Affordable Housing in Kenya, & Cytonn Weekly #42/2022

By Cytonn Research, Oct 23, 2022

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 117.9%, a slight increase from the 116.7% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 19.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 488.0% from 253.8% recorded the previous week. The subscription rate for the 364-day paper slightly increased to 39.7% from 39.2% while the subscription rate for the 182-day paper declined to 48.2% from 139.5% recorded the previous week. The yields on the government papers were on upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 1.8 bps, 0.8bps and 4.2 bps to 9.9%, 9.7% and 9.1%, respectively. In the Primary Bond Market, the Central Bank of Kenya released the auction results for the newly issued bond; FXD1/2022/025 highlighting that the bond recorded an undersubscription of 74.5%;

We are projecting the y/y inflation rate for the month of October 2022 to fall within the range of 8.4%-8.8%;

Equities

During the week, the equities market recorded mixed performance with NASI and NSE 25 declining by 1.2% and 0.6% respectively while NSE 20 gained by 0.3%, taking their YTD performance to losses of 23.2%, 11.0% and 17.2%, for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as KCB Group and Safaricom of 5.8% and 2.3%. The losses were however mitigated by gains recorded by banking stocks such as ABSA and Equity Group of 4.0% and 2.8% respectively;

Also during the week, the Global Company Ratings (GRC), an affiliate of Moody’s Investors Services, affirmed Centum Investments long and short-term issuer ratings of ‘A+’ and ‘AI’ respectively with a stable outlook;

Real Estate

During the week, property developer Unity homes completed 10.0% of its Kshs 5.4 bn housing project dubbed Unity East, which sits on a 10.4-acre piece of land at Tatu City in Ruiru Sub - County. In the retail sector, Naivas Supermarket announced plans to open 4 new branches in the country in the next four weeks. In the hospitality sector, Nairobi was voted as Africa’s leading business travel destination in the 29th World Travel Awards which was held at the Kenyatta International Convention Centre (KICC). For Real Estate Investment Trusts, Fahari I-REIT closed the week trading at an average price of Kshs 6.5 per share on the Nairobi Stock Exchange, while Acorn D-REIT and Acorn I-REIT prices stood at Kshs 23.8 and Kshs 20.8 per unit, respectively, on the Unquoted Securities Platform as at 7th October 2022;

Focus of the Week

Following the transition of Kenya’s government regime in September 2022, President William Ruto outlined his various agenda with the affordable housing initiative being one of the agenda embraced by the President from the previous regime. The government aims to deliver 200,000 affordable housing units per year for the next five years, with a target of 5,000 units per county. This week, we review the initiative which was launched in 2017 with the goal of delivering 500,000 units by December 2022;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.68%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.93% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- During the week, Cytonn Investments CEO Edwin H. Dande appeared on Spice FM, discussing the state of Kenya's Capital Markets. Watch the conversation here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 117.9%, a slight increase from the 116.7% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 19.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 488.0%, up from 253.8% recorded the previous week. The subscription rate for the 364-day paper slightly increased to 39.7% from 39.2% recorded the previous week while the subscription rate for the 182-day paper declined to 48.2% from 139.5% recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 1.8 bps, 0.8 bps and 4.2 bps to 9.9%, 9.7% and 9.1%, respectively.

In the Primary Bond Market, the Central Bank of Kenya released results for the newly issued bond; FXD1/2022/025 with effective tenors to maturity of 25 years. As per our expectations, the bond recorded an undersubscription of 74.5%, partly attributable to investors’ preference for the shorter dated papers as they sought to avoid duration risk. The government issued the bond seeking to raise Kshs 20.0 bn for budgetary support, received bids worth Kshs 14.9 bn and accepted bids worth Kshs 13.7 bn, translating to a 91.7% acceptance rate. The coupon rate and weighted average yield for the bond each came in at 14.2%.

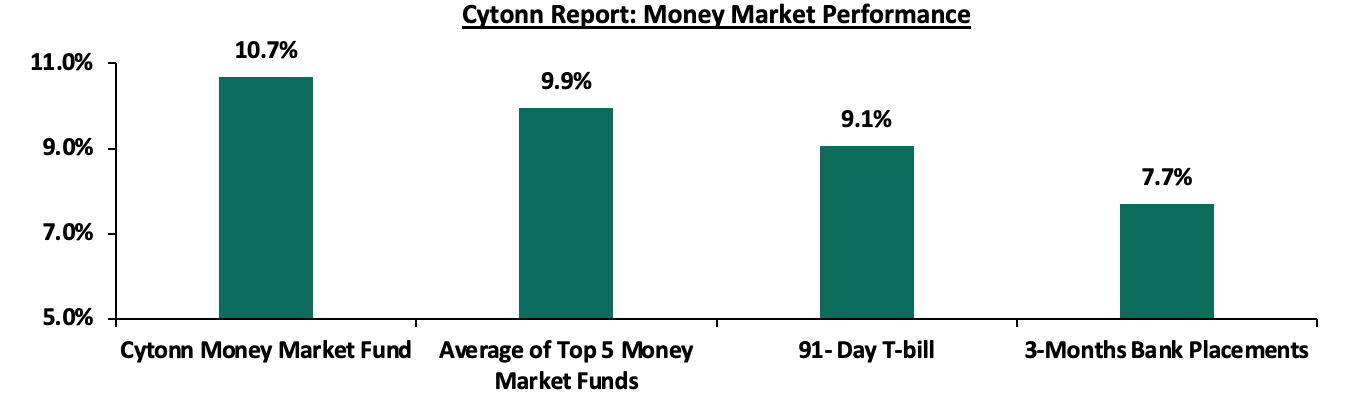

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 4.2 bps to 9.1%. The average yields of the Top 5 Money Market Funds and the Cytonn Money Market Fund remained unchanged at 9.9% and 10.7%, respectively.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 22nd October 2022:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 22nd October 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.7% |

|

2 |

GenCap Hela Imara Money Market Fund |

10.0% |

|

3 |

Zimele Money Market Fund |

9.9% |

|

4 |

NCBA Money Market Fund |

9.7% |

|

5 |

Dry Associates Money Market Fund |

9.5% |

|

6 |

Sanlam Money Market Fund |

9.5% |

|

7 |

Old Mutual Money Market Fund |

9.4% |

|

8 |

Madison Money Market Fund |

9.3% |

|

9 |

Nabo Africa Money Market Fund |

9.3% |

|

10 |

Apollo Money Market Fund |

9.3% |

|

11 |

Co-op Money Market Fund |

9.2% |

|

12 |

CIC Money Market Fund |

9.1% |

|

13 |

Orient Kasha Money Market Fund |

8.8% |

|

14 |

ICEA Lion Money Market Fund |

8.5% |

|

15 |

AA Kenya Shillings Fund |

8.2% |

|

16 |

British-American Money Market Fund |

7.7% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 5.1% from 5.0% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased by 139.1% to Kshs 31.7 bn from Kshs 13.3 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory, an indication of rising risk concerns over the economy by investors on the back of persistent inflationary pressures. The yield on the 10-year Eurobond issued in 2014 increased the most by 0.9% points to 17.3% from 16.4% recorded in the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 20th October 2022;

|

Cytonn Report: Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

8.1% |

8.1% |

5.6% |

6.7% |

6.6% |

|

30-Sep-22 |

17.6% |

14.7% |

14.0% |

15.6% |

14.7% |

13.2% |

|

14-Oct-22 |

16.4% |

14.3% |

13.6% |

15.3% |

14.4% |

12.9% |

|

17-Oct-22 |

16.7% |

14.4% |

13.7% |

15.5% |

14.5% |

13.0% |

|

18-Oct-22 |

16.3% |

14.3% |

13.6% |

15.3% |

14.4% |

12.9% |

|

19-Oct-22 |

16.6% |

14.3% |

13.6% |

15.5% |

14.4% |

13.0% |

|

20-Oct-22 |

17.3% |

14.8% |

13.8% |

15.8% |

14.7% |

13.3% |

|

Weekly Change |

0.9% |

0.5% |

0.2% |

0.5% |

0.3% |

0.3% |

|

MTD Change |

(0.3%) |

0.0% |

(0.2%) |

0.2% |

0.1% |

0.1% |

|

YTD Change |

12.9% |

6.7% |

5.7% |

10.2% |

8.0% |

6.7% |

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.1% against the US dollar to close the week at Kshs 121.1, from Kshs 121.0 recorded the previous week, partly attributable to increased dollar demand from the oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 7.1% against the dollar, higher than the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand as most economies gradually recover,

- An ever-present current account deficit estimated at 5.2% of GDP in the 12 months to August 2022, same as what was recorded in a similar period in 2021, and,

- The aggressively growing government debt which continues to put pressure on forex reserves given that 68.1% of Kenya’s debt was US Dollar denominated as of July 2022.

The shilling is however expected to be supported by:

- Sufficient diaspora remittances standing at a cumulative USD 4.0 bn as of September 2022 YTD, representing a 14.3% y/y increase from USD 3.5 bn recorded over the same period in 2021, and,

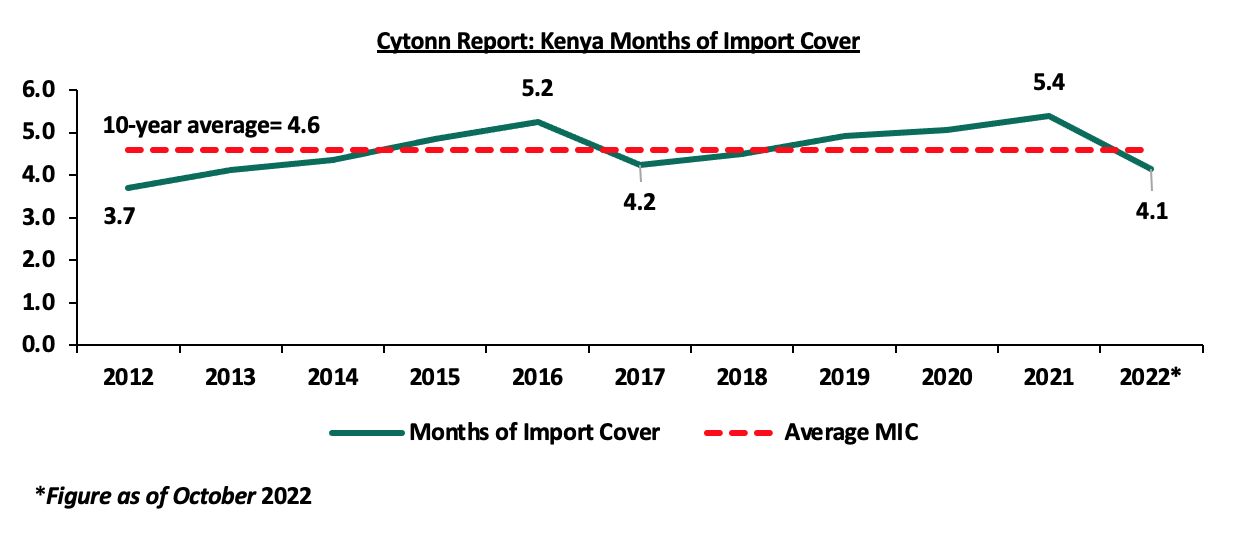

- Sufficient Forex reserves currently at USD 7.3 bn (equivalent to 4.1 months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, however it’s important to note that Forex reserves have dropped by 16.5% YTD from USD 8.8 bn. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years;

Weekly Highlight:

- October 2022 inflation projections

We are projecting the y/y inflation rate for October 2022 to fall within the range of 8.4%-8.8%, mainly on the back of;

- The decline in fuel prices: For the period between 14th October 2022 to 15th November 2022 the prices of Super Petrol, Diesel and Kerosene declined by 0.6%, 1.2% and 0.7% to Kshs 178.3 per litre, Kshs 163.0 per litre and Kshs 146.9 per litre from Kshs 179.3 per litre, Kshs 165.0 per litre and Kshs 147.9 per litre, respectively, and,

- Upward Revision of the Central Bank Rate (CBR): During the September sitting, the Monetary Policy Committee increased the CBR by 75 bps to 8.25%, from the previous 7.50% with the aim of anchoring inflation with the rate having marked a 5-year high in the month of September.

In our view, the decline in the fuel prices is expected to have a ripple effect on the prices of other commodities given that fuel is a major input in most sectors. Additionally, we expect maize prices to fall as we enter the harvesting season and consequently lead to a decline in the food index as maize flour is a significant contributor to the index. We also expect the MPC’s decision to hike the borrowing rates by 75 bps to 8.25% in September to ease the inflationary pressures on commodities by reducing consumer spending. However, we do not expect the decision to have a significant effect on the inflation rate as the elevated pressure is largely external.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 8.7% behind its prorated borrowing target of Kshs 180.6 bn having borrowed Kshs 164.9 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We expect sustained gradual economic recovery as evidenced by the revenue collections of Kshs 486.0 bn in the FY’2022/2023, equivalent to a 22.7% of its target of 2.1 tn. Despite the performance, we believe that the projected budget deficit of 6.2% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. We however expect the support from the IMF and World Bank to finance some of the government projects and thus help maintain a stable interest rate environment since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market recorded mixed performance with NASI and NSE 25 declining by 1.2% and 0.6% respectively while NSE 20 gained by 0.3%, taking their YTD performance to losses of 23.2%, 11.0% and 17.2%, for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as KCB Group and Safaricom of 5.8% and 2.3%. The losses were however mitigated by gains recorded by banking stocks such as ABSA and Equity Group of 4.0% and 2.8% respectively.

During the week, equities turnover declined by 41.4% to USD 5.2 mn from USD 8.8 mn recorded the previous week, taking the YTD turnover to USD 691.0 mn. Additionally, foreign investors turned net sellers, with a net selling position of USD 1.0 mn, from a net buying position of USD 1.4 mn recorded the previous week, taking the YTD net selling position to USD 177.4 mn.

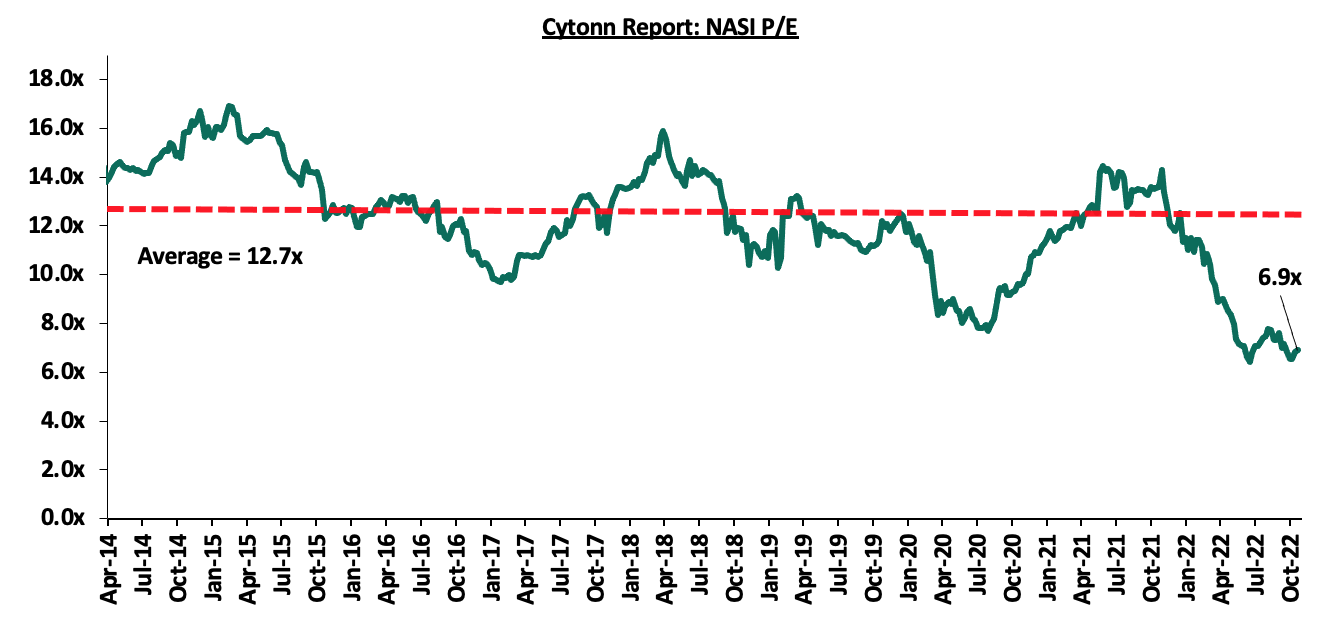

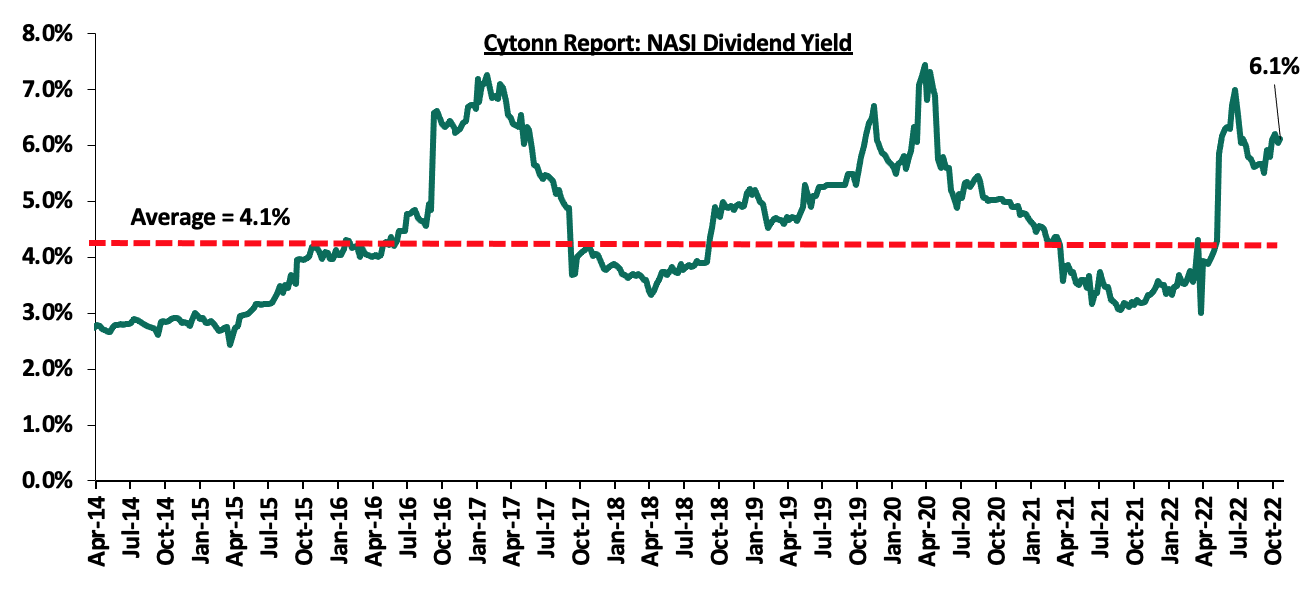

The market is currently trading at a price to earnings ratio (P/E) of 6.9x, 45.5% below the historical average of 12.7x, and a dividend yield of 6.1%, 2.0% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Weekly Highlight:

Centum Investments National Rating

During the week, Global Company Ratings (GCR), an affiliate of Moody’s Investors Services, affirmed Centum Investments long and short-term issuer ratings of ‘A+’ and ‘AI’ respectively with a stable outlook. However, its Real Estate development subsidiary has a rating of ‘BBB+’ with a negative outlook. The table below summarizes the ratings;

|

Cytonn Report: Centum Investment Company PLC’s National Ratings |

||

|

Rating |

Dec 2021 |

Oct 2022 |

|

Long Term Issuer |

A+ |

A+ |

|

Short Term Issuer |

A1 |

A1 |

|

Outlook |

Stable |

Stable |

Source: GCR Ratings

According to GCR Ratings, both Centum Investments Company’s long and short term Issuer national ratings of A+ and A1 remained unchanged from the December ratings, attributable to the company’s strong liquidity position, an improved asset coverage to debt ratio, and rebalancing of its investments portfolio. Centum’s current ratio increased by 27.2% to 1.0 in FY’2022, from 0.8 in FY’2021, driven by a 58.9% increase in current assets relative to a 24.9% increase in current liabilities. Additionally, Centum’s total debt margin declined by 19.1% to Kshs 20.6 bn as at March 2022, from Kshs 25.5 bn recorded in March 2021. Key to note, Centum’s strategy to sell its Sidian Holdings is aimed at reducing its debt further to a maximum exposure of 25.0% from the 30.0% recorded in FY’2022.

We expect that the ratings affirmation will increase investor sentiments on the stock that has recorded a 37.1% Year to date decline to Kshs 9.2 per share as at 21st October 2022, from Kshs 14.7 record at the start of the year. Further, we expect that the declining debt margins will help to improve the company’s performance metrics as evidenced by the 2.1% decline in losses made to Kshs 1.3 bn in March 2022, from losses of Kshs 1.7 bn recorded in March 2021.

Universe of coverage:

|

Company |

Price as at 14/10/2022 |

Price as at 21/10/2022 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

38.8 |

36.6 |

(5.8%) |

(19.8%) |

53.5 |

8.2% |

54.6% |

0.6x |

Buy |

|

Kenya Reinsurance |

2.0 |

1.9 |

(7.0%) |

(18.8%) |

2.5 |

5.4% |

40.3% |

0.1x |

Buy |

|

Co-op Bank*** |

12.0 |

12.0 |

0.0% |

(7.7%) |

15.6 |

8.3% |

38.3% |

0.7x |

Buy |

|

Equity Group*** |

44.1 |

45.4 |

2.8% |

(14.0%) |

59.7 |

6.6% |

38.2% |

1.1x |

Buy |

|

Sanlam |

9.9 |

9.1 |

(8.1%) |

(21.4%) |

11.9 |

0.0% |

31.2% |

1.0x |

Buy |

|

ABSA Bank*** |

11.2 |

11.6 |

4.0% |

(1.3%) |

14.9 |

1.7% |

30.2% |

1.0x |

Buy |

|

I&M Group*** |

17.0 |

17.0 |

(0.3%) |

(20.8%) |

20.5 |

8.8% |

30.0% |

0.4x |

Buy |

|

Jubilee Holdings |

240.0 |

237.5 |

(1.0%) |

(25.0%) |

305.9 |

0.4% |

29.2% |

0.4x |

Buy |

|

Diamond Trust Bank*** |

48.9 |

49.0 |

0.2% |

(17.6%) |

59.5 |

6.1% |

27.6% |

0.2x |

Buy |

|

NCBA*** |

30.5 |

30.3 |

(0.8%) |

18.9% |

35.2 |

6.6% |

22.8% |

0.7x |

Buy |

|

Standard Chartered*** |

138.3 |

138.5 |

0.2% |

6.5% |

155.0 |

10.1% |

22.0% |

0.9x |

Buy |

|

HF Group |

3.1 |

3.0 |

(5.1%) |

(22.4%) |

3.5 |

0.0% |

19.7% |

0.1x |

Accumulate |

|

CIC Group |

1.9 |

2.0 |

5.8% |

(7.4%) |

2.3 |

0.0% |

15.4% |

0.7x |

Accumulate |

|

Britam |

6.0 |

6.2 |

2.6% |

(18.0%) |

7.1 |

0.0% |

14.8% |

1.0x |

Accumulate |

|

Liberty Holdings |

5.5 |

5.9 |

7.7% |

(16.4%) |

6.8 |

0.0% |

14.4% |

0.4x |

Accumulate |

|

Stanbic Holdings |

97.3 |

98.0 |

0.8% |

12.6% |

99.9 |

9.2% |

11.1% |

0.8x |

Accumulate |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Residential Sector

During the week, property developer Unity homes completed 10.0% of its Kshs 5.4 bn housing project dubbed Unity East, which sits on a 10.4-acre piece of land at Tatu City in Ruiru Sub - County. This constitutes 64 units of the total 640 houses whose construction began in November 2021 as the second phase of the project. The project will be delivered in batches with the last batch of units expected to be delivered by September 2024. Other projects by the developer include Unity West which was completed in November 2021, Unity Gardens completed in 2018, and, Silver Hill which was launched in October 2022. The table below shows the typologies, plinth areas and unit prices for the aforementioned apartments at Unity East;

|

Cytonn Report: Summary of Unity East Apartments Prices |

|||

|

Typologies |

Unit Size (SQM) |

Price (Kshs) |

Price Per SQM |

|

2 bedroom |

75 |

7.7 mn |

103,012 |

|

3 bedroom |

150 |

15.5 mn |

103,012 |

|

4 bedroom |

150 |

15.5 mn |

103,012 |

|

Average |

125 |

12.9 mn |

103,012 |

Source: Unity Homes Sales Team

In terms of performance, Ruiru apartments recorded an average selling price of Kshs 89,418 per SQM in Q3’2022. Notably, the average price per SQM for apartments at Unity East is Kshs 103,012, which is higher than Ruiru’s market average owing to their high quality and prime location within Tatu City. On the other hand, the high occupancies and uptakes realized in Ruiru positions the development viable as the developer is expected to gain higher returns. The table below shows the lower middle satellite towns residential apartment’s performance during Q3’2022;

(All values in Kshs unless stated otherwise)

|

Cytonn Report: Nairobi Metropolitan Area Apartments Average Performance Q3’2022 |

||||||||

|

Area |

Price per SQM Q3'2022 |

Rent per SQM Q3'2022 |

Occupancy Q3'2022 |

Uptake Q3'2022 |

Annual Uptake Q3'2022 |

Rental Yield Q3'2022 |

Price Appreciation Q3'2022 |

Total Returns |

|

Lower Mid-End Satellite Towns |

||||||||

|

Ruaka |

108,117 |

546 |

80.7% |

82.8% |

21.5% |

5.1% |

2.3% |

7.4% |

|

Ngong |

64,382 |

360 |

82.3% |

83.0% |

11.7% |

5.6% |

1.7% |

7.3% |

|

Ruiru |

89,418 |

480 |

87.4% |

86.3% |

17.8% |

5.6% |

1.5% |

7.2% |

|

Kikuyu |

81,624 |

474 |

76.6% |

85.8% |

15.7% |

5.2% |

1.9% |

7.2% |

|

Athi River |

58,199 |

329 |

85.2% |

92.8% |

15.2% |

5.6% |

1.4% |

7.0% |

|

Syokimau |

71,302 |

343 |

86.6% |

89.8% |

12.5% |

5.2% |

1.7% |

6.9% |

|

Thindigua |

101,089 |

498 |

89.9% |

80.8% |

17.7% |

5.4% |

1.2% |

6.6% |

|

Rongai |

91,597 |

316 |

89.2% |

76.4% |

12.6% |

6.1% |

(0.2%) |

5.9% |

|

Kitengela |

59,434 |

277 |

85.9% |

97.5% |

10.3% |

5.0% |

0.4% |

5.3% |

|

Average |

80,573 |

403 |

84.9% |

86.1% |

15.0% |

5.5% |

1.3% |

6.8% |

Source: Cytonn Research 2022

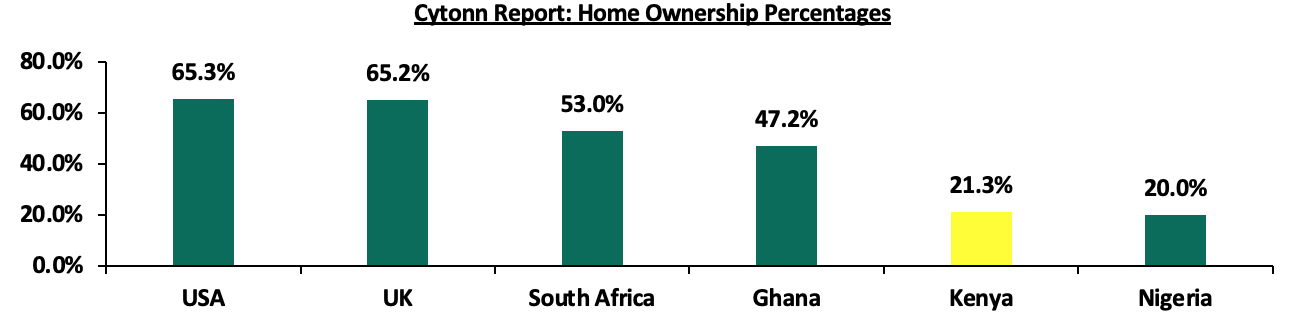

Upon completion, the project is expected to help curb Kenya’s accumulated housing deficit which stands at 2.0 mn housing units translating to 200,000 units annually. Additionally, the initiative will provide descent homes to citizens and improve home ownership rates in the country which have remained significantly low at 21.3% in urban areas as at 2020, compared to other African countries like South Africa and Ghana with 53.0% and 47.2% urban home ownership rates respectively.

- Retail Sector

During the week, Naivas Supermarket announced plans to open 4 new outlets in the country in the next four weeks. This will bring the retailers total number of outlets countrywide to 90, having opened 6 new outlets so far this year in a bid to maintain market dominance. The new outlets will be located at;

- Greenwood City Mall in Meru County which will be launched on October 31st 2022,

- Kahawa Sukari opposite Engen Petrol Station, which will be launched on November 7th 2022,

- Ruai town which will be launched on November 7th 2022 as well, and,

- Parklands along Ojijo Road, which will be launched in mid-November 2022.

The move by Naivas Supermarket is driven by; i) availability of prime retail spaces, ii) increasing demand for goods and services from consumers further fuelled by the incoming festive season, iii) strategic location of the outlets, iv) need to step up competition from close rivals such as QuickMart supermarket, and, v) availability of new market opportunities. The new outlet in Meru will be the first Naivas Supermarket in upper Mt. Kenya region. The table below shows a summary of the number of stores of key local and international retailer supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||||

|

Name of retailer |

Category |

Branches as at FY’ 2018 |

Branches as at FY’ 2019 |

Branches as at FY’ 2020 |

Branches as at FY’ 2021 |

Branches opened in 2022 |

Closed branches |

Current branches |

Branches expected to be opened |

Projected branches FY’2022 |

|

|

Naivas |

Local |

46 |

61 |

69 |

79 |

7 |

0 |

86 |

4 |

90 |

|

|

QuickMart |

Local |

10 |

29 |

37 |

48 |

3 |

0 |

51 |

0 |

51 |

|

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

1 |

1 |

24 |

4 |

28 |

|

|

Carrefour |

International |

6 |

7 |

9 |

16 |

0 |

0 |

16 |

0 |

16 |

|

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

0 |

0 |

12 |

0 |

12 |

|

|

Tuskys |

Local |

53 |

64 |

64 |

3 |

0 |

61 |

3 |

0 |

3 |

|

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

3 |

|

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

0 |

35 |

2 |

0 |

2 |

|

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

13 |

0 |

0 |

0 |

|

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

4 |

0 |

0 |

0 |

|

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

65 |

0 |

0 |

0 |

|

|

Total |

|

257 |

313 |

334 |

186 |

11 |

179 |

197 |

8 |

205 |

|

Source: Online Research

We expect the retail sector to continue realizing development activities which in turn boost its performance driven by; i) continuous expansion by retailers in the country owing to stiff competition in the market, ii) improved accessibility, iii) political stability after the August general elections which has enhanced ease of doing business in the country, and, iv) rapid population and urbanization growth rates driving demand for goods and services. However, the rapid developments in the e-commerce sector and the existing oversupply of retail spaces in the country which is at 2.2 mn SQFT is expected to curtail ideal uptake and occupancy of the spaces and the overall performance of the retail sector.

- Hospitality Sector

During the week, World Travel Awards (WTA), a global organization established to acknowledge, reward, and celebrate excellence across all sectors of the tourism industry, announced the winners of the 29th World Travel Awards at the Kenyatta International Convention Centre (KICC). In the African category, Nairobi was voted as Africa’s leading business travel destination, with Kenya being voted Africa’s leading destination. This was supported by the presence of renowned conferencing centres such as the KICC, prestigious lodging options such as Fairmont and the Norfolk, a stable business environment, favourable infrastructure, numerous historical sites, and, a rich cultural heritage. The table below shows some of the key awards for Kenya and the respective winners in 2022;

|

Award |

2022 Winner |

|

Africa’s Leading Business Travel Destination 2022 |

Nairobi |

|

Africa’s Leading Airline 2022 |

Kenya Airways (KQ) |

|

Africa’s Leading Airline - Business Class 2022 |

Kenya Airways (KQ) |

|

Africa’s Leading City Hotel 2022 |

Fairmont, the Norfolk |

|

Africa’s Leading Hotel Brand 2022 |

Fairmont Mount Kenya Safari Club |

|

Africa’s Leading Meetings & Conference Center 2022 |

Kenya International Conference Center (KICC) |

Source: World Travel Awards

In our view, the fact that Nairobi has received this award for the fourth consecutive year signifies the continued confidence in the city as a vibrant business destination. This is majorly attributed to the high investor confidence in Kenya’s hospitality sector owing to the stable business environment, rich cultural and historical heritage, wide range of high-class hospitality centres, and, good infrastructure. We expect the award to further boost the sector’s performance in terms of increased flight arrivals, hotel bookings and hotel occupancy rates, whose performance is on an upward trajectory driven by; i) aggressive marketing of Kenya’s Tourism sector through the Magical Kenya platform, ii) sustained decline in COVID-19 infections world over, iii) peaceful post-electioneering period that has enhanced business stability in the Kenyan economy, and, iv) increased activities in sports and leisure events such as the World Rally Championship expected to be held annually until 2026.

- Real Estate Investment Trusts

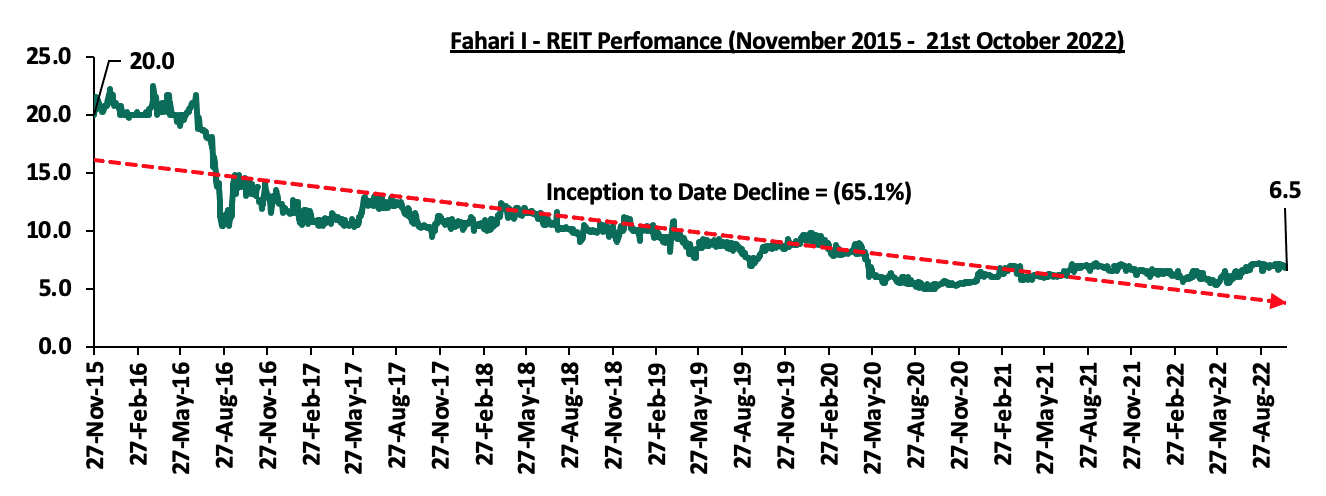

In the Nairobi Stocks Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.5 per share. The performance represented a 3.8% Year-to-Date (YTD) increase. However, the performance represented a 65.1% Inception-to-Date (ITD) decline from Kshs 20.0. The graph below shows Fahari I-REIT’s performance from November 2015 to 21st October 2022:

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.8 and Kshs 20.8 per unit, respectively, as at 7th October 2022. The performance represented a 19.0% and 4.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 5.5 mn and 14.5 mn shares, with a turnover of Kshs 116.9 mn and Kshs 300.3 mn, respectively, since its Inception in February 2021.

We expect the performance of Kenya’s Real Estate sector to improve owing to the anticipated growth in performance in the residential and hospitality sectors, coupled with the rapid expansion in the retail sector. Despite this, setbacks such as the minimal investor appetite for the REIT instrument continue to pose a challenge to the optimum performance of the sector.

The former President Uhuru Kenyatta launched Kenya’s affordable housing initiative in 2017, as part of the key pillars of the ‘Big Four Agenda’ with the aim of delivering 500,000 units by December 2022. However, due to various setbacks, the government delivered less than 3,000 units through the Pangani and Park Road projects, indicating a massive deficit in the delivery. To support the initiative, President William Ruto outlined affordable housing as one of his main agenda with the aim of delivering 200,000 units per year, and a target of 5,000 units per county. Barely two months into his reign the president has; i) floated a mortgage plan that will allow tenants to own homes through monthly rental payments in the Mukuru Kwa Jenga project, and, ii) announced plans to commission an affordable housing project consisting of 5,000 units in Homa Bay County with a start date of November 2022.

We have been tracking the progress of affordable housing with the following reports:

- In April 2018 we covered the Affordable Housing in Kenya where we discussed whether the delivery of affordable housing can be a reality and concluded that the initial plan was very useful but some elements needed to be addressed to increase the likelihood of success,

- In May 2020 we covered a topical on Accelerating Funding to Affordable Housing where we discussed ways of accelerating funding for affordable housing and concluded that there was need to mobilize alternative sources of funding, particularly the opening up of capital markets access to developers, to provide a low-cost capital raising mechanism, and,

- The most recent topical being Affordable Housing in Kenya which was done in January 2022. Here, we focused on the status of affordable housing in the Nairobi Metropolitan Area (NMA) and benchmarked with more established case studies with the aim of giving recommendations on what can be done to achievement the initiative.

This week, we seek to review the initiative with a focus on the feasibility of the current government’s plan to deliver 200,000 housing units annually for the next five years, a total of one million units. We shall cover the topic by looking into the following:

- Introduction,

- Current State of housing in Kenya,

- The Affordable Housing Initiative in Kenya,

- Analysis of Affordable Housing in other countries, and,

- Recommendations and Conclusion.

Section I: Introduction to Affordable Housing

Affordable housing refers to a housing plan that is appropriate for the needs of a range of very low to moderate-income households and priced so that these households are also able to meet other basic living costs such as food, transport, clothing, medical care and education. According to the Kenya National Bureau of Statistics (KNBS), 74.4% of Kenyan employees in the formal sector earn a monthly median gross income of Kshs 50,000 or less, implying that a large percentage of these individuals would benefit from the plan. Using the UN Habitat definition of Affordable housing, assuming one is able to spend 30.0% of their income into housing, at a commercial mortgage rate of 12.0% and for a 25-year mortgage, it means an affordable house is a house that is valued at Kshs 1.0mn for a single income household and Kshs 2.0 mn for a double income household.

However, the government has developed its own definition of affordable housing as follows;

- Social Level: This category includes individuals with monthly income below Kshs 19,999, which represents 2.6% share of formally employed people in the country,

- Low Cost Level: This category includes individuals with monthly income between Kshs 20,000 – Kshs 49,999, which represents 71.8% share of formally employed people in the country, and,

- Mortgage Gap Level: This category includes individuals with monthly income between Kshs 50,000 – Kshs 149,000, which represents 22.6% share of formally employed people in the country.

Given the above, the initiative targets 97.0% of individuals in the formal sector, which is relatively high and signifies the need to provide affordable homes in a bid to curb Kenya’s housing deficit while also promoting home ownership rates in the country. The table below gives a summary of what constitutes the average sizes and prices of affordable housing units in comparison to the current apartment prices in the Nairobi Metropolitan Area;

|

Cytonn Report: Comparison of Affordable Housing Units and Apartment prices in the NMA |

||||||

|

Typology |

Size (SQM) |

Unit Price (Kshs mn) |

Price per SQM (Kshs) |

Unit Price of a similar apartment (Kshs mn) |

Price per SQM of a similar apartment (Kshs) |

Price Per SQM Difference |

|

1 |

30 |

1.0 |

33,333 |

2.4 |

80,573 |

58.6% |

|

2 |

40 |

2.0 |

50,000 |

3.5 |

87,500 |

42.9% |

|

3 |

60 |

3.0 |

50,000 |

5.5 |

91,667 |

45.5% |

|

Average |

|

|

44,444 |

|

86,580 |

49.0% |

Source: Boma Yangu

As seen above, the government program is 49.0% cheaper than similar apartments. In a bid to attract potential buyers of the affordable housing units, the National Housing Corporation Strategic Plan 2019-2023 outlines different ways in which buyers can be financed in order to purchase the units;

- Social level and low Cost buyers to be financed through the Tenant Purchase Scheme (TPS) for over 25-year’s period with a 3.0% - 7.0% interest,

- The Mortgage Gap buyers to be financed through affordable mortgages in the open market with intervention of the Kenya Mortgage Financing Corporation (KMRC), and,

- Housing loans for individuals living in rural and peri-urban areas capped at 7.0% interest rate to finance personal initiative of constructing housing units in those areas.

It is worth noting that it is not clear how 7.0% financing rates will be achieved since the government itself is borrowing at 14.0% for a 25-year bond, hence not clear how KMRC will be able lend the 7.0% unless it’s assumed that there will be a government subsidy.

Section II: Current State of Housing in Kenya

The National Housing Corporation estimates that the current housing deficit in Kenya stands at 2.0 mn housing units with nearly 61.0% of urban households living in informal settlements. The deficit continues to rise due to fundamental constraints on both the demand and supply side. The need for 250,000 housing units against an estimated supply of 50,000 units every year results into an annual deficit of 200,000 dwelling units. Additionally, KNBS indicates that 83.0% of the existing housing supply is distributed between the high income and upper-middle-income segments, with only 15.0% for the lower middle and the remaining 2.0% for the low-income population. Therefore, only 17.0% of the housing supply goes into serving the lower-middle income segment, which does not achieve the main objective of the initiative. Consequently, Kenya’s home ownership rates continue to lag behind, compared to other African countries such as South Africa and Ghana, as shown below;

Source: Centre for Affordable Housing Africa

Section III: Affordable Housing Initiative in Kenya

Kenya’s affordable housing initiative though not entirely new was launched in 2017 in order to provide citizens with low-cost decent homes while also reducing Kenya's housing deficit and increasing home ownership rates. The government thus implemented strategies to ensure that their objectives were met, such as;

- Closing the annual low-income housing gap by 60.0%,

- Reducing the cost of construction per SQM which in turn lowers cost of housing units,

- Increasing the construction sector contribution to GDP,

- Addressing interest rate and tenure in order to enhance affordability of homes, and,

- Increasing the budgetary allocation, among others.

Moreover, the government came up with various bodies and a platform to help realize its initiative such as;

- Boma Yangu Portal aimed at enhancing transparency of the initiative while also making it easier to track its progress,

- Kenya Mortgage Refinance Company (KMRC) mandated to provide home loans to potential buyers through Primary Mortgage Lenders such as commercial banks and Saccos among others, and,

- National Housing Cooperation (NHC) aimed at implementing policies and overseeing the development of initiated projects.

Despite this, the objectives of the initiative have not been fully met with approximately only 1.0% of the housing units delivered so far. This has been primarily on the back of various setbacks such as inadequate funding. Some of the projects in the pipeline within the Nairobi Metropolitan Area include;

|

Cytonn Report: Summary of Notable Ongoing Affordable Housing Projects in the Nairobi Metropolitan Area |

|||

|

Name |

Developer |

Location |

Number of Units |

|

Pangani Affordable Housing Program |

National Government and Tecnofin Kenya Limited |

Pangani |

1,562 |

|

River Estate Affordable Housing Program |

National Government and Edderman Property Limited |

Ngara |

2,720 |

|

Park Road Affordable Housing Program |

National Housing Corporation |

Ngara |

1,370 |

|

Mukuru Affordable Housing Program |

National Housing Corporation |

Mukuru, Enterprise Road |

15,000 |

Source; Boma Yangu Portal

In addition to the above, there exist various privately initiated affordable housing projects aimed at fast tracking the program such as;

|

Cytonn Report: Private Affordable Housing Projects in the Nairobi Metropolitan Area |

|||

|

Project Name |

Developer |

Location |

Number of Units |

|

Kentek Ventures |

Kentek Venture Limited |

Ruiru |

53,716 |

|

Moke Gardens |

Moke Gardens Real Estate |

Athi River |

30,000 |

|

Habitat Heights |

Afra Holding Limited |

Mavoko |

8,888 |

|

Tsavo Apartments |

Tsavo Real Estate |

Embakasi, Riruta,Thindigua, Roysambu and Rongai |

3,200 |

|

Unity West |

Unity Homes |

Tatu City |

3,000 |

|

RiverView |

Karibu Homes |

Athi River |

561 |

Source: Online Search

The under-supply of housing units continues to remain a challenge owing to factors such as;

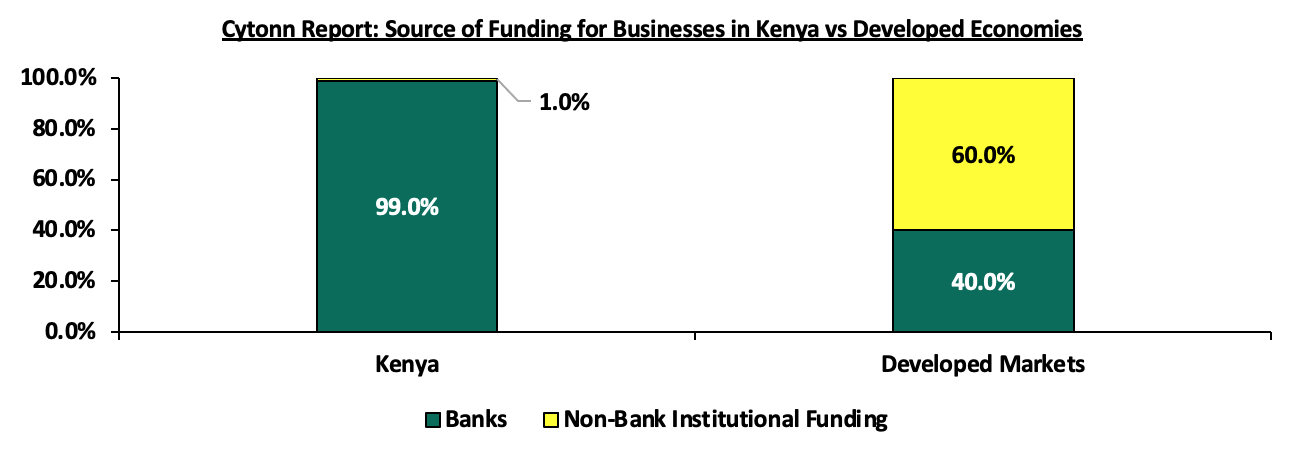

- Inadequate Funding: Assuming the average production cost for a house will be 2.0 mn, to produce 200,000 houses per year will cost the government Kshs. 400.0 billion yet only Kshs 20.3 bn was allocated to the housing sector with the affordable housing initiative only getting Kshs 2.7 bn in the FY’22/23 budget. If the initiative is taken seriously, it would mean allocating 12.1% of the Kshs 3,3 tn budget to housing, and it’s not clear from which budget allocation it would be taken from. Consequently, funding continues to be a major challenge. This has further been fueled by the overreliance on banks for funding by private developers hence making it difficult to raise funds for affordable housing projects, unlike developed countries where capital markets account for majority of funding as highlighted below;

- Increasing cost of construction: According to Integrum 2022 Construction Index, the average cost of construction per SQM in Kenya has risen by 3.6% to Kshs 34,650 in 2022 from Kshs 33,450 in 2021. This is attributable to rise in prices of key construction materials such as cement and steel which in turn increased the cost of development hence projects stalling,

- Rising demographics surpassing the existing supply: Kenya has a high urbanization and population growth rates at 4.0% and 2.3%, respectively, compared to global averages of 1.6% and 1.2%, respectively, as at 2021. This increases the demand for housing amidst an existing under supply,

- Inadequate supply of development land due to high cost of land: There is scarcity of affordable land for development due to rising land prices in urban areas with the average land prices in the NMA coming in at Kshs 130.42 mn as at Q3’2022, a 1.6% increase from Kshs 130.41 mn recorded in Q3’2021,

- Challenging access to construction finance loans due to adverse financial terms: There has been rising loan default rates which has seen financial institutions ask for more collateral from borrowers,

- Ineffectiveness of Public-Private Partnerships (PPPs) for affordable housing development owing to setbacks such as extended PPP timelines and lack of clarity on returns and revenue-sharing, among others,

- Longer transaction timelines: It takes 44 days to register a property in Kenya with the average cost to register the property standing at 5.9% of the property price. This is higher when compared to some African countries like Ghana, which takes 33 days, with the average cost coming in at 4.1%, illustrating the generally slow processes in Kenya,

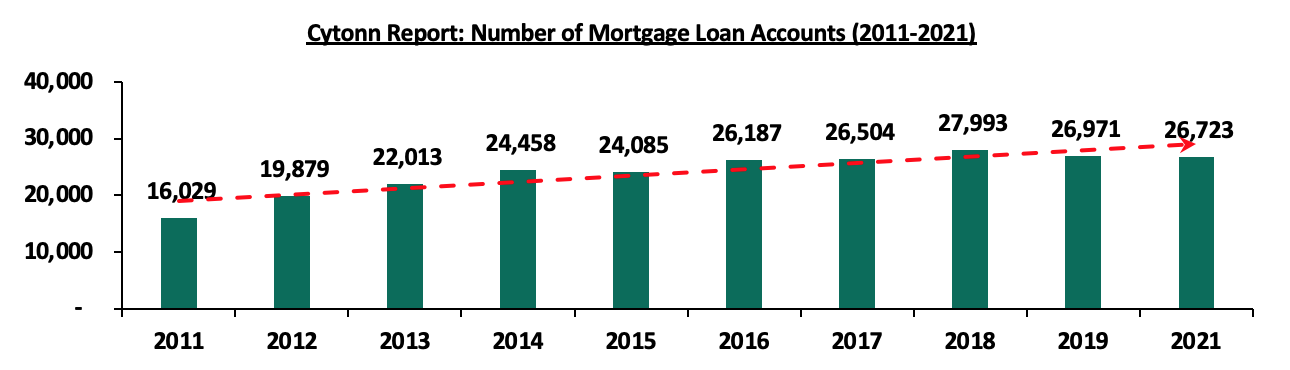

- Unaffordable and inaccessible mortgages for those willing to be homeowners: Accessing mortgage by low income earners is a difficult task, given that mortgages require decent formal employment, a piece of land or property to act as collateral, as well as the rising cost of construction making prices of developments high and in turn causing low mortgage accounts as shown below:

Source: Central Bank of Kenya

Given the above challenges, it is clear that for the affordable housing initiative to prosper, the government needs to address the challenges in a better and strategic way. So far, the President has outlined plans to achieve the initiative, as follows;

- Involvement of private sector developers in the delivery of the projects,

- Creation of mandatory housing funds by parliament to help develop the projects,

- Engagement of pension institutions to help provide mortgages to potential homebuyers, and,

- Release of land by county governments for construction,

Despite the above plans, it is still unclear where the funds will come from, given the high construction costs. In addition, no incentives have been put in place to encourage large numbers of private sector developers to participate in the initiative. Also, the uptake of homes under pension schemes has been low as the number of individuals exiting the scheme increases owing to various setbacks hence it is not clear to which extent the schemes will be of help. In our view, the affordable housing initiative heavily relies on the government’s effectiveness and given the bureaucracy of Kenya’s County governments, it is unclear how the President intends to synchronize the various counties in order to achieve this objective.

Section IV: Analysis of Affordable Housing in Other Countries

In our previous topicals on Affordable Housing in Kenya, Accelerating Funding to Affordable Housing and Affordable Housing in the Nairobi Metropolitan Area (NMA) covered in April 2018, May 2020, and January 2022 respectively, we highlighted several countries such as Singapore, Canada, South Africa, among others, that have achieved notable milestones in affordable housing. This week, we will look at various lessons that we can learn from the aforementioned countries on suitable affordable housing initiatives;

|

Country |

Cytonn Report: Key Take-Outs |

|

Singapore |

|

|

Estonia |

|

|

Canada |

|

|

South Africa |

|

|

Japan |

|

From the case studies, the number of housing units constructed per year in the selected countries is significantly higher than that in Kenya, with only 431 units having been completed in 2021. This is due to a number of factors in these countries, such as long-lasting government initiatives, ready monetization of housing assets, higher government subsidies and, better sector government regulation. However, we note that the average number of units on an annual basis for each of the countries is way below the 200,000 housing units targeted by the Kenyan government, hence calling into question the feasibility of the 200,000 per year target. The table below shows the number of affordable housing units delivered so far in the respective case study countries;

|

Cytonn Report: Summary of number of affordable housing units delivered in 2021 in the respective case study countries |

|

|

Name |

Number of Units Completed |

|

Singapore |

10,400 |

|

Estonia |

6,735 |

|

Canada |

56,207 |

|

South Africa |

6,000 |

|

Average |

7,578 |

N/B: Average done exclusive of Canada

Section V: Recommendations and Conclusion

From the above analysis, we recommend the following to be implemented to accelerate the affordable housing initiative in Kenya;

- Set a housing goal that is credible: It is not clear how the 200,000 units per year was arrived at, but it does not seem achievable looking at what other select countries have done given an average of 7,578 units per year, and these are more advance economies. For the initiative to gain traction, it needs to be taken seriously, and to be taken seriously the target needs to be something that is credible,

- Focus on Demystifying Capital Markets: Lack of funding is the biggest obstacle to provision of housing and for the housing agenda to be achieved, the majority of capital has to come from Capital Markets. As discussed above, it would require about Kshs 400.0 bn per year to meet the government target, yet in the latest financial year only Kshs. 2.7 bn was allocated to the sector, leaving a huge gap. The government should tap into capital market products such as infrastructure bonds, asset-backed securities, and Real Estate Investment Trusts (REITS). These can provide more funding for the ongoing and future housing projects, allow lenders to free up capital to make more loans, and, provide a way to earn income from the mortgage payments made by homeowners. However, these instruments still attract low interests from Kenyan investors due to numerous obstacles to capital formation in our capital market. For example, REITS legislation has been in existence for almost 10 years, and so far there is only one listed REIT,

- Increase Financing By Improving PPP Operation: Currently, the Kenyan government is employing PPPs to undertake the development of infrastructure and affordable housing projects in the country. However, various challenges such as high transaction costs, lengthy procurement processes, bureaucracy, and lack of focus towards public benefits hamper their optimal operation, leading to slowed delivery of projects. The government should address these challenges by increasing budgetary support for PPPs, decentralizing PPPs to the county level, and continually streamlining the Public Private Partnerships (PPP) Bill 2021,

- Reduce Construction Costs Through Innovation: Housing developers, contractors, and other industry participants should seize the chances for the development of affordable housing through technologies that implement standardized building designs, components, and alternative materials such as prefabricated concrete panels to make a difference in the housing situation in Kenya. By using these innovative methods, developers will increase the affordability of units through reduced costs, and further speed up the completion of construction projects. Canada has been using modular construction technology, which allows for speedier prefabrication of homes in a factory setting. This technology has less impact on the environment, can be applied in any type of modern construction, and reduces the cost of construction by reducing the amount of time and labor required on-site,

- Create a Better Quality-Control Policy Framework: There is need for a policy framework to ensure that developers comply with sustainable standards and that the units are affordable for low and middle-income households. There is also need for a policy framework to guide the standards the affordable housing units should achieve in terms of design, size of units, location and long-term maintenance. This should also ensure that there is no deterioration of housing standards over time and that those developers do not abandon or compromise the quality of housing they provide to low-income earners. In Japan, there are three important public systems related to sustainable housing design, namely the Housing Performance Indication System (HPIS), long-life quality housing (LQH) certification, and Comprehensive Assessment System for Built Environment Efficiency (CASBEE) for detached houses. The Japanese government has established a number of independent third-party organizations to monitor and audit compliance with the systems. The government also provides financial incentives to developers who comply, such as reduced interest rates on loans for affordable housing projects,

- Increase Serviced Land for Development: Affordable housing projects require land which is serviced with infrastructure and in economically viable. There is therefore need for the government to set up measures to increase the supply of serviced land, through increased investment in physical and social infrastructure especially in still developing areas of the country. The government should also encourage the construction of infrastructure by private developers through incentives such as rebates. The South African government has increased available serviced land for government housing projects by making it easier for municipalities to rezone land for housing purposes, and by establishing a fund to finance the infrastructure necessary to develop serviced land through the National Housing Development Agency (NHDA),

- Devolve the Management of Housing Assets: To ensure that even residents can easily acquire and maintain homes, the government should concentrate more on creating an environment that is favorable to owners and investors, by promoting management of housing through the private sector. This can reduce the burden on the government from continually maintaining housing units once developed, and diverting the funds towards initiation of other projects. In Estonia, homeowners are responsible for their apartments, but apartment associations take active role in the management and renovation process of the building and the living environment surrounding. This is through a board that oversees the maintenance of the building, whose decisions are passed by majority vote, thereby ensuring that all residents have access to essential amenities,

- Increase Stakeholder Engagement to Ease Challenges with Relocation: There should be more public participation and consultations to avoid relocation resistance by tenants to the new houses. The government should develop a policy to support tenant relocation to the subject affordable housing developments, which could help to ensure that the process is conducted in a more transparent and efficient manner. The government should also set up a fund to help with costs incurred by the target beneficiaries, which will offset the challenges associated with relocation and provide for a smoother transition for those relocated to the new houses. In South Africa, the Department of Human Settlements (DHS) manages the process of moving tenants to new government housing. The DHS engages with civic organizations and academia to share good practice, exchange knowledge and disseminate information regarding the access of housing for South African citizens. The department is also responsible for identifying accommodation for tenants, as well as coordinating the move itself, and,

- Creation of a Housing Finance Company to finance the supply side of Real Estate development, the same way we have KMRC to finance the demand side through provision of mortgages for potential home buyers.

In conclusion, the Kenyan government's affordable housing initiative is a welcome and necessary intervention in the provision of adequate housing for all Kenyan citizens. The initiative, if successful, will go a long way in addressing the housing crisis in the country and improving the lives of many Kenyans, even as it will create many jobs. Our assessment finds that the initiative is off to a good start, with a number of projects already underway. We expect that the projects undertaken in the initiative will enhance development in all sectors of the economy as the country further develops. However, we believe that 200,000 housing units annually is way ambitious given the existing challenges; put simply we don’t see a path to achieving that goal without radical action to remove the systemic obstacles to capital formation. As such, the government should execute comprehensive solutions to these challenges by taking lessons from other affordable housing initiatives, thereby allowing the affordable housing initiative to at least keep up with the other countries.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.