Sep 27, 2020

Introduction

The Capital Markets Authority recently updated its guidelines of Collective Investments Schemes (CIS) on matters affecting valuation, performance measurement and reporting by Fund Managers in a bid to encourage international best practice in the capital markets through standardization. This move by the regulator was necessitated by the feedback and observations they have received and made from the market. Aside from enhancing accountability and transparency in the reporting of CIS’ performance, the guidance will also be critical for investor protection and encourage the fair treatment of customers.

As such, we felt the need to shed some light on the collective investment space, as an update to the previous work we have done on the same where, in May 2019, we wrote about investing in unit trusts from the personal finance perspective. In the topical, we highlighted the various types of unit trusts as well as the performance of the unit trusts in Kenya. Therefore, given the recent developments in the industry vis-à-vis the recently published guidelines by the Capital Markets Authority, we shall reiterate the topic and address the following;

- Current CIS regulation framework,

- Performance of CIS’ in Kenya,

- What are the drivers to the recent prominence of CIS in Kenya? and,

- Conclusion – we shall give an outlook on the industry.

Section I: Current CIS regulation framework

To start with, a Collective Investment Scheme (CIS) is a pool of funds from various investors who have a common goal, it is promoted in most cases by a fund manager. The first law that defined collective investment schemes was the Unit Trusts Act of 1965 which was used when the first unit trusts were set up in the 1990s and remained applicable until 2000. Further to this, the Capital Markets Authority through the Capital Markets Act is empowered to regulate both the funds and the funds’ service providers:

- Unit Trusts – the investment schemes where investors sharing the same financial objective pool funds, give a group of professional managers who will then invest in securities like shares, bonds, money market instruments or other authorized securities in order to achieve the objective of the fund. There are various kinds of funds depending on the underlying assets.

- Fund Managers – the individuals authorized by the authority having met certain requirements to be make investment decisions on behalf of the fund,

- Unit Trust Trustees – a corporate trustee assigned to the fund to ensure the fund is run in-line with the fund’s goals and objectives and the key responsibility is to safeguard the assets of the trust, and,

- Custodians – a bank or a financial institution approved by the regulator to ensure safe custody of all assets of the unit trust,

The governance structure of CIS is such that there are checks and balances to ensure investors capital and returns are truly protected. The trustees oversee what the fund manager does within the confines of laws, regulations and consititutive documents. There is monthly reporting to the Capital Markets Authority as the referee of the investment industry.

Section II: Performance of CIS’ in Kenya

In the country, most CIS’ are set up as “Unit Trusts” where the scheme is formed under trust law and the holdings in such a scheme are known as units. The fund manager, in collaboration with the custodian and the unit trust’s trustee, invest funds on behalf of unitholders, in line with the fund’s objectives. The table below shows the objectives, asset allocation, risk tolerance and investment horizon for the different types of funds.

|

Factor |

Money Market Fund/ Fixed-income Fund |

Equity Fund |

Balanced Fund |

|

Objective |

Prefers liquidity & stable returns |

Capital appreciation |

Both liquidity and capital appreciation |

|

Asset Allocation |

The fund manager will invest in fixed income like treasury bills and bonds |

The fund manager will invest in equities |

The fund manager will invest in fixed income like treasury bills and bonds and equities |

|

Risk Tolerance |

Low Risk |

High Risk |

Moderate Risk |

|

Time Horizon |

Short-term investors |

Long-term investors |

Medium-term investors |

According to our report on Q1’2020 unit trust performance, Money Market Funds continued to be the most popular product in terms of market share having a share of 88.2%, an increase from 87.0% in FY’2019 Growth of Unit Trusts as shown in the table below;

|

Assets Under Management (AUM) by Type of Collective Investment Scheme (All values in Kshs mns unless stated otherwise) |

||||||

|

No. |

Product |

FY'2019 AUM |

Q1’2020 AUM |

FY'2019 Market Share |

Q1’2020 Market Share |

Variance |

|

1 |

Money Market Funds |

66,193.0 |

67,358.0 |

87.0% |

88.2% |

1.2% |

|

2 |

Equity Fund |

4,485.2 |

3,631.6 |

5.9% |

4.8% |

(1.1%) |

|

3 |

Balanced Fund |

1,312.0 |

1,166.5 |

1.7% |

1.5% |

(0.2%) |

|

4 |

Others |

4,108.1 |

4,188.2 |

5.4% |

5.5% |

0.1% |

|

|

Total |

76,098.4 |

76,344.3 |

100.0% |

100.0% |

|

Source: Capital Markets Authority: Collective Investments Scheme Quarterly Report

According to the Capital Markets Authority, there were 24 approved collective investment schemes made up of 92 funds in Kenya as of Q1’2020, unchanged since Q1’20015. Out of the 24 however, only 19 are currently active while 5 are inactive. During the month of September, the CMA granted African Diaspora Asset Management (ADAM) a fund manager’s License, bringing the total number of licensed fund managers to 25.

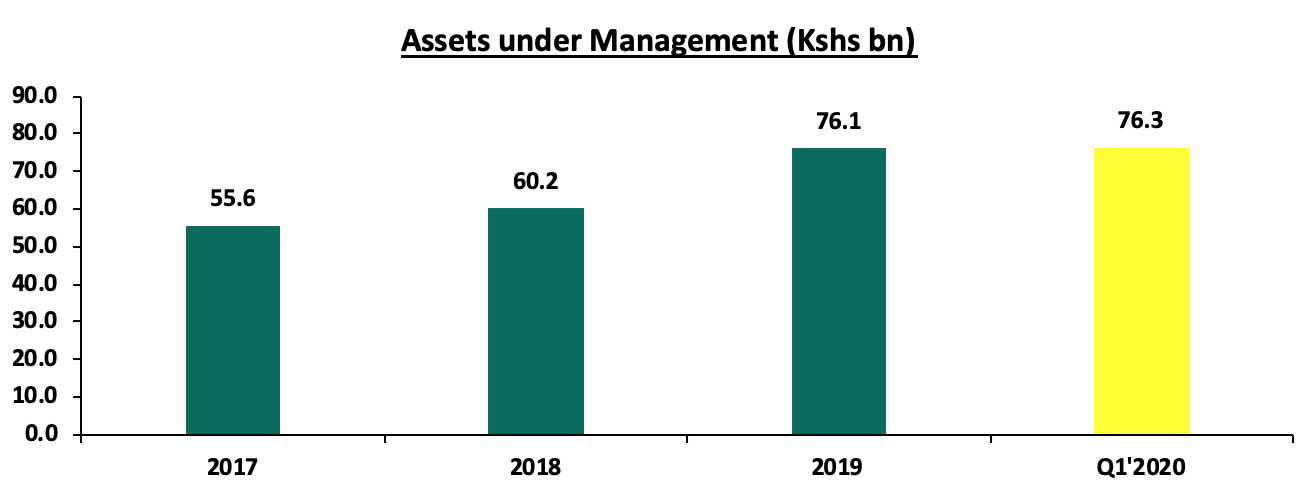

Assets ˜Under Management (AUM) of the industry during the period of review grew at a rate of 0.32% to Kshs 76.3 bn in Q1’2020, from Kshs 76.1 bn as at FY’2019, as per the below diagram;

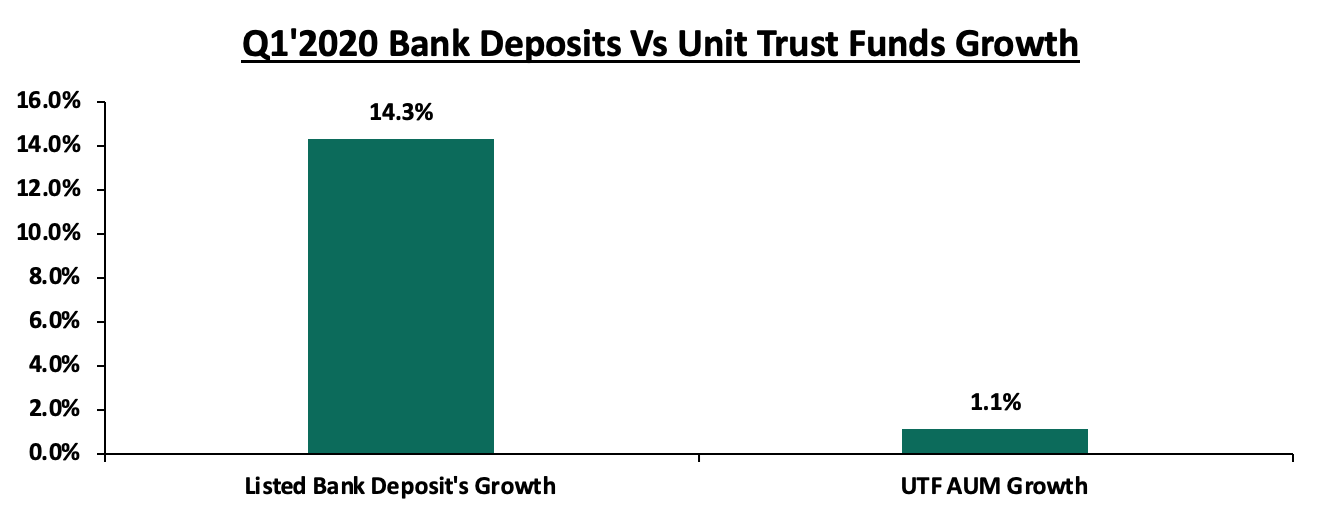

The sector has continued to grow to record a 2-year CAGR growth of 17.0%, but in Q1’2020 the growth was muted growing by 1.1%, down from the 26.5% recorded in FY’2019. Compared to bank deposits, Unit trusts funds usually grow at a much slower pace, an indication that our capital markets potential and growth remains constrained. The chart below shows the aunnualized unit trust growth versus bank deposit growth for the first quarter of the year.

*Growth is annualized

Section III: What are the drivers to the recent prominence of CIS in Kenya?

Collective investment schemes are becoming popular in the Kenyan market mainly driven by the attractive features they possess which include:

- Affordability: Compared to other avenues of investing, a majority of the Collective Investment Schemes’ (CIS’) in the market require an initial investment ranging between Kshs 100.0 - Kshs 10,000.0, which is relatively more affordable. This works to the benefit of both the investor and the fund manager in that for an investor; he/she can access investment opportunities which would otherwise be inaccessible due to the size of their initial investment amount, while for the fund manager; he/she can access a wider customer base and ultimately grow their assets under management,

- Liquidity: Compared to other investment options such as equities, unit trusts are liquid, as it is easy to sell and buy units without depending on supply and demand at the time of investment or exit. Furthermore, the advent of digitization and automation within the industry has enhanced liquidity enabling an investor to receive their funds within 3 to 5 working days if they are withdrawing to their bank accounts, and immediate access to funds when withdrawing via M-pesa. This is part of the reason for the popularity of products such as Money Market Funds in Kenya apart from the funds’ affordability in its initial and additional investment requirements, and,

- Diversification: CIS’ are advantageous since investors get the opportunity to diversify their portfolio as a result of the access to a wider range of investment securities even with limited capital, which would have otherwise been inaccessible if they invested on their own. For example, an investor who puts in Kshs 2,000.0 in a CIS can get exposure and ultimately returns from both the equities and fixed income market which in some instances require high initial investment amounts,

Aside from the attractive features they possess, investing through a CIS comes with certain benefits such as:

- Professional Fund Management: Unit trusts are run by investment managers who have successfully made investment decisions through a wide variety of market conditions over a long period and thus have the expertise to screen for high yielding investments opportunities in the market, coupled with other support functions such as operations which process the day to day transactions to ensure efficiency,

- Security of Fund: Unit trusts are well regulated through the Capital Markets Authority and controlled by the Collective Investment Schemes Act, which prohibits investment managers from taking certain risks. They also come with safeguards like unit trust fund is compelled by law to appoint a trustee who looks after all the assets that the fund owns which means that if anything happens to the unit trust company or the asset manager the investments will not be affected,

- Transparency and Effective Communication: Unit trusts are required to publish their daily and effective annual yields on the daily newspapers, and thus an investor can therefore always confirm the value of their investment as well as benchmark the performance against other unit trusts. It is also mandatory for the scheme to issue monthly statements showing an investor’s investments position,

- Excellent Returns: History has shown that average returns from unit trust companies compare very favorably with returns from more traditional investment products. Unit trusts have also proven themselves as an excellent way of beating inflation,

- Easy Access to the Investment: Funds invested in unit trust investments can easily be redeemable either the full or partial investment based on the prevailing unit price, and,

- Diversification: Unit trust Funds ensure diversification of risk through investing in a variety of asset classes. Through this, they provide an avenue for small scale investors to get exposure to a wide range of investments which would otherwise require one to have a lot of capital to access. Due to this nature, unit trusts have universally been identified as the small investor’s answer to achieving wide investment diversification without the need of huge and prohibitive sums of money, while still offering a safe haven for the less sophisticated and less capitalized, conservative individuals as the market becomes sophisticated and more volatile as the funds are managed by qualified fund managers who screen for viable investment opportunities.

To show the benefit that a CIS has, we came up with the below scenario which shows the amount one would require as initial investment, in order to get a return of at least 10.0% from the public markets. The case also assumes that the client is risk-averse and requires a security that provides a guaranteed return as the bare minimum i.e. Fixed-income.

|

|

Client A* |

Client B |

|

Investment Vehicle |

Money Market Fund |

4-year T-Bond (Fixed Income) |

|

Investment Period |

1 year |

4 years |

|

Return |

10.08%** |

10.11% |

|

Minimum Investment Required |

1,000.00 |

1,000,000.00 |

*Collective Investment Scheme

**Average Return for the top five Money Market Funds

Based on the above, client A can start earning a return of about 10.0% on amounts as low as 1,000.0 when investing through a CIS, in this case, a money market fund. If the client opts to invest directly in the markets, they would require at least Kshs 1,000.000.0 to purchase a four-year government bond that will get them the same return of about 10.1%.

Section IV: Conclusion

Despite the good regulations in place, there is always room for improvement. During the month, the CMA published the guidance to collective investment schemes on performance measurement and presentation. The guidance, which will be effective 1st January 2021, gives directives to fund managers on the valuation, performance measurement and reporting of the relevant schemes. CMA highlighted that these guidelines are meant to encourage international best practice in the capital markets through standardization thereby enhancing the comparability and consistency of the information presented across the sector. Fund managers will now be required to establish comprehensive and documented investment policies and procedures to govern the valuation of the assets held by the CIS. The same policies will indicate how performance is calculated, measured and presented aside from identifying the methodology to be used for valuing each asset type. Additionally, they will be required to provide performance measurement reports to the CMA and all existing and prospective investors within 21 days after the end of each quarter.

The move by the CMA is commendable although we believe certain actions on their part can help improve the growth and formation of more schemes. This includes but not limited to; (i) allowing the formation of sector funds which will allow investors to invest in specific sectors i.e. a technology fund or a real estate fund, (ii) expand eligibility of trustees of Unit Trust Funds to include non-bank trustees such as corporate trustees, and, (iii) allowing funds to have as many custodians as it suites the unit holders which will help reduce transaction costs for those investing between various financial institutions. Ultimately, the above will promote capital market growth since it reduces the existing conflict of interest and levels the playing field.

We shall be covering the changes done by the CMA in more details next week and how the same shall impact the sector.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.