Jan 15, 2018

Following the recent headline on the Business Daily on the total cost of credit at 19% compared to the legislated cap at 14%, we:

- revisit the topic on interest rate caps by a general overview,

- have a look at initiatives put in place to make credit cheaper and more accessible,

- assess the impact on private sector credit growth, and,

- analyse the true cost of credit and what more can be done (see here for the Business Daily article).

Section I: Revisiting the Topic on Interest Rate Caps by a General Overview

We have already done four previous focus notes on the topic, namely,

- Interest Rate Cap is Kenya’s Brexit - Popular But Unwise, dated August 2016, less than a month before the signing into law, where we first expressed our view that the interest rate caps will have a clear negative impact on the economy. We noted that free markets tend to be strongly correlated with stronger economic growth, plus we noted the lack of compelling evidence that interest rate caps were successful, as evidenced by the World Bank report on the capping of interest rates in 76 countries around the world. In Zambia, for example, interest rate caps were introduced in December 2012 and repealed 3-years later, in November 2015, after the impact was found to be detrimental to the economy. We called for the implementation of a strong consumer protection agency and framework, coupled with the promotion of initiatives for competing and alternative products and channels,

- Impact of the Interest Rate Cap, dated August 2016, just after the interest rate cap bill was signed into law, where we highlighted the immediate effects of the interest rate cap, with the President having signed the Bill into law, and banking stocks losing 15.6% in the span of 2-days. Here we re-iterated our stance on the negative effects of the interest rate caps, while identifying the winners and losers of the Banking (Amendment) Act 2015,

- The State of Interest Rate Caps, dated May 2017, 9-months after the Banking (Amendment) Act 2015 was signed into law, where we assessed the interest rate cap and its effect on private sector credit growth, the banking sector and the economy in general, following concerns raised by the International Monetary Fund (IMF). We called on policymakers to address the issue swiftly, noting that there existed, and continues to exist, opportunities for structured financial products and private equity players to come in and provide capital for SMEs and other businesses to grow,

- Update on Effect on Interest Rate Caps on Credit Growth and Cost of Credit, dated July 2017, approximately 1-year after the Banking (Amendment) Act 2015 was signed into law, where we analysed the decline in private sector credit growth and lending by commercial banks, coupled with the elevated total cost of credit, which was higher than the 14.0%, as banks load excessive additional charges, while noting that the large banks, which control a substantial amount of the loan book, are the most expensive. We called for (i) repeal or modification of the interest rate caps, (ii) increased transparency, (iii) improved and more accommodating regulation, (iv) consumer education, and (v) diversification of funding sources into alternatives.

Section II: Initiatives Put in Place to Make Credit Cheaper and More Accessible

The government, in collaboration with Financial Services Regulators, has adopted various initiatives in the past, with the aim of keeping the total cost of credit low and enhancing credit growth. The major ones include:

- The Banking (Amendment) Act 2015, introduced in August 2016, which capped lending rates at 4.0% points above the Central Bank Rate (CBR), was introduced to protect consumers from banks enjoying high interest rate spreads at the expense of consumers, and make credit easier to access and more affordable,

- Making public the Cost of Credit website by The Kenya Bankers Association (KBA) and the Central Bank (CBK). This is a website in which commercial banks and micro-finance institutions are required to publish their true cost of credit, and,

- Setting out new regulations by the Central Bank of Kenya (CBK) that will see commercial banks incur heavy penalties, of up to a maximum of Kshs 20.0 mn, from Kshs 5.0 mn previously, for failure to disclose the true cost of credit to consumers.

Section III: Assess the Impact on Private Sector Credit Growth

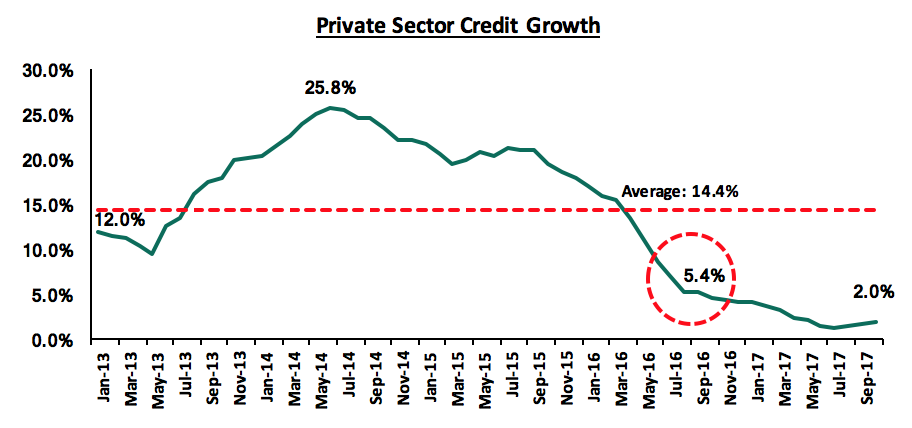

Despite the positive intention behind the Banking (Amendment) Act, private sector credit growth declined to an 8-year low of 1.4% in July 2017, attributable to the fact that banks preferred, and justifiably so, not to lend to consumers or businesses but invest in risk-free treasuries, which offer better returns on a risk adjusted basis. Following the capping of the interest rates, which excludes the extra charges, most commercial banks have taken advantage of the loophole allowing them to charge extra fees on the loans issued to increase the cost of credit well above the statutory ceiling of 14.0%, averaging 18.0%, which is 3.5% above the 14.0% cap. To a large extent, the negative impact of the introduction of interest rate caps has proved to outweigh its benefits, as credit growth has dipped compared to the pre-rate cap era, as illustrated in the graph below, which shows private sector credit growth over the last 4-years. As can be seen from the graph below, private sector credit growth touched a high of 25.8% in June 2014, and has averaged 14.4%, but has dropped to 2.0% levels after the capping of interest rates.

Section IV: Analyse the True Cost of Credit and What More Can Be Done

Further, in line with providing the market with information, and in an effort to promote transparency and control the total cost of credit, CBK and Kenya Bankers Association (KBA) made public a website called the ‘CostofCredit’ website, in which banks, both commercial and micro-finance institutions, are required to publish their Annual Percentage Rate (APR), loan repayment schedule and any additional details on their loans. Loans with a 1-year duration, both secured and unsecured, should attract the maximum chargeable interest of 14.0%, but banks have managed to increase the true cost of credit with bank charges varying depending on the bank.

There are various costs associated with a loan in addition to the interest rate component, which range from bank fees and charges to third party costs, such as insurance fees, legal fees and government levies. The total cost of credit is therefore defined as all costs related to the issue of credit, including interest and any fees tied to acquiring credit, usually expressed by the Annual Percentage Rate (APR), a metric that factors in additional costs and fees on the annual interest rate.

Moving to analyse the true cost of credit, below we have the ranking of the cheapest and most expensive banks, based on the APR, assuming an individual has taken up a personal secured loan, with the average APR in the sector under this category recorded at 16.7%, same as was recorded 6-months ago in July 2017. The two tables below show the Cheapest Banks having an average APR of 15.1% (same as in July 2017), with the Most Expensive Banks having an average APR of 18.7% (20 bps lower than 18.9% in July 2017).

|

Personal Secured Loans- Cheapest Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Guaranty Trust Bank |

14.0% |

0.0% |

0.0% |

14.0% |

14.0% |

|

2 |

CBA |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Victoria Commercial Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Paramount Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Oriental Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Middle East Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

I&M Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Habib Bank Zurich |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

Average |

14.0% |

0.9% |

0.1% |

15.1% |

15.1% |

|

Source: www.costofcredit.co.ke

|

Personal Secured Loans- Most expensive Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Equity Bank |

14.0% |

5.0% |

0.5% |

20.6% |

20.6% |

|

2 |

Prime Bank |

14.0% |

4.0% |

0.4% |

19.2% |

19.2% |

|

3 |

Family Bank |

14.0% |

3.2% |

0.8% |

18.8% |

18.8% |

|

4 |

Barclays Bank |

14.0% |

3.0% |

0.8% |

18.5% |

19.9% |

|

5 |

Eco-bank Kenya |

14.0% |

3.0% |

0.3% |

17.9% |

17.9% |

|

5 |

NIC Bank |

14.0% |

3.0% |

0.3% |

17.9% |

17.9% |

|

5 |

Spire Bank |

14.0% |

3.0% |

0.3% |

17.9% |

17.9% |

|

Average |

14.0% |

3.5% |

0.5% |

18.7% |

18.9% |

|

Source: www.costofcredit.co.ke

When it comes to applying for a 3-year mortgage, the APR is elevated due to third party charges such as legal fees and other related costs, with bank charges remaining relatively unchanged. However, the average sector APR has is at 18.9% same as in July, 2017 under the mortgage category. The two tables below show the Cheapest Banks having an average APR of 18.2% (same as in July 2017), with the Most Expensive Banks having an average APR of 20.0% (same as in July 2017).

|

Mortgage - Cheapest Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Victoria Commercial Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

Middle East Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

I&M Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

Guaranty Trust Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

ABC Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

Guardian Bank |

14.0% |

1.1% |

5.6% |

18.2% |

18.2% |

|

Average |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

Source: www.costofcredit.co.ke

|

Mortgage - Most Expensive Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Equity Bank |

14.0% |

5.0% |

6.0% |

21.3% |

21.3% |

|

2 |

Barclays Bank |

14.0% |

3.0% |

6.3% |

20.0% |

20.0% |

|

2 |

NIC Bank |

14.0% |

3.0% |

6.3% |

20.0% |

19.7% |

|

3 |

KCB Group |

14.0% |

2.6% |

6.3% |

19.8% |

19.7% |

|

4 |

Eco-bank Kenya |

14.0% |

3.0% |

5.8% |

19.7% |

19.8% |

|

5 |

Cooperative Bank |

14.0% |

2.5% |

5.8% |

19.3% |

19.3% |

|

5 |

Bank of Baroda |

14.0% |

0.0% |

8.3% |

19.3% |

19.3% |

|

Average |

14.0% |

3.2% |

6.1% |

20.0% |

20.0% |

|

Source: www.costofcredit.co.ke

From the tables above we can draw the following conclusions and insights on the total cost of credit as highlighted below;

- The total cost of credit is remains high, given the excessive fees being charged by large portions of the banking sector, with these additional costs accounting for 13.7% of the total cost of credit (Annual Percentage Rate) in the sector, meaning that 13.7% of the total lending rate is attributable to additional costs, hence the APR has remained consistently above the 14.0% cap, at 16.7%, over the last 6-months, and,

- The larger banks in the industry, which control a substantial amount of the loan book, are the costliest, and hence are able to sway the market, given the low customer bargaining power.

While interest rates have remained relatively stable at low levels, following the Banking (Amendment) Act 2015, private sector credit growth has continued to dip, slowing to an average of 2.4% for the first 10-months of the year 2017 compared to the 5-year average of 14.4%. This implies that while the interest rates might be relatively low, the government is the ultimate beneficiary, rather than the ordinary borrower the law was meant to serve. Banks have expressed the decline in the private sector credit growth is attributed to the inability to fit SMEs and other “high risk” borrowers within the 4.0% risk margin, with the yield on a 5-year government bond currently at 12.6%, just 1.4% points below the capped 14.0%. Despite the current low interest rates environment, the total cost of credit is quite high, with some banks charging close to 20.0%, which is 7.4% points premium over a government security, with spreads of up to 5.0% points, as a result of the excessive fees being charged by large portions of the banking sector, with these additional costs accounting for 13.7% of the total cost of credit in the sector.

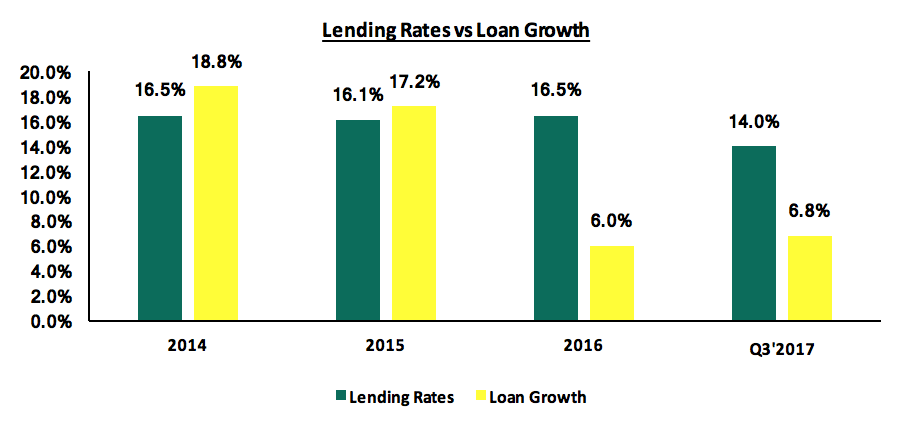

However, given the total cost of credit has remained relatively high, it is quite ironic that banks are still not lending to the private sector, as they would still be able to make attractive margins at the current levels. The reduced lending can be evidenced by the paltry loan growth recorded by the commercial banks. For instance, as shown in the chart below, the average rates for commercial banks’ loans and advances have been 16.5% in 2014, 16.1% in 2015 and 16.5% in 2016, while the rate over the year 2017 has been fixed at 14.0%. When this is compared to loan growth, as shown in the chart below, it is noticeable that loan growth was highest during a time of no interest rate caps, dipping to 6.0% in 2016 when the interest rate caps were introduced, and this dragged on with loan growth averaging at 6.8% for the first three quarters of 2017. As such, free pricing of loans with no government interference has led to the highest rates of credit growth, when compared to the fixed rate regime the economy is currently under.

Given the current state of low lending in the economy, and that we are under a fixed-rate regime on interest rates, below are the initiatives that need to be taken to spur credit growth once again in the economy:

- Repeal or at least significantly review the Banking (Amendment) Act 2015, given the current regulatory framework has proved to be a hindrance to credit growth, evidenced by the continued decline of private sector credit growth, which is at 2.0% as at October 2017, below the government set target of 18.3%, and compared to 5.4% when the amendment was introduced in August 2016,

- The implementation of a strong consumer protection agency and framework, to include robust disclosures on cost of credit, free and accessible consumer education, enforcement of disclosures on borrowings and interest rates, while also handling issues of contention and concerns from consumers. Following the financial crisis in 2008, the US government set up the Consumer Financial Protection Bureau, responsible for consumer protection in the financial sector, with enforcement actions proving effective in enhancing credit growth, as the agency has realized more than USD 11.7 bn in relief, passing the benefits on to more than 27.0 mn consumers,

- Diversify funding sources, which will enable borrowers to tap into alternative avenues of funding that are more flexible and pocket-friendly, which can be done through the promotion of initiatives for competing and alternative products and channels, in order to make the banking sector more competitive. In a normal developed economy, 40% of business comes from the banking sector, with 60% coming from non-bank institutional funding. In Kenya, it is at 95% of all funding that comes from bank funding, and only 5% from non-bank institutional funding, showing that the economy is over reliant on bank lending and should have more alternative and capital markets products funding businesses. Alternative Investment managers and the Capital Markets Authority need to look at how to enhance non-bank funding, such as high yield investment vehicles, some of which include High Yield Notes and Cash Management Solution, CMS, products. The products offer investors with cash to invest a rate of about 18% to 19%, equivalent to what the fund takers, such as real estate developers, would have to pay to get funds from the banks. Instead of a saver taking money to the bank and getting negligible returns, they can just invest in a funding vehicle where the business would pay them the same 18% to 19% that they would pay to get the same money from the bank. For the saver, it helps improve their rate from low rates, at best 7%, to as high as 18%, and for the business seeking funding, it helps them access funding much faster to grow their business,

- Level the playing field by making tax incentives available to banks to be also available to non-bank funding entities. For example, providing alternative and capital markets funding organizations with the same withholding tax incentives that banking deposits enjoy, of a 15% final withholding tax,

- Consumer education, where borrowers are educated on how to be able to access credit, the use of collateral, and establishing a strong credit history. However, this will also require the adoption of risk based lending by banks where cost of credit varies based on your credit history,

- Increased transparency, in a bid to spur competitiveness in the banking sector and bring a halt to excessive fees and costs, with recent initiatives by the CBK and KBA, such as the stringent new laws and cost of credit website being commendable initiatives,

- Improved and more accommodative regulation, such as the Movable Property Security Rights Bill 2017, which seeks to facilitate use of movable assets as collateral for credit facilities, allowing borrowers to use a single asset to access credit from different lenders, and,

- Have advocacy groups such as the East African Association of Structured Products engage policy makers on the need for alternative and structured products as viable options to bank funding, hence reducing overreliance on banks and increasing competition.

Despite the capping of interest rates on loans, both secured and unsecured, to a maximum chargeable interest of 14.0%, commercial banks have managed to increase the true cost of credit way above the ceiling. This coupled with the fact that the government has crowded out the private sector of credit and locked out “high risk” borrowers, following the rigid loan pricing framework, has resulted to the slowing of the private sector credit growth to an average of 2.4% for the first ten months of the year 2017. This could end up impacting negatively on the economy as evidenced by the deterioration of GDP to 4.4% in Q3’2017, which was partly attributed to a slowdown in the growth of the financial intermediation sector, which expanded by 2.4%, down from 7.1% recorded in Q3’2016.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor