Sep 25, 2022

For many people, retirement means settling into a more relaxed lifestyle and having time to enjoy things they did not have time for before retirement, such as hobbies, family and recreational activities. This lifestyle necessitates careful planning in advance through having a solid retirement plan which can either be signing up to a social security fund, enrolling into a pension scheme or investing in other assets like real estate. In Kenya, there are several pension schemes and a National Social Security Fund, NSSF, that allows people to save for retirement. However, there have been ongoing discussions surrounding the effectiveness of the fund, primarily on the contribution amounts. There are also ongoing discussions on whether to increase the regular contributions towards the social security fund in order to build a bigger retirement pot and offer workers monthly stipends after their retirement as opposed to the current one-off payment. As such, we saw it fit to cover a topical on the Kenyan National Social Security Fund to shed light on the recent developments and look at whether NSSF has been able to meet its objectives in terms of reducing dependency of retirees. We shall do this by taking a look into the following;

- Introduction to the National Social Security Fund,

- Effectiveness of the National Social Security Fund,

- Factors hindering growth of the National Social Security Fund,

- Key considerations to improving NSSF in Kenya, and,

- Conclusion.

Section I: Introduction to the National Social Security Fund

Social security is defined as any programme of social protection established by legislation, or any other mandatory arrangement, that provides individuals with a degree of income security when faced with the contingencies of old age, survivorship, incapacity, disability or unemployment. In Kenya, the National Social Security Fund (NSSF) offers social protection to all Kenyan workers in the formal and informal sectors by providing a platform to make contributions during their productive years to cater for their livelihoods in old age and the other consequences resulting from unprecedented occurrences such as death or invalidity among others.

The National Social Security Fund (NSSF) has evolved over time having been established in 1965 through an Act of Parliament Cap 258 of the Laws of Kenya. The Fund initially operated as a Department of the Ministry of Labor until 1987 when the NSSF Act was amended transforming the Fund into a State Corporation under the Management of a Board of Trustees. The Act was established as a mandatory national scheme whose main objective was to provide basic financial security benefits to Kenyans upon retirement. The Fund was set up as a Provident Fund providing benefits in the form of a lump sum. Thereafter, the National Social Security Fund (NSSF) Act, No.45 of 2013 was assented to on 24th December 2013 and commenced on 10th January 2014 thereby transforming NSSF from a Provident Fund to a Pension Scheme. Every Kenyan with an income was required to contribute a percentage of his/her gross earnings so as to be guaranteed basic compensation in case of permanent disability, basic assistance to needy dependents in case of death and a monthly life pension upon retirement. The Act establishes two Funds namely;

- Pension Fund, and,

- Provident Fund

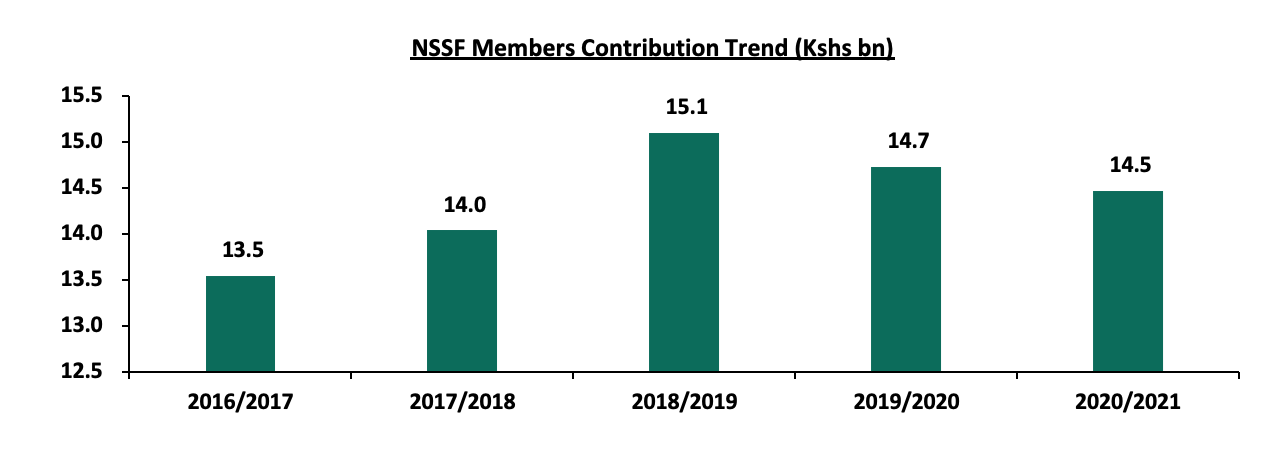

Key to note, NSSF has not gained enough traction overtime attracting a cumulative registered membership of 2.6 mn equivalent to 10.8% of total labor force of 24.1 mn persons as of FY’2019/2020 with the members’ contributions growing at a 5-year CAGR of 2.4% to Kshs 14.5 bn in FY’2020/2021 from Kshs 12.9 bn recorded in FY’2015/2016. The slow traction on membership and contribution is mainly attributable to slow economic growth and high level of unemployment in Kenya making it hard for people to register and make regular contribution to NSSF. The graph below shows the contribution trend in the last five financial years;

Source: NSSF Annual Reports

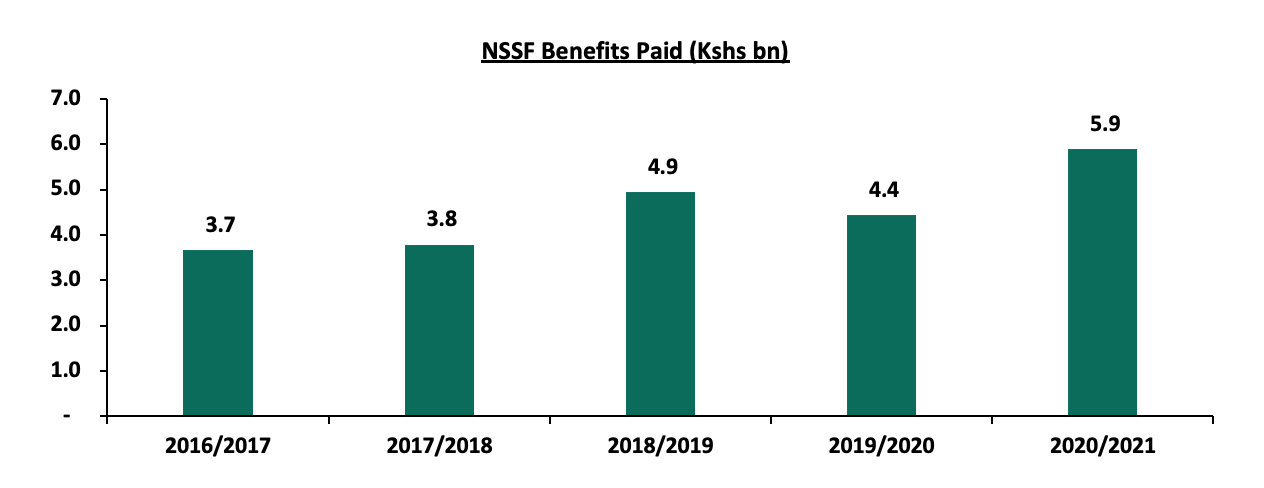

Similarly, payment of claims after retirement has evolved over time growing at a 5-year CAGR of 13.6% to Kshs 5.9 bn in FY’2020/2021 from Kshs 3.1 bn recorded in FY’2015/2016. The graph below shows the benefits payout over the last five financial years;

Source: NSSF Annual Reports

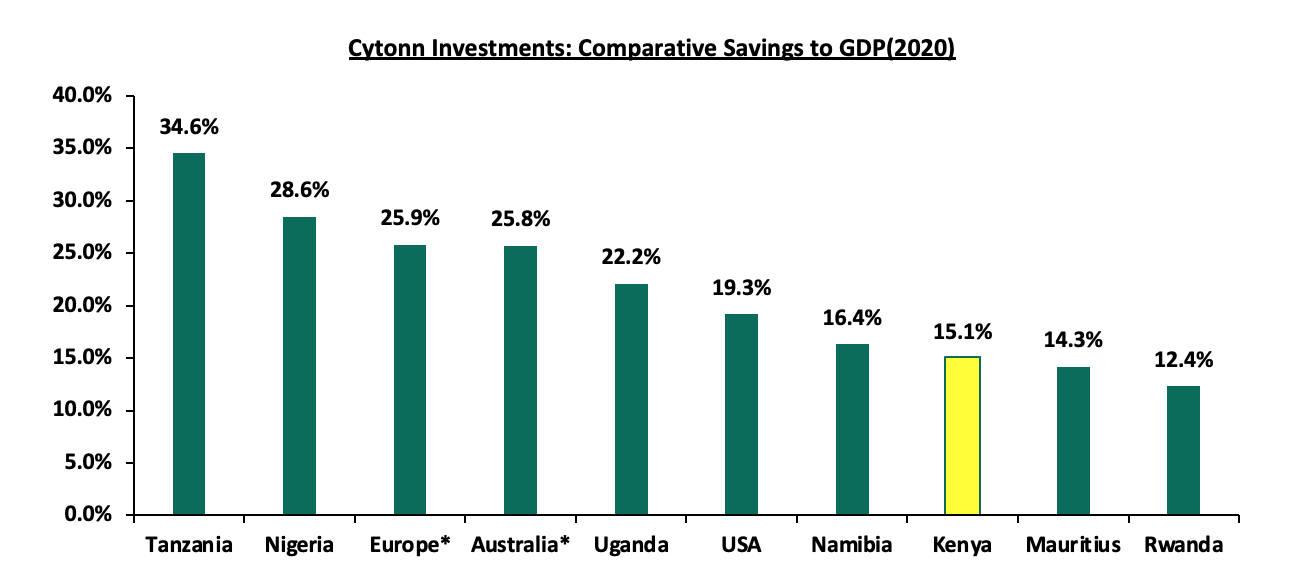

Despite the government making NSSF mandatory, Kenya’s saving culture still lags behind in comparison to other more developed countries partly attributable to low disposable income with 35.7% of Kenyan population as of 2020 living below the poverty line coupled with lack of sufficient knowledge on importance of saving for retirement. The graph below shows the gross savings to GDP of select countries in the Sub Saharan Africa Region and the developed economies;

*Figures as of 2021

Source: World Bank

Section II: Effectiveness of the National Social Security Fund

One of the main objectives of the National Social Security fund is to provide a source of income to retirees and improve adequacy of benefits paid out to the beneficiaries. However, according to the Retirement Benefits Authority, Kenya has an Income replacement ratio of 43.0% compared to the recommended ratio of 75.0%, indicating that most retirees in Kenya are likely to remain financially dependent after retiring.

To shed more light on the adequacy of NSSF savings in reducing the dependence of retirees, we compare three scenarios as follows;

- Individual A who relies purely on NSSF contributions (a standard contribution of Kshs 200.0 per month which is matched by the employer),

- Individual B who relies on NSSF but tops up the contribution with Kshs 1,000.0 every month as additional voluntary contributions, and,

- Individual C tops up their NSSF with an additional Kshs 5,000.0. We also assume the following;

|

Adequacy of NSSF savings in catering for post-retirement, |

|

|

Start Working Age (Years) |

25 |

|

Retirement Age (Years) |

60 |

|

Savings Period (Years) |

35 |

|

Assumed Constant Annual Interest Rate |

7.0% |

|

Average Salary (Kshs) |

50,000.0 |

|

Monthly Pension Contribution (Kshs) |

Amount At Maturity (Before Tax) (Kshs) |

Number of Year post Retirement one can maintain the same living standard |

|

|

Individual A |

400.0 |

724,624.0 |

1.7 |

|

Individual B |

1,400.0 |

2,536,185.1 |

6.0 |

|

Individual C |

5,400.0 |

9,782,428.1 |

23.3 |

Generally, one needs about 70.0% of what they make at the peak of their career to maintain the same standard of living in retirement. By this finding, we can estimate roughly the number of years post-retirement that the three individuals in the table above can live comfortably on their pension money. As per the table above, individual A will have a consistent income for 1.7 years.

Evidently NSSF savings (as in for Individuals A and B) are not adequate to cater for their post retirement assuming that they live for more than 15 years, an indication that NSSF does not meet its objective of alleviating poverty and reduction of dependency post retirement.

Section III: Factors Hindering growth of the National Social Security Fund

Despite the various incentives that have been put in place, the national social security fund has not gained enough traction to achieve its required objectives. In this regard, we analyze the factors that have hindered growth of the fund as follows:

- Slow economic growth - The Kenyan economy has continued to record slow growth with the average GDP growth rate coming in at 4.4% over the last ten years resulting to low income levels. Further, economic disruptions caused by COVID-19 lockdown negatively affected disposable income as businesses were closed and many employees were laid off which is evidence by 2.4% decline in member’s contribution to Kshs 14.7 bn in FY’2019/2020 from Kshs 15.1 bn in FY’2018/2019,

- High Unemployment rate in Kenya - The unemployment rate in Kenya stood at 5.7% at the end of 2021 mainly as a result of the challenges facing the county’s economic development coupled with the rising youth population in Kenya, whose unemployment rate stood at 13.8% in 2021. This consequently raises the dependency ratio of the working population making it extremely difficult for them to commit to social security contributions towards their retirement, and,

- Government Regulations - Given that NSSF is a government owned institution, it directly receives the full impact of the laws especially that of increased taxation which have negative implication towards the growth and operations of the NSSF. Increase taxation also reduce disposable income for both employers and employees leaving a small fraction for saving.

Section IV: Key considerations to improving NSSF in Kenya

We note that the government has continually tried to enforce a savings culture in the country through various reforms such as an increase in contributions as well as making the contributions mandatory. For instance, in the New NSSF Act 2013, the government had recommended a mandatory registration contribution to NSSF by employees and employers. However, the Act was rejected by the high court on the basis of;

- The provisions of NSSF Act, 2013 was not subjected to public participation and was not tabled before the senate prior to its enactment as per constitutional requirement,

- Imposing mandatory registration and contribution to NSSF would have overburdened employees and consequently reduce disposable income since a vast majority of employees have their pay slips already strained due to their various financial commitment with other institutions and their subscription to other pensions schemes, and,

- The provisions of the Act would have given NSSF competitive advantage thus making the Fund a monopoly in provision of pension and social security services in the country.

In our view, the following are some of the actionable steps that can be taken into consideration to ensure growth of the NSSF while working towards meeting its objective and achieving a win-win situation for the government, employers and employees;

- Ensure involvement of all stakeholders in NSSF reforms - The general public and all stakeholders need to be involved whenever there is a recommendation for reforms in the NSSF. As stated above, the High Court stopped the NSSF Act of 2013 which included a bid to increase monthly contributions to Kshs 2,068.0 from the current Kshs 200.0 as it was not subjected to public participation in breach of the Constitution which demands public input before major decisions are taken. Additionally, the promoters of the Act failed to get approval from the Senate despite the law affecting county employees and finances of the devolved governments. The higher pension contributions would have boosted growth of NSSF by building a bigger retirement pot and offering workers better replacement ratios as opposed to the current plan,

- Mass education on developing a savings culture - There is need to educate Kenyans on developing a savings culture given that majority of Kenyans including young people in the informal sector believe that they are too young to start saving for retirement and it is only the older people who should have retirement benefit schemes. Additionally, majority of Kenyan usually worry less concerning their retirements because of the belief on assistance by their children as they have invested in them. Such attitude hinders people from voluntarily joining schemes such as the NSSF when they have a source of regular incomz;

- Enforcement of compliance from employers - The NSSF should seal all loopholes in order to ensure full compliance by all employers in remitting NSSF contributions. This can be done through incorporating technologies that allow payroll-related contributions under one platform in order to improve efficiency and reconcile the records while identifying employers who remit some payments and leave out others,

- Induce operational efficiency – In the financial year ended 30th June 2021, NSSF’s total expenses amounted to Kshs 6.6 bn, equivalent to 45.4% of the members contributions of Kshs 14.5 bn, with the total expenses to AUM increasing by 0.1% points to 2.3% in FY’2020/2021 from 2.2% FY’2019/2020. Key to note, total expenses increased by 21.5% in the year ended 30th June 2021, while members contributions declined by 1.8% to Kshs 14.5 bn from Kshs 14.7 bn in the year ended 30th June 2020. For NSSF to better serve the interests of all stakeholders, there needs to be proactive measures around increasing efficiency and cutting down on unnecessary expenditure, and,

- NSSF should invest the savings in high yielding investments – The fund should continually seek to raise the interests on the savings in order to motivate employees in formal and informal sectors to save for their retirement. This can only be achieved through improving its financial security by continuously investing in worthwhile ventures that will have maximum returns so that its members can benefit maximally. In FY’2020/2021, investment income increased by 240.7% to Kshs 32.7 bn, translating to a Return on Investments of 11.9%, a significant increase from 4.0% in FY’2019/2020. Average interest earned on members funds also increased to 10.0% in FY’2020/2021, from 7.0% in FY’2019/2020. However, In the last five financial years, the average interest on members’ funds has come in at 6.8%. When compared against the average inflation during the same period of 5.9%, this presents real returns of a paltry 0.9%.

Section V: Conclusion

The country’s economy is not in a good shape with recent developments including debt sustainability concerns, a high cost of living mainly stemming from the prevailing inflationary pressures and local currency depreciation and a deteriorating business environment as consumers continue to cut back on spending. As such, we expect the government to devise ways to stabilize the economy aimed at enabling the citizens earn stable income in order to afford a decent living as well as save for their retirement. This will allow them to sign up to NSSF as well as make additional contribution to registered Benefits Scheme and make regular contributions in their employment years. This will aid in reducing poverty in old age as well as provision of regular income to replace earnings in retirement.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.