Mar 8, 2020

Student Housing, or purpose-built student accommodation (PBSA), refers to housing that has been designed specifically to meet the demands and requirements of the modern-day student. The concept has gained much traction globally and has become a mainstream investment class asset gaining more attention from institutional investors especially in developed European markets and the United States, driven by the huge student enrolment numbers and a failure on the institutions’ part to provide accommodation that is commensurate with the increase in student enrolment populations. For instance, the US market registered 19.8 mn students in 2019, of which 1.5 mn were international, against a student housing supply of 2.7 mn. Generally, the US, UK and Australia markets accounted for the largest share of international students in 2019 with 26.0%, 12.0%, and 8.0%, respectively. Other factors influencing the growth include high rental yields in comparison to other assets, and the sub-sector’s stability even in times of economic downturns. In Kenya, the concept is also gradually gaining traction as the demand-supply gap between student accommodation and student enrolment continues to widen every year. We recently saw Acorn listed a green bond that is targeted at funding student housing and has recently discussed the potential for a D-REIT, again targeted at student housing. This week, we turn our focus on student housing and as such, we shall cover the following:

- Global Overview of Student Housing,

- Student Housing in Kenya,

- Student Housing Demand in Kenya and Factors Affecting Supply,

- Market Performance Summary, and,

- Conclusion and Recommendation.

Section I. Global Overview of Student Housing

Broadly categorised as a residential multifamily class, student housing has become an attractive investment class in its own right. Globally, the market has grown from a portfolio of USD 2.5 bn (Kshs 250.0 bn) as at 2007 to USD 17.2 bn (Kshs 1.7 tn) as at 2018, an 11-year CAGR of 19.2%, according to Knight Frank’s Global Student Property Report 2019. The growth has been driven by a number of reasons:

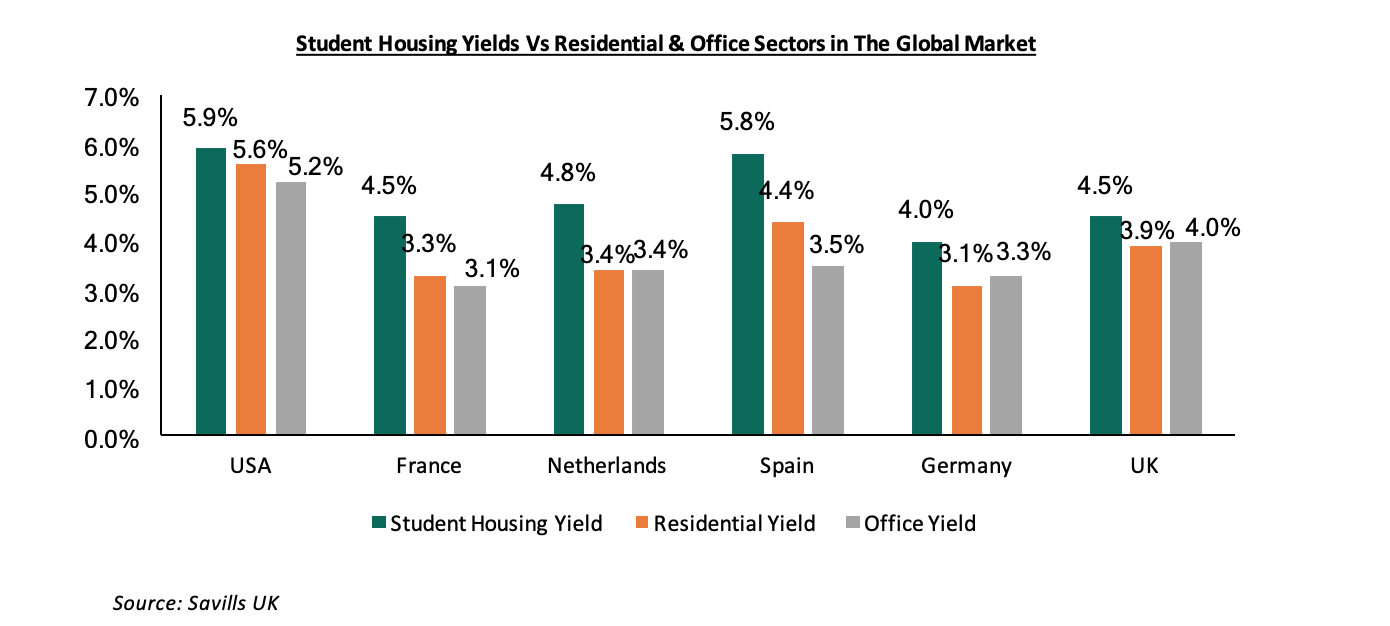

- Attractive Returns – Student housing continues to deliver relatively high returns and consistent rental income to investors in comparison to other asset classes, which tend to fluctuate with prevailing real estate cycles. According to Savills, a UK-based real estate services provider, student housing in the UK and the US delivered average rental yields of 4.5% and 5.9%, respectively, compared to their respective 10-year government bonds of 1.1% and 2.5%, respectively. As such, the sector continues to attract high net-worth investors seeking strong returns on their investment,

- Hedge Against Economic Headwinds – Student housing has proven to be resilient especially during economic downturns as well as the usual real estate cycles. This is as student enrolment increases every year despite the prevailing economic climate, and even tends to spike during economic downturns as more people seek to diversify their skillsets, and,

- Expanding Middle Class – According to World Economic Forum, every year, 140 mn households globally move into the middle-income class and another 20 mn move into the high-income bracket, increasing their expenditure on basics such as food and housing by 225.0% on average and on services such as healthcare and education by 350.0%. The growth in disposable incomes leads to student mobility as more people seek quality higher education, creating more markets for student housing.

The US and UK are the most mature student housing markets and continue to dominate global investment deals. The market is largely characterized by cross-border investments, i.e. investments in other countries, and as at 2018, these stood at 37.0% of all real estate investment, in comparison to offices and retail which accounted for 34.0% and 29.0%, respectively.

|

Notable Cross Border Student Housing Providers |

|||

|

Company |

Invested Countries |

Student Housing Brand |

Portfolio |

|

Global Student Accommodation Group(GSA) |

UK, Australia, Japan, UAE, Germany, Spain, Ireland, China |

The Student Housing Company, Uninest, Nexo |

>70,000 beds |

|

Greystar Student Living |

US, UK, Netherlands |

RESA, Chapter Living |

>100,000 beds |

|

International Campus |

Germany, Netherlands, Australia |

The Fizz |

3,500 rooms |

|

The Student Hotel |

Netherlands, France, Spain, Italy, Germany |

The Student Hotel(TSH) |

4,400 rooms |

Major institutional investors include sovereign wealth funds (SWF), pension funds, insurance funds, as well as large-scale real estate developers. The most common methods of investing include buying properties for earning rental income whereas others invest in Real Estate Investment Trusts (REITs) that own student accommodation. In terms of returns, the sub-sector registered relatively high returns surpassing other real estate classes such as conventional residential and commercial sectors.

Source: Savills UK

In the Sub-Saharan Africa region, most of the region’s private providers are based in South Africa as it has the highest student population in the region at 1.1 mn, with operators such as South Point, International Housing Solutions (IHS), and Respublica being some of the most prominent student housing providers. According to United Nations Education, Scientific and Cultural Organization (UNESCO) statistics, in Sub-Saharan Africa, South Africa currently has the highest inbound student mobility ratio (number of students from abroad studying in a given country, as a percentage of the total tertiary enrolment in that country) in Africa at 4.1 compared to countries like Kenya with 0.9. This translates to a relatively high number of international students in Africa at 45,334 whereas Kenya has 5,254. The largest Pan-African providers of private student housing are AfricanIcon and Shelter Afrique, with 44,218 and 30,000 beds, respectively, according to a 2016 JLL report.

Section II. Student Housing in Kenya

All universities in Kenya are experiencing an acute student housing shortage. The existing capacity is limited and new developments have ultimately not kept pace with the growth in enrolment. According to the Ministry of Education, available student housing in Kenya stands at 300,000 against a university enrolment of 520,900 as at 2018, excluding technical colleges. According to Cytonn Research, on average, the majority of higher institutions in Kenya, therefore, only cater to approximately 22.6% of their student population, having looked at various tertiary institutions, their on-campus hostels capacity against their student enrolment. Assuming that 10.0% live at home, this means private investors are left to cater for at least 67.4%, which translates to over 350,000-bed spaces.

Similar to affordable housing, the majority of the private student housing stock lacks in quality and amenities that are expected of student accommodation. There is a huge gap of institutional-grade student housing stock to warrant interest from willing international institutional investors seeking to deploy capital in regions with strong returns. At present, the minimal available investment grade portfolio is within Nairobi County with the key market players as shown below:

|

Purpose-Built Student Housing Investors in Kenya |

|||||

|

Key Players |

Type |

Brand |

Investment Areas |

Portfolio |

Incoming Supply |

|

Acorn/Helios |

Joint Venture |

Qwetu/Qejani |

Ruaraka, Madaraka, Parklands, Jogoo Road |

1,572 |

50,000 |

|

Questworks |

Developer |

Parallelfour |

Madaraka |

<200 |

800 |

|

Century Developments Ltd/Kuramo |

Joint Venture |

- |

Nairobi County |

- |

10,000 |

|

Defoca (Kenya Defense Forces Old Comrades Association) |

Owner |

Kafoca Studyville |

Madaraka |

500 |

- |

|

Total |

2,272 |

60,800 |

|||

Online sources

Century Developments and Kuramo’s partnership deal is set to deliver 10,000 Purpose-built units in the next five years, Parallelfour is currently under construction and is set for completion by 2021, while no timeline has been given for Acorn’s pipeline of 50,000 units.

Acorn Holdings, a joint venture between Acorn and UK-based Private Equity firm Helios, is currently the leading purpose-built student accommodation player in the Kenyan market having developed 1,572 rooms with 2,313 beds as at 2020. In November 2019, the firm issued the first Kenyan green bond on the international Securities Market of the London Stock Exchange (LSE) raising 85.0% of its Kshs 4.3 bn target, affirming that Kenya is indeed an attractive market for foreign investors. The medium-term note (MTN) program will be used to finance the construction of green-certified student properties, to create quality and affordable accommodation for 5,000 students in Nairobi. Currently, the firm has upcoming student housing projects on Thika Road, Athi River, Kilimani and Waiyaki Way.

Section III. Student Housing Demand in Kenya and Factors Affecting Supply

Unlike in the developed matured markets where the student population is expected to dip, Kenya’s market is still nascent. The demand for student housing is attributable to:

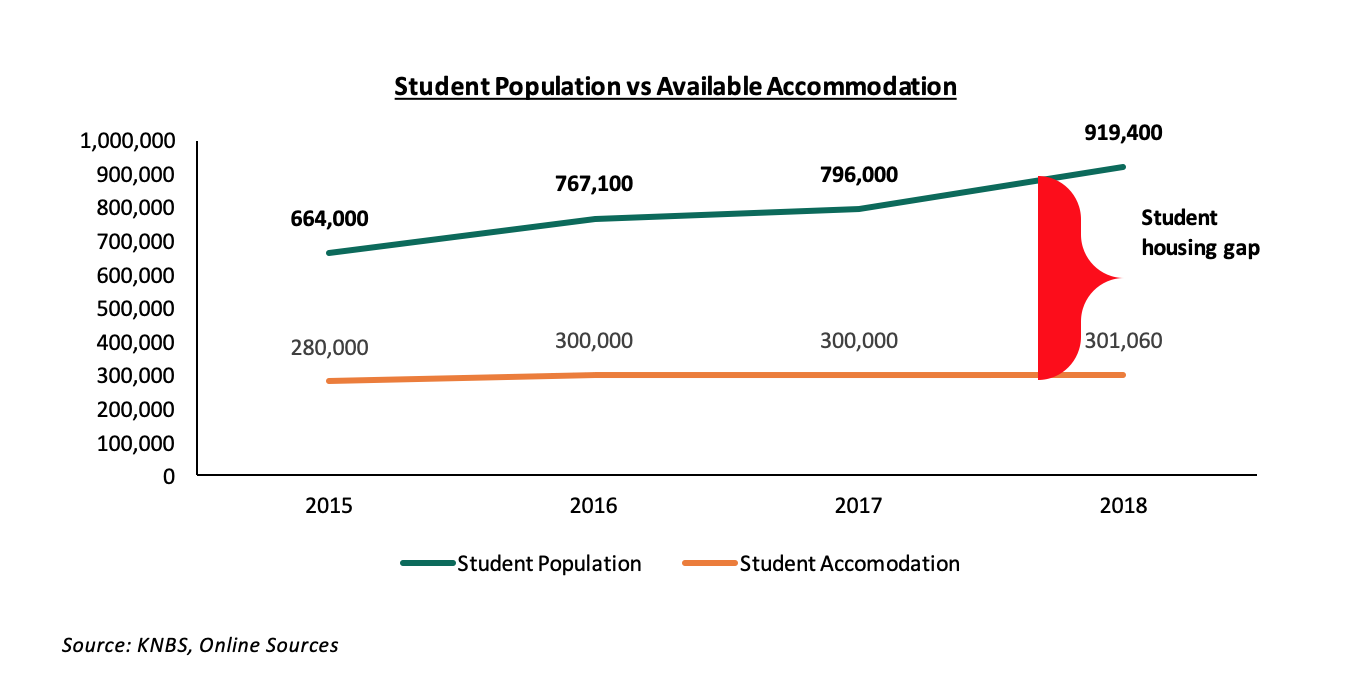

- Rapidly Growing Student Population: At present, the student population in universities and vocational centres according to Kenya National Bureau of statics 2019 Economic Survey stood at 796,000 in 2017/18 and was expected to grow by 15.5% to 919,400 in the 2018/19 academic year. The numbers are set to increase as the university/college age demographic continues to grow. According to the 2019 census data, the number of 18-24 year individuals came in at 6.4 mn, representing 13.4% of the total Kenyan population of 47.6 mn,

Source: KNBS, Online Sources

Purpose-built student housing volumes in Kenya have only registered a paltry change over the past five decades with no institution having developed a new project. The recorded change is due to newly opened institutions, and Acorn’s portfolio of 1,060 units as at 2019. We expect this to grow by a further 1,000 units once Acorn and Questworks complete their respective Thome and Madaraka projects by 2021. With the current available stock at 301,060, the student housing gap has been growing at a 4-year CAGR of 20.7%, and 123.8% more per year than the affordable housing deficit which grows by 200,000 units p.a. according to the National Housing Corporation (NHC).

- Increase in Tertiary Institutions: According to the Kenya National Bureau of Statistics (KNBS), the number of technical colleges and universities grew by a 4-year CAGR of 32.0% and 4.4%, respectively. In a bid to gain scale, the institutions continue to expand through satellite branches supported by government policy on increasing the number of universities in each county as well as infrastructural improvements, necessitating investment in student accommodation,

- Public Policy: Government measures such as scrapping visa requirements for other African countries is a boost for enrolment of international students to local institutions. In addition, the Kenya National Qualifications Authority is developing a policy to help the country increase the number of international students from across Africa to 30,000 and turn it into a regional higher education hub, which will result in greater demand for quality student accommodation.

In terms of supply, provision of student’s halls of residence was traditionally assumed to be the role of the institution. However, with public sector budget constraints especially towards varsities’ funding and insufficient land supply for private universities, the institutions rely on the private sector to plug the deficit. To this end, various institutions namely Moi University, Kenyatta University, South Eastern Kenya University and the University of Embu have initialized public-private partnerships to address the hostel deficit. However, despite these agreements having been signed as early as 2014, none has come to fruition, which we attribute to the challenges faced by public-private partnerships (PPPs)in Kenya such as; (i) difficulties in managing the multi-stakeholder nature of most of the PPP projects, (ii) lack of appropriate legal frameworks in Kenya to enable transfer of public land into special purpose vehicles to be able to attract private capital and bank debt, and (iii) the extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years. The PPP hostel projects have a design, build, own, operate and transfer model, where the developers will recoup their return after 20 years.

The shortage of purpose-built student accommodation is attributable to:

- High Land Costs - Land in urban areas in Kenya has continued to soar, driven by demand for development class land which has also led to its shortage, especially in Nairobi, where the price per acre averages Kshs 139.4 mn,

- Insufficient Access to Funding - Unlike in the developed markets where investors can easily secure debt and equity financing, obtaining financing for local developers has been difficult due to reluctance of lending institutions to finance such private developers and therefore apply strict underwriting standards. Additionally, the local capital markets, which can be a source of long-term funding remains relatively undeveloped compared to developed markets and also limited access, and,

- Inadequate Expertise - Purpose-built student housing accommodation requires high development and management expertise, which the majority of developers lack capacity for.

Section IV. Market Performance Summary

We conducted research across 9 areas namely, Parklands, Ruiru, Kahawa Sukari, Thome, Juja, Rongai, Athi River, and Karen. The student housing market in Kenya tends to be fragmented with majority of housing in major established universities ranging from studio units to shared apartments, with sizes ranging from 9 SQM for a single room to 30 SQM for shared living. However, the majority of the stock is old and rundown buildings lacking in necessary student services such as ample security, professional management and reliable internet access.

From the research, as the number of occupants per room increase, the average monthly rent per person decreases with average monthly rent per person for a 6-sharing apartment totalling Kshs 270 per SQM. Additionally, shared living recorded the highest occupancy rates in comparison to single living owing to the fact majority of the students choose to forego privacy to save on rental costs.

On average, the private hostels charge Kshs 8,742 per month compared to university-let hostels, which charge a maximum of Kshs 1,000 per month.

|

Student Housing Performance in Nairobi Metropolitan Area - 2020 |

||||

|

Number of Persons per Room |

Average Rent (Kshs) |

Average Rent per SQM |

Average Occupancy |

Average Rental Yield |

|

1 |

12,735 |

637 |

76.8% |

11.7% |

|

2 |

8,188 |

457 |

81.2% |

8.9% |

|

4 |

6,672 |

345 |

81.0% |

6.7% |

|

6 |

5,498 |

270 |

86.5% |

5.6% |

|

Average |

8,742 |

427 |

81.4% |

*7.4% |

*The average is a weighted average based on the number of people sharing per room |

||||

Source: Cytonn Research 2020

We also analysed the data depending on the market segments; upper mid-end markets, which tend to host private universities and the low mid-end and satellite towns which largely host mid-tier colleges and public universities. All purpose-built student accommodation tends to be located in the upper mid-end markets such as Madaraka, Parklands and Thome. As such, they attract relatively higher rental rates that average at Kshs 599 per SQM in comparison to the low mid-end markets with Kshs 430 per SQM.

In lower mid-end areas, student housing is of lower quality and most rent at an average of Kshs 7,624 per month. Common facilities offered include simple furnishing comprising of simple metal or wooden bed, study desk, a kitchenette, hot shower, and free wifi. In terms of security, most rely on proximity to police stations.

However, purpose-built student housing offer amenities such as tuck shops, back-up generators, CCTV and 24/7 security teams, secure biometric access, common rooms with DSTV, gyms, and game rooms, laundry machines, separate study rooms, and some even offer shuttle services. The rents for PBSA range from Kshs 10,000 with the highest in the market being Kshs 31,000 per month.

|

Nairobi Metropolitan Area Student Housing Summary 2020 |

|||||

|

Area |

Average Plinth Area |

Average Monthly Rent (Kshs) |

Average Rent per SM |

Average Occupancy |

Average Rental Yield |

|

Upper Mid-End Student Housing |

|||||

|

Parklands |

21.6 |

11,643 |

574 |

84.4% |

9.8% |

|

Madaraka |

21.5 |

12,361 |

583 |

79.0% |

9.4% |

|

Thome |

23.8 |

14,538 |

619 |

75.2% |

9.5% |

|

Karen |

16.1 |

10,022 |

624 |

72.2% |

9.2% |

|

Average |

20.7 |

12,141 |

599 |

77.7% |

9.5% |

|

Lower Mid-End Student Housing |

|||||

|

Rongai |

18.2 |

11,393 |

534 |

71.3% |

9.1% |

|

Kahawa Sukari |

13.1 |

4,472 |

332 |

84.9% |

6.8% |

|

Athi River |

24.9 |

7,792 |

352 |

79.4% |

6.7% |

|

Thika |

13.0 |

3,964 |

320 |

77.4% |

5.9% |

|

Juja |

14.9 |

3,583 |

249 |

85.0% |

5.1% |

|

Average |

17.3 |

7,624 |

430 |

78.3% |

7.5% |

NB: The yields are calculated assuming an average development cost per SQM of Kshs 50,000 for non-purpose built student housing, and Kshs 59,000 per SQM for PBSA |

|||||

Source: Cytonn Research 2020

- Rental Rates – Karen and Thome attract the highest rent per SQM with Kshs 619 and Kshs 624, respectively. These areas host top tier private universities such as Catholic University of Eastern Africa and United States International University, and thus, they attract students largely from the middle class and high-income families. Generally, the average monthly rental rates fluctuate based on location, the type of institutions targeted, which tend to warrant differences in terms of the quality of student housing and amenities expected by the students. Additionally, hostels within Nairobi County tend to charge higher than satellites owing to the relatively high land costs, which are passed onto the tenants,

- Amenities - Rental properties in the off-campus market offer a number of amenities, many of which are absent in on-campus housing. Three amenities that are available off-campus and almost non-existent on campus include; hot showers, wireless internet access and DSTV,

Occupancy Rates – The low mid-end areas recorded slightly higher occupancy rates averaging 78.3% compared to upper mid-end areas with 77.7%. This is because the former tend to attract more student populations owing to their affordability. For instance, a student studying at a university in Karen would choose to live and commute from Rongai where the housing is relatively more affordable.

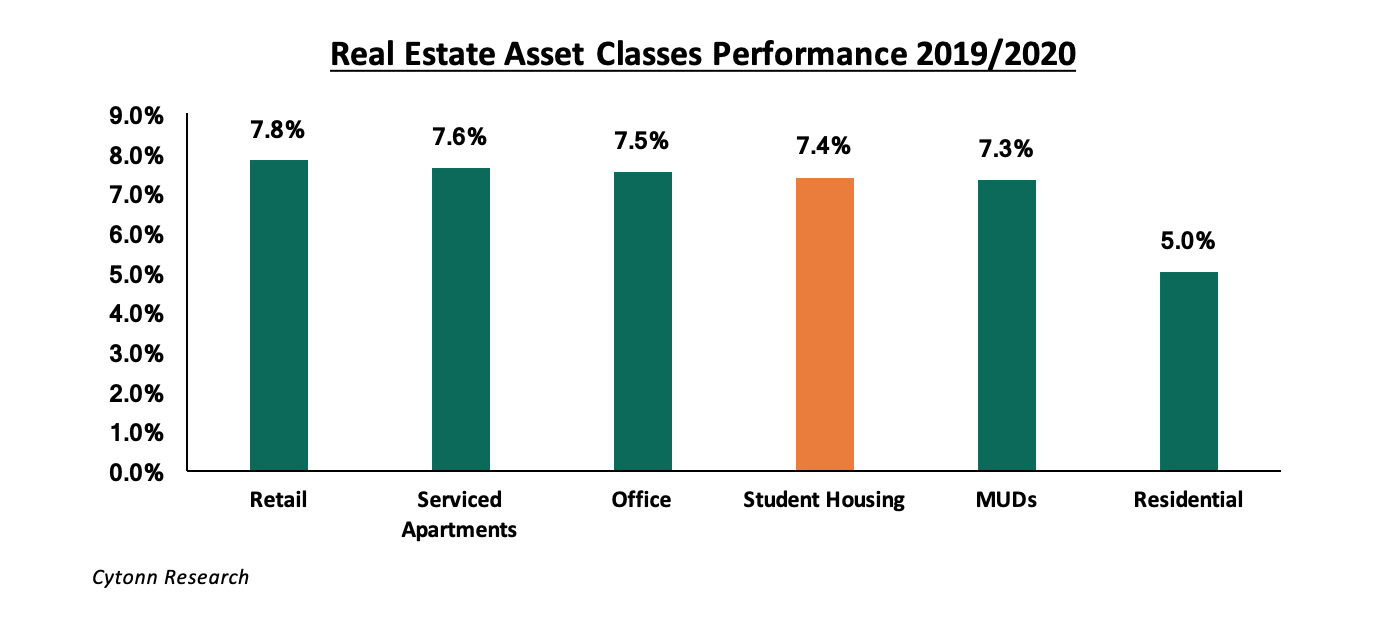

In comparison to other asset classes within the real estate sector, student housing posted a relatively high rental yield averaging 7.4% and surpassing Mixed-use developments (MUDs) and residential sectors with 7.3% and 5.0%, respectively, as shown below:

Cytonn Research

Section V. Conclusion and Recommendation

Currently, less than 25.0% of the current demand is met by university-operated supply. As such, the student housing market in Kenya is driven by a large volume of private owners with relatively small portfolios of off-campus hostels, where the quality of accommodation is often way below what students want, or expect. We expect that the government’s policy to have a university in every county as well as plans to increase international students to 30,000, will sustain the high student accommodation demand, creating an opportunity for investors to meet the demand for well-located, high-quality and affordable accommodation.

For investment opportunity, Nairobi Metropolitan Area hosts the majority of the big local universities including the University of Nairobi, Kenyatta University (KU), Jomo Kenyatta University of Agriculture and Technology (JKUAT) and accounts for a majority share of the total student enrolment at 43.1% as per the 2018/19 academic year. Additionally, Nairobi hosts the best private universities in Kenya popular with international students, namely, United States International University and Strathmore University, and as such, we expect that the region will continue to present a large gap for quality purpose-built accommodation.

To have successful student housing, that benefits from constant occupancy rates and consistent rental income, investors should conduct thorough research to identify the niche markets. The developments should be in-line with international standards such as (i) high-quality finishes and amenities, (ii) thoughtful and market-specific design, and (iii) are located in close proximity to universities, ideally less than five minutes walking distance.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.