Jun 10, 2018

In our Focus Note on the interest rate cap review and how it should focus more on stimulating capital markets, published on 13th May, 2018, we highlighted that the Treasury was completing a draft proposal that would seek to address credit management in the economy. The National Treasury thus embarked on two recent possible solutions as follows:

- proposed a credit guarantee scheme for loans advanced to small and medium size enterprises (SMEs). The proposal is still at an early stage and the amounts and inception date are still not in place, as stakeholder consultations continue, and,

- developed a draft Financial Markets Conduct Bill, 2018 that will see the establishment of the Financial Markets Conduct Authority that will (a) regulate the cost of credit with the aim of protecting consumers, (b) promote a fair, non-discriminatory environment for credit access, and (c) ensure uniformity in standards and practices in the issue of financial products and services.

In light of these efforts, we look at the Financial Markets Conduct Bill, 2018, focusing on:

- a background of the Financial Markets Conduct Bill, 2018 – What led to its proposal?

- key highlights of the draft Bill,

- views on the Bill by key stakeholders, and,

- conclude by giving our views on the way forward.

Section I: Background of the Financial Markets Conduct Bill, 2018 – What led to its proposal?

Before the introduction of the interest rate cap that saw lending rates and deposit rates pegged to the Central Bank Rate (CBR), private sector credit growth had already begun declining from the 5-year high of 25.8% recorded in June 2014. From the chart below, we have identified two points of decline as follows:

- Period where banks begun to collapse: late 2015 saw the collapse of Imperial Bank, after which Chase Bank and Dubai Bank followed in early 2016, prompting concerns around the corporate governance and asset quality of banks. Private sector credit growth thereafter started on a steep decline, and,

- Period when the interest rate cap was introduced: September 2016 saw the passing into law of the Banking (Amendment) Act, 2016, which capped lending rates at 14.0%, 4.0% points above the prevailing CBR, 10.0% at the time. This marks the second noticeable node in the chart where private sector credit growth begun on a decline, though relatively more gradual.

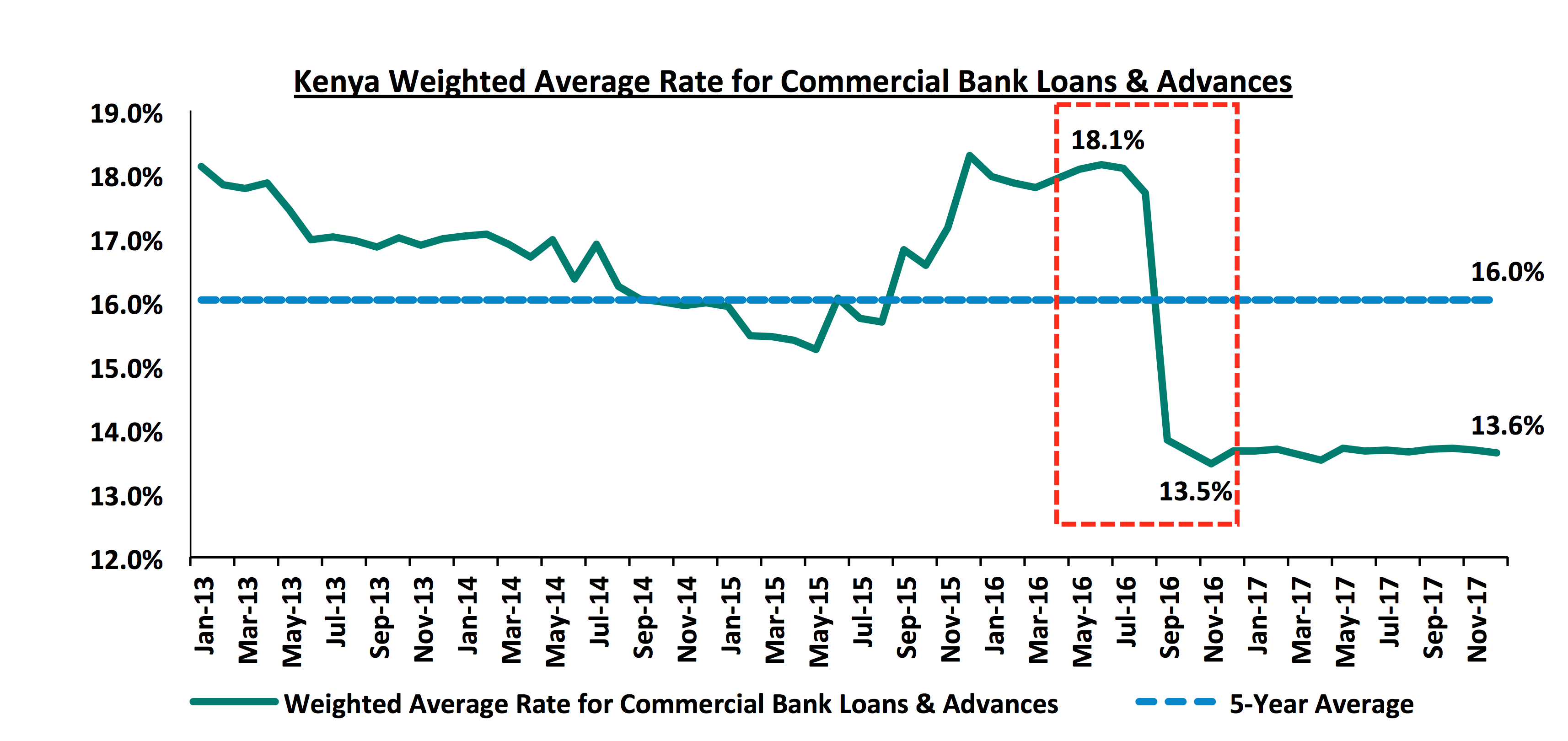

The further decline in private sector credit growth prompted calls from both the international and local communities to repeal or amend the interest rate cap, because the private sector had at their grasp seemingly cheaper loans rates (without additional fees and charges), but these loans were now not accessible; especially with banks adopting a more stringent credit risk assessment framework and preferring the less risky government securities as an alternative avenue to channel their funds. The chart below illustrates the drastic drop in loan rates by commercial banks following the introduction of the interest rate cap in September 2016:

The Government stood by its decision to cap interest rates, while the CBK in conjunction with the Kenya Bankers Association (KBA) set out to assess the effects of the cap on private sector lending and in turn, the economy. In March 2018, the International Monetary Fund (IMF) announced its decision to withdraw the USD 1.5 bn stand-by credit and precautionary facility to Kenya, citing failure to meet conditions previously agreed upon for the facility to be extended, key among these being lowering of the budget deficit to 3.7% of GDP by the fiscal year 2018/19 (projections as per the Draft 2018 BPS indicated a deficit of 6.0%). To have the facility extended, the National Treasury and the President endorsed the repeal of the cap, stating that it had contributed towards crowding out the private sector from accessing credit. The National Assembly, on the other hand, did not uphold the same view, stating that banks were colluding to frustrate the intended efforts of the cap, in order to have it repealed and in turn revert to their previously high margins. In light of this, the Treasury came up with the idea to draft a Bill that would address credit management in the economy. Treasury Cabinet Secretary, Mr. Henry Rotich, stated that the draft Bill would not only be centered on the cost of credit, but would also present some consumer protection policies. Now with the draft released, we look at its key highlights, and how effective it might be in achieving its intended purpose if passed.

Section II: Key highlights of the draft Bill

The Financial Markets Conduct Bill, 2018 seeks to amend the Banking Act and the Consumer Protection Act, and aims to promote a fair, non-discriminatory financial market, conducive for credit access by:

- Establishing practices and standards that cut across the board for providers of financial products and services,

- Regulating the cost of credit, and,

- Establishing the Financial Markets Conduct Authority, the Financial Sector Ombudsman and the Financial Sector Tribunal for effective supervision of providers’ dealing with retail customers.

The National Treasury accepted comments from institutions, organizations and individuals until 5th June, 2018, in order to ensure wide consultation and public participation before its review and finalization.

Here are eight key take-outs from the Bill:

- The Bill proposes the establishment of the Financial Markets Conduct Authority, an independent body whose key objectives are as follows:

- To protect retail financial customers from misleading conduct by financial product and service providers,

- To promote fair and sustainable access to financial products and services while ensuring information about these products and services are readily available to retail customers, to enable them make informed financial decisions and promote financial literacy,

- To ensure the accuracy, availability and protection of financial information through credit sharing mechanisms and public advertisements,

- To protect retail financial customers from inappropriate lending practices by regulating the cost of credit, and,

- The Authority shall cooperate and collaborate with the other financial services regulators when performing its functions for instance, the Bill provides that the Authority will collaborate when licensing and carrying out inspections & investigations, to minimize the duplication of effort and expense.

- The Bill introduces a Financial Conduct License that:

- Limits the provision of financial products and services to retail customers without the license,

- Curbs loan hawking by limiting persons who don’t hold the license from advertising for the provision of credit or the sale of or lease of property, where the advertisement suggests that the vendor will facilitate the provision of credit to a buyer or lessee of the property, and,

- Ensures licensed lenders advertisements are truthful and are not in any way misleading or deceptive even by omission.

Key to Note: Where an entity already holds a license under a sectoral law - such as the Capital Markets Act, the Banking Act or Microfinance Act - which covers the provision of financial products, that entity will be considered to have satisfied the requirements of the Bill. This is subject to a period of exemption of twenty-four months from when the Bill comes into force.

- Full disclosure: The Bill provides that a pre-contract statement and quotation be provided to a potential borrower and the guarantor before issuance of a loan. This ensures full disclosure from lenders for loans advanced including, the dates and number of instalments for the loans, the total amount to be paid in principal, interest, loan fees and charges at the end of the loan period.

- With regards to interest rates:

- The Bill limits lenders from charging or recovering from the borrower or guarantors interest exceeding the maximum rates as prescribed by the Authority from time to time,

- Lenders shall not have provisions in credit contracts that (a) allow for interest rates charged to vary during the term of the contract, unless by a fixed relationship to another reference rate as specified in the contract, that should be the same for all similar credit contracts by the same issuer, and (b) allow the lender to charge any interest, fee, charge or cost unless clearly stated in nature, amount and method of calculation in the pre-contract statement and quotation, and paid prior to disbursement of the loan,

- The lender is required to determine the likelihood that the borrower and the guarantor will be able to comply with the financial obligations under the contract without substantial hardship, and should the lender decline to lend, they will be under obligation to give a specific reason, and,

- The Bill has also specifically provided for early repayment, for which lenders had previously before charged a penalty.

- The draft Bill provides protection to guarantors, with a requirement that they are made aware of all the clauses in a loan contract before signing, and variation to guarantor terms after the agreement is signed is allowed.

- Safeguarding of financial customer information: lenders shall be restricted from providing credit reports that contain information about the customer, as well as recommendations about the credit worthiness of the customer, based on prohibited information.

- The Bill proposes the establishment of the Financial Sector Ombudsman, whose key objectives will be to resolve complaints by retail financial customers and providers of financial products and services in accordance with provisions of the Bill.

- The Bill proposes the establishment of the Financial Services Tribunal, which will also have the power to enforce terms of the credit contract, as well as to vary the terms of the contract on a case-by-case basis, apart from resolving disputes between financial customers and providers of financial products and services in accordance with provisions of the Bill.

Section III: Views on the Bill by key stakeholders

The Central Bank of Kenya (CBK) is of the view that the proposed bill is a deliberate attempt to strip it of its key mandate, and that it was not consulted by the National Treasury in the drafting of the Bill. In addition, the CBK noted that the proposed Bill does not address the capping of interests as had been anticipated.

We are sympathetic to the CBK sentiments that the proposed mandates of the Financial Markets Conduct (FCMA) Authority infringe on the mandate of the CBK in the following ways:

- Article 231(2) of the Constitution provides that the CBK is responsible for formulating monetary policy, promoting price stability and issuing currency. The FCMA’s mandate to prescribe interest rates charged by lenders takes away from the CBK, through the Monetary Policy Committee (MPC), the mandate to signal interest rates through the CBR, and,

- Article 231(3) of the Constitution further provides that the CBK shall not be under the direction or control of any person or authority in the exercise of its powers or in the performance of its functions. The FCMA introduces a parallel regulator from the CBK for commercial banks.

The Bill also subordinates the Banking Act by giving directives on the conduct of commercial banks. Furthermore, the proposed Bill seems to be re-introducing the concept of a common financial services authority but the progress on the Financial Services Authority Bill, 2016, which laid out the same has not been mentioned in the proposed Bill.

The Treasury has since defended the Bill, stating that before re-looking at the interest rate cap, the Treasury wanted to regulate lenders to ensure proper lending practices. This also seems to conflict with the CBK’s mandate.

Section IV: Our views on the way forward

If the Bill is adopted by Parliament and signed into law, it will:

- Ensure better conduct by banks and other lenders in terms of extending credit to retail financial customers. By categorically not defining lenders as banks, this, in our view, might be the introduction of licensing for credit companies that are not banks,

- Provide consumer protection, specifically for retail customers by ensuring their credit contracts are clear and well understood in terms of interest, fees, charges and costs on credit facilities,

- Add yet another level of consumer protection by providing legal avenues solely dedicated to resolving any complaints and disputes that may arise as a result of a breach of contract issued in accordance with provisions of the Bill, and,

- Improve on terms and conditions for credit access in the country, especially for retail customers.

However, while the Bill seeks to promote access to credit, protect consumers and regulate the cost of credit, we note that it does not point to a repeal or revision of the interest rate cap, as had earlier been anticipated. In our view, the Bill will achieve consumer protection but will fail to address the problem of access to credit. With the cap still in place and should the Bill be enacted, two boxes will be checked i.e. loans will appear cheaper though the true cost of credit still remains high given extra fees and charges by banks, and retail customers will be protected from exploitation by lenders. However, we are of the view that more still needs to be done to address the fact that banks will most likely still prefer to lend to the risk free government as opposed to lending to a riskier retail customer at the current 13.5% (4.0% points above the current CBR of 9.5%).

As concluded in our recent topical dubbed Rate Cap Should Focus More on Stimulating Capital Markets, we are still of the view that a repeal or review of the cap is necessary. We however remain concerned that a repeal would be more focused on banks, yet to manage bank dominance and funding reliance we have to focus on expanding capital markets as an alternative to banks. We laid out 7 measures as necessary accompaniments to the repeal. Below we look at the 7, highlighting what has been addressed by the Bill and what still needs to be addressed:

|

No. |

Measure |

Narrative |

Addressed? |

|

1. |

Legislation and policies to promote competing sources of financing should be the centerpiece of the repeal legislation |

Given that the Bill addresses “lenders” and not banks, it is an indication that it might be encompassing all lenders that are not banks |

Yes |

|

2. |

Consumer protection |

The Bill is centered on consumer protection, protecting the retail financial customer |

Yes |

|

3. |

Promote capital markets infrastructure |

The Bill could not have addressed this as it does not refer to the capital markets but is focused on lending. This one is for the Capital Markets Authority (CMA) to address by enhancing the capital markets’ depth and making it easier for new and structurally unique products to be introduced into the capital and financial markets |

No |

|

4. |

Addressing the tax advantages that banks enjoy |

The Bill does not address this. Making tax incentives that are available to banks also available to non-bank funding entities and capital markets products such as unit trust funds and private investment funds will be instrumental to leveling the capital playing field |

No |

|

5. |

Consumer education |

Borrowers need to be educated on the elements the Bill provides for their protection, as well as credit access, use of collateral, and the importance of a strong credit history. Educating those who will benefit from the Bill is essential to helping the consumer protection measures effective |

No |

|

6. |

The adoption of structured and centralized credit scoring and rating methodology |

The Bill does not address this. A centralized Credit Reference Bureau (CRB) would enhance risk pricing transparency and credit history information to lenders and borrowers, thus enabling banks to price customers appropriately and spur increased access to credit |

No |

|

7. |

Increased transparency |

The Bill addresses this by making it mandatory for lenders to fully disclose, in a simple and clear manner, the interest, charges and fees on credit facilities |

Yes |

Only 3 out of 7 of our suggested measures have been addressed by the Bill i.e. introduction of legislation & policies to promote competing sources of financing, consumer protection and increased transparency.

Conclusion:

In conclusion, more still needs to be done by the key stakeholders to properly address the credit crunch and revive private sector credit growth in the economy. The Bill has partly addressed its intended purpose i.e. consumer protection, but has not addressed the issue of the interest rate cap, and has clashed with the CBK’s constitutional mandate and provisions of the Banking Act. In our view, it would work better if the National Treasury were to have consultations with key stakeholders involved in credit access, to review the Bill and come up with a solution that addresses the remaining measures above, while avoiding conflicting and redundant provisions for already existing Authorities and Acts. It would be unwise to proceed with the Bill in its current form.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.