Apr 28, 2024

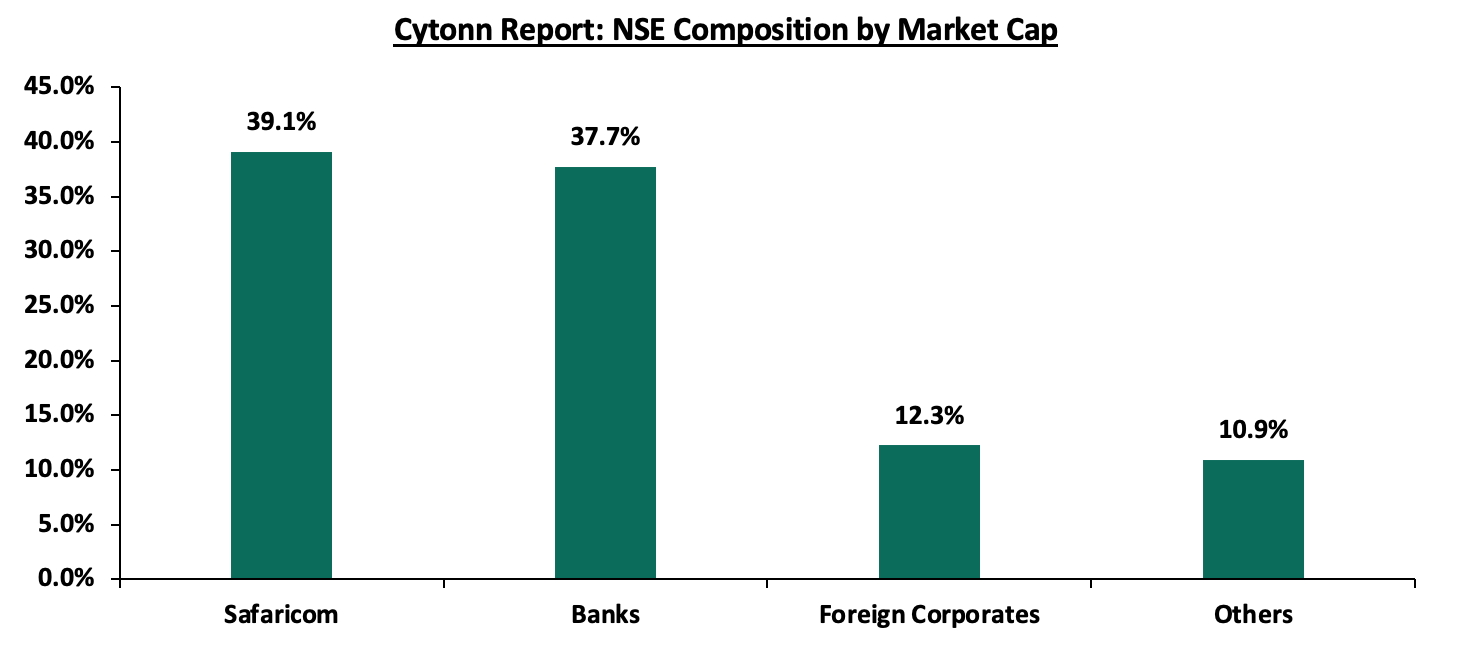

The Nairobi Securities Exchange (NSE) last recorded an Initial Public Offers (IPOs) in 2015, when Stanlib Investments issued an IPO of the first Real Estate Investment Trust (Fahari I-REIT) at the bourse, managing to raise Kshs 3.6 bn against the target of Kshs 12.5 bn, 28.8% success rate. This translates to an eight-year IPO drought, with the most recent activity at the bourse being the listing by introduction, meaning no money was raised) out of the Local Authority Pension Trust (LAPTRUST) Imara Income Real Estate Investment Trust (I-REIT) under the Restricted Sub-Segment in 2022. LAPTRUST holds 100.0% of the Imara I-REIT shares with no initial offer to the public. Currently, the bourse has 66 listed securities with a total market capitalization of Kshs 1.7 tn as at 25th April 2024. The bourse continues to be Safaricom-dominated, with Safaricom’s market capitalization of Kshs 653.1 bn equivalent to 39.1% of the entire market capitalization. Additionally, Safaricom (39.1%) and Banks (37.7%) and foreign corporates (12.3%) make up 89.1% of the total bourse, leaving all other local sectors to share the remaining 10.9%. The Capital Markets Authority (CMA) raised concerns that Kenya has been unable to achieve its projected listings targets as articulated in its Capital Markets Master Plan released in 2016 which envisioned at least four listings on the NSE every year; by its own masterplan CMA is now behind by 28 listings. To cure this, the President in September 2022 set a target of 10 listings in one year, however this has not been achieved as of 2024. The chart below highlights the composition of stocks at the Nairobi Securities Exchange;

Source: Cytonn Research

Given that a few large-cap stocks, namely Safaricom PLC, Equity Group Holdings, KCB Group Ltd and East African Breweries Ltd hold almost 62.0% of the total market capitalization, the market remains volatile, which presents a risk of a market collapse due to concentration risk.

It is important to note that capital markets development is crucial for the growth of the Kenyan economy for several reasons; Firstly, the capital markets increase the proportion of long-term savings (pensions, life covers, et cetera) that is channelled to long-term investment. Capital markets enable the contractual savings industry (pension and provident funds, insurance companies, medical aid schemes, collective investment schemes, etc.) to mobilize long-term savings from small individual households and channel them into long-term investments. In this way, the capital markets enable corporations to raise funds to finance their investment in real assets. In addition, capital markets development increases the efficiency of capital allocation. Efficient capital allocation means that funds are allocated to the investment projects or firms that bring the most value to the economy; the marginal product of capital value is the highest.

Given the significant role that the capital markets play, we shall then focus on Unlocking Kenya’s Capital Markets. As such, we shall cover;

- Current State of the Nairobi Securities Exchange (NSE),

- Current State of other Components of the Kenya Capital Markets,

- Challenges facing Kenya’s Capital Markets, and,

- Recommendations and Conclusion.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.