Jan 2, 2022

Economic Growth

The Sub-Saharan Africa economy is projected to expand by 3.1% in 2021 according to World Bank’s African Pulse issue and 3.0% according to the IMF, and is expected to grow further in 2022 by 3.5% and 3.8%, according to projections from the World Bank and IMF respectively. The growth will be driven by elevated commodity prices, relaxation of COVID-19 containments measures, increased vaccination and recovery in global trade. The SSA remains prone to threats such as emergence of new waves of the pandemic, coupled with slow vaccine roll out in some economies and concerns over debt sustainability. The region’s public debt to Gross domestic product is estimated at 71.0%, which is 30.0% points more than in 2013.

Currency Performance

In 2021, SSA Currency markets recorded mixed performance, with most currencies depreciating against the dollar. This is attributable to increased dollar demand in the region following the reopening of major economies in 2021, coupled with a faster increase in imports as compared to exports. Below is a table showing the performance of select African currencies;

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Dec-19 |

Dec-20 |

Dec-21 |

2020 y/y change (%) |

2021 y/y change (%) |

|

Zambian Kwacha |

14.1 |

21.1 |

16.7 |

(50.4%) |

21.0% |

|

Ugandan Shilling |

3,660.0 |

3,647.0 |

3,544.3 |

0.4% |

2.8% |

|

Tanzania Shilling |

2,293.0 |

2,314.0 |

2,297.8 |

(0.9%) |

0.7% |

|

Ghanaian Cedi |

5.7 |

5.8 |

6.0 |

(3.2%) |

(3.4%) |

|

Kenyan Shilling |

101.3 |

109.2 |

113.1 |

(7.7%) |

(3.6%) |

|

Malawian Kwacha |

729.1 |

763.2 |

817.3 |

(4.7%) |

(7.1%) |

|

Nigerian Naira |

306.0 |

380.7 |

410.9 |

(24.4%) |

(8.0%) |

|

South African Rand |

14.0 |

14.7 |

15.9 |

(5.0%) |

(8.1%) |

|

Botswana Pula |

10.6 |

10.8 |

11.7 |

(2.3%) |

(8.7%) |

|

Mauritius Rupee |

36.2 |

39.6 |

43.3 |

(9.3%) |

(9.3%) |

Key take outs from the table above are;

- The Mauritian Rupee was the worst performer, depreciating by 9.3% against the dollar, attributable to lower dollar inflows from export and tourism sectors as a result of strict lockdown measures to curb spread of the Delta variant of COVID-19.

- The Zambian kwacha registered significant recovery, appreciating by 0% compared to the 50.4% depreciation recorded in 2020. The strong performance of the Kwacha is mainly attributable to the strong recovery in global copper prices which led to improved foreign exchange flows from the mining sector.

- The Kenya Shilling depreciated by 3.6% in 2021 to close at Kshs 113.1 against the US Dollar, compared to Kshs 109.2 recorded at the end of 2020, driven by the increased global crude oil prices that led to increased dollar demand from oil and energy importers who had to increase the amounts they pay for oil imports and hence depleting dollar supply in the market.

African Eurobonds

Africa’s appetite for foreign-denominated debt has continued to increase, with USD 11.8 bn worth of Eurobonds issued by African sovereigns in 2021. The latest issuer in 2021 was Nigeria, who raised a total of USD 4.0 bn in September 2021, after receiving bids worth USD 12.2 bn, translating to a subscription rate of 3.1x. The oversubscription is mainly driven by the yield hungry investors and also the positive outlook of Nigeria’s economic recovery. Other countries that issued Eurobonds include Kenya which raised USD 1.0 bn in June 2021, in an issue that was 5.0x oversubscribed. Similarly, Ghana raised USD 3.0 bn from a zero-coupon Eurobond issue that was 2.0x oversubscribed.

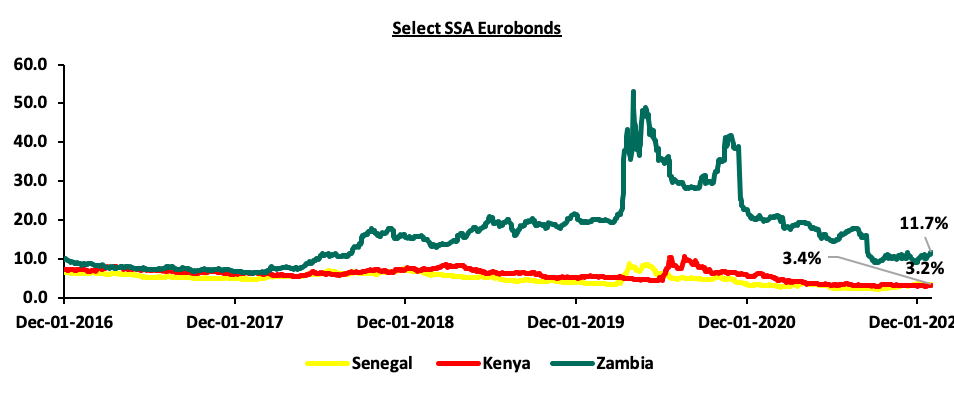

Below is a 5-year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Source: S&P Capital IQ

There was a general decline in the yields of the various Eurobonds from different countries due to general improvement in investor sentiment as the economies recovered and demand for commodities increased. However, yields have slightly edged up in the tail end of Q4’2021, as investors attach a higher risk premium on the region, following the emergence of the new Omicron variant that continues to pose a risk to the region’s economic recovery.

Equities Market Performance

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in 2021, with most of the markets recording positive returns, attributable to the improved investor sentiments in the region. The Zambia Stock market (LASILZ) was the best performing with a 96.2% index gain, attributable to the recovery of copper prices. On the other hand, Rwanda’s RSEASI was the worst-performing index, recording losses of 5.5%, mainly attributable to a deterioration in the business environment following the sustained lockdowns put in place to curb the spread of COVID-19, hence lowering investor sentiments. Below is a summary of the performance of key indices:

|

Equities Market Performance (Dollarized*) |

||||||

|

Country |

Index |

Dec-19 |

Dec-20 |

Dec-21 |

2020 y/y change (%) |

2021 y/y change (%) |

|

Zambia |

LASILZ |

303.3 |

185.2 |

363.4 |

(39.0%) |

96.2% |

|

Ghana |

GGSECI |

405.5 |

332.5 |

464.4 |

(18.0%) |

39.7% |

|

South Africa |

JALSH |

4,079.3 |

4,069.0 |

4638.8 |

(0.3%) |

14.0% |

|

Kenya |

NASI |

1.6 |

1.4 |

1.5 |

(15.2%) |

4.4% |

|

Tanzania |

DARSDEI |

1.5 |

1.5 |

1.6 |

0.7% |

3.4% |

|

Uganda |

USEASI |

0.5 |

0.4 |

0.4 |

(26.8%) |

0.2% |

|

Nigeria |

NGEASI |

87.7 |

105.8 |

103.9 |

20.6% |

(1.8%) |

|

Rwanda |

RSEASI |

0.1 |

0.2 |

0.1 |

3.4% |

(5.5%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: S&P Capital IQ

Robust GDP growth in Sub-Saharan Africa region is expected to continue in 2022 in line with the rest of the global economy. The region still faces key challenges among them emergence of new COVID-19 waves coupled with slow pace of vaccine rollout. The region continues to suffer from high debt levels that will make them less attractive to foreign capital and high costs of debt service following expiry of Debt Service Suspension Initiative and weakening of local currencies.