and Kajiado Counties. Below is the analysis of the infrastructure provision;

- Roads

Roads are the most common mode of transport in Kenya, as evidenced by the Economic Survey 2022 report by the Kenya National Bureau of Statistics (KNBS). According to the report, the sector had the highest value output of Kshs 1.8 tn, compared to the overall transport and storage sector which recorded a value output of Kshs 2.3 tn, as at 2021. In terms of expenditure, the survey report highlights that the government is expected to spend an estimated total Kshs 207.2 bn for the FY’2021/22 on road projects, which is a 6.1% increase from the Kshs 195.3 bn recorded for the FY’2020/21. This is relatively higher compared to the Kshs 182.5 bn budget allocation towards the road sector in the FY’2021/22, indicating the much focus on the sector by the government. The graph below shows the Kenyan government’s expenditure on roads in the last six years;

Source: Kenya National Bureau of Statistics

In terms of performance in the Nairobi Metropolitan Area, a total of 132.8 Km road networks worth Kshs 93.1 bn have been so far completed, between 2021 and May 2022. This is an increase compared to the 97.7 Km roads worth Kshs 4.3 bn recorded in 2021. Some of the roads completed so far in 2022 include: 27.1 Km Nairobi Expressway, 4.5 Km Hunters-Githurai Missing Link, and, 3.5 Km Mugi Road, all located in Nairobi County. Below is a summary of completed road network coverage in the Nairobi Metropolitan Area (NMA) between January 2021 and May 2022;

|

Roads Completed in Nairobi Metropolitan Area in 2021-May 2022 |

||

|

County |

Coverage (KM) |

Cost (Kshs bns) |

|

Nairobi |

35.1 |

88.7 |

|

Kajiado |

70.0 |

3.0 |

|

Kiambu |

15.7 |

0.7 |

|

Machakos |

12.0 |

0.6 |

|

Total |

132.8 |

93.1 |

|

||

Source: KENHA, KeRRA, KURA

In addition to the aforementioned completed road projects, currently there are 940.5 Km ongoing construction and rehabilitation projects in the NMA worth Kshs 97.3 bn. This is a slight increase from the 939.6 Km projects worth Kshs 162.4 bn that was recorded in 2021, with some of the ongoing construction projects being; i) Athi River Machakos Turn Off, ii) Western By Pass, and, iii) Gatukuyu Matara Road, among many others. Below is a summary of the ongoing road network coverage in the NMA;

|

Summary of Nairobi Metropolitan Area Ongoing Road Projects |

|||

|

County |

Total Coverage (KM) |

Average Completion Status |

Total Cost (Kshs bns) |

|

Kiambu |

502.0 |

52.6% |

38.8 |

|

Machakos |

202.0 |

39.2% |

20.4 |

|

Kajiado |

142.4 |

57.5% |

7.3 |

|

Nairobi |

94.1 |

44.6% |

7.3 |

|

Average |

940.5 |

48.5% |

97.3 |

Source: KENHA, KURA, KeRRA,

- Water Supply

In 2021, the Government of Kenya spent a total of Kshs 63.3 bn towards the development of water supply projects, according to the Economic Survey 2022 report by the Kenya National Bureau of Statistics. This is a 5.5% increase from the Kshs 60.1 bn that was spent in the 2020, a sign of Government’s efforts to increase the supply of water in various parts of the country. The graph below shows Government’s expenditure on water supply projects in the last 5 years;

Source: Kenya National Bureau of Statistics

In the Nairobi Metropolitan Area’s (NMA), most sources of water originate from piped water systems and boreholes. In terms of water coverage performance, the Impact Report Issue No. 13 by the Water Services Regulator Board (WASREB) highlights the NMA’s average coverage increased by 1.0% points to 55.8% in 2020 from 54.8% recorded in 2019, due to increased development projects. Some of the completed water projects as at 2021 include: Muthua Community Water Supply Project, Kabiria Community Water Supply Project, Ruiru-Juja-Githurai Water Project, and, Kigoro Water Treatment Plant, among others.

In terms of coverage per County, Nairobi registered the highest water coverage at 79.0% compared to NMA’s average of 55.8%, as at 2020, due to presence of adequate water supply systems and networks. On the other hand, Kajiado recorded the least water coverage at 31.0%, which is also an 11.0% points decline from 42.0% that was recorded in 2019, attributed to inadequate water supply with the problem being compounded by the high population growth rate at 4.6% compared to Kenya’s 2.1%, according to the Kenya National Bureau of Statistics. The table below show the NMA water coverage as at 2020:

|

Nairobi Metropolitan Area Water Coverage as at 2020 |

||

|

County |

2020 |

2019 |

|

Nairobi |

79.0% |

77.0% |

|

Kiambu |

67.0% |

67.0% |

|

Machakos |

46.0% |

33.0% |

|

Kajiado |

31.0% |

42.0% |

|

Average |

55.8% |

54.8% |

Source: Water Service Regulatory Board

Below is a list of some of the water and sewer system companies within the Nairobi Metropolitan Area;

|

Nairobi Metropolitan Area Water and Sewer Systems Companies |

|||

|

Company |

County |

Company |

County |

|

Kiambu Water and Sewerage Company |

Kiambu |

Nairobi City Water & Sewerage Company |

Nairobi |

|

Thika Water and Sewerage Company |

Kiambu |

Runda Water Services Provider |

Nairobi |

|

Ruiru-Juja Water and Sanitation |

Kiambu |

Machakos Water and Sewerage Company |

Machakos |

|

Limuru Water and Sewerage Company |

Kiambu |

Mavoko Water and Sewerage Company |

Machakos |

|

Kikuyu Water and Sewerage company |

Kiambu |

Kangundo–Matungulu Water and Sewerage Company |

Machakos |

|

Gatundu Water and Sanitation Company |

Kiambu |

Mwala Water and Sanitation Company |

Machakos |

|

Karimenu Water and Sanitation Company |

Kiambu |

Oloolaiser Water and Sewerage Company |

Kajiado |

|

Kikuyu Water and Sewerage company |

Kiambu |

Nol-Turesh Loitokitok Water & Sanitation Company |

Kajiado |

|

Karuri Water and Sewerage Company |

Kiambu |

Olkejuado Water and Sewerage Company |

Kajiado |

Source; Water Service Regulatory Board

Despite the 1.0% increase in the water supply network in 2020, the overall NMA is not adequately supplied with water due to a myriad of setbacks, which include;

- Financial dependency on the National Government to deliver the projects. This is attributed to financial constraints at county levels, as a result of inadequate revenue collection by the county governments and some water service providers,

- Conflicts of decisions among County administrations and the Water Service Sector, leading to stalling of projects,

- Inadequate skilled personnel which in turn affects the managerial and operational efficiency of projects, and,

- Political influence that get directly involved in the day-to-day management and operations of the utilities, resulting in conflicts, and, misdirection of resources.

In order to curb these challenges and increase water supply in Kenya, the government through the Water Services Regulator Board (WASREB), came up with the YoY Water Governance Training Handbook in 2015. This is a report aimed at educating and guiding the public, as well as the stakeholders in the water services sector, on the best practices and matters relating to the water sector. In addition to this, there are various ongoing water supply projects in the Nairobi Metropolitan Area which include:

- Nairobi Bulk Water Supply Project, to service Nairobi city,

- Rehabilitation of Ndarugu and Thiririka Water Treatment Plant Project in Kiambu County,

- Karimenu and Karure Water Systems Development in Kiambu County,

- Westlands Water Development Project in Nairobi County,

- Mwala Constituency Water Project Phase 3 in Machakos County, and,

- Machakos Water Supply, among many others.

- Sewer Systems

In the Nairobi Metropolitan Area, sewer systems recorded an average network coverage 19.0% in 2020, a 1.0% points increase from the 18.0% that was recorded in 2019 according to the Impact Report Issue No. 13 report by the Water Services Regulator Board (WASREB). Nairobi County led with a 51.0% coverage whereas counties such as Kajiado had negligible connectivity, with majority of the population relying on sources such as pit latrines, septic tanks, and bio digesters. The table below shows the water and sewer coverage of various counties within the NMA as at 2020;

|

Nairobi Metropolitan Area Sewer Systems Coverage as at 2020 |

||

|

County |

Sewer Coverage 2020 |

Sewer Coverage 2019 |

|

Nairobi |

51.0% |

51.0% |

|

Kiambu |

11.0% |

10.0% |

|

Machakos |

14.0% |

11.0% |

|

Kajiado |

0.0% |

0.0% |

|

Average |

19.0% |

18.0% |

Source: Water Service Regulatory Board

The above data clearly depicts a big gap in the establishment of sewer systems in the Nairobi Metropolitan Area, with Kajiado’s negligible coverage causing an alarm. To curb the low network coverage, the government has initiated various sewer network projects in order to increase the infrastructure coverage in the Nairobi Metropolitan Area. Moreover, there exist various sewer line companies mandated with the task of developing and implementing sewer line projects in the NMA, as indicated in the previous infrastructure section (Water Supply Section). Some of the ongoing sewer infrastructure projects include;

- Solid Waste Treatment Project to service Nairobi city,

- Westlands Trunk Sewers Development Project in Nairobi County,

- Kilimani Trunk Sewers Development Project in Nairobi County,

- Kajiado and Kitengela Sewerage System Project,

- Mwala Constituency Sanitation Project Phase 3 in Machakos County, and,

- Machakos Sewerage Project, among many others.

Section IV: Importance of Roads, Water, and, Sewer Network Availability to the Real Estate Sector

Infrastructure development is of key importance in the performance of Kenya’s Real Estate sector. Below are the impacts of infrastructure availability towards the property sector;

- Boosting Property Investments: The availability of infrastructure such as roads and water among others helps boost property investments in the country through developments, as well as boosting the overall rates and prices of units and spaces,

- Promoting Accessibility to Properties: Establishment of roads and railway lines enhances the accessibility to various properties such as retail centres, residential units, tourism destination centres, and working areas, which in turn leads to increased demand for the properties and their overall performance,

- Reducing Development Costs: According to the Centre for Affordable Housing Finance in Africa, infrastructure accounts for approximately 14.0% of construction costs in Kenya, hence their presence eases the burden of construction to developers by reducing the costs which could otherwise be incurred by them,

- Recognition of Nairobi as a Regional Hub: The continued development of infrastructure facilities and developments has made Kenya’s Nairobi to be recognized globally as a regional hub. In turn, the country has witnessed various foreigners invest into the Kenyan property market, with some of the investors being; Eat n’ Go Limited, CCI Group of Companies, Unity Homes, Carrefour, Chicken Cottage, and, Simbisa Brand, among many others,

- Facilitates Trade Activities: Presence of infrastructure boosts commerce activities in an area. For example, good roads within an area would help in transportation of products from one area to another. Additionally, presence of electricity, water, sewer and drainage systems, among other infrastructure facilities, enhances the efficient operation of business activities in an area, contrary to an area with limited infrastructure,

- Promoting Tourism Activities & Foreign Investments: A well infrastructure-equipped economy not only boosts local investments but also foreign investments. In Kenya, Nairobi has mostly been recognized as a regional hub thereby attracting investments by foreigners, due to its strategic location and infrastructural availability. Some of the international entities include; Café Java, CCI Group of Companies, Hilton Hotel, among many others.

Additionally, availability of adequate infrastructure such as airports/airstrips, and roads, boosts tourism activities in the country by promoting accessibility into the country, as well as movement by tourists to various destinations,

- Improving Living Standards: Overall, the presence of infrastructure networks improves the living standards of citizens in a country, contrary to an area with inadequate infrastructure. This is so because infrastructure supply such as water is deemed a basic necessity for living hence lack of it is detrimental to an economy. Moreover, with the modern world of today, infrastructure networks such as electricity, and internet, are also considered basic requirements despite other people lacking it, and,

- Source of Employment Opportunity: For infrastructure to exist, there needs to be a project team to implement the projects such as; Architects, Project Managers, Construction Managers, Quantity Surveyors, Engineers, and, Contractors, among many others. This in turn creates employment opportunity to people or an entity.

Despite the above benefits, there are challenges associated with infrastructural developments to the property sector, hence the need to expand infrastructure services in the country. These challenges mainly originate from overpopulation in urban areas as a result of urbanization. In turn, this leads to; i) inadequate development space in certain areas, ii) degradation of existing public amenities and facilities, iii) traffic congestion, iv) reduction in the quality of life, and, v) chronic power and water shortages.

Section V: Conclusion & Recommendation

Infrastructure is the backbone of a country’s economy evidenced by the various benefits it is associated with such as: creation of employment opportunities, boosting investments in the country, promoting accessibility to various parts of the country, as well as boosting trade activities, among many others. As such the government of Kenya (GoK) has made it a bigger priority to focus on the implementation and delivery of infrastructural developments in order to improve the economy’s status and performance. Therefore, to gauge Real Estate investment opportunities based on infrastructure, we looked at the key infrastructural sectors and ranked them in terms of performance and availability as follows;

The points are 1-4, with 4 awarded to the Best Performing Area Based on Infrastructure Availability

|

County Ranking based on the State of Infrastructure Development January 2021 – May 2022 |

||||||

|

County |

Completed Roads |

Roads in Pipeline |

Water Connectivity |

Sewer Connectivity |

Average Points |

Rank |

|

Nairobi |

4 |

1 |

4 |

4 |

3.3 |

1 |

|

Kiambu |

2 |

4 |

3 |

2 |

2.8 |

2 |

|

Machakos |

1 |

3 |

2 |

3 |

2.3 |

3 |

|

Kajiado |

3 |

2 |

1 |

1 |

1.8 |

4 |

Based on the above infrastructure services, Nairobi tops as the best County for Real Estate developments such as the residential units, due to the presence of adequate completed road networks, and, adequate water and sewer connectivity. Some of the areas to invest in Nairobi County due to the presence adequate infrastructure include; Kilimani, Westlands, Upperhill, Gigiri, and Karen, among many others. Kiambu County follows closely in terms of infrastructure availability, with some of the best areas to implement Real Estate investments being; Ruiru, Kahawa Sukari, Juja, and, Thika, among others.

We expect the infrastructure sector of Kenya especially the Nairobi Metropolitan Area (NMA), to continue recording more construction and rehabilitation projects mainly supported by government’s aggressiveness on the same. However, financial constraints continue to remain a major factor impeding the progress of the projects as they require massive funds to establish. As such, the government should embark on implementing suitable project frameworks such as effective PPP strategies, and, efficient procurement strategies, among others, in order to curb project irregularities such as loss of funds.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.