Oct 27, 2019

Technology has continued to be a disruption in the investment industry, both in Kenya and globally, thus, following our Fintech Impact on Kenya’s Financial Services Industry report on technology in financial services, in this week’s report we focus specifically on investments. One of the most tangible disruptions is the ability that technology provides to make investments easier to access, be it through a website or mobile phone. From the comfort of your phone, you can now access an investment company’s website or application, make an investment or withdraw an investment. This was not possible a few years ago where you had to visit a brick and mortar branch to create an investment account and manage your account. All these aspects of modern investing are relatively recent disruptive innovations being used by firms to remain competitive in a market where clients are not only more knowledgeable but need things done much faster and more efficiently. However, Kenya needs to accelerate adoption of technology in the investments sector; for example, technology is present in mobile banking, mobile money through Mpesa, government bond issuance through M-Akiba, but investment instruments like Unit Trust Funds and Pensions are yet to digitize and could do a better job adopting technology.

In this week’s focus note we aim to analyze how technology has impacted the investment industry. As such, we shall look at the following:

- Technology Factors Shaping the Investment Industry in Kenya, and,

- Outlook on the Future of Technology and the Investment Industry.

Section I: Technology Factors Shaping the Investment Industry in Kenya

The Kenyan investment industry is seeing its historical operating model disrupted by technology and regulations. Currently, the investment industry in Kenya remains very manual and at the dawn of technological revolution, there’s need to accelerate digitization and move transactions to mobile/ electronic channels. From Initial Public Offers (IPO) to Mergers and Acquisitions (M&A), to research and trading, investment firms are getting leaner, smaller, and reinventing their core businesses will help them keep up with innovations. In this section, we highlight the three key factors that are shaping the Kenyan investment landscape.

- Mobile Phone and Internet Penetration

The ICT sector in Kenya has experienced rapid growth, from 10.0% in 2017 to 22.0% in 2018, and contributed to 1.6% of the total GDP in 2018, according to the Jumia Mobile Report 2019. The report highlights a 91.0% mobile subscription penetration rate with an internet connectivity penetration rate of 84.0%. That means 43.3 mn of the Kenyan population has access to the internet.

|

Mobile Penetration in Kenya |

||

|

Category |

Kenya |

Africa |

|

Total Population |

51.6 mn (Ave. Age- 18 years |

1.3 bn (Ave. Age- 20 years |

|

GDP Growth |

5.7% (Established in 2018) |

3.5% (Established in 2018) |

|

Mobile Subscriptions |

46.9 mn (91.0% Penetration) |

1.1 bn (80.0% Penetration) |

|

Internet Users |

43.3 mn (84.0% Penetration) |

473.0 mn (36.0% Penetration) |

|

Active Social Media Users |

8.2 mn (16.0% Penetration) |

216.0 mn (17.0% Penetration) |

Source: Jumia Mobile Report 2019

The table above shows mobile, internet and social media penetration in Kenya compared to the whole of Africa. It goes to show that the internet, mobile and social media are key channels that a business cannot avoid to use in targeting clients, especially in Kenya.

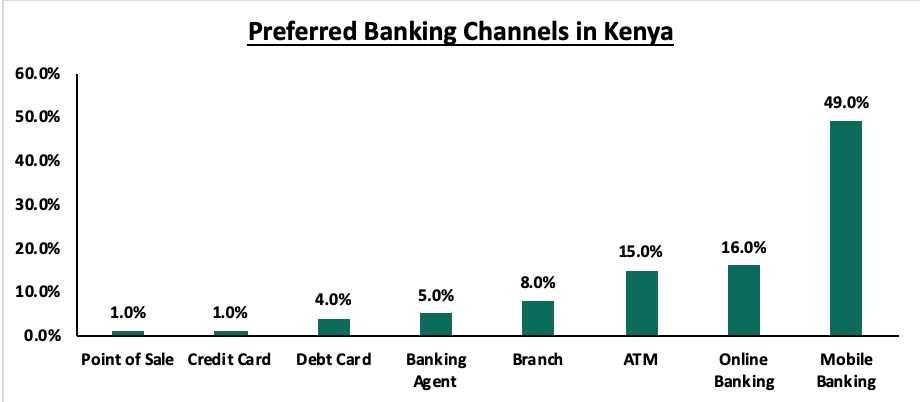

Increasingly, mobile banking has become the most preferred channel for users at 49.0%, while the traditional forms e.g. ATMs rated at 16.0%, according to the Kenya Bankers Customer Service Survey Q4’2018. This goes to show the disruptive effects of technology on client preference relative to the brick and mortar model.

Source: Customer Service Survey Quarter Four 2018

Some of the investment companies in Kenya e.g. Britam, Cytonn, CIC Group to mention a few have capitalized on this disruption to improve how they interact with their clients. They have done this through interactive mobile applications that enable their clients to invest, withdraw and transfer funds easily without manual intervention. Other firms have gone a notch higher and utilized the USSD (Unstructured Supplementary Service Data) platform to target the feature phone (a mobile phone that incorporates features such as the ability to access the Internet and store and play music but lacks the advanced functionality of a smartphone) users as they expand into the retail market space.

- Mobile Money Penetration

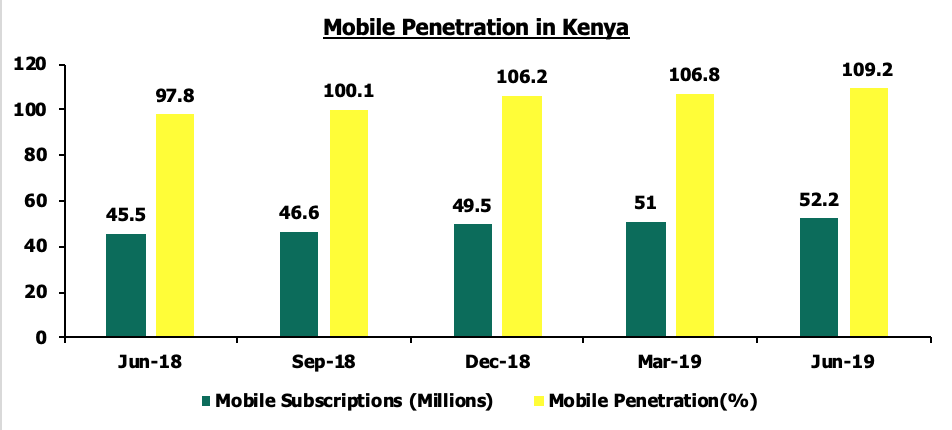

Mobile money is a technology that allows people to receive, store and spend money using a mobile phone. It's sometimes referred to as a 'mobile wallet'. A report released by the Communication Authority of Kenya covering April to June 2019 showed that the number of total active mobile money subscriptions was at 32.6 million. The mobile money subscriptions represent 62.5% of the total mobile subscriptions, which stands at 52.2 million, a growth of 5.2% from Quarter 4, 2018. Investment firms in Kenya are adapting their investing methods to allow mobile money options due to increased adoption. This makes it flexible for investors to invest and withdraw money easily. M-Akiba (M – mobile, Akiba – savings in Kiswahili), is a Kenyan government bond that was launched in 2017 and is accessible through the mobile phone. It is a three-year bond with an initial minimum investment of Kshs 3,000 and offers an interest rate of 10.0% p.a. Although the investments in the initial launch did not meet the expected target of Kshs 1 bn, the post-issuance study by Financial Sector Deepening Kenya found that the product was able to attract a new client segment interested in the Kenyan government bond. 85% of the investors had never bought a bond before and they were distributed across virtually all 47 counties. All this was made possible due to the mobile money penetration in the country.

Source: Communication Authority of Kenya, Operator’s Returns

- Big Data and Research

Big data is a massive volume of both structured and unstructured data that's so large it is difficult to process using traditional techniques. It has had a lot of influence on how investment firms make decisions as well as create better client experiences. With big data, the firms can get insights into their client datasets as well as customize products, facilitate loss prevention and improve their pricing accuracy. There is plenty of data in the investments industry. The firms must collect, store, and analyze large amounts of data and thus, leveraging on Big data, they can learn more about their clients and improve their investment operations thereby driving new revenues. Big data is helpful in segmenting the clients, identifying and preventing fraud, risk modeling, client retention and identifying the main channels of transactions.

In summary, the above 3 factors tell us:

- Increased innovation around mobile applications as a tool for customer interaction and differentiated business models will set apart the winners from the losers in the industry.

- Integration with mobile payment platforms to offer clients an easy way to invest and access their funds will allow you to target new client segments.

- Lastly, using big data to analyze and pick trends from the volumes of client data that investment firms collect, will allow them to keep improving their customer experience and offer targeted products in the market.

Section III: Outlook on the Future of Technology and the Investment Industry

Technology and evolving customer behaviors are driving change across financial services. In the Kenyan investments environment, remaining competitive means adapting to these changes, embracing new thinking, and leading the charge to innovate. Below are the technology areas we feel will drive the investment market in Kenya;

- Improved Client Experience: This will remain a priority for investment firms. Removing any friction process that involves manual work will be a key focus. Allowing clients to set up accounts in seconds, invest and withdraw anytime as well as offer value-added services on mobile will be a key differentiator.

- Digital and Mobile Experience: We expect to see new innovations in mobile services as investment firms adopt the “digital-first” strategy. Mobile technology is a major game-changer for financial inclusion, and the disruptions such as mobile wallets will become a key thing for investment firms. The world’s largest money market fund Yu’e Bao has focused on this strategy and seen its Assets Under Management grow 80 times for the 13 money market funds on its online cash management platform. In the next few years, if an investment firm does not embrace a digital structure, its business model will surely fail.

- Change in Company Structures: From Goldman Sachs, Lloyd’s of London, JPMorgan and more, investment firms are making big bets on technology innovation while bracing for the impact of the growing FinTech sector. Now seeing themselves as technology groups, rather than investment firms, they are recruiting more Artificial Intelligence (AI) talent and diving deep into data offerings. These shakedowns will continue happening as investment firms balance between investment analysts and technologists in decision-making.

- Artificial Intelligence (AI) and Robotics: Investment firms already have huge chunks of data that their existing employees can do little about. Cognitive technology can handle these large chunks of data easily and provide business insights by creating connections amongst the datasets. Investment firms will advance the way they use technology to create Mergers and Acquisitions (M&A) prediction models, perform due diligence processes and automate the majority of their workflows. There are limitless possibilities when it comes to AI and investment firms will have to be keen to discover the potential. With the disruption caused by internet penetration in Kenya, AI is expected to do the same across several sectors amongst those in the investment industry. Just like all innovations, AI poses a threat and opportunity.

- Internet of Things (IoT): The Internet of Things describes the network of physical objects—“things”—that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet. The integration of IoT capabilities within the financial services industry is still in its early stages in Kenya, but many believe digital applications represent the future of investing. Investment firms who will deploy IoT shall allow their clients to make contactless investments and track their returns with greater accuracy while giving the investment firms huge client data sets that they can analyze to predict trends.

- Cybersecurity: The development of data science and data mining technology has driven an evolving debate on protection and privacy, which has increasingly translated into legislation. The new General Data Protection Regulation (GDPR) standards for processing, storing, and securing the personal data of EU citizens has had a far-reaching influence in the various markets with the threat of major fines if you do not adhere. Enabling innovation and constructive use of data and protecting citizens from breaches or cybercrime linked to weak data laws are fine balances that investment firms have to consider even as they create their competitive edge riding on technological advancements.

In closing, we expect the investment industry to continue adopting new technologies into their processes and create a competitive advantage in the market as they strive to give their clients above-average market returns.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.