Affordable Housing Agencies Report, & Cytonn Weekly #08/2024

By Research Team, Feb 25, 2024

Executive Summary

Fixed Income

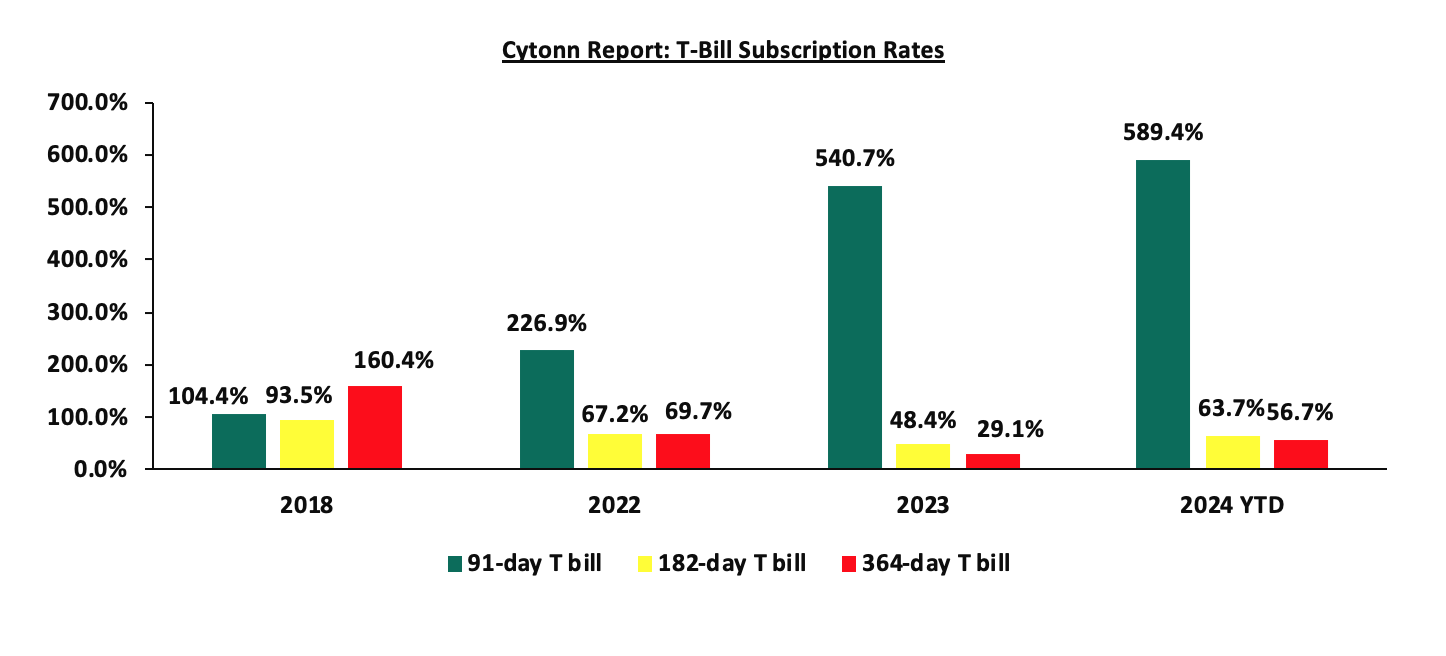

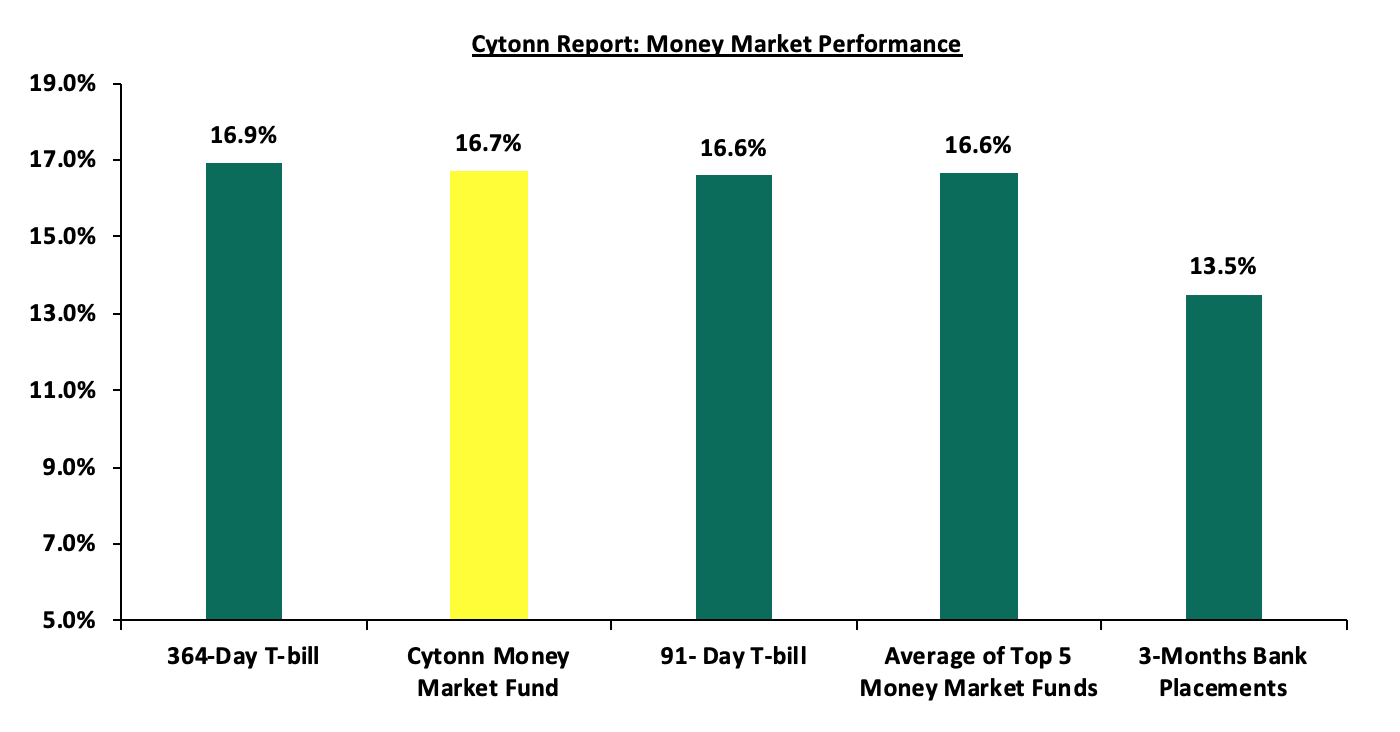

During the week, T-bills were oversubscribed for the eighth consecutive week, with the overall oversubscription rate coming in at 154.1%, albeit lower than the oversubscription rate of 177.8% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 9.9 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 247.6%, significantly lower than the oversubscription rate of 654.1% recorded the previous week. The subscription rates for the 182-day paper decreased to 74.2% from 112.3% recorded the previous week, while the subscription rates for the 364-day paper increased significantly to 196.5% from the 52.8% recorded the previous week. The government accepted a total of Kshs 23.1 bn worth of bids out of Kshs 37.0 bn of bids received, translating to an acceptance rate of 62.4%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day, and 91-day papers increasing by 0.1 bps, 1.9 bps, and 3.6 bps to 16.9%, 16.7%, and 16.6%, respectively;

We are projecting the y/y inflation rate for February 2024 to come in at the range of 6.6%-6.8% mainly on the back of reduced fuel prices, the upward revision of the CBR to 13.0% from 12.5%, and the strengthening of the Kenyan shilling against the US Dollar;

Yields on the Government securities have been on an upward trajectory with the 91-day paper now yielding 16.6% from 9.4% in January 2023. Going forward, we anticipate a very modest increase in yields on the government papers before they stabilize in the remaining months of FY’2023/24. The increase will be muted going forward due to the positive investor sentiment brought about by the successful offering of the Eurobond, which helped alleviate the fears of possible default by the government. There also has been adequate liquidity in the financial markets as can be seen from the high subscriptions in the last infrastructure bond;

Equities

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 3.4%, while NSE 25, NASI, and NSE 20 gained by 3.1%, 1.9%, and 1.0% respectively, taking the YTD performance to gains of 0.9%, 1.8%, 3.7%, and 3.8% for NASI, NSE20, NSE 25 and NSE 10 respectively. The equities market performance was driven by gains recorded by large cap stocks such as Equity Group, Co-operative Bank, and NCBA of 8.0%, 6.6%, and 3.6% respectively. The gains were, however, weighed down by losses recorded by large-cap stocks such as EABL, BAT, and DTBK of 3.4%, 1.0%, and 0.1% respectively;

Real Estate

During the week, Shelter Afrique, a pan-African finance institution that exclusively supports the development of the housing and Real Estate sector in Africa, signed a partnership with the government aimed at facilitating the sale of apartments and masionettes totaling Kshs 1.6 bn to senior civil servants. This partnership is poised to aid Shelter Afrique, in offloading units that have remained unsold for extended periods;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 24.4 and Kshs 21.7 per unit, respectively, as of 23rd February 2024. The performance represented a 22.0% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 19.3%, remaining relatively unchanged from the yield recorded in the previous week;

Focus of the Week

Housing is guaranteed as an Economic and Social right by the Constitution of Kenya 2010, as outlined in section 43(1)(b) - “every individual has the right to accessible and adequate housing, as well as to reasonable standards of sanitation”. Therefore, the government has a responsibility to provide adequate housing to its citizens and is obligated to implement policies and initiatives aimed at addressing housing needs as well as the living standards across the country. World Bank data shows that Kenya’s population and urbanization growth rates are at 1.9% and 3.7% respectively, above global averages of 0.8% and 1.5%, as of 2022. With a rapidly growing population and an increasing middle class, demand for housing is set to increase. In response to the escalating demand, the government has implemented a variety of strategies through various agencies, including the introduction of several housing initiatives geared towards tackling the housing shortage in the country. Given this context, it becomes imperative to analyze the diverse agencies and initiatives geared towards addressing the pressing need in Kenya. In our topical this week, we discuss in depth various agencies involved in the implementation of the government’s agenda and their interrelationship, their formations and histories, mandates, challenges, existing gaps in Kenya’s affordable housing landscape and propose solutions. The agencies and initiatives covered in this report are National Housing Corporation (NHC), Kenya Mortgage Refinance Company (KMRC), Capital Markets Authority (CMA), Affordable Housing Bill 2023, State Department of Housing and Urban Development, and, Kenya Revenue Authority (KRA);

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 16.70% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 19.26% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

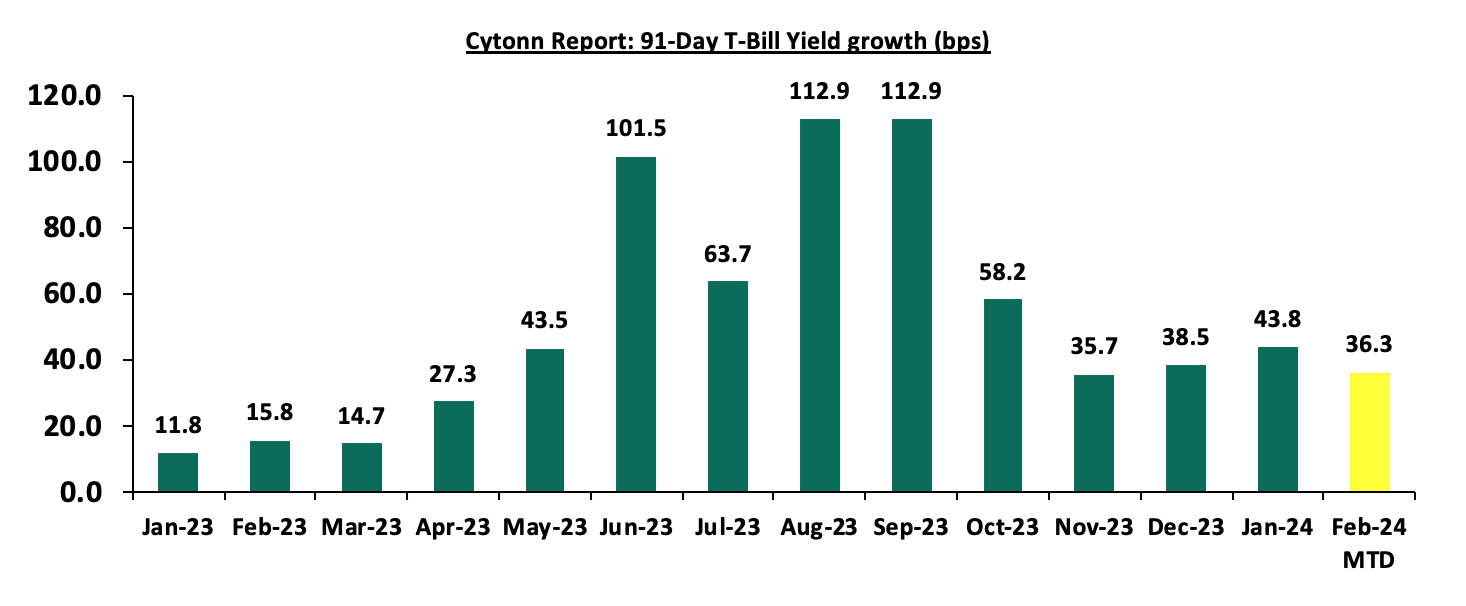

During the week, T-bills were oversubscribed for the eighth consecutive week, with the overall oversubscription rate coming in at 154.1%, albeit lower than the oversubscription rate of 177.8% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 9.9 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 247.6%, significantly lower than the oversubscription rate of 654.1% recorded the previous week. The subscription rates for the 182-day paper decreased to 74.2% from 112.3% recorded the previous week, while the subscription rates for the 364-day paper increased significantly to 196.5% from the 52.8% recorded the previous week. The government accepted a total of Kshs 23.1 bn worth of bids out of Kshs 37.0 bn of bids received, translating to an acceptance rate of 62.4%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day and 91-day papers increasing by 0.1 bps, 1.9 bps and 3.6 bps to 16.9%, 16.7% and 16.6%, respectively. The chart below shows the yield growth rate for the 91-day paper over the period:

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD):

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the 364-day and 91-day papers increased by 0.1 bps and 3.6 bps to 16.9% and 16.6%, respectively. The yields of the Cytonn Money Market Fund remained unchanged at 16.7% recorded the previous week, while the average yields on the Top 5 Money Market Funds increased by 13.6 bps to 16.6% from the 16.5% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 16th February 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 23rd February 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

17.5% |

|

2 |

Lofty-Corban Money Market Fund |

17.2% |

|

3 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

16.7% |

|

4 |

GenAfrica Money Market Fund |

16.1% |

|

5 |

Apollo Money Market Fund |

15.8% |

|

6 |

Kuza Money Market fund |

15.7% |

|

7 |

Nabo Africa Money Market Fund |

15.7% |

|

8 |

Madison Money Market Fund |

15.3% |

|

9 |

Enwealth Money Market Fund |

15.0% |

|

10 |

Jubilee Money Market Fund |

15.0% |

|

11 |

Co-op Money Market Fund |

14.8% |

|

12 |

AA Kenya Shillings Fund |

14.7% |

|

13 |

Absa Shilling Money Market Fund |

14.3% |

|

14 |

GenCap Hela Imara Money Market Fund |

14.0% |

|

15 |

Mayfair Money Market Fund |

14.0% |

|

16 |

Mali Money Market Fund |

13.9% |

|

17 |

Sanlam Money Market Fund |

13.8% |

|

18 |

Old Mutual Money Market Fund |

13.5% |

|

19 |

Orient Kasha Money Market Fund |

13.0% |

|

20 |

Dry Associates Money Market Fund |

12.7% |

|

21 |

KCB Money Market Fund |

12.6% |

|

22 |

CIC Money Market Fund |

12.5% |

|

23 |

ICEA Lion Money Market Fund |

12.0% |

|

24 |

Equity Money Market Fund |

11.5% |

|

25 |

British-American Money Market Fund |

10.0% |

Source: Business Daily

Liquidity:

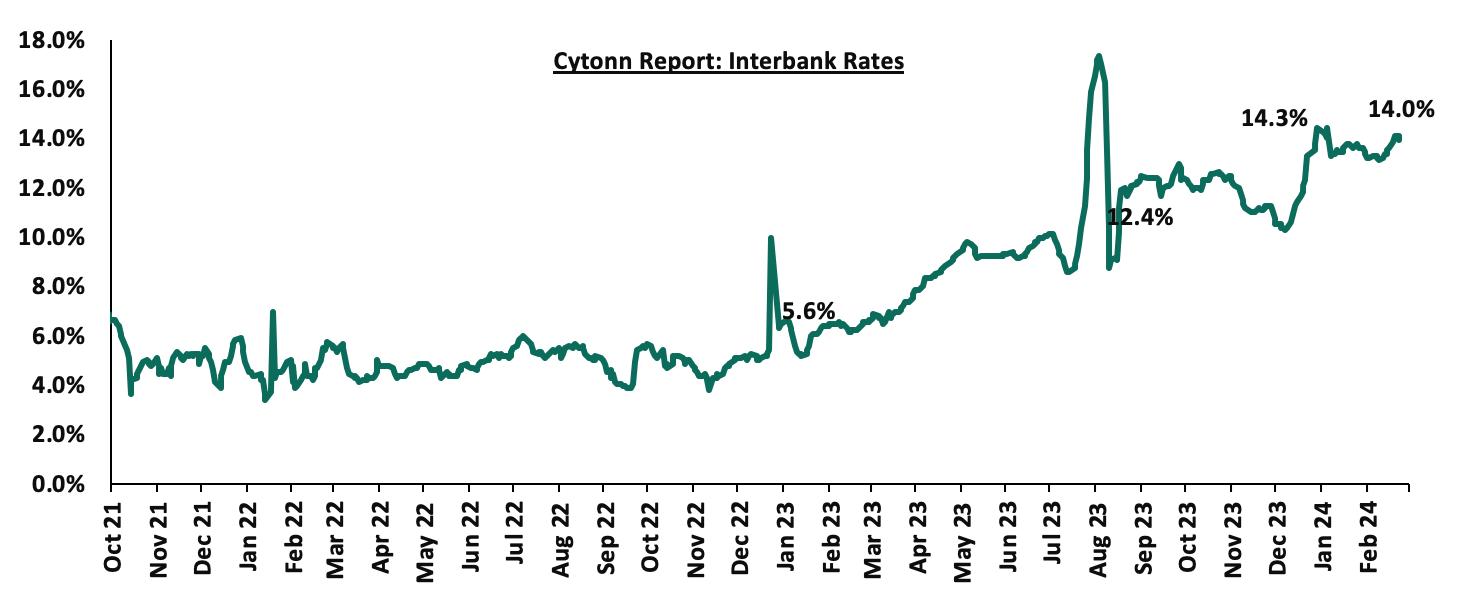

During the week, liquidity in the money markets marginally tightened, with the average interbank rate increasing by 0.6% points to 14.0% from 13.4% recorded the previous week, partly attributable to the tax remittances that offset government payments. The average interbank volumes traded decreased significantly by 41.9% to Kshs 23.6 bn from Kshs 40.5 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory, with the yields on the 7-year Eurobond issued in 2019 and the 6-year Eurobond issued in 2024 decreasing the most by 0.2% to 9.1% and 9.8%, from 9.3% and 10.0% respectively, recorded the previous week, attributable to the recent June maturity buyback, indicating improved investor perception on the country. The table below shows the summary of the performance of the Kenyan Eurobonds as of 22nd February 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

6-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

4.1 |

24.1 |

3.3 |

8.3 |

10.4 |

6.0 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

01-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

- |

|

01-Feb-24 |

10.6% |

10.6% |

11.3% |

10.5% |

10.1% |

- |

|

15-Feb-24 |

9.5% |

10.4% |

9.3% |

10.1% |

9.8% |

10.0% |

|

16-Feb-24 |

9.4% |

10.4% |

9.2% |

10.0% |

9.8% |

9.9% |

|

19-Feb-24 |

9.4% |

10.4% |

9.2% |

10.0% |

9.8% |

9.9% |

|

20-Feb-24 |

9.5% |

10.4% |

9.1% |

10.0% |

9.8% |

9.9% |

|

21-Feb-24 |

9.5% |

10.4% |

9.2% |

10.0% |

9.8% |

9.9% |

|

22-Feb-24 |

9.4% |

10.3% |

9.1% |

9.9% |

9.8% |

9.8% |

|

Weekly Change |

(0.1%) |

(0.1%) |

(0.2%) |

(0.1%) |

(0.0%) |

(0.2%) |

|

MTD Change |

(1.2%) |

(0.3%) |

(2.2%) |

(0.6%) |

(0.3%) |

9.8% |

|

YTD Change |

(0.4%) |

0.2% |

(1.0%) |

0.0% |

0.2% |

9.8% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling appreciated against the US Dollar by 1.2%, to close the week at Kshs 144.1, from Kshs 145.9 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 8.2% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,253.0 mn in the 12 months to January 2024, 5.3% higher than the USD 4,039.0 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the January 2024 diaspora remittances figures, America remained the largest source of remittances to Kenya accounting for 54.0% in the period, and,

- The tourism inflow receipts which came in at USD 333.9 mn in 2023, a 24.6% increase from USD 268.1 mn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 30.7% to 192,000 in the 12 months to December 2023, from 161,000 recorded during a similar period in 2022.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period in 2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.5% of Kenya’s external debt was US Dollar denominated as of September 2023, and,

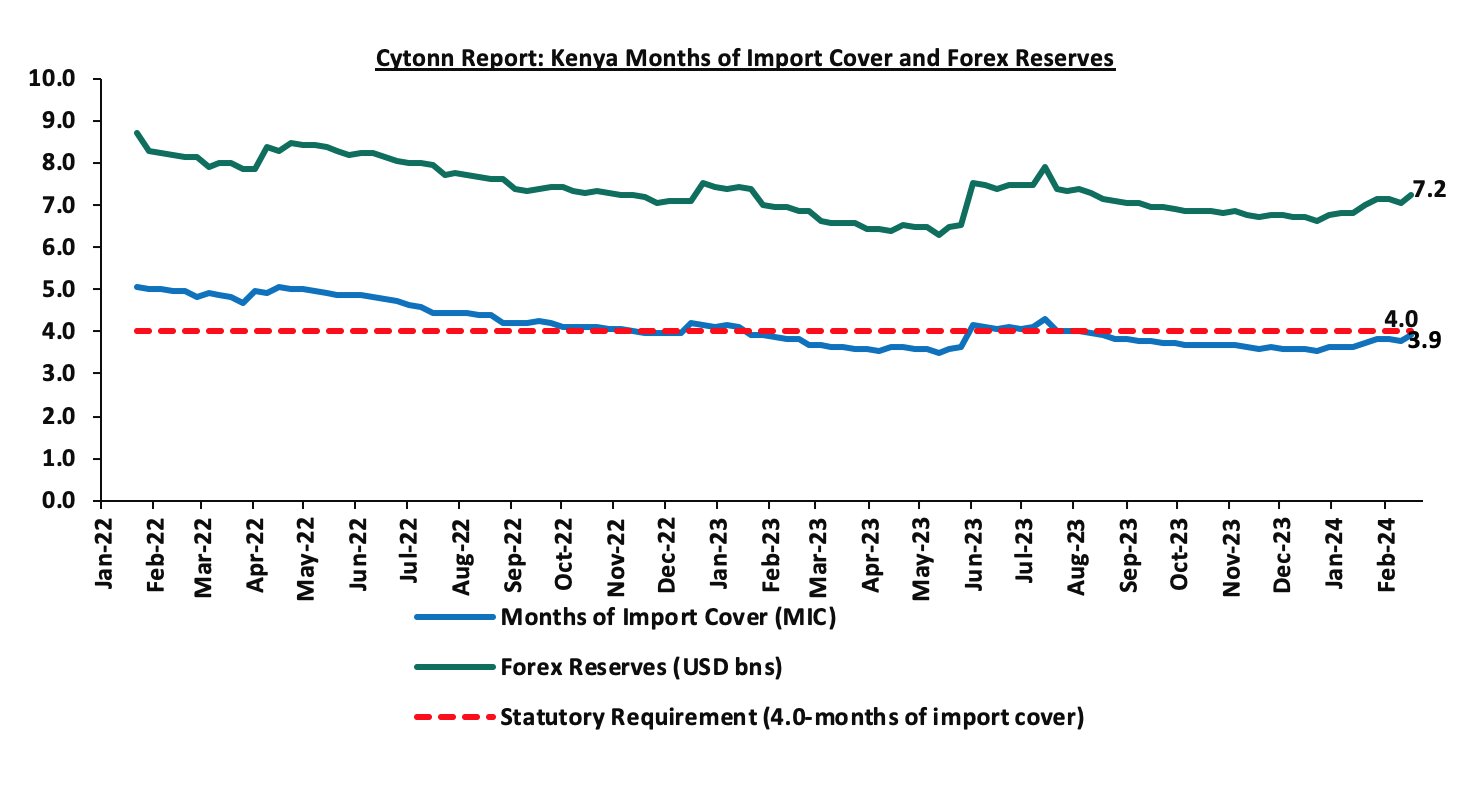

- Dwindling forex reserves, currently at USD 7.2 bn (equivalent to 3.9 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

Key to note, Kenya’s forex reserves increased by 2.7% during the week to USD 7.2 bn from the USD 7.0 bn recorded the previous week, equivalent to 3.9 months of import cover, an increase from the 3.8 months of import cover recorded the previous week, and remained below the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- February 2024 Inflation Projection

We are projecting the y/y inflation rate for February 2024 to come in at the range of 6.6%-6.8% mainly on the back of:

- Reduced Fuel Prices – The prices for super petrol, Diesel, and Kerosene decreased by Kshs 1.0 each to retail at Kshs 206.4, Kshs 195.5, and Kshs 193.2 per litre, from Kshs 207.4, Kshs 196.5 and Kshs 194.2 per litre respectively according to the latest EPRA report, following the government's efforts to stabilize pump prices through the petroleum pump price stabilization mechanism which has so far expended Kshs 9.9 bn in the FY2023/24 to cushion the increases applied to the petroleum pump prices. This slight decline in fuel prices is likely to contribute to the easing of inflationary pressures as it provides a stabilizing effect on consumer purchasing power as well as business operational costs.

- The upward revision of the Central Bank Rate (CBR) to 13.00% from 12.50% – Earlier this month, the Monetary Policy Committee noted that there was a need to tighten the monetary policy following the sustained depreciation of the Kenyan shilling - that has since the raise of the CBR gained against the US Dollar - as well as the heightened inflationary pressures which came in at 6.9% in the month of January, 0.3% points increase from the 6.6% in December and remaining within the upper bound of the inflation target range of 2.5% to 7.5%. In line with this, the committee increased the CBR by 50 bps to 13.00% from 12.50%. The ongoing transmission of the policy tightening, coupled with the prudent monetary stance, is expected to guide the economy toward a more sustainable inflation rate.

- Strengthening of the Kenya Shilling against the US Dollar – The Kenya Shilling has gained against the dollar for the last four consecutive weeks, having recorded an 8.2% year-to-date gain to Kshs 144.1 as of 23rd February 2024 from the Kshs 157.0 recorded at the beginning of the year. This can be attributed to the increase in the CBR to 13.00% in an effort to support the weakening shilling. Notably, the successful buyback of the USD 2.0 bn Eurobond and issuance of a new USD 1.5 bn (KENINT2031) Eurobond has increased investor confidence reducing the uncertainty around the exchange rate and thus a lack of incentive to hold on to the dollar. This gain in the exchange rate is expected to stabilize the economy and hence inflation.

- Reduction in electricity prices – Earlier this month, EPRA announced the implementation of a 9.3% average decrease in electricity prices, with the Fuel Energy Cost decreasing to Kshs 4.1 from Kshs 4.3 as well as the foreign exchange rate fluctuation declining to Kshs 3.2 from Kshs 6.5. This is attributable to the lower foreign currency repayments of power purchases made by Kenya Power in the month of January. With electricity being one of the major inputs of inflation, this decline is expected to reduce production costs for businesses as well as reduce electricity costs for households thus easing inflation

Going forward, we expect inflationary pressures to ease in the short term, while remaining in the CBK’s target range of 2.5% to 7.5% aided by the easing in fuel prices and a further strengthening of the Kenya shilling against the US Dollar. Additionally, the upward revision of the CBR to 13.00% in the latest MPC meeting, from 12.50%, is meant to continue reducing money supply, in turn easing inflation in the short to medium term. We also expect the measures taken by the government to subsidize major inputs of agricultural production such as fertilizers to lower the cost of farm inputs and support the easing of inflation in the long term.

- Review of Yields Trend on Government Papers and our View Going Forward

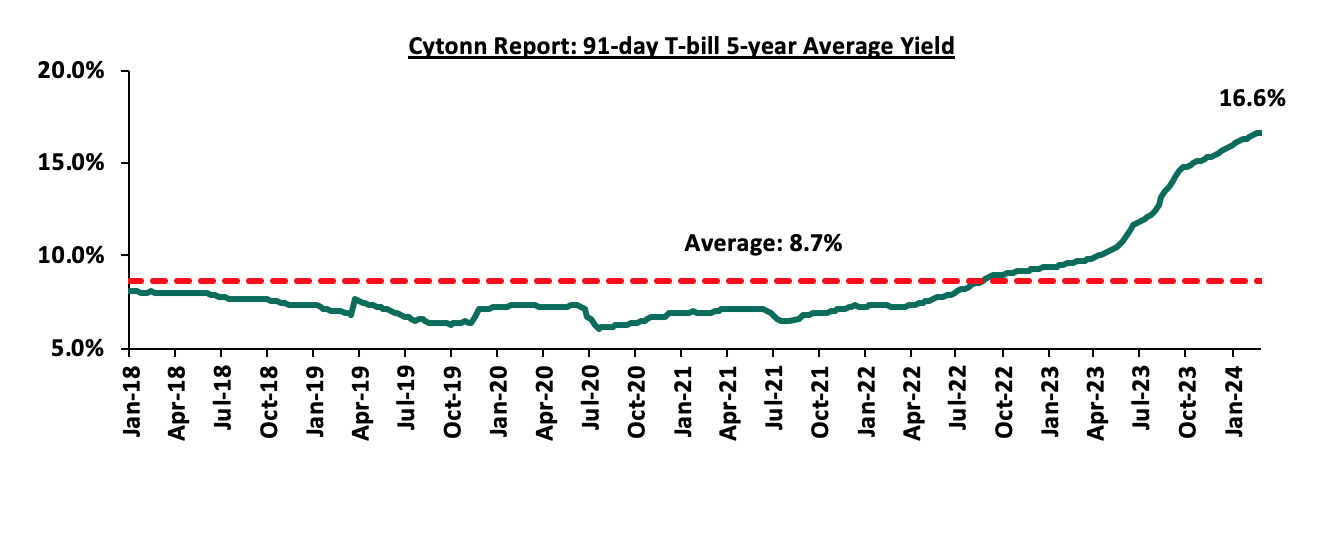

Yields on the Government securities have been on an upward trajectory with the 91-day paper now yielding 16.6% from 9.4% in January 2023. Going forward, we anticipate a very modest increase in yields on the government papers before they stabilize in the remaining months of FY’2023/24. The increase will be muted going forward due to the positive investor sentiment brought about by the successful offering of the Eurobond, which helped alleviate the fears of possible default by the government. There also has been adequate liquidity in the financial markets as can be seen from the high subscriptions in the last infrastructure bond.

Most recently the government successfully issued a Eurobond buyback, which was used to repay 72.0% of the 10-year issue which was maturing in June 2024, thereby reducing the credit risk associated with the country by international investors. With the above positivity, yields on all Kenyan Eurobonds eased over the past week, with the June 2024 maturity ending the week at 9.4%, down from 10.3% recorded the previous week, while the new issue maturing in 2031 closed this week at 9.8% from 10.0% recorded the previous week.

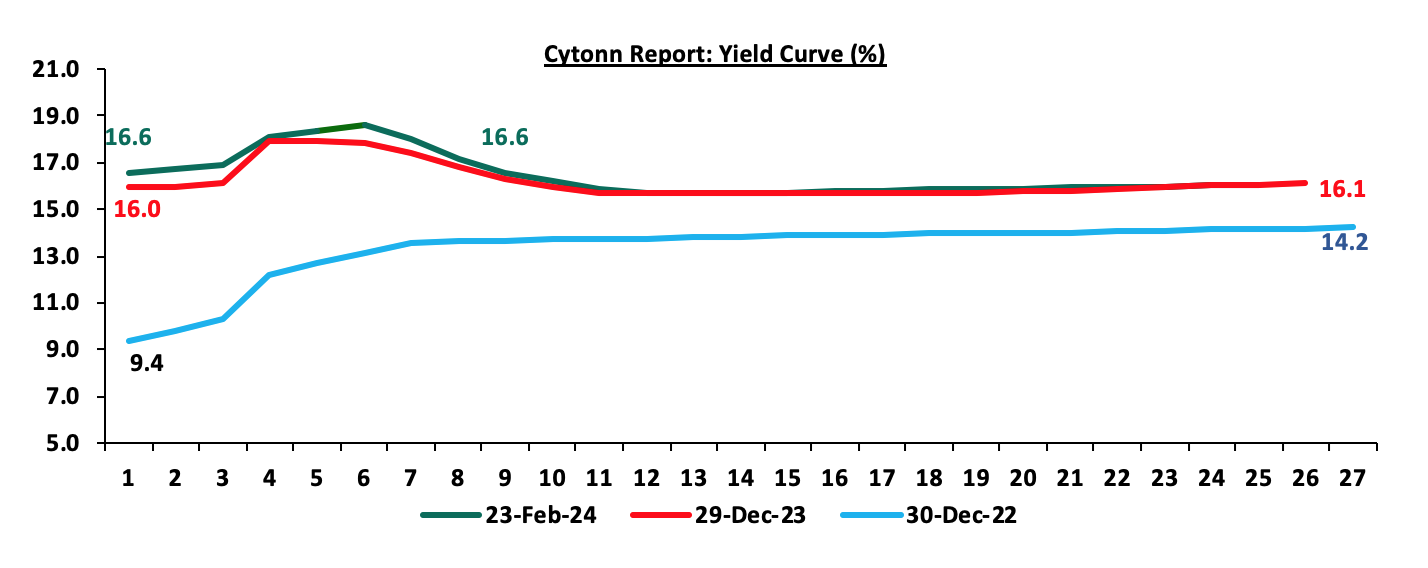

The Yield curve has shifted upwards from the beginning of last year with the short term experiencing the largest increase. The chart below shows the changes in the yield curve over the period:

The chart below shows a trend analysis of the 91-day T-Bill yield curve:

Going forward some of the key things that will affect the performance of the interest rates will include:

- On the actual budget deficit as at 31st January, the government is lagging behind its revenue target having collected only 48.9% of the revised target of Kshs 2.6 tn and 83.9% of the prorated target, with tax revenue only achieving 48.7% of the revised targets. But we have noted that government expenditure is also slower at 42.3% of the revised estimates of Kshs 4.3 tn, and 72.4% of the prorated. If the above trend continues, then there will be a reduction in the pressure to borrow, however, the same could impact the general performance of the economy.

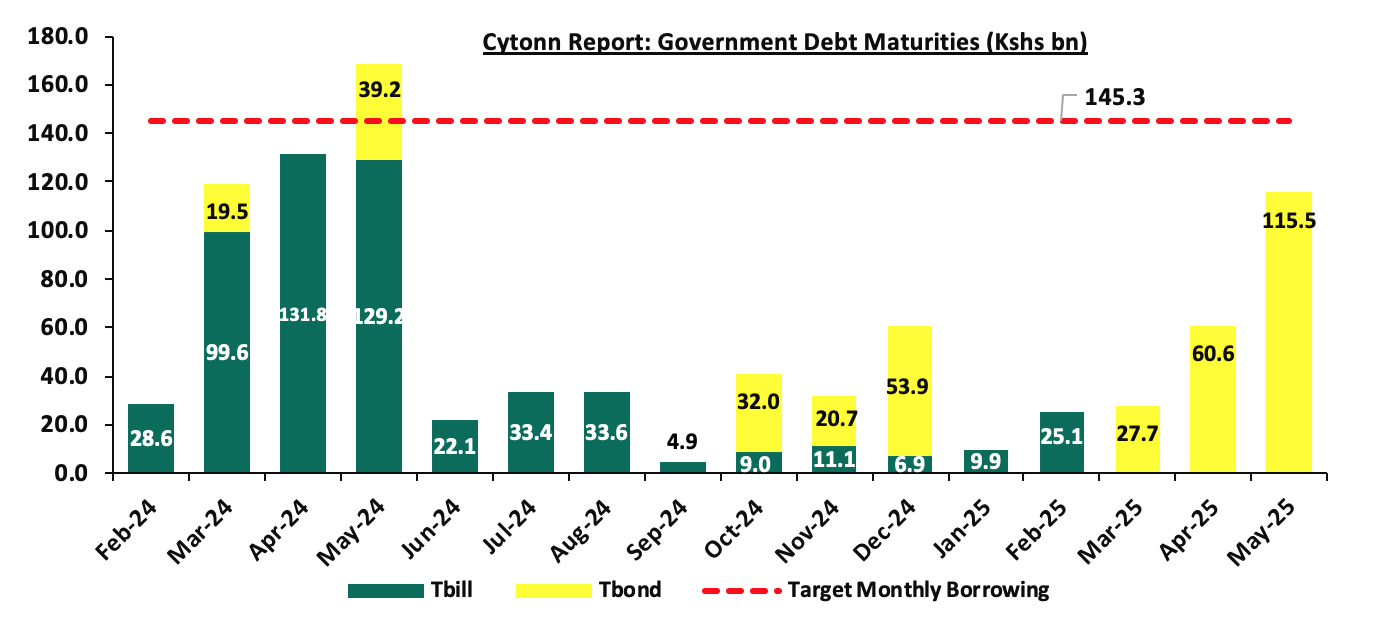

- On government maturities, for FY’2023/24, the government has pending maturities amounting Kshs 470.1 bn, with Kshs 411.4 bn in T-Bills and Kshs 58.7 bn in T-Bonds to the end of the Financial year 2023/24, and Kshs 444.3 bn, so far, in the next financial year - FY’2024/25. In order to meet its domestic borrowing target, the government has to borrow Kshs 145.3 bn monthly which is lower than the average of Kshs 179.8 bn of monthly borrowing to December 2023. The chart below summarizes the upcoming maturities for the reminder of FY’2023/24 and for the Financial year 2024/25:

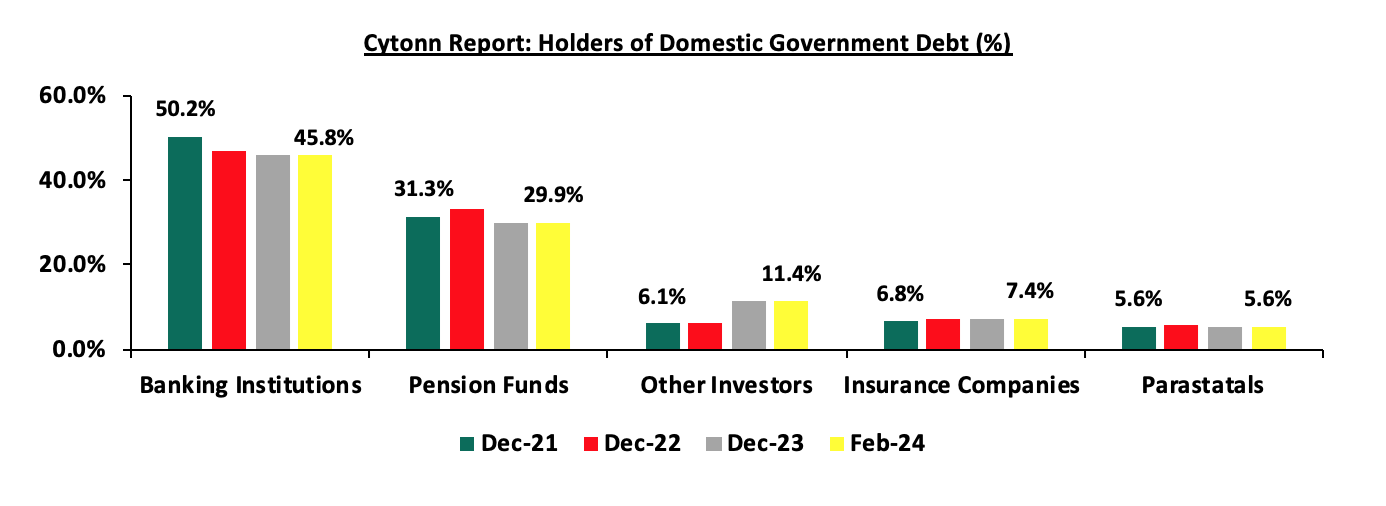

- The holding of government securities has continued to be diversified with the banks holding decreasing to 45.8% in February 2024, from 50.2% in December 2021, while that of retail investors increased to 11.4% in 2024 from 6.1% in December 2021. The other key investors remained pension funds, insurance companies, and parastatals with a holding of 29.9%, 7.4%, and 5.6% respectively, as of February 2024, whose percentage holding has remained more stable over the period. With some of the other asset classes expected to lag behind in performance, there is expected to be more demand for government securities especially by banking institutions, a positive move in stabilizing the interest rates. The chart below represents holders of government domestic debt over the period:

- The increase in interest rates on government securities and the recent increase in the Central Bank Rate (CBR) to 13.0%, is expected to have a significant impact on credit to the private sector. The high interest rates could crowd out the private sector and currently, the growth of credit to the private sector stands at 13.9%. There has been a significant increase in the Non-Performing Loans (NPL) ratio which increased to 14.8% in 2023 from 13.3% in 2022 as more borrowers found it difficult to service the highly-priced loans.

Our view: Owing to the above, we anticipate yields of government papers in the domestic market to increase modestly before stabilizing.

Going forward, we expect the government to start issuing medium-term to long-term dated papers to reduce the proportion of Treasury bills in domestic debt, which will help spread the government debt over a long period as opposed to short maturities. Additionally, the 2024 Medium-Term Debt Management Strategy (MDTS) proposes to adjust the ratio of domestic borrowing to external borrowing to 45:55 in FY’2024/25, from the current 50:50, by cutting down net domestic borrowing to Kshs 377.7 bn in FY’2024/25 from the current Kshs 471.4 bn. A reduction in domestic borrowing, coupled with the easing of CBR in the medium term, will result in a decline in yields on government securities.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 5.0% ahead of its prorated net domestic borrowing target of Kshs 310.8 bn, having a net borrowing position of Kshs 326.3 bn out of the domestic net borrowing target of Kshs 471.4 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to maintain the fiscal surplus through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 3.4%, while NSE 25, NASI, and NSE 20 gained by 3.1%, 1.9%, and 1.0% respectively, taking the YTD performance to gains of 0.9%, 1.8%, 3.7% and 3.8% for NASI, NSE20, NSE 25 and NSE 10 respectively. The equities market performance was driven by gains recorded by large cap stocks such as Equity Group, Co-operative Bank, and NCBA of 8.0%, 6.6%, and 3.6% respectively. The gains were, however, weighed down by losses recorded by large-cap stocks such as EABL, BAT, and DTBK of 3.4%, 1.0%, and 0.1% respectively.

During the week, equities turnover increased by 32.4% to USD 8.7 mn from USD 6.5 mn recorded the previous week, taking the YTD total turnover to USD 39.7 mn. Foreign investors remained net sellers for the seventh consecutive week with a net selling position of USD 1.5 mn, from a net selling position of USD 1.7 mn recorded the previous week, taking the YTD foreign net selling position to USD 4.7 mn.

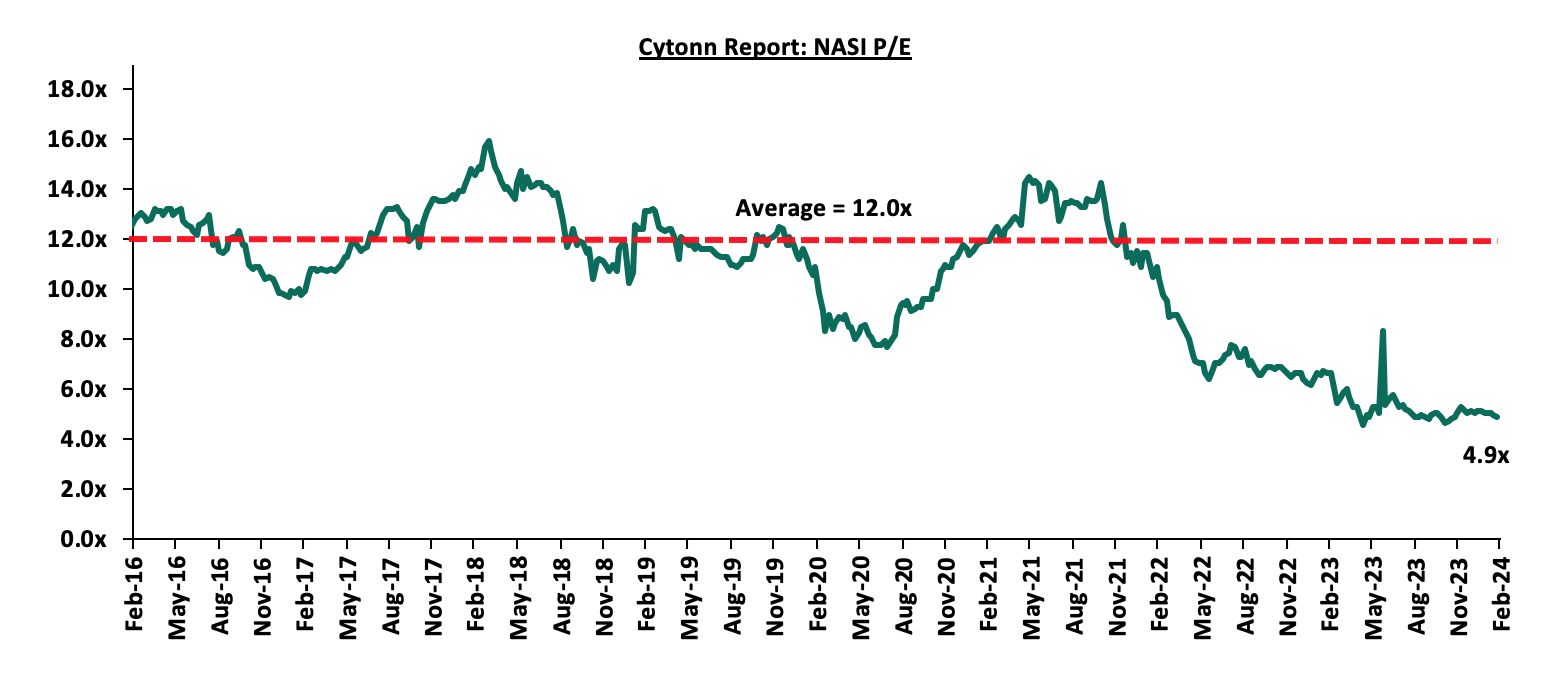

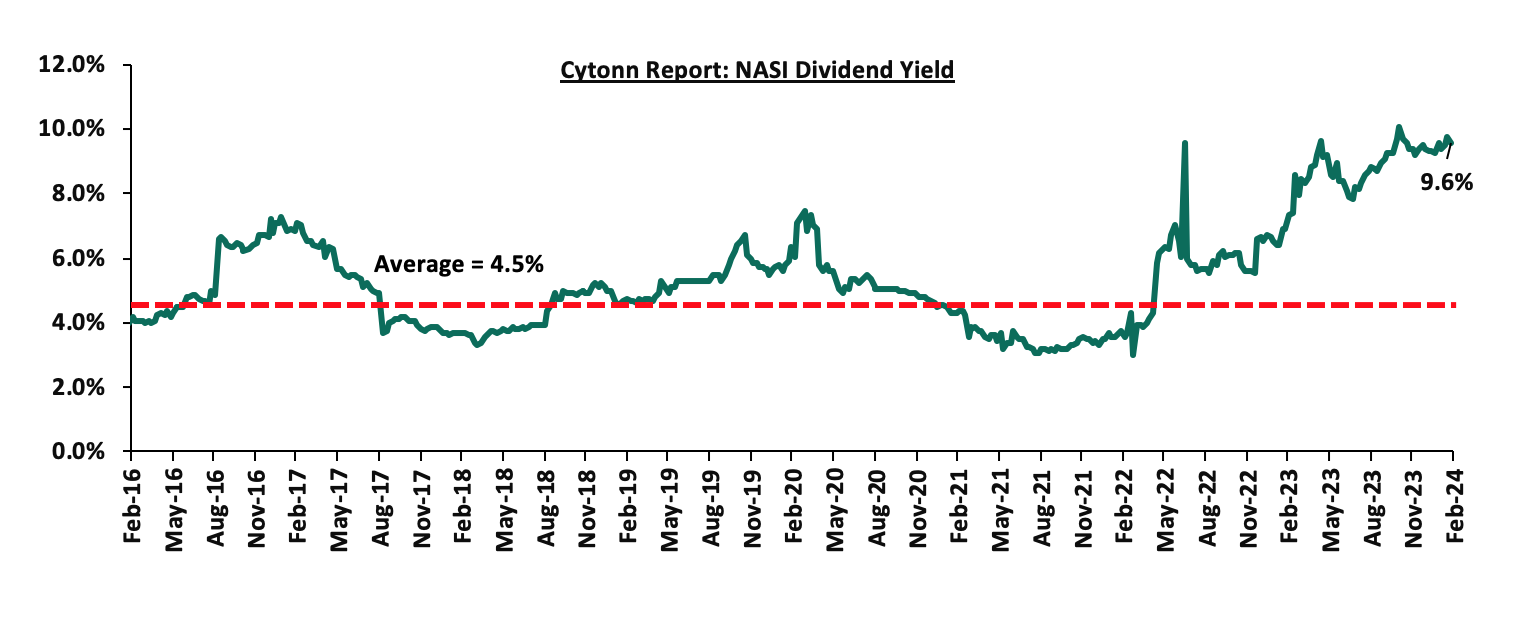

The market is currently trading at a price-to-earnings ratio (P/E) of 4.9x, 58.9% below the historical average of 12.0x. The dividend yield stands at 9.6%, 5.1% points above the historical average of 4.5%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Universe of Coverage |

||||||||||

|

Company |

Price as at 16/02/2024 |

Price as at 23/02/2024 |

w/w change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

19.9 |

20.5 |

3.3% |

(6.6%) |

22.0 |

31.2 |

9.8% |

62.0% |

0.4x |

Buy |

|

Jubilee Holdings |

180.0 |

180.0 |

0.0% |

(2.7%) |

185.0 |

260.7 |

6.7% |

51.5% |

0.3x |

Buy |

|

Sanlam |

6.8 |

7.0 |

2.7% |

16.0% |

6.0 |

10.3 |

0.0% |

47.8% |

2.0x |

Buy |

|

NCBA*** |

36.3 |

37.6 |

3.6% |

(3.2%) |

38.9 |

48.3 |

11.3% |

39.8% |

0.8x |

Buy |

|

Diamond Trust Bank*** |

45.6 |

45.5 |

(0.1%) |

1.7% |

44.8 |

58.5 |

11.0% |

39.6% |

0.2x |

Buy |

|

Kenya Reinsurance |

1.9 |

2.0 |

5.9% |

5.9% |

1.9 |

2.5 |

10.2% |

38.3% |

0.2x |

Buy |

|

ABSA Bank*** |

12.1 |

12.3 |

1.2% |

6.1% |

11.6 |

14.6 |

11.0% |

30.2% |

1.0x |

Buy |

|

I&M Group*** |

17.4 |

18.9 |

8.6% |

8.0% |

17.5 |

22.1 |

11.9% |

29.2% |

0.4x |

Buy |

|

CIC Group |

2.0 |

2.1 |

3.5% |

(9.6%) |

2.3 |

2.5 |

6.3% |

27.1% |

0.7x |

Buy |

|

Stanbic Holdings |

114.0 |

114.8 |

0.7% |

8.3% |

106.0 |

132.8 |

11.0% |

26.7% |

0.8x |

Buy |

|

Standard Chartered*** |

163.5 |

164.0 |

0.3% |

2.3% |

160.3 |

185.5 |

13.4% |

26.5% |

1.1x |

Buy |

|

Britam |

5.0 |

4.7 |

(5.2%) |

(8.0%) |

5.1 |

6.0 |

0.0% |

26.2% |

0.6x |

Buy |

|

Co-op Bank*** |

12.1 |

12.9 |

6.6% |

13.7% |

11.4 |

13.8 |

11.6% |

18.6% |

0.6x |

Accumulate |

|

Equity Group*** |

38.0 |

41.0 |

8.0% |

19.9% |

34.2 |

42.8 |

9.8% |

14.1% |

0.9x |

Accumulate |

|

Liberty Holdings |

5.5 |

5.5 |

0.0% |

42.5% |

3.9 |

5.9 |

0.0% |

7.6% |

0.4x |

Hold |

|

HF Group |

3.9 |

4.1 |

7.0% |

20.0% |

3.5 |

3.9 |

0.0% |

(5.8%) |

0.2x |

Sell |

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued to its future growth (PEG Ratio at 0.6x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investor sell-offs to continue weighing down the equities outlook in the short term.

- Residential Sector

During the week, Shelter Afrique, a pan-African finance institution that exclusively supports the development of the housing and real estate sector in Africa, signed a partnership with the government aimed at facilitating the sale of apartments and maisonettes totaling Kshs 1.6 bn to senior civil servants. This partnership is poised to aid Shelter Afrique in offloading units that have remained unsold for extended periods, in some cases spanning years. Among the properties earmarked for sale are units situated in various locations including Athi River's Everest Park, Nakuru Meadows, Kisumu's Translake Estate, Serene Valley in Rironi, KMA Mtwapa, and Pine City in Machakos.

Priced between Kshs 2.7 mn and Kshs 19.0 mn, these residences are being made available to Members of Parliament, judicial officers, employees of State corporations, and constitutional commissions. Eligible individuals can opt for government-backed financing to facilitate their purchases, leveraging their respective housing mortgage schemes or independent public mortgage schemes, where applicable.

Charles Hinga, Principal Secretary of the State Department for Housing and Urban Development, emphasized the government's commitment to facilitating additional financing for affordable housing purchases through entities like the Kenya Mortgage Refinance Company (KMRC) and partner banks and SACCOs. KMRC's mandate to provide long-term fixed-rate funding at single-digit interest rates is anticipated to enhance the accessibility and affordability of mortgage loans, thereby bolstering the housing market and addressing challenges associated with poor sales attributed to economic constraints such as high interest rates and stiff competition from other developers.

We expect the deal with Shelter Afrique to significantly boost the residential real estate sector in Kenya. By facilitating the sale of apartments and maisonettes to senior civil servants, this partnership addresses the challenge of unsold units, thereby injecting liquidity into the market. The availability of government-backed financing options for eligible individuals further enhances affordability and accessibility to housing, aligning with the government's commitment to promoting affordable housing initiatives. Overall, this collaboration is expected to stimulate demand, alleviate housing shortages, and contribute to the overall growth and stability of the residential real estate market in Kenya.

- Regulated Real Estate Funds

- Real Estate Investments Trusts (REITs)

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 24.4 and Kshs 21.7 per unit, respectively, as of 23rd February 2024. The performance represented a 22.0% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.7 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 633.8 mn, respectively, since inception in February 2021.

REITs provide various benefits like tax exemptions, diversified portfolios, and stable long-term profits. However, the continuous deterioration in performance of the Kenyan REITs and restructuring of their business portfolio is hampering major investments that had previously been made. The other general challenges include; i) inadequate comprehension of the investment instrument among investors, ii) prolonged approval processes for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, continue to limit the performance of the Kenyan REITs market.

- Cytonn High Yield Fund (CHYF)

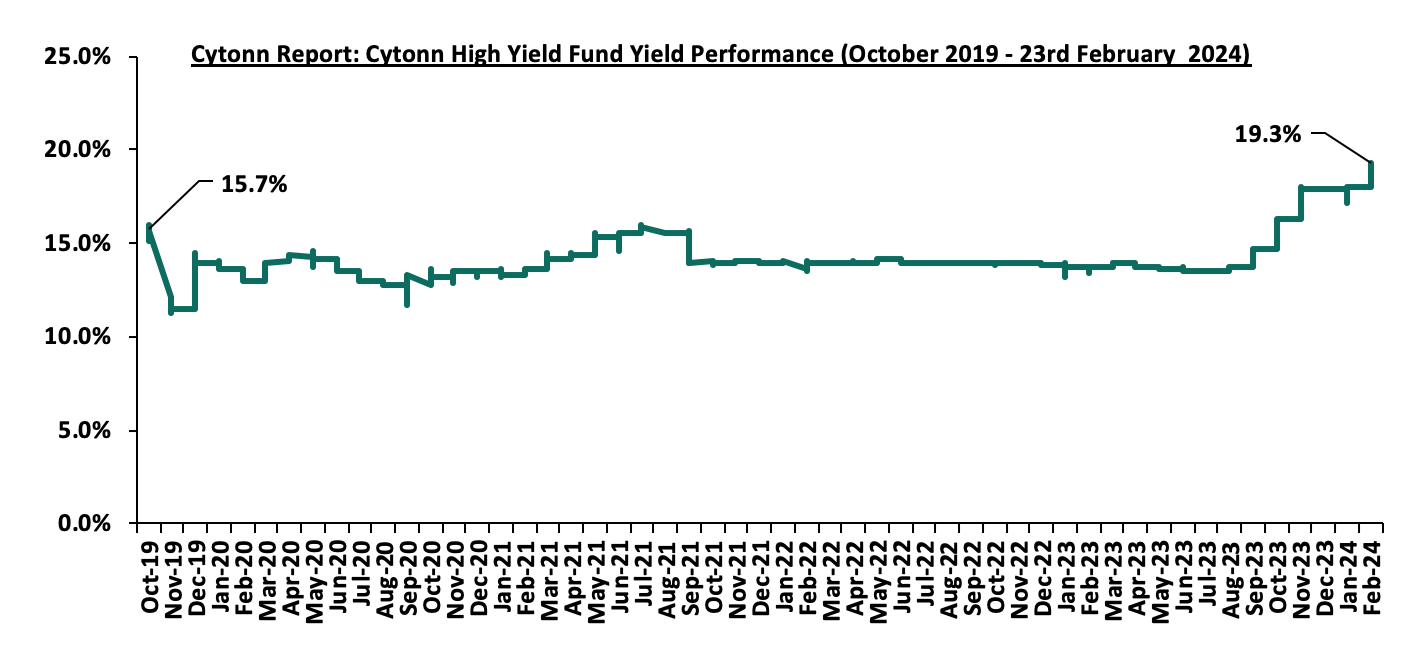

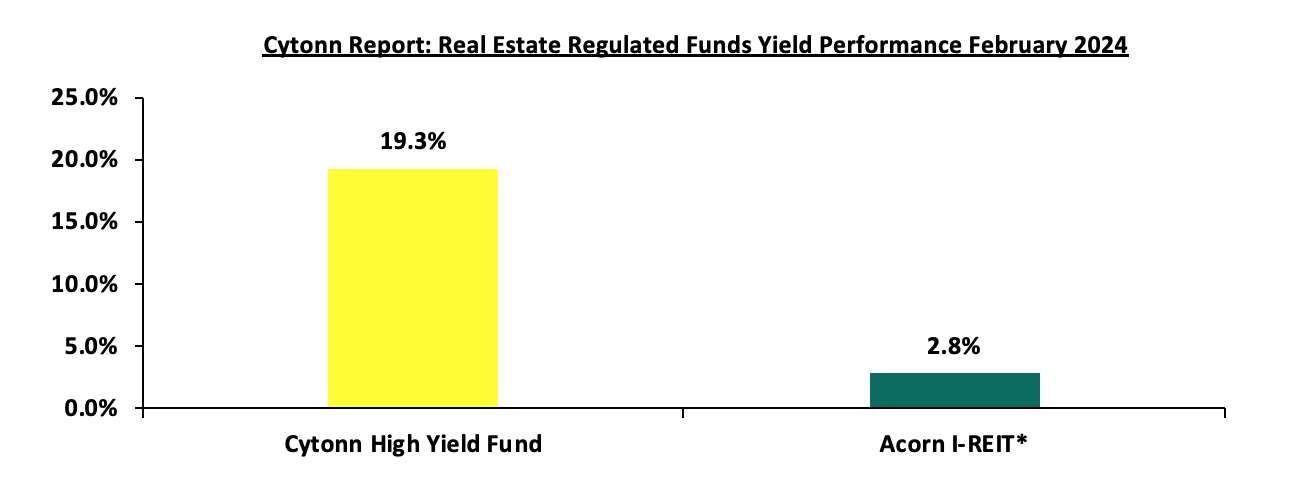

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 19.3%, remaining relatively unchanged from the yield recorded in the previous week. On a Year-to-Date (YTD) basis, the performance represents a 1.3% increase from the 18.0% yield recorded on 1st January 2024 and a 3.6% Inception-to-Date (ITD) increase from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2019 to 23rd February 2024;

Notably, the CHYF has outperformed Acorn I-REIT a regulated Real Estate fund with an annual yield of 19.3%, as compared to Acorn I-REIT with a yield of 2.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of two Regulated Real Estate Funds;

*H1’2023

Source: Cytonn Research

We expect that Kenya’s Real Estate sector will receive backing from the following factors: i) a rise in initiatives and the development of affordable housing projects, which are projected to invigorate the residential sector, ii) favourable demographics in the country, driving the demand for housing and Real Estate, and, iii) ongoing infrastructural enhancements that will unlock fresh investment opportunities in new areas. Nonetheless, challenges such as escalating construction costs, insufficient investor familiarity with REITs, and prevailing oversupply in specific Real Estate segments will persist, constraining the sector's performance by curbing development and investment opportunities.

Housing is guaranteed as an Economic and Social right by the Constitution of Kenya 2010, as outlined in section 43(1)(b), “every individual has the right to accessible and adequate housing, as well as to reasonable standards of sanitation”. This provision underscores the entitlement of every individual to accessible and adequate housing. Therefore, the government has a responsibility to provide adequate housing to its citizens and is obligated to implement policies and initiatives aimed at addressing housing needs as well as the living standards across the country.

To address the housing shortage, both the Jubilee and Kenya Kwanza governments initiated their housing agendas through The Big Four and the Bottom-Up Economic Transformation Agenda (BETA) plans respectively. Under The Big Four, which was launched in 2017, the Jubilee government aimed at delivering 1,000,000 units by 2022. Jubilee government aimed to tackle housing needs by addressing both the supply and demand sides. On the supply side, the government aimed to raise 60.0% of funding from the private sector, facilitate off-plan sales by regulating escrow accounts, create incentives for private landowners to encourage development, facilitate Public-Private Partnerships (PPPs) to encourage private sector participation, and streamline permits and approvals for developers. On the demand side, the government planned to establish a Tenant Purchase Scheme (TPS) for social housing, reduce the cost of mortgages and increase the repayment period to 25 years, remove stamp duty for first-time homebuyers, establish multi-generational mortgages, establish a mortgage refinance company, provide a credit line for financial mortgages, and, streamline background checks with banks to expand the bankability of customers.

Through the aforementioned initiatives, the Jubilee Government achieved the following milestones; i) establishment of the Kenya Mortgage Refinance Company (KMRC), a non-deposit-taking financial institution mandated to provide long-term loans to Primary Mortgage Lenders, ii) removal of stamp duty for first-time homebuyers purchasing homes under the Affordable Housing Program (AHP), iii) developed 13,529 affordable units, iv) implementation of the Tenant Purchase Scheme (TPS) under the National Housing Corporation, and, iv) elimination of VAT tax for affordable housing programs among others.

Housing remains a key pillar under the Kenya Kwanza regime, as per the Bottom Up Economic Transformation Agenda BETA. The government aims to deliver 250,000 housing units annually. Consequently, the government wants to achieve this ambitious target through; i) structuring affordable long-term housing finance scheme, including a National Housing Fund and Cooperative Social Housing Schemes, that will guarantee the offtake of houses from developers, ii) growing the number of mortgages from 30,000 to 1,000,000 by enabling low-cost mortgages of Kshs 10,000 and below, and, iii) giving developers incentives to build more affordable housing. With the aforementioned, the government has embarked on implementing its housing agenda laying foundation for various Affordable Housing Projects across the country. Furthermore, the regime has intensified its efforts to pool more funds for Affordable Housing, as evidenced by the proposed Affordable Housing Bill 2023.

World Bank data shows that Kenya’s population and urbanization growth rates at 1.9% and 3.7% respectively, above global averages of 0.8% and 1.5%, as of 2022. With a rapidly growing population and an increasing middle class, demand for housing is set to increase. Simultaneously, Kenya’s housing deficit is expected to persist. To bridge this gap, the current regime, against a backdrop of an estimated 50,000 units being delivered currently on annual basis, aims at facilitating the delivery of an additional 200,000 houses per year to meet the set target of 250,000 units. If achieved, this would result in an increase in affordable housing supply from the current 2.0% to 50.0% by 2027.

Considering the aforementioned points, housing is a dire need in the country. It is also evident that housing has been a major priority in the country. Moreover, numerous approaches have been undertaken by various agencies, along with the introduction of several housing initiatives to address the housing needs in the country. Given this context, it becomes imperative to analyse the diverse agencies and initiatives geared towards addressing the pressing need in Kenya. In our topical this week, we focus on examining various agencies and initiatives in the affordable housing scheme by covering the following;

- Key affordable Housing Agencies and Initiatives (National Housing Corporation (NHC), Kenya Mortgage Refinance Company (KMRC), Capital Markets Authority (CMA), Affordable Housing Bill 2023, State Department of Housing and Urban Development, and, Kenya Revenue Authority),

- Existing housing gaps,

- Recommendations, and,

- Conclusion.

Section I: Key Affordable Housing Agencies and Initiatives

In this section we shall delve into the various agencies and initiatives involved in implementation of the government’s affordable housing agenda and cover the following areas; formation and history, mandates, achievements, and challenges;

- National Housing Corporation (NHC)

- Formation and History

National Housing Corporation (NHC) is a statutory body that was established by an Act of Parliament, with its mandate contained under the Housing Act Cap 117 laws of Kenya. NHC was previously referred to as the Central Housing Board (CHB) which began its operations in June 1953. The primary function of the CHB included; promoting low-cost housing, stimulating the building industry, encouraging and assisting in housing research, and, availing loans to local governments. In 1964, the United Nations recommended to Kenya the establishment of a separate corporation that would operate with greater independence from the Ministry of Housing and be capable of providing support to a broader range of initiatives beyond local authorities, including initiating its own projects. By 1965, the Board was empowered to directly initiate construction projects in the event local authorities were unable or unwilling to undertake such projects. In the same year, through an amendment to the Housing Ordinance of 1953, the National Housing Corporation (NHC) was established, replacing the Central Housing Board.

- Mandate

National Housing Corporation (NHC) mandate is stipulated by Housing Act Cap 117. The mandates of the Corporation are well outlined in sections 8,9,10,11, and 12 of the Housing Act.

Section 8 provides for loans and grants by the Corporation and repayments of loans. Under this section; the Corporation may from the Housing Fund and from time to time as provide by the act;

- lend or grant money to any local authority, for the purpose of enabling the authority to exercise any of the powers conferred upon it,

- give loans to any company, society or individual person for the purpose of enabling such company, society or individual person to acquire land and construct thereon approved dwellings or to carry out approved schemes,

- offer loans to organizations established for promoting the development of housing,

- construct dwellings, carry out approved schemes and layout and provide services for approved schemes,

- acquire any land or building, or estate or interest for any of the purposes of the Act,

- maintain any land or building, or estate or interest therein, for any of the purposes of the Act,

- appoint and employ on such terms and condition as the Corporation may determine such officers and servants as it may deem necessary, and,

- pay such allowance to members of the Corporation as the Minister may, in writing, approve.

Section 9 of the Housing Act accords the Corporation power to guarantee loans for the purpose of purchasing or constructing approved dwellings or carrying out approved schemes.

Section 10 provides for “Others powers of the Corporation” which include;

- undertake and encourage research and experiment in housing related matters, and undertake and encourage the collection and dissemination of information concerning housing and related matters,

- take part in housing exhibitions and other forms of publicity,

- undertake and encourage the provisions of training in furtherance of the purposes of the Act and provide training for members of its staff,

- perform such other duties connected with housing as the Minister may direct, and,

- to establish, promote or aid in establishing or promoting, constitute, form or organize companies’ syndicates or partnerships alone or in conjunction with any other person or institutions for the carrying on of any such functions as the Corporation is empowered to carry on under this Act.

Section 11 provides for the charge of loan on rates and revenues of local authorities.

Section 12 provides powers of the Corporation in the event local authority is in default.

- Achievements

NHC has managed to develop a number of affordable housing projects across the country. According to the Draft NHC Strategic Plan 2023-2027, the Corporation completed the development of 550 housing units during the period between 2023 – 2027, out of a target of 185,000 housing units. This was in addition to 465 housing units the Corporation had developed in the 2019-2023 plan period. During the same period, a total of 5,365 units were also sold. Currently, the development of a further 734 units is underway and at different levels of completion. During the current plan period, the Corporation also took over the management of 1,370 units under the Affordable Housing Project at Parkroad. To finance the strategy, the Corporation mobilized Kshs 7.1 bn through internal funding, borrowing and government funding. NHC also received approval from the National Treasury to borrow Kshs 3.8 bn to support housing.

Additionally, NHC implemented various resource mobilization initiatives geared at raising funds towards implementation of the strategic plan during the 2019-2023 period including signing a Financial Advisory Services Agreement (FASA) with IFC in an effort to source for developers for the construction of 3,500 affordable houses at the Stoni Athi Waterfront City at an estimated cost of Kshs 7.0 bn.

- Challenges

- Financial Constraints: This poses a significant challenge to the NHC by obstructing the Corporation’s ability to effectively fulfill its responsibilities. The absence of regular government funding hampers NHC’s ability to efficiently implement affordable housing projects as outlined in its strategic plans. Additionally, the Corporation's financial constraints limit investments in crucial areas including research and development and staffing,

- Lack of a clear mandate: NHC’s mandate as discussed above encompasses about 15 different areas spanning property development, management, research and financing. It is not clear what is its core mandate. In fact, a reading of the mandate seems to lean heavily towards lending, yet in reality its more focused on construction,

- Land Development Delays and Title Acquisition Challenges: Delays in the development process, often stemming from bureaucratic processes and legal complexities, prolong project timelines negatively impacting on completions. As a result, this ties up resources and impedes the NHC's capacity to achieve its targets,

- Fraudulent House Allocation: NHC has been embroiled in negative publicity, involving senior executives including the managing director, finance director, and company secretary as a result of mismanagement over the years. In general, these occurrences tarnished the reputation of the NHC and raised critical questions about its governance and ethical standards,

- ERP System Stalled Implementation: Despite investing Kshs 81.3 mn to procure the ERP system, the project encountered delays and ultimately stalled, resulting in a failure to realize the intended benefits. This challenge highlights several issues within the NHC, including ineffective project management, lack of accountability, and poor vendor management,

- Lack of Risk Management Policy: Without a structured approach to identify, assess, mitigate, and monitor risks, the NHC may struggle to anticipate and respond effectively to potential threats and uncertainties. This challenge highlights systemic weaknesses in the NHC's governance framework, indicating a lack of emphasis on risk-aware decision-making and proactive risk management practices, and,

- Lack of Accountability: According to a recent audit report on the NHC as published by the Office of the Auditor General, the auditor raised concern regarding the lack of a detailed inventory list of houses signed by the Accounting Officers of both transferring and receiving entities, which is contrary to Regulation 169(1) of the Public Procurement and Asset Disposal Regulations 2020. The absence of a detailed inventory list indicates a failure in accountability. It suggests that the NHC may not be able to fully account for the houses or assets in question, which raises concerns about the Corporation's ability to manage resources effectively and transparently.

- Kenya Mortgage Refinance Company (KMRC)

- Formation and History

The Kenya Mortgage Refinance Company (KMRC) is a financial institution, backed by the treasury, that does not accept deposits. It was established in 2018 under the Companies Act 2015 and received its license from the Central Bank of Kenya (CBK) to start its main operations in September 2020. KMRC holds the exclusive license for conducting Mortgage Liquidity Facility (MLF) activities in Kenya. Typical of all MLFs, the KMRC acts as an intermediary between Primary Mortgage Lenders (PMLs) and thus does not lend directly to individual borrowers. These activities involve supplying long-term funds to PMLs, including banks, microfinance institutions, and SACCOs at 5.0% with a repayment period of up to 25 years. As a result, this has boosted the funds available for subsequent lending to borrowers at single-digit rates. Correspondingly, KMRC has increased the supply of housing finance in Kenya’s housing market by refinancing mortgage loans of its member PMLs.

- Mandate

KMRC’s mandate is to provide long-term funds to Primary Mortgage Lenders (PMLs) for purposes of increasing availability of affordable home loans to Kenyans. KMRC provides concessional, fixed, long term finance to the Primary Mortgage Lenders who include Banks and SACCOs so that they can transfer the same benefits to ‘wananchi’, making home loans more accessible to especially the moderate to low-income earners in the country.

- Achievements

Here are the key achievements by KMRC;

- Increased liquidity to the Primary Mortgage Lenders: The long-term funding provided by KMRC has contributed to boosting the liquidity of the mortgage market, facilitating lenders' access to the necessary funds for offering mortgages to borrowers. In 2022, KMRC closed the year having disbursed Kshs 6.8 bn to nine PMLs, up from Kshs 1.3 bn disbursed in 2021, representing a 425.0% increase. As of September 2023, KMRC had approved refinancing for mortgage loans amounting to Kshs 9.6 bn. Out of the approved refinancing loans, Kshs 8.7 bn had been disbursed for affordable housing mortgages to PMLs which translates to 2,890 affordable housing mortgages to PMLs,

- Enhanced infrastructure for the Mortgage market: KMRC has played a pivotal role in enhancing and fortifying Kenya's mortgage market infrastructure. Through the implementation of standardized procedures and practices, as well as the facilitation of capacity-building programs for mortgage lenders, KMRC has bolstered the market's stability, efficiency, and quality. These initiatives have effectively eased access to financing for borrowers, thereby empowering more individuals to fulfil their dreams of homeownership,

- Improved Mortgage Uptake in the country: As at December 2022, KMRC had refinanced, 2,522 mortgages, contributing to 9.1% of the total mortgage loan in the country. As at September 2023, KMRC had approved further refinancing for 3,142 mortgage loans, out of which amounts had been disbursed to PMLs for 2,890 affordable housing mortgages. Consequently, this has enabled banks and SACCOs in partnership with KMRC to lend at a single digit rate of 9.5%, which is comparatively lower than market rate 12.3% as 2022, according to to the Bank Supervisory Annual Report 2022,

- Contributed to improved living standards: By fostering job creation, KMRC has enhanced the well-being of numerous families across the nation. By September 2023 , KMRC is estimated to have directly created 7,855 employment opportunities. Additionally, in the same year, KMRC positively affected approximately 12,568 individuals through its mortgage lending activities, thereby assisting in facilitating home ownership,

- Successful issuance of its inaugural bond: In January 2022, KMRC received approval from the CMA to launch its Kshs 10.5 bn Medium Term Note program. In the initial phase of the issuance, the company sought to raise Kshs 1.4 bn and achieved an oversubscription of 478.6%. Furthermore, by issuing bonds, KMRC is playing a role in the enhancement and progression of Kenya's underdeveloped capital market, and,

- Promoted Financial Sector Inclusion: KMRC successfully managed to standardize mortgage origination practices for participating SACCOs in 2021. SACCOs play a vital role in Kenya’s finance and housing finance sector by bridging the gap in the housing finance market experienced in the lower income brackets, through the provision of unsecured, medium-term loans to their members.

- Challenges

Albeit, the aforementioned success, KMRC has faced numerous challenges which include;

- Low Qualifying Mortgage Amounts: For the majority of its operational history, KMRC maintained a maximum loan size that lagged behind the average mortgage size in the market until February 2024. At that point, KMRC increased its maximum loan size nationwide to Kshs 10.5 mn, up from Kshs 8.0 mn in the Nairobi Metropolitan Area and Kshs 6.0 mn elsewhere in the country. The low qualifying amounts meant many loans could not qualify for KMRC refinancing. This essentially meant that absorption rates for KMRC backed mortgages continued to be lower,

- Increasing Property Prices: The escalating selling prices of residential properties have posed a growing challenge for low-income earners seeking access to mortgages. This trend can be attributed to various factors, including the prevailing macroeconomic conditions in the country, rising construction costs, and expensive land registration processes,

- Increased credit risk evidenced by a high number of Non-Performing Loan (NPLs): According to Quarterly Economic Review July- September 2023 Non-Performing Loans (NPLs) to the Real Estate Sector increased 2.0% in Q3’2023 to Kshs 97.5 bn from Kshs 96.0 bn in Q2’2023. On y/y basis, Non-Performing Loans (NPLs) to the Real Estate sector increased by 29.5% to Kshs 97.5 bn in 2023 from Kshs 75.6 bn recorded in 2022. A rise in Non-Performing Loans (NPLs) within the Real Estate sector signifies heightened risk for lenders. Such circumstances can pose challenges for KMRC in securing funding from capital markets, as investors may exercise greater caution in extending loans to the company, and,

- Cost of capital: KMRC’s current funding model is unclear and unsustainable, owing to the large negative spread between its cost of capital and lending rate. Based on KMRC’s latest issuance, its 7 year tenor bond raised in the market cost 12.5%. It is therefore not clear how the institution will maintain lending at rate of 5.0% to 9.5% while its borrowing costs are high hence deeming clarity on how KMRC will sustainably fund mortgages using its current financing model, once it exhausts the funding that was contributed by the original shareholders.

- Capital Markets Authority

- Formation

We shall primarily focus on Real Estate Investment Trusts (REITs) in the affordable housing sector. In 2013, both Kenya and South Africa joined the growing number of African countries embracing Real Estate Investment Trusts (REITs) as a viable investment mechanism, following the examples set by Ghana and Nigeria. Currently, in Kenya, there are only four authorized REITs: i) ILAM Fahari I-REIT, ii) Acorn Student Accommodation I-REIT, iii) Acorn Student Accommodation D-REIT, and, iv) LAPTrust Imara I-REIT. A REIT, is a regulated investment entity, that facilitates pooled investments to offer third-party financing opportunities for the real estate sector. In Kenya, REITs operate under the Capital Markets (Real Estate Investment Trusts) (Collective Investment Schemes) Regulations of 2013. Unlike companies, REITs are structured as trusts. They can be classified as either listed or unlisted. Listed REITs have their units traded on the Nairobi Securities Exchange (NSE), providing investors with a liquid real estate investment akin to ordinary company shares. In Kenya, there are three main types of REITs including Income REITs (I-REITs), Development REITs (D-REITs) and Islamic REITs. Typically, in I-REITs, investors gain through capital appreciation and rental income. For D-REITs, investors gain from sale profits once an asset is sold in a commercial arm’s length transaction. An Islamic REIT is a unique type of REIT that invests primarily in income-producing Shari’ah-compliant Real Estate developments. For more information, please see our recent topical Real Estate Investments Trusts (REITs) Progress Update in Kenya.

- Mandate

In this section, we will categorize the role of REITs, analyzing their role in catalyzing both the demand and supply aspects of housing;

- Demand Side

- Addressing financial gaps: REITs present developers with an alternative funding option distinguished by advantageous terms and reduced borrowing expenses in contrast to traditional sources such as bank loans. Through offering access to capital at competitive rates, REITs empower developers to surmount financial obstacles that could otherwise impede the realization of affordable housing initiatives,

- Off-take arrangement: Through agreements to purchase or lease a predetermined quantity of housing units, I-REITs offer developers a dependable revenue stream, enhancing the appeal of projects to investors. This reliability reduces uncertainties associated with sales and occupancy rates, fostering investor confidence and project sustainability, and,

- Capital mobilization: By enabling both individuals and institutions to pool their resources, this investment vehicle directs substantial funds toward projects intended to alleviate the housing deficit. Through democratizing access to real estate investment opportunities, REITs draw in a varied range of investors, thereby facilitating the accumulation of significant capital for the development of affordable housing.

- Demand Side

- Timely delivery of Housing Units: D-REITs can effectively oversee the entire development process from inception to completion. Their experience in navigating regulatory frameworks, coordinating with contractors, and managing construction timelines allows them to expedite project delivery without compromising on quality. This timely delivery will not only benefit the community by providing much-needed housing, but also will contribute to the overall economic development of the region,

- Exercise Expertise in Project Management: REITs, via their Trustees, hold substantial expertise in project management, property development, and asset management, all of which are vital for executing affordable housing initiatives. With experience in site selection and design optimization, REITs Trustees identify suitable locations and maximize affordability without compromising quality and in adherence to the Offering Memorandum and the Trust Deed, and,

- Streamlining Development process: REITs expedite the development process by forming strategic partnerships with experienced developers and property managers. These partnerships boost efficiency by harnessing the expertise of seasoned industry professionals. Through cost-effective construction practices and enhanced operational efficiency, REITs guarantee the smooth and budget-conscious execution of affordable housing projects.

- Achievements and Recent Activities

Kenya adopted REIT regulations in 2013, in the same year as South Africa, however the country lags behind South Africa, which boasts 33 listed REITs. In Kenya there are only four authorized REITs: i) ILAM Fahari I-REIT, ii) Acorn Student Accommodation I-REIT, iii) Acorn Student Accommodation D-REIT, and, iv) LAPTrust Imara I-REIT. Until its delisting on February 12th 2024, ILAM Fahari I-REIT stood as the sole actively traded REIT on the NSE (Nairobi Securities Exchange). This section shall highlight some of the recent achievements and activities in the REITs segment which includes;

- Licensing of NCBA Bank Kenya PLC as REIT Trustee: On February 5th, 2024, NCBA Bank Kenya PLC received a license from the Capital Markets Authority (CMA) to operate as a Real Estate Investment Trust (REIT) trustee in Kenya. This approval elevates the total count of licensed REIT trustees in Kenya to four. The inclusion of NCBA Bank Kenya is anticipated to support investments within the real estate sector, thereby fostering economic growth and furthering initiatives such as the Affordable Housing Initiative. This brings the total number of REITs to 4 in Kenya, the other REITs Trustees includes; Kenya Commercial Bank (KCB), Co-operative Bank (Coop) and Housing Finance Bank,

- Strategic Sale by Acorn Student Accommodation D-REIT: In December 2023, Acorn Student Accommodation Development REIT (ASA D-REIT) announced it had sold its latest stabilized asset, Qwetu Aberdare Heights II, to the Acorn Student Accommodation Income REIT (ASA I-REIT) in a Kshs 1.5 bn deal. The acquisition of the 630-bed capacity hostel located adjacent to Qwetu Aberdare Heights I and United States International University (USIU) brings the total number of assets acquired by the I-REIT to four over the last three years. The success of the Qwetu Hostels and Qejani brands by Acorn Holdings signifies the potential of REITs in sourcing for financing for the development or construction of Real Estate. The two REITs have enabled the provision of quality student accommodation by enabling both the demand and supply sides,

- LAPTrust Imara I-REIT’s Trading debut: In October 2023, LAPTrust Imara I-REIT traded for the first time since its listing. In two transactions totaling 30.0 mn shares and valued at Kshs 600.0 mn, the share price of the I-REIT stayed steady at Kshs 20.00, matching its listing price. The I-REIT, structured as a close-ended fund comprising 346.2 mn units valued at Kshs 6.9 bn, was originally planned to remain non-public, with no securities available to the general market for the next three years. and,

- Proposed establishment of the Kenya National REIT (KNR): In February 2023, the Capital Markets Authority (CMA), alongside the Sanduku Investment Initiative, the Association of Pension Trustees and Administrators of Kenya (APTAK), and the Nairobi Securities Exchange (NSE), disclosed their ongoing initiatives to establish the Kenya National REIT (KNR). This entity aims to serve as an accrediting body for REITs and their stakeholders within the Kenyan REITs market. REITs registered under KNR will be designed to attract immediate investor interest in the capital markets, serving as scalable asset classes with the potential to foster national economic development. Furthermore, the Retirement Benefits Authority (RBA) and APTAK will collaborate with trustees to review REIT investment mandates, facilitating the involvement of pension funds in KNR REITs as an alternative asset class. We note however, that since the proposal was first floated in February 2023, no further discussions with regards to the matter have been floated and KNR is yet to materialize. Further, it’s not clear what specific advantages the Sanduku initiative will be offering that is not present in the current REIT regime.

- Challenges

- The high minimum capital requirement of Kshs 100.0 mn for Trustees: Currently, the minimum capital requirement to qualify as a REIT Trustee in Kenya stands at Kshs 100.0 mn, a considerable sum. It's imperative to reassess and potentially reduce this minimum capital for Trustees in order to foster greater participation in the REIT market. Currently, Kenya only has four authorized entities serving as REIT trustees which includes Kenya Commercial Bank (KCB), Co-operative Bank (Coop), Housing Finance Bank, National Commercial and NCBA Bank,

- Rigidity in Terms of Qualifying Legal Entities to be REITs: Only trusts are allowed to be REITs, we also need to allow other forms of legal entities as REITs. REITs should incorporate flexibility in selecting legal structures, thereby enhancing the diversity and vitality of the REIT market. For instance, in Belgium and United States, a variety of legal entities are allowed, such as public limited companies, limited liability companies, and cooperative companies, catering to diverse investor preferences and business models,

- Rigidity in Terms of either Development and Income REITs: Currently REITs are limited to only Development and Income REITs. There is no provision for hybrid REIT which can incorporate both Income and Development REITs,

- High Minimum Asset Size for Investment Companies: According to the regulations established by the Capital Markets Authority (CMA), the minimum asset thresholds for Income REITs (I-REITs) and Development and Construction REITs (D-REITs) are set at Kshs 300.0 mn and Kshs 100.0 mn respectively. These criteria present substantial obstacles for numerous companies in the country to acquire and handle the necessary assets, particularly impacting the ability of medium and small start-ups to participate in the REIT market,

- High Minimum investment requirement of Kshs 5.0 mn: The high capital requirements to REITs limits participation limits participation. The high minimum investment threshold of Kshs 5.0 mn for REITs restricts access to a broader base of investors, particularly retail investors who may not have such substantial capital available. This limitation hinders the democratization of real estate investment opportunities and excludes smaller investors from benefiting from the potential advantages of REITs,

- Requirement to Go Public Immediately: This regulation comes with various drawbacks, such as restricted time for preparation, inflexibility in making strategic and operational choices, the burden of meeting performance expectations, and susceptibility to risks related to market timing,

- Inadequate Investor Knowledge: Insufficient investor awareness and education about REITs instruments have led to restricted investment activity. This lack of comprehension among investors significantly influenced the low subscription rate of 29.0% and the subsequent underperformance of Stanlib Fahari I-REIT. Furthermore, it contributed to the unsuccessful issuance of Fusion D-REIT in 2016,

- The processes for licensing and approval are excessively lengthy: The licensing and approval processes for REITs are demanding and time-consuming, requiring extensive documentation and compliance with various legal and regulatory requirements. This complex procedure may discourage potential promoters from investing in REITs, leading them to consider alternative, more efficient methods for raising capital, and,

- Limited Availability of Investment-Grade Assets: The selection of investment-grade real estate assets in Kenya capable of generating appealing and consistent returns is limited. For example, Stanlib Fahari I-REIT had to seek regulatory exemption to prolong the deadline for acquiring real estate assets after failing to meet the 75.0% threshold of income-generating real estate assets within two years of the REIT's operational authorization.

- Affordable Housing Bill 2023

- Introduction

The Affordable Housing Bill 2023 is among the initiatives introduced by Kenya Kwanza government aimed at establishing a fund dedicated to facilitating the provision of affordable housing within the country. On December 7th 2023, the National Assembly Majority Leader Kimani Ichung’wa introduced the Affordable Housing Bill in Parliament as a response to a ruling by the High Court. The bill aims at addressing the grey areas initially proposed in the Finance Bill 2023 under Section 84. In November 2023, the High Court declared the levy unconstitutional and discriminatory, citing its lack of a comprehensive legal framework and its violation of articles 10 and 201 of the Kenyan Constitution regarding principles of public finance on equity. Moreover, the court noted that the levy unfairly targeted only formal sector employees, excluding those in the informal sector.

In an urgent effort to address these concerns, the government, led by the Majority Leader, aims to regularize the levy through the Affordable Housing Bill 2023. Additionally, the bill aims to clarify fiscal ambiguities highlighted by the court. The bill proposes a mandatory deduction of 1.5% from an employee’s gross monthly salary, with employers required to match this contribution with another 1.5% on behalf of each employee from their monthly payroll. We note that the Bill has passed the First Reading and was referred to Senate for further consideration. The Second Reading has been set for 23rd March 2024.

- Mandate

The mandates of the Affordable Housing Bill 2023 are well spelt out in Section 3(i) which includes; i) give effect to Article 43(1)(b) of the constitution on right to accessible and adequate housing, ii) impose a levy to facilitate the provision of affordable housing, and, iii) provide a legal framework for the implementation of affordable housing programs and projects.

Furthermore, the bill goes ahead to provide for the establishment of the Affordable Housing Fund aimed at providing financial support to housing initiatives. Section 11 of the bill highlights the allocation plan, specifying designated percentages of collected monies through the Housing Levy for various purposes to specified agencies, including; i) 30.0% to the National Housing Corporation, ii) 25.0% to slum upgrading, iii) 36.0% to institutional housing programs, iv) up to 2.0% to the levy collector, and, v) up to 2.0% to the Board for administrative tasks. For a more detailed analysis of the Bill please see our topical on the Review of the Affordable Housing Bill 2023.

- Affordable Housing Bill 2023 – Limiting Factors

The proposed Bill has sparked several concerns including:

- Informal Sector Compliance: The process of including individuals from the informal sector in the housing levy remains unclear. It's crucial for the government to outline its strategy for ensuring that those in the informal sector comply with the levy requirements. The lack of explicit instructions has resulted in speculation and uncertainty. This clarification is particularly important as it was a key factor in the High Court's ruling that the levy was discriminatory,

- Call for clarity in Eligibility and Allocation: The bill mandates that individuals seeking eligibility for affordable housing must be Kenyan citizens aged 18 or older with a valid identity card. This means that anyone meeting the deposit requirements, typically set as a percentage of the unit's value (e.g., 10.0%), and possessing all required documentation, can apply for a unit, regardless of whether they already own a home. However, there is a call for a refined eligibility and allocation system that prioritizes individuals facing severe housing needs. This encompasses those who lack housing or reside in informal settlements,

- Punitive 3.0% in case of non-compliance: The suggested penalty outlined in the Bill, standing at 3.0% of the entire outstanding sum to be paid to the Fund, has raised worries regarding its severity. Given the current challenging macro-economic conditions, such a stringent penalty might worsen the financial burden on businesses,

- “Cannibalism” concern: There are apprehensions regarding certain individuals acquiring and possessing multiple units at the expense of other Kenyans. The Bill does not clearly outline how such situations will be prevented,

- Eliminate Ambiguity: The bill defines affordable housing as housing that meets both adequacy standards and does not exceed 30.0% of an individual's monthly income for rent or purchase. Essentially, any dwelling, irrespective of its price, qualifies as affordable housing if the rent or mortgage payment is less than 30.0% of a person's monthly income. This definition lacks clarity and requires clarification to remove any uncertainty regarding what falls under affordable housing according to the law, and,

- Provide a Complete List of Agencies: While the bill establishes an eligibility criterion for affordable housing applicants, an ambiguity arises from the lack of specificity regarding the approved agencies to which formal applications must be submitted. This uncertainty could pose challenges for prospective applicants, as they may be unable to identify the specific entities responsible for processing their applications.

- State Department of Housing and Urban Development

The State Department is under the Ministry of Lands, Public Works, Housing and Urban Development. The Department has five Divisions namely: Housing Policy Management and Implementation, Human Settlements, Housing Finance and Incentives, Appropriate Building Materials and Technology (ABMT), and Housing Sector Monitoring and Evaluation. Each department has its designed responsibilities.

The State Department is responsible for providing policy direction and coordination of all matters related to housing and urban planning and development. Its functions include; i) Housing Policy Management, ii) Development and Management of Affordable Housing, ii) Management of Building and Construction Standards and Codes, iii) National Secretariat for Human Settlement, iv) Management of Civil Servants Housing Scheme, v) Development and Management of Government Housing, vi) Shelter and Slum Upgrading, vii) Building Research Services, viii) Registration of Contractors and Materials Suppliers Building Research Services, ix) Registration of Civil, Building and Electro-Mechanical Contractors, x) Registration of Architects and Quantity Surveyors, and xi) Urban Planning and Development.

The state department is one of the key promoters of the Affordable Housing Program by facilitating the Boma Yangu initiative. However, there is need of a robust oversight structure for policies management and housing program development. This will ensure that projects are implemented in the set time frame and policies are followed.

- Kenya Revenue Authority (KRA)

The Kenya Revenue Authority was established by an Act of Parliament, Chapter 469 of the laws of Kenya, which became effective on 1st July 1995. KRA is charged with collecting revenue on behalf of the government of Kenya.

The core functions of the Authority are:

- To assess, collect and account for all revenues in accordance with the written laws and the specified provisions of the written laws,

- To advise on matters relating to the administration of, and collection of revenue under the written laws or the specified provisions of the written laws, and,

- To perform such other functions in relation to revenue as the Minister may direct.

We consider the Kenya Revenue Authority to play a crucial role in advancing the housing agenda due to its involvement in numerous housing initiatives. These include;

- Reduction of corporate tax for developers who build a minimum of 100 low cost units from 30.0% to 15.0% under affordable housing program,

- Exemption of VAT on importation and local purchase of goods for the construction of houses under the affordable housing scheme,

- VAT exemptions for construction inputs for affordable housing program,

- Exemption from 4.0% (urban areas) and 2.0% (rural areas) stamp duty for first time buyers of houses under the affordable housing scheme, and,

- REIT tax exemptions; including; Exemptions from Income Tax, exemption from Value Added Tax (VAT), and, adjustment in Stamp Duty.

Section II: Existing Housing Agency Gaps in Kenya

In this segment, we will analyze the existing gaps within the Affordable Housing Agencies in the country;

The National Housing Corporation's (NHC) mandate covers approximately 15 diverse areas, including property development, management, research, and financing. However, the core mandate remains ambiguous. Although the mandate appears to emphasize lending upon initial review, the actual focus appears to be predominantly on construction activities. This discrepancy highlights a notable gap in clarifying NHC's primary mission and priorities. In addition, there is existence of overlapping research mandates between the National Housing Corporation (NHC) and the State Department of Housing and Urban Development which indicates a potential inefficiency and duplication of efforts within the government's housing sector. This overlap suggests a need for better coordination and collaboration between the NHC and the State Department of Housing and Urban Development to streamline research efforts thus avoiding duplication.

In addition, Audit findings on the National Housing Corporation (NHC), as reported by the Office of the Auditor General, highlighted a concerning gap. The audit revealed a lack of a comprehensive inventory list of houses signed by the Accounting Officers of both transferring and receiving entities. The failure to maintain such a detailed inventory list indicates a significant lapse in accountability within the NHC. Moreover, the National Housing Corporation (NHC) has faced considerable negative publicity due to incidents involving senior executives such as the managing director, finance director, and company secretary. These cases point to a history of mismanagement within the organization. Consequently, the reputation of the NHC has been significantly tarnished, leading to widespread concerns regarding its governance and ethical standards .Additionally, there seems to be a degree of overlap in the lending functions between NHC and KMRC.

Only in February 2024 did KMRC revise its loan size limit, raising it to Kshs 10.5 mn nationwide. This delay in adjusting loan size limits had notable consequences. The previously low qualifying amounts meant that a considerable number of loans did not meet KMRC's criteria for refinancing. As a result, many potential borrowers were excluded from accessing KMRC-backed mortgages, leading to lower absorption rates for these products.