Sep 22, 2024

National Social Security schemes are created by governments to form the first pillar of social security. In Africa, Kenya was the second country after Ghana to form a national security scheme, The National Social Security Fund (NSSF), done in 1965 through an Act of Parliament (Cap 258). It is a provident fund, which provides benefits to retiring members as a lump sum rather than through periodic payments. In recent years, discussions around the growth and reform of the NSSF have gained momentum, with key considerations on how to increase coverage, especially for the informal sector, and improve service delivery. The fund has also faced a number of challenges in recent years, with concerns about mismanagement, corruption, and inefficiencies often overshadowing the fund’s broader mission and leading to a decline in public confidence. Most recently, the fund was in the news for yet to be quantified losses associated with questionable bond trading. As such, we saw it fit to cover a topical on the Kenyan National Social Security Fund to shed light on the recent developments and look at whether NSSF has been able to meet its objectives in terms of reducing the dependency of retirees. We shall do this by taking a look into the following;

- Introduction to the National Social Security Fund,

- Recent Developments at the National Social Security Fund,

- Effectiveness of the National Social Security Fund,

- Factors hindering growth of the NSSF,

- Key considerations to improving NSSF in Kenya, and,

- Conclusion.

Section I: Introduction to the National Social Security Fund

Social security is defined as any programme of social protection established by legislation, or any other mandatory arrangement, that provides individuals with a degree of income security when faced with the contingencies of old age, survivorship, incapacity, disability, or unemployment. In Kenya, the National Social Security Fund (NSSF) offers social protection to all Kenyan workers in the formal and informal sectors by providing a platform to make contributions during their productive years to cater for their livelihoods in old age and the other consequences resulting from unprecedented occurrences such as death or invalidity among others.

The National Social Security Fund (NSSF) has evolved over time having been established in 1965 through an Act of Parliament Cap 258 of the Laws of Kenya. The Fund initially operated as a Department of the Ministry of Labor until 1987 when the NSSF Act was amended transforming the Fund into a State Corporation under the Management of a Board of Trustees. The Act was established as a mandatory national scheme whose main objective was to provide basic financial security benefits to Kenyans upon retirement. The Fund was set up as a Provident Fund providing benefits in the form of a lump sum. Thereafter, the National Social Security Fund (NSSF) Act, No.45 of 2013 was assented to on 24th December 2013 and commenced implementation on February 2023 thereby transforming NSSF from a Provident Fund to a Pension Scheme. Every Kenyan with an income was required to contribute a percentage of his/her gross earnings so as to be guaranteed basic compensation in case of permanent disability, basic assistance to needy dependents in case of death, and a monthly life pension upon retirement. The Act establishes two Funds namely;

- Pension Fund, and,

- Provident Fund.

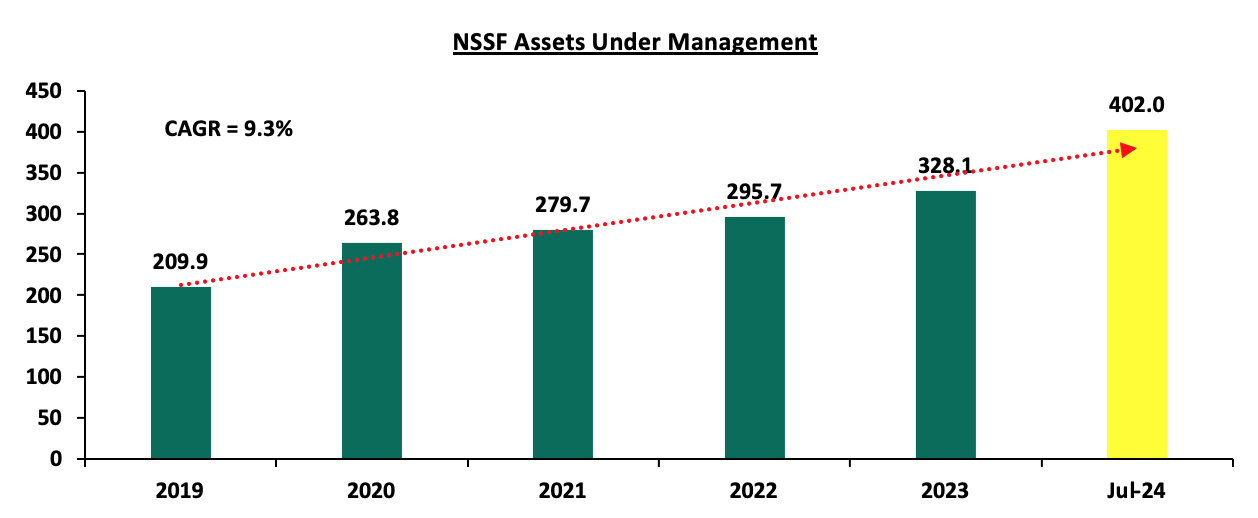

NSSF has gained traction over the years, but particularly in the last year, owing to implementation of the NSSF Act of 2013, which came into effect in February last year. The Act increased contributions to the fund from the initial Kshs 400.0 to 12.0% of individuals' income, with the employee and employers both contributing 6.0%. In December 2023, total investments held by NSSF increased by 6.4% to stand at Kshs 328.1 bn, from Kshs 308.3 bn in December 2022. As of the half year ended July 2024, the assets held by NSSF stood at Kshs 402.0 bn. The graph below shows the movement of the fund’s Assets Under Management in the last five years:

Source: RBA Annual Reports

Notably, 75.6% of NSSF Assets are managed by six external fund managers, while the remaining 24.4% are held internally by the fund. This translated to NSSF internally managing Kshs 80.3 bn, while the remaining Kshs 247.9 bn is held by six external fund managers as of 2023, with the largest share held by Gen Africa Asset Managers. The table below shows the distribution of the NSSF funds managed by different fund managers:

|

Cytonn Report: NSSF Portfolio Managed by External Fund Managers |

|||||

|

Fund Manager |

Assets in bn |

||||

|

Dec-19 |

Dec-20 |

Dec-21 |

Dec-22 |

Dec-23 |

|

|

British America Asset Managers Limited |

76.7 |

82.3 |

- |

- |

- |

|

Gen Africa Asset Managers |

44.1 |

47.8 |

56.4 |

57.3 |

59.2 |

|

Old Mutual Asset Managers |

37.8 |

42.2 |

48.3 |

49.2 |

52.9 |

|

Africa Alliance Kenya Investment Bank |

33.1 |

37.5 |

42.6 |

43.8 |

21.2 |

|

Sanlam Investments East Africa Ltd |

- |

- |

46 |

39.5 |

30.2 |

|

Co-op Trust |

- |

- |

46.9 |

47.8 |

52.9 |

|

CIC Asset Managers Ltd. |

- |

- |

0.1 |

12.5 |

31.4 |

|

TOTAL |

191.7 |

209.8 |

240.3 |

250.1 |

247.9 |

Source: RBA Annual Reports

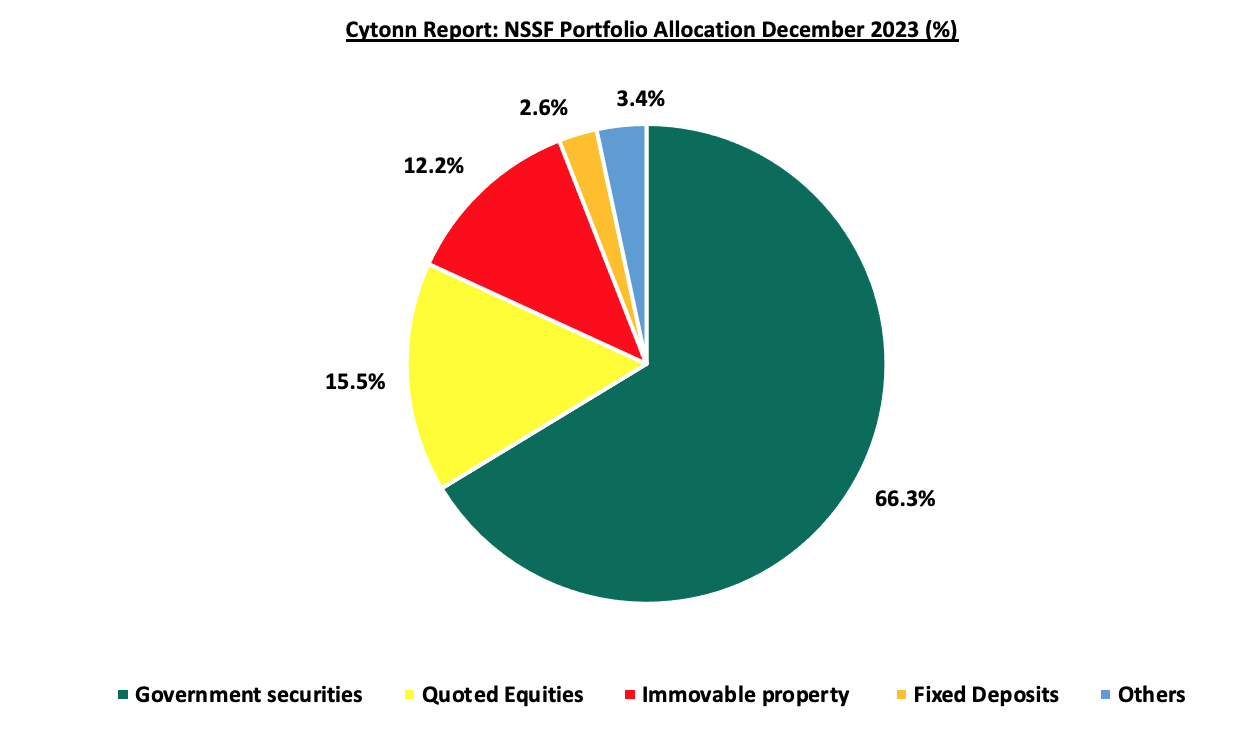

From their 2023 data, NSSF's portfolio is heavily invested in government securities representing 66.3% of the total assets. This exposure is understandable, and actually common for most other pension schemes because of the safety, stability, and credibility associated with government bonds. This was followed by quoted equities and immovable property at 15.5% and 12.2%, respectively.

Source: RBA Annual Reports

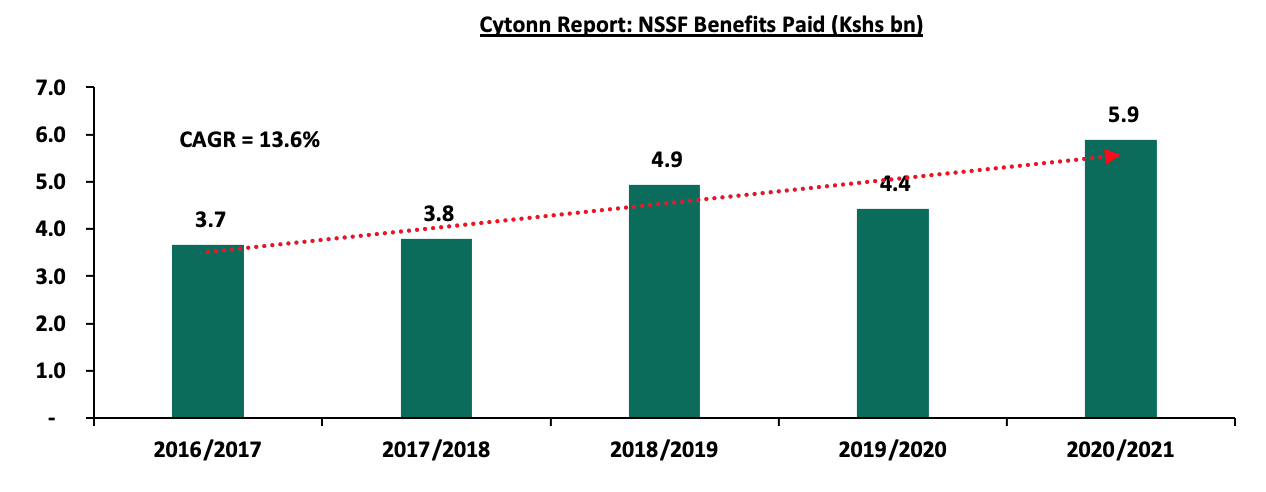

Payment of claims after retirement has also evolved over time growing at a 5-year CAGR of 13.6% to Kshs 5.9 bn in FY’2020/2021 from Kshs 3.1 bn recorded in FY’2015/2016, from their last published annual report. The graph below shows the benefits payout over the last reported periods;

Source: NSSF Annual Reports

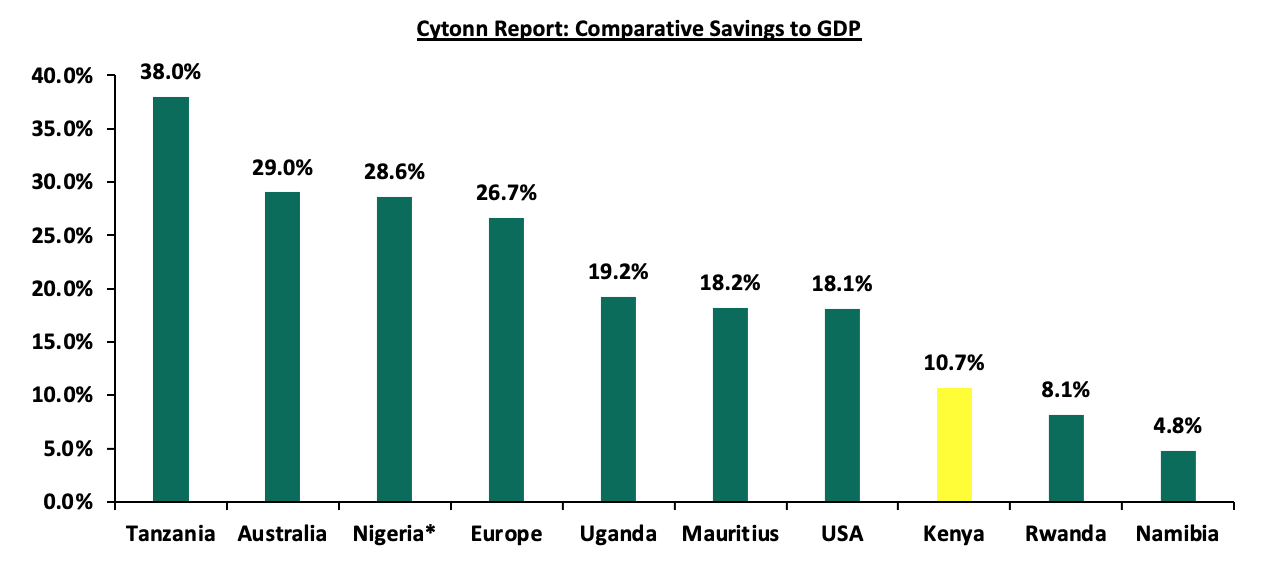

Despite the government making NSSF mandatory, Kenya’s saving culture still lags behind in comparison to other more developed countries partly attributable to low disposable income with 35.1% of the Kenyan population as of 2023 living below the poverty line coupled with lack of sufficient knowledge on the importance of saving for retirement. The graph below shows the gross savings to GDP of select countries in the Sub-Saharan Africa Region and the developed economies;

*Figures as of 2023

Source: World Bank

Section II: Recent Developments at the National Social Security Fund

The National Social Security Fund (NSSF) has recently found itself under intense scrutiny due to a series of troubling developments. First, data from the Controller of Budget for the last financial year which ended in June indicates that government defaults to NSSF and NHIF almost tripled, reaching Kshs 716.0 mn in 2023 from Kshs 215.0 in the previous year. Earlier this month, The Central Bank of Kenya (CBK) also raised serious concerns regarding irregular trading activities involving the National Social Security Fund (NSSF), prompting a request for the Capital Markets Authority (CMA) to conduct a thorough investigation.

- Government Default on Remittance: Unremitted contributions to both the NSSF and the National Hospital Insurance Fund (NHIF) surged from Kshs 215.0 mn to Kshs 716.0 mn within a single fiscal year, according to the Controller of Budget. NSSF, by itself, had its unremitted contributions from the government increase by 251.7% to Kshs 182.0 bn from Kshs 64.0 bn in the previous financial year. These form part of the larger pending bills issue that the government has been dealing with, following intense pressure on the exchequer from debt repayments.

While this pressure on the exchequer is understandable, the default on retirement funds contributions has to be worrying. For many retirees, the NSSF is not just a fund; it represents the culmination of years of hard work and savings. When defaults like these lead to delays in payments of their benefits, it makes them even more vulnerable and uncertain. Having to deal with delayed disbursements on top of the bureaucratic inefficiencies isn’t a good look for our system. - Irregular bond trading: Earlier this month, the Central Bank of Kenya (CBK) initiated an investigation, through a request to the Capital Markets Authority, into irregular trading activities involving the NSSF, where bonds were allegedly bought at inflated prices and sold at losses. This raises serious concerns about market integrity and investment management within institutions like the National Social Security Fund (NSSF). Surprisingly, this isn’t the first of such cases, in 2008, the Kenya Anti-Corruption Commission – as it was then known – received a report that the National Social Security Fund (NSSF) had lost Kshs 1.6 bn of pension funds through irregular trading in shares by Discount Securities Limited. Investigations were done for these, and seven directors at the fund were prosecuted and found guilty of illegally acquiring Kshs 1.2 bn meant for shares that was paid by NSSF, with each getting different sentences.

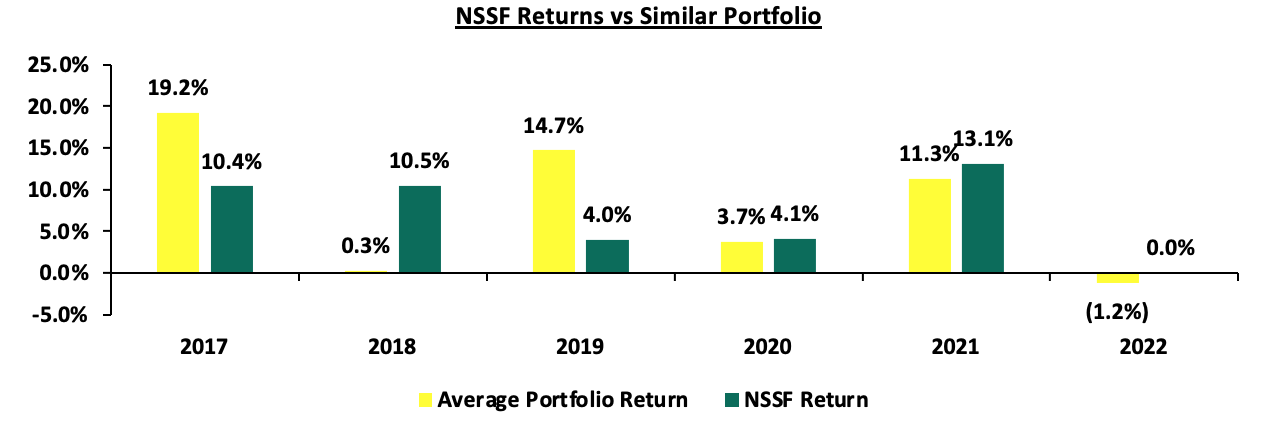

The recurrence of such issues emphasizes the urgent need for enhanced oversight and accountability within the NSSF. Selling bonds at a loss has serious consequences. First, it directly harms the fund's financial health, leading to lower returns and less money available for member payouts. This is what makes Kenyans doubt the ability of the fund's management. As we become more skeptical, the fund continues to face reputational damage. Notably, the fund hasn’t released their performance report since 2022, and the last reported performance was 0.0% in 2022. Below is the performance summary for the last few years, compared to the estimated returns from a portfolio of 60% bonds and 40% equities:

Source: NSSF strategic plan 2023-2027

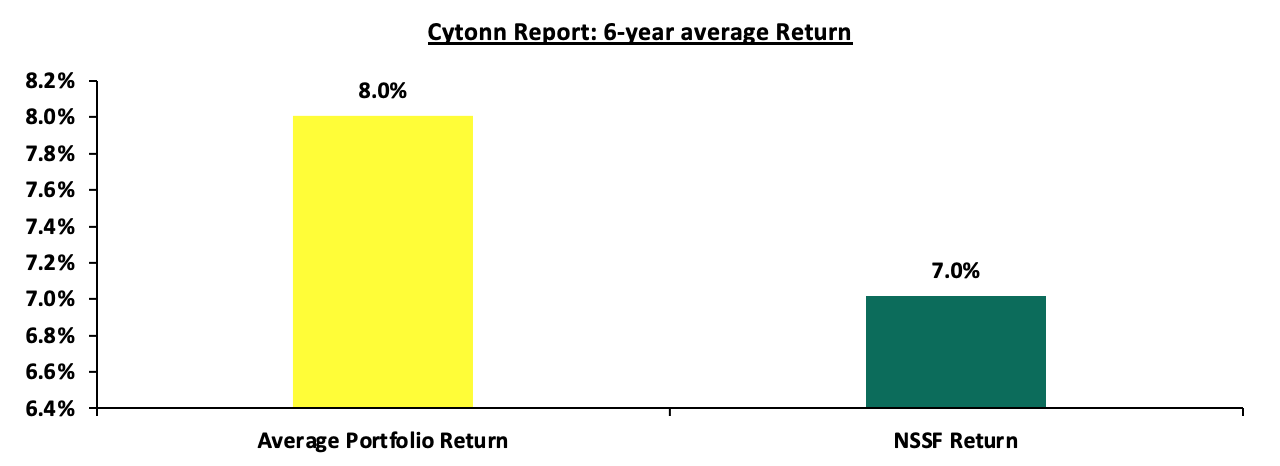

On average, the NSSF portfolio has underperformed by 1.0 percentage point compared to a comparable benchmark. While NSSF recorded a return of 7.0%, a similarly constructed portfolio—split between 60% government bonds and 40% equities from the NASI—achieved 8.0% over the same period. While there may be a number of reasons for this, occurrences such as the irregular bond trades could definitely have contributed to this.

Section III: Effectiveness of the National Social Security Fund

One of the main objectives of the National Social Security fund is to provide a source of income to retirees and improve the adequacy of benefits paid out to the beneficiaries. According to the Retirement Benefits Authority (RBA), the retirement benefits industry in Kenya has a membership of over 7.3 mn with a coverage of 25.0% of the working-age population, with the mandatory scheme, National Social Security Fund (NSSF), accounting for over 80.0% of the total membership as of 2021. Despite this, Kenya has an Income replacement ratio of 43.0% compared to the recommended ratio of 75.0%, indicating that most retirees in Kenya are likely to remain financially dependent after retiring.

To shed more light on the adequacy of NSSF savings in reducing the dependence of retirees, we compare three scenarios as follows;

- Individual A who relies purely on NSSF contributions (a standard contribution of Kshs 200.0 per month which is matched by the employer),

- Individual B who relies on NSSF but tops up the contribution with Kshs 1,000.0 every month as additional voluntary contributions, and,

- Individual C tops up their NSSF with an additional Kshs 5,000.0. We also assume the following;

|

Cytonn Report: Adequacy of NSSF savings in catering for post-retirement, |

|

|

Start Working Age (Years) |

25 |

|

Retirement Age (Years) |

60 |

|

Savings Period (Years) |

35 |

|

Assumed Constant Annual Interest Rate |

7.0% |

|

Average Salary (Kshs) |

50,000.0 |

|

Cytonn Report: Income Replacement |

|||

|

Monthly Pension Contribution (Kshs) |

Amount At Maturity (Before Tax) (Kshs) |

Number of Years post Retirement one can maintain the same living standard |

|

|

Individual A |

400.0 |

724,624.0 |

1.7 |

|

Individual B |

1,400.0 |

2,536,185.1 |

6.0 |

|

Individual C |

5,400.0 |

9,782,428.1 |

23.3 |

Generally, one needs about 70.0% of what they make at the peak of their career to maintain the same standard of living in retirement. By this finding, we can estimate roughly the number of years post-retirement that the three individuals in the table above can live comfortably on their pension money. As per the table above, individual A will have a consistent income for 1.7 years.

Evidently, NSSF savings (as in for Individuals A and B) are not adequate to cater to their post-retirement assuming that they live for more than 15 years after retirement, an indication that NSSF does not meet its objective of alleviating poverty and reduction of dependency post-retirement.

Section IV: Factors Hindering the Growth of NSSF

The growth of the National Social Security Fund (NSSF) in Kenya has been hindered by a range of interrelated factors that have affected its efficiency, financial stability, and ability to provide adequate retirement benefits. In this regard, we analyze the factors that have hindered growth of the fund as follows:

- Leadership and Governance Issues: The NSSF has faced persistent governance issues, including allegations of mismanagement and corruption. Investigations into corruption allegations involving senior officials at the NSSF have undermined confidence in the fund’s management and led to calls for reforms. However, these reforms have faced delays due to bureaucratic hurdles and resistance from entrenched interests. The lack of effective governance has contributed to inefficiencies and mismanagement,

- Investment Return Challenges: The fund has faced challenges in achieving satisfactory investment returns due to ineffective asset management and underperforming investments. This has hindered the National Social Security Fund (NSSF)’s ability to grow its asset base and provide adequate benefits to its members. Moreover, the fund has struggled with unremitted contributions from state corporations, government-owned enterprises, and semi-autonomous agencies. By the end of FY’2023/24, unremitted contributions to NSSF reached Kshs 182.0 mn, a significant 251.7% increase from the Kshs 64.0 mn recorded at the end of FY’2022/23. This surge in unremitted contributions highlights the growing funding gap that threatens NSSF’s ability to meet its retirement obligations,

- Slow Economic Growth: Kenya’s economy has faced persistent slow growth, with an average GDP growth rate of 4.5% over the last 5 years. This slow economic performance has resulted in low-income levels for many citizens, directly impacting their ability to make regular contributions to the National Social Security Fund (NSSF). Furthermore, inflation and increasing cost of living have reduced disposable income, making it difficult for both individuals and employers to meet their NSSF obligations. This economic stagnation has contributed to lower contribution inflows, limiting the fund's ability to grow its asset base and deliver adequate retirement benefits,

- High Unemployment Rate in Kenya: The unemployment rate in Kenya stood at 5.6% at the end of 2023, and is projected at 6.6% by the end of 2024; primarily due to the challenges facing the country’s economic development, alongside a rising youth population. This has increased the dependency ratio of the working population, making it difficult for them to commit to social security contributions towards their retirement. Consequently, this hinders the National Social Security Fund (NSSF)'s growth as fewer people are able to contribute to the fund, limiting its ability to expand its asset base,

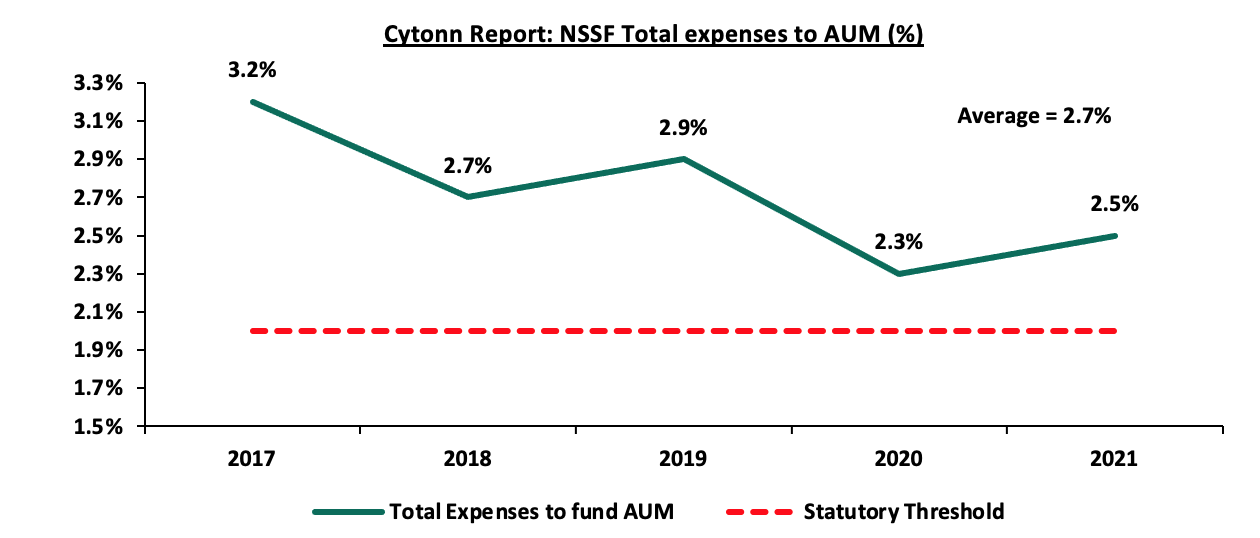

- Inefficiencies: Section 50 of the National Social Security Fund Act, 2013, stipulates that the fund shall not pay out more that 2.0% of its total assets in the first six years of its operation, and thereafter, its capped at 1.5%, However, the fund has consistently breached this guideline, with the average payout for the last reported 5 years, coming in at 2.7%. This breach signals inefficiency, especially in management of costs in the fund, which continues to erode member’s savings and subsequently their trust in the fund. The graph below shows the expenses of the fund as a percentage of its Assets in the last five reported years:

- Openness and Transparency - Transparency is critical in enhancing trust and ensuring that members are informed about how their contributions are managed and invested. The fund should, therefore, aim to release its financials on time. On their website, the last available reports are from 2021, two and a half years ago.

- Government Interference - Given that NSSF is a government-owned institution, it often makes decision with politics in the background hence the poor returns and many incidences of corruption and mismanagement.

Section V: Key Considerations for Improving NSSF in Kenya

We note that the government has continually tried to enforce a savings culture in the country through various reforms such as an increase in contributions as well as making the contributions mandatory. For instance, in the NSSF Act 2013, the government recommended a mandatory registration contribution to NSSF by employees and employers. The Act aimed to enhance the sustainability of retirement benefits for Kenyan workers. Key provisions of the Act include an increase in contribution rates, from a flat rate of Kshs 400.0 to 12.0% of an employee's monthly earnings, with 6.0% contributed by the employee and an equal amount by the employer.

However, the enactment of the Act has faced legal challenges. Multiple petitions were filed questioning its constitutionality, leading to a decision by the Employment and Labor Relations Court (ELRC). On September 19th, 2022, in Kenya Tea Growers Association & 8 Others v. NSSF Board & Others, the ELRC ruled that the Act was unconstitutional on the basis of;

- The provisions of the NSSF Act, 2013 were not subjected to public participation and were not tabled before the Senate prior to its enactment as per constitutional requirements,

- Imposing mandatory registration and contribution to NSSF would have overburdened employees and consequently reduce disposable income since a vast majority of employees have their pay slips already strained due to their various financial commitments with other institutions and their subscription to other pensions schemes, and,

- The provisions of the Act would have given NSSF a competitive advantage thus making the Fund a monopoly in the provision of pension and social security services in the country.

Following this ruling, the NSSF Board of Trustees appealed, and the case eventually reached the Supreme Court of Kenya. The Supreme Court examined whether the ELRC had the jurisdiction to rule on the Act's constitutionality. Ultimately, the court affirmed the ELRC’s jurisdiction but remitted the case to the Court of Appeal for further consideration. In our view, the following are some of the actionable steps that can be taken into consideration to ensure growth of the NSSF while working towards meeting its objective and achieving a win-win situation for the government, employers and employees;

- Ensure involvement of all stakeholders in NSSF reforms - The general public and all stakeholders need to be involved whenever there is a recommendation for reforms in the NSSF. As stated above, the High Court stopped the NSSF Act of 2013 which included a bid to increase monthly contributions to Kshs 2,068.0 from the current Kshs 200.0 as it was not subjected to public participation in breach of the Constitution which demands public input before major decisions are taken. Additionally, the promoters of the Act failed to get approval from the Senate despite the law affecting county employees and the finances of the devolved governments. The higher pension contributions would have boosted the growth of NSSF by building a bigger retirement pot and offering workers better replacement ratios as opposed to the current plan,

- Mass education on developing a savings culture - There is a need to educate Kenyans on developing a savings culture given that the majority of Kenyans including young people in the informal sector believe that they are too young to start saving for retirement and it is only the older people who should have retirement benefit schemes. Additionally, the majority of Kenyans usually worry less about their retirements because of the belief in assistance by their children as they have invested in them. Such attitude hinders people from voluntarily joining schemes such as the NSSF when they have a source of regular income;

- Enforcement of compliance from employers - The NSSF should seal all loopholes in order to ensure full compliance by all employers in remitting NSSF contributions. This can be done by incorporating technologies that allow payroll-related contributions under one platform in order to improve efficiency and reconcile the records while identifying employers who remit some payments and leave out others,

- Improved openness & transparency - Transparency is critical in enhancing trust and ensuring that members are informed about how their contributions are managed and invested. The fund should, therefore, aim to release its financials on time. On their website, the last available reports are from 2021, two and a half years ago. This will help boost confidence among members and stakeholders. It would be a good sign if both 2022 and 2023 financials were then concurrently published,

- Induce operational efficiency – In the financial year ended 30th June 2021, NSSF’s total expenses amounted to Kshs 6.6 bn, equivalent to 45.4% of the members' contributions of Kshs 14.5 bn, with the total expenses to AUM ratio increasing by 0.1% points to 2.3% in FY’2020/2021 from 2.2% FY’2019/2020. Key to note, total expenses increased by 21.5% in the year ended 30th June 2021, while members' contributions declined by 1.8% to Kshs 14.5 bn from Kshs 14.7 bn in the year ended 30th June 2020. For NSSF to better serve the interests of all stakeholders, there needs to be proactive measures around increasing efficiency and cutting down on unnecessary expenditure,

- Make NSSF Autonomous from Political Interference: We should consider a governance model that makes NSSF a semi-autonomous body insulated from government interreference, and,

- NSSF should invest the savings in high-yielding investments – In the last five financial years, the average interest on members’ funds has come in at 6.8%. When compared against the average inflation during the same period of 5.9%, this presents real returns of a paltry 0.9%. The fund should continually seek to raise the interest on the savings in order to motivate employees in formal and informal sectors to save for their retirement. This can only be achieved through improving its financial security by investing in worthwhile ventures that will have maximum returns so that its members can benefit maximally.

Section V: Conclusion

The National Social Security Fund (NSSF) is at a pivotal moment, grappling with significant challenges that threaten both its credibility and the financial security of its members. For many retirees, the NSSF embodies years of hard work and sacrifice, making the protection of their benefits paramount. To restore trust, it is essential to implement robust oversight mechanisms, including independent audits and strict enforcement of remittance timelines. The time has come for all stakeholders—government, regulators, and fund management—to unite in a concerted effort to revitalize the NSSF, ensuring it can fulfill its vital role in safeguarding the retirement futures of millions of Kenyans. Immediate action is not just necessary, it is mandatory. This will aid in reducing poverty in old age as well as providing regular income to replace earnings in retirement.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.