Affordable Housing in Kenya, & Cytonn Weekly #16/2018

By Cytonn Research Team, Apr 22, 2018

Executive Summary

Fixed Income

T-bills were oversubscribed during the week with a subscription rate of 162.5%, up from a subscription rate of 87.1% the previous week. Yields on the 91, 182 and 364-day papers remained unchanged at 8.0%, 10.3% and 11.1%, respectively. Kenya’s value of horticulture exports increased by 13.3% in 2017 to Kshs 115.0 bn, from Kshs 101.5 bn in 2016, driven by further compliance of Kenyan produce with requirements from main export markets such as the Eurozone;

Equities

During the week, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 4.5%, 2.5% and 3.6%, respectively. For the last twelve-months (LTM), NASI, NSE 20 and NSE 25 have gained 36.6%, 17.8% and 34.9%, respectively. SBM Kenya completed the acquisition of Chase Bank Limited that was under receivership, with 75% of moratorium deposits and the majority of staff and branches transferred to SBM Bank Kenya Ltd;

Private Equity

In the FinTech space, Tala, an international mobile lending firm operating in Kenya, Tanzania, USA and the Philippines, raised Kshs 6.5 bn (USD 64.8 mn) in Series C funding. The funding constitutes of Kshs 1.5 bn (USD 15.0 mn) in debt funding and Kshs 5.0 bn (USD 49.9 mn) in equity funding;

Real Estate

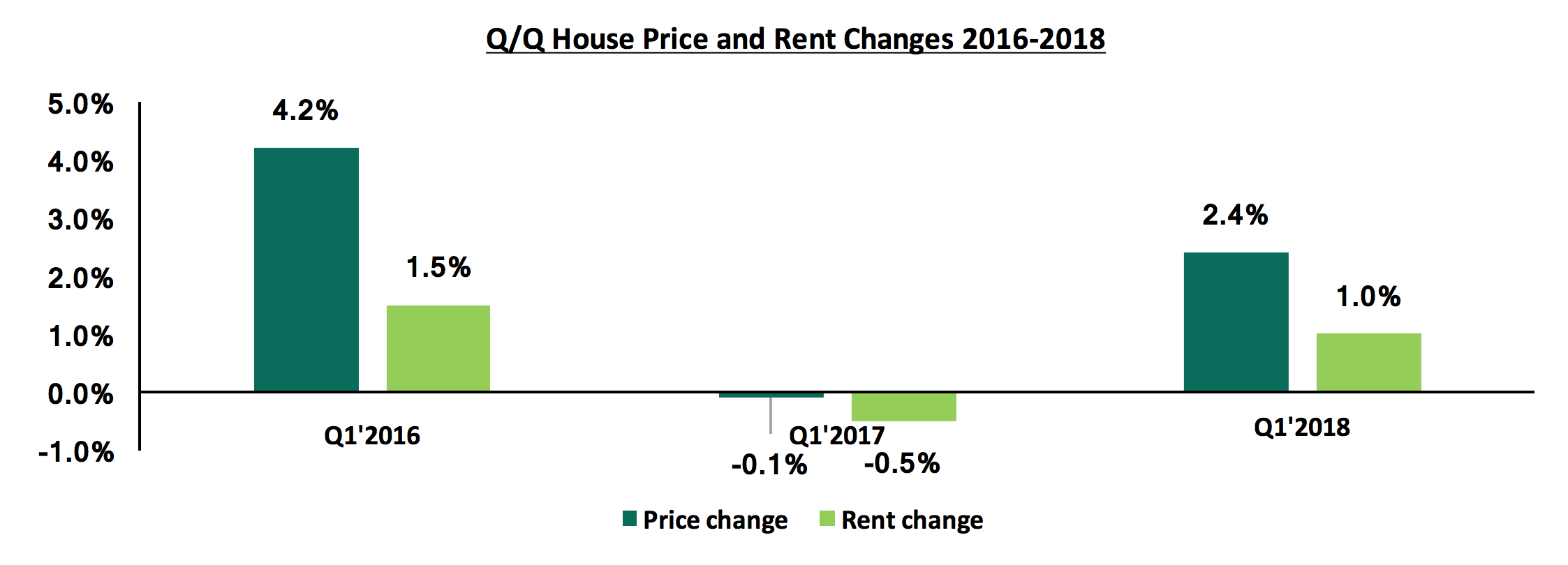

During the week, Hass Consult released their Q1’2018 Land and House Price Indices Report, highlighting that the real estate market performance in Q1’2018 is recovering as a result of conclusion of the electioneering period that slowed activity in the sector. The asking prices for residential property sales increased by 2.4% during the quarter, asking rents increased by 1.0% over the same period, while Land recorded an overall 1.4% increase in asking prices during the quarter. High Court Judge Wilfrida Okwany suspended the Ministry of Lands’ notice published on April 4th, 2018, discontinuing manual transactions at both the Nairobi and Central Registries to pave way for online transactions until May 2nd, 2018 when the case filed by the Law Society of Kenya (LSK) to stop the automation of land transactions will be heard;

Focus of the Week

The Kenyan Government launched the ‘The Big Four’ Agenda for economic development on 12th December 2017. The four agendas include (i) ensuring food security, (ii) provision of affordable housing, (iii) supporting the manufacturing sector, and (iv) provision of affordable healthcare. Subsequent to this, we have seen the government put in place various efforts towards the realization of some these key pillars and, this week, we examine the affordable housing initiative by the government with the aim of establishing the viability of the government’s project and see what needs to be done for it to be a reality;

- Cytonn Real Estate, our development affiliate, shall break ground for the RiverRun Estates, a comprehensive Kshs.15 bn master-plan development located in Ruiru, Kiambu County on Monday 23rd, April 2018 at 8:30 AM at the site. H.E. Hon Governor of Kiambu County, Ferdinand Waititu will be the guest of honor. The development is estimated to provide over 2,200 jobs and deliver 1,150 homes when complete. Phase 1 is already over 30% sold and early buyers have enjoyed up to 45% capital appreciation. To attend, RSVP here.

- Cytonn Foundation, the Corporate Social Responsibility (CSR) arm of Cytonn Investments, held the Cytonn Entrepreneurs Hub Discussion Forum that brought together a panel of distinguished entrepreneurs to share their perspective of what it takes to start, run and grow a business. The panel comprised of Simon Kabu, - Founder & CEO of Bonfire Adventures, Suzie Wokabi - Founder & CEO of Suzie Beauty, Irene Wanjiku - Managing Director of REXE Roofing and Ben Kiruthi, an award winning, international and destination wedding photographer. The panel discussion was moderated by Bonney Tunya -CNBC Africa’s East Africa Anchor and a financial journalist. See event note here.

- Our Investments Analyst, Stephanie Onchwati, discussed the Kenyan banking sector and the operating environment. Watch Stephanie on CNBC here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com or book through this link Wealth Management Training. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: Full Stack Software Engineer, Application Security Engineer and Distribution and Unit Managers for Nakuru and Kisumu, among others. Visit the Careers section at Cytonn’s Website to apply

During the week, T-bills were oversubscribed recording a subscription rate of 162.5%, up from a subscription rate of 87.1% the previous week, due to improved liquidity mainly as a result of government payments during the week. The subscription rates for the 91, 182 and 364-day papers came in at 129.3%, 179.5%, and 158.6% compared to 43.9%, 69.5%, and 121.9%, respectively, the previous week. Yields on the 91, 182 and 364-day papers remained unchanged at 8.0%, 10.3% and 11.1%, respectively. The acceptance rate for T-bills declined to 81.4% from 99.4% last week, with the government accepting a total of Kshs 20.8 bn of the Kshs 20.9 bn worth of bids received, against the Kshs 24.0 bn on offer. The government is currently 17.7% ahead of its domestic borrowing target for the current fiscal year, having borrowed Kshs 283.0 bn, against a target of Kshs 240.4 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 297.6 bn).

Last week, the Kenyan Government re-opened 2 bonds, FXD 1/2008/15 and FXD 1/2018/20, with 4.9-years and 19.9-years to maturity, and coupons of 12.5% and 13.2%, respectively, in a bid to raise Kshs 40.0 bn for budgetary support. Given that (i) the government is currently 17.7% ahead of its pro-rated domestic borrowing target, and has collected 72.9% of its total foreign borrowing target, which is 90.2% of its pro-rated target, and (ii) the KRA is not significantly behind target, having collected 91.2% of its half year 2017/18 target, we don’t expect the government to come under pressure to borrow during the current fiscal year, neither do we expect upward pressure on interest rates in the same period. These Treasury bonds are currently trading at yields of 12.1% and 13.1% in the secondary market, respectively. As such we see the average yield of the bonds coming in between 12.0% and 12.3% for the FXD 1/2008/15 and between 13.0% and 13.3% for the FXD 1/2018/20.

Liquidity levels improved in the money market on account of government payments, as indicated by the decline in the average interbank rate to 4.6%, from 6.1% recorded the previous week. There was a decrease in the average volumes traded in the interbank market by 36.6% to Kshs 14.4 bn, from Kshs 22.7 bn the previous week.

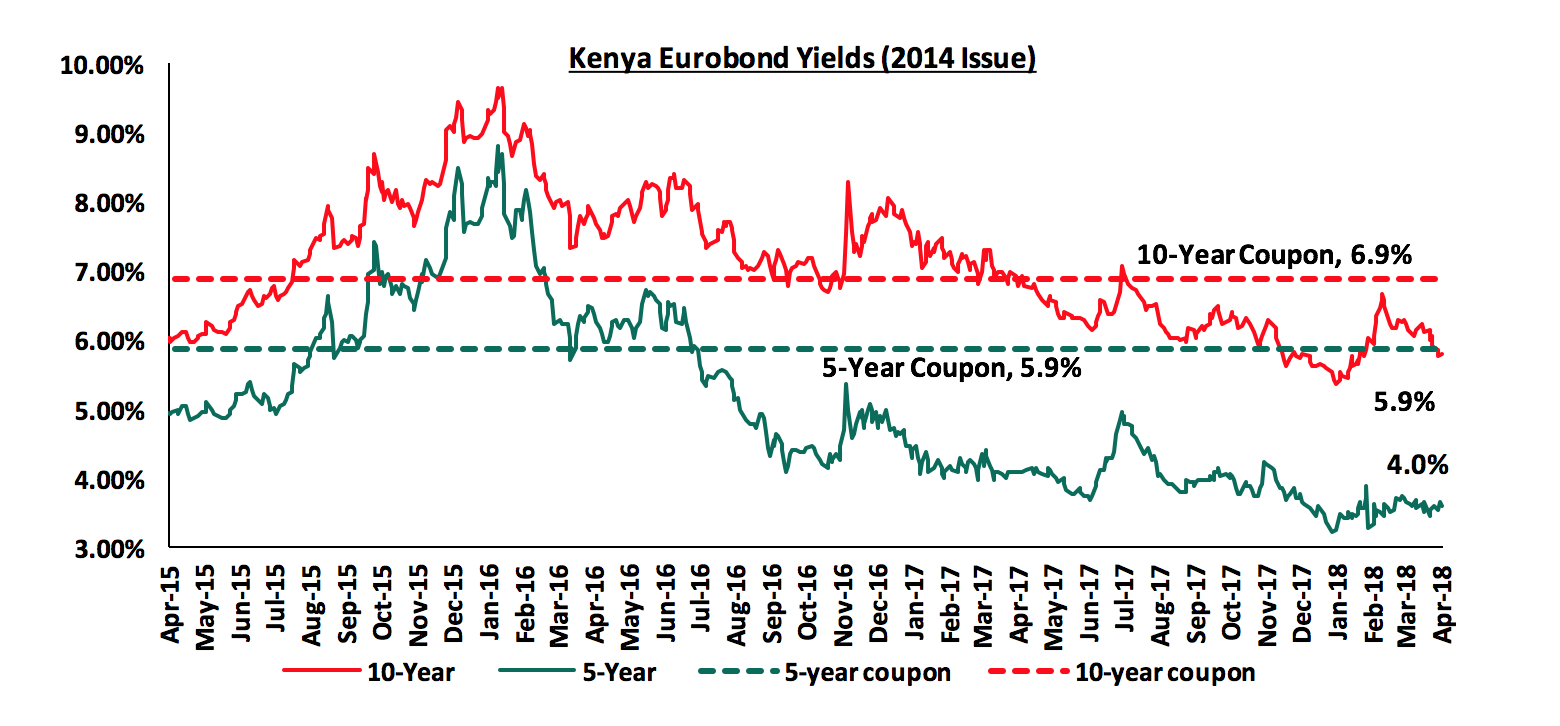

According to Bloomberg, the yield on the 5-year Eurobond issued in June 2014 increased by 40 bps to 4.0% from 3.6%, while the yield on the 10-year Eurobond increased by 10 bps to 5.9% from 5.8% the previous week. According to the CBK, the rise in yields was as a result of varying market sentiments from foreign investors. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.8% points and 3.7% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country. Key to note is that these bonds currently have 1.2 and 6.2-years to maturity for the 5-year and 10-year bonds respectively.

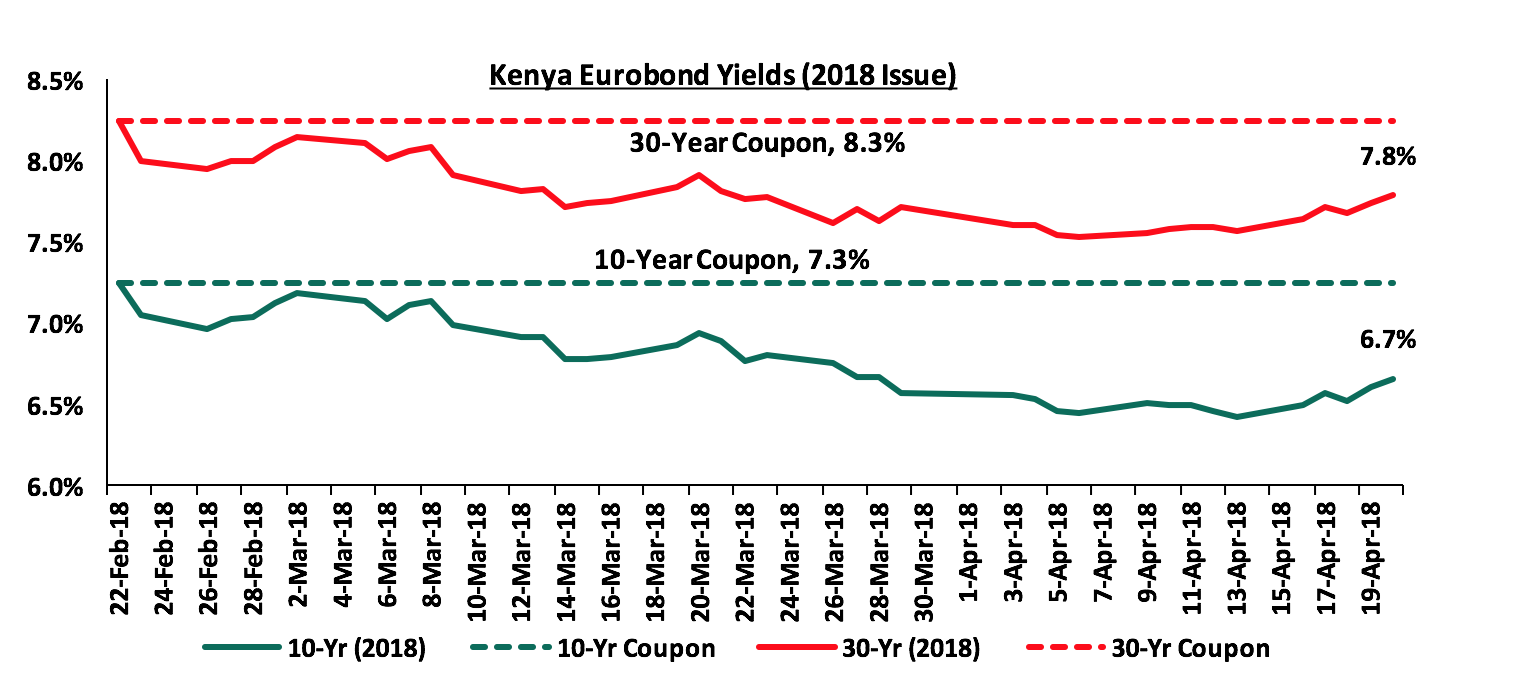

For the February 2018 Eurobond issue, during the week, the yields on the 10-year and 30-year Eurobonds increased by 30 bps and 20 bps to 6.7% and 7.8 from 6.4% and 7.6% the previous week, respectively. Since the issue date, yields on the 10-year and 30-year Eurobonds have declined by 0.6% points and 0.5% points, respectively, indicating foreign investor confidence in Kenya’s macro-economic prospects.

The Kenya Shilling appreciated by 0.6% against the US Dollar during the week, to close at Kshs 100.3 from Kshs 100.9 the previous week, the highest the Kenya Shilling has been to the USD since July 2015, driven by horticulture export inflows. On a YTD basis, the shilling has gained 2.8% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by;

- Weakening of the USD in the global markets as indicated by the US Dollar Index, which shed 9.9% in 2017, and has shed 2.0% YTD, as the Euro and the Sterling Pound continue to strengthen against the USD with the continued recovery of the Eurozone,

- Stronger horticulture export inflows driven by increasing production and improving global prices. Kenya’s value of horticulture exports increased by 13.3% in 2017 to Kshs 115.0 bn from Kshs 101.5 bn in 2016, driven by compliance of Kenyan produce with requirements from main export markets such as the Eurozone. Cut flowers, which contribute 70.0% of total horticulture export earnings, increased by 16.1% to Kshs 82.2 bn from Kshs 70.8 bn in the same periods,

- Improving diaspora remittances, which increased by 47.5% to USD 210.4 mn in February 2018 from USD 142.7 mn in February 2017, driven by continued marketing of Kenya as an attractive investment destination for Kenyans in the diaspora, and,

- High forex reserves, currently at USD 9.5 bn (equivalent to 6.4 months of import cover), up from USD 8.8 bn last week, and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018, after which a new facility will be discussed.

Rates in the fixed income market have remained stable as the government rejects expensive bids. The government is under no pressure to borrow for this fiscal year due to: (i) they are currently ahead of their domestic borrowing target by 17.7%, (ii) they have met 72.9% of their total foreign borrowing target and 91.2% of its pro-rated target for the current fiscal year, and (iii) the KRA is not significantly behind target in revenue collection, and therefore we expect interest rates to remain stable. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 losing 4.5%, 2.5% and 3.6%, respectively, taking their YTD performance to 6.7%, 0.0% and 11.4%, for NASI, NSE 20 and NSE 25, respectively. This week’s performance was driven by losses in Equity Group, Safaricom Ltd and BAT that declined by 8.1%, 6.5%, and 6.3%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have gained 36.6%, 17.8%, and 34.9%, respectively.

Equities turnover increased by 30.8% to USD 41.2 mn, from USD 31.5 mn the previous week. We expect the market to remain stable supported by positive investor sentiment this year, as investors take advantage of the attractive stock valuations in select counters.

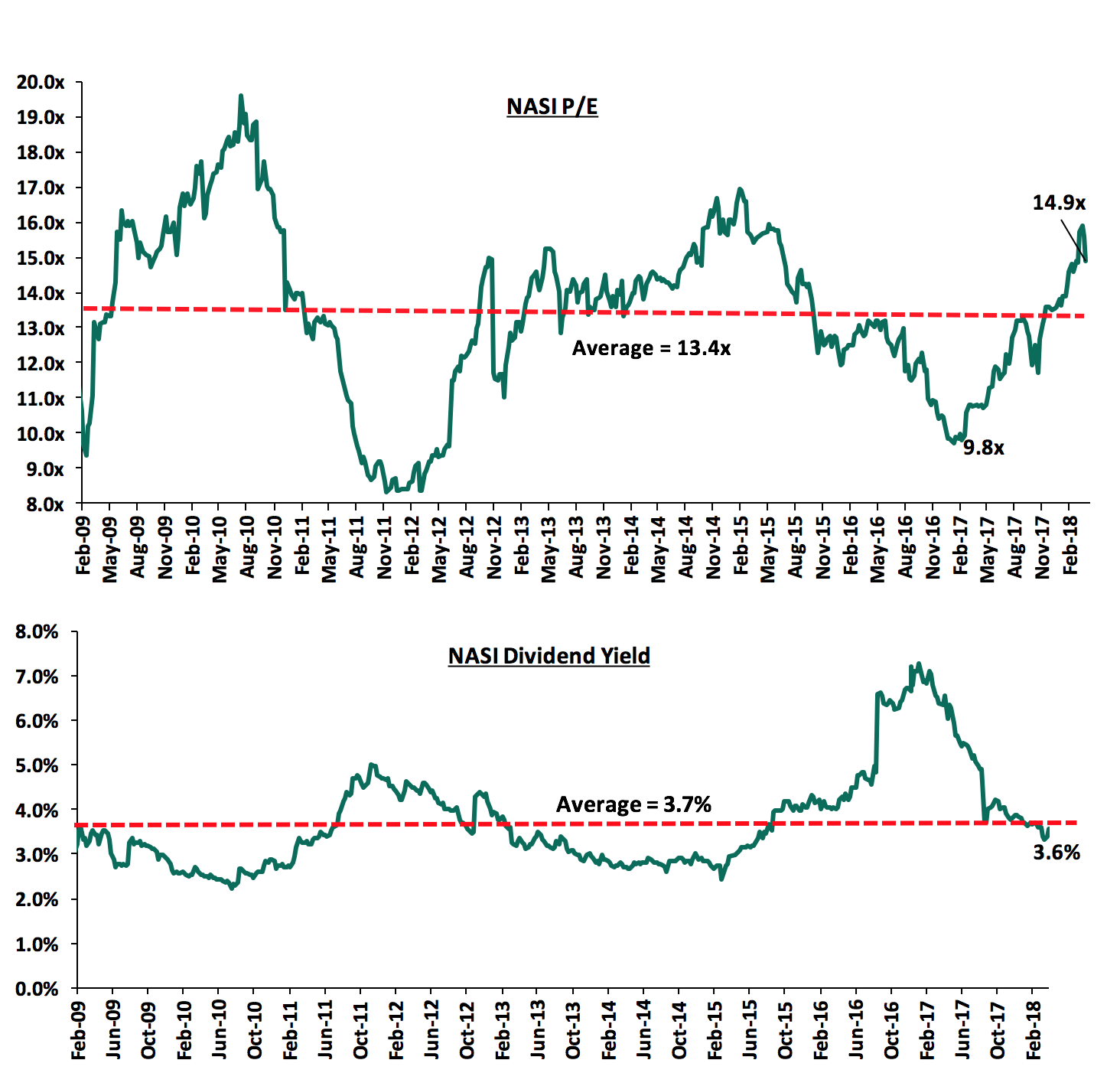

The market is currently trading at a price to earnings ratio (P/E) of 14.9x, which is 11.2% above the historical average of 13.4x, and a dividend yield of 3.6%, lower than the historical average of 3.7%. The current P/E valuation of 14.9x is 52.0% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 79.5% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

During the week, SBM Bank Kenya Limited completed the acquisition of certain assets and liabilities of Chase Bank Limited that was under receivership. The agreement for the acquisition between the Central Bank of Kenya (CBK), Kenya Deposit Insurance Corporation (KDIC) and SBM Bank Kenya provides that there will be a transfer of 75% of the value of all deposits currently under moratorium at Chase Bank Limited to SBM Kenya Ltd. The deal will also see the transfer of a majority of staff and branches of Chase Bank Limited to SBM Bank Kenya Limited. The remaining 25% of deposit value will remain with Chase Bank Limited. The 75% of moratorium deposits that will be transferred to SBM Bank is subject to the following conditions:

- 25% of each transferred deposit will be held in a current account with SBM, with no interest payable and unrestricted withdrawal,

- 25% will be held in a savings account with SBM Bank, at a deposit interest rate of 6.7% per annum, with unrestricted withdrawal, and,

- the remainder of each transferred deposit will be held in a fixed deposit account at an interest rate of 6.7% per annum. The deposits will mature in tranches, with a third maturing every year to a maximum of three years for those held in the fixed deposit account. Non-moratorium depositors will also be transferred to SBM Bank and will continue to have unrestricted access to their deposits.

The completion of the acquisition is positive for the Kenyan banking sector because this is the first time in Kenya that a bank has been successfully brought out of receivership. Given that the transaction value and stake are yet to be disclosed, we shall be updating our transactions multiples once more details of the acquisition are disclosed. The recent bank acquisitions are as highlighted below:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

DTB Kenya |

Habib Bank Limited Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar - 2017 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov - 2016 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun - 2016 |

|

I&M Holdings |

Giro Commercial Bank |

2.9 |

100.0% |

5.0 |

1.7x |

Jun - 2016 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar - 2015 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul - 2014 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov - 2013 |

|

Average |

80.3% |

1.8x |

KCB Group received USD 80 mn of the USD 100 mn long-term line of credit advanced by the African Development Bank (AFDB). The credit is to be used to facilitate financing to Micro, Small and Medium Enterprises (MSMEs) as well as deserving corporate businesses across the agribusiness value chain and the energy sector. Banks have been receiving funding from external development financing institutions to facilitate onward lending to MSMEs. Victoria Commercial Bank (VCB) also received USD 5 mn of Subordinated tier 2 Compliant loan from Swedfund, a Swedish development finance institution, to boost its capital base, which will improve the bank’s lending capacity to Small and Medium Enterprises (SMEs). The time horizon mismatch between issued loans, that tend to be relatively long term, and deposits that tend to be of a relatively shorter term, results in an asset liability mismatch by tenor, and to balance this out, banks have been obtaining attractively priced credit facilities from external development finance institutions. Development finance institutions have been lending to banking institutions in Kenya, especially those engaged in providing finance to MSMEs, as it contributes to societal impact whilst providing attractive financial returns. Previous issues such as that of the International Finance Corporation (IFC) to Co-operative bank were priced at The London Inter-Bank Offered rate (LIBOR), plus a premium, which was unspecified. The current 12-month LIBOR rate is at 2.8%.

Below is a summary of credit extended to banking institutions in the country in 2018:

|

|

Issuer |

Bank |

Amount of Loan (Kshs bn) |

Term of Credit |

|

1 |

IFC |

Cooperative Bank |

15.2 |

7-years |

|

2 |

Africa Development Bank |

Kenya Commercial Bank |

10.4 |

Not specified |

|

3 |

SwedFund |

Victoria Commercial Bank |

0.5 |

Not specified |

|

|

Total |

|

26.1 |

|

There has been a general increase in the size of the loans disbursed following the enactment of the Banking (Act) Amendment law. According to the Central bank the average size of the loans disbursed rose to Kshs 600,000 from Kshs 400,000. This could be an indicator that the quality of the loans disbursed could be much better as there are a few people who qualify for the loans. The downside to this is that the people who much need the loans have been locked out and this is reflected in the private sector credit growth that has slowed to 2.1% compared to the 5-year average of 14%. There has been lots of pressure to repeal or amend the Interest rate cap law, as it has not achieved the intended outcome of making credit affordable. A repeal of the law would inject some much-needed credit growth stimulus into the private sector. For more on the effects of the interest rate cap, see our Update on the Interest Rate Cap Effects on Credit Growth.

Below is our Equities Universe of Coverage:

|

all prices in Kshs unless stated otherwise |

||||||||||||

|

No. |

Company |

Price as at 13/04/18 |

Price as at 20/04/18 |

w/w Change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/ (Downside)** |

P/TBv Multiple |

||

|

1. |

NIC Group*** |

44.0 |

42.5 |

(3.4%) |

17.2% |

60.4% |

61.6 |

2.8% |

47.8% |

0.8x |

||

|

2. |

Union Bank Plc |

6.3 |

6.1 |

(2.4%) |

(21.8%) |

40.6% |

8.2 |

0.0% |

33.6% |

0.7x |

||

|

3. |

Zenith Bank |

26.1 |

27.0 |

3.4% |

5.3% |

86.1% |

33.3 |

10.0% |

33.4% |

1.4x |

||

|

4. |

Diamond Trust Bank |

210.0 |

212.0 |

1.0% |

10.4% |

68.3% |

272.9 |

1.2% |

30.0% |

1.2x |

||

|

5. |

Ghana Commercial |

6.5 |

6.3 |

(3.1%) |

24.6% |

21.0% |

7.7 |

6.0% |

28.7% |

1.7x |

||

|

6. |

KCB Group |

52.5 |

52.0 |

(1.0%) |

21.6% |

52.9% |

63.7 |

5.8% |

28.2% |

1.6x |

||

|

7. |

CRDB |

170.0 |

170.0 |

0.0% |

6.3% |

(8.1%) |

207.7 |

5.7% |

27.9% |

0.7x |

||

|

8. |

I&M Holdings |

129.0 |

125.0 |

(3.1%) |

(1.6%) |

38.9% |

151.2 |

2.8% |

23.8% |

1.4x |

||

|

9. |

Stanbic Bank Uganda |

31.0 |

31.0 |

0.0% |

13.8% |

19.2% |

36.3 |

0.0% |

17.0% |

2.0x |

||

|

10. |

Co-operative Bank |

19.3 |

18.5 |

(3.9%) |

15.6% |

60.9% |

20.5 |

4.3% |

15.2% |

1.7x |

||

|

11. |

National Bank |

8.3 |

7.5 |

(9.1%) |

(19.8%) |

34.2% |

8.6 |

0.0% |

14.6% |

0.5x |

||

|

12. |

Barclays Bank |

13.0 |

13.0 |

(0.4%) |

34.9% |

61.9% |

13.7 |

7.7% |

13.5% |

1.6x |

||

|

13. |

Equity Group |

55.5 |

51.0 |

(8.1%) |

28.3% |

55.7% |

54.3 |

3.9% |

10.5% |

2.5x |

||

|

14. |

Bank of Kigali |

290.0 |

289.0 |

(0.3%) |

(3.7%) |

18.0% |

299.9 |

4.3% |

8.1% |

1.7x |

||

|

15. |

UBA Bank |

10.7 |

11.2 |

5.2% |

8.7% |

115.4% |

10.7 |

7.6% |

3.1% |

1.0x |

||

|

16. |

Stanbic Holdings |

91.0 |

90.0 |

(1.1%) |

11.1% |

55.2% |

87.1 |

5.8% |

2.6% |

1.1x |

||

|

17. |

Ecobank GH |

11.3 |

11.3 |

0.5% |

48.8% |

54.7% |

10.7 |

7.3% |

2.2% |

4.0x |

||

|

18. |

HF Group*** |

12.1 |

11.9 |

(1.7%) |

14.4% |

17.8% |

11.0 |

2.9% |

(4.8%) |

0.4x |

||

|

19. |

Bank of Baroda |

135.0 |

140.0 |

3.7% |

23.9% |

27.3% |

130.6 |

0.0% |

(6.7%) |

1.1x |

||

|

20. |

SBM Holdings |

7.7 |

7.6 |

(1.8%) |

1.3% |

(1.8%) |

6.6 |

5.3% |

(8.4%) |

0.9x |

||

|

21. |

Access Bank |

11.5 |

11.2 |

(2.2%) |

7.2% |

78.6% |

9.5 |

5.8% |

(9.4%) |

0.8x |

||

|

22. |

Guaranty Trust Bank |

44.1 |

44.9 |

1.8% |

10.1% |

80.1% |

37.2 |

6.0% |

(11.0%) |

2.7x |

||

|

23. |

Standard Chartered KE |

240.0 |

236.0 |

(1.7%) |

13.5% |

18.0% |

192.6 |

7.2% |

(11.2%) |

1.9x |

||

|

24. |

Stanbic IBTC Holdings |

49.0 |

49.0 |

0.0% |

18.1% |

151.3% |

37.0 |

1.0% |

(23.4%) |

2.9x |

||

|

25. |

CAL Bank |

1.9 |

1.9 |

0.0% |

71.3% |

208.3% |

1.4 |

0.0% |

(24.3%) |

1.2x |

||

|

26. |

Stanchart GH |

35.1 |

35.1 |

0.1% |

39.1% |

122.0% |

19.5 |

2.8% |

(41.8%) |

5.0x |

||

|

27. |

FBN Holdings |

12.3 |

12.9 |

4.9% |

46.0% |

256.0% |

6.6 |

1.6% |

(46.8%) |

0.7x |

||

|

28. |

Ecobank Transnational |

18.4 |

19.5 |

6.0% |

14.7% |

164.2% |

9.3 |

3.1% |

(49.3%) |

0.9x |

||

|

*Target Price as per Cytonn Analyst estimates |

|

|

|

|||||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

|

|

|

|||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder |

|

|

|

|||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings growth this year, we are “POSITIVE” for investors with a long-term investment horizon.

Tala, a mobile-based lending firm headquartered in California has raised Kshs 6.5 bn (USD 64.8 mn) in Series C funding (the third round of capital injection from external investors). Tala has operations in Kenya, Tanzania, USA and the Philippines. The funding is to be spent on product development and personnel development ahead of the planned product launch in Mexico and India later this year. Tala raised Kshs 1.0 bn (USD 10.0 mn) in Series A funding on Sep 3rd, 2015, Kshs 3.0 bn (USD 29.9 mn) in Series B funding on Feb 22nd, 2017, bringing the total amount raised since it began its operations to Kshs 10.5 bn (USD 104.7 mn). Tala’s latest funding comprised of Kshs 5.0 bn (USD 49.9 mn) in equity funding and Kshs 1.5 bn (USD 15.0 mn) debt. Tala offers loan amounts between Kshs 1,000.0 and Kshs 50,000.0, at weekly and monthly interest rates of 11.0% and 15.0%, respectively. So far, the firm has disbursed Kshs 30.0 bn (USD 299.9 mn) to 1.3 mn borrowers in Kenya, Tanzania and the Philippines, with Kenya taking up Kshs 27.9 bn (USD 278.2 mn), 93.0% of the total loans disbursed. Tala is the third mobile app-based lender to raise fresh funds to expand operations in Kenya after (i) Jumo raised Kshs 300 bn (USD 3.0 mn), and (ii) Branch International recently raised Kshs 7.0 bn (USD 697.9 mn. The continued increase in investments and funding of microfinance institutions in Kenya is in a bid to grow the institutions loan books since their loans are easily accessible compared to banks, by use of mobile phones and because their credit standards are less stringent. The private sector credit growth remains below the CBK target of 12.0%- 15.0%, having come in at 2.1% in February 2018. Despite the interest rate cap and reduced lending, bank funding still accounts for 95.0% of business funding in Kenya compared to 40.0% in developed markets. This highlights the need to diversify funding sources and enable borrowers to tap into alternative avenues of funding that are more flexible compared to loans from commercial banks.

Private equity investments in Africa remain robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic growth projections in Sub Saharan Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Saharan Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

During the week, Hass Consult released their Q1’2018 Land and House Price Indices Report. According to the report, the real estate market performance in Q1’2018 recorded an improvement following the conclusion of the prolonged electioneering period. The asking prices for residential property sales increased by 2.4% during the quarter, while the asking rents also increased by 1.0% during the same period. Land recorded an overall 1.4% q/q increase in asking prices, with satellite towns recording a 2.4% q/q growth in land prices, outperforming Nairobi suburbs, which recorded a 0.2% q/q increase, indicating that in the land sector, the pockets of value lie mainly in satellite towns.

In terms of specific locations, for house prices the performance was as below:

- Apartments: Lang’ata was the best performing suburb recording sales price appreciation of 2.5% q/q, attributed to its proximity to CBD and affordability compared to the high-end units in its neighbourhood such as Karen. Lavington was the worst performing with asking prices declining by 1.5% q/q, attributable to the increase in supply of apartments in the area and its environs,

- Detached Housing Units: Eastleigh was the best performing suburb with a sales price appreciation of 2.1% q/q attributable to the high demand for affordable housing in the area. Lavington was the worst performing suburb for detached houses with asking prices declining by 1.5% q/q attributable to the rezoning of the area allowing for high rise developments, hence no longer being attractive for buyers seeking detached units, due to the increase in congestion,

- Satellite Towns: Ngong was the best performing satellite town for both detached units and apartments, recording a sales price appreciation of 3.7% q/q and 2.8% q/q, respectively, attributable to the ongoing infrastructural developments in the area such as the expansion of Ngong Road, the Southern Bypass, and the Ngong-Kimuka SGR Station, all of which are opening up the area thereby driving demand for real estate. Juja was the worst performing town in the apartments segment with asking sales price declining by 0.3% q/q while Syokimau was the worst performing in the detached houses segment with asking sales price declining by 0.4% q/q. For both towns, the slowdown in appreciation rates was attributable to low demand due to their locations in the outskirts of Nairobi that are unattractive to potential clients,

- Performance by Typology: semi-detached units were the best performing typology in the market, recording a sale price appreciation of 2.8% q/q in Q1’2018. In Q4’2017, the typology recorded a sales price appreciation of 3.4% q/q compared to a decline of 1.1% q/q for apartments, and an appreciation of 0.7% q/q for detached units. This is different from the norm where typically apartments have been the best performing typology. The higher performance of the semi-detached units is attributed to the high demand for semi-detached units by the increasing upper middle-income segment against low supply for the same, as developers focus on detached units for the high-end segment and apartments for the middle-income segment.

The rental markets performance was in tandem with the sales market with asking rentals across all property types increasing by 1.0% q/q. The performance by locations and typologies is as covered below:

- Apartments: The best performing suburb was Langata which recorded a 4.7% q/q increase in the rental prices attributed to its proximity to Central Business District (CBD) and affordability compared to the high-end units in its neighbourhood such as Karen, with the worst performing submarkets being Lavington and Upperhill, whose asking rental price declined by 1.7%, attributable to increased supply and growing commercial nature of Upperhill,

- Detached Housing Units: Ridgeways was the best performing submarket at a 1.5% increase in asking rents during the quarter attributable to the exclusivity guaranteed by its location, its proximity to amenities such as ridgeways mall and proximity to CBD. The worst performing submarket was Kitisuru, which recorded a 1.5% q/q decline in asking rental rates owing to its high prices hence low affordability translating to low demand,

- Satellite Towns: For apartments, the best performing town was Kitengela, which recorded 2.9% increase in asking rental price. This is attributed to the town hosting the population working in Kajiado county. The worst performing town was Kiambu which recorded the highest rental decline of 1.5%, for detached units, Tigoni, was the best performing town recording 1.9% q/q, while Kiserian was the worst performing town recording a 3.5% decline in asking rental rates attributable to its location in the outskirts of Nairobi that is unattractive to potential clients.

The table below summarises the Q1’2018 performance:

|

Q1'2018 Performance According to Typologies |

||

|

Typology |

Q/Q Change in Asking Sale Price |

Q/Q Change in Asking Rental Price |

|

Semi Detached Houses |

2.8% |

3.0% |

|

Detached Houses |

2.7% |

0.0% |

|

Apartment |

0.6% |

1.4% |

|

Average |

2.0% |

1.5% |

|

Semi-detached units outperformed other typologies in the market, recording an asking sale and rental price appreciation of 2.8% q/q and 3.0% q/q, respectively, in Q1’2018 |

||

Source: Hass Consult Research

These findings are in tandem with our Q1’2018 research, in which we noted that the market recorded a 1.3%-point increase in price per SQM q/q, indicating a recovery of the market from the effect that the electioneering period had in 2017. We expect the market performance to continue on an upward trend in 2018 given the strong fundamentals that continue to support the real estate sector, such as: (i) positive demographic trends such as population growth rate and urbanisation rate at 2.6% and 4.4% p.a against global averages of 1.2% and 2.1% p.a, respectively, that drive demand for housing, (ii) increased investor appetite due to the constantly growing housing deficit of 200,000 units p.a, and government incentives such as a 50% tax cut, from 30% to 15%, for developers who develop at least 100 affordable units annually, and the slashing of statutory fees such as NEMA and NCA, (iii) the market gaining further impetus from the government’s affordable housing initiative, and (iv) continued infrastructural development.

Below is a summary of the residential market performance over the last 3-years:

Source: Hass Consult Research

For the land price index, the following were the key take outs:

- Land asking prices, recorded an overall 1.4% q/q increase, attributable to stabilization of the political environment. Satellite Towns outperformed Nairobi suburbs recording a 2.4% q/q appreciation rate against a 0.3% q/q increase in asking prices recorded in Nairobi Suburbs. This is attributable to the fact that land prices in Nairobi suburbs are driven mainly by demand from developers and not speculators unlike the satellite towns,

- For suburbs, Gigiri was the best performing suburb, with asking prices increasing by 4.8% q/q due to increased housing demand for high end housing in the area by the UN, Embassies and diplomats, and increased office space developments in the area, while Kilimani was the worst performing with the asking price declining by 1.9%,

- For satellite towns, Juja was the best performing town with asking prices increasing by 7.7% q/q driven by relatively affordable prices at an average of Kshs.12.0Mn per acre compared to areas such as Ruaka at an average of Kshs. 85.2Mn per acre and speculation, while Mlolongo was the worst performing satellite town, recording a drop in asking prices by 3.4% q/q attributable to the traffic congestion along Mombasa road hence unattractive to potential clients.

The performance is in line with Cytonn Research findings in our Cytonn Annual Market Outlook - 2018, where we noted that we expect the performance to remain positive, with the market expected to record an annual capital appreciation of 10.2% in 2018 from 6.5% in 2017.

|

Hass Consult Land Price Index Summary 2016-2018 |

|||

|

Q1'2016 |

Q1'2017 |

Q1'2018 |

|

|

Nairobi Suburbs |

(0.2%) |

1.3% |

0.3% |

|

Nairobi Satellite Towns |

1.1% |

3.4% |

2.4% |

|

Average |

0.5% |

2.4% |

1.4% |

|

|||

Source: Hass Consult Land Price Index

In retail sector, foreign retailers continue making inroads in the Kenyan retail sector capitalizing on the financial woes of some of the major local retail chains. This week, French-based retailer, Carrefour, opened a 5th outlet at the Sarit Centre Shopping Mall taking up space vacated by Uchumi. In addition to this the retail store has four more stores at The Hub in Karen, Two Rivers Mall along Limuru Road, Thika Road Mall along Thika Superhighway and the Junction Mall along Ngong Road. The retailer ventured into Kenyan market in May 2016 and has recorded revenues of up to Kshs 1.5 bn in the first seven-months of operations in its first outlet in The Hub Karen, hence supporting the aggressive expansion in the Kenyan market. The expansion activities by retailers indicate a healthy retail sector, which is supported by; (i) positive demographics evidenced by high population growth rate of 2.6% against global average of 1.2% that has led to sustained demand, (ii) high urbanization rates of 4.4% higher than global rates of 2.1% that has resulted in the need for more retail stores, (iii) high economic growth rates with a GDP growth rate averaging above 5.0% over the last 5 years thus boosting disposable incomes and increasing purchasing power, (iv) rapid growth of infrastructure making more areas accessible to investors, (v) Kenya’s growing position as a regional and continental hub hence witnessing an increase in multinationals operating in the county, and (vi) e-commerce as seen through the increased digitization of cash systems and a rise in mobile money and access to internet. We thus have a positive outlook for the retail sector in Kenya. However, retailers, especially local chains will have to institute better financial and supply chain management processes, and strong corporate governance frameworks, in order to avoid pitfalls that Nakumatt and Uchumi are struggling with.

High Court Judge Wilfrida Okwany has suspended the Ministry of Lands notice published on April 4th, 2018, discontinuing manual transactions at both the Nairobi and Central Registries to pave way for online transactions, until May 2nd, 2018 when the case filed by the Law Society of Kenya (LSK) to stop the automation of land transactions will be heard. The Ministry of Lands notice indicated that all property transactions including land searches, application for registration of documents, transfer of ownership or lease, caution and withdrawal of caution, as well as issuance of consent and valuation requests were to be done online.

The LSK is however against the automation of land transactions, terming it illegal for the reasons that: (i) it is against section 34 of the Advocates Act, which states, “no unqualified person shall, either directly or indirectly, take instructions or draw or prepare any document or instrument relating to the conveyancing of property”, (ii) Parliament was yet to pass a law that supports online land transactions, (iii) many Kenyans with no access to internet and online portal risk being dispossessed of their lands, and (iv) online processing of land transactions would expose the property owners to risk of fraud and loss of property through acts such as hacking. The concerns raised by LSK are valid as The Ministry of Lands ought to involve all the stakeholders through public participation to get the views on the practicality of rolling out an online based system in a country where internet access has not attained wide coverage and user/public sensitization also need to be prioritized before rolling out the online system. Digitization however has many advantages including promoting efficiency in the Ministry of Lands and cutting on costs related to the conveyancing process.

Another highlight of the week was that the National Assembly majority leader tabled a bill in Parliament seeking to amend the Stump Duty Act to exempt first time home buyers from paying stamp duty. Stamp duty tax is paid on the market value of a property at the rate of 4.0% for urban areas and 2.0% for rural areas and is payable within 30-days of signing sale agreement. In our opinion, if the bill is passed, it will be a move in the right direction as despite the minimal effect on the total house price, it will reduce the first time home buyers’ financial burden.

We remain positive on the performance of real estate sector in 2018 following the conclusion of the electioneering period that slowed activities in the sector in 2017 and the expected recovery of the economy growth with the GDP growth expected to come in at between 5.3%-5.5 % in 2018, up from the expected GDP growth of 4.7% for 2017. The pocket of value for the sector is in the residential theme boosted by fundamentals such as: (i) positive demographic trends evidenced by high population growth rate of 2.6% against global average of 1.2% that has led to sustained demand and high urbanization rates of 4.4% higher than global rates of 2.1%, (ii) Increased investor appetite due to the constantly growing housing deficit at 200,000 units p.a., iii) government incentives such as the 50% tax cut for developers of at least 100 affordable housing units annually, removal of statutory fees such as NEMA and NCA application fees, (iv) Kenyan Government’s Big Four initiative, and (v) continued infrastructural development.

On December 12th, 2017, the President, H.E Uhuru Kenyatta, launched ‘The Big Four’ plan for economic development of Kenya, focusing on:

- Food and Nutrition Security – The government plans to achieve 100.0% food security through enhanced large-scale production, boosting SME productivity and reduction of food costs,

- Manufacturing – The aim is to grow the contribution of manufacturing to GDP from 9.2% in 2016 to 20.0% by 2022 through establishment of industrial parks, Special Economic Zones and implementation of policies to boost processing of textiles, leather, oil, gas, construction material, foods, fish, iron and steel,

- Affordable Healthcare – This aims to increase the current universal health care coverage in Kenya from 36.0% to 100.0% by 2022 through scaling up NHIF uptake, increased budgetary allocation to health and adoption of low cost service delivery models, and,

- Affordable Housing – The government plans to deliver 1 mn units over the next 5-years out of which, 20.0% will be social housing while 80.0% will be affordable housing.

In his speech, the President promised that through the delivery of 1 mn housing units, half a million more Kenyans will own homes by the end of his second term in the year 2022. Out of these units, 800,000 will be affordable houses costing between Kshs 0.8 mn and Kshs 3.0 mn and 200,000 will be social housing units costing between Kshs 0.6 mn and Kshs 1.0 mn, according to the Big 4 Agenda Blueprint. It must not be lost on us, however, that this is not entirely a new initiative and that previous plans and proposals for the same have not been realised to date. For example, Kenya’s first medium-term goal (2009-2012) of the Vision 2030 strategy had a target of increasing housing production from 35,000 units annually to 200,000 units annually for all income levels. However, the Kenyan Government delivered approximately 3,000 units only during that period, compared to a target of 800,000 houses, according to the World Bank Economic Update of 2017. This then begs the question of whether the delivery of affordable housing can be a reality this time around. This week, we examine affordable housing with the aim of establishing the viability of the government’s project by looking at the following:

- What is Affordable Housing?

- The Kenyan Context: Demand and Supply of Affordable Housing – Drivers and Limitations

- The Case of Singapore

- The Case of South Africa

- The Kenyan Government Affordable Housing plan

- What is Affordable Housing?

According to The Economic Times, affordable housing are units that are reasonably priced for that section of society with the median household income or below. The National Affordable Housing Summit Group of Australia defines it as housing that is reasonably adequate in standard and location for lower or middle-income households and does not cost so much that a household is unlikely to meet other basic needs on a sustainable basis. Different institutions have different views on what affordable housing is but most agree that it should meet the needs of low to lower-middle income households.

Going by the first definition and Kenya National Bureau of Statistics (KNBS) data on income distribution in the formal sector, affordable housing would be units that can be afforded by individuals who earn Kshs 50,000 and below per month, which is a total of 74.4% of persons employed in the formal sector in Kenya. To gauge the price of a house affordable by these income levels, we assume a 20-year mortgage, at a 13.5% interest rate, with a 10.0% deposit and using the rule of the thumb of a maximum of 40.0% of their income being used to pay monthly instalments, then the median income individual can afford a maximum of Kshs 1.8 mn for a house. The very best case scenario would be to assume twice the monthly income where a household has 2 income-earners, then the median income household can afford a maximum of Kshs 3.6 mn for a house. As a result, in our view, at prevailing market conditions, an affordable house would be of Kshs 3.6 mn and below.

As per the Big Four Agenda Blue Print, the Kenyan Government intends to offer affordable housing at Kshs 0.8 mn to Kshs 3.0 mn per unit, at lower interest rates of up to 5.0% and longer mortgage tenors of up to 30 years. Using the affordability method described above, the houses that the government is targeting, at Kshs. 0.8 million to Kshs. 3.0 million per unit, will therefore cater for individuals earning an income of between Kshs 9,700 and Kshs 36,600 per month, at 5.0% interest and a 30-year tenor. So the unit prices, if they can be achieved are clearly within the affordability bracket of below Kshs. 50,000 per month income, assuming two income earners, but assuming 1 income earner, the maximum house price would be Kshs. 1.8 million. If produced, these houses would be clearly affordable, so this leaves two key questions:

- First, can the government, or private developers or some partnership between the two actually produce houses at a cost that can be sold for between Kshs. 0.6 mn to 3.0 mn? and,

- For those who qualify, which entity would provide the mortgage at interest rates of 5.0% per annum?

- The Kenyan Context: Demand and Supply of Affordable Housing – Drivers and Limitations

According to the National Housing Corporation, Kenya has a cumulative housing deficit of 2 mn units growing by 200,000 units per year being driven mainly by i) rapid population growth of 2.6% p.a compared to the global average of 1.2%, and ii) a high urbanisation rate of 4.4% against a global average of 2.1%. Supply, on the other hand, has been constrained with the Ministry of Housing estimating the total annual supply to be at 50,000 units. Notably, the Ministry indicates that 83.0% of the existing housing supply is for the high income and upper-middle-income segments, with only 15.0% for the lower-middle and 2.0% for the low-income population. In summary, while 74.4% of Kenya’s working population requires affordable housing, only 17.0% of housing supply goes into serving this low to lower-middle income segment.

The main limitations to the delivery affordable housing have been;

- Inadequate Supply of Affordable Development Class Land - There is an inadequate supply of serviced land at affordable prices due to soaring land prices in urban areas. In Nairobi, for example, land prices have been growing at a 6-year CAGR of 17.4%. This has led to increased development costs as land costs account for 25% - 40% of development costs in urban areas, which consequently impacts on end-user prices. In an area such as Ruaka for example, land that was Kshs 50 mn per acre 5 years ago, currently costs Kshs 100 mn an acre. If a developer puts up 100 units per acre, the land cost alone for each unit would be 1 mn and thus achieving affordable housing would be difficult,

- Costs of Construction - Mid-level construction costs in Kenya range from Kshs 44,000 - Kshs 64,000 per square metre (SQM) depending on the level of finishes, height and other related factors, and account for 50% - 70% of development costs. Considering a mid-level 2-bed house of 70 SQM, the construction cost alone would be at least Kshs 3.0 mn using a rate of Kshs 44,000 per SQM, meaning the total development cost will range from Kshs 4.0 mn-Kshs 6.0 mn, limiting the affordability of such a house,

- Inadequate Infrastructure - Several parts of Kenya lack the requisite infrastructure for development, such as proper access roads, power and sewerage services. Developers are forced to incur these costs, which are then passed on to the end buyer,

- Cost and Access to Finance for Development - Real estate development is a capital-intensive investment and thus developers have to explore alternative sources of capital, which come at a high cost ranging from 14% - 18% per annum. The capping of interest rates at 13.5% has resulted to a decline in credit growth to private sector as banks tighten their underwriting standards and also on a risk adjusted basis, government paper has become more attractive than lending to private sector. Even with the capping of interest rates, the actual cost of credit is still high, averaging between 16.0% and 18.0% due to additional administration fees, which then raise the cost of development. This situation is made worse by the dominance of banks in terms of provision of credit facilities in the Kenyan economy. In a developed market, bank funding accounts for only 40.0% of total funding, with the balance of 60.0% being non-bank funding from avenues such as the capital markets and other alternative funding such as high yield investment instruments. In Kenya, 95.0% of all funding is from banks, with only 5.0% from non-bank funding, limiting the supply of capital to developers,

- Preferential Treatment of Banking Sector Relative to Alternative Funding Sources: Related to access to financing discussed above, the banking sector enjoys preferential treatment for interest income from banking sector fixed deposits. A fixed deposit in the bank incurs a final withholding tax of 15.0% compared to other instruments such commercial paper issued by a developer, which will incur a total tax of 30.0%. This differences in tax treatment then drive individuals to purchase bank fixed deposit papers, compared to commercial paper or privately issued notes, which will incur higher tax rates. A symmetric treatment of taxation of interest earned will likely spur more savers to be steered to private commercial paper that can be used for affordable housing development,

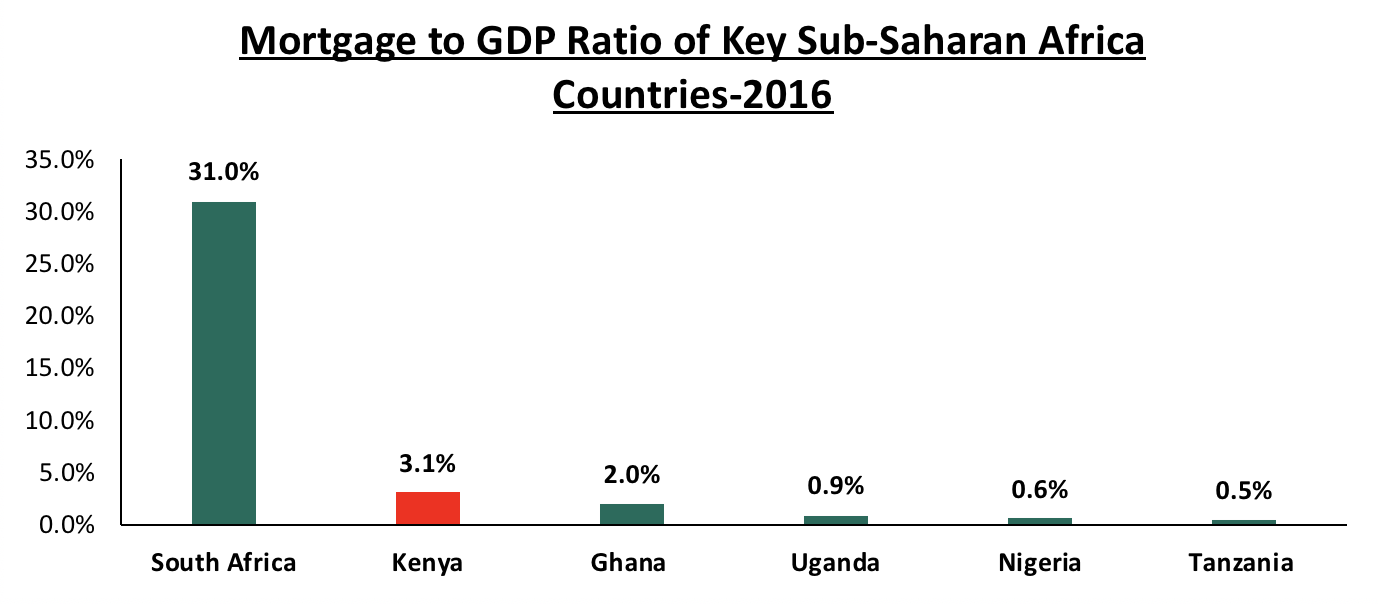

- Access to and Affordability of Mortgages - Access to mortgages in Kenya remains low mainly due to i) low-income levels that cannot service a mortgage, ii) soaring property prices, iii) high interest rates and deposit requirements which lock out many borrowers, iv) exclusion of employees in the informal sector due to insufficient credit risk information, and v) lack of capital markets funding towards real estate purchases for end buyers. According to Central Bank of Kenya, there were only 24,085 mortgages in Kenya as at December 2016 out of a total adult population of approximately 23 mn persons, with the mortgage to GDP ratio standing at 3.1% in 2016 compared to countries such as South Africa and USA, which have a ratio of above 30.0% and 70.0%, respectively,

- General Bureaucracy and ineffective policy actions: To deliver the high numbers of affordable housing units required, the process of land and real estate transactions needs to be much faster and less susceptible to rent collection by gate keepers. Policy actions, such as the reduction of income tax for developers producing 100 affordable units annually from 30.0% to 15.0%, need to be clear and accessible, and,

- Ineffectiveness of Public-Private Partnerships (PPPs) for Housing Development - The government has previously enlisted the help of the private sector for financing and development of affordable housing. This has however not achieved the intended objective as a result of:

- Regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security,

- Lack of clarity on returns and revenue-sharing,

- The extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years, and,

- Bureaucracy and slow approval processes.

- The Case of Singapore:

We took Singapore as a case study given that it is said to be a country with one of the best housing solutions in the world. In 1960, just after acquiring independence, Singapore had a cumulative housing requirement of 147,000 units for the 10-year period that ended in 1969 for a population of 1.6 mn people, which was growing at 6.4% per annum. The private sector only had the ability to provide 2,500 units per year and at price levels out of reach for the low-income segment. The government, therefore, put in place policies and strategies to promote home-ownership for its residents. Currently, according to the World Bank, 80.0% of Singaporeans live in houses built by the government, through the Housing Development Board (HDB) (the equivalent of the National Housing Corporation in Kenya), with 90.0% being owner-occupied, yet when they attained self-government in 1959 only 9.0% lived in public housing. The following are the main types of housing provided under the HDB:

- Build to Order (BTO): These are flats constructed by the HDB usually sold off-plan with a tender for construction being called only when the number of applicants reaches at least0% of the total number of apartments in a specific contract,

- Design Build and Sell Scheme (DBSS): Flats built under this scheme were for public housing but developed private developers. Buyers bought houses directly from the private developer and on completion, the projects were handed over to the HDB to manage. The scheme was suspended after 2015 due to the unsatisfactory spaces of units and high prices charged by developers which led to poor reception, and,

- Executive Condominiums (EC): These are more executive apartments built and sold by private developers to buyers who can exceed HDB income ceilings but cannot afford private homes.

Through the production of different classes of housing with different eligibility criteria, Singapore has managed to match housing with need based on income and below we look at ways through which housing for majority of Singapore’s population have been achieved;

- Strong Policies on Home Ownership: The government has set up priority schemes meant to improve the chances of first-time home buyers being allotted new houses. For example, 95.0% of flats supply under the DBSS scheme were set aside for first-time families during the first month after its launch. In addition, priority is granted to married couples, while the unmarried can only apply for flats of their own if they are unwed by age 35. There are also household income ceilings set for each type of housing as a way of matching every type of housing with those who can afford it,

- Minimum Occupation Period Policy: In order to limit speculative purchases, there are set occupation periods before a home-owner can resell a unit. For example, for all units purchased from HDB, the minimum occupation period is 5-years,

- Use of Social Security Payments to Pay for Housing: Citizens of working age are required to make monthly contributions of 20.0% of their income to the Central Provident Fund (CPF) (the equivalent of the NSSF). They are then entitled to draw down a portion of their savings as down-payment for housing and to service monthly mortgage instalments,

- Efficient Urban Planning and Green Building Requirements: With a population of approximately 5.6 mn and a land size of 719 SQKM, Singapore is classified as one of the most densely populated cities in the world at 7,909 people per square kilometre (Nairobi’s is 4,850/km2). Due to land scarcity, urban planners sought to maximise land use through construction of high rise and high-density buildings. The government then implemented a mandatory code in 2008 with requirements to ensure environmental sustainability of buildings leading to a higher quality of life for its residents,

- Government Land Ownership: In Singapore in 1967, the Land Acquisition Act empowered the government to acquire land at a low cost for public use and thus today 90.0% of land is government-owned. In this way, the government was able to acquire land that was not under its control and use it for housing development,

- Strong Government Support: There is a high level of public subsidies to the HDB at USD 1.19 bn as at 2017 highlighting the strong government commitment to public housing. In addition, the government gives housing grants to lower and middle-income families to make house purchase affordable. These are usually inversely related to one’s income and thus a lower income qualifies for a higher grant amount, and,

- Public-Private Housing: The government launched public-private housing, which comprises of the Executive Condominiums, which are built and sold by private developers but at lower prices than private homes because the land prices are subsidized by the government. These units are subject to the same regulations as those of the HBD. In this way, the government was able to provide housing for those who exceeded HBD’s income ceilings but couldn’t afford private properties,

The above factors clearly show-case how Singapore has been able to provide housing for majority of its population. For Kenya, the lessons are:

- First, we need a more comprehensive, well thought out and sustainable plan that integrates a set of solutions since there is no silver bullet. We think the current affordable housing plan can be more comprehensive and the government may want to consider taking a little bit more time to flesh it out to include more and better integrated sets of solutions,

- Provision of subsidies beyond just bringing in current stock of government land,

- Efficient urban planning to not only meet housing demand but to also do so in a sustainable manner; it will be challenging to deliver affordable housing without a comprehensive urban plan, of which housing is just one component,

- A clear eligibility criterion to boost home-ownership, flexible solutions that match individuals’ income, and minimum occupation periods for those who qualify, and,

- Use of social security payments as down-payment for housing.

- The Case of South Africa

We also looked at a case study of affordable housing in South Africa, a middle-income country in Africa with a large housing deficit, but with significant government efforts towards addressing the same. Since 1994, the government’s efforts have resulted in the building of 2.8 mn units by 2015 (approx. 133,000 units annually). The housing deficit reduced from about 3.0 mn units in 1994 to about 2.1 mn units, out of a population of 57.3 mn people as at 2018. Below we look at how the government has implemented the affordable housing programme and the challenges it faces;

- Subsidies for Low-income Populations – Under the Reconstruction and Development Programme (RDP) all households earning a gross income of approximately USD 295 (Kshs 30,000) per month or less qualify for housing subsidies worth USD 13,515 (Kshs 1.4 mn) with preference given to those of 40-years and above and those with special needs. According to the Centre of Affordable Housing Finance Africa (CAHF) subsidy beneficiaries get a freehold title to a 180-250 SQM serviced plot with a 40 SQM structure for free, and this helps in increasing home-ownership,

- Access to Finance for House Purchase - With a 30.4% mortgage to GDP ratio, South Africa has the highest mortgage penetration in Africa driven by i) relatively low lending rates with a Monetary Policy Rate of 6.8% and average lending rates of 10.3% per annum, ii) presence of a secondary mortgage market with the first residential mortgage-backed securitization being issued in 1999 and currently about 5.0% of the outstanding mortgage loans are securitised, iii) longer tenors by the Government Employees Scheme providing 30-year mortgages, iv) growth of pension-backed housing loans that enable employees to obtain home loans with their retirement fund savings as security, and v) a relatively high private credit bureau coverage at 64.4% of adults compared to Kenya at 30.4%, thus there’s ease of access to information to enable financial institutions determine the credit-worthiness of individuals,

- Minimum Occupancy Period - Similar to Singapore, government subsidised houses in South Africa cannot be sold for the first 8-years. This encourages home ownership and limits speculative purchases,

- Public-Private Partnerships – The national government has partnered with private developers in the bid to deliver affordable housing. A case in point is the Fleurhof Project, a USD 350.0 mn (Kshs 35.4 bn) residential development in Johannesburg, near Soweto. The project targeting low-income households started in 2009 was done through a partnership between International Housing Solutions (IHS), a private equity firm, and Calgro M3, the developer. It comprises of a total of 10,882 units, out of which 66.0% were affordable, costing between USD 37,000 and USD 60,000 (Kshs 3.7mn - Kshs 6.1mn), while the rest were subsidized. The project is approximately 52.7% complete with 5,733 units done by 2017. The development was a Public-Private Partnership but with the government providing land only. The City of Johannesburg also participated through funding some of the bulk and link infrastructure worth approximately USD 21.0 mn (Kshs 2.1 bn). Around 5,000 residents currently live at the Fleurhof Project, and,

- Compact Unit Sizes - The government, through its provision of subsidised housing, and private developers targeting the low-income spectrum develop compact units, which result in lower prices. For example, at the Fleurhof Project, unit sizes range from 40 SQM for a 2-bed unit to 120 SQM for a 4-bed unit. Effectively, private developers are able to achieve higher revenues per SQM either through selling or renting. At Fleurhof, for example, for the 40 SQM 2-bed unit costing Kshs 3.7 mn, the selling price is Kshs 92,500 per SQM which is higher than the average price of apartments in lower-middle satellite towns in Nairobi at Kshs 81,286 per SQM as at Q3’2017.

While the South African Government has made significant steps in providing housing for the low-income segment, the underserved segment in South Africa is the middle-income population who earn more than the USD 295.0 threshold for subsidies but not enough to service a mortgage and thus a lot more needs to be done to address the shortage. Nevertheless, we can learn lessons from the case study including;

- Use of capital markets as a way to access funding for house purchases eg mortgage-backed securities,

- The role of private equity investors and the government in enabling Public-Private Partnerships, and,

- Optimisation on unit sizes as way of lowering house prices while maintaining revenue margins for developers.

- The Kenya Government Affordable Housing Plan

We now look at the Kenya Government’s strategy in relation to the main limitations to affordable housing and analyse the feasibility of the strategy. The government intends to deliver 1 mn homes in the next 5-years, out of which 800,000 are affordable housing (bedsitters, 1, 2 and 3-bed units costing Kshs 0.8 mn - 3.0 mn) while 200,000 are social housing, which involves redevelopment of slums (1-2 room units costing Kshs 0.6 mn- 1.0 mn). This is expected to be implemented on 7,000 acres in 5 cities, namely Nairobi, Mombasa, Nakuru, Kisumu, and Eldoret. The following are the main ways through which the Kenyan Government intends to achieve affordable housing:

|

No. |

Key Issues |

Government’s Proposed Strategies |

Feasibility |

|

1. |

Affordable Development Class land |

i. Partnering with private developers through availing of public land for development ii. Undertaking land-swaps, which involve the transfer of public land to private developers in exchange for more suitable land for development, but of equal value iii. Establishment of a land bank - A task force has been formed to explore and set aside land from excess land holdings by corporations and parastatals including East African Portland Cement, Kenya Broadcasting Corporation, Kenya Prisons as well as the Ministry of Agriculture and Livestock iv. Approval of idle land tax as a way of discouraging speculative land purchase and unlock land that is suitable for affordable housing development Our take: This will avail strategically located land for investors and other government projects. It will enable development of affordable housing as investors will reallocate funds that would have otherwise been used for land purchase, to construction of more units. In addition, it will enable making use of lands in prime and convenient locations that would have otherwise been inaccessible, that will attract buyers. Finally, this will also provide suitable decantation sites for relocation of families from slums and other areas targeted for redevelopment to social housing |

High |

|

2 |

Construction Costs |

i. Development of local construction technology sector ii. Standardizing design elements, cost effective procurement and fast project delivery iii. Negotiation for low rates for key construction inputs for developers iv. Setting up a central procurement unit for key construction input materials to facilitate bulk purchases Our take: The government is likely to use Alternative Building Technology(ABT) such as Expanded Polystyrene to enable fast project delivery as it is known to lower the construction period by up to 50.0%. The government is also likely to benefit from economies of scale through the bulk purchases for mass housing developments. The key limitation for ABT would be on the requirement for training of both the personnel and the public to appreciate its use, and that costs tends to be similar to the traditional brick and mortar costs. Nevertheless, we have seen projects such as buildings for the National Police Service by the NHC taking shape and within a short period, and thus we are of the view that this has a moderate feasibility |

Medium |

|

3 |

Developer Financing |

i. Partnerships with the private sector to obtain 60% of the required funding ii. Funding from the National Social Security Fund (NSSF) through reviewing the RBA Act to allow the NSSF to invest more than 30.0% of its funds in real estate, operationalization of NSSF Act to increase minimum contributions from employees and leveraging on the NSSF balance sheet for funding iii. Off-plan sales from housing units through regulated escrow accounts Our take: There is a huge opportunity in funding from not only the NSSF but also the entire pension industry with assets worth Kshs 963.1 bn as at the end of June 2017 and growing at a 7-year CAGR of 13.5% from Kshs 396.7 bn in June 2010. The current allocation to real estate stands at 21.3% with only 0.12% in private equity and REITs. Increased allocation to alternative assets will not only diversify their pension funds’ portfolios and generate stable returns, but also provide the much-needed real estate development financing and exit for developments. The key limitation to investment is the relatively low rental yields from the residential market which range from 5%-6%, which in our view, can be increased through the development of compact units which cost lower, but generate attractive rents. We are sceptical about funding from the private sector given underlying issues such as the cost of debt versus the long-term nature of government projects, lack of clarity on guarantees to investors and how they will be implemented, and the unfavourable PPP framework |

Medium |

|

4 |

Home-Buyer Financing |

i. Extension of lines of credit from institutions such as World Bank to enable borrowing for as low as 5% interest rate ii. Extension of background checks to include the informal sector iii. Incentives to first-time buyers such as a waiver on stamp duty iv. Tenant-purchase scheme for social housing v. Provision of multi-generational mortgages that have long tenors and can be passed on to one’s heir vi. Setting up of National Housing Development Fund whose role will be management of funds set aside for planning and provision of social housing. It will also enable potential home-buyers to save towards home-ownership and consequently offer offtake for housing developments vii. Setting up a Mortgage Refinancing Company (MRC) to enable longer-term and affordable loans. The purpose of the MRC is to provide liquidity to financial institutions by allowing them to refinance illiquid mortgage assets thus enabling mortgages to be issued at longer tenors and with lower rates given the reduced liquidity risk. Our take: We commend the provisions of incentives to first time buyers, the extension of lines of credit from the World Bank and AfDB and plans to enable longer-term mortgages as they will reduce the financial burden for buyers. However, we are the view that the MRC will indeed increase liquidity, hence access to credit, but not necessarily reduce cost. Investors are likely to buy into the long-term mortgage-backed bond at a minimum of the risk-free rate for a 10-year bond, which currently stands at about 12.9%. Inclusive of a 1.0% spread to the MRC and a minimum risk premium that will be charged by banks of 4.0%, the cost of debt is likely to be at least 17.9%, which is still high and will lock out many low to middle-income earners. In addition, banks are likely to raise the risk premium for employees in the informal sector due to the undefined and irregular incomes. In order for the MRC to be effective, we need to put more effort toward the attainment of stable and lower interest rates environment and especially on government instruments, which may crowd out MRC from accessing the needed funding. |

Medium |

|

5 |

Public-Private Partnerships |

i. The government intends to review the PPP framework to enable fast-tracking of approval processes and accommodate new approaches such as Joint Ventures and Land Swaps. Our take: There is still uncertainty regarding revenue-sharing and the returns to private investors in PPPs, as well as policies that will curtail corruption and bureaucracy associated with government projects. In addition, private developers are likely to shy away from projects of more than 5 years given the uncertainty associated with transitioning to a new government after the end of the current term |

Low |

|

6 |

Infrastructure |

i. The government will utilise its funds to provide off-site and social infrastructure ii. Proposed deductions of 25.0% of the cost, from taxable income, where infrastructure has been provided by a developer Our take: This will have a positive impact as it will ease accessibility to undeveloped areas with lower land prices and reduce the overall development costs a developer would otherwise incur. However, developers are likely to shy away given the slow processes of approval for compensations from the government. In addition, in projects of lengthy time-frames of beyond 5 years, there is a risk of changing policies with the entry of new governments |

Medium |

Having looked at the 6 key challenges facing affordable housing and the strategies the government has put in place to address them, 1 has a high likelihood of materializing, 4 have a medium likelihood of materializing, and 1 has a low likelihood of materializing. We are thus of the view that the government has a moderate likelihood of meeting its targets with the success depending on its execution. Borrowing lessons from the case studies in Singapore and in South Africa, the following are required in order to increase the likely of affordable housing coming to fruition in Kenya;

- A better integrated framework that brings together a wider set of comprehensive solutions to addressing the problem, with the government at the centre as the driver of the initiative. As aforementioned there is no silver bullet for the affordable housing – the government, the Capital Markets Authority, NSSF, Retirement Benefits Authority, Kenya Revenue Authority, private sector finance and development, all have a role to play and the specific solutions need to be wider,

- Increase the Sources of Funding which may Include the Deepening of Capital Markets & Access to Non-Bank Funding – There needs to be concerted effort to look into ways of deepening the capital markets as a means to raising capital for funding real estate development, and below are some ways that can be used to achieve this:

-

- The first is through the development of Structured Products in the Kenyan market. As mentioned in our Cytonn Weekly #43/2017 , Structured Products have been a welcome alternative to banks for businesses seeking capital for growth, and the same can be applied to real estate financing. Structured Products have been better received in developed markets where the ratio of bank funding versus capital markets funding is 40.0% to 60.0%; which means banks finance up to 40.0% of business funding, the balance comes from capital markets. In developing markets such as Kenya, capital markets – whether public / regulated capital markets or private capital markets – remain under-developed, hence businesses are forced to source up to 95.0% of funding from banks, leaving only 5.0% of funding with other alternative funding. In fact, the entire 5.0% of funding from capital markets comes from regulated capital markets such as Capital Markets Authority registered offerings and SACCOs, with local private capital markets providing negligible funding. As such, real estate development and investment is not being provided with adequate access to this source of capital, which if provided at competitive rates can increase the development of affordable housing. Given the need for funding businesses in a growing economy where SMEs create majority of jobs, private markets such as Structured Products offer a compelling alternative for developers to seek financing,

- There is need for lobbying and tax law amendments to have the tax rates on Structured Products and non-bank funding to be given the same tax treatment as interest earned on commercial bank deposits, where withholding tax is the final tax, rather than an advance tax like in the case of Structured Products and non-bank funding. This will spur the development of alternative sources of funding at competitive rates available to the real estate development sector and encourage the development of affordable housing, and,

- There is currently only one REIT on the stock exchange and it is currently trading at 40.3% below its listing price due to negative investor sentiments. We need to have a candid review as to why REITs have not picked up in Kenya.

- Strong Government Support - It is evident from the case studies that government involvement and commitment is imperative for the realisation of affordable housing. This is needed in the following ways:

- Budgetary Allocation for Housing - During the Budget reading of 2017/18, the Cabinet Secretary allocated only Kshs 2.9 bn for housing for civil servants, whereas the funding requirement for proposed projects in 2018 alone is Kshs 1,580.9 bn according to the Big Four Agenda document, with the government intending to rely mainly on the NSSF and Public-Private Partnerships for funding. There’s need for increased budgetary allocation for the affordable housing effort given that the NSSF has a set statutory maximum for allocation to real estate whereas the funding from PPPs is largely dependent on the financial muscle of the private developer and investors who would like to participate,

- Guarantees for Offtake - If there are guarantees for offtake of developments, this will be an incentive to private developers as they will be assured of exit from projects, and hence spur the development of affordable housing,

- Legislative Reviews- There’s need for amendment of laws to allow people to use their pension to guarantee house purchases, so they may not require the deposit, or to access a portion of pension funds for use as down-payment. Currently, Section 38 of the RBA Act of 2009 allows members to attach up to 60.0% of their accumulated benefits as collateral for mortgage but this has not had a significant impact on mortgage uptake.

- Strict Housing Policies- In order to boost home-ownership, it is necessary to set up and adhere to strict rules and eligibility measures for house-purchase such as minimum occupancy periods and housing to income ceilings, so as to restrict to prospective home-owners only as opposed to speculative buyers. This will also ensure equitable allocation of housing based on income and need,

- Efficient Urban Planning – There’s need for efficient planning to allow the best use of land in a sustainable manner to cater for the growing population with key considerations on the provision of services such as water, power, garbage and sewage disposal. We encourage the development of master-plans with a work-play-live environment as it will spur the growth of towns, create employment away from the main urban nodes and will produce fully-integrated communities,

- Getting Cheaper Materials for the Alternative Building Technology and Adequate Training on the Same- There’s need to explore cheaper building technology to lower construction costs. Training of labour on the use of ABT is essential so as to boost its application. In addition, the public need to be sensitized on the functionality of ABT so they are more receptive,