Jul 10, 2022

Eurobonds are fixed income debt instruments denominated in a currency other than the currency in which the bonds are issued. Sub-Saharan Eurobonds, of which most are listed on the London and Irish stock exchanges, allow governments and corporations to raise funds by issuing bonds in a foreign currency. Majority of countries in the region issue Eurobonds to finance maturing debt obligations and heavy infrastructural projects.

Africa’s appetite for foreign-denominated debt has slowed down in 2022, with the only issuers being Nigeria and Angola who raised USD 1.3 bn and USD 1.8 bn in March and April 2022, respectively. The reduced issuance of Eurobonds is on the back of increasing yields, as investors demand more compensation due to increasing inflationary pressures across most African countries. Key to note, the region’s continued economic recovery has been dented by surging fuel and food prices that have strained the external and fiscal balances of commodity importing countries. In order to finance their fiscal deficits as well as existing debt, the countries in the region are expected to return to the market for further issuance.

We have previously covered a topical on the “Sub-Saharan Africa (SSA) Eurobonds: 2019 Performance” in January 2020, where we expected the Eurobond yields to stabilize mainly on the back of loosened monetary policy regimes in advanced countries. Additionally, we did a note on “Sub-Saharan Africa Q3’2021 Eurobonds Performance” in September 2021, where we expected yields to rise given the resurgence in the number of Covid-19 infections in many countries in the region. This week we analyze the Sub-Saharan Africa (SSA) Eurobond performance so far in 2022, given the significantly rising yields. The analysis will be broken down as follows:

- Background of Eurobonds in Sub Saharan Africa,

- Eurobond Performance in Sub-Saharan Africa,

- Debt Sustainability in the Sub-Saharan African region, and,

- Outlook on SSA Eurobonds Performance.

Section I. Background of Eurobonds Issued in Sub-Saharan Africa

Collectively, in H1’2022, only two countries in the Sub-Saharan Region issued Eurobonds, raising a collective USD 3.0 bn. The new instruments attracted investors’ interest with both issues recording an oversubscription of 2.6x, underlining the sustained investor confidence in the African debt market.

Nigeria became the first African nation to access funds from the International Capital Market (ICM) after issuing a Eurobond in March 2022, raising an equivalent total of USD 1.3 bn. The issue had a tenor of 7.0 years, and a coupon rate of 8.4%. The issue received bids worth USD 3.7 bn translating to a 2.9x subscription rate as the government sought to raise funds for budgeted capital intensive infrastructural projects, strengthen economic recovery and boost the country’s level of external reserves. Angola also went in to the market by issuing a 10.0 year Eurobond that raised USD 1.8 bn, with a coupon rate of 8.8%. The issue received bids worth USD 4.0 bn translating to a 2.3x subscription rate with the government intending to use USD 750.0 mn to buy back existing Eurobonds due in 2025 and 2028 as well as finance the country’s budget. The table below summarizes the two Eurobonds issued in 2022 so far:

|

Country |

Amount Issued USD bn |

Issue Tenor (yrs) |

Issue Date |

Maturity Date |

Coupon |

Yield at Issue Date |

Subscription Rate |

Yield as at 30th June 2022 |

Yield Change (% points) |

|

Nigeria |

1.25 |

7.0 |

18-Mar-22 |

9-Mar-29 |

8.4% |

8.4% |

2.9x |

10.9% |

2.5% |

|

Angola |

1.75 |

10.0 |

8-Apr-22 |

26-Mar-32 |

8.8% |

8.8% |

2.3x |

9.4% |

0.6% |

|

H1’ 2022 Issues |

3.0 |

8.5 |

- |

- |

8.6% |

8.6% |

2.6x |

10.2% |

1.6% |

|

H1’ 2021 Issues |

6.1 |

- |

- |

- |

- |

- |

3.8x |

- |

- |

Key take-outs:

- The region’s H1’2022 issues raised USD 3.0 bn, compared to USD 6.1 bn raised over a similar period in 2021, a decline of 49.3%, due to heightened risk perception which has pushed up interest rates and caused yields on previously issued bonds to rise significantly making issuing more expensive for Sub-Saharan countries and made governments across the continent opt against further issuance including Kenya,

- The issues in 2022 recorded an average oversubscription of 2.6x, lower than the 3.8x oversubscription recorded in H1’2021. The oversubscription underlines the continued demand by premium investors to hold riskier assets coupled with high yields offering to investors by Sub-Saharan countries,

- Since issuance in March 2022, the yields on the Nigeria 7-year Eurobond issue have increased by 2.5% points to 10.9% as at 30th June 2022, from the 8.4% recorded on 18th March, 2022. The rise in the Eurobond yields has been driven by the high perceived risk as well as reduced attractiveness on the country’s and other emerging markets Eurobonds due to the hike in US interest rates targeting to curb the rising inflation which has led to increased costs borrowing. This has led to a decline in foreign-debt issuance, and,

- The Angola’s 10-year issue comes after IMF’s 3-year support program totaling USD 4.5 bn elapsed in December 2021. The program aimed at restoring Angola’s external and fiscal sustainability, which left the economy in a good shape. Consequently, the Eurobond recorded an oversubscription of 2.3x, an indication of improved investor confidence in Angola’s economy.

Section II: Analysis of Existing Issues

Yields on select SSA Eurobonds were on an upward trajectory both year on year (y/y) and Year to Date (YTD). The significant increase in the yields is partly attributable to investors attaching higher risk premium on the Sub-Saharan region and other emerging markets due to heightened perceived risks arising from increasing inflationary pressures and local currency depreciation. Further, the region is expected to record slower economic growth of 3.8% in 2022 as compared to 4.5% growth estimates recorded in 2021. The slowdown is mainly on the back of supply chain disruptions brought about by the pandemic as well as the persistent Russian-Ukrainian geopolitical pressures coupled with high debt levels and wider fiscal deficits. The table below highlights the recent performance of select African Eurobonds:

|

Yield Changes in Select SSA Eurobonds Issued Before 2022 |

|||||||||

|

Country |

Issue Tenor (yrs) |

Issue Date |

Maturity Date |

Coupon |

Yield as at June 2021 |

Yield as at Jan 2022 |

Yield as at June 2022 |

y/y change (%Points) |

YTD change (%Points) |

|

Benin |

6 |

Jun-19 |

Jun-26 |

5.8% |

3.7% |

3.7% |

6.3% |

2.6% |

2.5% |

|

Benin |

31 |

Jan-21 |

Jan-52 |

4.9% |

6.5% |

6.9% |

10.3% |

3.7% |

3.4% |

|

Ivory Coast |

11 |

Feb-21 |

Dec-32 |

4.8% |

5.6% |

5.6% |

9.3% |

3.6% |

3.7% |

|

Ivory Coast |

12 |

Nov-20 |

Jan-32 |

4.9% |

4.9% |

5.3% |

9.4% |

4.5% |

4.1% |

|

Senegal |

30 |

Mar-18 |

Mar-48 |

4.8% |

6.6% |

6.9% |

11.0% |

4.3% |

4.1% |

|

Benin |

11 |

Jan-21 |

Jan-32 |

4.9% |

4.8% |

5.1% |

9.4% |

4.6% |

4.3% |

|

Kenya |

30 |

Feb-18 |

Feb-48 |

8.3% |

7.4% |

8.0% |

13.7% |

6.3% |

5.7% |

|

Kenya |

12 |

Jun-21 |

Jun-34 |

6.3% |

6.2% |

6.5% |

12.5% |

6.3% |

6.1% |

|

Senegal |

10 |

Jul-14 |

Jul-24 |

6.3% |

2.4% |

3.2% |

9.8% |

7.4% |

6.6% |

|

Kenya |

12 |

May-19 |

May-32 |

8.0% |

6.3% |

6.7% |

13.3% |

7.0% |

6.6% |

|

Zambia |

12 |

Jul-15 |

Jul-27 |

9.0% |

19.3% |

14.8% |

22.8% |

3.5% |

8.0% |

|

Ghana |

10 |

Jul-13 |

Jul-23 |

7.9% |

4.0% |

7.6% |

16.0% |

12.0% |

8.4% |

|

Kenya |

8 |

May-19 |

May-27 |

7.0% |

5.0% |

5.7% |

14.3% |

9.3% |

8.6% |

|

Kenya |

10 |

Feb-18 |

Feb-28 |

7.3% |

5.3% |

5.7% |

14.6% |

9.3% |

8.9% |

|

Ghana |

7 |

Nov-20 |

Nov-27 |

6.4% |

6.2% |

10.4% |

21.4% |

15.2% |

11.0% |

|

Ghana |

7 |

Jul-21 |

May-29 |

7.8% |

7.3% |

11.1% |

22.4% |

15.1% |

11.3% |

|

Ghana |

6 |

Sep-16 |

Sep-22 |

9.3% |

4.7% |

8.0% |

20.2% |

15.6% |

12.2% |

|

Kenya |

10 |

Jun-14 |

Jun-24 |

7.3% |

3.3% |

4.4% |

17.0% |

13.7% |

12.6% |

|

Ghana |

4 |

Jul-21 |

Jul-25 |

5.8% |

6.7% |

13.3% |

27.6% |

20.9% |

14.3% |

|

Zambia |

10 |

Apr-14 |

Apr-24 |

8.5% |

26.3% |

19.1% |

39.0% |

12.7% |

19.9% |

Source: Reuters

From the table above,

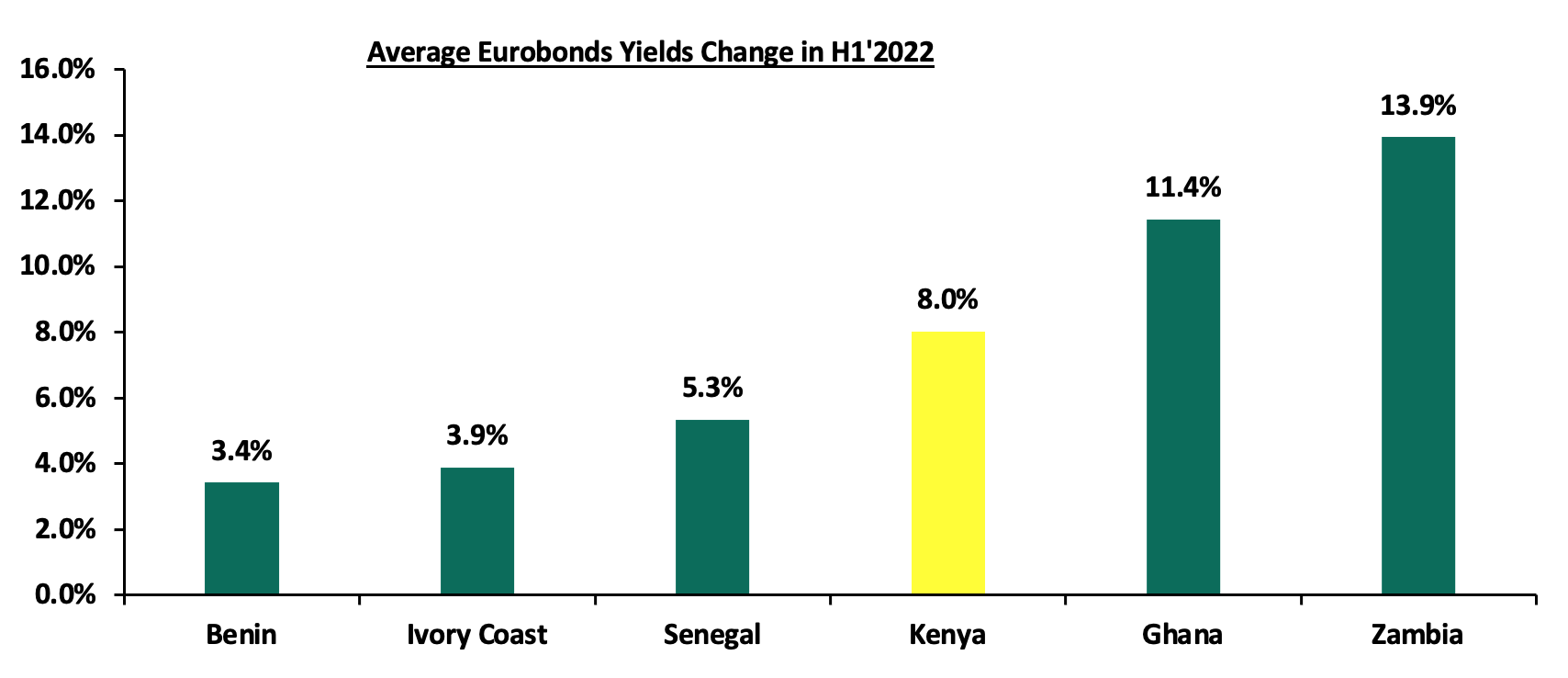

- Yields on the Zambia Eurobonds continued to rise at an average of 13.9% with yields of the 10-year Eurobond issued in 2014 increasing by 19.9% points to 39.0% in June 2022, from 19.1% at the beginning of the year. This is mainly attributable to the high risk attached to the country following its default on the USD 42.5 mn and USD 56.1 mn Eurobond debt in 2020 and 2021, respectively. Further, the country is still struggling with high debt levels which stood at 123.0% to GDP as at the end of 2021,

- Yields on Kenyan Eurobonds also recorded significant increases at an average of 8.0% with the 10-year Eurobond issued in 2014, increasing by 12.6% points to 17.0% in June 2022, from 4.4% recorded at the beginning of the year partly attributable to the heightened perceived risk stemming from inflationary pressures as well as uncertainties surrounding the August 2022 general election, and,

- Yields on the Benin’s Eurobonds recorded the least increase at an average of 3.4% with yields of the 6-year Eurobond issued in 2019 increasing by 2.5% points to 6.3% in June 2022, from 3.7% at the beginning of the year. This is mainly attributable to improved investor sentiment on Benin as a result of strong economic growth and low government debt to GDP ratio of 50.6% at the end of 2021, which is significantly lower than most countries in the region.

The graph below summarizes the average YTD change in the Eurobond yields of select countries;

Source: Reuters

*Average yields increase calculated as an average of the Country’s Eurobonds yields increase

Since Eurobonds are denominated in foreign currency, the depreciation of a country’s local currency means that they will incur a relatively higher cost to purchase foreign currency used to service outstanding debt obligations. Below is a summary of the performance of the different resident currencies as at the end of June 2022:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Jun-21 |

Jan-22 |

Jun-22 |

Last 12 Months change (%) |

H1’2022 change (%) |

|

Nigerian Naira |

410.5 |

412.4 |

415.1 |

(1.1%) |

(0.6%) |

|

South African Rand |

14.3 |

15.9 |

16.0 |

(12.1%) |

(0.9%) |

|

Tanzanian Shilling |

2319 |

2,304.5 |

2,330.5 |

(0.5%) |

(1.1%) |

|

Zambian Kwacha |

22.6 |

16.7 |

17.2 |

24.0% |

(2.6%) |

|

Mauritius Rupee |

42.7 |

43.6 |

45.0 |

(5.3%) |

(3.1%) |

|

Botswana Pula |

10.8 |

11.7 |

12.2 |

(12.8%) |

(3.8%) |

|

Kenyan Shilling |

107.9 |

113.2 |

117.8 |

(9.2%) |

(4.1%) |

|

Ugandan Shilling |

3556.8 |

3,544.6 |

3,749.5 |

(5.4%) |

(5.8%) |

|

Malawian Kwacha |

805.8 |

816.8 |

1,019.5 |

(26.5%) |

(24.8%) |

|

Ghanaian Cedi |

5.8 |

6.1 |

7.9 |

(35.9%) |

(29.1%) |

Source: S&P Capital

All the select currencies depreciated against the US Dollar in H1’2022 mainly due to the rising commodity prices given that most countries in the region are import-dependent economies. The Ghanaian Cedi recorded the worst performance having depreciated by 29.1% year to date. The performance is attributable to increased dollar demand since most economic activities in Ghana are recovering from the Covid-19 shock. Further, high government borrowing with Ghana’s public debt to GDP ratio reaching 81.8% in 2021 has put pressure on forex reserves to service some of the public debt. Similarly, the Kenya Shilling depreciated by 4.1% in 2022 to close June at Kshs 117.8 against the US Dollar, compared to Kshs 113.2 recorded at the beginning of the year. Going forward, we expect continued depreciation of the local currencies given the continued rise in global crude oil prices following supply chain disruptions arising from the Russia’s invasion of Ukraine.

Section III: Debt Sustainability in the Sub-Saharan Africa Region

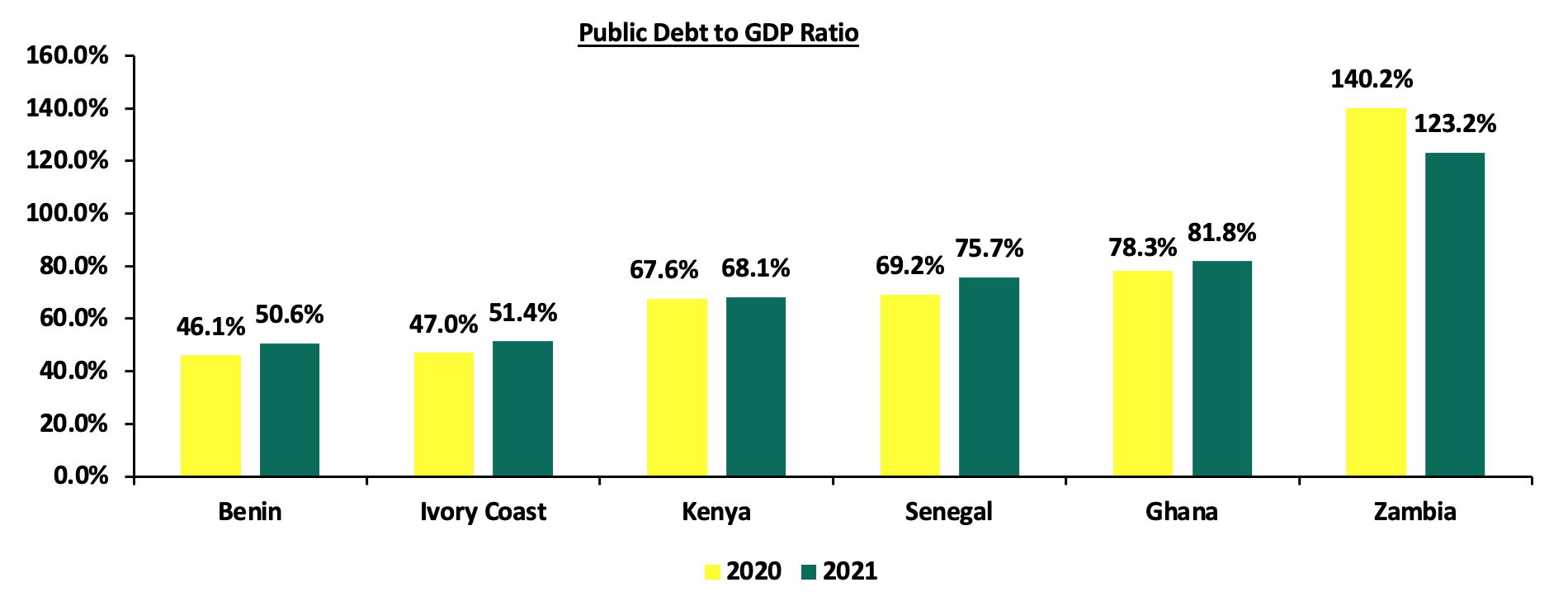

For the African countries, rising public debt levels and increased debt vulnerabilities were already a concern in most countries prior to the onset of the COVID-19 pandemic. However, the pandemic posed unprecedented challenges to low- and middle-income countries increasing financing needs and thus public borrowing. This saw a weakening of individual countries' economic fundamentals and capacity to service and repay their existing public debt. Below is a summary of public debt to GDP ratios of the select Sub-Saharan African countries:

Source: IMF

From the graph above the key take outs include;

- Public debt to GDP ratio for all the select countries increased in 2021 with the exception of Zambia. Zambia’s public debt to GDP ratio stood at 123.2% in 2021, a decrease from 140.2% in 2020. The high ratios reflect Zambia’s indebtedness with outstanding foreign debt including USD 3.0 bn in international bonds, USD 2.1 bn to multilateral lending agencies such as the IMF and USD 3.0 bn to China and Chinese entities. In 2020 and 2021, Zambia failed to make Eurobonds interest payment totaling USD 98.6 bn. Consequently, in April 2022, Fitch Ratings affirmed Zambia's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'RD’. Despite deterioration of the debt sustainability ratings, Zambia is expected to restructure its debt before the end of 2022 after securing a staff level agreement with the IMF on a USD 1.4 bn under the Extended Credit Facility (ECF) programme,

- Kenya’s public debt to GDP has grown to 68.1% as at the end of 2021. The increase in debt stock has been partly driven by huge spending on large infrastructure projects as well as widening fiscal deficit, which was at 8.1% of GDP in FY’2021/2022. Concerns are also high on the progressive shift of the debt portfolio in favor of expensive commercial loans and the bilateral loans comprising 50.1% of the total debt. IMF downgraded the country’s risk of external debt distress from moderate to high on the account of elevated vulnerabilities instigated by the Covid-19 crisis. Kenya’s debt-carrying capacity was also downgraded by the IMF from strong to medium in 2021, coupled with Fitch Ratings affirmation of Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'B+' with a Negative Outlook,

- Ghana’s total public debt has grown at a 5-year CAGR of 14.9% to USD 58.6 bn in 2021, from USD 29.2 bn in 2016 making the country classified as being at high risk of debt distress as the country struggles to service its debts. The public debt to GDP ratio stood at 81.8% in 2021 and is projected to rise further to 84.6% in 2022. The continued increase in the public debt stock has largely been driven by the continuous accumulation of budget deficits, the currency depreciation and off-budget borrowings. In January 2022, Fitch Ratings downgraded Ghana's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'B-' from 'B' and affirmed a Negative Outlook in May 2022 mainly attributable to existing macroeconomic imbalance. Ghana faces the risk of being locked out of international debt markets due to inflationary concerns making it urgent for the government to seek an IMF debt-relief program before public finances deteriorate further. Depreciating currency has also worsened debt repayment due to high interest rates amid slowed fiscal consolidation in Ghana.

Section IV: Outlook on SSA Eurobonds Performance

- Yields will continue to rise: From the analysis, most of the Eurobond yields in Sub-Saharan Africa increased in 2022, attributable to economic performance uncertainties, with investors attaching a higher risk premium on the region and increased interest in the developed economies. Notably, the debt levels in Sub-Saharan Africa has been on the rise mainly due to fiscal deficits given inflated import bills and widening trade deficit as oil prices continue to rise. To bridge the fiscal deficit gap, some countries have been forced to re-enter the international fixed income market to raise funds to fund their budget deficits as well as refinance existing debt obligations as seen by Angola’s issue in March 2022 to partly repay part of the 2025 and 2028 Eurobonds,

- Public Debt to GDP levels are elevated and will continue to increase: High public debts in Sub-Saharan Africa continue to raise sustainability concerns as many countries face the risk of losing access to the international financial markets. Public debt in the region has recorded significant growth and as per World Bank’s Africa’s Pulse April 2022, the region’s public debt to GDP ratio increased to 61.0% in 2021, from 60.0% in 2020. The public debt is expected to increase in most countries following tightened global financial conditions arising from policy rates increases in the developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures which could worsen public finances further, increase public debt and weigh down on the debt sustainability, and,

- Rising yields and Debt levels raises Debt Sustainability concerns: Debt sustainability in the SSA continues to be a major concern given the high debt burden as well as the change in the composition of the regions public debt profile to sovereign bonds. Countries with a higher debt service and riskier debt profiles are expected to face debt sustainability issues. According to the IMF’s Regional Economic Outlook: Sub-Saharan Africa, April 2022, six countries were in debt distress with fourteen being at high risk of falling into debt distress in 2022. This is due to significant shortfalls in revenue collection and depreciating local currencies which in turn make debt servicing more expensive. We expect continued deterioration of the region’s debt sustainability given the rising sovereign and corporate spreads as well as debt servicing costs which in turn could lead to a series of defaults.

Conclusion: With rising public debt and debt sustainability concerns, SSA countries are faced with one of two choices, either restructure the existing debt or restructure their economies to be more productive to service the existing debt even as they reduce future borrowings.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.