Jul 5, 2020

The African regional growth is expected to be significantly lower with the World Bank in their Africa’s Pulse report revising the growth to a contraction of 5.1% in 2020 from a growth of 3.0% projected at the beginning of the year. The International Monetary Fund (IMF) on the other hand, released the Sub-Saharan Regional Economic Outlook, revising the Sub-Saharan Africa (SSA) GDP growth to a contraction of 3.2%, from a contraction of 1.6% projected earlier in April 2020, in their World Economic Outlook (The Great Lockdown) report. The lower growth rate is mainly attributable to the uncertainty around the tenor of the pandemic and its implications around the various SSA economies given the acceleration of the virus despite the measures taken by most governments to contain its spread. Commodity driven economies saw their GDP revised downwards by an average of 2.0% due to the plummeting of oil prices, declining economic activities as well as low oil production in countries such as Nigeria. Economies dependent on Tourism activities such as Mauritius, on the other hand, saw their GDP growths revised downwards by more than 5.0% on average.

Currency Performance

All select currencies depreciated against the US Dollar except for the Malawian Kwacha, which remained relatively stable against the dollar attributable to the high forex reserves, which continue to provide a buffer to the Kwacha against exchange shocks. The depreciation recorded by the currencies is partly attributable to the ongoing COVID-19 pandemic, which has seen a fast-falling demand for export commodities given the lockdown measures put in place. The Zambian Kwacha was the worst performer, depreciating by 28.6% against the dollar YTD, owing to the low economic productivity given the fall of copper prices as well as increased imports, which continue to increase pressure to the currency. Credit Rating Agencies such as Moody’s had flagged the default risk and thereby downgraded their assessments of the country’s debt in April to Ca from Caa2 and revised the outlook to negative from stable. The Kenya Shilling depreciated by 5.1% in H’1 2020 to close at Kshs 106.5 against the US Dollar, attributable to high dollar demand from foreigners exiting the market amidst the pandemic.

Below is a table showing the performance of select African currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Jun-19 |

Dec-19 |

Jun-20 |

Last 12 Months change (%) |

YTD change (%) |

|

Malawian Kwacha |

762.1 |

729.1 |

728.4 |

4.4% |

0.1% |

|

Tanzanian Shilling |

2295.0 |

2293.0 |

2313.0 |

(0.8%) |

(0.9%) |

|

Ghanaian Cedi |

5.4 |

5.7 |

5.7 |

(6.5%) |

(1.2%) |

|

Ugandan Shilling |

3690.0 |

3660.0 |

3719.1 |

(0.8%) |

(1.6%) |

|

Kenyan Shilling |

102.3 |

101.3 |

106.5 |

(4.1%) |

(5.1%) |

|

Mauritius Rupee |

35.5 |

36.2 |

40.0 |

(12.7%) |

(10.5%) |

|

Botswana Pula |

10.7 |

10.5 |

11.9 |

(11.0%) |

(13.0%) |

|

Nigerian Naira |

305.9 |

306.0 |

360.0 |

(17.7%) |

(17.6%) |

|

South African Rand |

14.1 |

14.0 |

17.3 |

(23.1%) |

(23.7%) |

|

Zambian Kwacha |

12.8 |

14.1 |

18.1 |

(40.8%) |

(28.6%) |

Source: Reuters

African Eurobonds:

During the first half of 2020, emerging market bond funds recorded heavy net outflows with the yields increasing as investors dumped risky assets amid the deepening coronavirus crisis. However, we saw some recoveries towards the tail end of Q2’2020, attributable to the easing of the lockdown measures in most economies, thus improving investor sentiments. In February 2020, the Government of Ghana launched the sale of a USD 750.0 mn tranche at a yield of 8.9% and with a tenor of 40-years, the longest dated Eurobond, as part of debt issuance to raise USD 3.0 bn. The bond was oversubscribed 5x attracting USD 14.0 bn, an indication that investors are still looking for value investments despite the pandemic.

Gabon also issued their maiden Eurobond in February 2020 of USD 1.0 bn with a tenor of 11-years and a coupon rate of 6.6%. The bond received bids worth USD 3.5 bn translating to a 3.5x subscription rate. The bond was for financing the country’s efforts in diversifying its exports by venturing into logging and agriculture to reduce the country’s over-dependence on the world demand for Manganese and Oil, and hence reduce exposure to the impact of fluctuating crude oil prices.

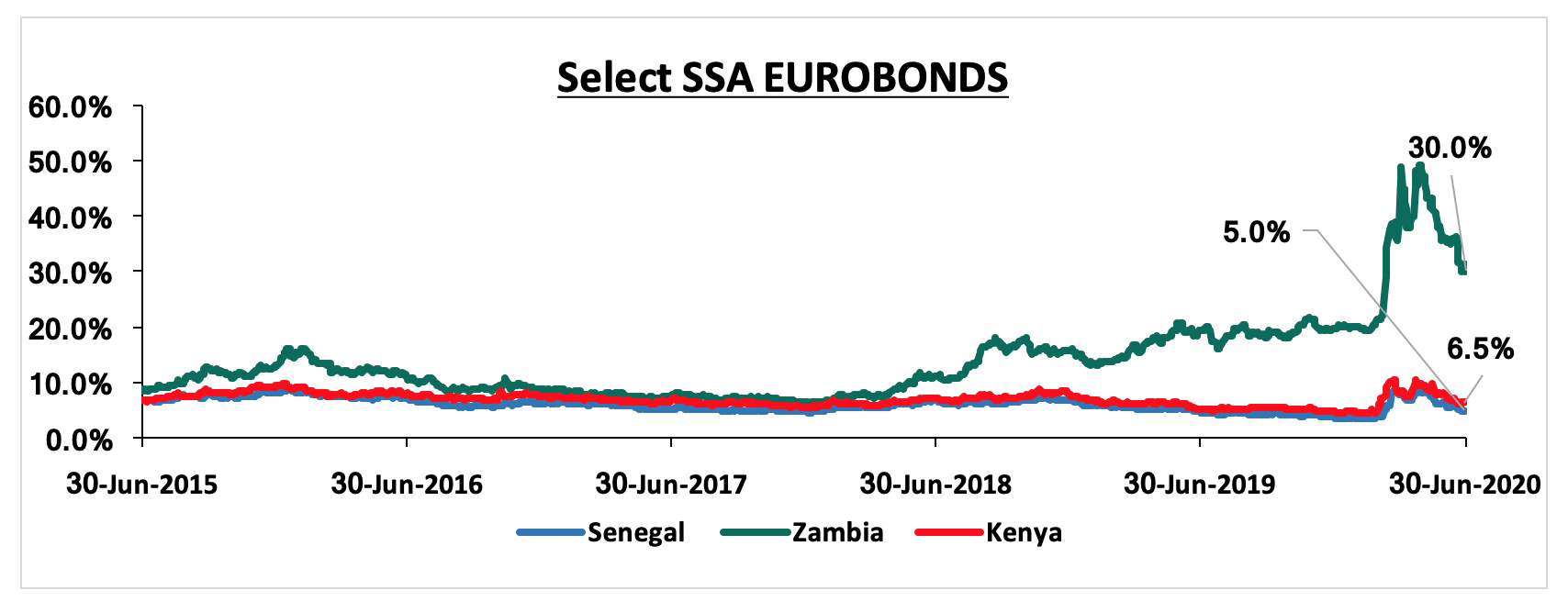

Below is a graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Source: Reuters

Key Takeout from the chart:

- Yields on the Zambia Eurobond increased in H1’2020 by 10.4% points to 30.0% from 19.6% recorded at the end of December 2019, attributable to exits by foreign investors amid fears of the country’s debt sustainability given the high servings levels and as COVID-19 impacts their Copper exports in terms of volumes and the prices have come off. In April 2020, Fitch Ratings downgraded Zambia’s Long Term debt to CC from CCC due to the country’s already constrained external liquidity that is likely to increase their defaulting risks.

Equities Market Performance

Most of the Sub-Saharan African (SSA) stock markets recorded negative returns in H1’2020, attributable to foreign investors’ selloffs in favor of safe havens, given the expected economic fallout. Below is a summary of the performance of key exchanges:

|

Equities Market Performance (Dollarized*) |

||||||

|

Country |

Index |

Jun-19 |

Dec-19 |

Jun-20 |

Last 12 Months change (%) |

YTD change (%) |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.2 |

12.8% |

12.8% |

|

Ghana |

GGSECI |

440.5 |

405.5 |

333.2 |

(24.4%) |

(17.8%) |

|

Kenya |

NASI |

1.5 |

1.6 |

1.3 |

(11.6%) |

(19.4%) |

|

Nigeria |

NGSEASI |

83.4 |

87.7 |

68.0 |

(18.4%) |

(22.5%) |

|

South Africa |

JALSH |

4104.6 |

4079.3 |

3138.5 |

(23.5%) |

(23.1%) |

|

Uganda |

USEALSI |

0.4 |

0.5 |

0.4 |

(15.1%) |

(27.0%) |

|

Zambia |

LASILZ |

355.5 |

303.3 |

216.8 |

(39.0%) |

(28.5%) |

|

Tanzania |

DARSDSEI |

0.8 |

1.5 |

0.7 |

(18.5%) |

(55.4%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Reuters

Analysis of trends observed in the chart above is as follows:

- RSEASI was the best performing index showing resilience amid the COVID-19 pandemic attributable to the easing of the lockdown measures with the government allowing restricted movement of people and restricted opening of businesses such as hotels and restaurants. The country received a total of USD 220.5 mn from the IMF to finance the country’s budget needs as well as the urgent balance of payments,

- DARSDSEI was the worst-performing index with losses of 55.4% YTD, attributable to the continued selloffs brought by concerns about the economic fallout caused by the Coronavirus. The ban on International travel bans has taken a toll on the country’s tourism sector, which had been one of the fastest-growing sectors in the economy, and,

- Nairobi All Share Index (NASI), recorded losses of 19.4% YTD, attributable to the ongoing Coronavirus pandemic, with investors selling out of the equities market.

GDP growth in Sub-Saharan Africa region is expected to decline owing to the ongoing COVID-19 pandemic that is expected to disrupt global supply chains and as the currencies lose value against the dollar in an uncertain global economy. Key risks remain difficult business conditions and poor infrastructure, reliance on commodity exports, political tension in some countries and debt sustainability due to high levels of public debt in most economies in the region. Stock market valuations remain unattractive for long-term investors.