Jul 4, 2021

According to the World Bank and the International Monetary Fund (IMF), the Sub Saharan economy is projected to grow at a rate between 3.4% and 2.8% in 2021 following a 2.4% decline in 2020 supported by recovering commodity prices and improving economic activity following the re-opening of most economies. There are still risks to these outlooks given subsequent waves of the virus, the governments’ high debt levels and historical challenges such as political instabilities in some of the countries.

Debt sustainability in the region continues to be a major concern and as per World Bank’s Africa’s Pulse April 2021, SSA’s public debt is projected to rise further to 69.0% of GDP in 2021, from 65.0% in 2020. Most African countries continued participating in Paris and Non-Paris club Debt Service Suspension initiatives in the first half of 2021 in a bid to manage their overall debt burden. According to the IMF’s Regional Economic Outlook, seventeen countries were in debt distress which is one more than before the pandemic. This is due to significant shortfalls in revenue collection and depreciating local currencies which in turn make debt servicing more expensive.

Currency Performance

Following a sharp depreciation of currencies in 2020, we have seen most currencies recover with South Africa gaining by 2.6% and Kenya at 1.2%. The Mauritius Rupee is the worst performer YTD given the low economic activity and the structure of its economy. The Zambian Kwacha is the largest decliner over the last twelve months having lost 24.9% due to the high demand for debt repayment by the government. Going forward, the increase in commodity prices will see commodity driven economies perform better due to increased dollar inflows from the higher prices which will support their currencies.

Below is a table showing the performance of select African currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Jun-20 |

Dec-20 |

Jun-21 |

Last 12 Months change (%) |

YTD change (%) |

|

South African Rand |

17.3 |

14.7 |

14.3 |

17.3% |

2.6% |

|

Ugandan Shilling |

3719.1 |

3647.0 |

3556.8 |

4.4% |

2.5% |

|

Kenyan Shilling |

106.5 |

109.2 |

107.9 |

(1.3%) |

1.2% |

|

Ghanaian Cedi |

5.7 |

5.8 |

5.8 |

(1.8%) |

0.7% |

|

Botswana Pula |

11.9 |

10.8 |

10.8 |

9.2% |

0.4% |

|

Tanzanian Shilling |

2313.0 |

2314.0 |

2319.0 |

(0.3%) |

(0.2%) |

|

Malawian Kwacha |

728.4 |

763.2 |

805.8 |

(10.6%) |

(5.6%) |

|

Zambian Kwacha |

18.1 |

21.1 |

22.6 |

(24.9%) |

(6.9%) |

|

Nigerian Naira |

360.0 |

380.7 |

410.5 |

(14.0%) |

(7.8%) |

|

Mauritius Rupee |

40.0 |

39.6 |

42.7 |

(6.8%) |

(8.0%) |

African Eurobonds:

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the first half of 2021 being Benin, Ivory Coast, Ghana and Kenya raising a total of USD 6.1 bn which translates to a 3.5x subscription rate. The high support is driven by the yield hungry investors and also the outlook of positive recovery in the regional economies.

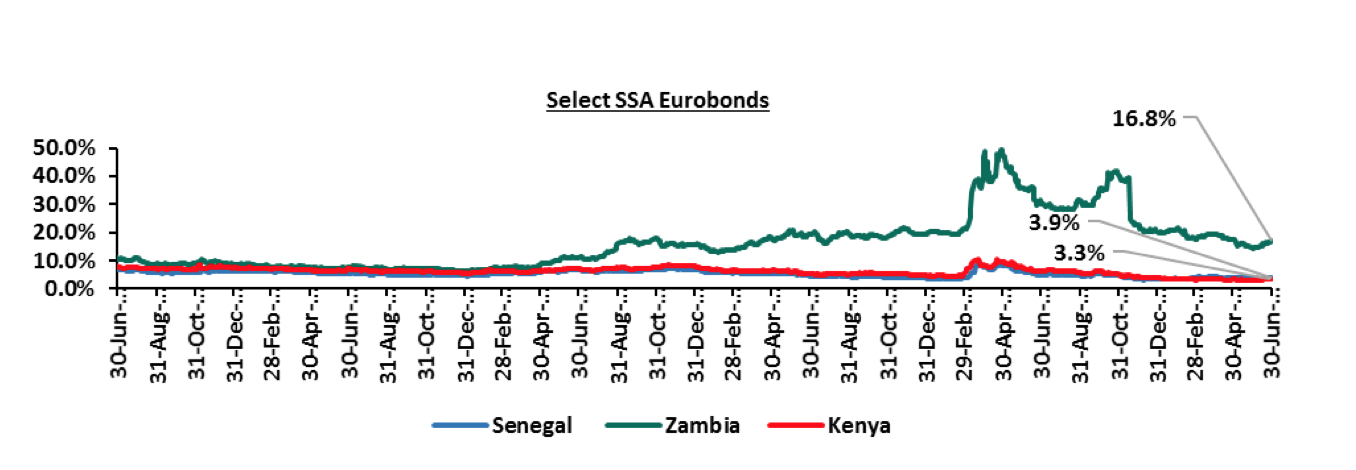

Below is a 5 year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Source: Reuters

Key Take outs from the chart:

- Yields on the Zambia Eurobond declined in H1’2021 by 3.4% points to 16.8%, from 20.2% recorded at the end of December 2020. The decline is partly attributable to; the rising copper prices that have improved the economic prospects of the country coupled with the government’s efforts on debt sustainability which has aided in regaining some of the investors’ confidence. Yields on the Zambia Eurobond however remain relatively high, owing to the high risk attached to the country as it failed to honor its service obligations of a USD 42.5 mn Eurobond coupon in November 2020 and is still struggling with high debt levels which are currently above 100.0% of the GDP,

- Yields on the Kenya Eurobond also declined by 0.6% points to 3.3%, from 3.9% recorded at the end of December 2020, partly attributable to improved investor confidence following the announcement of the IMF Credit Facility that came with conditions meant to enforce fiscal consolidation and ensure debt sustainability in Kenya, and,

- Yields on the Senegal Eurobond increased by 0.7% points to 3.9% from 3.2% recorded at the end of December 2020, attributable to the economic decline due to the COVID-19 pandemic with the tourism and transport sectors being some of the hardest hit sectors.

Equities Market Performance

Sub-Saharan Africa (SSA) stock markets recorded a mixed performance in H1’2021, with most of the markets recording positive returns, attributable to foreign investors’ activities as they looked for higher returns. The Ghanaian Stock market (GGSECI) was the best performing index with a 36.6% YTD gain, supported by a stable economy and currency. Nigeria’s NGSEASI was the worst-performing index with losses of 12.8% YTD, attributable to capital flight to other asset classes, mostly fixed income where the yields have gone up since the start of the year. The devaluation of the currency in 2021 as well as the souring inflation, which has been above 20.0%, has led to poor market performance, elevating the risks caused by the pandemic. Below is a summary of the performance of key indices:

|

Equities Market Performance (Dollarized*) |

||||||

|

Country |

Index |

Jun-20 |

Dec-20 |

Jun-21 |

Last 12 Months change (%) |

YTD change (%) |

|

Ghana |

GGSECI |

330.6 |

332.5 |

454.2 |

0.6% |

36.6% |

|

Uganda |

USEASI |

0.4 |

0.4 |

0.4 |

(10.0%) |

16.7% |

|

Kenya |

NASI |

1.3 |

1.4 |

1.6 |

7.2% |

15.4% |

|

South Africa |

JALSH |

3138.5 |

4069.0 |

4626.1 |

29.6% |

13.7% |

|

Zambia |

LASILZ |

216.8 |

185.2 |

205.5 |

(14.6%) |

11.0% |

|

Tanzania |

DARSDSEI |

1.5 |

1.5 |

1.6 |

(0.3%) |

4.9% |

|

Rwanda |

RSEASI |

0.2 |

0.2 |

0.2 |

(25.0%) |

0.0% |

|

Nigeria |

NGSEASI |

68.0 |

105.8 |

92.2 |

55.6% |

(12.8%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Reuters

GDP growth in Sub-Saharan Africa region is expected to recover gradually in 2021, in line with the rest of the global economy. The region still faces key challenges among them the COVID-19 pandemic with the region experiencing a slow distribution of the vaccines. Additionally, some of the countries are suffering from high debt levels that increased to 69.0% from 65.0% in 2020 making them less attractive to foreign capital. The significant weakening of the currencies has made debt service also become very expensive.